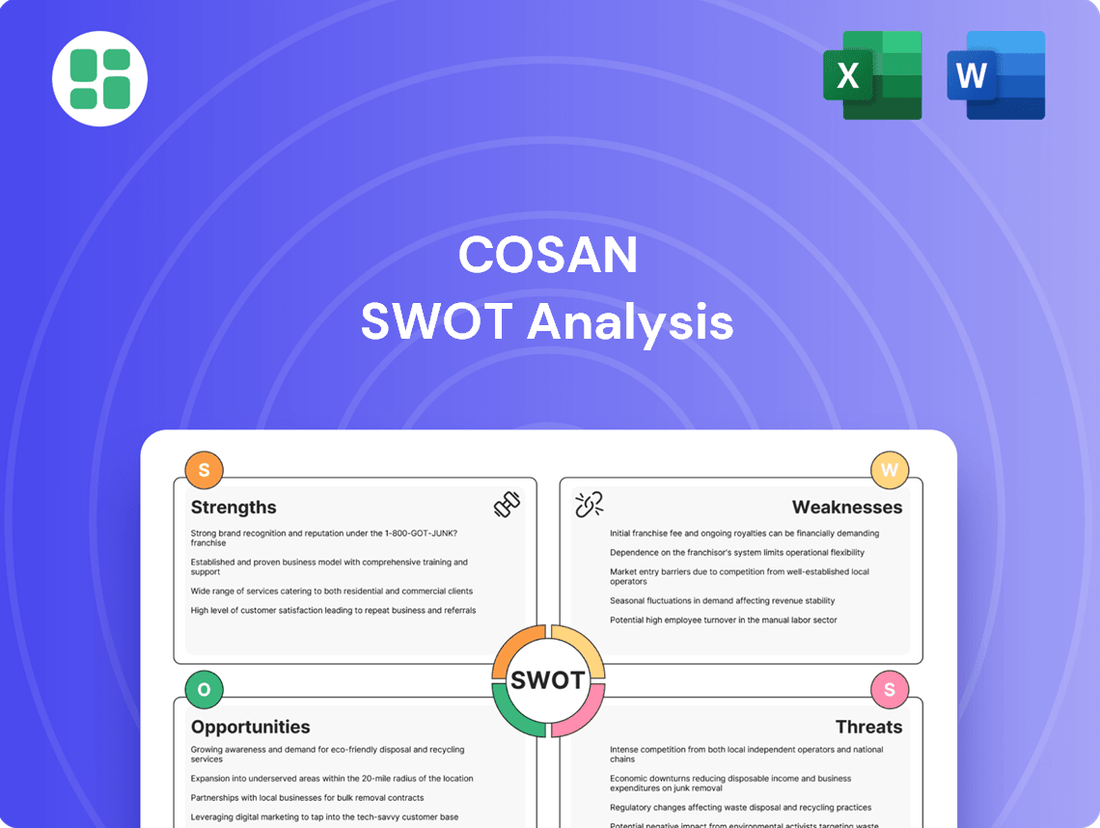

Cosan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosan Bundle

Cosan's diversified portfolio, spanning energy and infrastructure, presents significant strengths, but also exposes it to market volatilities and regulatory shifts. Understanding these dynamics is crucial for navigating its complex landscape.

Want the full story behind Cosan's competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Cosan's strength lies in its highly diversified business model, spanning critical sectors such as energy, logistics, and agribusiness. This broad operational base, encompassing sugar and ethanol production, fuel distribution through Raízen, and gas and energy distribution via Compass Gás e Energia, significantly mitigates risks associated with fluctuations in any single market. For instance, in the first quarter of 2025, Raízen reported a 12% increase in its bioenergy segment's adjusted EBITDA, showcasing the resilience of its core operations.

Furthermore, Cosan benefits from market leadership in several of its key segments. Raízen, a joint venture with Shell, stands as a global leader in bioenergy and is a major player in Brazil's fuel distribution market, holding approximately 25% market share as of late 2024. Similarly, Rumo, Cosan's logistics arm, is the largest railway operator in Brazil, crucial for transporting agricultural commodities and contributing to operational efficiencies and expanded market reach.

