Crown Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Holdings Bundle

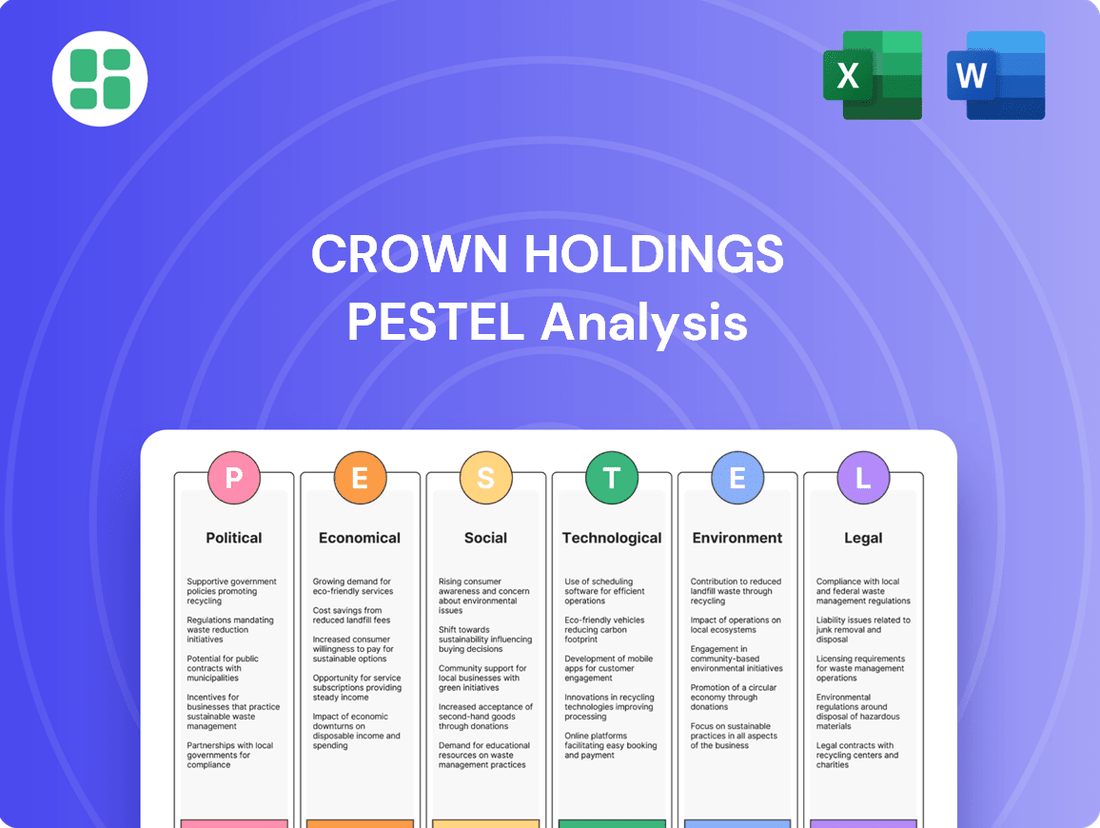

Unlock the intricate external forces shaping Crown Holdings's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities for the packaging giant. Gain a critical edge in your strategic planning and investment decisions by downloading the full, actionable report today.

Political factors

Changes in global trade policies and tariffs directly affect Crown Holdings' operational costs and market access. For instance, the imposition of tariffs on aluminum, a key raw material for beverage cans, can lead to increased production expenses. In 2024, ongoing trade tensions between major economies continue to create uncertainty, potentially impacting the cost of imported components and finished goods.

Protectionist measures and trade disputes can disrupt Crown's established supply chains and manufacturing footprints. The company's extensive global network, with facilities in numerous countries, is particularly sensitive to shifts in trade agreements and the imposition of new trade barriers. These disruptions can lead to higher logistics costs and delays in product delivery.

Conversely, the relaxation of trade barriers or the establishment of new, favorable trade agreements can present significant opportunities for Crown Holdings. Such developments could reduce import duties on raw materials, facilitate easier access to new international markets, and potentially lower the overall cost of goods sold, thereby boosting profitability.

Governments globally are tightening rules on packaging, covering materials, what's on the label, and how it's thrown away. For Crown Holdings, this means constantly tweaking how they design and make products to meet these evolving environmental and public health standards in different countries.

Failure to comply with these increasingly stringent regulations can result in significant financial penalties and even block market access. For instance, in 2024, the European Union continued to advance its Circular Economy Action Plan, with specific proposals targeting packaging waste reduction and increased recycled content mandates, directly impacting companies like Crown Holdings operating within the EU.

Crown Holdings' operations are significantly influenced by political stability in its key markets. For instance, in 2024, regions experiencing heightened geopolitical tensions, such as parts of Eastern Europe and the Middle East, present ongoing risks to supply chain integrity and manufacturing continuity. Sudden policy changes, like trade tariffs or nationalization efforts, can directly impact profitability and investment decisions.

