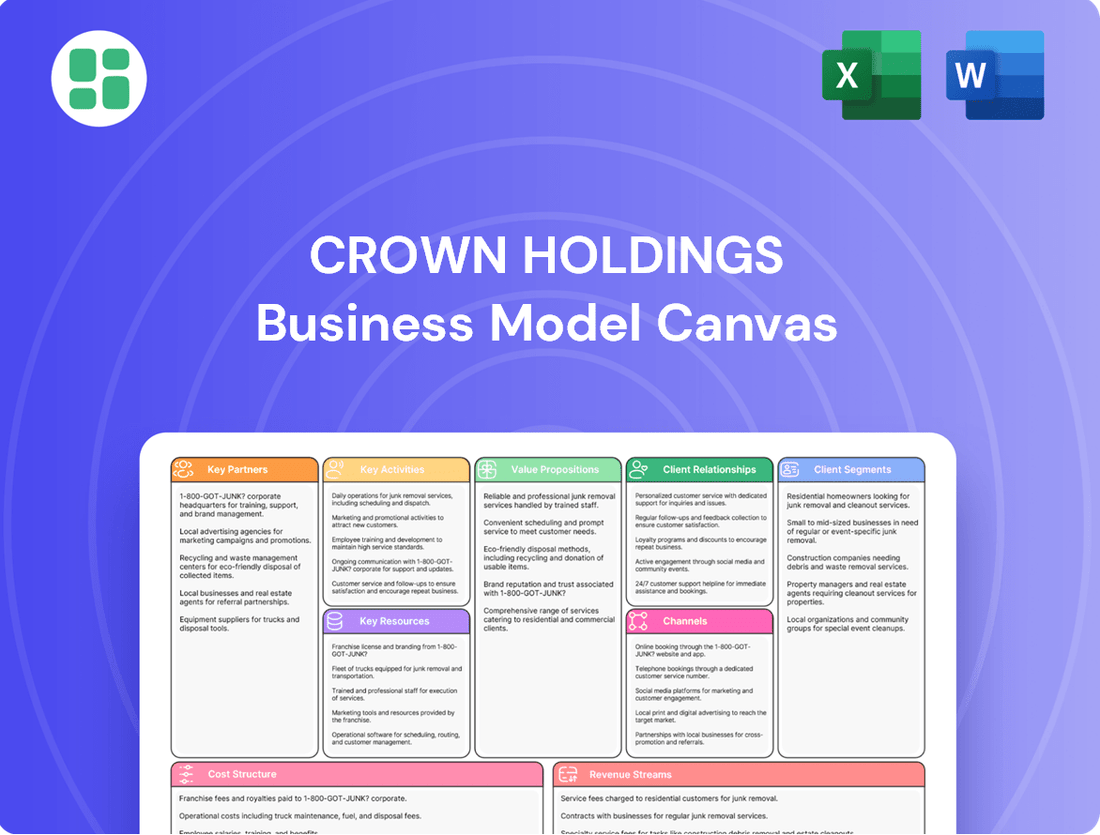

Crown Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Holdings Bundle

Unlock the strategic core of Crown Holdings with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, key resources, and revenue streams, offering a clear view of their operational success. Discover how they innovate and maintain market leadership.

Partnerships

Crown Holdings cultivates vital relationships with suppliers of aluminum and steel, the backbone of its rigid packaging. These alliances are critical for securing a steady flow of quality materials, essential for maintaining competitive pricing on products like beverage cans. In 2023, Crown's cost of goods sold was approximately $10.5 billion, highlighting the significant impact of raw material procurement on its financial performance.

Crown Holdings actively collaborates with leading equipment manufacturers to integrate advanced machinery and technology into its global operations. These strategic alliances provide access to cutting-edge automation and production innovations, crucial for maintaining high efficiency across its facilities.

In 2024, Crown Holdings continued to leverage these partnerships to enhance its manufacturing capabilities, ensuring the production of sophisticated and high-quality packaging solutions. This focus on technological advancement through key equipment suppliers directly supports Crown's strategy of operational excellence and product innovation in the competitive beverage and food packaging markets.

Crown Holdings collaborates with a network of global logistics providers, including major players like Kuehne+Nagel and DHL, to ensure the efficient movement of its rigid packaging products. These partnerships are crucial for managing a complex international supply chain, with Crown's products reaching customers across continents. In 2024, the company continued to leverage these relationships to optimize delivery times and reduce transportation costs, a key factor in maintaining competitive pricing for its diverse clientele.

Technology and R&D Collaborators

Crown Holdings actively partners with universities and research bodies to push the boundaries of packaging innovation. These collaborations are crucial for developing next-generation sustainable materials, exploring novel packaging formats, and refining production processes for greater efficiency. For instance, in 2024, Crown continued its engagement with leading materials science institutions to explore advanced coatings and barrier technologies for food and beverage packaging, aiming to reduce material usage while maintaining product integrity.

These strategic alliances are fundamental to Crown's ongoing pursuit of product and operational excellence. By tapping into external expertise, the company accelerates its R&D pipeline, ensuring it remains at the forefront of industry trends and customer demands. In 2024, such partnerships contributed to the development of several pilot programs focused on lightweighting aluminum cans and improving the recyclability of composite packaging solutions.

- University Collaborations: Partnering with academic institutions on materials science and engineering for sustainable packaging solutions.

- Specialized R&D Firms: Engaging external experts for niche technological advancements and specific product development challenges.

- Industry Consortia: Participating in collaborative research initiatives focused on broad industry challenges like circular economy principles in packaging.

Recycling and Sustainability Initiatives

Crown Holdings actively collaborates with recycling organizations, industry associations, and waste management firms. These partnerships are crucial for advancing circular economy principles and sustainable practices throughout the packaging sector.

The company's engagement in initiatives such as the First Movers Coalition highlights its dedication to sourcing low-carbon materials. For instance, in 2024, Crown Holdings continued to invest in technologies that enhance recycled content utilization in its beverage can production, aiming to increase the percentage of recycled aluminum used in its products.

