Crown Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Holdings Bundle

Crown Holdings, a leader in metal packaging, boasts significant strengths in its global reach and diversified product portfolio, but faces challenges from fluctuating raw material costs and intense competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the packaging industry.

Want the full story behind Crown Holdings' market position, potential threats, and competitive advantages? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Crown Holdings' global leadership in rigid packaging is a significant strength, underscored by its extensive product portfolio. As a premier supplier to major consumer marketing companies and industrial clients, Crown offers a wide variety of metal beverage, food, and aerosol cans, alongside metal closures and specialized packaging solutions. This broad offering, which also includes transit and protective packaging, solidifies their position as a critical partner across numerous industries and geographies.

The company's diversified product range and market reach are key differentiators. For instance, Crown's beverage can segment is a major contributor, and in 2024, the demand for sustainable packaging solutions continued to drive growth in this area. Their ability to serve both consumer-facing markets and industrial applications provides a robust business model, mitigating risks associated with any single sector's performance.

Crown Holdings showcased impressive financial strength in 2024, achieving a record adjusted free cash flow of $814 million. This robust performance significantly reduced the company's net debt, bolstering its financial stability.

The strong cash flow generation provides Crown Holdings with substantial flexibility. This allows for strategic investments in growth initiatives, attractive shareholder returns via dividends and share repurchases, and continued efforts to de-risk its balance sheet.

Crown Holdings' 'Twentyby30™' program sets 20 ambitious sustainability goals, targeting significant reductions in greenhouse gas emissions, water usage, and waste by the year 2030. This proactive approach to environmental stewardship directly addresses growing consumer and regulatory pressure for greener products and operations.

The company's focus on infinitely recyclable aluminum, with a remarkable 60-day can-to-can recycling loop, positions them favorably in a market increasingly prioritizing circular economy principles. This commitment not only enhances brand reputation but also provides a tangible competitive edge as demand for sustainable packaging solutions continues to surge.

Strategic Capacity Expansion and Operational Excellence

Crown Holdings has significantly bolstered its global beverage can capacity, completing a multi-year expansion program. This strategic move enhances their manufacturing capabilities to meet escalating customer demand while concurrently reducing capital expenditures. The company's operational excellence, marked by improved efficiencies and strong manufacturing performance, has been a key driver of this success.

This strategic capacity enhancement has directly translated into substantial volume growth for Crown. Key markets demonstrating this upward trend include Brazil, North America, and Europe, indicating successful market penetration and responsiveness to regional demand. For instance, in the first quarter of 2024, Crown reported a 3.0% increase in beverage can volumes, a testament to the effectiveness of their expansion strategy.

- Global Capacity Enhancement: Completed a strategic, multi-year global beverage can capacity expansion program.

- Reduced Capital Expenditures: The expansion was achieved with a focus on reducing capital expenditures.

- Volume Growth Drivers: Operational excellence and improved efficiencies have fueled significant volume growth.

- Key Market Performance: Notable volume increases observed in Brazil, North America, and Europe during 2024.

Resilient Global Beverage Can Business

Crown's global beverage can business is a cornerstone of its operations, representing a significant 67% of its projected revenue for 2024. This segment consistently demonstrates resilience and growth, often exceeding broader industry expansion rates. This outperformance is largely fueled by strong volume increases and the growing consumer preference for beverage cans as an environmentally friendly packaging choice.

Key factors contributing to this strength include:

- Dominant Revenue Driver: The beverage can segment is Crown's largest revenue generator, highlighting its strategic importance and market penetration.

- Above-Industry Growth: Consistent volume increases have allowed this segment to outpace overall industry growth estimates.

- Sustainability Appeal: The perception of beverage cans as a sustainable packaging solution resonates with environmentally conscious consumers, driving demand.

- Market Leadership: Crown's established position and operational efficiency in this sector provide a competitive advantage.

Crown's robust financial performance in 2024, highlighted by a record $814 million in adjusted free cash flow, significantly strengthened its balance sheet by reducing net debt. This financial flexibility enables strategic investments in growth, shareholder returns, and continued balance sheet de-risking, showcasing a well-managed and financially sound operation.

The company's commitment to sustainability, particularly through its 'Twentyby30™' program and focus on infinitely recyclable aluminum, positions it favorably in an increasingly eco-conscious market. This proactive environmental stewardship not only enhances brand image but also provides a distinct competitive advantage as demand for sustainable packaging solutions continues to climb.