International Relations and Sanctions

Geopolitical shifts and the implementation of international sanctions present a significant hurdle for Crown Holdings. For instance, sanctions imposed on Russia following the 2022 invasion of Ukraine, which continued to be a factor in 2024, directly impacted global supply chains and trade routes. This can restrict Crown's access to key markets or raw materials, potentially disrupting production and sales, particularly for its beverage can segment which relies on global aluminum markets.

These international relations can directly affect Crown Holdings' financial performance. For example, if a major market where Crown operates faces new sanctions, it could lead to a reduction in sales volume and revenue. In 2023, global trade tensions, including those related to China and the US, created uncertainty, impacting the cost of imported components and finished goods for companies like Crown. The company must actively monitor these evolving geopolitical landscapes to mitigate risks and adjust its market strategies accordingly.

- Sanctions Impact: Restrictions on trade and finance due to geopolitical tensions can limit Crown's operational scope and profitability in affected regions.

- Supply Chain Disruption: International sanctions can sever critical supply lines for raw materials like aluminum, impacting production costs and availability.

- Market Access: Geopolitical instability might close off or severely restrict access to key consumer markets, hindering revenue growth and diversification efforts.

- Financial Transaction Limitations: Sanctions can impede cross-border payments and investments, complicating financial management and capital allocation for multinational corporations like Crown Holdings.

Governmental Support for Recycling and Circular Economy Initiatives

Governments worldwide are increasingly championing recycling and circular economy principles. For Crown Holdings, this translates into both opportunities and potential new requirements. For instance, the U.S. Environmental Protection Agency (EPA) has set ambitious goals, aiming to reduce waste generation and increase recycling rates by 50% from 2018 levels by 2030. Such initiatives can drive demand for recycled materials, a key input for Crown's packaging products.

Policies like extended producer responsibility (EPR) are also becoming more prevalent. In the EU, the Circular Economy Action Plan is pushing for greater recyclability and recycled content in packaging. By 2030, many EU countries aim to have at least 30% recycled content in plastic packaging. These regulations directly influence Crown's material sourcing and product design, encouraging innovation in sustainable packaging solutions.

- Governmental Incentives: Policies offering tax credits or subsidies for using recycled aluminum and plastics can lower production costs for Crown Holdings.

- Regulatory Mandates: Increasing requirements for recycled content in beverage cans and food packaging, such as the UK's Plastic Packaging Tax, can create a competitive advantage for companies already investing in these areas.

- Infrastructure Investment: Public funding for advanced recycling technologies and collection systems can improve the availability and quality of recycled feedstocks for Crown's manufacturing processes.

- Circular Economy Targets: National and regional targets for waste reduction and increased recycling rates, like those in Canada aiming for higher plastic recycling rates, signal a growing market for sustainable packaging solutions.

Political stability and government policies significantly shape Crown Holdings' operating environment. In 2024, ongoing trade disputes and protectionist tendencies, particularly between major economic blocs, continue to introduce volatility. These factors directly impact the cost of raw materials like aluminum and access to key international markets, influencing Crown's global supply chain and manufacturing strategies.

Regulatory landscapes concerning packaging materials and waste management are becoming increasingly stringent worldwide. For instance, the EU's continued push for a circular economy by 2030, with mandates for higher recycled content in packaging, directly affects Crown's product development and material sourcing. Non-compliance can lead to substantial fines and market access limitations.

Geopolitical tensions and international sanctions pose considerable risks. The residual impacts of sanctions imposed in 2022 and continuing into 2024 have disrupted global trade flows and financial transactions. This can restrict Crown's access to critical resources and markets, impacting its financial performance and investment decisions in affected regions.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Crown Holdings, providing a comprehensive overview of its external operating landscape.

It offers actionable insights for strategic decision-making, highlighting key trends and potential challenges relevant to Crown Holdings's global operations.

A digestible summary of Crown Holdings' PESTLE analysis, offering clear insights into external factors impacting the company, streamlining strategic decision-making and mitigating potential risks.

Economic factors

Global economic growth is a significant lever for Crown Holdings, directly impacting consumer spending on packaged goods. For instance, the International Monetary Fund (IMF) projected global GDP growth to be 3.2% in 2024, a slight slowdown from 2023 but still indicative of expansion. This growth translates into enhanced consumer purchasing power, which in turn fuels demand for Crown's beverage, food, and aerosol can products.

During economic upturns, a rise in consumer confidence typically boosts sales volumes for packaged goods. Conversely, economic slowdowns, such as the potential for slower growth in major markets in late 2024 and 2025, could temper this demand. For example, if consumer disposable income tightens due to inflation or job market concerns, spending on non-essential packaged items might decrease.

