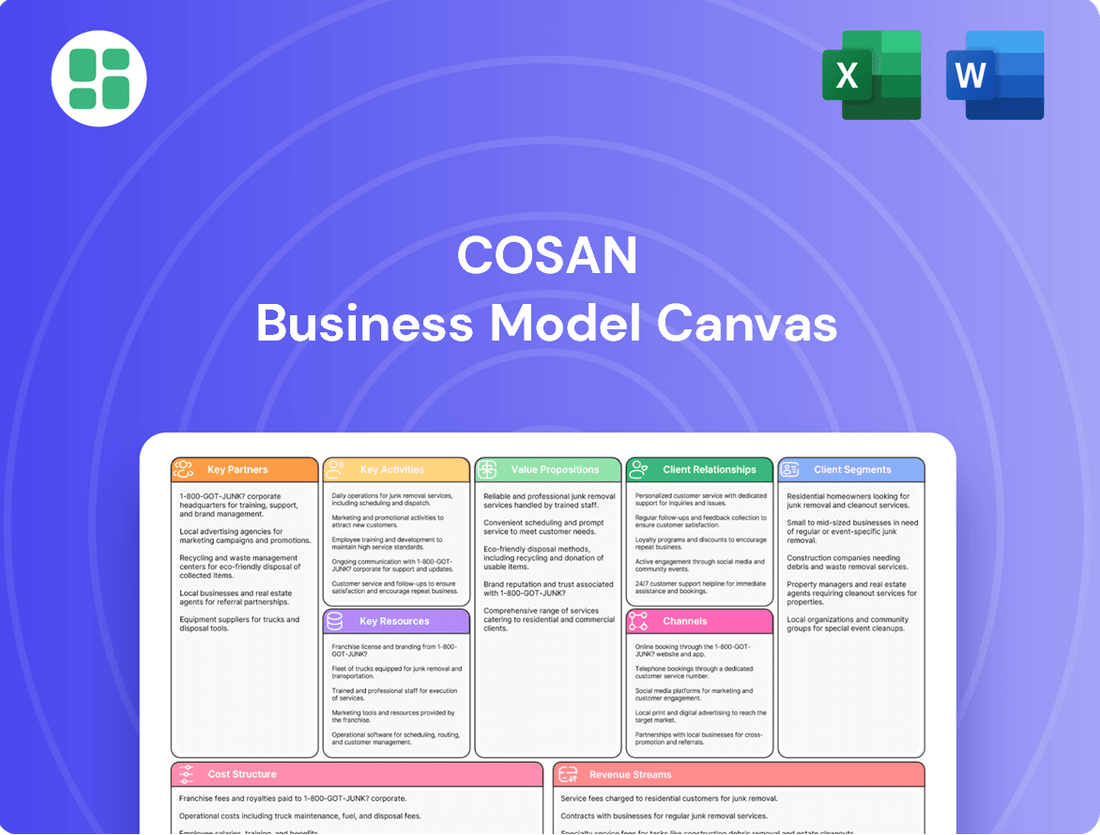

Cosan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosan Bundle

Curious about how Cosan masterfully navigates the energy and infrastructure sectors? Our comprehensive Business Model Canvas breaks down their key partners, revenue streams, and value propositions, offering a clear roadmap to their success. Discover the strategic framework that drives their integrated operations.

Ready to gain a deeper understanding of Cosan's operational excellence? This full Business Model Canvas provides a detailed look at their customer relationships, cost structure, and key resources, essential for anyone studying or competing in their markets. Unlock the blueprint to their competitive advantage.

See how Cosan builds and delivers value across its diverse portfolio. Our complete Business Model Canvas unpacks their core activities, channels, and customer segments, giving you a strategic advantage in your own business planning. Download the full version to learn from a market leader.

Partnerships

Cosan's strategic joint venture with Shell, forming Raízen, is a cornerstone of its business model. This partnership effectively combines Shell's extensive global brand recognition and distribution infrastructure with Cosan's deep-rooted expertise in sugar, ethanol, and bioenergy. This synergy is crucial for achieving broad market reach and sharing the substantial investments required for advancing renewable energy projects.

Raízen's operations, a direct outcome of this joint venture, are centered on the production and distribution of ethanol, sugar, and fuels. Notably, this includes a significant presence through Shell-branded service stations spanning Brazil, Argentina, and Paraguay, demonstrating the venture's expansive market penetration. In 2024, Raízen continued to be a major player in Brazil's fuel market, with its ethanol production contributing significantly to the country's renewable energy goals.

