Crown Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Holdings Bundle

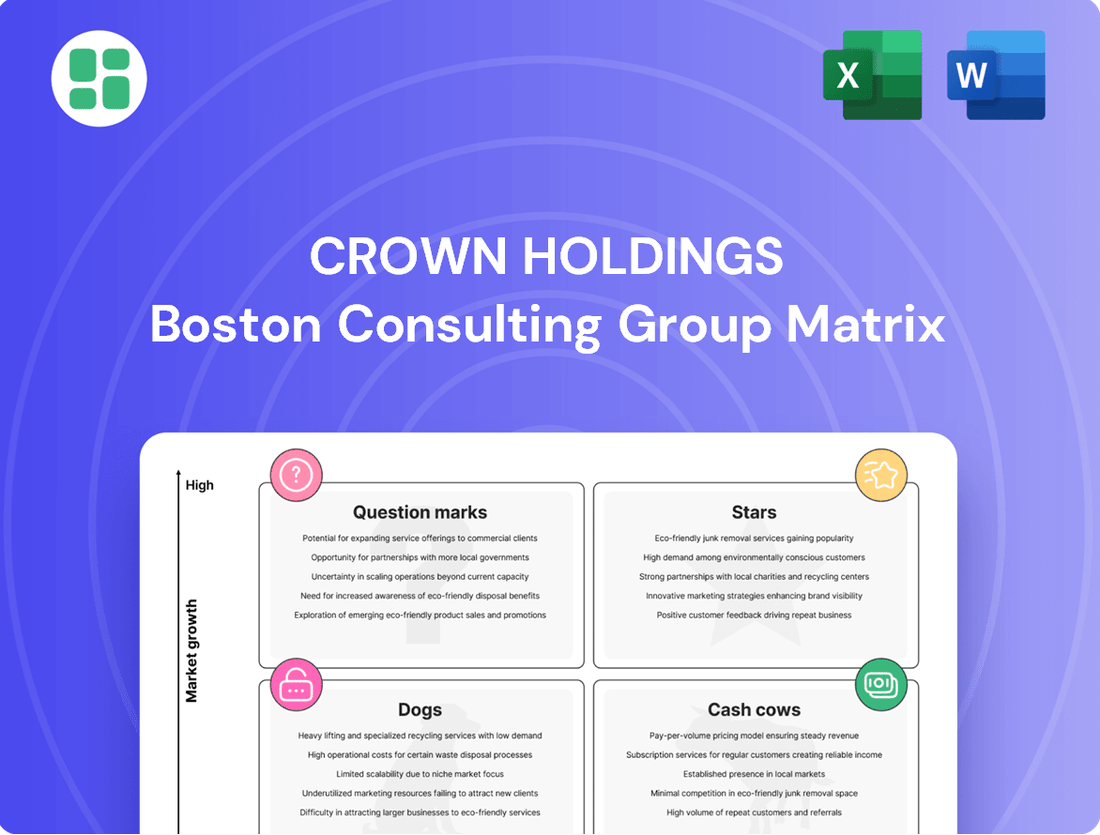

Crown Holdings' BCG Matrix is a powerful tool for understanding its product portfolio's market share and growth potential. See which of their offerings are Stars, Cash Cows, Dogs, or Question Marks. Purchase the full report for a comprehensive breakdown and actionable strategies to optimize their business.

Stars

Global Aluminum Beverage Cans represent a significant portion of Crown Holdings' business, making up 67% of its revenue in 2024. This segment is a strong performer, with global beverage can shipments growing by 5% in 2024, underscoring its importance to the company's overall financial health.

The outlook for the global beverage cans market is very positive, with an expected compound annual growth rate of 5.8% between 2025 and 2034. Crown Holdings is well-positioned to capitalize on this, as evidenced by its consistent volume growth in key markets such as Brazil, North America, and Europe.

Crown Holdings' commitment to sustainability, exemplified by its Twentyby30™ program, positions its sustainable packaging solutions as a key growth driver, aligning with its Stars in the BCG Matrix. This program targets significant reductions in greenhouse gas emissions, water usage, and waste, reflecting a proactive approach to environmental responsibility.

The company's focus on aluminum cans, a cornerstone of its product portfolio, is particularly advantageous. Aluminum's infinite recyclability and inherent circularity make it the preferred choice for environmentally conscious brands and consumers. This inherent sustainability is a major tailwind, fueling robust demand for Crown's offerings.

In 2024, the demand for sustainable packaging continued its upward trajectory, with a significant portion of consumers indicating a willingness to pay a premium for eco-friendly options. This trend directly benefits Crown, as its aluminum cans are perfectly positioned to capture this growing market segment, reinforcing their status as a Star product.