Crown Holdings relies heavily on aluminum and steel, making it vulnerable to price swings. For instance, aluminum prices saw considerable volatility in 2023 and early 2024, influenced by global production levels and energy costs, directly affecting Crown's manufacturing expenses.

These commodity price fluctuations, whether due to geopolitical tensions affecting supply chains or shifts in global demand, can significantly squeeze Crown's profit margins. The cost of goods sold directly correlates with these raw material markets, impacting the company's bottom line.

To mitigate these risks, Crown Holdings employs strategies like hedging and robust supply chain management. These measures are vital to stabilize costs and maintain predictable profitability in the face of an unpredictable commodity landscape.

Rising inflation presents a significant challenge for Crown Holdings, potentially increasing operational expenses across labor, energy, and transportation sectors. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2024, impacting input costs for manufacturers.

Concurrently, elevated interest rates, such as those maintained by the Federal Reserve in late 2024 and early 2025, can escalate borrowing costs. This directly affects Crown Holdings' ability to finance capital expenditures and manage working capital, potentially influencing investment strategies and overall financial health.

Exchange Rate Fluctuations

Crown Holdings operates globally, meaning its financial results are exposed to fluctuations in various currencies. When these foreign currency earnings and expenses are translated back into the company's reporting currency, typically the US dollar, exchange rate volatility directly impacts reported revenues and costs. This can lead to unexpected swings in profitability and cash flow, making financial planning more challenging.

For instance, a stronger US dollar relative to currencies where Crown operates could reduce the reported value of its international sales. Conversely, a weaker dollar might boost reported international revenues but also increase the cost of imported materials. In 2024, major currency pairs like EUR/USD and USD/JPY experienced notable volatility, with the Euro trading in a range of approximately $1.07 to $1.12 against the dollar, and the Yen fluctuating between ¥145 and ¥160 per dollar. These movements directly affect Crown's consolidated financial statements.

Beyond reported financials, significant currency shifts can also influence the price competitiveness of Crown's products in different geographical markets. If the dollar strengthens considerably, products manufactured in the US and sold abroad become more expensive for foreign buyers, potentially dampening demand. This dynamic necessitates careful pricing strategies and hedging to mitigate the impact of adverse currency movements on market share and sales volume.

- Global Operations Exposure: Crown Holdings' international presence means its financial performance is inherently linked to exchange rate movements across numerous trading currencies.

- Profitability Impact: Fluctuations in exchange rates directly alter the translated value of revenues and expenses, creating potential for both gains and losses on Crown's consolidated income statement and impacting its bottom line.

- Competitive Landscape Shifts: Significant currency appreciation or depreciation can alter the relative pricing of Crown's products in international markets, affecting its competitive positioning and sales volumes.

- 2024 Currency Volatility: Major currency pairs like EUR/USD and USD/JPY saw considerable movement in 2024, with EUR/USD trading between roughly $1.07 and $1.12, and USD/JPY between ¥145 and ¥160, highlighting the real-time risks Crown faces.

Disposable Income and Demand for Premium Packaging

Changes in disposable income significantly shape consumer preferences for packaged goods, directly affecting the demand for premium packaging solutions. As consumers have more discretionary funds, they are often willing to pay a premium for enhanced product presentation and perceived quality, which translates to higher demand for innovative and aesthetically pleasing packaging from companies like Crown Holdings.

Conversely, economic downturns or stagnant wage growth can lead to a recalibration of consumer spending. In such scenarios, demand may pivot towards more cost-effective packaging options, forcing manufacturers to adapt their product mix and pricing strategies to remain competitive. For instance, a dip in consumer confidence can lead to a reduction in luxury goods purchases, impacting the demand for high-end packaging.

- Global Disposable Income Growth: Projections indicate continued growth in global disposable income, with the Asia-Pacific region expected to be a key driver. For example, a report from Statista in late 2024 projected that global disposable income would continue its upward trend, albeit with regional variations.

- Impact on Premium Goods: An increase in disposable income often correlates with a rise in demand for premium and specialty packaged goods, as consumers trade up for enhanced experiences.

- Economic Sensitivity: Packaging choices are sensitive to economic fluctuations; a decrease in disposable income can shift demand towards basic, functional packaging over elaborate designs.

- Strategic Pricing: Crown Holdings must continually monitor disposable income trends to optimize its product portfolio and pricing to align with evolving consumer purchasing power.

The economic environment significantly influences Crown Holdings' demand and cost structure. Global GDP growth of 3.2% projected for 2024 by the IMF suggests continued expansion, which generally supports consumer spending on packaged goods. However, potential slowdowns in major markets in late 2024 and 2025 could temper this demand, especially if consumer confidence weakens due to inflation or job market concerns.

Preview Before You Purchase

Crown Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Crown Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the external forces shaping the global packaging industry and Crown Holdings' position within it.