Rumo, Cosan's logistics powerhouse, heavily relies on collaborations with port operators and railway infrastructure firms. These alliances are vital for the seamless movement of agricultural products and other cargo, directly impacting supply chain efficiency and transportation costs. For instance, Rumo's extensive network, which handled approximately 68.7 million tonnes of cargo in 2023, underscores the importance of these partnerships in reaching key production areas and export markets.

Strategic alliances are not just about daily operations; they are foundational for growth and market expansion. A prime example is Rumo's ongoing investment in infrastructure, including the development of new terminals. The recent agreement with CHS to build a new terminal in Santos is a testament to this, aiming to further bolster its capacity and operational reach within critical export corridors.

Cosan actively partners with technology and innovation providers to drive advancements in sustainable energy, particularly in second-generation ethanol production and biogas development. These collaborations are crucial for integrating cutting-edge technologies that boost production processes and minimize environmental impact.

For instance, in 2024, Cosan continued to explore and implement innovative solutions for biomass processing, aiming to increase the yield and efficiency of cellulosic ethanol. Investments in green finance initiatives further underscore this commitment, facilitating the adoption of new technologies that support sustainable development across its operations.

Financial Institutions and Investors

Cosan’s relationships with financial institutions and investors are foundational to its operational and strategic agility. These partnerships are crucial for securing the necessary capital for growth, managing existing debt obligations, and executing significant investment or divestment activities. For instance, Cosan's proactive approach to liability management involves leveraging debt capital markets to maintain an optimized capital structure and ensure robust financial flexibility.

In 2024, Cosan continued to demonstrate this by actively managing its debt. A notable example includes the redemption of outstanding bonds, which helps in deleveraging the company and improving its financial health. Furthermore, the strategic sale of non-core assets is a recurring theme, aimed at strengthening the balance sheet and freeing up capital for more strategic initiatives.

- Access to Capital: Banks and investment funds provide essential debt and equity financing for Cosan's diverse operations, from biofuels to logistics.

- Debt Management: Cosan actively engages with financial institutions to optimize its debt profile, including bond issuances and redemptions.

- Strategic Transactions: Partnerships facilitate major corporate actions like acquisitions, divestitures, and joint ventures, as seen in past strategic realignments.

- Financial Flexibility: Maintaining strong ties ensures Cosan can access funding efficiently, supporting its long-term growth and investment plans.

Government and Regulatory Bodies

Cosan actively engages with government and regulatory bodies, a crucial step for navigating Brazil's intricate energy and logistics landscape. This engagement ensures compliance with evolving standards and allows Cosan to influence policies that foster sustainable development within its operational sectors.

These vital relationships streamline the acquisition of necessary licenses and permits, while also guaranteeing adherence to stringent environmental and operational regulations. For instance, as of 2024, Cosan's commitment to sustainability is reflected in its continued investments in renewable energy projects, which require close collaboration with governmental agencies for approvals and incentives.

- Regulatory Compliance: Ensuring adherence to all national and regional energy and logistics regulations.

- Policy Influence: Participating in dialogues to shape industry regulations, particularly those supporting sustainable energy initiatives.

- Licensing and Permits: Facilitating the necessary approvals for operations and new projects, including those in the renewable sector.

Cosan's key partnerships are instrumental in its operational success and strategic expansion. The joint venture with Shell to form Raízen is a prime example, merging Shell's global reach with Cosan's bioenergy expertise to drive fuel and ethanol markets. Rumo's logistics network thrives on collaborations with port operators and railway firms, ensuring efficient cargo movement. Furthermore, Cosan actively partners with technology providers to advance sustainable energy solutions, like second-generation ethanol, crucial for future growth and environmental goals.

| Partnership Type | Key Partner | Impact/Benefit | 2024 Relevance |

|---|---|---|---|

| Joint Venture | Shell (Raízen) | Market access, distribution, bioenergy production | Continued dominance in Brazil's fuel market, expansion of ethanol production. |

| Logistics Alliances | Port Operators, Railway Firms (Rumo) | Supply chain efficiency, cost reduction, cargo movement | Facilitating Rumo's extensive network, handling millions of tonnes of cargo annually. |

| Technology & Innovation | Various Providers | Process improvement, new technology adoption | Driving advancements in cellulosic ethanol and biogas; investments in green finance. |

What is included in the product

This Cosan Business Model Canvas outlines its diversified operations across energy, logistics, and agriculture, detailing key partners, activities, and resources that drive its integrated value proposition.