Beverage cans are the go-to packaging for about 80% of new beverage launches, driven by both consumers switching to cans and innovative new drinks hitting the market. This strong preference highlights a booming market for a wide array of beverages, from specialized hydration drinks to novel alcoholic and non-alcoholic options. Crown's capacity to support these developing product categories firmly places its beverage can division in the Star quadrant.

Beverage Cans in Emerging High-Growth Regions

Beverage cans in emerging high-growth regions represent a significant growth engine for Crown Holdings, solidifying their position as Stars in the BCG Matrix. These markets, characterized by rapidly expanding middle classes and increasing disposable incomes, are driving robust volume expansion for beverage packaging. Crown's strategic investments and operational presence in these dynamic economies are key to capitalizing on this upward trend.

Crown Holdings has experienced substantial volume growth in key emerging markets, notably Brazil and Mexico. For instance, in 2024, Crown reported significant volume increases in its Latin American segment, often outperforming the more mature North American and European markets. This growth is directly attributable to the rising demand for beverages in these regions, where the beverage can is a preferred packaging format.

- High Growth Rates: Emerging markets like Brazil and Mexico consistently exhibit higher beverage consumption growth rates compared to developed economies, providing a fertile ground for volume expansion.

- Market Share Expansion: Crown's focused strategy allows it to capture a larger share of these expanding consumer bases, translating into significant revenue and profit growth.

- Strategic Focus: The company's commitment to investing in and adapting to the needs of these high-growth regions underpins its Star status within the portfolio.

- 2024 Performance: Crown's Latin American operations, heavily influenced by these emerging markets, demonstrated double-digit volume growth in key product categories throughout 2024, reflecting the strength of this segment.

Two-Piece Metal Beverage Cans

The two-piece metal beverage can segment, primarily aluminum, represents a significant portion of the expanding beverage can market. This market was valued at approximately USD 28.6 billion in 2024 and is anticipated to grow to USD 50.3 billion by 2034.

Crown Holdings is a prominent player in this segment. The advantages of two-piece cans, such as their light weight, recyclability, and cost-effective manufacturing, contribute to their widespread adoption.

The consistent and robust demand for two-piece cans across a diverse range of beverage types underscores Crown's substantial market share within this expanding industry.

- Market Value: The global beverage can market was valued at USD 28.6 billion in 2024.

- Projected Growth: Expected to reach USD 50.3 billion by 2034.

- Key Advantages: Lightweight, recyclable, and efficient production.

- Crown's Position: A leading producer in this high-demand segment.

Crown Holdings' Global Aluminum Beverage Cans segment is a clear Star in its BCG Matrix. This is driven by the segment's high market share in a rapidly growing industry, fueled by consumer preference for sustainable and convenient packaging. The segment's 67% contribution to Crown's 2024 revenue and a projected 5.8% CAGR for the beverage can market between 2025 and 2034 highlight its stellar performance and future potential.

| Segment | Market Growth | Crown's Market Share | BCG Status |

|---|---|---|---|

| Global Aluminum Beverage Cans | High (5.8% CAGR 2025-2034) | High (67% of 2024 Revenue) | Star |

| Emerging Markets (Brazil, Mexico) | Very High | Increasing | Star Driver |

| Sustainable Packaging Solutions | High | Strong | Star Enabler |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Crown Holdings' Stars, Cash Cows, Question Marks, and Dogs.

Crown Holdings' BCG Matrix provides a clear, visual overview of its business units, relieving the pain of strategic uncertainty.

Cash Cows

Crown Holdings' traditional metal food cans are a classic Cash Cow within its BCG Matrix. This segment operates in a mature, yet remarkably stable, global market. Projections indicate the global food cans market will see a compound annual growth rate (CAGR) between 2.89% and 6.75% from 2025 to 2034, underscoring its steady, albeit not explosive, expansion.

The consistent demand for these cans means they are a reliable source of substantial cash flow for Crown. Because the market is well-established, there's less need for aggressive marketing spend. This allows the company to maintain high profit margins, making these products a vital contributor to its overall financial health.

Three-piece metal food cans, a cornerstone of the packaging industry, are projected to hold a significant 33.6% of the canned food packaging market share by 2025. Crown Holdings, a major producer, leverages the inherent strength and affordability of these cans, which are favored for their durability and cost-effectiveness in food packaging.

This segment represents a stable demand for Crown, translating into consistent revenue streams and robust cash generation. The widespread adoption of these cans in the food industry underpins their status as a cash cow for the company.