Sociological factors

Consumers worldwide increasingly favor packaging that is both eco-friendly and recyclable, a trend that significantly impacts companies like Crown Holdings. This growing preference stems from heightened environmental awareness and a desire to reduce personal ecological footprints.

Crown Holdings is well-positioned to leverage this shift, given that metal packaging, its core product, boasts a high and well-established recycling rate. For instance, in 2023, the U.S. recycling rate for aluminum cans reached approximately 49%, demonstrating the inherent sustainability of the material.

Failing to adapt to these evolving consumer expectations could pose a substantial risk to Crown Holdings. A disconnect with consumer demand for sustainable solutions might result in diminished brand reputation and a potential migration of market share towards competitors offering more environmentally conscious packaging alternatives.

The increasing consumer emphasis on health and wellness is significantly reshaping dietary patterns, directly impacting the demand for particular food and beverage packaging. For example, the growing popularity of functional beverages and plant-based alternatives, which are often perceived as healthier, could drive demand for specialized packaging solutions that maintain product integrity and appeal. Crown Holdings needs to adapt by offering innovative packaging that supports these evolving consumer preferences, potentially including formats designed for single servings or those that enhance the shelf-life of fresh ingredients.

Modern consumers increasingly value convenience, fueling demand for packaging that is easy to handle, transport, and consume on the go. Crown Holdings' beverage and food can offerings align with this, but ongoing advancements in easy-open closures and user-friendly designs are crucial. For instance, the global market for convenient food packaging is projected to reach $350 billion by 2027, highlighting the significant opportunity and competitive pressure.

Demographic Shifts and Urbanization

Global demographic shifts are profoundly reshaping consumer behavior and, consequently, packaging needs. By 2050, the United Nations projects that 68% of the world's population will live in urban areas, a significant increase from 56% in 2021. This escalating urbanization often correlates with busier lifestyles and a greater demand for convenience. Crown Holdings, a major player in rigid packaging, must adapt its product lines to cater to these evolving preferences.

Smaller household sizes, a trend observed across many developed and developing nations, directly impact the demand for specific packaging formats. For instance, a single-person household is less likely to purchase large family-sized containers. This suggests a growing market for single-serving or smaller-portion packaging solutions, a segment Crown Holdings can leverage. The aging global population also presents opportunities, as older consumers may seek easier-to-open packaging and lighter materials.

- Urbanization Impact: Increased urban living drives demand for convenient, ready-to-consume food and beverage packaging.

- Household Size Trends: Smaller households favor smaller pack sizes, influencing product portfolio design.

- Aging Population: An aging demographic may require packaging with enhanced usability features, such as easy-open mechanisms.

- Consumption Pattern Shifts: These demographic changes necessitate flexible and diverse packaging solutions to meet varied consumer needs.

Social Media and Brand Perception

Social media's omnipresence means consumer opinions about brands like Crown Holdings can shift dramatically and quickly. For instance, a viral post highlighting a company's environmental impact or labor practices can significantly alter public perception. Crown's commitment to sustainability, such as its 2023 goal to reduce greenhouse gas emissions by 15% compared to a 2019 baseline, is a key area of public interest on these platforms.

The scrutiny of brand actions extends to product safety and corporate social responsibility. Consumers increasingly expect transparency and ethical conduct from the companies they patronize. Crown Holdings' engagement in community initiatives, like its support for local recycling programs, is often discussed and evaluated online, directly impacting its brand equity.

Maintaining a positive online presence is therefore paramount. This involves proactive communication about Crown's sustainability targets, such as its 2024 aim to increase the use of recycled content in its beverage cans, and demonstrating a commitment to ethical operations. Negative sentiment can spread rapidly, making consistent, honest communication essential for safeguarding brand value.

- Social media's impact on brand perception is undeniable, with consumer sentiment able to change rapidly.

- Crown Holdings' sustainability initiatives, such as its 2023 greenhouse gas reduction targets, are under constant public observation.

- Product safety and corporate social responsibility are key discussion points online, directly influencing brand equity.

- Transparent communication and ethical practices are vital for maintaining a positive public image for Crown Holdings.

Societal expectations around health and wellness are increasingly influencing consumer choices, directly impacting the types of products packaged by companies like Crown Holdings. The growing demand for functional beverages and plant-based alternatives, often perceived as healthier, drives the need for specialized packaging that maintains product integrity and appeal. This trend highlights an opportunity for Crown to innovate with packaging formats that support these evolving consumer preferences, such as single-serving options or those designed to extend the shelf-life of fresh ingredients.

Consumer demand for convenience continues to rise, pushing for packaging that is easy to handle and consume on the go. Crown's existing beverage and food can offerings are well-suited to this, but continuous improvement in areas like easy-open closures and user-friendly designs is crucial. The global convenient food packaging market is projected to reach $350 billion by 2027, underscoring both the significant opportunity and the competitive landscape.

