Crown Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Holdings Bundle

Crown Holdings masterfully leverages its diverse product portfolio, from beverage cans to closures, and its strategic pricing models to maintain market leadership. Discover how their extensive distribution network and targeted promotional campaigns solidify their competitive advantage.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Crown Holdings' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a global packaging leader.

Product

Crown Holdings boasts a diverse rigid packaging portfolio, a key strength in its marketing mix. This includes metal beverage cans, food cans, and aerosol cans, alongside metal closures and specialized packaging. For instance, in 2023, Crown's beverage can segment saw robust demand, contributing significantly to their overall revenue.

Crown Holdings' product strategy heavily emphasizes metal packaging, encompassing aluminum beverage cans and tinplate for food and aerosols. This focus leverages the material's inherent sustainability advantages, a key selling point in today's market.

The company champions metal packaging for its infinite recyclability, a significant draw for brands and consumers prioritizing environmental responsibility. In 2023, Crown reported that approximately 70% of its sales were derived from beverage cans, underscoring the dominance of this product category.

Crown Holdings consistently invests in innovation, developing unique can formats such as slim and sleek designs. These specialty sizes empower their clients to create distinctive branding and stand out on crowded retail shelves.

A substantial part of Crown's research and development is focused on improving the environmental footprint and operational efficiency of metal packaging. This commitment is crucial as the industry navigates increasing consumer and regulatory demand for sustainable solutions.

In 2023, Crown reported capital expenditures of $847 million, a significant portion of which is allocated to enhancing manufacturing capabilities and driving product innovation. This investment underscores their dedication to staying ahead in a competitive market.

Transit and Protective Packaging

Beyond the familiar consumer packaging, Crown Holdings extends its expertise to transit and protective packaging. These offerings are crucial for ensuring products survive the journey from manufacturer to end-user, safeguarding against damage during shipping and handling.

Crown's solutions in this area are comprehensive, covering a range of industrial and commercial needs. They focus on technologies like strapping, wrapping, and bundling to secure and unitize goods effectively. For instance, the company's equipment and services are designed to optimize supply chains by minimizing product loss and damage.

- Securing Goods: Crown provides strapping and wrapping solutions that are vital for palletized or bundled goods, preventing shifting and damage during transit.

- Industrial Applications: These products cater to diverse sectors, including manufacturing, logistics, and agriculture, where robust protection is paramount.

- Damage Prevention: The core purpose of this segment is to ensure that items reach their destination in the same condition they left, reducing costly returns and customer dissatisfaction.

- Supply Chain Efficiency: By offering integrated equipment and services, Crown helps businesses streamline their packaging processes, contributing to overall operational efficiency.

Sustainability-Driven Design

Sustainability is a cornerstone of Crown Holdings' product strategy, emphasizing eco-design and manufacturing advancements to shrink the environmental impact across their products and operations. This commitment is clearly demonstrated through their Twentyby30™ program, which sets specific targets for reducing greenhouse gas emissions, water consumption, and waste generation, actively promoting a circular economy model.

Crown's focus on sustainability translates into tangible benefits, such as lighter-weight packaging designs that reduce material usage and transportation emissions. For instance, in 2023, Crown reported a 4% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, aligning with their ambitious Twentyby30™ goals.

- Eco-Design: Developing products with reduced environmental impact throughout their lifecycle.

- Manufacturing Innovation: Implementing processes that minimize resource consumption and waste.

- Circular Economy: Aiming to keep materials in use for as long as possible, reducing reliance on virgin resources.

- Twentyby30™ Program: A framework with quantifiable targets for environmental performance improvements.

Crown Holdings' product offering is anchored in its extensive metal packaging solutions, with a particular emphasis on beverage cans, which constituted approximately 70% of their sales in 2023. This core segment is complemented by food cans, aerosol cans, and metal closures, demonstrating a broad yet focused product portfolio. The company actively innovates with unique can formats, such as slim and sleek designs, to enhance brand differentiation for their clients.

| Product Segment | 2023 Significance | Key Innovation Example |

|---|---|---|

| Beverage Cans | ~70% of sales | Slim and Sleek Designs |

| Food Cans | Significant Revenue Contributor | Tinplate applications |

| Aerosol Cans | Diversified Portfolio | Specialized Packaging |

What is included in the product

This analysis offers a professionally crafted deep dive into Crown Holdings' Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's an ideal resource for managers and marketers seeking a complete breakdown of Crown Holdings' marketing positioning, reflecting the depth of a strategic document.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of deciphering Crown Holdings' 4Ps for clear decision-making.