Cosan's robust logistics and infrastructure assets, primarily through its subsidiary Rumo, represent a significant strength. Rumo manages extensive port operations and railway networks, crucially linking Brazil's major agricultural heartlands to vital export terminals. This integrated system facilitates highly efficient and environmentally friendly transportation, a key differentiator in the market.

In 2023, Rumo demonstrated this strength with impressive operational results, including a 12.8% increase in cargo volume handled compared to 2022, reaching 73.4 million tons. This growth, coupled with an average tariff increase of 10.5%, directly translated into enhanced margins and solidified Rumo's market leadership, underscoring the competitive edge provided by these infrastructure assets.

Cosan stands out as a frontrunner in the global shift towards sustainable energy. Through its joint venture Raízen, a significant player in Brazil's energy sector, Cosan is deeply invested in biofuels, particularly ethanol. This commitment is further bolstered by Compass, its natural gas distribution company, which is also exploring renewable energy avenues.

The company's strategic focus on reducing its carbon footprint and its ambition to lead in climate change assessments directly taps into the burgeoning global demand for green energy solutions. This positions Cosan favorably for substantial long-term growth as economies worldwide prioritize decarbonization efforts.

Strategic Capital Allocation and Portfolio Management

Cosan’s strategic capital allocation is a key strength, evidenced by its disciplined approach to portfolio optimization. A prime example is the divestment of its stake in Vale, a move that significantly reduced its debt burden and sharpened its focus on core operations. This strategic pruning allows for more efficient resource deployment, bolstering financial health.

The company is actively working to improve its debt ratios, aiming for greater financial stability. This focus on deleveraging, coupled with strategic investments in growth areas, positions Cosan for more sustainable expansion. By prioritizing its core businesses and seeking out value-adding partnerships, Cosan is building a more resilient financial structure.

- Disciplined Divestment: Sale of Vale stake to reduce debt and refine asset base.

- Portfolio Optimization: Focus on core businesses for improved efficiency and growth.

- Debt Reduction: Active efforts to improve financial leverage and stability.

- Strategic Partnerships: Cultivating alliances to enhance market position and capabilities.

Consistent Dividend Growth and Shareholder Returns

Cosan demonstrates a strong commitment to shareholder returns through its consistent dividend growth. Between 2020 and 2023, the company achieved an impressive average annual dividend growth rate of 19.7%. This upward trend highlights Cosan's robust financial performance and its dedication to rewarding investors.

Looking ahead, projections for 2024 suggest this positive trajectory for dividend payouts will continue. This sustained growth in distributions makes Cosan an attractive option for investors focused on generating reliable passive income from their investments.

- Consistent Dividend Growth: Average annual growth of 19.7% from 2020-2023.

- Financial Strength: Demonstrated ability to increase payouts reflects a healthy financial position.

- Shareholder Focus: Strategy balances sustainable growth with increasing shareholder returns.

- Positive Outlook: 2024 projections indicate continued dividend increases, benefiting income-focused investors.

Cosan's diversified business model is a significant strength, allowing it to operate across energy, logistics, and agribusiness. This broad reach, including fuel distribution via Raízen and railway operations through Rumo, helps buffer against sector-specific downturns. For example, Raízen's bioenergy segment saw a 12% adjusted EBITDA increase in Q1 2025, demonstrating operational resilience.

Market leadership in key segments further bolsters Cosan's position. Raízen, a joint venture with Shell, is a global bioenergy leader and a dominant force in Brazil's fuel market, holding about 25% share as of late 2024. Rumo, its logistics arm, is Brazil's largest railway operator, vital for agricultural exports.

Cosan's substantial logistics infrastructure, particularly Rumo's extensive railway network and port facilities, provides a critical competitive advantage. This integrated system efficiently connects Brazil's agricultural regions to export markets, as evidenced by Rumo's 12.8% cargo volume increase in 2023, reaching 73.4 million tons.

The company's strategic focus on sustainable energy, led by Raízen's biofuel production and Compass's natural gas ventures, positions it well for future growth. This commitment to green energy aligns with global decarbonization trends, enhancing long-term prospects.