Demographic shifts, particularly increasing urbanization, are reshaping consumer behavior and packaging needs. By 2050, the UN projects 68% of the world's population will live in urban areas, up from 56% in 2021. This trend correlates with busier lifestyles and a greater demand for convenience, necessitating that Crown adapt its rigid packaging product lines to meet these evolving preferences.

Smaller household sizes are becoming more common globally, directly influencing the demand for specific packaging formats. Single-person households, for instance, are less likely to purchase large, family-sized containers, indicating a growing market for single-serving or smaller-portion packaging solutions. The aging global population also presents opportunities, with older consumers often seeking easier-to-open packaging and lighter materials.

| Sociological Factor | Impact on Crown Holdings | Supporting Data/Trend |

|---|---|---|

| Health & Wellness Focus | Drives demand for specialized packaging for functional beverages and plant-based alternatives. | Growing consumer preference for perceived healthier options. |

| Convenience Demand | Requires easy-to-handle, on-the-go packaging solutions, with continuous innovation in closures. | Global convenient food packaging market projected to reach $350 billion by 2027. |

| Urbanization | Increases demand for convenient, ready-to-consume food and beverage packaging. | UN projects 68% global population in urban areas by 2050 (up from 56% in 2021). |

| Smaller Households/Aging Population | Favors smaller pack sizes and packaging with enhanced usability features like easy-open mechanisms. | Trend towards single-person households and an aging demographic. |

Technological factors

Crown Holdings benefits from continuous technological advancements in automation and robotics. These innovations are crucial for boosting manufacturing efficiency, cutting labor expenses, and elevating product quality. For instance, in 2023, the company continued to invest in advanced manufacturing technologies, aiming to streamline operations and maintain its competitive edge in a dynamic market.

By adopting cutting-edge machinery and optimizing production processes, Crown Holdings can achieve higher output volumes, minimize waste, and enhance its cost competitiveness. This strategic focus on technological upgrades allows the company to respond more nimbly to fluctuating market demands, a key advantage in the global packaging industry.

Advancements in material science are directly impacting the packaging industry. Developments in lighter-weight metals and advanced alloys are enabling the creation of more efficient and sustainable packaging solutions. For instance, the ongoing evolution of aluminum alloys, crucial for beverage cans, aims to reduce material usage while maintaining structural integrity. Crown Holdings, a major player, benefits from these innovations by offering packaging that can improve product performance and reduce transportation costs.

Innovative internal coatings for cans are also a significant technological factor. These coatings are designed to enhance product safety, prevent interactions between the contents and the metal, and extend shelf life. As regulatory standards for food and beverage packaging become more stringent, particularly concerning migration of substances, Crown Holdings' ability to adopt and develop these advanced coatings is vital. This allows them to meet specific customer needs and maintain a competitive edge in a health-conscious market.

The company's commitment to research and development in material science and coatings is a key driver for future growth. In 2023, Crown Holdings reported significant investment in R&D, focusing on areas like sustainable materials and advanced barrier technologies for their packaging solutions. This strategic focus ensures they can adapt to market demands for improved functionality, environmental responsibility, and enhanced product protection, directly influencing their market position and profitability.

Crown Holdings is leveraging digitalization to transform its supply chain. The integration of AI, IoT, and big data analytics allows for more precise demand forecasting and optimized inventory management. This digital shift is crucial for navigating the complexities of global logistics and improving responsiveness to market shifts, a key advantage in the packaging industry.

Real-time data insights are directly contributing to cost reductions. For instance, by optimizing transportation routes and load consolidation through advanced analytics, Crown Holdings can significantly lower fuel consumption and shipping expenses. This operational efficiency is projected to yield substantial savings, especially as global shipping costs remain a significant factor in 2024 and 2025.

A digitally integrated supply chain inherently builds greater resilience. By having better visibility into every stage of the process, from raw material sourcing to final product delivery, Crown Holdings can more effectively mitigate disruptions. This enhanced operational agility is vital for maintaining consistent supply and meeting customer demands in an increasingly unpredictable global marketplace.

Development of Smart and Interactive Packaging

The integration of smart technologies into packaging represents a significant technological shift. Emerging tools such as QR codes, NFC tags, and augmented reality (AR) are transforming static packaging into dynamic, interactive experiences for consumers. This innovation not only boosts consumer engagement but also provides critical benefits like enhanced product traceability and robust anti-counterfeiting capabilities.

While these advancements are more established in flexible packaging, their potential for rigid packaging, where Crown Holdings has a strong presence, is substantial. Exploring these interactive features could unlock new value propositions, setting Crown Holdings' products apart in a competitive market. For instance, a 2024 report indicated that 65% of consumers are more likely to purchase a product with smart packaging features that offer additional information or interactive content.

- Enhanced Consumer Engagement: Interactive packaging can provide personalized content, promotions, and product information, fostering a deeper connection with consumers.

