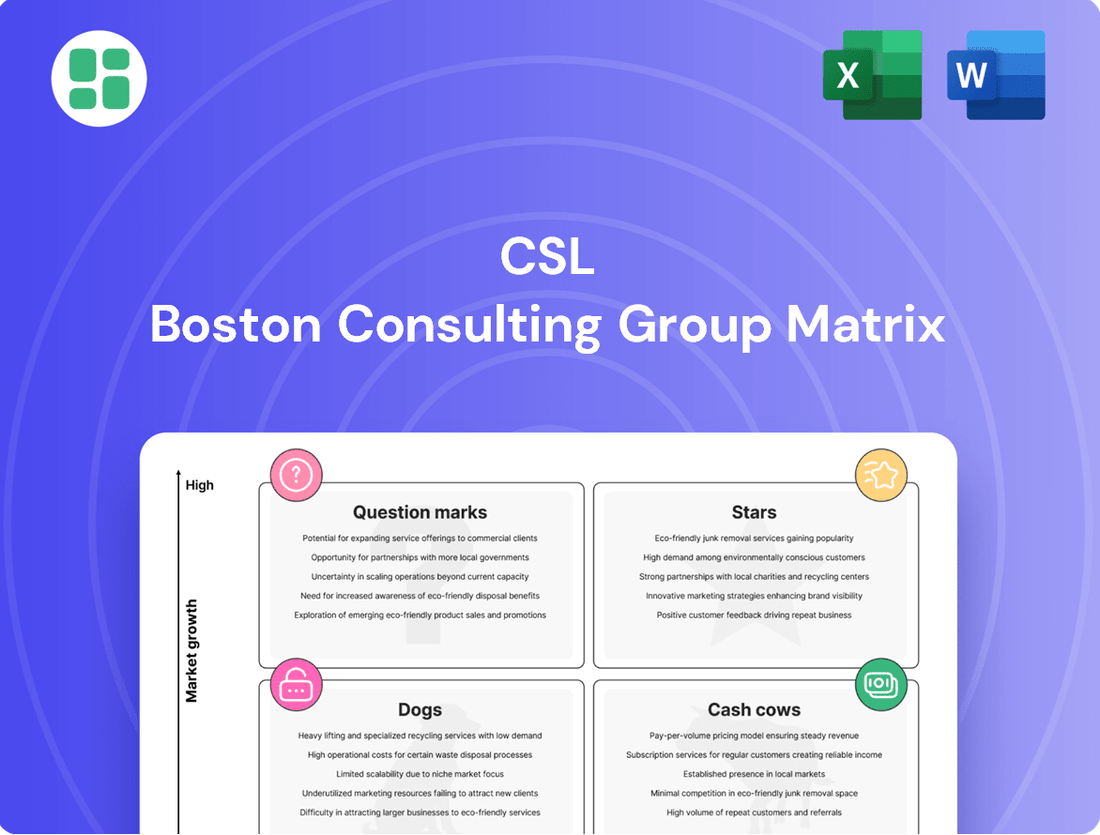

CSL Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSL Bundle

Unlock the secrets to a company's product portfolio with the BCG Matrix, a powerful tool for strategic decision-making. Understand where each product fits – are they high-growth Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks? This initial glimpse offers clarity, but the full report provides the actionable insights you need to optimize your investments and drive future success.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ANDEMBRY (garadacimab) represents a significant "Star" for CSL, being their first internally developed recombinant monoclonal antibody. Its recent regulatory approvals in Switzerland and Japan in February 2025, followed by Health Canada in August 2025, position it for strong market entry. The anticipated FDA approval by June 2025 further solidifies its potential.

As the sole once-monthly treatment targeting factor XIIa for hereditary angioedema (HAE), ANDEMBRY is poised to capture considerable market share. This novel prophylactic option offers a distinct advantage in convenience and efficacy, aiming to reverse prior market share declines in the HAE segment for CSL.

Specialty immunoglobulins for neurological disorders represent a significant growth area within CSL's portfolio, likely fitting into the Stars category of the BCG matrix. The global immunoglobulin market is projected to reach USD 36.7 billion by 2034, with a compound annual growth rate of 6.9%. This expansion is fueled by a rising prevalence of immunodeficiency disorders, including neurological conditions such as CIDP and MMN.