Cosan's disciplined capital allocation, including the sale of its Vale stake, has strengthened its financial position by reducing debt and sharpening its focus on core businesses. This strategic optimization, coupled with efforts to improve debt ratios, fosters greater financial stability and sustainable expansion.

Cosan has shown a strong commitment to shareholder returns, with an average annual dividend growth of 19.7% between 2020 and 2023. Projections for 2024 indicate this trend will continue, making the company attractive for income-focused investors.

| Key Strength | Description | Supporting Data/Metric | Impact |

| Diversified Business Model | Operations across energy, logistics, agribusiness | Raízen's Q1 2025 bioenergy EBITDA up 12% | Mitigates sector-specific risks |

| Market Leadership | Dominant positions in key segments | Raízen: ~25% Brazil fuel market share (late 2024) | Enhances pricing power and market reach |

| Logistics Infrastructure | Extensive railway and port network (Rumo) | Rumo cargo volume up 12.8% in 2023 (73.4M tons) | Drives operational efficiency and cost advantages |

| Sustainable Energy Focus | Investment in biofuels and renewables | Raízen's leading role in ethanol production | Aligns with global decarbonization trends, future growth potential |

| Disciplined Capital Allocation | Portfolio optimization and debt reduction | Vale stake divestment to reduce debt | Improves financial health and focus on core assets |

| Shareholder Returns | Consistent dividend growth | 19.7% avg. annual dividend growth (2020-2023) | Attracts income-focused investors, signals financial strength |

What is included in the product

Analyzes Cosan’s competitive position through key internal and external factors, highlighting its integrated business model and market leadership while considering regulatory risks and commodity price volatility.

Identifies key competitive advantages and potential threats for strategic mitigation.

Weaknesses

Cosan faced significant financial challenges, reporting substantial net losses in the fourth quarter of 2024 and the first quarter of 2025. These losses were largely attributable to the declining value of its investment in Vale and weaker-than-expected results from Raízen.

The company's financial health was further strained by a persistently high net debt, which stood at R$64.14 billion as of December 2024. This elevated debt level, coupled with a declining debt service coverage ratio, signals considerable pressure on Cosan's profitability and its ability to manage its financial obligations.

Raízen, a cornerstone of Cosan's operations, faced considerable headwinds in the latter half of fiscal year 2024/25. The company reported substantial net losses in both the fourth quarter of FY24/25 and the first quarter of FY25. This downturn was primarily attributed to a reduction in sugarcane crushing volumes, a decline in ethanol prices, and the detrimental impact of adverse weather, including drought and wildfires, which significantly hampered agricultural output.

These operational challenges at Raízen have necessitated a significant strategic review and led to management realignments within the subsidiary. The financial strain caused by Raízen's underperformance directly affects Cosan's consolidated financial performance, highlighting a critical area of weakness for the parent company.

Cosan's significant reliance on agricultural commodities like sugarcane exposes it to substantial price volatility in global markets. For instance, fluctuations in ethanol and sugar prices directly impact its key subsidiary, Raízen, a major player in these sectors.

Furthermore, the company is susceptible to weather-related risks, such as droughts and wildfires, which can severely affect crop yields and production volumes. These unpredictable events can lead to significant operational disruptions and impact profitability, as evidenced by recent challenges faced by Raízen in its agricultural operations.

Macroeconomic Headwinds in Brazil

Cosan faces significant headwinds from Brazil's macroeconomic landscape. High and volatile interest rates, like the Selic rate which stood at 10.50% as of May 2024, directly increase Cosan's borrowing costs. This elevated cost of capital strains its cash flow and can dampen profitability across its diverse operations.

Furthermore, persistent inflation, which averaged around 4.62% in Brazil for 2023, erodes purchasing power and can impact consumer demand for Cosan's products and services. Currency fluctuations, particularly the Brazilian Real's volatility against the US Dollar, also present challenges, affecting the cost of imported inputs and the repatriation of earnings from international activities.

- Elevated Interest Rates: The Selic rate's presence at 10.50% (May 2024) makes debt servicing more expensive, impacting Cosan's financial leverage.

- Inflationary Pressures: Brazil's inflation, averaging 4.62% in 2023, can reduce consumer spending power and increase operational costs.