- Recycling Partnerships: Collaborations with entities like The Recycling Partnership and the Aluminum Association drive improvements in collection and recycling rates.

- Industry Associations: Membership in groups like the Can Manufacturers Institute facilitates advocacy for policies supporting sustainable packaging.

- Waste Management Integration: Working with waste management providers ensures a steady supply of high-quality recycled feedstock for production.

- Low-Carbon Sourcing: Participation in the First Movers Coalition signals a commitment to decarbonizing supply chains, with a focus on recycled aluminum and sustainable energy.

Crown Holdings' key partnerships extend to technology providers and specialized R&D firms, crucial for innovation in packaging materials and manufacturing processes. These collaborations allow Crown to integrate advanced solutions, such as AI-driven quality control systems, enhancing production efficiency and product consistency. In 2024, Crown continued to invest in these technological alliances to maintain its competitive edge in the global packaging market.

| Partner Type | Focus Area | Impact on Crown Holdings | Example/Data Point (2024 Focus) |

|---|---|---|---|

| Technology Providers | Automation, AI, Advanced Manufacturing | Improved efficiency, quality control, cost reduction | Integration of smart factory solutions to optimize production lines |

| Specialized R&D Firms | Materials Science, Sustainable Technologies | Development of new packaging formats, enhanced recyclability | Exploration of novel barrier coatings for extended shelf life |

| University Collaborations | Sustainable Materials, Engineering | Innovation in lightweighting and recycled content | Joint research on advanced aluminum alloys for can production |

| Recycling Organizations | Circular Economy, Waste Management | Securing feedstock, improving recycling rates | Partnerships to increase post-consumer recycled aluminum content |

What is included in the product

A comprehensive, pre-written business model tailored to Crown Holdings' strategy, detailing customer segments, channels, and value propositions for beverage and food packaging.

Reflects the real-world operations and plans of Crown Holdings, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Crown Holdings' Business Model Canvas offers a structured approach to pinpointing and addressing inefficiencies in their global packaging operations, thereby alleviating the pain of complex supply chain management.

Activities

Crown Holdings actively pursues product design and innovation, constantly developing novel packaging solutions. This includes a significant emphasis on sustainable materials and an expanding variety of can sizes to cater to diverse customer needs and market trends.

In 2024, Crown Holdings continued to invest in R&D to drive these innovations. For example, their focus on lightweighting aluminum cans aims to reduce material usage and transportation emissions, aligning with global sustainability goals. This commitment to innovation is crucial for maintaining a competitive edge in the dynamic packaging industry.

Crown Holdings' key activity centers on the large-scale, efficient, and quality-controlled manufacturing of metal packaging. This includes beverage cans, food cans, aerosol cans, and various metal closures, serving diverse industries globally. Their extensive network of production facilities is optimized for high operational performance to consistently meet market demand.

In 2024, Crown Holdings continued to leverage its global manufacturing footprint, operating over 150 facilities across more than 40 countries. This vast network allows for localized production, reducing transportation costs and lead times, which is critical for serving major beverage and food companies. The company's commitment to operational excellence ensures consistent product quality and output volumes, a cornerstone of their value proposition.

Crown Holdings' key activities include meticulous supply chain management, encompassing the procurement of essential raw materials like aluminum and steel, alongside the management of extensive inventory across its global network. This ensures a steady and cost-efficient flow of materials to its manufacturing facilities.

Coordinating complex global logistics is paramount, involving the transportation of finished goods from production sites to a diverse customer base worldwide. In 2023, Crown Holdings reported net sales of $13.1 billion, underscoring the sheer scale of its operations and the critical role of efficient logistics in achieving this revenue.

Effective supply chain management directly translates to optimized operational efficiency and enhanced responsiveness to market demands. This focus allows Crown to maintain a competitive edge by minimizing lead times and controlling costs throughout its value chain.

Sales and Marketing

Crown Holdings actively engages with consumer marketing companies and industrial clients across the globe. This involves understanding their unique packaging requirements and showcasing the advantages of Crown's diverse product portfolio. This proactive approach is crucial for securing significant, high-volume contracts and fostering enduring customer loyalty.

The company's sales and marketing efforts consistently emphasize its commitment to quality, operational reliability, and environmental sustainability. These core tenets are central to how Crown communicates its value proposition to the market.

- Global Reach Crown serves a vast array of clients worldwide, from major consumer goods brands to industrial manufacturers.

- Value Proposition Focus Marketing highlights product quality, supply chain reliability, and increasingly, sustainable packaging solutions.

- Contract Acquisition Sales activities are geared towards securing long-term, large-volume supply agreements, a key revenue driver.

- Customer Relationship Management Maintaining strong, collaborative relationships with clients is paramount for repeat business and market insights.

Research and Development

Crown Holdings heavily invests in Research and Development to enhance packaging performance and sustainability. This focus includes improving the recyclability of rigid packaging materials and refining manufacturing processes to reduce waste and energy consumption. These R&D efforts are crucial for maintaining Crown's long-term competitive edge in the evolving packaging market.

In 2024, Crown's commitment to innovation is evident in its continuous exploration of new applications for its rigid packaging solutions. By prioritizing R&D, the company aims to meet growing consumer demand for environmentally friendly options and to develop advanced packaging that offers superior functionality.

- Innovation Focus: Improving packaging performance, reducing environmental impact, and exploring new applications for rigid packaging.

- Sustainability Efforts: Enhancing material recyclability and optimizing manufacturing processes.

- Competitive Advantage: R&D drives Crown's long-term market position and ability to adapt to industry trends.

Crown Holdings' key activities are centered on innovation and manufacturing. They design and produce a wide range of metal packaging, including beverage cans, food cans, and aerosol cans, with a strong focus on sustainable materials and lightweighting. This commitment to R&D, evident in their continuous exploration of new packaging applications, ensures they meet evolving market demands for environmentally friendly solutions.