- Improved Traceability and Authenticity: Technologies like NFC tags allow for seamless tracking of products throughout the supply chain, aiding in combating counterfeiting and ensuring product integrity.

- New Revenue Streams: Smart packaging can open avenues for data collection and personalized marketing, potentially creating new revenue opportunities for packaging manufacturers and their clients.

Recycling Technology and Infrastructure Improvements

Innovations in recycling technologies, like advanced sorting systems, are making it more efficient and profitable to reclaim metals from challenging packaging formats. These advancements directly benefit companies like Crown Holdings by bolstering the circularity of their metal products.

A strong recycling infrastructure is crucial for Crown Holdings, as it underpins their sustainability objectives and ensures a consistent supply of recycled aluminum and steel. For instance, the U.S. recycling rate for aluminum cans reached approximately 45% in 2023, a figure Crown Holdings aims to support and enhance through its operations.

Crown Holdings actively engages in collaborations to further improve recycling processes and infrastructure. These partnerships are vital for driving progress in material recovery and achieving higher recycling rates, which in turn supports the economic viability of metal packaging.

- Enhanced Sorting: Technologies like optical sorters and artificial intelligence are improving the separation of different metal types, increasing purity and value.

- Circular Economy Support: Robust recycling infrastructure directly feeds Crown Holdings' supply chain with recycled content, reducing reliance on virgin materials.

- Industry Collaboration: Partnerships with waste management companies and industry associations are key to expanding collection and improving processing capabilities.

Technological advancements in automation and AI are significantly boosting Crown Holdings' manufacturing efficiency, leading to reduced labor costs and improved product quality. The company continued its investment in advanced manufacturing technologies throughout 2023 to maintain its competitive edge.

Innovations in material science, particularly lighter-weight aluminum alloys, are enabling more sustainable and cost-effective packaging solutions for Crown Holdings. These developments are crucial for enhancing product performance and lowering transportation expenses.

Digitalization is transforming Crown Holdings' supply chain through AI and big data, enabling more accurate demand forecasting and optimized inventory management. This digital integration enhances operational resilience and cost reduction, especially with real-time data insights improving transportation logistics.

Smart packaging technologies like QR codes and NFC tags are creating interactive consumer experiences and improving product traceability for Crown Holdings. A 2024 report indicated that 65% of consumers prefer smart packaging, highlighting its growing importance.

Legal factors

Crown Holdings operates under a complex web of global packaging and food safety regulations, including those from the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). These regulations dictate everything from the chemical composition of food contact materials to allowable migration levels of substances into food. For instance, the FDA's 21 CFR Part 177 outlines approved polymers for food packaging, and non-compliance can lead to product recalls and significant fines.

Adherence to these evolving standards is critical for Crown Holdings' market access and reputation. In 2024, the industry continues to see increased scrutiny on materials like PFAS, with potential bans or restrictions being considered by various regulatory bodies worldwide. Staying ahead of these changes, such as investing in research for compliant alternatives, is essential to mitigate risks and ensure continued business operations.

Environmental legislation, such as the EU's Circular Economy Action Plan which aims to increase recycling rates and reduce waste, directly influences Crown Holdings' packaging solutions. These regulations, including waste reduction targets and extended producer responsibility (EPR) schemes, necessitate investments in sustainable materials and product design to meet evolving compliance requirements.

Crown Holdings must navigate a complex web of environmental laws, including those focused on waste management and recycling mandates across its global operations. For instance, in 2023, the company continued to invest in technologies and processes to improve the recyclability of its aluminum cans, aligning with increasing governmental pressure and consumer demand for more sustainable packaging options.

Adherence to these stringent environmental standards, such as those pertaining to plastic waste reduction or the promotion of recycled content in packaging, requires significant capital expenditure and robust reporting mechanisms. Failure to comply can result in substantial fines and damage to Crown's reputation, impacting its ability to operate and attract environmentally conscious investors.

Antitrust and competition laws are significant for Crown Holdings, a global packaging leader. These regulations, enforced by bodies like the U.S. Federal Trade Commission (FTC) and the European Commission, aim to prevent market monopolization and ensure fair play. For instance, in 2023, the FTC continued its robust enforcement, scrutinizing several large mergers across various industries, setting a precedent for how such deals are reviewed.

Crown Holdings must ensure all its mergers, acquisitions, and strategic partnerships comply with these stringent rules. Failure to do so could result in hefty fines, forced divestitures of business units, or prolonged legal battles, impacting its financial performance and market position. The company's ability to grow through strategic consolidation hinges on navigating this complex legal landscape effectively.

Maintaining a competitive environment is paramount for Crown Holdings' long-term success. The company's commitment to fair competition not only avoids legal repercussions but also fosters innovation and customer choice within the packaging sector. This focus on ethical market practices supports sustainable growth and strengthens its reputation as a responsible industry participant.