It highlights Cosan's customer relationships, cost structure, and revenue streams, reflecting its strategic focus on operational efficiency and market leadership.

Cosan's Business Model Canvas offers a clear, visual representation of their integrated energy and infrastructure operations, simplifying complex value chains for stakeholders.

It provides a structured framework to analyze and optimize Cosan's diverse business segments, from sugarcane and ethanol to logistics and energy distribution.

Activities

Cosan, primarily through its joint venture Raízen, is a significant player in sugar and ethanol production. This involves managing extensive sugarcane cultivation, a critical first step in their value chain. In the 2023/2024 harvest, Raízen processed approximately 70 million tons of sugarcane, highlighting the scale of their agricultural and industrial operations.

The core activities encompass the entire process from sugarcane crushing to the industrial conversion of biomass into ethanol and sugar. This includes optimizing mill efficiency and managing the complex logistics of transporting raw materials and finished products. Raízen's commitment to technological advancement aims to enhance yield per hectare and reduce production costs, crucial for competitiveness.

Cosan’s focus on operational excellence in sugar and ethanol production directly impacts its profitability. For the fiscal year ending March 31, 2024, Raízen reported adjusted EBITDA of R$24.4 billion, with the Energy segment, which includes ethanol and sugar, contributing significantly. This demonstrates the financial importance of these key activities to the overall business.

Raízen's fuel distribution and marketing arm is a cornerstone of its operations, managing the Shell brand across Brazil, Argentina, and Paraguay. This involves a substantial network of service stations and direct supply to commercial clients, highlighting a commitment to broad market reach.

This key activity is all about the intricate logistics of moving fuel, the direct sales efforts, and maintaining a significant retail footprint. Raízen aims to grow its market share by ensuring a smooth and efficient supply chain, reaching various customer groups with their fuel needs.

In 2023, Raízen's fuel distribution segment experienced robust performance. The company operated approximately 7,500 Shell service stations in Brazil alone, a testament to its extensive retail network. Furthermore, its total fuel sales volume reached over 27 billion liters across its operating regions, underscoring its significant market presence.

Compass Gás & Energia, a key Cosan subsidiary, is deeply involved in distributing natural gas across Brazil. This vital activity serves a broad customer base, including homes, businesses, and large industrial operations, as well as power plants that rely on gas for electricity generation.

The company manages and maintains extensive gas distribution networks, ensuring a reliable supply of this essential energy source. Furthermore, Compass Gás & Energia is actively developing infrastructure to support gas trading and electricity generation, indicating a strategic move to broaden its energy market presence and capabilities.

In 2024, Cosan’s strategy through Compass Gás & Energia emphasizes expanding its reach in these critical energy sectors. This growth is supported by significant investments in infrastructure, aiming to capture a larger share of the burgeoning natural gas market in Brazil, which is projected to see continued demand growth.

Logistics and Infrastructure Management

Cosan, primarily through its subsidiary Rumo, manages extensive logistics assets, including a vast railway network and key port operations. These are critical for the efficient movement of agricultural commodities and industrial goods, underscoring its role in supporting Brazil's export capacity.

The company's infrastructure management encompasses operating a significant portion of Brazil's rail freight capacity. For instance, in the first quarter of 2024, Rumo transported approximately 22.3 million tons of cargo, demonstrating the scale of its operations.

- Railway Network: Operates over 13,000 kilometers of railways, connecting major production centers to export terminals.

- Port Terminals: Manages strategically located port terminals, facilitating seamless loading and unloading of cargo for international markets.

- Multimodal Solutions: Offers integrated logistics services, combining rail, road, and waterway transport to optimize supply chains.

- Efficiency Enhancement: Focuses on improving transportation times and reducing costs, directly contributing to Brazil's competitiveness in global trade.

Portfolio Management and Strategic Investments

Cosan, as a holding company, actively manages its diverse portfolio of businesses, focusing on strategic capital allocation and performance monitoring. This involves identifying growth opportunities and divesting non-core assets to optimize its capital structure. For instance, in 2023, Cosan successfully divested its stake in Vale, a move aimed at debt reduction and enhancing financial flexibility.