- Currency Volatility: Fluctuations in the Brazilian Real impact the cost of imports and the value of repatriated profits.

- Deleveraging Challenges: The high-interest rate environment makes it harder for Cosan to reduce its debt levels effectively, increasing financial risk.

Complexity of Business Portfolio and Management Changes

Cosan's broad business portfolio, spanning energy, logistics, and agriculture, naturally introduces management complexity. Coordinating diverse operations and ensuring strategic alignment across subsidiaries like Raízen and Comgás requires robust oversight. This diversification, while offering resilience, can also dilute focus and create challenges in optimizing capital allocation across different sectors.

Recent management shifts within Cosan's various units, including leadership changes at Raízen, introduce transitional risks. While these adjustments are often intended to streamline operations or drive new growth, they can temporarily disrupt momentum and require time for new leadership to fully integrate and execute strategic objectives. The effectiveness of these changes will be a key factor in future performance.

Past capital allocation decisions, such as the aborted Moove IPO in late 2023 and earlier discussions around investing in Vale, highlight the inherent complexities in managing such a large and varied conglomerate. These instances suggest that navigating strategic opportunities and divestitures within a diversified structure can be challenging, impacting overall financial flexibility and strategic execution.

- Diversified Portfolio Complexity: Managing a conglomerate with diverse interests in energy, logistics, and agriculture presents inherent operational and strategic coordination challenges.

- Transitional Risks from Leadership Changes: Recent management shifts across subsidiaries, while aiming for efficiency, can introduce temporary disruptions and require time to realize intended benefits.

- Capital Allocation Challenges: Past instances like the failed Moove IPO and debated Vale investment underscore the difficulties in optimizing capital deployment across a broad range of business units.

Cosan's substantial debt burden, reaching R$64.14 billion as of December 2024, coupled with a declining debt service coverage ratio, poses a significant financial risk. This high leverage amplifies the impact of rising interest rates, making debt servicing more costly and straining cash flow. The company's reliance on agricultural commodities, like sugarcane, also exposes it to price volatility and weather-related disruptions, as seen with Raízen's recent performance issues.

The complexity of managing a diversified portfolio across energy, logistics, and agriculture can dilute focus and complicate capital allocation. Recent management changes within subsidiaries, such as Raízen, introduce transitional risks that may temporarily hinder operational momentum. Past capital allocation challenges, including the aborted Moove IPO in late 2023, highlight difficulties in optimizing strategic opportunities within the conglomerate.

| Financial Metric | Value (as of Dec 2024) | Implication |

|---|---|---|

| Net Debt | R$64.14 billion | High leverage increases financial risk, especially in a rising interest rate environment. |

| Debt Service Coverage Ratio | Declining | Indicates reduced ability to meet debt obligations, pressuring profitability. |

| Selic Rate (May 2024) | 10.50% | Increases borrowing costs, impacting Cosan's profitability and deleveraging efforts. |

Preview the Actual Deliverable

Cosan SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Cosan. The complete, in-depth version becomes available immediately after purchase, providing you with the full, professionally structured report.

Opportunities

The global drive towards decarbonization offers a prime opportunity for Cosan, especially via Raízen's established position in bioenergy and advanced ethanol production. This sector is experiencing robust growth, with the International Energy Agency projecting renewable energy capacity to increase by over 80% by 2026, reaching over 7,700 GW.

Cosan can leverage this trend by expanding its renewable energy infrastructure, including new ethanol facilities and exploring green hydrogen production. Such expansion aligns with increasing market demand and supportive government policies aimed at fostering clean energy adoption.

Cosan has a significant opportunity to boost its logistics operations through Rumo. By expanding its reach to more agricultural areas and linking them to vital ports, Cosan can improve efficiency and secure a larger slice of the market.

Investments like the Lucas do Rio Verde railway project are crucial. This initiative will not only expand transport capacity but also contribute to lower carbon emissions, reinforcing Rumo's competitive edge in the logistics sector.

Cosan's strategic divestments, like the sale of its stake in Vale, are generating significant capital. This move directly supports their ongoing debt reduction strategy, aiming to bolster the company's financial stability. For instance, by the end of Q1 2024, Cosan had already reduced its net debt by a notable amount, freeing up resources.