Labor Laws and Employment Regulations

Crown Holdings navigates a complex web of international labor laws, impacting everything from hiring practices to termination procedures. For instance, in 2024, many European nations continued to strengthen worker protections, potentially increasing compliance costs for multinational corporations.

Failure to adhere to these varied regulations, which cover aspects like minimum wage, working hours, and union rights, can lead to significant penalties and operational disruptions. Crown Holdings' commitment to fair labor practices is thus not only a legal necessity but also a critical component of its brand reputation.

Key areas of focus include:

- Compliance with minimum wage laws across all operating regions, which can vary significantly year-over-year.

- Adherence to regulations on working hours and overtime pay, a frequent point of contention and legal scrutiny.

- Ensuring fair treatment and non-discrimination in employment practices, aligning with global human rights standards.

- Managing employee benefits and social security contributions according to local mandates, a growing area of complexity.

Intellectual Property Rights and Patent Protection

Crown Holdings' competitive edge hinges on robust intellectual property protection, particularly patents covering its innovative packaging designs, advanced manufacturing techniques, and unique material formulations. The company actively navigates legal frameworks for patent registration and enforcement, as seen in its ongoing efforts to safeguard its technological advancements. For instance, in 2023, the company reported continued investment in R&D, a key driver for patentable innovations, though specific patent litigation details remain proprietary.

The legal landscape surrounding patent registration, enforcement, and infringement directly impacts Crown Holdings' ability to maintain its market position. Staying abreast of evolving patent laws and actively defending its intellectual property against potential infringements is crucial to prevent costly legal battles and protect its technological investments. The company's commitment to innovation is reflected in its consistent R&D spending, which fuels the development of new patentable technologies.

Furthermore, Crown Holdings places significant emphasis on respecting the intellectual property rights of other entities. Proactive measures to avoid infringing on existing patents are essential to circumvent potential legal disputes and associated financial liabilities. This diligence ensures operational continuity and avoids disruptions that could arise from intellectual property conflicts.

- Patent Portfolio Management: Crown Holdings actively manages its patent portfolio to protect innovations in areas like advanced can coatings and sustainable packaging materials.

- R&D Investment: The company's commitment to research and development, a significant portion of its operational budget, directly supports the generation of new intellectual property. In 2023, Crown Holdings allocated substantial resources to R&D, aiming to secure patents for next-generation packaging solutions.

- Legal Compliance: Adherence to intellectual property laws in all operating regions is paramount, minimizing the risk of infringement claims and fostering a secure environment for technological advancement.

- Enforcement Strategies: Crown Holdings employs legal strategies to enforce its patent rights, ensuring that its proprietary technologies are not unlawfully replicated by competitors.

Crown Holdings must navigate a complex global regulatory environment, including stringent food safety standards from bodies like the FDA and EFSA, which dictate material composition and allowable substance migration. The company also faces evolving environmental legislation, such as the EU's Circular Economy Action Plan, pushing for increased recyclability and reduced waste, necessitating investment in sustainable materials and design.

Environmental factors

The growing global emphasis on environmental sustainability directly fuels demand for packaging crafted from highly recyclable materials like aluminum and steel, which are central to Crown Holdings' operations. This aligns perfectly with the company's business model, positioning it to capitalize on the shift towards a circular economy.

Crown Holdings actively promotes the inherent recyclability of metal packaging, a key advantage in a market increasingly prioritizing eco-friendly solutions. For instance, the U.S. recycling rate for aluminum cans reached approximately 49% in 2023, a figure Crown aims to leverage by highlighting the material's infinite recyclability compared to less sustainable alternatives.

Crown Holdings faces increasing pressure from regulators and stakeholders to curb greenhouse gas emissions and energy use, a trend impacting manufacturers globally. This translates into a challenge for Crown to shrink its carbon footprint across its entire value chain, from acquiring raw materials to production and delivery.

Meeting these environmental targets necessitates significant investment in renewable energy sources and more efficient technologies. For instance, Crown Holdings has been actively pursuing sustainability initiatives, aiming for a 15% reduction in absolute Scope 1 and 2 greenhouse gas emissions by 2030 compared to a 2019 baseline. In 2023, the company reported a 6% reduction in absolute Scope 1 and 2 emissions.

Crown Holdings, a major player in the packaging industry, faces significant environmental challenges related to water. Its manufacturing processes, especially for metal and plastic packaging, are inherently water-intensive, requiring substantial volumes for cooling, cleaning, and other operations. As global water scarcity intensifies, particularly in regions where Crown operates, the company must prioritize water efficiency.

Stricter regulations on wastewater discharge are also a growing concern. For instance, in 2023, the European Union continued to implement and enforce its Urban Wastewater Treatment Directive, impacting industrial discharge standards. Crown Holdings is compelled to invest in advanced wastewater treatment technologies to meet these evolving environmental standards and minimize its ecological footprint.