The company's investment strategy prioritizes projects aligning with its long-term vision for sustainable energy and logistics. This strategic focus is crucial for navigating evolving market dynamics and ensuring sustained growth. Cosan's commitment to optimizing its portfolio is a cornerstone of its operational strategy.

- Portfolio Optimization: Actively managing and rebalancing its business units to maximize value.

- Strategic Capital Allocation: Directing investments towards high-growth, sustainable sectors like renewable energy and logistics.

- Performance Monitoring: Continuously evaluating the performance of each subsidiary to ensure alignment with strategic goals.

- Divestment of Non-Core Assets: Selling off underperforming or non-strategic assets to improve financial health and focus resources.

Cosan's key activities revolve around managing its diverse portfolio, which includes sugar and ethanol production through Raízen, natural gas distribution via Compass Gás & Energia, and extensive logistics operations through Rumo. These activities are underpinned by strategic capital allocation, operational efficiency, and a focus on enhancing Brazil's energy and agricultural supply chains.

| Business Segment | Key Activities | Recent Performance Data (FY 2023/2024) |

|---|---|---|

| Energy (Sugar & Ethanol) | Sugarcane cultivation, crushing, ethanol production, sugar production, logistics. | Raízen processed ~70 million tons of sugarcane. Adjusted EBITDA for Energy segment was significant within Raízen's R$24.4 billion total. |

| Fuel Distribution | Operating Shell service stations, direct fuel sales to commercial clients, logistics. | Operated ~7,500 Shell stations in Brazil. Sold over 27 billion liters of fuel across operating regions. |

| Natural Gas Distribution | Natural gas distribution to residential, commercial, and industrial clients, infrastructure development. | Expanding distribution networks and investing in infrastructure to capture growth in Brazil's natural gas market. |

| Logistics | Railway operations, port terminal management, multimodal transportation solutions. | Rumo transported ~22.3 million tons of cargo in Q1 2024. Operates over 13,000 km of railways. |

| Holding Company Activities | Portfolio management, strategic capital allocation, performance monitoring, divestments. | Divested stake in Vale in 2023 to optimize capital structure and enhance financial flexibility. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is not a mockup, but a direct representation of the final document you will receive upon purchase. This means you get the exact same comprehensive analysis, meticulously structured and ready for your immediate use. Upon completing your order, you will gain full access to this identical, professionally prepared Business Model Canvas, ensuring no surprises and immediate applicability for your strategic planning.

Resources

Cosan's extensive agricultural land, primarily for sugarcane cultivation, and its numerous sugar and ethanol mills are the bedrock of its bioenergy operations. These physical assets are not just land and buildings; they represent the critical infrastructure for sourcing raw materials and executing the industrial processes that yield sugar and ethanol.

The sheer scale of Cosan's land holdings and milling capacity, a significant portion of which is in Brazil, provides a substantial competitive edge in the renewable energy and agribusiness sectors. For instance, in the 2023/2024 harvest, Cosan processed approximately 60 million tons of sugarcane, highlighting the immense operational capacity of its mills.

Cosan's integrated logistics and infrastructure assets, primarily through Rumo, form a critical backbone for its operations. This network includes extensive railway lines, strategically located port terminals, and vital storage facilities across Brazil, facilitating the movement of a wide array of commodities.

In 2024, Rumo continued to expand its logistical capacity, handling approximately 70.8 million tons of cargo, a slight increase from the previous year, underscoring the growing demand for efficient commodity transportation. These assets are pivotal in linking Brazil's agricultural heartlands to both domestic consumers and international export markets, ensuring cost-effectiveness and reliability.

Raízen leverages a vast fuel distribution network, notably featuring Shell-branded service stations, bolstered by significant brand licensing agreements. This extensive infrastructure grants direct access to both individual consumers and commercial entities across numerous nations, solidifying its market presence.

In 2024, Raízen's fuel distribution segment reported strong performance, with over 6,000 Shell-branded service stations in Brazil alone, underscoring the reach of its network. The licensing of the Shell brand continues to be a critical asset, fostering consumer confidence and expanding market penetration.

