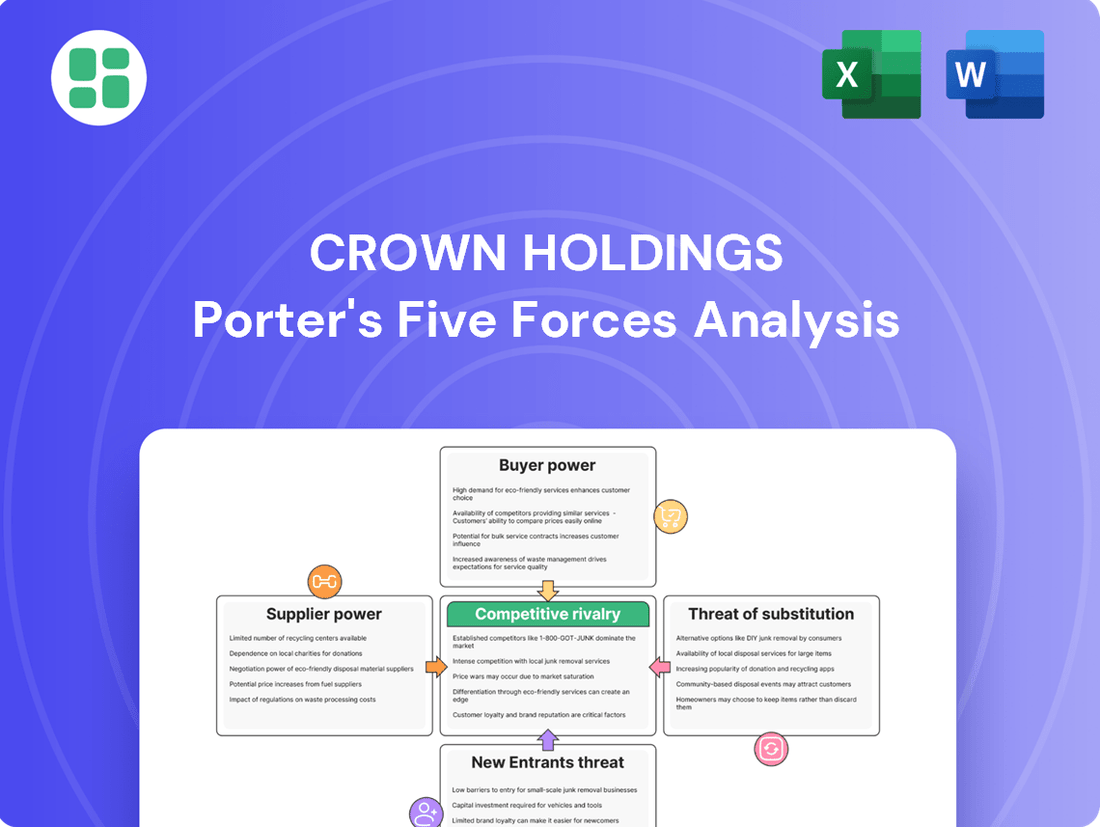

Crown Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Holdings Bundle

Crown Holdings operates in a competitive landscape shaped by significant buyer power and the constant threat of substitutes in the beverage and food packaging industry. Understanding the nuances of supplier relationships and the intensity of rivalry is crucial for strategic planning.

The complete report reveals the real forces shaping Crown Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The rigid packaging sector, including companies like Crown Holdings, is heavily dependent on aluminum and steel. A limited number of global suppliers often control these essential raw materials. This concentration grants suppliers considerable bargaining power, especially when alternative sources are scarce or when particular material specifications are needed.

The bargaining power of these suppliers is further intensified by material scarcity. For instance, in 2024, the global aluminum market experienced price volatility driven by production constraints in key regions, directly impacting the cost of goods for packaging manufacturers. This situation highlights how supplier concentration and material availability significantly shape the cost structure and operational flexibility for companies in this industry.

The prices of key raw materials like aluminum and steel are subject to significant fluctuations. In 2024, global aluminum prices have seen considerable swings, driven by factors such as energy costs and supply chain disruptions. Similarly, steel prices have remained volatile due to ongoing geopolitical tensions and shifts in demand from major manufacturing sectors.

This price volatility directly affects Crown Holdings' manufacturing expenses, as aluminum and steel represent a substantial component of their overall cost base. For instance, a 10% increase in aluminum prices could significantly impact the company's profitability if not managed effectively.