CSL Behring's immunoglobulin business demonstrated impressive performance, with a 20% increase at constant currency for the year ending June 30, 2024. This strong growth highlights CSL's dominant presence in this expanding market segment, underscoring the strategic importance and high potential of these specialized therapies.

CSL Seqirus, a significant player in influenza prevention with a 22.79% market share in 2023, is focusing on next-generation vaccines. Their investments are directed towards innovative options like adjuvanted and cell-based influenza vaccines.

Products such as FLUAD®, an adjuvanted vaccine for seniors, and FLUCELVAX® Quadrivalent, a cell-based option, are key growth drivers for CSL Seqirus. These advanced vaccines are designed for specific patient groups and aim for enhanced efficacy, positioning CSL Seqirus to capture growth in specialized segments of the influenza vaccine market.

The company reported a 4% revenue increase at constant currency for FY2024, largely attributed to the performance of these differentiated vaccine offerings. This growth underscores the market's receptiveness to innovative influenza prevention technologies.

Novel Recombinant Therapies in Hematology

CSL's novel recombinant therapies in hematology, particularly Factor VIII and Factor IX products, are positioned as Stars in its BCG matrix. These represent significant growth opportunities, addressing unmet needs in hemophilia A and B treatment. The company's strong R&D focus on recombinant protein technology underpins its strategy to capture substantial market share.

The global hemophilia market is substantial and growing, with projections indicating continued expansion. For instance, the hemophilia market was valued at approximately $11.5 billion in 2023 and is expected to reach over $16 billion by 2029, growing at a compound annual growth rate of around 5.5%. CSL's investment in these advanced recombinant therapies is strategically aligned with this upward trend.

- Market Growth: The hemophilia market is experiencing robust growth, driven by increased diagnosis, improved treatment access, and the development of novel therapies.

- Unmet Needs: CSL's recombinant Factor VIII and IX products aim to offer enhanced efficacy, safety profiles, and potentially longer half-lives compared to existing treatments, addressing key unmet patient needs.

- Competitive Landscape: While the market has established players, the introduction of innovative recombinant therapies allows CSL to differentiate and compete effectively for market share.

- R&D Investment: CSL's commitment to R&D in this area, evidenced by its pipeline, signifies a strategic focus on high-potential therapeutic areas with significant commercial prospects.

FILSPARI (sparsentan) for IgA Nephropathy

FILSPARI, developed by CSL Vifor in partnership with Travere Therapeutics, is a promising new treatment for IgA nephropathy (IgAN). Its recent Swiss approval in October 2024 and anticipated standard EU marketing authorization in April 2025 highlight its strategic importance. This dual-action therapy targets a significant unmet need in the nephrology market, a sector experiencing considerable growth and offering substantial global opportunities for CSL.

FILSPARI's positioning as an innovative therapy for IgA nephropathy, a primary driver of kidney failure, suggests strong potential for market expansion and increased market share for CSL Vifor. The IgAN market is projected to grow, with estimates suggesting it could reach billions by the late 2020s, driven by increasing diagnosis rates and a lack of effective treatments.

- FILSPARI's Market Entry: Swiss approval in October 2024 and EU authorization expected April 2025.

- Therapeutic Area: IgA nephropathy (IgAN), a leading cause of kidney failure.

- Market Potential: Growing nephrology market with significant global opportunities.

- CSL's Strategy: Expansion into innovative treatments for high-growth disease areas.

CSL's specialty immunoglobulins for neurological disorders are strong Stars, with the global immunoglobulin market projected to hit $36.7 billion by 2034, growing at 6.9% annually. CSL Behring's immunoglobulin business saw a 20% revenue increase at constant currency for the year ending June 30, 2024, highlighting its dominance in this expanding sector.

CSL Seqirus's focus on next-generation influenza vaccines, like FLUAD® and FLUCELVAX® Quadrivalent, positions them as Stars. The company reported a 4% revenue increase in FY2024, driven by these differentiated offerings, which cater to specific patient needs and aim for enhanced efficacy.

CSL's recombinant Factor VIII and IX products in hematology are Stars, targeting the growing hemophilia market, valued at $11.5 billion in 2023 and expected to exceed $16 billion by 2029. These therapies address unmet needs with improved profiles.