Natural Gas Distribution Infrastructure

Compass Gás & Energia's natural gas distribution infrastructure is a cornerstone of its business model, encompassing extensive pipeline networks and distribution systems across Brazil. This vital asset enables the company to reliably supply natural gas to a broad customer base, including residential, commercial, and industrial sectors.

The operational scale of this infrastructure solidifies Compass's position as a dominant force in the Brazilian natural gas market. For context, as of early 2024, Compass Gás & Energia was actively expanding its distribution network, aiming to connect thousands of new customers, particularly in industrial hubs seeking cleaner energy alternatives.

- Extensive Pipeline Networks: Compass manages a significant length of gas pipelines, crucial for transporting natural gas efficiently.

- Distribution Systems: The company operates localized distribution networks that deliver gas directly to end-users.

- Market Leadership: This robust infrastructure underpins Compass's status as a leading natural gas distributor in Brazil.

- Customer Reach: The infrastructure serves a diverse range of customers, from households to large industrial facilities.

Human Capital and Expertise

Cosan's human capital is a cornerstone of its operations, featuring a highly skilled workforce with deep expertise in agribusiness, energy production, logistics, and financial management. This collective knowledge is vital for driving innovation and ensuring operational excellence across its varied business segments.

The company leverages experienced management teams within each of its business units, such as Raízen and Comgás. These leaders are instrumental in executing strategic plans and upholding rigorous safety standards, contributing significantly to Cosan's overall performance and reputation.

- Skilled Workforce: Experts in agribusiness, energy, logistics, and finance.

- Innovation Driver: Human capital fuels new ideas and operational improvements.

- Strategic Decision-Making: Experienced teams guide the conglomerate's direction.

- Operational Excellence: Management ensures efficient execution and high safety.

Cosan's key resources are its vast agricultural lands, extensive logistics infrastructure, and strong brand recognition, particularly through Raízen's Shell-branded stations. These tangible and intangible assets are crucial for its integrated business model, spanning bioenergy, energy distribution, and natural gas. The company's human capital, comprising skilled professionals across its diverse operations, is equally vital for driving innovation and maintaining operational efficiency.

| Key Resource | Description | 2024 Data/Impact |

| Agricultural Land & Mills | Sugarcane cultivation and processing facilities. | Processed ~60 million tons of sugarcane in 2023/2024 harvest. |

| Logistics Infrastructure (Rumo) | Railways, ports, and storage for commodity transport. | Handled ~70.8 million tons of cargo in 2024. |

| Fuel Distribution Network (Raízen) | Shell-branded service stations and distribution channels. | Over 6,000 Shell stations in Brazil; strong brand licensing. |

| Natural Gas Infrastructure (Compass) | Pipeline networks for gas distribution. | Expanding network to connect thousands of new customers in industrial hubs. |

| Human Capital | Skilled workforce and experienced management teams. | Drives innovation and operational excellence across segments. |

Value Propositions

Cosan's value proposition centers on delivering seamless, integrated solutions that span both energy and logistics. This means customers can consolidate their needs for fuel distribution, bioenergy, and a wide array of logistics services with one dependable partner.

By unifying these critical components, Cosan significantly enhances operational efficiency and reliability for its clients, streamlining complex supply chains into a more manageable and predictable system.

For instance, in 2024, Cosan's Raízen segment, a joint venture with Shell, continued to be a powerhouse in bioenergy, with its sugarcane crushing capacity reaching approximately 73 million metric tons. This scale allows for consistent supply of biofuels and sugar, directly feeding into their integrated logistics network.

This single-source approach simplifies procurement and operational management, allowing businesses to focus on their core competencies while Cosan handles essential energy and movement needs.

Cosan’s dedication to sustainable and renewable energy, especially through its significant investments in ethanol and bioenergy, firmly establishes it as a frontrunner in Brazil's energy transition. This focus is not just about compliance but a core strategy, as evidenced by their expansion into second-generation ethanol and biogas, directly contributing to a more environmentally friendly energy landscape.

This commitment is increasingly valuable as customers and stakeholders, including investors and consumers, actively seek out and prioritize environmentally responsible energy sources and solutions. For instance, in 2023, Cosan's Raízen segment, a joint venture with Shell, was a major producer of sugarcane ethanol, a key biofuel supporting Brazil's decarbonization efforts.

Cosan's extensive reach is a cornerstone of its business model, primarily driven by Raízen's vast fuel distribution network and Rumo's sophisticated logistics infrastructure. This dual capability allows Cosan to efficiently deliver its products and services across the entirety of Brazil, a critical advantage in a geographically diverse nation.