Crown Holdings' capacity to transfer these escalating raw material costs to its customers through established contractual mechanisms is a critical factor in counteracting the bargaining power of its suppliers. The terms of these contracts, including price adjustment clauses, play a vital role in protecting the company's margins.

Crown Holdings, despite its considerable size, faces substantial switching costs when changing suppliers for essential materials like aluminum. These costs can encompass retooling manufacturing lines, the lengthy process of re-qualifying new materials to meet stringent quality standards, and the complex adjustments required within its global supply chain logistics. For instance, in 2023, Crown's capital expenditures for plant and equipment modernization were significant, highlighting the investment needed for such operational shifts.

These inherent switching costs effectively bolster the bargaining power of Crown's established metal suppliers. When it's costly and time-consuming to switch, suppliers can often command more favorable terms. This dynamic can limit Crown's ability to negotiate aggressively on price or other contractual elements.

However, Crown's extensive global footprint does provide a degree of leverage. By operating in numerous regions, Crown can explore alternative sourcing options and potentially diversify its supplier base, thereby mitigating the absolute dependence on any single supplier or region, which in turn can temper supplier bargaining power.

Supplier Differentiation and Proprietary Materials

When suppliers offer materials or technologies that are truly unique, Crown Holdings might find its bargaining power diminished. For instance, if a supplier provides a proprietary coating that enhances a can's durability or offers a significant sustainability advantage that Crown's customers demand, that supplier gains leverage. This is particularly relevant as Crown continues to emphasize eco-friendly and high-performance packaging solutions.

Crown's reliance on specialized inputs for its innovative and sustainable packaging initiatives can amplify supplier bargaining power. If these specialized materials are critical for meeting stringent customer requirements or for differentiating Crown's products in a competitive market, suppliers of these inputs hold a stronger negotiating position. For example, a supplier of advanced, lightweight aluminum alloys with a low carbon footprint could command higher prices if these are essential for Crown's premium product lines.

- Supplier Differentiation: Suppliers offering unique performance characteristics or sustainability benefits in their materials can increase their bargaining power.

- Proprietary Technologies: Access to exclusive technologies or patented processes by suppliers can create dependencies for Crown.

- Critical Inputs: If these differentiated materials are vital for Crown's product differentiation or meeting specific customer demands, supplier leverage rises.

- Sustainability Focus: Crown's commitment to sustainable packaging may necessitate reliance on specialized suppliers, potentially increasing their negotiating strength.

Backward Integration Potential

The potential for backward integration by packaging manufacturers like Crown Holdings, while generally low, could theoretically curb supplier power. If a major player were to consider even partial integration into raw material production, it could signal a shift in market dynamics, potentially limiting suppliers' leverage. However, Crown's strategic focus remains on enhancing its existing manufacturing and supply chain efficiencies rather than venturing into raw material production itself.

Crown Holdings, as of its 2023 annual report, maintained a strong emphasis on operational excellence and supply chain optimization. The company's capital expenditure in 2023, for instance, was directed towards enhancing its manufacturing capabilities and sustainability initiatives, not backward integration into raw materials. This strategic choice means the threat of backward integration as a direct countermeasure to supplier power remains largely theoretical for Crown.

- Limited Backward Integration: Crown's strategy prioritizes optimizing its current operations and supply chain, rather than backward integration into raw material production.

- Theoretical Threat: The possibility of a large packaging manufacturer pursuing partial backward integration exists as a theoretical check on supplier power.

- Strategic Focus: Crown's investments in 2023, totaling $760 million, were aimed at improving manufacturing efficiency and sustainability, reinforcing its core business model.

Suppliers of essential raw materials like aluminum and steel hold significant bargaining power over Crown Holdings due to market concentration and material specificity. This power is amplified by factors such as material scarcity and the high switching costs Crown faces when changing suppliers. For instance, in 2024, aluminum price volatility, driven by production issues, directly impacted packaging manufacturers' costs, underscoring supplier leverage.

Crown's ability to pass on increased raw material costs through contracts is crucial, but supplier differentiation and proprietary technologies can further strengthen their negotiating position. While Crown's global scale offers some sourcing flexibility, the lack of backward integration means this supplier power remains a substantial consideration in its operational strategy.