Crown's strategic expansion of its global beverage can capacity has been a major success, enhancing manufacturing capabilities to meet rising customer demand while simultaneously controlling capital expenditures. This operational excellence has driven substantial volume growth, with key markets like Brazil, North America, and Europe showing notable increases in 2024, as evidenced by a 3.0% rise in beverage can volumes in Q1 2024.

| Metric | 2023 (Approx.) | 2024 (Projected/Actual) | Significance |

|---|---|---|---|

| Adjusted Free Cash Flow | $731 million | $814 million | Record generation, indicating strong operational efficiency and financial health. |

| Beverage Can Volume Growth | ~2-3% | 3.0% (Q1 2024) | Demonstrates market demand and effectiveness of capacity expansions. |

| Sustainability Goals Progress | Ongoing | On track for 2030 targets | Addresses market demand for eco-friendly packaging and regulatory trends. |

What is included in the product

Analyzes Crown Holdings’s competitive position through key internal and external factors, detailing its strengths in market leadership and operational efficiency, alongside threats from raw material price volatility and evolving environmental regulations.

Helps identify and address Crown Holdings' competitive vulnerabilities by clearly outlining threats and weaknesses.

Weaknesses

Crown Holdings faces a significant challenge due to its heavy reliance on raw materials like aluminum and steel, which are key components in its beverage can production. The prices of these metals are inherently volatile, influenced by global supply and demand dynamics, geopolitical events, and trade policies. For instance, in early 2024, aluminum prices saw fluctuations driven by production issues in key regions and ongoing trade tensions, directly impacting Crown's input costs.

This exposure to commodity price swings can directly squeeze profit margins. While Crown attempts to pass these increased costs onto its customers, the ability to do so effectively is not guaranteed. Competitive pressures and customer contract terms can limit the extent to which price increases can be implemented, particularly in the short term. This makes managing production costs a constant balancing act for the company.

Crown Holdings' transit and protective packaging segment, despite its diversification, faces a significant weakness in its reliance on industrial demand. This reliance was evident in 2023, where the segment experienced lower volumes and profitability directly linked to a slowdown in industrial and commercial applications. This vulnerability makes the company susceptible to economic downturns and sector-specific challenges within these industries.

The packaging sector, especially for rigid containers, demands substantial upfront investment, even after recent expansions. Building new facilities and production lines, along with ongoing upkeep of existing equipment, requires significant capital. This can put a strain on financial reserves and affect the company's ability to generate free cash flow, even when capital spending is at a more typical level.

Intense Competition in Packaging Markets

The rigid packaging sector, where Crown Holdings operates, is characterized by a moderate level of fragmentation. Key global players, including Crown, Ball Corporation, and Ardagh Metal Packaging, maintain extensive international operations, fostering a highly competitive environment.

This intense competition often translates into significant pricing pressures for manufacturers. To counter this, companies like Crown must continually invest in innovation and operational efficiency to defend their market share and secure customer loyalty.

- Market Fragmentation: The rigid packaging market is moderately fragmented, with major global players like Crown Holdings, Ball Corporation, and Ardagh Metal Packaging.

- Pricing Pressures: Intense competition directly leads to downward pressure on pricing, impacting profit margins.

- Innovation Imperative: Continuous investment in new technologies and product development is crucial for maintaining market position.

- Customer Lock-in: Strategies to enhance customer relationships and product differentiation are vital for retaining business.

Potential for Regulatory and Environmental Compliance Costs

Crown Holdings faces potential headwinds from increasingly stringent environmental regulations. For instance, the ongoing development and implementation of Extended Producer Responsibility (EPR) schemes across various global markets, including North America and Europe, could require significant capital outlays for compliance and waste management infrastructure. These evolving mandates, aimed at enhancing recycling rates and product lifecycle management, may necessitate further investments in new technologies or process modifications, thereby impacting operational costs and potentially reducing profit margins.

The company's commitment to sustainability, while a strength, also exposes it to the financial implications of adapting to evolving environmental standards. For example, stricter recycling regulations or new material sourcing requirements could force Crown to incur additional expenses. These could include investments in advanced sorting technologies or the development of new packaging materials that meet enhanced recyclability criteria. Such compliance costs, while necessary for long-term viability and brand reputation, represent a potential drag on profitability.

- Evolving Regulations: Anticipated stricter recycling mandates and Extended Producer Responsibility (EPR) schemes in key markets like the EU and North America could increase compliance expenses.

- Investment Needs: Adapting to new environmental standards may require substantial investments in advanced recycling technologies and sustainable material sourcing.

- Cost Impact: These compliance costs could potentially raise operational expenses and impact profit margins, especially in the short to medium term.

