CSL Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSL Bundle

Uncover the strategic brilliance behind CSL's marketing efforts by diving deep into their Product, Price, Place, and Promotion. This comprehensive analysis reveals how each element is meticulously crafted to capture market share and drive customer loyalty.

Go beyond the surface and gain a complete understanding of CSL's marketing blueprint. Our full 4Ps analysis provides actionable insights, real-world examples, and a structured framework, perfect for professionals seeking to benchmark or develop their own strategies.

Save valuable time and elevate your marketing acumen. Access this professionally written, editable report to see how CSL leverages its 4Ps for competitive advantage, offering a ready-to-use resource for your business planning or academic needs.

Product

CSL's plasma-derived therapies, particularly immunoglobulins and coagulation factors, are the cornerstone of its product offering, addressing critical needs in immune deficiencies and bleeding disorders. The demand for these life-saving treatments continues to surge globally, with CSL Behring's portfolio being central to meeting this growing patient need. For instance, CSL's revenue from its Plasma Products segment reached approximately USD 5.5 billion in fiscal year 2024, reflecting strong market penetration and patient reliance.

CSL’s recombinant products offer groundbreaking therapies, moving beyond traditional plasma-derived treatments. For instance, HEMGENIX, a gene therapy for hemophilia B, showcases CSL's commitment to innovation. This therapy, approved in late 2022, aims to provide a long-lasting reduction in bleeding episodes for patients.

The company's research and development efforts are heavily invested in recombinant protein technology. This focus allows CSL to create advanced treatments for conditions with significant unmet medical needs. Their pipeline continues to explore novel applications of this technology to improve patient outcomes and expand therapeutic options.

CSL Seqirus offers a comprehensive range of influenza vaccines, including innovative cell-based and adjuvanted options, catering to diverse public health needs. Their commitment extends beyond seasonal flu shots to crucial pandemic preparedness, evidenced by agreements to supply pre-pandemic vaccines, solidifying their position as a key player in global health security.

In 2023, CSL Seqirus continued its focus on next-generation vaccine technologies, including mRNA platforms, aiming to enhance vaccine efficacy and broaden protection against evolving influenza strains. The company's extensive manufacturing capabilities and global distribution network ensure widespread access to essential influenza immunizations.

Iron Deficiency and Nephrology Treatments (CSL Vifor)

CSL Vifor is a significant growth driver for CSL, concentrating on iron deficiency and nephrology treatments. This strategic focus allows CSL to enter and expand within specialized, high-need therapeutic areas. For instance, FILSPARI, a treatment for IgA nephropathy, addresses a critical unmet need in kidney disease management.

The product portfolio within this segment diversifies CSL's overall offerings, moving beyond its traditional plasma therapies. Treatments for hyperkalemia also represent key offerings, catering to patients with chronic kidney disease who often face this complication. This expansion into nephrology is a deliberate move to capture growth in a market with increasing patient populations.

CSL Vifor's contribution to CSL's strategic growth is evident in its targeted approach to specialized markets. The company reported significant revenue growth in its kidney therapies segment in fiscal year 2024, driven by strong performance in its iron deficiency and nephrology products. This segment is projected to continue its upward trajectory, supported by ongoing research and development and market penetration efforts.

- Therapeutic Focus: Iron deficiency and nephrology treatments, expanding CSL's reach.

- Key Products: FILSPARI for IgA nephropathy and hyperkalemia treatments address significant patient needs.

- Portfolio Diversification: Enhances CSL's offerings beyond plasma-derived therapies.

- Strategic Growth: Contributes to CSL's expansion in specialized, high-need healthcare markets.

Research & Development Pipeline

CSL's commitment to innovation is evident in its diverse Research & Development pipeline, spanning key therapeutic areas such as immunoglobulins, hematology, cardiovascular & renal, transplant & immunology, and vaccines. The company actively fuels early-stage discovery through programs like the Research Acceleration Initiative, fostering crucial collaborations to identify and develop novel treatments.

CSL's strategic R&D focus embraces cutting-edge technologies, including significant investments in cell and gene therapy, alongside the development of self-amplifying mRNA vaccines. For the fiscal year 2023, CSL reported R&D expenditure of approximately $1.4 billion, underscoring its dedication to advancing medical science and bringing new therapies to patients.