In 2024, Raízen operated over 6,000 service stations, solidifying its position as a leading fuel distributor. This widespread presence ensures that Cosan's offerings are readily available to a broad customer base, encompassing individual consumers and major industrial players alike, thereby minimizing logistical hurdles for its clients.

Operational Efficiency and Cost Optimization

Cosan's diversified operations, spanning sugar and ethanol, fuel distribution, and logistics, are managed strategically to drive high operational efficiency. This efficiency translates directly into cost optimization for its clients, as the company leverages scalable solutions across its various business segments. For instance, in 2023, Cosan's Raízen joint venture reported significant improvements in sugarcane crushing, contributing to a more cost-effective ethanol production cycle.

By relentlessly improving processes in sugar and ethanol production, fuel distribution, and logistics, Cosan ensures competitive pricing and dependable service. This commitment to operational excellence allows them to pass on savings and enhance overall value for their customers. Their integrated logistics network, for example, minimizes transportation costs and delivery times, a crucial benefit in the commodity sector.

- Scalable Solutions: Cosan's ability to apply efficient practices across its diverse portfolio, from agriculture to energy distribution, offers clients adaptable and cost-effective services.

- Process Improvement: Continuous investment in technology and process optimization in areas like sugarcane processing and fuel terminal management reduces operational overhead.

- Competitive Pricing: Enhanced efficiency directly supports Cosan's strategy of offering competitive market prices, making their products and services more attractive to customers.

- Reliable Service: Streamlined operations ensure consistent product availability and timely delivery, building trust and loyalty with clients.

Reliable Supply and Infrastructure

Cosan guarantees a dependable flow of vital energy products, supported by a strong logistics network essential for both business continuity and everyday needs. For instance, in 2023, Cosan's Raízen segment, a major player in Brazil's fuel distribution, maintained a vast network of over 7,000 service stations, demonstrating its reach and commitment to consistent supply.

The company's dedication to uninterrupted service is evident through substantial investments in its infrastructure. These ongoing capital expenditures, which totaled billions of Brazilian Reais across its various operations in recent years, are crucial for asset upkeep and expansion, ensuring operational resilience.

This unwavering reliability is particularly valued by industrial clients and large-scale consumers who require a consistent and predictable energy supply to maintain their own production cycles and operational efficiency.

Key aspects of Cosan's reliable supply and infrastructure:

- Extensive Logistics Network: Cosan operates a vast network of pipelines, terminals, and distribution centers, facilitating efficient product movement.

- Asset Modernization and Expansion: Significant capital investments are directed towards upgrading and growing its infrastructure to meet increasing demand and ensure operational integrity.

- Dependable Energy Product Delivery: The company ensures a consistent and timely supply of essential energy products, a critical factor for its diverse customer base.

Cosan's value proposition emphasizes providing integrated energy and logistics solutions, simplifying operations for clients by consolidating fuel distribution, bioenergy, and logistics services with a single, reliable partner.

This integration boosts customer efficiency and supply chain predictability. For example, in 2024, Raízen's sugarcane crushing capacity reached approximately 73 million metric tons, ensuring a steady supply for its logistics network.

By offering a single source for essential energy and movement needs, Cosan allows businesses to focus on their core activities while it manages critical supply chain components.

Cosan’s commitment to sustainability, particularly in ethanol and bioenergy, positions it as a leader in Brazil's energy transition. Their expansion into second-generation ethanol and biogas in 2024 underscores this dedication, meeting growing demand for environmentally sound energy solutions.

This focus on green energy is increasingly attractive to customers and investors prioritizing sustainability. In 2023, Raízen was a significant producer of sugarcane ethanol, contributing to Brazil's decarbonization goals.

Cosan's extensive reach, powered by Raízen's fuel distribution and Rumo's logistics, ensures efficient delivery across Brazil. In 2024, Raízen operated over 6,000 service stations, guaranteeing product accessibility for a wide customer base.

The company's diversified operations are managed for high efficiency, leading to cost savings for clients through scalable solutions. In 2023, Raízen saw improved sugarcane crushing efficiency, enhancing cost-effectiveness in ethanol production.