Strategic water management is therefore crucial for Crown's long-term sustainability and operational resilience. This includes implementing water reduction initiatives, exploring water recycling and reuse programs, and ensuring robust compliance with local and international environmental regulations. By proactively addressing these water-related factors, Crown can mitigate risks and enhance its corporate responsibility profile.

Waste Management and Circular Economy Initiatives

The global shift towards a circular economy significantly influences Crown Holdings, pushing for reduced waste and increased resource efficiency in its packaging operations. This trend encourages the development of robust collection, sorting, and recycling systems for its aluminum and steel cans, as well as its rigid and flexible packaging products. For instance, in 2023, Crown Holdings reported that 78% of the aluminum used in its beverage cans was recycled content, a figure that aligns with circular economy principles and highlights the company's ongoing efforts in this area.

Crown Holdings' engagement in circular economy initiatives is crucial for its long-term sustainability and market positioning. The company actively collaborates with recycling partners and invests in infrastructure designed to facilitate closed-loop systems, thereby enhancing the recyclability and reuse of its packaging materials. This strategic focus is vital as regulatory pressures and consumer demand for sustainable packaging solutions continue to grow worldwide.

- Circular Economy Impact: The global drive for circularity necessitates minimizing waste and maximizing the lifespan and recyclability of packaging.

- Crown's Role: Crown Holdings is increasingly focused on enhancing the collection, sorting, and recycling infrastructure for its products.

- Recycling Rates: In 2023, Crown Holdings utilized approximately 78% recycled aluminum in its beverage cans, demonstrating progress in material circularity.

- Strategic Investments: Collaborations with recycling organizations and investments in closed-loop systems are key to Crown's sustainability strategy.

Biodiversity and Ecosystem Impact

While metal packaging generally has a lower direct impact on biodiversity than some other materials, Crown Holdings must remain diligent in its sourcing and operational practices. Responsible mining for aluminum and steel, crucial raw materials, and managing the ecological footprint of its manufacturing plants are key considerations. For instance, in 2023, Crown Holdings reported on its efforts to improve water efficiency, a factor indirectly linked to ecosystem health, by reducing its water withdrawal intensity by 12% since 2015.

The company's environmental strategy acknowledges the need to assess the broader supply chain's impact. This includes scrutinizing the mining sector's practices, which can affect land use and local ecosystems. Crown Holdings is committed to responsible land management and stringent pollution control measures across its global operations to mitigate any adverse effects on biodiversity.

Crown Holdings' sustainability goals, as outlined in their 2024 reporting, emphasize a commitment to minimizing environmental impact throughout their value chain.

- Responsible Sourcing: Ensuring raw materials like aluminum and steel are sourced from suppliers adhering to environmental and social standards.

- Operational Footprint: Implementing measures at manufacturing facilities to reduce pollution, manage waste effectively, and conserve resources like water and energy.

- Supply Chain Transparency: Working towards greater visibility into the environmental practices of upstream suppliers, particularly in mining operations.

- Ecosystem Protection: Adopting land-use policies that consider local biodiversity and implementing pollution control technologies to safeguard natural habitats.

Crown Holdings is navigating increasing environmental regulations and a strong consumer push for sustainability, particularly concerning packaging materials. The company's focus on aluminum and steel, which are highly recyclable, positions it well to meet these demands. For instance, in 2023, Crown reported that 78% of the aluminum used in its beverage cans was recycled content, a significant step towards a circular economy.

The company is actively working to reduce its carbon footprint, with a target of a 15% reduction in absolute Scope 1 and 2 greenhouse gas emissions by 2030 from a 2019 baseline. By 2023, Crown had achieved a 6% reduction in these emissions, demonstrating tangible progress in its sustainability efforts.

Water scarcity and stricter wastewater discharge regulations present ongoing challenges. Crown is investing in water efficiency and advanced treatment technologies to comply with standards like the EU's Urban Wastewater Treatment Directive, aiming to mitigate its water-intensive operations.

Crown's commitment to responsible sourcing and land management is crucial, especially given the environmental impact of mining raw materials. The company's 2024 sustainability goals emphasize supply chain transparency and ecosystem protection, reflecting a broader strategy to minimize its overall environmental impact.

| Environmental Factor | Crown Holdings' Response/Data | Year |

|---|---|---|

| Recycled Content in Beverage Cans | 78% recycled aluminum | 2023 |

| Scope 1 & 2 GHG Emissions Reduction Target | 15% reduction from 2019 baseline by 2030 | |

| Achieved Scope 1 & 2 GHG Emissions Reduction | 6% reduction from 2019 baseline | 2023 |

| Water Withdrawal Intensity Reduction | 12% reduction since 2015 | 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Crown Holdings is built on a robust foundation of data from official government publications, leading financial news outlets, and reputable industry analysis firms. This ensures that insights into political, economic, social, technological, legal, and environmental factors are current and fact-based.