This deleveraging process is crucial for improving Cosan's overall financial health. Lowering interest expenses directly impacts profitability, and a stronger balance sheet can lead to a more favorable market valuation. Investors often view reduced debt as a sign of responsible financial management, potentially attracting more capital.

Potential for IPOs and Strategic Partnerships in Subsidiaries

Cosan is exploring the possibility of initial public offerings (IPOs) for key subsidiaries such as Moove and Compass, or alternatively, securing strategic partners for various projects. This approach aims to unlock substantial value and enhance liquidity, facilitating further investments or debt reduction, especially if market conditions prove more favorable than in previous attempts.

The potential for capital recycling through these strategic moves is significant. For instance, a successful IPO for Moove, a lubricants distributor, could provide the capital needed to expand its international footprint, potentially mirroring its 2023 performance where it saw revenue growth. Similarly, Compass, a natural gas distributor, could leverage a strategic partnership to accelerate infrastructure development. The Brazilian IPO market has shown some resilience in early 2024, with several companies successfully listing, suggesting a potentially more receptive environment for Cosan's subsidiaries.

- Moove IPO Potential: Moove's established market presence and international expansion plans make it a strong candidate for an IPO, potentially raising capital for further growth.

- Compass Strategic Partnerships: Securing strategic partners for Compass could accelerate its natural gas distribution network expansion, capitalizing on Brazil's growing energy demand.

- Market Environment Impact: A more robust IPO market in 2024-2025 could significantly boost the valuation and liquidity generated from any subsidiary listings.

- Capital Recycling: These initiatives enable Cosan to recycle capital, allowing for reinvestment in core businesses or deleveraging of its balance sheet.

Growing Demand for Natural Gas and Energy Distribution

Compass Gás e Energia's strategic focus on broadening natural gas distribution networks is well-positioned to capitalize on Brazil's ongoing energy transition. This aligns with a national push for cleaner energy alternatives, directly addressing growing demand.

The acquisition of Compagas is a key factor, expanding Compass’s reach and operational footprint. Coupled with investments in new renewable energy projects under the Compass umbrella, this signals significant growth potential within the broader gas and energy sector.

This expansion is further bolstered by an increasing customer base, particularly within the more profitable residential segments. These segments typically offer better margins, enhancing overall financial performance for Cosan's energy division.

- Expanding Natural Gas Infrastructure: Compass Gás e Energia is actively increasing its natural gas distribution network, a move that directly supports Brazil's energy transition goals.

- Strategic Acquisitions: The acquisition of Compagas is a prime example of Cosan's strategy to consolidate and grow its presence in the natural gas market.

- Renewable Energy Integration: Development of new renewable energy projects by Compass demonstrates a forward-looking approach, diversifying its energy portfolio and capturing emerging market opportunities.

- Margin Improvement: Growth in the residential customer base is expected to yield improved margins, contributing positively to the company's profitability.

Cosan's strong position in the bioenergy sector, particularly through Raízen, is a significant opportunity. The global shift towards decarbonization is driving demand for renewable fuels, with the International Energy Agency projecting a substantial increase in renewable energy capacity by 2026. Cosan can capitalize on this by expanding its ethanol production and exploring green hydrogen, aligning with supportive government policies.

The company can also enhance its logistics operations via Rumo by extending its network to more agricultural regions and connecting them to key ports, thereby increasing efficiency and market share. Investments in projects like the Lucas do Rio Verde railway further bolster this, expanding transport capacity and reducing carbon emissions.

Cosan is also exploring strategic moves like IPOs for subsidiaries such as Moove and Compass, or seeking strategic partners. These actions aim to unlock value and improve liquidity, potentially providing capital for growth or debt reduction, especially if market conditions for listings are favorable in 2024-2025.

Compass Gás e Energia is poised to benefit from Brazil's energy transition by expanding its natural gas distribution networks, supported by acquisitions like Compagas and investments in renewables. The growing residential customer base is also expected to improve profit margins.

Threats

Brazil's economic landscape, characterized by elevated interest rates and persistent inflation, presents a significant headwind for Cosan. For instance, the Brazilian Central Bank's Selic rate remained at 10.50% as of May 2024, increasing borrowing costs for the company and potentially dampening investment. This environment, coupled with political uncertainties, can lead to unpredictable shifts in consumer spending and operational costs, impacting Cosan's profitability and strategic planning.