The company also excels in supply chain management and global logistics. This involves sourcing raw materials like aluminum and steel efficiently and managing inventory across its extensive network. Coordinating the transportation of finished goods to customers worldwide is critical, as demonstrated by their $13.1 billion in net sales in 2023, highlighting the scale of their operations.

Furthermore, Crown Holdings actively engages in sales and marketing to build strong customer relationships. They focus on understanding client needs and promoting their high-quality, reliable, and sustainable packaging solutions, aiming to secure long-term, high-volume contracts.

| Key Activity | Description | 2024 Focus/Impact |

|---|---|---|

| Product Design & Innovation | Developing new packaging solutions, emphasizing sustainable materials and diverse can sizes. | Lightweighting aluminum cans to reduce material usage and emissions. |

| Manufacturing | Large-scale, efficient, and quality-controlled production of metal packaging. | Leveraging a global network of over 150 facilities across more than 40 countries. |

| Supply Chain & Logistics | Procuring raw materials, managing inventory, and coordinating global transportation. | Ensuring cost-efficient material flow and timely delivery of finished goods. |

| Sales & Marketing | Engaging with clients, understanding needs, and securing contracts. | Highlighting quality, reliability, and sustainability to foster customer loyalty. |

Delivered as Displayed

Business Model Canvas

The preview you're seeing is an authentic representation of the Crown Holdings Business Model Canvas, not a mockup. This means the document you're viewing is an exact section of the comprehensive analysis you will receive upon purchase. You'll gain full access to this same detailed document, ready for immediate use and customization, ensuring no surprises and complete transparency.

Resources

Crown Holdings operates a vast global manufacturing network, boasting 189 production plants strategically located across 39 countries as of December 31, 2024. This extensive footprint is a cornerstone of its business model, allowing for localized production and distribution.

These facilities are outfitted with specialized machinery crucial for the efficient production of rigid packaging solutions, catering to a wide array of customer needs. The sheer scale of this operational capacity underscores Crown's commitment to manufacturing excellence.

This widespread global presence is key to Crown's ability to serve its multinational clientele effectively. It ensures timely delivery and responsiveness to the diverse demands of various international markets, solidifying its position as a global leader.

Crown Holdings' proprietary technology and patents are a cornerstone of its business model, safeguarding innovations in packaging. These include unique designs and manufacturing methods that set their products apart in the market.

The company boasts a portfolio of intellectual property covering everything from advanced material compositions to intricate packaging designs. This allows Crown to offer specialized solutions that competitors may find difficult to replicate.

Key examples of this innovation include their SuperEnd® and 360 End™ beverage ends, which represent significant advancements in can technology. These patented features offer enhanced functionality and consumer appeal, directly contributing to Crown's competitive advantage.

This strong IP position not only protects Crown's market share but also drives value by enabling premium product offerings and fostering ongoing research and development. For instance, their focus on sustainable packaging solutions, often protected by patents, aligns with growing market demand and regulatory trends.

Crown Holdings’ success hinges on its highly skilled workforce, comprising engineers, designers, manufacturing specialists, and sales professionals. This deep pool of talent possesses critical industry knowledge and technical expertise essential for innovation and operational excellence.

In 2024, Crown Holdings continued to invest in its human capital, recognizing it as a core asset. The company’s ability to attract and retain top engineering and manufacturing talent directly impacts its capacity for product development and efficient, high-quality production.

The technical expertise of Crown’s employees is paramount to their customer engagement strategy. Their understanding of client needs and market trends allows for tailored solutions, reinforcing Crown's position as a leader in the packaging industry.

Strong Brand Reputation and Customer Relationships

Crown Holdings has cultivated a formidable brand reputation and deep customer relationships, particularly with major global consumer and industrial companies. This trust, built over years of reliable service, translates into significant competitive advantages. In 2024, Crown's ability to maintain these strong ties is evident in its consistent revenue streams and its position as a preferred supplier for many leading brands.

These established connections are more than just repeat business; they represent a bedrock of market leadership. The loyalty fostered through dependable quality and service ensures a predictable demand for Crown's diverse packaging solutions. This is a critical asset in a dynamic market, allowing for greater strategic planning and investment.

- Customer Loyalty: Crown's long-standing relationships with major global clients foster consistent demand.

- Market Leadership: A strong brand reputation supports Crown's position as a preferred packaging provider.

- Trust and Reliability: Established trust with key partners is a vital intangible asset for sustained growth.

Financial Capital

Financial capital is a critical resource for Crown Holdings, enabling significant investments in its global manufacturing footprint. This includes maintaining and upgrading existing facilities, as well as funding new plant constructions to meet growing demand.

The company's capacity to generate substantial adjusted free cash flow is paramount. In 2024, Crown Holdings reported a record adjusted free cash flow of $814 million, providing the necessary fuel for these capital-intensive operations and strategic growth initiatives.

- Global Plant Maintenance and Upgrades: Financial capital is essential for ensuring Crown's worldwide production facilities operate efficiently and meet evolving industry standards.

- Research and Development Funding: Significant investment is channeled into R&D to develop innovative packaging solutions and improve manufacturing processes.

- Large-Scale Operational Management: Maintaining and optimizing complex global supply chains and operations requires robust financial backing.

- Record Adjusted Free Cash Flow: The $814 million generated in 2024 underscores Crown's financial strength, supporting ongoing investments and strategic flexibility.

Crown's key resources include its extensive global manufacturing network, comprising 189 production plants across 39 countries as of December 31, 2024. This vast operational infrastructure is complemented by proprietary technology and patents, which protect innovations in packaging design and manufacturing. Furthermore, a highly skilled workforce, encompassing engineers, designers, and manufacturing specialists, drives operational excellence and product development.