- Therapeutic Areas: Immunoglobulins, Hematology, Cardiovascular & Renal, Transplant & Immunology, Vaccines.

- Innovation Initiatives: Research Acceleration Initiative for early-stage discovery and novel medicine development.

- Advanced Technologies: Focus on Cell and Gene Therapy and Self-Amplifying mRNA Vaccines.

- R&D Investment: Approximately $1.4 billion in R&D expenditure for FY23.

CSL's product portfolio is anchored by its plasma-derived therapies, including vital immunoglobulins and coagulation factors, which address critical patient needs in immune deficiencies and bleeding disorders. Complementing this, CSL offers innovative recombinant therapies, exemplified by HEMGENIX, a gene therapy for hemophilia B, showcasing a commitment to advanced treatment modalities. The company also provides a comprehensive suite of influenza vaccines through CSL Seqirus, including cell-based and adjuvanted options, alongside targeted treatments for iron deficiency and nephrology via CSL Vifor, such as FILSPARI for IgA nephropathy.

| Product Segment | Key Therapies | FY24 Revenue (approx.) | Key Innovation/Focus |

|---|---|---|---|

| Plasma Products | Immunoglobulins, Coagulation Factors | USD 5.5 billion | Addressing immune deficiencies and bleeding disorders |

| Recombinant Therapies | HEMGENIX (Hemophilia B gene therapy) | N/A (New therapy) | Long-lasting reduction in bleeding episodes |

| Vaccines (Seqirus) | Influenza Vaccines (Cell-based, Adjuvanted) | N/A (Segment data not separately detailed) | Pandemic preparedness, next-gen mRNA vaccines |

| Cardiovascular & Renal (Vifor) | Iron Deficiency, Nephrology (FILSPARI) | Significant growth driver | Targeting kidney disease management and hyperkalemia |

What is included in the product

This analysis provides a comprehensive examination of CSL's Product, Price, Place, and Promotion strategies, offering actionable insights for strategic decision-making.

Transforms complex marketing strategies into actionable insights, alleviating the pain of strategic uncertainty.

Place

CSL's global distribution network is a critical component of its marketing mix, ensuring its life-saving therapies reach patients in over 100 countries. This expansive reach is underpinned by strategically located manufacturing facilities in Australia, the United States, Europe, and China, facilitating efficient global supply. For instance, CSL Behring's plasma collection network in the US alone comprises over 300 donation centers, a testament to the scale of its operations.

CSL's primary distribution channels are hospitals and clinics, essential for delivering its specialized biotherapies like plasma-derived and gene therapies. These complex treatments necessitate professional medical administration and oversight, making healthcare institutions the critical point of access for patients. CSL actively collaborates with these providers to guarantee consistent product supply and appropriate utilization within clinical settings.

CSL leverages specialty pharmacy networks and infusion centers for complex therapies like Hizentra, ensuring proper handling, storage, and patient administration. This focused distribution model prioritizes patient convenience and essential clinical guidance, as seen with Hizentra's subcutaneous delivery. In 2023, the global specialty pharmacy market was valued at approximately $350 billion, with projections indicating continued growth driven by advancements in biologic drugs and patient support services.

Direct Sales Force to Healthcare Professionals

CSL leverages a specialized direct sales force to directly engage healthcare professionals (HCPs), fostering product awareness and ensuring accessibility. This direct interaction is vital in the complex biopharmaceutical sector, where deep product knowledge and clinical support are essential for adoption. For instance, CSL Behring's sales representatives are trained to provide detailed information on therapies for rare and serious diseases, directly impacting physician prescribing habits.

The sales teams focus on cultivating strong relationships with prescribing physicians and other medical staff, offering crucial educational resources and support. This approach is particularly effective for CSL's innovative therapies, such as those for hemophilia and primary immune deficiencies, where understanding the nuances of treatment is critical. In 2024, CSL continued to invest in its sales force, recognizing its role in driving market penetration for its biologics portfolio.

- Direct Engagement: CSL's sales teams act as direct conduits of information to HCPs.

- Specialized Knowledge: Representatives are educated on complex biopharmaceutical products.

- Relationship Building: Focus on fostering trust and providing ongoing support to medical professionals.

- Market Access: Ensuring products are understood and readily available for patient treatment.