FILSPARI, for IgA nephropathy, represents a Star for CSL Vifor, with Swiss approval in October 2024 and EU authorization anticipated in April 2025. This treatment targets a significant unmet need in the growing nephrology market.

| Product/Therapy Area | BCG Category | Key Growth Drivers | Market Data Point | CSL Performance Indicator |

| ANDEMBRY (garadacimab) | Star | Novel once-monthly HAE treatment targeting factor XIIa | Anticipated FDA approval by June 2025 | First internally developed recombinant monoclonal antibody |

| Specialty Immunoglobulins (Neurology) | Star | Rising prevalence of immunodeficiency disorders, neurological conditions | Global immunoglobulin market to reach $36.7B by 2034 (6.9% CAGR) | CSL Behring: 20% revenue increase (constant currency) FY2024 |

| Next-Gen Influenza Vaccines (Seqirus) | Star | Adjuvanted and cell-based vaccine innovation | CSL Seqirus 22.79% market share in influenza (2023) | 4% revenue increase (constant currency) FY2024 |

| Recombinant Hematology Therapies | Star | Addressing unmet needs in hemophilia A and B | Hemophilia market: $11.5B (2023) to $16B+ by 2029 (5.5% CAGR) | Strong R&D focus on recombinant protein technology |

| FILSPARI (IgA Nephropathy) | Star | Dual-action therapy for IgAN, a leading cause of kidney failure | IgAN market projected to reach billions by late 2020s | Swiss approval Oct 2024, EU authorization Apr 2025 |

What is included in the product

The CSL BCG Matrix categorizes business units by market share and growth rate, offering strategic guidance for investment.

Provides a clear, visual framework to identify and address underperforming business units, simplifying strategic decision-making.

Cash Cows

CSL Behring's core intravenous immunoglobulin (IVIg) therapies are firmly positioned as Cash Cows within the CSL BCG Matrix. In 2024, IVIg commanded a significant 66.4% share of the global immunoglobulin market, underscoring its dominance and consistent revenue-generating power.

These established therapies consistently deliver robust cash flow, contributing substantially to CSL's financial performance, as evidenced by the company's US$2.91 billion NPATA for FY2024. Despite the immunoglobulin market's ongoing growth, IVIg represents a mature segment where CSL's leading position requires minimal additional investment to sustain its strong market share and profitability.

CSL Seqirus's established seasonal influenza vaccines represent a core Cash Cow for the company. As the world's second-largest influenza vaccine producer, CSL Seqirus commanded a substantial 22.79% market share in 2023. This mature yet robust market ensures consistent demand, with the company distributing 110 million doses in FY2024 alone.

The reliable cash flow generated by these established quadrivalent vaccine formulations, including those prepared for the 2024/25 and 2025/26 seasons, significantly contributes to CSL's overall strong financial performance and stability.

Albumin products are a cornerstone of CSL's revenue generation, demonstrating consistent performance. In the first half of fiscal year 2025, sales in this segment saw a healthy 9% increase, with a significant boost coming from demand in China.

In 2023, the albumin segment represented a substantial portion of the global market for plasma-derived medicines, underscoring its established and strong market presence.

Operating within a mature and stable market, albumin-based therapies cater to critical care and various other essential medical applications, solidifying their role as reliable cash cows for CSL Behring.

Hizentra (Subcutaneous Immunoglobulin - SCIg)

Hizentra, CSL's subcutaneous immunoglobulin (SCIg) product, is a prime example of a cash cow. Its impressive 16% sales growth in the first half of fiscal year 2025, boosted by the introduction of new pre-filled syringes, highlights its strong market performance.

The SCIg market itself is expanding, with a projected compound annual growth rate of 7.2%. Hizentra, as an established leader within this segment, capitalizes on patient preference for convenient, home-based self-infusions.

CSL's strategic focus on patient-centric delivery for Hizentra, coupled with its substantial market share, directly translates into consistent and significant cash flow generation for the company.

- Product: Hizentra (Subcutaneous Immunoglobulin - SCIg)

- Growth Driver: 16% increase in H1 FY2025 sales, aided by pre-filled syringes.

- Market Position: Established brand in a growing SCIg segment (7.2% CAGR projected).

- Financial Impact: Significant contributor to CSL's cash flow due to strong market share and efficient delivery.

Established Hemophilia Therapies (e.g., Idelvion)

CSL Behring's established hemophilia therapies, including Idelvion, represent a significant cash cow within their portfolio. These treatments have consistently provided a stable revenue stream, with Idelvion sales experiencing a 6% increase in the first half of fiscal year 2025, reaching $450 million.