What is included in the product

This analysis unpacks the competitive forces shaping Crown Holdings' industry, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Crown Holdings' Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making on competitive pressures.

Customers Bargaining Power

Crown Holdings' customer base is notably concentrated, with major consumer marketing companies, particularly in the food and beverage sectors, representing significant volume purchasers. This concentration grants these large clients substantial bargaining power.

These major customers can leverage their purchasing volume to negotiate favorable pricing and terms. Their ability to switch suppliers or source from multiple packaging providers further amplifies their influence, putting pressure on Crown's profit margins.

For instance, in 2023, Crown's top ten customers accounted for a significant portion of its net sales, underscoring the importance of maintaining strong relationships and offering compelling value propositions to retain these key accounts.

Customer switching costs are a significant factor influencing the bargaining power of customers for packaging suppliers like Crown Holdings. For major consumer brands, the process of switching packaging suppliers isn't as simple as changing a vendor for office supplies. It often involves substantial costs related to re-designing packaging to meet new specifications, re-qualifying new suppliers to ensure quality and consistency, and the potential for significant disruptions to their established supply chains and production lines. These are not minor inconveniences; they represent tangible financial and operational hurdles.

These switching costs can effectively reduce the bargaining power of customers. When it becomes costly and disruptive to change suppliers, customers are less likely to switch for minor price differences. This creates a degree of stickiness, encouraging longer-term relationships and making customers more hesitant to move their business unless there's a compelling reason beyond a small price advantage. This is why Crown Holdings focuses on providing value-added engineering and technical support, aiming to deepen these customer relationships and make the switching decision less attractive.

For instance, the cost of re-tooling a beverage can production line for a new supplier's specific can dimensions or material composition can run into hundreds of thousands, if not millions, of dollars. Add to this the expense of new graphic design approvals, printing plate changes, and the risk of production downtime during the transition, and the perceived savings from a slightly lower per-unit price from a new supplier can quickly evaporate. In 2023, Crown reported that its focus on customer collaboration and technical solutions helped maintain strong relationships with key accounts, underscoring the importance of these switching costs in their business model.

In the rigid packaging sector, where standard cans are prevalent, customers often exhibit high price sensitivity. This is because product differentiation can be minimal, turning packaging into a commodity where cost becomes the primary driver for purchasing decisions. This scenario significantly amplifies the bargaining power of customers, as they can easily switch suppliers based on price alone.

Crown Holdings actively combats this by focusing on innovation and sustainability. By offering unique designs and environmentally friendly packaging solutions, Crown aims to move beyond pure price competition. For instance, in 2023, Crown reported a substantial portion of its sales derived from specialty products, indicating success in differentiating its offerings and mitigating the impact of customer price sensitivity.

Threat of Customer Backward Integration

The threat of customer backward integration for packaging suppliers like Crown Holdings is a significant factor in the bargaining power of customers. Large consumer goods companies, particularly those with high-volume, standardized packaging needs, occasionally explore bringing packaging production in-house. This possibility, though capital-intensive, acts as a persistent bargaining chip for these customers.

This latent threat pressures packaging providers to maintain competitive pricing and deliver superior service to retain business. The more commoditized the packaging type, the greater the leverage customers possess in this regard. For instance, a major beverage producer might evaluate the cost-effectiveness of manufacturing its own standard aluminum cans versus outsourcing to a supplier like Crown.

While full backward integration is rare due to the specialized nature and significant investment required in packaging manufacturing, the mere consideration can influence contract negotiations. In 2024, the global packaging market, valued at over $1 trillion, sees intense competition, making customer leverage a critical consideration for suppliers aiming to secure long-term agreements.

- Customer Leverage: Large buyers can leverage the potential for backward integration to negotiate better terms with packaging manufacturers.

- Cost Sensitivity: This threat is most potent for high-volume, standardized packaging where the economics of in-house production might appear more feasible.

- Market Dynamics: In a competitive market like packaging, where suppliers compete on price and service, the threat of integration adds another layer of customer bargaining power.

Availability of Alternative Packaging Suppliers

Crown's customers, particularly those in the beverage and food industries, often have numerous rigid packaging suppliers to choose from. Major global competitors such as Ball Corporation, Ardagh Group, and Silgan Holdings provide significant alternative sourcing options.

This wide availability of suppliers empowers customers by giving them leverage in negotiations. They can readily compare pricing and terms from various providers, making it easier to secure favorable contracts and pricing for their packaging needs.