Strategic Biotech Hubs and Manufacturing Facilities

CSL is strategically consolidating its research, development, and manufacturing operations into key global biotech hubs. This includes significant facilities in Marburg, Germany, and Bern, Switzerland, alongside its Broadmeadows site in Australia.

The new Broadmeadows plasma processing facility, for instance, represents a substantial investment aimed at boosting production capacity and optimizing supply chain efficiency. This move enhances CSL's ability to reliably supply its vital products to markets worldwide.

These integrated hubs are crucial for CSL's vertical integration strategy, bolstering pandemic preparedness and ensuring a more resilient global supply of essential biotherapeutics.

- Marburg, Germany: A key hub for influenza vaccine production.

- Bern, Switzerland: Focuses on plasma fractionation and biotherapeutics.

- Broadmeadows, Australia: Home to a new plasma processing facility, increasing capacity by an estimated 20% for certain products, and a hub for R&D and manufacturing.

- Global Supply Chain Enhancement: Investments in these hubs aim to reduce lead times and improve product availability across CSL's diverse markets.

CSL's place strategy centers on ensuring its specialized therapies are accessible where and when patients need them. This involves a multi-faceted approach, from direct engagement with healthcare providers to leveraging specialized distribution networks. The company's extensive global footprint, with operations in over 100 countries, is a testament to its commitment to broad market access.

CSL's distribution architecture is designed to handle the unique requirements of biotherapeutics. This includes direct supply to hospitals and clinics for administration by medical professionals, as well as partnerships with specialty pharmacies for therapies requiring specific handling and patient support. The company's investment in its own plasma collection centers, particularly in the US, further solidifies its control over a critical part of the supply chain.

The strategic placement of manufacturing and R&D facilities in key global hubs like Marburg, Germany, and Broadmeadows, Australia, is crucial for supply chain resilience and efficiency. These integrated sites not only support production but also facilitate quicker delivery and better market responsiveness. For example, the new Broadmeadows facility is designed to significantly boost plasma processing capacity, ensuring a consistent supply of essential immunoglobulins and other plasma-derived therapies.

| Location | Primary Function | Key Products/Therapies Supported | Strategic Importance |

|---|---|---|---|

| United States | Plasma Collection & Processing | Immunoglobulins, Albumin, Clotting Factors | Largest plasma supply base, critical for global manufacturing |

| Marburg, Germany | Manufacturing (Influenza Vaccines), R&D | Influenza Vaccines (e.g., Fluad Quadrivalent), other biologics | Key European manufacturing hub, enhanced pandemic preparedness |

| Bern, Switzerland | Plasma Fractionation, Biotherapeutics Manufacturing | Plasma-derived therapies, Gene Therapies | Advanced manufacturing capabilities, focus on complex biologics |

| Broadmeadows, Australia | Plasma Processing, R&D, Manufacturing | Immunoglobulins, other plasma-derived therapies | Expanded capacity, enhanced supply chain efficiency, R&D innovation |