Crown Holdings, a leading Tier 1 aerosol can manufacturer, holds a strong position in established markets such as personal care, household products, and automotive. These segments, while mature, exhibit consistent consumer demand, allowing Crown to generate stable cash flow.

The company's extensive history and significant market share in these areas translate into efficient production and reliable revenue streams. For instance, the global aerosol can market was valued at approximately $65 billion in 2023 and is projected to grow steadily, with these established applications forming a substantial portion of that value.

Standard Metal Closures

Standard Metal Closures represent a significant Cash Cow for Crown Holdings. As a primary supplier of these essential components for a wide array of consumer goods, Crown operates within mature markets characterized by steady demand and substantial transaction volumes.

The company's entrenched market position and highly optimized production processes for closures translate directly into dependable, consistent cash generation. These operations require relatively minimal reinvestment for growth, allowing the generated cash to be deployed elsewhere within the business or returned to shareholders.

- Market Maturity: The markets for standard metal closures are well-established, offering predictable revenue streams.

- High Volume, Stable Demand: These closures are ubiquitous in consumer packaged goods, ensuring consistent demand.

- Efficient Operations: Crown's manufacturing expertise drives profitability and cash flow from this segment.

- Cash Generation: The segment reliably produces excess cash due to its mature nature and low capital expenditure requirements.

General Industrial Packaging

Within Crown Holdings' extensive transit and protective packaging segment, general industrial packaging products operate as cash cows. These are established offerings, not driven by rapid technological shifts or specialized high-growth niches.

While the broader transit packaging market experiences growth, these mature industrial applications deliver dependable revenue. For instance, in 2023, Crown's overall sales reached $13.4 billion, with its Packaging segment contributing significantly, showcasing the stability of its mature product lines.

Crown leverages its vast manufacturing infrastructure and established client base to ensure consistent profitability from these cash cow products.

- Cash Cow Status: Mature industrial packaging products provide stable, predictable revenue streams for Crown Holdings.

- Market Position: These offerings benefit from Crown's extensive manufacturing footprint and existing customer relationships.

- Financial Contribution: They contribute to the overall financial health of the Packaging segment, which is a key part of Crown's business.

- Profitability Driver: Their low need for significant R&D investment and established market share allows for consistent profitability.

Crown Holdings' established beverage can segment is a prime example of a Cash Cow. This sector benefits from consistent consumer demand and a well-defined market, ensuring reliable cash flow generation for the company.

The global beverage can market is projected to grow steadily, with an estimated CAGR of around 3.5% between 2024 and 2030, highlighting the enduring appeal and stability of this product category.

Crown's significant market share and efficient manufacturing processes in this area allow for high profitability with minimal incremental investment. This stability makes the beverage can segment a cornerstone of Crown's financial performance, enabling the allocation of capital to other strategic growth areas.

| Segment | BCG Category | Key Characteristics | Financial Impact |

|---|---|---|---|

| Beverage Cans | Cash Cow | Mature market, consistent demand, high volume production | Reliable, substantial cash flow generation |

| Food Cans | Cash Cow | Stable global market, steady expansion (2.89%-6.75% CAGR 2025-2034) | Consistent revenue, high profit margins |

| Aerosol Cans | Cash Cow | Established markets (personal care, household), steady consumer demand | Stable cash flow, efficient production |

Preview = Final Product

Crown Holdings BCG Matrix

The BCG Matrix analysis of Crown Holdings you are currently previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously crafted with industry-specific data, offers actionable insights into Crown Holdings' product portfolio, categorizing each segment as Stars, Cash Cows, Question Marks, or Dogs. You can confidently expect the same detailed analysis and professional formatting in the version you download, making it ready for immediate integration into your strategic planning and decision-making processes.

Dogs

Crown Holdings finalized the sale of its stake in Eviosys, a European tinplate packaging company, in December 2024. This move signals a strategic decision to exit a segment that likely didn't align with core objectives or wasn't meeting performance expectations, fitting the profile of a Dog in the BCG Matrix.

The divestiture resulted in a substantial gain for Crown Holdings, underscoring the company's initiative to optimize its business structure and reallocate resources toward higher-growth or more strategically important areas. This action reflects a commitment to portfolio refinement.

Within Crown Holdings' Transit Packaging segment, specific sub-segments are showing signs of weakness, despite overall market growth. In 2024, this unit saw reduced volumes and profitability, indicating challenges in key product lines. These underperforming areas are essentially cash traps, consuming capital without generating sufficient returns, a common characteristic of Question Marks or potential Dogs in a BCG matrix analysis.