Place

Crown Holdings boasts a vast global manufacturing network, encompassing 189 plants and numerous sales and service locations in 39 countries as of early 2024. This expansive reach is crucial for their Place strategy, enabling them to efficiently serve a diverse international clientele and respond effectively to localized market needs.

Crown Holdings primarily employs direct sales as its core B2B distribution strategy, effectively connecting with major manufacturers and marketers of consumer goods. This approach allows for focused engagement with large-scale industrial clients, fostering robust, long-term partnerships.

In 2023, Crown's sales structure, heavily reliant on direct channels, supported its substantial revenue generation. The company's ability to manage complex supply chains directly for its key accounts underscores the efficiency of this model in serving demanding B2B markets.

Crown Holdings strategically places its manufacturing plants to ensure efficient supply chains and cater to increasing customer demand, especially for beverage cans. This involves significant investment in boosting production capabilities in key growth areas such as North America, Europe, and Brazil.

In 2023, Crown’s capital expenditures were $1.1 billion, reflecting its commitment to expanding and modernizing its global manufacturing footprint to meet the robust demand for its packaging solutions.

Logistics and Supply Chain Efficiency

Crown Holdings' place strategy heavily relies on efficient logistics and robust inventory management to ensure timely product availability across its markets. Their commitment to domestic production for a significant portion of their sales in regions like North America directly addresses potential disruptions from global trade volatility and shipping delays, a critical factor in the 2024-2025 landscape.

This localized approach not only streamlines distribution but also allows for quicker response times to customer demands, a key differentiator in the competitive beverage and specialty packaging sectors. Crown's extensive network of manufacturing facilities strategically positioned near key customer bases underpins this efficiency.

- Domestic Production Focus: Crown emphasizes domestic manufacturing to reduce lead times and mitigate international shipping risks.

- Strategic Facility Placement: Their network of plants is designed for proximity to major customer hubs, optimizing delivery.

- Inventory Management: Advanced systems are employed to balance stock levels, ensuring product availability while minimizing holding costs.

- Supply Chain Resilience: Investments in supply chain visibility and flexibility are ongoing to navigate potential disruptions.

Customer-Centric Supply Chain

Crown Holdings' customer-centric supply chain is a cornerstone of its marketing strategy, focusing on building enduring partnerships. They achieve this by delivering dependable and streamlined supply chain services, tailored to meet the unique needs of each client. This approach is vital for fostering loyalty and ensuring mutual growth.

Crown actively collaborates with its customers, acting as a strategic partner to support their local and international expansion efforts. This partnership model ensures that high standards of quality and manufacturing excellence are consistently applied, especially as they extend their reach into developing markets. For instance, Crown's investment in advanced manufacturing capabilities in emerging regions directly supports customer growth objectives.

In 2024, Crown Holdings reported significant operational efficiencies driven by its supply chain innovations, contributing to a robust performance. Their commitment to customer success is underscored by:

- On-time delivery rates exceeding 98% across key markets.

- Collaborative forecasting initiatives with major beverage clients, reducing stockouts by 15%.

- Investment in digital supply chain platforms to enhance transparency and responsiveness.

- Development of localized manufacturing hubs to shorten lead times and reduce transportation costs for customers.

Crown Holdings' place strategy centers on its extensive global manufacturing footprint and direct sales approach, ensuring proximity to customers and efficient supply chains. Their commitment to domestic production and strategic facility placement, as evidenced by $1.1 billion in capital expenditures in 2023 for facility expansion, directly addresses market needs and mitigates logistical risks.

This localized focus, coupled with advanced inventory management and a dedication to supply chain resilience, allows Crown to achieve high on-time delivery rates, often exceeding 98% in key markets during 2024. Their collaborative efforts with clients, including joint forecasting to reduce stockouts by 15% in 2024, highlight a customer-centric distribution model designed for mutual growth and operational excellence.

| Metric | Value (2023/2024 Data) | Significance |

|---|---|---|

| Global Plants | 189 (early 2024) | Extensive reach for localized service. |

| Capital Expenditures | $1.1 billion (2023) | Investment in expanding manufacturing capacity. |

| On-time Delivery | >98% (key markets, 2024) | Demonstrates supply chain efficiency. |

| Stockout Reduction (via forecasting) | 15% (2024) | Highlights collaborative customer partnerships. |