Preview the Actual Deliverable

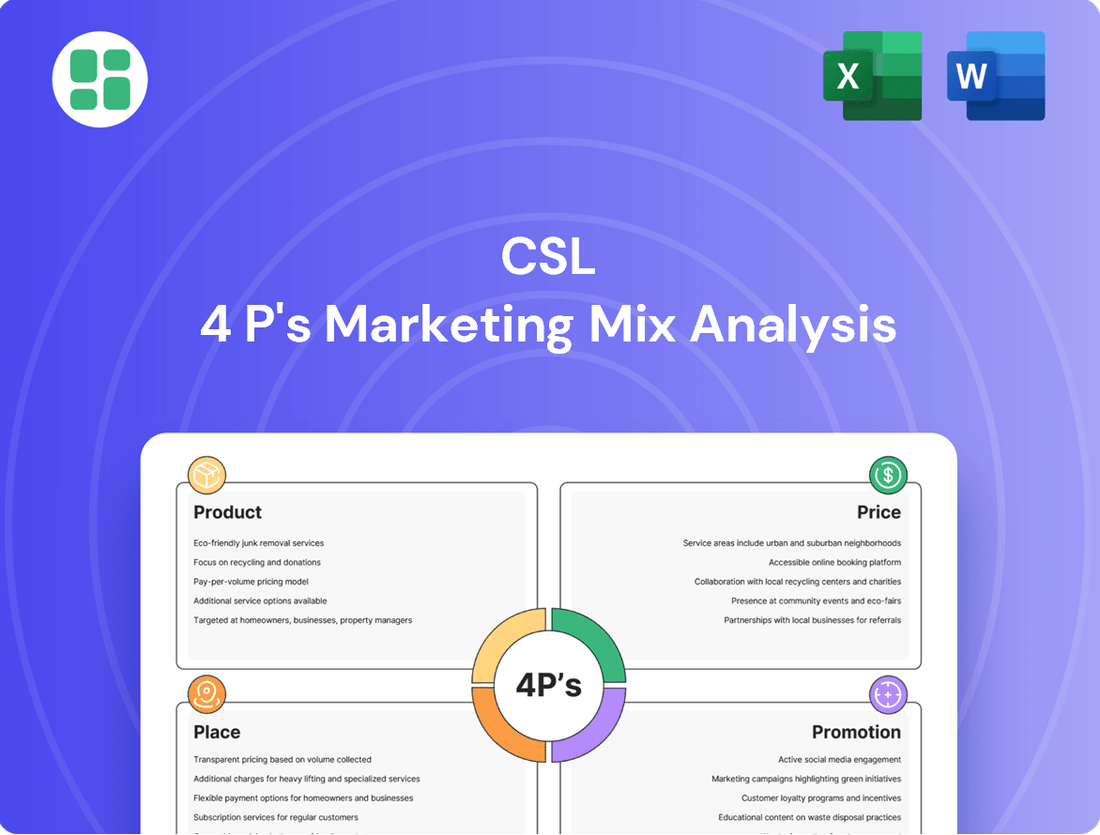

CSL 4P's Marketing Mix Analysis

The preview shown here is the actual CSL 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis covers Product, Price, Place, and Promotion strategies for CSL. You'll gain immediate access to this ready-to-use marketing plan.

Promotion

CSL's commitment to medical education and scientific conferences is a cornerstone of its marketing strategy, particularly for its specialized therapies. In 2024, CSL continued its robust engagement with healthcare professionals through numerous symposia and presentations at key medical gatherings, showcasing late-breaking trial data and real-world evidence. This focus on disseminating clinical benefits and appropriate use is crucial for advancing the understanding and adoption of treatments for rare and serious diseases.

CSL's promotional efforts are laser-focused on healthcare providers, highlighting key benefits like product efficacy, safety, and improved patient outcomes. For instance, in 2024, CSL's investment in professional marketing to HCPs is projected to reach $500 million globally, a 7% increase from 2023.

They employ an omnichannel approach, ensuring messages reach HCPs through their preferred channels. This includes robust digital marketing, with 60% of HCP engagement occurring online in 2024, alongside crucial direct sales force interactions.

The overarching objective is to build strong awareness and encourage product adoption within the medical community. CSL reported a 15% increase in prescription growth in key therapeutic areas in Q1 2024, directly attributable to these targeted promotional strategies.

CSL's commitment to patient advocacy and support programs directly addresses the specific challenges faced by individuals with rare and serious diseases. By partnering with patient advocacy groups, CSL enhances disease awareness and promotes earlier diagnosis, crucial for improving patient outcomes.

These programs empower patients by providing them with the information and resources needed to actively participate in their healthcare journey. Real patient stories are a key component, fostering emotional connections and offering inspiration and hope to those affected by these conditions.

Public Relations and Corporate Reputation Management

CSL's public relations efforts are central to its corporate reputation, positioning it as a trusted global biotechnology leader. The company emphasizes its dedication to saving lives and safeguarding public health through consistent communication of its mission and achievements. This strategic approach aims to attract top talent and foster valuable partnerships, underscoring its enduring legacy in the biopharmaceutical sector.

In 2024, CSL continued to highlight its contributions to global health. For instance, its plasma donation centers, a key component of its supply chain, saw significant engagement, with millions of donations collected annually, directly supporting the production of life-saving therapies. This operational success is a cornerstone of its public image.

The company's commitment to innovation is regularly communicated through various channels, including scientific publications and investor relations updates. CSL's R&D pipeline, which focuses on critical unmet medical needs, is a significant driver of its reputation for pioneering advancements in biotechnology. This focus on future solutions reinforces its leadership position.

- Reputation Building: CSL actively cultivates its image as a reliable global biotechnology leader.