Within Crown Holdings' portfolio, certain legacy food packaging lines might be classified as Dogs. These are often older technologies or products serving markets with shrinking consumer bases or facing significant pressure from newer, more sustainable alternatives. For instance, packaging for specific types of canned goods that are seeing reduced consumption due to changing dietary habits or the rise of fresh alternatives could fall into this category.

These segments likely contribute very little to Crown's overall revenue and profitability. They typically require ongoing investment to maintain operations but offer minimal potential for future growth or market share expansion. The cash generation from these lines is usually low, barely covering their operational costs, and they present a challenge in terms of capital allocation.

Niche Industrial Packaging with Low Volume

Niche industrial packaging with low volume, serving highly specialized or declining industrial applications, represents Crown Holdings' Dogs. These segments often feature marginal market share for Crown and may experience disproportionately high production costs relative to their revenue. Consequently, these low-volume, low-growth niches contribute minimally to the company's overall profitability.

For instance, consider specialized containers for legacy industrial equipment or niche chemical containment. While these might represent a small fraction of Crown's vast portfolio, their operational costs can outweigh their revenue generation. In 2024, Crown Holdings' diversified product lines, including beverage cans, specialty packaging, and aerosol cans, generated billions in revenue, with these niche industrial segments likely accounting for a very small percentage, potentially in the tens of millions, and often with lower margins compared to core offerings.

- Low Market Share: Crown's presence in these highly specialized industrial packaging niches is often small, reflecting limited demand or intense competition from smaller, specialized players.

- Low Growth Prospects: The underlying industrial applications these packages serve are typically mature or in decline, offering little opportunity for significant expansion.

- High Production Costs: The specialized nature and low volumes often lead to inefficient production runs, increasing per-unit costs and reducing profitability.

- Minimal Profit Contribution: These segments are unlikely to be major drivers of Crown's overall financial performance, often viewed as legacy products or necessary but unprofitable offerings.

High-Cost, Low-Efficiency Manufacturing Operations

Within Crown Holdings' extensive operations, certain manufacturing facilities or product lines may be characterized as high-cost, low-efficiency units. These segments, lacking substantial potential for significant improvement or turnaround, represent areas where operational expenses outstrip output gains. Crown's stated commitment to enhancing manufacturing performance, as evidenced by their continuous improvement initiatives, suggests a strategic focus on identifying and addressing these less productive segments.

While specific examples are not detailed in publicly available information, the concept of high-cost, low-efficiency operations is a common challenge in large manufacturing conglomerates. For instance, older facilities with outdated machinery or those in regions with higher labor and energy costs could fall into this category. Crown's financial reports, such as their 2023 annual filings, often discuss capital expenditures aimed at modernizing plants and increasing automation, indirectly highlighting the existence of less efficient legacy operations.

- Identify underperforming facilities: Crown Holdings likely has internal metrics to flag manufacturing sites with suboptimal cost-to-output ratios.

- Focus on efficiency improvements: Efforts to upgrade technology and streamline processes are key to tackling these issues.

- Strategic review of assets: Less efficient operations might be candidates for divestiture or significant restructuring if turnaround potential is limited.

- Impact on profitability: High-cost, low-efficiency operations directly reduce overall profit margins for the company.

Crown Holdings' divestiture of its Eviosys stake in December 2024 aligns with the characteristics of a Dog in the BCG Matrix, representing an exit from an underperforming segment. Niche industrial packaging serving declining applications also fits this profile, often having low market share, minimal growth, and high production costs, thus contributing little to overall profitability.

These segments require ongoing investment but offer limited future growth potential, acting as cash traps. For example, specialized containers for legacy industrial equipment, likely representing a small fraction of Crown's billions in revenue, may have lower margins and higher costs compared to core offerings.

The company's focus on improving manufacturing performance and modernizing facilities, as seen in capital expenditures discussed in 2023 filings, suggests an effort to address high-cost, low-efficiency operations that also fall into the Dog category.

| BCG Category | Crown Holdings Example | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|---|

| Dogs | Eviosys Stake (Divested 2024) | Low | Low/Declining | Low/Negative | Divestiture/Restructuring |

| Dogs | Niche Industrial Packaging | Low | Low/Declining | Low | Minimize investment, potential divestiture |

| Dogs | High-Cost, Low-Efficiency Facilities | N/A (Internal Operations) | N/A | Low/Negative | Efficiency improvements, potential closure/divestiture |

Question Marks

Crown Holdings is actively investing in advanced and smart packaging solutions, representing a potential Stars or Question Marks in the BCG matrix. Innovations like AI-powered defect detection systems and child-safe, tamper-resistant containers are being explored to meet growing consumer safety and operational efficiency demands.