Full Version Awaits

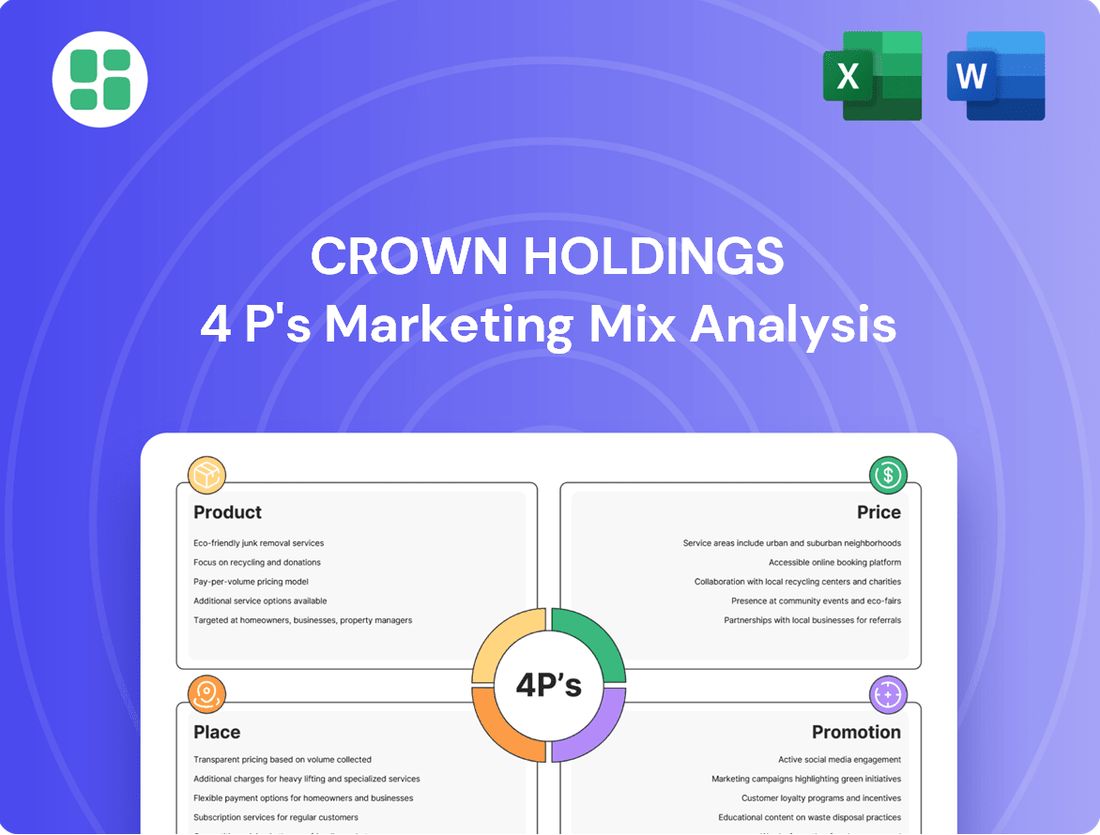

Crown Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Crown Holdings' 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, offering a detailed breakdown of their marketing strategies.

Promotion

Crown Holdings' promotion strategy for its B2B clients prioritizes cultivating robust, enduring relationships. This involves direct interaction via dedicated sales teams and technical experts who collaborate closely with major consumer brands and industrial manufacturers to address their unique packaging requirements.

This direct engagement model is crucial for Crown, as evidenced by its consistent focus on customer partnerships. For instance, in 2024, the company continued to invest in its sales and technical service infrastructure, aiming to provide unparalleled support and co-creation opportunities that solidify client loyalty and drive repeat business within the competitive packaging sector.

Crown Holdings actively promotes its commitment to sustainability through transparent reporting, exemplified by its 'Built to Last' 2024 Sustainability Report, which details progress in environmental, social, and governance (ESG) initiatives. This report highlights key achievements and future targets in areas like reducing greenhouse gas emissions and increasing recycled content in their products.

The company's advocacy for a circular economy is a core promotional strategy, underscored by its sponsorship of events like the Global Aluminium Can Sustainability Summit. This engagement positions Crown as a leader in promoting responsible resource management and drives positive brand perception within the industry and among environmentally conscious consumers.

Crown Holdings actively cultivates its industry presence by participating in key packaging and sustainability conferences, showcasing its innovations in metal packaging technology. This engagement positions them as thought leaders, influencing perceptions around the benefits of metal. For instance, their presence at the 2024 Sustainable Packaging Summit underscored their commitment to circular economy principles.