Cosan's diversified operations expose it to significant competitive threats across all its business segments. In fuel distribution, for instance, the Brazilian market sees intense rivalry from major players like Petrobras and Raízen, impacting pricing strategies and market share. Similarly, the sugar and ethanol sector contends with global commodity price volatility and competition from other large producers.

Logistics, particularly with Rumo, faces competition from other rail operators and alternative transport modes, necessitating ongoing infrastructure investments to maintain efficiency and cost-effectiveness. The natural gas distribution segment, through Comgás, also operates in a regulated environment with potential for new entrants and evolving energy sources, demanding continuous adaptation to market dynamics and customer needs.

Changes in government policies and regulations affecting the energy, environmental, and agricultural sectors pose a significant threat to Cosan. For instance, shifts in biofuel mandates, such as potential alterations to Brazil's RenovaBio program, could directly impact demand for Cosan's ethanol production. Stricter environmental regulations, like those concerning carbon emissions or land use for agriculture, might necessitate increased capital expenditures for compliance, thereby affecting profitability.

Fluctuations in Global Commodity Prices

Cosan's financial performance is intrinsically tied to the volatile global commodity markets, particularly sugar, ethanol, and oil. These price swings directly affect the revenue streams of its key Raízen and Moove businesses, creating significant financial risk. For instance, a sharp decline in sugar prices, perhaps due to bumper harvests in Brazil or India, could substantially reduce Raízen's profitability.

The company's reliance on these commodities means that external factors like geopolitical events or changes in global demand can have an outsized impact. A downturn in crude oil prices, for example, directly impacts Moove's lubricants business, potentially squeezing margins. This inherent price volatility necessitates robust risk management strategies to mitigate potential earnings erosion.

Consider these specific impacts:

- Sugar Price Sensitivity: Raízen's sugar segment revenue is directly correlated with global sugar prices, which can fluctuate based on supply and demand dynamics.

- Ethanol Market Volatility: Ethanol prices, influenced by sugar cane availability and the price of gasoline, can also impact Raízen's performance.

- Oil Price Impact: Moove's lubricant sales are sensitive to crude oil prices, affecting input costs and end-product pricing.

Climate Change Impacts and Agricultural Risks

Climate change poses a significant threat to Cosan's operations, particularly through increasingly frequent extreme weather events. These events, such as prolonged droughts and devastating wildfires, directly impact the crucial sugarcane crops that form the backbone of its agribusiness and bioenergy segments, notably through its subsidiary Raízen. For instance, Raízen experienced a notable decline in production during the 2024 harvest due to adverse weather conditions.

The consequences of these climatic shifts extend beyond reduced yields. They can lead to substantial increases in operational costs, as companies like Cosan may need to invest more in irrigation, crop protection, and recovery efforts. Furthermore, disruptions to agricultural output can create significant volatility in supply chains, affecting the reliable delivery of products and potentially impacting market prices and revenue streams for Cosan's various business units.

- Extreme Weather Events: Increased frequency of droughts and wildfires directly impacts sugarcane yields.

- Production Declines: Raízen, a key Cosan subsidiary, saw production dips in 2024 attributed to climate-related issues.

- Operational Costs: Higher expenses for irrigation and crop management are anticipated due to changing weather patterns.

- Supply Chain Disruptions: Volatility in agricultural output can lead to unreliable supply chains and market price fluctuations.

Cosan faces significant threats from Brazil's challenging economic climate, marked by high interest rates, with the Selic rate at 10.50% as of May 2024, increasing borrowing costs. Intense competition across its diverse segments, from fuel distribution to sugar and ethanol, pressures pricing and market share. Additionally, regulatory changes and global commodity price volatility, particularly for sugar, ethanol, and oil, directly impact its revenue streams and profitability.

SWOT Analysis Data Sources

This SWOT analysis for Cosan is built upon a foundation of robust data, drawing from official financial reports, comprehensive market intelligence, and expert industry analysis. These sources provide the necessary depth and accuracy for a strategic understanding of the company's position.