These cutting-edge areas, while promising high growth, likely represent a smaller portion of Crown's current market share. Significant investment is needed to scale these technologies, positioning them as Question Marks requiring strategic focus and capital allocation for future market leadership.

Crown Holdings is actively developing refillable aerosol packaging, tapping into the increasing consumer preference for sustainability and circular economy models. This innovation directly addresses the growing demand for eco-friendly options in the packaging industry.

The market for reusable packaging is still in its nascent stages, showing high growth potential but currently experiencing low adoption rates and market share. This presents a significant opportunity for companies like Crown to establish a strong foothold.

Significant investment will be crucial to encourage consumer uptake and secure a leading position in this emerging market. For instance, in 2024, the global sustainable packaging market was valued at approximately $315 billion, with reusable packaging segments expected to see substantial compound annual growth rates in the coming years.

Crown's Asia-Pacific business faces a strategic challenge, as evidenced by an 11% unit volume sales decline in Q3 2024, despite the region's robust growth forecast for food and beverage metal cans. This performance suggests Crown may be a Question Mark in this high-potential market, indicating a need for significant investment to bolster its market share.

High-Performance Protective Packaging for E-commerce & Pharma

Crown Holdings' protective packaging for e-commerce and pharma likely falls into the question mark category within the BCG matrix. This segment is characterized by high growth potential due to the booming e-commerce sector and the stringent requirements of the pharmaceutical industry. For instance, the global e-commerce packaging market was valued at approximately $50 billion in 2023 and is projected to grow significantly. Similarly, the pharmaceutical packaging market is also expanding, driven by increased drug production and a focus on patient safety and product integrity.

Crown's offerings in this area, while potentially innovative, may still be establishing market share against more entrenched competitors. The high-performance nature of these solutions, designed to withstand rigorous transit conditions and ensure product sterility or protection, requires significant investment in research and development. This often means that while the market opportunity is substantial, the current market penetration and revenue generation might be lower compared to Crown's more mature product lines.

- High Growth Market: The e-commerce and pharmaceutical sectors are experiencing substantial growth, creating a strong demand for specialized protective packaging.

- Potential for Investment: Crown's high-performance solutions in this area represent a strategic opportunity for future investment and market expansion.

- Developing Market Share: While the market is attractive, Crown's current penetration and revenue from these specific product lines may be in the early stages of development.

- Competitive Landscape: The market likely includes established players, meaning Crown needs to differentiate its offerings to gain a stronger foothold.

Innovative Metal Can Coatings and Materials

The metal can industry is seeing significant innovation in coatings and materials, particularly with the shift towards BPA-free linings and advanced barrier technologies. This trend is largely fueled by increasing consumer demand for healthier and safer packaging options. Crown Holdings, a major player in this space, is actively investing in research and development to stay ahead of these evolving consumer preferences and regulatory landscapes.

Crown's commitment to sustainability and R&D positions it well to capitalize on these advancements. By developing and introducing new, improved coatings, the company can create significant product differentiation. This focus on innovation allows Crown to capture market share from competitors who may be slower to adapt to these material science breakthroughs.

- BPA-Free Linings: Consumer health concerns are driving the adoption of alternative, BPA-free internal coatings for food and beverage cans.

- Enhanced Barrier Technologies: Innovations in coatings are improving shelf life and product integrity by offering better protection against oxygen and moisture ingress.

- Crown's R&D Focus: Crown Holdings is investing in developing proprietary coating solutions to meet these market demands and enhance its competitive edge.

Crown's ventures into smart packaging and refillable aerosols represent potential Question Marks. These areas, while high-growth, require substantial investment to gain market traction and establish a significant share. For instance, the global sustainable packaging market reached approximately $315 billion in 2024, highlighting the growth potential for eco-friendly solutions like refillable aerosols.

The company's performance in the Asia-Pacific region, with an 11% unit volume sales decline in Q3 2024 despite market growth, also suggests a Question Mark. This indicates a need for strategic adjustments and investment to improve market penetration in a promising, yet challenging, territory.

Crown's protective packaging for e-commerce and pharmaceuticals are also likely Question Marks. These segments, valued at roughly $50 billion for e-commerce packaging in 2023, are high-growth but demand significant R&D investment to compete effectively against established players.

BCG Matrix Data Sources

Our Crown Holdings BCG Matrix is informed by comprehensive financial disclosures, detailed market research reports, and industry-specific growth forecasts to provide a clear strategic overview.