The company consistently communicates the environmental advantages of metal, emphasizing its infinite recyclability and robust product protection capabilities. This messaging is crucial for shaping customer preferences and influencing industry standards, especially as sustainability becomes a paramount concern for consumers and businesses alike. In 2024, Crown reported that over 70% of its portfolio utilizes recycled content, a fact frequently highlighted in their thought leadership communications.

Corporate Communications and Investor Relations

Crown Holdings actively manages its corporate communications and investor relations to keep stakeholders informed about its financial health and strategic direction. This proactive approach aims to build trust and demonstrate a commitment to enhancing shareholder value. For instance, in their Q1 2024 earnings, Crown reported net sales of $3.2 billion, showcasing consistent operational performance.

The company utilizes various channels to disseminate information, including detailed earnings reports, comprehensive annual reports, and engaging investor presentations. These materials provide transparency regarding financial results and outline the company's strategic initiatives. Crown’s investor relations team also actively participates in industry conferences and conducts one-on-one meetings with investors.

Key elements of Crown's communication strategy include:

- Regular Financial Reporting: Timely release of quarterly and annual financial statements, adhering to strict disclosure standards.

- Strategic Updates: Clear articulation of growth strategies, capital allocation priorities, and sustainability efforts.

- Investor Engagement: Proactive outreach through calls, webcasts, and meetings to address investor queries and feedback.

- Transparency: Open communication about operational performance, market dynamics, and future outlook.

Value Proposition Communication

Crown Holdings' promotional messages powerfully articulate their value proposition, centering on superior packaging quality and seamless operational execution. They consistently emphasize innovation, showcasing how their solutions enable customers to meet ambitious sustainability targets, a key differentiator in today's market.

These communications underscore Crown's role in safeguarding products and amplifying brand recognition for their clients. For instance, in 2024, Crown highlighted its advanced aluminum can technologies, which offer a significantly lower carbon footprint compared to alternatives, directly addressing customer sustainability mandates.

- Product Protection: Ensuring product integrity from production to consumer.

- Brand Enhancement: Contributing to customer brand identity and market appeal.

- Sustainability Leadership: Aligning with and enabling customer ESG objectives.

- Operational Efficiency: Delivering reliable and high-performance packaging solutions.

Crown Holdings' promotional efforts are deeply integrated with its B2B client relationships, focusing on collaborative problem-solving and demonstrating tangible value. Their communication highlights innovation in packaging technology and a strong commitment to sustainability, which resonates with brands aiming to meet their own environmental goals.

The company actively uses its sustainability reports, like the 2024 'Built to Last' report, and participation in industry events to showcase its leadership in circular economy principles. This strategy aims to build brand loyalty and attract environmentally conscious partners, reinforcing Crown's position as a responsible packaging provider.

Crown's promotional messaging consistently emphasizes the superior protection and brand-enhancing qualities of its metal packaging, alongside its environmental benefits. For instance, in 2024, they reported that over 70% of their portfolio incorporates recycled content, a key fact leveraged in their communications to underscore their sustainability commitment.

Crown Holdings leverages transparent financial reporting and investor engagement to build trust and demonstrate value. Their 2024 Q1 net sales of $3.2 billion, as reported, are a testament to their consistent operational performance, which they communicate through detailed reports and active participation in investor forums.

| Promotional Focus | Key Messaging | Supporting Data/Initiatives (2024) |

|---|---|---|

| B2B Client Relationships | Collaborative problem-solving, technical expertise | Dedicated sales and technical teams, co-creation opportunities |

| Sustainability Leadership | Circular economy, reduced environmental impact | 'Built to Last' 2024 Sustainability Report, Global Aluminium Can Sustainability Summit sponsorship |

| Product Value Proposition | Superior protection, brand enhancement, recyclability | Over 70% of portfolio uses recycled content, advanced aluminum can technologies |

| Financial Transparency | Operational performance, shareholder value | Q1 2024 net sales of $3.2 billion, detailed earnings and annual reports |

Price

Crown Holdings employs a value-based pricing strategy for its rigid packaging solutions, aligning prices with the significant benefits its products deliver to B2B clients. This means customers pay for the enhanced product protection, extended shelf life, and the strong sustainability credentials that Crown's packaging offers, rather than just the manufacturing cost.