The company's strong brand reputation and deep customer relationships, particularly with major global consumer and industrial companies, represent a significant intangible asset. This trust, built on years of reliable service, ensures consistent demand and market leadership. Financial capital, evidenced by a record adjusted free cash flow of $814 million in 2024, is crucial for investments in facilities, R&D, and strategic growth initiatives.

| Key Resource | Description | 2024 Relevance |

| Global Manufacturing Network | 189 production plants in 39 countries | Enables localized production and distribution |

| Proprietary Technology & Patents | Innovations in packaging design and manufacturing | Provides competitive advantage and specialized solutions |

| Skilled Workforce | Engineers, designers, manufacturing specialists | Drives innovation, operational excellence, and customer engagement |

| Brand Reputation & Customer Relationships | Long-standing ties with major global clients | Ensures consistent demand and market leadership |

| Financial Capital | Record adjusted free cash flow of $814 million | Funds investments in facilities, R&D, and growth |

Value Propositions

Crown Holdings boasts a truly global manufacturing and distribution network, a critical value proposition for its multinational clientele. This extensive reach ensures a consistent supply of its products, significantly mitigating risks for businesses operating across various continents. For instance, in 2023, Crown's operations spanned over 40 countries, underscoring its ability to serve diverse markets reliably.

This worldwide footprint translates directly into supply security for clients, irrespective of their operational base. Whether a beverage company has bottling plants in Europe or Asia, Crown's infrastructure is designed to meet those demands. This reliability is paramount in today's volatile supply chain environment, where disruptions can be costly.

Crown Holdings boasts a diverse product portfolio, offering a comprehensive suite of rigid packaging solutions. This includes metal beverage cans, food cans, and aerosol cans, alongside metal closures and specialized packaging designed for a wide array of consumer and industrial uses.

This extensive range allows Crown to cater to varied customer demands across numerous market segments. For instance, in 2023, the company reported net sales of $12.9 billion, underscoring the breadth of its market penetration and product acceptance.

Crown Holdings excels in delivering packaging that's precisely tailored to client needs, offering innovative designs and sustainable choices that align with specific branding and functional demands. This bespoke approach is crucial for clients aiming to stand out in crowded marketplaces.

The company's dedication to pioneering new packaging concepts is a cornerstone of their value proposition, focusing on creating distinctive aesthetics and tactile experiences for emerging products. For instance, in 2024, Crown continued to invest heavily in R&D, with a reported focus on advanced material science for lighter and more recyclable packaging solutions.

Quality and Reliability

Crown Holdings places a premium on delivering packaging that is not only high-quality and durable but also exceptionally safe. Their commitment ensures that products remain protected from the point of manufacture through to the consumer, preserving brand reputation. This unwavering dedication to reliability fosters deep trust, leading to enduring customer relationships.

For instance, in 2023, Crown Holdings reported a net sales increase of 4% to $13.16 billion, demonstrating continued customer demand for their dependable solutions. This financial performance underscores the market's recognition of their quality promise.

- Enhanced Product Protection

- Maintained Brand Integrity

- Customer Trust and Loyalty

- Reduced Product Spoilage and Damage

Sustainability Solutions

Crown Holdings provides packaging solutions that prioritize environmental responsibility. They offer eco-friendly options and champion recyclability, directly supporting clients' sustainability objectives. The company's commitment is evident in its 2024 Sustainability Report, which details significant strides in reducing greenhouse gas emissions and minimizing waste.

Metal packaging, a core offering, boasts infinite recyclability, presenting a distinct advantage for brands aiming to enhance their environmental credentials. This inherent circularity in metal packaging aligns perfectly with the growing consumer demand for sustainable products.

- Environmentally Conscious Packaging: Crown offers a range of packaging that helps clients meet their environmental targets.

- Recyclability Focus: The company actively promotes the recyclability of its products, particularly metal, which can be recycled endlessly.

- 2024 Sustainability Progress: Crown's 2024 report shows progress in reducing greenhouse gas emissions and waste.

Crown Holdings' value proposition centers on providing a diverse, high-quality, and precisely tailored range of rigid packaging solutions. This includes metal beverage, food, and aerosol cans, as well as closures, catering to a broad spectrum of consumer and industrial needs. Their 2023 net sales of $12.9 billion highlight the extensive market acceptance of this varied portfolio.

Innovation is a key differentiator, with Crown investing in R&D for advanced materials and unique designs to enhance brand appeal and functionality. Their commitment to packaging safety and durability further solidifies customer trust, as evidenced by a 4% net sales increase to $13.16 billion in 2023, reflecting ongoing market confidence.

Furthermore, Crown champions environmental responsibility by offering eco-friendly and infinitely recyclable metal packaging options. This aligns with client sustainability goals and growing consumer demand for greener products, a focus reinforced by their 2024 sustainability initiatives aimed at reducing emissions and waste.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Global Reach & Supply Security | Extensive manufacturing and distribution network ensuring consistent supply across 40+ countries (as of 2023). | Mitigates supply chain risks for multinational clients. |

| Diverse Product Portfolio | Comprehensive range of rigid packaging: beverage cans, food cans, aerosol cans, closures. | Net sales of $12.9 billion in 2023 demonstrate broad market penetration. |

| Customized & Innovative Solutions | Tailored packaging designs focusing on aesthetics, functionality, and sustainability. | Heavy R&D investment in 2024 for advanced materials and lighter, recyclable options. |

| Quality, Safety & Reliability | High-quality, durable, and safe packaging protecting products from manufacture to consumer. | 4% net sales increase to $13.16 billion in 2023 reflects customer trust in dependable solutions. |

| Environmental Responsibility | Eco-friendly options and promotion of infinitely recyclable metal packaging. | Supports client sustainability objectives and growing consumer demand for green products. |

Customer Relationships

Crown Holdings assigns dedicated account managers to its key clients, fostering robust, long-term relationships. This personalized approach ensures a deep understanding of evolving customer needs, leading to tailored service and support. This strategy builds significant loyalty and trust, a cornerstone of their business model.