The company's long-standing presence and reputation in the hemophilia market, coupled with a chronic and clearly defined patient population, solidify these products' position. Despite advancements in gene therapy, the ongoing need for long-term treatment ensures these recombinant factor products remain robust income generators.

- Established Market Presence: CSL Behring has a deep-rooted history and strong brand recognition in the hemophilia treatment space.

- Consistent Revenue Generation: Products like Idelvion are reliable income streams, with H1 FY2025 sales showing a 6% growth.

- Chronic Patient Need: The ongoing, long-term nature of hemophilia ensures a sustained demand for established therapies.

- Market Stability: While new therapies emerge, the broad patient base and treatment requirements maintain the cash cow status of these recombinant factor products.

Cash Cows in CSL's portfolio are products with high market share in mature, slow-growing industries. These generate substantial and consistent profits with minimal investment. CSL Behring's intravenous immunoglobulin (IVIg) therapies, for example, held a commanding 66.4% of the global immunoglobulin market in 2024, providing stable revenue. Similarly, CSL Seqirus's seasonal influenza vaccines, with a 22.79% market share in 2023, are reliable income generators. These products are vital for CSL's financial stability, funding other business segments.

| Product Segment | Market Share (approx.) | Recent Performance | Cash Flow Contribution |

| IVIg Therapies (CSL Behring) | 66.4% (2024) | Consistent revenue generation | Significant |

| Seasonal Influenza Vaccines (CSL Seqirus) | 22.79% (2023) | 110 million doses distributed FY2024 | Robust |

| Albumin Products (CSL Behring) | Substantial portion of plasma-derived medicines market (2023) | 9% sales increase H1 FY2025 | Reliable |

| Hizentra (SCIg) (CSL Behring) | Established leader in growing SCIg market | 16% sales growth H1 FY2025 | Consistent and significant |

| Hemophilia Therapies (CSL Behring) | Strong presence in mature market | Idelvion sales up 6% H1 FY2025 ($450M) | Stable revenue stream |

What You’re Viewing Is Included

CSL BCG Matrix

The preview you see is the identical, fully formatted CSL BCG Matrix document you will receive immediately after purchase. This comprehensive tool is designed to provide actionable insights into your business portfolio, with no watermarks or demo content to distract from its strategic value. You can confidently expect to download the exact same analysis-ready file, ready for immediate integration into your business planning and decision-making processes.

Dogs

CSL112, a promising infusion therapy aimed at treating cardiovascular disease, unfortunately encountered a significant setback. In February 2024, its pivotal Phase III clinical trial failed to meet its primary endpoint, effectively halting its path to commercialization.

This development represents a substantial loss, with an estimated $1 billion in research and development investment now unlikely to yield any return. The failure to produce a viable commercial product or capture market share firmly places CSL112 in the 'Dog' category of the BCG matrix, highlighting a significant drain on company resources without a corresponding benefit.

CSL's strategic pivot in 2025, prioritizing core therapeutic areas and external collaborations, signals a likely discontinuation of older, niche products. These are often characterized by a loss of competitive advantage or presence in stagnant markets with minimal revenue impact. For instance, a product with declining sales, perhaps seeing a 5% year-over-year drop in 2024, would be a prime candidate for deprioritization.

For a company with a long history, some older products, even if still approved, are now up against strong generic or biosimilar competition. This often means their market share and profits have shrunk considerably.

These products might still be available, but they bring in very little money and cost a lot to keep going. Think of them as 'dogs' in the company's product lineup, draining resources without much return.

For instance, in 2024, a pharmaceutical giant might see its once-blockbuster drug, now off-patent for over a decade, contribute less than 1% of its total revenue, while still requiring regulatory oversight and inventory management.

Non-Core Assets from Acquisitions with Limited Growth

Within CSL's portfolio, certain non-core assets acquired through acquisitions, such as potentially smaller, underperforming segments from the 2022 Vifor acquisition, might fit the description of Dogs. These are assets operating in markets with limited growth prospects and holding a low market share, meaning they generate minimal returns and have little potential for future expansion.