Crown's significant reliance on volatile commodity prices, particularly aluminum, presents a key weakness. Fluctuations in these raw material costs, as seen with aluminum prices in early 2024 influenced by production issues and trade tensions, directly impact Crown's input expenses and can compress profit margins if not fully passed on to customers.

The transit and protective packaging segment's dependence on industrial demand makes it vulnerable to economic slowdowns. This was evident in 2023 when industrial sector contractions led to lower volumes and profitability in this division.

The capital-intensive nature of the rigid packaging industry requires substantial ongoing investment in facilities and equipment. This high capital expenditure can strain free cash flow generation, even during periods of normal operational activity.

Intense competition within the moderately fragmented rigid packaging market leads to pricing pressures. Crown, alongside major competitors like Ball Corporation, must continually invest in innovation and efficiency to maintain market share and pricing power.

Preview Before You Purchase

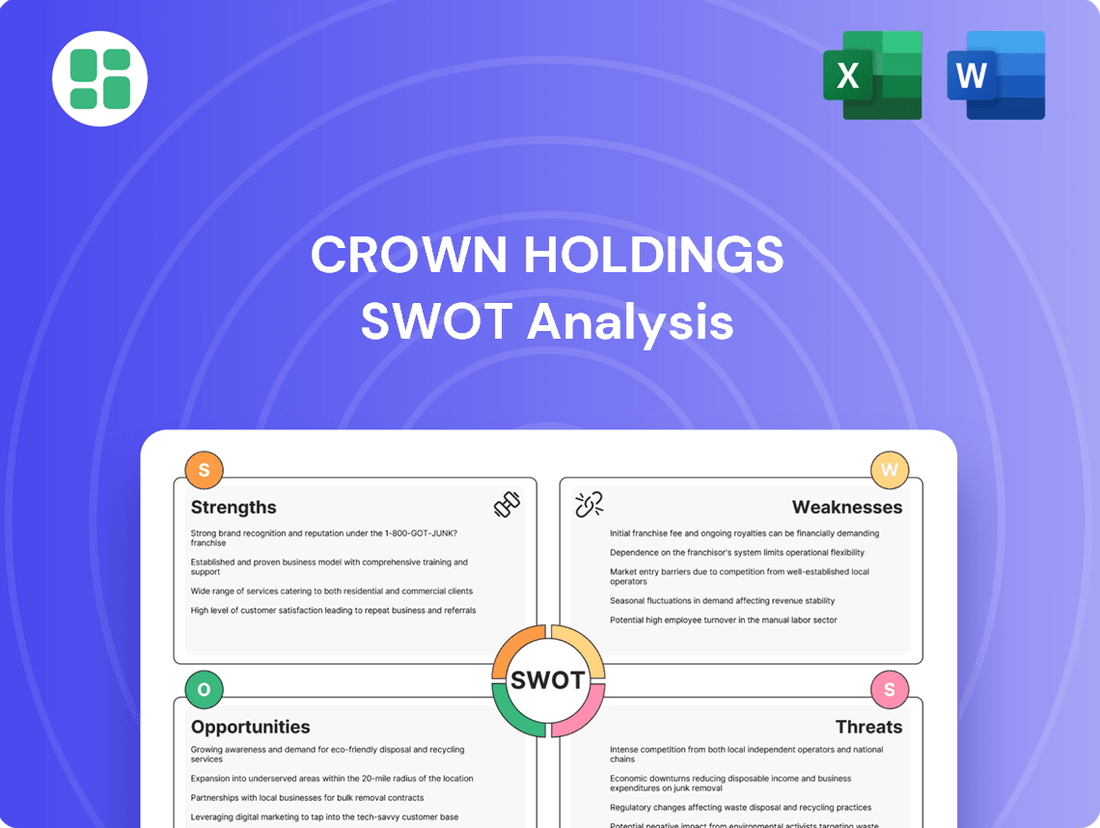

Crown Holdings SWOT Analysis

This is the same Crown Holdings SWOT analysis document you'll download. The full content, detailing strengths, weaknesses, opportunities, and threats, is unlocked after payment.

Opportunities

The global demand for sustainable packaging is surging, driven by both consumer preference and stricter environmental regulations. This trend represents a substantial growth avenue for companies like Crown Holdings.

Crown's strategic emphasis on infinitely recyclable metal packaging, especially aluminum cans, positions them favorably. For instance, the aluminum beverage can market is projected to grow, with some estimates suggesting a compound annual growth rate (CAGR) of over 3% through 2028, demonstrating tangible market expansion for Crown's core products.