Crown Holdings provides expert technical support and consulting, assisting clients with packaging line integration and operational optimization. This specialized support helps customers overcome technical hurdles, directly contributing to enhanced customer satisfaction and improved operational efficiency.

Crown Holdings actively engages in collaborative innovation with its clients, focusing on joint research and development to create novel packaging solutions. This partnership approach ensures that new products are precisely tailored to meet evolving customer needs and emerging market demands.

Supply Chain Integration

Crown Holdings' customer relationships are deeply intertwined with supply chain integration, particularly for its high-volume clients.

- Just-in-Time Delivery: By embedding its operations within client supply chains, Crown facilitates just-in-time delivery, ensuring that beverage and food manufacturers receive packaging precisely when needed, minimizing their on-site inventory.

- Demand Forecasting: This close integration enables more accurate demand forecasting, allowing Crown to align its production schedules with client consumption patterns, thereby reducing waste and improving efficiency. For instance, in 2024, Crown's focus on advanced analytics for demand planning has been a key differentiator in securing long-term contracts.

- Inventory Management: The collaborative approach to supply chain management enhances inventory control for customers, reducing holding costs and the risk of stockouts. This operational synergy is vital for clients managing extensive product lines and seasonal demand fluctuations.

- Streamlined Operations: Ultimately, this deep integration streamlines the entire process from production to delivery, boosting responsiveness and creating a more resilient supply chain for both Crown and its customers.

Global Service Network

Crown Holdings' global service network ensures multinational clients receive consistent support and service across various geographical regions. This capability guarantees uniform quality and assistance, regardless of a client's location, reinforcing Crown's standing as a dependable worldwide partner.

- Global Reach: Crown operates manufacturing facilities and sales offices in over 40 countries, enabling localized support for its international clientele.

- Standardized Quality: The company maintains consistent operational standards across its network, ensuring that all clients experience the same high level of service and product quality.

- Client Retention: In 2023, Crown reported that approximately 80% of its revenue came from repeat customers, a testament to the strength of its global service relationships and client satisfaction.

- Strategic Partnerships: Crown actively cultivates long-term relationships with major global brands, providing them with integrated packaging solutions and dedicated account management worldwide.

Crown Holdings cultivates strong customer relationships through dedicated account management, expert technical support, and collaborative innovation. This focus on personalized service and joint development ensures tailored solutions that meet evolving client needs, fostering loyalty and trust. Their global service network further solidifies these bonds by providing consistent, high-quality support across all operational regions.

The integration of Crown's operations into client supply chains, particularly for high-volume customers, is a critical aspect of their customer relationship strategy. This deep linkage facilitates just-in-time delivery and more accurate demand forecasting, which in turn optimizes inventory management for clients and streamlines overall operations. This symbiotic relationship enhances responsiveness and builds a more resilient supply chain for all parties involved.

Crown's commitment to customer relationships is underscored by its significant client retention rates. In 2023, approximately 80% of Crown's revenue stemmed from repeat customers, highlighting the success of their approach in building lasting partnerships. This high retention is a direct result of their ability to provide consistent, high-quality service and innovative solutions tailored to the specific needs of major global brands.

| Customer Relationship Aspect | Description | Impact on Crown Holdings | Key Data Point (2023/2024 Focus) |

|---|---|---|---|

| Dedicated Account Management | Personalized service for key clients | Fosters loyalty and deep understanding of needs | N/A (qualitative focus) |

| Technical Support & Consulting | Expert assistance with packaging integration | Enhances customer satisfaction and operational efficiency | N/A (qualitative focus) |

| Collaborative Innovation | Joint R&D for new packaging solutions | Ensures products meet evolving market demands | N/A (qualitative focus) |

| Supply Chain Integration | Just-in-time delivery, demand forecasting | Optimizes client inventory, improves efficiency | Focus on advanced analytics for demand planning in 2024 |

| Global Service Network | Consistent support across regions | Ensures uniform quality, builds worldwide trust | ~80% revenue from repeat customers in 2023 |

Channels

Crown Holdings leverages a global direct sales force as a cornerstone of its business model, directly engaging with major consumer marketing companies and industrial clients. This direct approach facilitates tailored communication, the negotiation of substantial contracts, and a nuanced understanding of unique customer requirements. In 2023, Crown Holdings reported net sales of $13.2 billion, with a significant portion driven by these large, directly managed accounts.

Crown Holdings leverages its vast global manufacturing and distribution network, boasting 189 facilities across 39 countries as of late 2024. This expansive infrastructure allows for efficient service to clients on multiple continents, acting as a direct channel for product delivery.

This extensive network ensures proximity to key markets, facilitating efficient supply chains and reducing lead times. The strategic placement of these facilities allows Crown to adapt quickly to regional demands and maintain a competitive edge in product distribution.

Crown Holdings leverages its corporate website as a central hub for information, detailing its diverse product portfolio, including beverage cans and specialty packaging. This digital platform also highlights the company's commitment to sustainability, showcasing its efforts in recycling and environmental stewardship.

The website acts as a crucial resource for stakeholders, offering insights into Crown's global operations and technological advancements in packaging solutions. In 2023, Crown reported net sales of $12.06 billion, underscoring the scale of its operations and the importance of its online presence in communicating its value proposition to a global audience.

Industry Trade Shows and Conferences

Crown Holdings leverages industry trade shows and conferences as a vital channel to connect with its target markets. These events, focused on packaging, food and beverage, and industrial sectors, are crucial for demonstrating innovation and expanding market reach. For instance, Crown's presence at events like the International Packaging Industry Exhibition (IPACK-IMA) in Milan allows for direct interaction with potential customers and partners.

These gatherings are instrumental in showcasing Crown's latest product developments and technological advancements. They offer a tangible platform to demonstrate the capabilities of their diverse packaging solutions, from rigid containers to advanced beverage cans. This direct engagement fosters relationships and provides valuable market feedback.