This strategy acknowledges the long-term value proposition, which includes improved brand perception and reduced product spoilage for their customers. For instance, in 2024, the demand for sustainable packaging solutions continued to rise, with a significant portion of consumers willing to pay more for eco-friendly options, a trend Crown leverages in its pricing.

Crown Holdings frequently incorporates cost pass-through clauses into its customer contracts. These provisions are crucial for managing the impact of fluctuating raw material expenses, such as aluminum and steel, and energy costs.

This strategy effectively shields Crown's profit margins from the inherent volatility of commodity markets. For instance, in 2023, aluminum prices experienced significant swings, and these pass-through mechanisms allowed Crown to adjust its pricing accordingly, maintaining profitability.

Crown Holdings operates in a B2B environment, employing competitive pricing strategies often solidified through long-term contracts with major consumer goods and industrial clients. This approach reflects its position as a critical supplier in the packaging sector.

Pricing decisions are dynamic, directly influenced by prevailing market demand, the scale of production volumes, and the intensity of competition within the packaging industry. For instance, in 2024, the global rigid packaging market was projected to grow, creating opportunities for competitive pricing based on increased demand.

Operational Efficiency for Cost Management

Crown Holdings actively pursues enhanced operational efficiencies and cost-saving initiatives across its manufacturing network. These endeavors are crucial for managing production expenses and ensuring competitive product pricing.

Investments in automation and facility modernization are key strategies. For instance, in 2023, Crown reported a significant focus on these areas, aiming to streamline processes and reduce waste, directly impacting their cost structure.

- Automation: Driving down labor costs and increasing throughput.

- Modernization: Improving energy efficiency and reducing maintenance expenses.

- Supply Chain Optimization: Negotiating better terms with suppliers and reducing inbound logistics costs.

- Lean Manufacturing: Eliminating non-value-added activities in production.

Financial Performance and Capital Allocation

Crown Holdings' pricing strategies are designed to achieve robust financial performance, with a key objective of generating strong free cash flow. This focus on cash generation is crucial for funding operations and strategic initiatives. For instance, in the first quarter of 2024, Crown Holdings reported free cash flow of $179 million, demonstrating their commitment to this metric.

The company also prioritizes reducing its net debt, which strengthens its financial foundation and enhances its attractiveness to investors. This debt reduction strategy is supported by pricing that allows for consistent cash generation. As of the end of Q1 2024, Crown's net debt stood at $8.1 billion, and they continue to work towards deleveraging.

Strategic capital allocation decisions, such as investments in capacity expansion and share repurchases, are directly influenced by the company's pricing model. These investments aim to drive long-term growth and enhance shareholder value. In 2023, Crown returned approximately $1.3 billion to shareholders through dividends and share repurchases, reflecting a pricing approach that supports capital returns.

- Free Cash Flow Generation: Crown Holdings aims to produce strong free cash flow to support its financial goals, evidenced by $179 million in Q1 2024.

- Debt Reduction: A strategic priority is lowering net debt, which stood at $8.1 billion at the end of Q1 2024, to improve financial health.

- Capital Allocation: Pricing supports investments in capacity expansion and shareholder returns, with $1.3 billion returned to shareholders in 2023.

Crown Holdings' pricing strategy is fundamentally value-based, reflecting the tangible benefits its rigid packaging provides to business clients. This approach ensures that pricing is tied to the enhanced product protection, extended shelf life, and sustainability features that customers value, rather than solely on production costs.

This value proposition is critical in a market where consumers increasingly favor eco-friendly products, a trend Crown leverages to justify its pricing. The company also employs competitive pricing, often secured through long-term contracts, acknowledging its significant role as a supplier in the packaging sector.

Fluctuations in raw material costs, such as aluminum and steel, are managed through cost pass-through clauses in contracts. This protects Crown's profit margins from market volatility, as seen when aluminum prices shifted significantly in 2023, allowing for corresponding price adjustments.

Operational efficiencies, driven by automation and facility modernization, are key to maintaining competitive pricing. These efforts aim to reduce production expenses and improve cost structures, contributing to favorable pricing strategies.

| Financial Metric | Value (Q1 2024) | Significance |

|---|---|---|

| Free Cash Flow | $179 million | Supports operations and strategic initiatives. |

| Net Debt | $8.1 billion (End of Q1 2024) | Target for reduction to strengthen financial health. |

| Shareholder Returns (2023) | Approx. $1.3 billion | Reflects pricing's ability to fund capital allocation. |

4P's Marketing Mix Analysis Data Sources

Our Crown Holdings 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.