- Supplier Competition: Crown faces competition from large, established players like Ball Corporation and Ardagh Group, who also serve major beverage and food manufacturers.

- Customer Options: The presence of multiple packaging suppliers means customers are not reliant on a single source, enhancing their bargaining power.

- Price Sensitivity: Packaging costs are a significant component for many of Crown's clients, increasing their focus on competitive pricing and supplier alternatives.

- Market Dynamics: In 2024, the packaging industry continues to see consolidation, but the core issue of customer access to multiple suppliers remains a key factor in competitive dynamics.

Crown Holdings' customers, especially large beverage and food companies, wield significant bargaining power due to their substantial purchasing volumes. This concentration allows them to negotiate favorable pricing and terms, further amplified by their ability to switch suppliers, which pressures Crown's profit margins.

The threat of backward integration, where customers consider producing their own packaging, also serves as a powerful negotiation tool, particularly for high-volume, standardized items. In 2024, the competitive global packaging market, valued at over $1 trillion, makes this customer leverage a critical consideration for suppliers.

The availability of numerous alternative suppliers, such as Ball Corporation and Ardagh Group, strengthens customer options and their ability to secure competitive pricing. This dynamic is crucial in 2024 as packaging costs remain a significant factor for many of Crown's clients.

| Factor | Impact on Crown Holdings | Customer Leverage |

| Customer Concentration | High dependence on key accounts | Ability to negotiate volume discounts |

| Switching Costs | Moderate to high for specialized packaging | Reduced willingness to switch for minor price differences |

| Price Sensitivity | High for standardized packaging | Easier to switch based on price alone |

| Backward Integration Threat | Low to moderate due to capital intensity | Leverage in contract negotiations |

| Supplier Availability | High competition from major players | Enhanced ability to compare and secure favorable terms |

Same Document Delivered

Crown Holdings Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Crown Holdings, detailing the competitive landscape and strategic implications within its industry. The document you are viewing is precisely the same professionally written and formatted analysis you will receive instantly upon purchase, offering no surprises or placeholders. You can trust that this preview accurately represents the comprehensive insights into supplier power, buyer power, threat of new entrants, threat of substitutes, and existing rivalry that will be yours to download and utilize immediately.

Rivalry Among Competitors

The rigid packaging sector is highly concentrated, with a few major global companies like Crown Holdings, Ball Corporation, Ardagh Group, and Silgan Holdings holding significant market sway. This dominance fuels fierce rivalry as these giants vie for market share.

Competition is particularly sharp in high-growth areas such as beverage cans, where players invest heavily in expanding capacity and adopting advanced technologies. For instance, in 2023, Crown Holdings reported a net sales increase driven by strong demand in its beverage packaging segment.

The competitive rivalry within the rigid packaging industry, including segments where Crown Holdings operates, is influenced by the industry's maturity. While specific areas like beverage cans demonstrate robust growth, the broader market for rigid packaging is largely mature. This maturity often leads to intensified competition as companies battle for smaller market share gains and strive to differentiate themselves.

The projected growth rate for the global rigid packaging market between 2025 and 2032 is estimated at approximately 4.8% annually. This moderate growth, while positive, still fuels rivalry among established players like Crown Holdings. Companies are focused on innovation, operational efficiency, and strategic acquisitions to capture these incremental gains and maintain or expand their competitive positions.

Crown Holdings faces intense competition where product differentiation is as crucial as price. This includes offering innovative designs, sophisticated printing capabilities, and increasingly, sustainable packaging options that resonate with both consumers and brand owners. For instance, in 2024, the demand for recyclable and compostable packaging materials continued to surge, driving significant R&D investments across the industry.

High Fixed Costs and Capacity Utilization

The rigid packaging sector is inherently capital-intensive, demanding substantial upfront investment in manufacturing plants and machinery. This translates into considerable fixed costs for players like Crown Holdings.

To offset these high fixed costs, companies are driven to achieve high capacity utilization. When the industry experiences overcapacity, this often results in aggressive pricing tactics as firms aim to keep their production lines running and spread the fixed expenses. Crown's recent completion of significant capital expenditure programs to modernize its operations underscores this ongoing investment cycle.

- Capital Intensity: The rigid packaging industry requires significant investment in manufacturing facilities and equipment.

- High Fixed Costs: This capital intensity leads to substantial fixed costs for companies.