These underperforming assets would be prime candidates for divestiture. By shedding these non-core components, CSL can streamline its operations and reallocate resources toward its more promising business units. For instance, if a particular acquired product line saw only a 2% revenue increase in 2024, compared to CSL's overall growth of 7.5%, it would likely be flagged.

- Limited Growth Markets: Assets in sectors experiencing minimal annual expansion, perhaps less than 3% year-over-year.

- Low Market Share: Possessing a market share below 5% within their respective industries.

- Divestiture Candidates: These assets are candidates for sale to optimize CSL's strategic focus and financial health.

Underperforming Regional Formulations or Delivery Methods

Underperforming regional formulations or delivery methods in CSL's BCG Matrix would be classified as Dogs. These are products or variations that, despite initial investment and regional focus, have failed to gain significant market traction. They might be overshadowed by superior competitor offerings or rendered obsolete by evolving consumer preferences and technological advancements.

For example, a specific vaccine formulation that proved less effective or convenient in a particular Asian market compared to a globally standardized version could be a Dog. Such products tie up valuable resources, including manufacturing capacity and marketing budgets, without generating substantial returns or contributing to CSL's overall market share growth. By 2024, CSL has actively managed its portfolio, divesting or phasing out less competitive offerings to reallocate capital to growth areas.

- Underperforming Regional Formulations: Products that haven't resonated with local market needs or preferences.

- Superseded Delivery Methods: Older methods replaced by more efficient or user-friendly alternatives.

- Resource Drain: These products consume capital and attention without significant market share gains.

- Portfolio Optimization: CSL's strategy involves identifying and addressing these "Dog" assets to improve overall portfolio performance.

Dogs in the BCG matrix represent products or business units with low market share in low-growth industries. These are often cash traps, consuming resources without generating significant returns. CSL's approach to managing these "Dogs" involves identifying them and making strategic decisions, often leading to divestiture or discontinuation to free up capital for more promising ventures.

For instance, a product experiencing declining sales, perhaps a 5% year-over-year drop in 2024, would be a prime candidate for deprioritization. Similarly, a once-blockbuster drug off-patent for over a decade might contribute less than 1% of total revenue in 2024 while still requiring oversight.

CSL’s strategic pivot in 2025, prioritizing core therapeutic areas, signals a likely discontinuation of older, niche products. These often have a loss of competitive advantage or presence in stagnant markets with minimal revenue impact.

The CSL112 setback in February 2024, with an estimated $1 billion in R&D investment now unlikely to yield returns, exemplifies a product firmly in the Dog category, highlighting a significant drain on company resources.

| Product/Segment | Market Growth | Market Share | Strategic Action (Likely) | 2024 Impact Example |

|---|---|---|---|---|

| CSL112 | Low (Cardiovascular Disease Market Maturation) | Low (Post-Trial Failure) | Discontinue/Divest | $1 Billion R&D Loss |

| Older Off-Patent Drug | Low (Generic Competition) | Very Low (<1%) | Phased Withdrawal/Divest | Minimal Revenue Contribution |

| Underperforming Acquired Segment | Low (Niche Market) | Low (<5%) | Divestiture | 2% Revenue Growth vs. 7.5% CSL Avg. |

Question Marks

HEMGENIX, the pioneering gene therapy for Hemophilia B, falls squarely into the Question Mark category of the BCG Matrix. While the gene therapy market itself is considered a high-growth sector, HEMGENIX's initial adoption has been notably slow.

As of June 2024, only 12 patients had received the therapy within the preceding 12 months. This low patient uptake, despite its groundbreaking nature and a U.S. price tag of $3.5 million, highlights significant market penetration challenges.

The substantial investment required to overcome these adoption hurdles, coupled with the limited current market share, firmly places HEMGENIX as a Question Mark. CSL's ongoing commitment to this high-risk, high-reward therapy signals a strategic intent to nurture it towards becoming a future Star performer.

CSL's early-stage pipeline, featuring assets like an anti-IL-11 mAb for IPF and TED, fits the 'Question Mark' category in the BCG matrix. These are promising but unproven, requiring significant investment for clinical trials and regulatory approval. For instance, the global IPF market, while niche, is projected for substantial growth, with some estimates suggesting a CAGR of over 10% in the coming years, indicating high potential if successful.

CSL's strategic move into mRNA vaccines, exemplified by its collaboration with Arcturus Therapeutics for self-amplifying mRNA technology, positions it to tap into a high-growth sector. This partnership aims to develop next-generation vaccines, a critical area given the ongoing evolution of infectious diseases and the proven success of mRNA platforms.