This alignment with sustainability goals allows Crown to differentiate itself from competitors offering less eco-friendly packaging options. It provides an opportunity to attract environmentally conscious customers and potentially capture market share from single-use plastics and other less sustainable materials.

Crown Holdings is well-positioned to capitalize on the growing demand for beverage cans in emerging markets. These regions, including Asia, Eastern Europe, and South America, are experiencing significant urbanization and shifts in consumer lifestyles, leading to increased consumption of packaged foods and beverages. For instance, the Asia-Pacific beverage can market alone was projected to reach over $28 billion by 2024, showcasing substantial growth potential for companies like Crown.

Crown Holdings can capitalize on advancements in packaging technology to differentiate its offerings. Innovations like lightweighting reduce material costs and environmental impact, while enhanced barrier properties extend shelf life. For instance, the global smart packaging market was projected to reach $68.5 billion by 2026, indicating significant growth potential.

The integration of smart packaging, including QR codes and NFC technology, presents opportunities for enhanced consumer engagement and supply chain transparency. These features can provide consumers with product information or interactive experiences. Furthermore, anti-counterfeiting measures are increasingly vital, especially in sectors like pharmaceuticals and luxury goods, creating demand for secure packaging solutions.

Growth in E-commerce and Packaged Food/Beverage Consumption

The expanding e-commerce sector and increasing demand for packaged food and beverages worldwide are key growth catalysts for the rigid packaging industry. Crown Holdings, with its comprehensive range of protective packaging solutions, is strategically positioned to leverage these trends, facilitating secure product transit and catering to consumer preferences for convenience.

E-commerce sales are projected to continue their upward trajectory, with global retail e-commerce sales expected to reach approximately $7.5 trillion by 2025. This surge directly translates to a greater need for robust and reliable packaging to ensure product integrity during shipping. Additionally, the packaged food and beverage market, valued at over $1 trillion globally, sees consistent growth driven by urbanization and changing lifestyles, further bolstering demand for efficient and safe packaging solutions.

Crown's ability to offer specialized packaging that protects goods from damage during transit, coupled with its capacity to innovate for consumer appeal and ease of use, directly addresses these market dynamics. For instance, advancements in lightweight yet durable metal packaging are particularly attractive for both online sales and the expanding beverage market.

- Global e-commerce sales are anticipated to approach $7.5 trillion by 2025, increasing packaging demand.

- The worldwide packaged food and beverage market exceeds $1 trillion, showing steady growth.

- Crown's protective packaging is essential for safe e-commerce deliveries and meeting consumer convenience.

Strategic Acquisitions and Partnerships

The packaging industry is actively consolidating, with major players prioritizing acquisitions and mergers to accelerate the development of advanced technologies and secure sustained growth. Crown Holdings can leverage this trend by pursuing strategic acquisitions or forming key partnerships. This approach would enable the company to broaden its geographic reach, bolster its technological expertise, and diversify its product portfolio, mirroring the success seen in its past acquisition of Helvetia Packaging.

Crown's strategic M&A activities are crucial for staying competitive. For instance, in 2023, the company completed acquisitions that contributed to its revenue growth, demonstrating the tangible benefits of such strategic moves. By identifying and integrating synergistic businesses, Crown can gain access to new markets and innovative solutions, further solidifying its market position.

- Geographic Expansion: Acquire companies in underpenetrated regions to increase global market share.

- Technology Enhancement: Integrate businesses with leading-edge manufacturing or material science capabilities.

- Product Diversification: Broaden offerings into adjacent packaging segments or sustainable solutions.

- Synergistic Integration: Focus on acquisitions that offer cost savings and operational efficiencies through shared resources.

The increasing consumer and regulatory focus on sustainability presents a significant opportunity for Crown Holdings. Their expertise in infinitely recyclable aluminum cans aligns perfectly with this global demand, as the aluminum beverage can market is expected to see a compound annual growth rate of over 3% through 2028.

Emerging markets offer substantial growth potential, driven by urbanization and evolving consumer lifestyles, which increase the demand for packaged goods. The Asia-Pacific beverage can market alone was projected to exceed $28 billion by 2024, highlighting a key area for expansion.

Technological advancements in packaging, such as lightweighting and smart packaging solutions, provide avenues for differentiation and enhanced consumer engagement. The global smart packaging market, valued at $68.5 billion by 2026, indicates a strong trend towards innovation.

The booming e-commerce sector, with global retail e-commerce sales anticipated to reach $7.5 trillion by 2025, necessitates robust packaging solutions for secure transit, a core strength of Crown's offerings.