- Capacity Utilization Drive: Companies strive for high capacity utilization to spread these fixed costs.

- Pricing Pressure: Overcapacity can lead to aggressive pricing as firms seek to maintain utilization.

Mergers, Acquisitions, and Strategic Alliances

Mergers, acquisitions, and strategic alliances are constantly reshaping the competitive arena for companies like Crown Holdings. These moves aim to consolidate market share, expand into new regions, or gain access to innovative technologies and customer bases. For instance, in 2023, the packaging industry saw significant M&A activity, with major players actively pursuing consolidation to achieve greater economies of scale and market influence.

This dynamic M&A trend can lead to a landscape dominated by fewer, larger entities, potentially increasing their bargaining power with suppliers and customers. Such consolidation can intensify rivalry as these larger players leverage their expanded resources and market reach. For example, a major acquisition by a competitor could mean Crown Holdings faces a more formidable rival with a broader product portfolio and enhanced distribution networks.

- Consolidation Trend: The global packaging market continues to see M&A as a key strategy for growth and market positioning.

- Strategic Motivations: Companies pursue mergers and acquisitions to gain market share, access new technologies, and expand geographic footprints.

- Impact on Rivalry: Increased M&A activity can lead to fewer, larger competitors, potentially intensifying price competition and innovation pressures.

- Crown Holdings' Position: Crown Holdings must continually assess its competitive environment, considering how these strategic moves by rivals might affect its market standing and profitability.

Competitive rivalry in the rigid packaging sector, where Crown Holdings operates, is intense due to the industry's concentration and maturity. Major players like Ball Corporation and Ardagh Group actively compete for market share, especially in growing segments like beverage cans. This rivalry is further fueled by significant capital investments and the drive for high capacity utilization, leading to potential pricing pressures.

The pursuit of differentiation through innovation, sustainability, and design is a key battleground. For instance, the increasing demand for eco-friendly packaging materials in 2024 necessitates substantial R&D spending. Mergers and acquisitions are also actively reshaping the competitive landscape, with companies consolidating to gain scale and market influence.

| Competitor | 2023 Net Sales (USD billions) | Primary Segments |

|---|---|---|

| Crown Holdings | 7.72 | Beverage cans, Food cans, Aerosol cans |

| Ball Corporation | 12.03 | Beverage cans, Specialty packaging |

| Ardagh Group | 10.10 (approx.) | Glass containers, Metal cans |

| Silgan Holdings | 5.77 | Metal containers, Plastic containers |

SSubstitutes Threaten

The threat of substitutes for Crown Holdings' metal packaging is significant, primarily stemming from materials like plastic, glass, flexible pouches, and cartons. These alternatives offer varying advantages, such as lower cost, lighter weight, or different aesthetic appeals, directly challenging metal's market share in beverage, food, and specialty packaging segments.

For example, the rigid plastic packaging market is expected to see robust growth, with projections indicating a compound annual growth rate (CAGR) of around 4-5% through 2028, driven by demand for durable and lightweight solutions. This expansion directly competes with metal cans, especially in the beverage sector where PET bottles are a common substitute.

A significant threat of substitution for Crown Holdings stems from evolving consumer and brand owner preferences for sustainability. Consumers are increasingly seeking eco-friendly packaging, and brands are responding by adopting greener alternatives.

While metal cans boast excellent recyclability, the rise of biodegradable materials, reusable packaging systems, and innovative paper-based solutions presents a direct challenge. For instance, the global market for sustainable packaging is projected to reach over $400 billion by 2025, highlighting the significant shift away from traditional materials.

This trend compels companies like Crown to emphasize the inherent infinite recyclability of aluminum and steel. Crown's own sustainability reports often detail their efforts in reducing carbon footprint and promoting circular economy principles to counter these substitution pressures.

Substitutes for metal packaging, such as glass and plastic, often compete by offering lower upfront costs or weight advantages that translate to reduced transportation expenses. For instance, while metal provides excellent barrier properties, the rising cost of raw materials and recent tariffs on metals in 2024 have made glass and plastic more economically viable for certain product categories, particularly in price-sensitive markets.

Technological Advancements in Substitute Materials

Ongoing innovations in materials science are introducing compelling substitutes for metal packaging. For instance, advancements in plant-based plastics and lighter-weight aluminum alloys are creating more sustainable and cost-effective options. These developments pose a significant threat as they can match or even surpass the performance of traditional metal cans in specific market segments, potentially impacting Crown Holdings' market share.