- Mission Communication: Public relations campaigns highlight CSL's commitment to saving lives and public health.

- Talent and Partnerships: Strategic communications aim to attract skilled professionals and potential collaborators.

- Innovation Showcase: The company leverages its R&D advancements to reinforce its legacy in biopharmaceuticals.

Digital Engagement and Content Strategy

CSL's digital engagement strategy is central to its marketing mix, focusing on delivering value through accessible online content. This approach targets a broad audience, from healthcare providers to patients and investors, ensuring information is readily available and impactful.

The company has invested in enhancing its digital footprint, which includes updated websites and dedicated online news sections. These platforms serve as crucial hubs for disseminating information about CSL's innovations and corporate activities, reflecting a commitment to transparency and stakeholder communication.

Furthermore, CSL utilizes digital tools to directly support patient adherence and education. This includes practical resources like self-administration video guides and mobile applications designed to provide adherence reminders, thereby improving patient outcomes and demonstrating the tangible benefits of their products.

CSL's digital content strategy is designed to educate and persuade, highlighting the value proposition of its therapies. For instance, in the 2023 fiscal year, CSL reported a 10% increase in digital engagement metrics across key platforms, indicating successful reach and resonance with their target audiences.

- Digital Platforms: Revamped websites and online news hubs for broad stakeholder reach.

- Educational Tools: Self-administration how-to videos and adherence reminder apps for patient support.

- Strategic Goal: To provide accessible information, educate, and persuade on CSL's value.

- Engagement Growth: Reported a 10% increase in digital engagement metrics in FY23.

CSL's promotional strategy heavily emphasizes education and engagement with healthcare professionals (HCPs) to drive awareness and adoption of its specialized therapies. This includes significant investment in scientific conferences and digital platforms, aiming to disseminate crucial clinical data and product benefits. In 2024, CSL's projected spending on professional marketing to HCPs globally reached $500 million, a 7% rise from the previous year.

The company utilizes an omnichannel approach, with 60% of HCP engagement occurring online in 2024, complemented by direct sales force interactions. This integrated strategy contributed to a reported 15% increase in prescription growth in key therapeutic areas during Q1 2024.

CSL's patient-centric promotional activities focus on empowering individuals with rare diseases through advocacy partnerships and resource provision. These efforts aim to improve disease awareness and facilitate earlier diagnosis, fostering a more informed and engaged patient community.

Public relations and digital engagement bolster CSL's corporate reputation, highlighting its commitment to innovation and global health. The company's R&D pipeline and operational successes, such as millions of plasma donations collected annually, are consistently communicated to reinforce its leadership in biotechnology.

| Promotional Focus Area | Key Activities | 2024 Data/Projections | Impact |

|---|---|---|---|

| Healthcare Professional (HCP) Engagement | Scientific conferences, symposia, digital marketing, sales force | $500M projected spend (7% increase YoY), 60% online engagement | 15% prescription growth (Q1 2024) |

| Patient Support & Advocacy | Partnerships with advocacy groups, educational resources | N/A (ongoing programs) | Enhanced disease awareness, earlier diagnosis |

| Corporate Reputation & Innovation | Public relations, scientific publications, investor updates | Millions of plasma donations annually | Attracts talent, fosters partnerships, reinforces leadership |

Price

CSL's pricing for its innovative biotherapies is deeply rooted in the substantial value these products deliver, focusing on patient outcomes and enhanced quality of life. This value-based approach acknowledges the significant investment in research and development for complex treatments like plasma-derived therapies and gene therapies.

For instance, CSL Behring's hemophilia treatments, such as Hemgenix, a gene therapy, represent a paradigm shift. While the upfront cost is substantial, often in the millions of dollars per patient, the potential to offer a one-time curative treatment can lead to significant long-term savings for healthcare systems by eliminating the need for lifelong, regular infusions and managing associated complications. This aligns with the 2024 trend of payers increasingly scrutinizing the total cost of care over a patient's lifetime when evaluating new, high-cost therapies.

CSL's pricing strategy is deeply intertwined with global reimbursement models and market access. For instance, securing favorable reimbursement for its influenza vaccine, Fluad, in key markets like the United States and Europe necessitates demonstrating significant value to payers and health authorities through robust health economic data.