Crown's participation in these key industry events directly contributes to its business development and brand visibility. In 2024, attending major shows like FachPack in Germany or Pack Expo in the United States provides opportunities to network with thousands of industry professionals, reinforcing Crown's position as a leader in the packaging industry.

- Product Showcase: Demonstrating new can technologies and sustainable packaging solutions.

- Client Engagement: Networking with prospective buyers and strengthening relationships with existing clients.

- Market Intelligence: Gathering insights into emerging trends and competitor activities.

- Brand Visibility: Enhancing Crown's presence and reputation within the packaging ecosystem.

Customer Service and Support Portals

Crown Holdings leverages dedicated customer service and support portals to manage client inquiries, technical assistance, and order processing. These platforms are crucial for ensuring customer satisfaction and operational smoothness.

In 2024, Crown Holdings continued to invest in digital tools to streamline customer interactions. For instance, their online portals offer 24/7 access to FAQs, product information, and order tracking, significantly reducing response times for common queries.

- Enhanced Accessibility: Customers can access support and manage their accounts through user-friendly online portals, available anytime, anywhere.

- Streamlined Operations: These portals facilitate efficient handling of technical issues, order modifications, and general inquiries, improving internal workflow.

- Customer Satisfaction: By providing timely and accurate information, Crown Holdings aims to foster strong, ongoing relationships and boost overall customer loyalty.

Crown Holdings utilizes a multifaceted channel strategy, combining direct sales, an extensive distribution network, digital platforms, industry events, and dedicated customer support. This integrated approach ensures broad market reach and deep customer engagement across its global operations.

The company's direct sales force is critical for managing large accounts, while its 189 facilities in 39 countries facilitate efficient product delivery. Crown's corporate website serves as a key information hub, and participation in trade shows like Pack Expo enhances brand visibility and market intelligence.

Dedicated customer service portals and online tools streamline inquiries and order processing, aiming to boost customer satisfaction and loyalty. These channels collectively support Crown's objective of delivering innovative and sustainable packaging solutions worldwide.

| Channel | Description | Key Activities/Benefits | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Engages directly with major consumer marketing and industrial clients. | Tailored communication, contract negotiation, understanding unique needs. | Drove a significant portion of $13.2 billion in net sales in 2023. |

| Global Distribution Network | 189 facilities across 39 countries. | Efficient service, proximity to markets, reduced lead times, adaptability to regional demands. | Supports serving clients across continents efficiently. |

| Corporate Website | Central hub for product information, sustainability efforts, and global operations. | Showcases portfolio, commitment to environmental stewardship, stakeholder insights. | Communicates value proposition for global audience; $12.06 billion net sales in 2023. |

| Industry Trade Shows & Conferences | Participation in events like Pack Expo, IPACK-IMA. | Demonstrates innovation, expands market reach, fosters relationships, gathers market intelligence. | Key for networking and reinforcing industry leadership in 2024. |

| Customer Service Portals | Online platforms for inquiries, technical assistance, and order processing. | 24/7 access to FAQs, order tracking, streamlined issue resolution. | Investment in digital tools in 2024 to improve customer interaction and satisfaction. |

Customer Segments

Global beverage companies represent a cornerstone of Crown Holdings' business. This segment encompasses major players in the soft drink, beer, and energy drink markets worldwide. In 2024, metal beverage cans, a key product for these clients, accounted for a significant 67% of Crown's total revenue, underscoring their importance.

Crown actively partners with these leading brand owners, catering to their needs in both established and rapidly expanding beverage categories. This focus allows Crown to support innovation and growth within the dynamic global beverage industry.

Large food manufacturers represent a core customer segment for Crown Holdings, relying on their metal cans for a broad spectrum of preserved goods, from everyday vegetables and fruits to essential pet food. This sector is a substantial revenue driver for Crown, benefiting from the inherent stability of the preserved food industry.

The demand for metal cans within this segment is robust, as evidenced by the positive trends observed in 2024. Specifically, North American food can shipments experienced an uptick during the year, underscoring the continued reliance of these manufacturers on metal packaging solutions for their products.

Crown Holdings serves companies that manufacture aerosols for a wide array of household and personal care items, including air fresheners, deodorants, and cleaning sprays. These brands rely on Crown for innovative aerosol can designs that enhance product appeal and functionality. In 2024, the global aerosol can market was valued at approximately $30 billion, with household and personal care products representing a significant portion of this demand.

Industrial and Commercial Enterprises

Industrial and Commercial Enterprises represent a broad customer base for Crown Holdings, encompassing businesses requiring transit and protective packaging. These clients span numerous sectors, all needing reliable packaging solutions for their goods.

In 2024, this segment experienced a dip in both volume and profitability. This downturn was largely attributed to a general slowdown in industrial activity, impacting the demand for packaging materials and equipment.

Despite the 2024 challenges, Industrial and Commercial Enterprises remain a vital component of Crown's overall business strategy. Their diverse needs ensure continued relevance within Crown's product and service offerings.

- Customer Need: Transit and protective packaging products, equipment, and services.

- 2024 Performance: Lower volumes and profitability due to subdued industrial demand.

- Strategic Importance: Remains a key part of Crown's diversified portfolio despite market headwinds.

- Sector Diversity: Encompasses businesses across various industrial and commercial applications.

Specialty Product Manufacturers

Specialty product manufacturers represent a key customer segment for Crown Holdings, particularly those needing highly customized metal packaging. This goes beyond the typical beverage can or food container, focusing on unique designs for niche markets or special promotional campaigns. Crown's advanced manufacturing and design capabilities are crucial here, allowing them to develop bespoke solutions that meet specific client requirements.

For instance, in 2024, Crown's ability to produce intricate shapes and finishes for decorative tins used in premium gift sets or limited-edition product launches showcases their value to this segment. This segment often requires lower volumes but higher complexity, demanding flexibility and innovation from their packaging partners. Crown's investment in new technologies and materials directly supports these specialized demands, ensuring they remain a preferred supplier for manufacturers seeking differentiation through packaging.