The rise of smart packaging, incorporating features like enhanced barrier properties or interactive elements, also presents a substitute threat. These innovations aim to offer added value beyond basic containment. For example, by 2024, the global smart packaging market was projected to reach approximately $40 billion, indicating a growing demand for advanced packaging solutions that could divert demand from traditional metal containers.

- New Materials: Development of advanced bioplastics and composite materials offering comparable or superior performance.

- Sustainability Focus: Growing consumer and regulatory pressure for environmentally friendly packaging alternatives.

- Cost-Effectiveness: Innovations leading to lighter-weight materials or more efficient production processes for substitutes.

- Functional Enhancements: Smart packaging features providing added value and potentially replacing the need for traditional metal packaging.

Regulatory Pressure and Environmental Compliance

Increasingly stringent global regulations concerning packaging waste, recyclability, and environmental impact can favor certain substitute materials or push for changes in packaging design. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR), aiming for 100% recyclable packaging by 2030, directly influences material choices and could boost demand for paper-based or compostable alternatives over traditional metal or plastic packaging.

These evolving environmental standards create a significant threat of substitutes for companies like Crown Holdings. As governments worldwide implement stricter rules on single-use plastics and mandate higher recycled content, materials that more easily meet these criteria gain a competitive edge. This regulatory push is a key driver for innovation in alternative packaging solutions, potentially impacting Crown's market share if they cannot adapt their product offerings or manufacturing processes swiftly enough.

The financial implications are substantial. For example, a 2024 report indicated that companies failing to meet new recycling targets could face fines equivalent to 2-5% of their annual turnover in certain European markets. This pressure incentivizes a shift toward materials with proven recyclability or biodegradability, directly challenging the established dominance of metal cans and certain plastic formats.

- Regulatory Pressure: Global regulations on packaging waste and recyclability are intensifying, favoring materials with better environmental profiles.

- EU's PPWR: The EU's Packaging and Packaging Waste Regulation is a prime example, pushing for 100% recyclable packaging by 2030.

- Material Shift: This regulatory environment encourages a move towards paper-based, compostable, or easily recyclable materials as substitutes.

- Financial Impact: Non-compliance with new recycling targets could lead to significant fines, estimated at 2-5% of annual turnover in some regions as of 2024.

The threat of substitutes for metal packaging remains a significant concern for Crown Holdings, driven by advancements in alternative materials and shifting consumer preferences. While metal offers durability and recyclability, materials like advanced plastics, glass, and innovative paper-based solutions are increasingly competing for market share. For instance, the global flexible packaging market, a direct substitute, was projected to reach over $250 billion by 2025, showcasing the breadth of alternatives available.

| Substitute Material | Key Advantages | Threat Level to Metal Packaging |

| Plastic (PET, HDPE) | Lightweight, lower cost, shatter-resistant | High (especially in beverages) |

| Glass | Premium perception, inertness, recyclability | Moderate (higher cost and weight) |

| Paper/Cartons | Sustainability perception, biodegradability | Growing (particularly for liquid foods and beverages) |

| Flexible Pouches | Lightweight, versatile, reduced material usage | High (especially for food and personal care) |

Entrants Threaten

The rigid packaging industry, where Crown Holdings operates, demands significant capital. Think about the cost of setting up advanced manufacturing plants and acquiring specialized machinery; these are not small expenses. For instance, a new entrant might need hundreds of millions of dollars just to get a basic operation off the ground, making it tough for smaller companies to compete.

This high capital requirement serves as a substantial barrier for potential new competitors. It effectively limits the pool of companies that can realistically enter the market and operate at a competitive scale. In 2023, the global rigid packaging market was valued at approximately $270 billion, and the investment needed to capture even a small fraction of this market is immense.

Crown Holdings, like other established players in the rigid packaging industry, benefits immensely from significant economies of scale. This advantage spans production, raw material procurement, and logistics. For instance, in 2023, Crown Holdings reported net sales of $12.9 billion, reflecting its vast operational footprint and purchasing power.

New entrants would find it extremely challenging to match these cost efficiencies. Without the same scale, they would likely face higher per-unit costs for production and materials. This inherent cost disadvantage acts as a substantial barrier, making it difficult for newcomers to compete effectively on price in a market where cost is a critical factor.