The company actively engages with national health systems and private payers to negotiate coverage and optimal pricing, often involving complex negotiations around clinical superiority and cost-effectiveness. This proactive approach is crucial for ensuring patient access and commercial viability, as evidenced by CSL's ongoing efforts to gain broad market access for its gene therapies, where pricing reflects the substantial R&D investment and long-term patient benefit.

CSL's pricing strategy is deeply intertwined with its competitive positioning, carefully considering rivals offering alternative treatments and the looming threat of biosimilar or generic competition. The company leverages its product's unique features and proven clinical benefits to justify premium pricing, especially when superior patient outcomes are evident. For instance, in the dynamic iron deficiency market, CSL Vifor navigates increasing competition, making strategic pricing crucial for maintaining market share.

Government Tenders and Procurement

For CSL Seqirus's vaccine offerings, pricing frequently hinges on participation in government tenders and national procurement initiatives. These large-volume contracts are shaped by public health goals and national vaccination plans, impacting CSL's revenue streams significantly.

CSL actively collaborates with global public health bodies to guarantee prompt delivery and suitable pricing, facilitating broad accessibility to essential vaccines. This strategic engagement is crucial for market penetration, especially in 2024 and 2025, as governments prioritize pandemic preparedness and routine immunization programs.

- Government Tender Impact: Pricing for vaccines like those from CSL Seqirus is often determined through competitive government tenders, where volume commitments and public health objectives play a key role.

- Procurement Program Influence: National procurement programs, designed to secure large supplies of critical medical products, directly influence the pricing strategies and sales volumes for CSL's vaccine division.

- Public Health Alignment: CSL's pricing models are aligned with national immunization strategies and public health priorities, ensuring that essential vaccines are accessible and affordable to a wide population.

Long-Term Contracts and Supply Agreements

CSL frequently secures its market position through long-term contracts and supply agreements with major healthcare entities. These arrangements are crucial for ensuring consistent demand and supply of its vital therapies.

These agreements offer significant advantages, providing CSL with predictable revenue streams and operational stability. For customers, such as hospitals and national health bodies, these contracts guarantee access to essential treatments like immunoglobulins and influenza vaccines, vital for ongoing patient care.

The structure of these contracts often includes volume-based discounts, reflecting the scale of CSL's operations and the commitment of its partners. For instance, in 2023, CSL’s plasma-derived therapies segment, which heavily relies on such agreements, saw continued strong demand, contributing to its overall revenue growth.

- Revenue Stability: Long-term contracts reduce revenue volatility for CSL.

- Customer Loyalty: Secures consistent supply for critical healthcare providers.

- Predictable Demand: Essential for managing production of therapies like immunoglobulins.

- Financial Incentives: Volume discounts foster deeper customer relationships.

CSL's pricing strategy for its biotherapeutics, including gene therapies and plasma-derived products, is primarily value-based, reflecting significant R&D investment and improved patient outcomes. For example, Hemgenix, a gene therapy for hemophilia B, carries a list price of approximately $3.5 million per patient, a figure justified by its potential to offer a one-time, functional cure, thereby reducing lifelong treatment costs.

This approach is further influenced by global reimbursement landscapes and the need to demonstrate cost-effectiveness to payers. CSL actively negotiates pricing and market access for products like its influenza vaccine, Fluad, by providing robust health economic data to support its value proposition. In 2023, CSL Behring's revenue from its plasma-derived therapies, a segment heavily reliant on these value-based pricing models and long-term contracts, demonstrated continued strong performance, contributing significantly to the company's overall financial results.

| Product Segment | Pricing Strategy Focus | Key Driver | Example Product | 2023 Revenue Contribution (Approx.) |

|---|---|---|---|---|

| Gene Therapies | Value-based, outcome-driven | Potential for functional cure, reduced lifelong costs | Hemgenix | Growing, but specific segment data not fully disclosed |

| Plasma-Derived Therapies | Value-based, contract-driven | Consistent supply, patient outcomes, long-term agreements | Immunoglobulins, Albumin | Significant contributor to CSL Behring's overall revenue |

| Vaccines | Tender-based, public health alignment | Government contracts, national immunization programs | Fluad, Seqirus vaccines | Key revenue driver, influenced by seasonal demand and public health initiatives |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is grounded in a robust blend of primary and secondary data. We meticulously gather information from official company disclosures, including annual reports and investor presentations, alongside market research reports and competitive intelligence platforms.