- Customization Expertise: Crown caters to clients needing unique metal packaging for niche applications, promotional items, or luxury goods, moving beyond standard food and beverage formats.

- Innovation Driven: The company leverages its innovation capabilities to develop bespoke packaging solutions, meeting specific design and functional requirements for specialty products.

- Market Differentiation: Specialty manufacturers rely on Crown's advanced capabilities to create distinctive packaging that helps their products stand out in competitive markets.

Crown Holdings serves a diverse range of customers, with global beverage companies being a primary focus, accounting for a substantial 67% of revenue in 2024 from metal beverage cans. This segment includes major players in soft drinks, beer, and energy drinks, who rely on Crown for packaging solutions that support their growth and innovation in a dynamic market.

Large food manufacturers also form a core customer base, utilizing Crown's metal cans for preserved goods like fruits, vegetables, and pet food. The demand in this sector remains strong, as indicated by positive trends in North American food can shipments observed in 2024, highlighting the continued importance of metal packaging for food preservation.

The company also caters to aerosol manufacturers for household and personal care items, a market valued at approximately $30 billion globally in 2024, with these products representing a significant share. Additionally, industrial and commercial enterprises require transit and protective packaging, though this segment saw reduced volumes and profitability in 2024 due to a general slowdown in industrial activity.

Specialty product manufacturers represent a crucial segment for Crown, requiring highly customized metal packaging for niche markets and promotional campaigns. Crown's advanced design and manufacturing capabilities enable them to create unique solutions, such as intricate decorative tins for premium gift sets, demonstrating their value in driving product differentiation.

| Customer Segment | Key Products/Services | 2024 Relevance/Data |

|---|---|---|

| Global Beverage Companies | Metal beverage cans | 67% of total revenue in 2024 |

| Large Food Manufacturers | Metal cans for preserved goods (fruits, vegetables, pet food) | Positive North American food can shipment trends in 2024 |

| Aerosol Manufacturers (Household & Personal Care) | Aerosol cans | Global aerosol can market valued at ~$30 billion in 2024 |

| Industrial & Commercial Enterprises | Transit and protective packaging, equipment, services | Lower volumes/profitability in 2024 due to industrial slowdown |

| Specialty Product Manufacturers | Customized metal packaging (e.g., decorative tins) | Focus on niche markets and promotional campaigns |

Cost Structure

Raw material costs represent a substantial component of Crown Holdings' expenses, with aluminum and steel being the primary inputs. These costs are directly tied to global commodity market dynamics, making them susceptible to significant price swings.

In 2024, Crown Holdings benefited from a favorable pricing environment for its key materials. This resulted in lower procurement expenses, with the company reporting a pass-through of $196 million due to these reduced material costs.

Manufacturing and production costs are a significant component of Crown Holdings' operations, encompassing expenses like labor, energy, and machinery upkeep across its global network of facilities. In 2023, Crown reported that its cost of sales, which includes these manufacturing expenses, amounted to $10.6 billion. The company actively pursues productivity enhancements by investing in facility upgrades and modernization to drive greater efficiency and manage these costs effectively.

Crown Holdings' logistics and distribution costs are significant, encompassing everything from freight and warehousing to managing a complex global supply chain. In 2024, these operational expenses are a key focus for maintaining competitiveness.

Efficiently moving aluminum cans and other packaging solutions to customers across diverse markets is paramount. These costs are carefully managed to ensure product availability and timely delivery, directly impacting customer satisfaction and operational efficiency.

Research and Development Expenses

Crown Holdings significantly invests in Research and Development (R&D) to foster innovation across its product lines. This includes developing advanced can designs, exploring novel materials for enhanced sustainability and performance, and refining manufacturing techniques for greater efficiency.

These R&D expenditures, while crucial for long-term growth and maintaining a competitive edge, represent a consistent and significant component of Crown's overall cost structure. The company strategically allocates capital to bolster its technological capabilities.

- Innovation Investment: Crown's R&D efforts are geared towards pioneering new packaging solutions and improving existing ones.

- Recurring Cost: R&D expenses are an ongoing operational cost, essential for future competitiveness.

- Technological Advancement: Capital is dedicated to enhancing the company's technological infrastructure and expertise.

- 2024 Data Point: Crown Holdings reported R&D expenses of $112 million for the fiscal year ending December 31, 2023, indicating a substantial commitment to innovation.

Sales, General, and Administrative (SG&A) Costs

Sales, General, and Administrative (SG&A) costs for Crown Holdings encompass the expenses related to their sales force, marketing campaigns, and the administrative backbone that keeps their global operations running smoothly. This includes everything from the salaries of their extensive sales teams to the costs associated with advertising and promoting their diverse packaging solutions. These expenditures are critical for maintaining Crown's significant market presence and driving future business growth.

In 2024, Crown Holdings continued to invest heavily in its SG&A functions to support its expansive reach and product innovation. For instance, the company's commitment to customer engagement and brand building is reflected in these operational costs. These investments are fundamental to securing new contracts and reinforcing relationships with existing clients across various industries.

- Salaries and Benefits: Compensation for sales, marketing, and administrative personnel globally.

- Marketing and Advertising: Expenditures on promotional activities, brand campaigns, and market research.

- Corporate Overhead: Costs associated with managing headquarters, legal, finance, and IT functions.

- Travel and Entertainment: Expenses incurred by sales and management teams for business development and client relations.

Crown Holdings' cost structure is heavily influenced by its raw material procurement, manufacturing efficiency, and extensive sales and administrative operations. The company navigates fluctuating commodity prices, particularly for aluminum and steel, while also investing in R&D and global logistics.

In 2023, Crown Holdings' cost of sales stood at $10.6 billion, reflecting the significant expenses associated with its manufacturing and production activities. The company also reported R&D expenses of $112 million for the fiscal year ending December 31, 2023, underscoring its commitment to innovation.