Threats

Economic downturns, such as the potential for a global recession in late 2024 or early 2025, pose a significant threat by dampening consumer spending and industrial activity, directly impacting demand for Crown Holdings' packaging solutions. High inflation rates, which saw consumer prices rise by an average of 3.4% globally in 2024 according to IMF projections, also increase operational costs for raw materials and logistics.

Geopolitical uncertainties, including ongoing trade disputes and regional conflicts, further exacerbate these risks by disrupting supply chains and creating unpredictable market conditions. These factors can lead to increased volatility in commodity prices, a key input for metal and plastic packaging, potentially squeezing profit margins for Crown Holdings.

While metal packaging, particularly aluminum cans, benefits from a sustainability halo, the broader packaging market is seeing significant innovation in other materials. Consumers are increasingly drawn to alternatives like advanced paper-based flexible packaging and even new generations of rigid plastics that offer enhanced recyclability and performance. This presents a threat to metal packaging as these alternatives could capture market share in key beverage and food applications, potentially impacting demand for Crown's core products.

Governments globally are tightening rules on packaging waste, with potential bans on specific materials and requirements for more recycled content. For instance, the European Union's Packaging and Packaging Waste Regulation (PPWR) aims for 100% recyclable packaging by 2030 and mandates significant recycled content levels.

Crown Holdings must adapt quickly to these evolving regulations. Non-compliance could lead to substantial fines, increased operational costs due to new material sourcing or processing, and potentially restricted access to key markets if products don't meet new environmental standards.

Supply Chain Disruptions and Trade Policy Impacts

Geopolitical instability and evolving trade policies pose significant threats to Crown Holdings' operations. Tariffs, such as those potentially impacting aluminum imports, can directly inflate production expenses and squeeze profit margins. For instance, in 2024, ongoing geopolitical conflicts in Eastern Europe and the Middle East continued to create uncertainty in global commodity markets, including aluminum, a key material for beverage cans.

These disruptions extend beyond just raw material costs. Supply chain bottlenecks, exacerbated by international trade disputes or unforeseen global events, can lead to material shortages. This scarcity makes it challenging for Crown Holdings to secure necessary components, potentially hindering their ability to meet customer demand and maintain consistent production schedules. The company's reliance on a global network means that localized disruptions can have ripple effects across its entire operational footprint.

- Increased Production Costs: Tariffs and rising commodity prices directly elevate manufacturing expenses.

- Material Shortages: Geopolitical tensions and trade disputes can disrupt the availability of essential raw materials like aluminum.

- Operational Inefficiencies: Supply chain disruptions make it harder to manage global logistics and meet production targets.

- Impact on Profitability: Higher costs and an inability to meet demand can significantly reduce earnings.

Cybersecurity Risks and Data Breaches

As a global entity with a vast operational and IT footprint, Crown Holdings is inherently exposed to cybersecurity risks. A significant data breach could lead to severe operational disruptions, potentially halting production lines and impacting supply chains. The compromise of sensitive customer or proprietary data can result in substantial financial penalties and a significant blow to the company's hard-earned reputation.

The financial ramifications of such breaches are considerable. For instance, the average cost of a data breach globally reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. For a company like Crown, this could translate into:

- Regulatory Fines: Significant penalties under data protection laws like GDPR or CCPA.

- Remediation Costs: Expenses associated with investigating the breach, restoring systems, and offering credit monitoring to affected individuals.

- Lost Revenue: Downtime and reputational damage can directly impact sales and market share.

The increasing focus on sustainability and the rise of alternative packaging materials present a significant threat. Innovations in paper-based and advanced plastic packaging could erode demand for Crown's metal solutions, especially in beverage and food sectors. Furthermore, stricter government regulations, such as the EU's PPWR mandating 100% recyclable packaging by 2030, necessitate costly adaptations and could restrict market access if not met.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Data/Trend |

|---|---|---|---|

| Market Shifts | Rise of Alternative Packaging | Loss of market share in key segments | Growing consumer preference for sustainable alternatives; increased R&D in paper/bioplastics. |

| Regulatory Environment | Stricter Packaging Waste Laws | Increased compliance costs, potential market exclusion | EU PPWR targets 100% recyclable packaging by 2030; increased recycled content mandates globally. |

| Economic Factors | Inflation and Economic Slowdown | Reduced consumer spending, higher operational costs | IMF projected global inflation around 3.4% in 2024; recessionary fears impacting consumer demand. |

| Geopolitical Risks | Supply Chain Disruptions & Tariffs | Increased raw material costs, material shortages | Ongoing conflicts impacting commodity prices (e.g., aluminum); trade disputes affecting logistics. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Crown Holdings' official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.