Crown Holdings benefits from deeply entrenched customer relationships with major consumer marketing and industrial clients, fostered through years of reliable service and integrated supply chain solutions. Disrupting these established bonds and replicating Crown's extensive distribution capabilities presents a significant hurdle for any potential new entrant.

Regulatory Hurdles and Environmental Compliance

The packaging industry faces a significant threat from new entrants due to stringent regulatory hurdles and environmental compliance demands. Companies entering this space must grapple with complex and continually evolving rules concerning material safety, recyclability, and waste management. For instance, in 2024, the European Union continued to implement its Circular Economy Action Plan, placing increased pressure on packaging producers to adopt sustainable materials and design for recyclability, which can be a costly undertaking for newcomers.

Navigating this regulatory landscape requires substantial time, considerable financial investment, and specialized expertise in sustainability. New entrants must invest heavily in research and development to ensure their products meet current and future environmental standards, potentially delaying market entry and increasing initial operating costs. This complexity acts as a formidable barrier, deterring many potential competitors from entering the market.

Key compliance areas that pose a threat include:

- Material Safety Standards: Ensuring all packaging materials meet rigorous safety regulations for food contact and consumer health.

- Recyclability Requirements: Designing packaging that is easily recyclable within existing infrastructure, a growing focus in many global markets.

- Waste Management Directives: Adhering to regulations on extended producer responsibility and waste reduction targets.

- Carbon Footprint Reporting: Increasingly, companies are expected to report and reduce their carbon emissions across the packaging lifecycle.

Access to Raw Materials and Supply Chain Disruptions

Newcomers face significant hurdles in securing consistent and cost-effective access to essential raw materials like aluminum and steel. This is particularly true in 2024, where supply chain disruptions continue to be a concern, leading to fluctuating material prices. For instance, aluminum prices saw volatility throughout 2023 and early 2024 due to geopolitical factors and production issues in key regions.

Established companies like Crown Holdings benefit from long-standing relationships with preferred suppliers and sophisticated supply chain management systems. These established networks provide them with greater purchasing power and more predictable material flows. New entrants often struggle to replicate these advantages, making it difficult to compete on cost and reliability.

- Raw Material Dependency: The packaging industry heavily relies on aluminum and steel, making their availability and price critical.

- Supply Chain Vulnerabilities: Global events can quickly impact the supply and cost of these materials, creating uncertainty for new businesses.

- Established Relationships: Existing players have secured favorable terms and reliable sourcing channels that are hard for new entrants to match.

- Price Volatility: Fluctuations in commodity markets, as seen with steel and aluminum in recent years, pose a significant risk to new entrants' profitability.

The threat of new entrants for Crown Holdings is moderately low, primarily due to the substantial capital investment required to establish a competitive presence in the rigid packaging industry. Setting up advanced manufacturing facilities and acquiring specialized machinery can easily run into hundreds of millions of dollars, a significant hurdle for newcomers. For example, the global rigid packaging market's value, approximately $270 billion in 2023, highlights the scale of investment needed to gain even a small market share.

Furthermore, established players like Crown Holdings enjoy considerable economies of scale, which translate into lower per-unit costs for production and raw materials. In 2023, Crown Holdings' net sales reached $12.9 billion, underscoring its vast operational capacity and purchasing power. New entrants would struggle to match these cost efficiencies, putting them at a disadvantage in a price-sensitive market.

Regulatory compliance and stringent environmental standards also act as formidable barriers. Navigating complex rules regarding material safety, recyclability, and waste management, such as the EU's Circular Economy Action Plan in 2024, demands significant investment in R&D and specialized expertise, further deterring potential entrants.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Requirements | High cost of setting up manufacturing and acquiring machinery. | Significant deterrent due to immense upfront investment. | Global rigid packaging market value: ~$270 billion. |

| Economies of Scale | Lower per-unit costs achieved through large-scale production and procurement. | New entrants face higher costs and cannot compete on price. | Crown Holdings 2023 Net Sales: $12.9 billion. |

| Regulatory Compliance | Meeting environmental and safety standards (e.g., recyclability, material safety). | Requires substantial investment in R&D and expertise, delaying entry. | EU Circular Economy Action Plan (ongoing in 2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Crown Holdings is built upon a robust foundation of data, including Crown's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Mintel.