The pass-through of reduced material costs in 2024, amounting to $196 million, highlights the impact of commodity market dynamics on Crown's financial performance and cost management strategies.

| Cost Category | 2023 Data (USD) | Key Drivers |

|---|---|---|

| Cost of Sales | $10.6 billion | Manufacturing, labor, energy, machinery upkeep |

| R&D Expenses | $112 million | Innovation, new product development, process improvement |

| Material Costs | Variable (influenced by commodity markets) | Aluminum, steel prices |

| SG&A Expenses | Significant ongoing investment | Sales force, marketing, administration, corporate overhead |

| Logistics & Distribution | Significant operational expense | Freight, warehousing, supply chain management |

Revenue Streams

The sale of metal beverage cans stands as Crown Holdings' primary revenue engine, accounting for a significant 67% of its total revenue in 2024. This substantial income is derived from the consistent, high-volume sales of both aluminum and steel cans to a wide array of global beverage manufacturers.

In 2024, this key segment demonstrated impressive volume growth, with notable increases observed across various geographical markets including Brazil, North America, and Europe. This expansion underscores the enduring demand for metal beverage packaging solutions.

Revenue is generated from the sale of metal cans specifically designed for food packaging and aerosol products, serving a broad range of consumer goods companies. This segment offers a reliable revenue source, as food packaging is a fundamental necessity. In 2024, North American food can shipments saw a notable increase, reflecting continued demand in this sector.

Crown Holdings generates revenue by selling metal closures for bottles and jars, a core offering that serves a vast array of food and beverage clients. This segment is crucial for maintaining product integrity and brand presentation.

Beyond standard closures, the company also profits from specialty packaging solutions tailored to unique customer needs across various industries. These custom designs often incorporate specific functionalities or aesthetic requirements, adding significant value.

In 2024, Crown Holdings continued to see strong demand for its diverse metal packaging portfolio. For instance, the company reported robust performance in its beverage can segment, which often goes hand-in-hand with closure sales, indicating a healthy market for their packaging solutions.

Sale of Transit and Protective Packaging Products

Crown's industrial packaging segment, encompassing transit and protective solutions like strapping and dunnage, is a significant revenue generator. These products are vital for securing goods across various industries during shipping and handling. Despite experiencing lower volumes in 2024 compared to previous periods, this segment continues to be a core part of their business.

The company offers a comprehensive range of materials designed to prevent damage and ensure the integrity of shipments. This includes specialized films, strapping systems, and cushioning materials tailored for diverse industrial needs. The performance of this segment is closely watched as an indicator of broader industrial activity.

- Industrial Packaging Revenue Contribution: While specific figures for 2024 are not yet fully detailed, this segment historically contributes a notable portion to Crown's overall revenue, supporting its diversified business model.

- Product Portfolio: Key offerings include steel and plastic strapping, stretch wrap, and various dunnage products, all designed for load stabilization and protection.

- Market Dynamics in 2024: The segment faced challenges with reduced industrial output in certain sectors during 2024, impacting sales volumes for transit and protective packaging.

- Strategic Importance: Despite volume fluctuations, the industrial packaging segment provides essential solutions to a wide customer base, underpinning Crown's position in the broader packaging market.

Equipment and Service Sales

Crown Holdings also generates revenue by selling packaging equipment and offering related services to a wide array of industrial and commercial clients. This segment is crucial as it provides customers with the necessary machinery to implement their packaging strategies.

These services extend beyond just equipment sales, encompassing vital support for packaging line integration and ongoing operational optimization. This ensures clients can maximize the efficiency and effectiveness of their packaging processes.

This revenue stream acts as a significant complement to their core product sales, allowing Crown Holdings to offer truly comprehensive, end-to-end solutions that address the full spectrum of customer needs in the packaging industry.

- Equipment Sales: Revenue from the sale of various packaging machinery.

- Service Revenue: Income generated from technical support, maintenance, and operational consulting for packaging lines.

- Integration Support: Fees for assisting clients in integrating new equipment into existing or new packaging operations.

- Operational Optimization: Revenue from services aimed at improving the efficiency and output of customer packaging lines.

Crown Holdings' revenue is primarily driven by the sale of metal beverage cans, which represented approximately 67% of its total revenue in 2024. This segment benefits from consistent high-volume sales to beverage companies globally, with notable volume growth observed in markets like Brazil, North America, and Europe during 2024.

The company also generates income from selling metal cans for food packaging and aerosols, serving a broad consumer goods base. In 2024, North American food can shipments saw an increase, highlighting sustained demand in this essential sector.

Additional revenue streams include the sale of metal closures for bottles and jars, specialty packaging solutions, and industrial packaging products like strapping and dunnage. While industrial packaging experienced some volume challenges in 2024 due to reduced industrial output, it remains a core segment.

| Revenue Stream | Primary Products/Services | 2024 Relevance |

|---|---|---|

| Beverage Cans | Aluminum and Steel Cans | ~67% of total revenue; strong volume growth in key markets. |

| Food & Aerosol Cans | Metal cans for food, hygiene, and personal care products | Consistent demand, with North American food can shipments increasing in 2024. |

| Closures | Metal closures for bottles and jars | Crucial for product integrity and brand presentation across food & beverage. |

| Specialty Packaging | Customized packaging solutions | Tailored designs with specific functionalities and aesthetics. |

| Industrial Packaging | Strapping, dunnage, films | Vital for transit and protective solutions; faced volume challenges in 2024 but remains core. |

| Equipment & Services | Packaging machinery, technical support, integration | Complements product sales, offering end-to-end solutions. |

Business Model Canvas Data Sources

The Crown Holdings Business Model Canvas is informed by a blend of publicly available financial disclosures, industry-specific market research reports, and internal operational data. These diverse sources provide a comprehensive view of the company's strategic positioning and market interactions.