The mRNA vaccine market is dynamic, with significant investment pouring into research and development. For instance, the global mRNA therapeutics market was valued at approximately USD 22.4 billion in 2023 and is projected to grow substantially. CSL's investment here represents a calculated effort to build a strong market presence in this competitive landscape.

New Indications for Existing Therapies (e.g., Alpha-1 Antitrypsin for aGvHD)

CSL is strategically leveraging its established plasma-derived therapies by investigating new applications, notably exploring Alpha-1 Antitrypsin (AAT) for the prevention of acute Graft-versus-Host Disease (aGvHD). This initiative aligns with a BCG matrix approach, where the core AAT therapy for Alpha-1 Antitrypsin Deficiency (AATD) represents a mature Cash Cow.

The expansion into aGvHD, a high-growth area, positions AAT as a potential Star. This new indication currently holds a low market share, necessitating substantial investment in clinical trials and market development to capture its full growth potential.

- AATD Market: CSL Behring's primary indication for AAT, treating Alpha-1 Antitrypsin Deficiency, is a well-established market, generating consistent revenue.

- aGvHD Potential: The exploration of AAT for aGvHD targets a significant unmet medical need in transplant patients, representing a high-growth opportunity.

- Investment Required: Significant capital is being allocated to Phase 3 clinical trials for AAT in aGvHD, with data expected to inform regulatory submissions.

- Market Entry Strategy: CSL is developing a targeted market entry strategy for aGvHD, focusing on key opinion leaders and transplant centers.

Certain Niche Products Acquired with Vifor Requiring Market Development

Certain niche products acquired through the Vifor Pharma deal, while operating in potentially growing markets, represent areas where Vifor previously held a limited market share. These products, therefore, would be classified as question marks within CSL's BCG Matrix. For instance, if a specific rare disease treatment acquired had a market size projected to grow at 8% annually but Vifor's market penetration was only 2% in 2024, CSL would need substantial investment to capture a more significant portion of this expanding market.

CSL will need to deploy significant capital and resources into developing robust marketing and sales infrastructures to drive adoption for these niche products. This strategic push is crucial for increasing market penetration and achieving substantial market share. For example, a successful market development strategy for a new iron deficiency treatment could see its market share grow from 5% to 15% within three years, requiring an estimated $100 million in marketing and sales investments for 2024-2026.

- Niche Product Market Development: Specific acquired Vifor products may be in expanding markets with low initial market share.

- Investment Requirement: Significant investment in marketing and sales is necessary to increase adoption and market share.

- Example Scenario: A rare disease drug with an 8% annual market growth and 2% Vifor market share in 2024 requires substantial development.

- Strategic Goal: To transform these question mark products into potential stars or cash cows through focused market development efforts.

Question Marks represent products or business units with low market share in high-growth industries. They require significant investment to increase market share and have uncertain future potential.

CSL's investment in its mRNA vaccine collaboration with Arcturus Therapeutics exemplifies this strategy, aiming to capture a significant portion of the rapidly expanding mRNA therapeutics market, which was valued at approximately USD 22.4 billion in 2023.

Similarly, the exploration of Alpha-1 Antitrypsin for Graft-versus-Host Disease, while building on a Cash Cow, targets a high-growth area with low current penetration, necessitating substantial clinical trial and market development funding.

The potential success of these ventures hinges on CSL's ability to effectively invest and execute, transforming these question marks into future Stars or Cash Cows.

| Business Unit/Product | Market Growth | Market Share | Investment Needs | Potential Outcome |

| HEMGENIX | High | Low (12 patients in 12 months as of June 2024) | High (for market penetration) | Star or Dog |

| mRNA Vaccines (Arcturus collab) | High | Low (early stage) | High (R&D, market development) | Star or Dog |

| AAT for aGvHD | High | Low (new indication) | High (Phase 3 trials, market entry) | Star or Dog |

| Acquired Niche Products (Vifor) | Moderate to High | Low (e.g., 2% for a rare disease drug) | High (marketing, sales infrastructure) | Star or Cash Cow |

BCG Matrix Data Sources

Our CSL BCG Matrix leverages robust data from internal sales figures, industry growth projections, and competitive landscape analyses to provide actionable strategic insights.