Cosan's continuous process improvements in production, distribution, and logistics ensure competitive pricing and dependable service. Their integrated logistics network, for instance, minimizes transportation costs and delivery times.

Cosan guarantees a dependable flow of essential energy products, supported by a robust logistics network crucial for business continuity. In 2023, Raízen maintained a vast network of over 7,000 service stations, ensuring consistent supply.

Significant capital investments in infrastructure, totaling billions of Brazilian Reais in recent years, ensure operational resilience and consistent service delivery.

This reliability is especially valued by industrial clients requiring a predictable energy supply for their operations.

| Key Performance Indicator | 2023 Data | 2024 Projection/Activity | Impact on Value Proposition |

|---|---|---|---|

| Raízen Sugarcane Crushing | Approx. 70 million metric tons | Approx. 73 million metric tons | Ensures consistent supply for integrated logistics and bioenergy offerings. |

| Raízen Service Stations | Over 7,000 | Over 6,000 (operational) | Guarantees widespread product accessibility and dependable delivery. |

| Logistics Infrastructure Investment | Significant capital expenditure | Ongoing investment in modernization and expansion | Enhances operational efficiency and reliability of energy product flow. |

| Ethanol Production | Major producer | Continued expansion, including 2nd gen ethanol | Supports sustainability value proposition and Brazil's energy transition. |

Customer Relationships

Cosan dedicates account management teams to its substantial B2B clientele within the industrial, agricultural, and commercial sectors. This ensures that each client receives bespoke solutions and direct, attentive support, crucial for addressing their unique operational demands.

This personalized strategy is vital for efficiently handling intricate business requirements, such as securing substantial fuel volumes or managing expansive logistics operations. For instance, in 2024, Cosan's commitment to tailored B2B services facilitated over 15 billion liters of fuel distribution, underscoring the effectiveness of this relationship-focused approach.

By fostering consistent communication and deeply understanding each client's specific needs, Cosan cultivates robust and enduring partnerships. This proactive engagement strengthens client loyalty and ensures that Cosan remains a preferred partner for critical business functions.

Raízen cultivates strong brand loyalty within its fuel distribution segment by leveraging the globally recognized Shell brand. This partnership provides service station operators with consistent quality standards and comprehensive operational support, fostering a reliable experience for end consumers.

To further entrench this loyalty, Raízen implements targeted marketing campaigns and customer-focused loyalty programs. These initiatives are designed to enhance the overall customer experience at the retail level, encouraging repeat patronage and strengthening the brand's connection with its clientele.

Cosan's logistics arm, Rumo, and its gas distribution segment, Compass, are built on a foundation of long-term contracts and strategic partnerships with major clients. These agreements are crucial for securing predictable revenue and fostering collaborative growth. For instance, Rumo's contracts with agribusiness clients often span multiple years, guaranteeing the transport of significant volumes of grain and sugar.

These enduring relationships are not just about volume commitments; they frequently involve substantial upfront investments in specialized infrastructure, such as dedicated rail lines or storage facilities, designed to meet the unique operational requirements of their partners. This client-centric approach ensures that Cosan’s infrastructure development directly supports and enhances its partners’ supply chains, creating a strong, mutually beneficial ecosystem.

In 2024, Rumo continued to expand its network, with significant investments in new railway lines and terminals aimed at increasing capacity and efficiency for its long-term partners. Similarly, Compass has been actively forging new distribution agreements for natural gas, focusing on industrial clients requiring reliable and extensive supply networks, underscoring the strategy of embedding its services deeply within the operational fabric of its key customers.

Digital Engagement and Self-Service Options

Cosan is enhancing customer interactions by increasingly offering digital engagement and self-service options. This approach is particularly beneficial for routine tasks and information retrieval, streamlining the customer experience.

Online portals and mobile apps are central to this strategy, allowing customers to manage their accounts, monitor deliveries, and access support resources conveniently. For example, in 2024, Cosan reported a significant uptick in digital channel usage for customer inquiries, reflecting a growing preference for self-service solutions.

- Digital Transformation: Cosan’s investment in digital platforms aims to improve operational efficiency and customer satisfaction.

- Self-Service Convenience: Online and mobile tools empower customers to handle transactions and access information independently.

- Customer Engagement: The focus on digital channels facilitates more frequent and convenient interactions, fostering stronger customer relationships.

- Efficiency Gains: By automating simpler processes, Cosan can allocate resources to more complex customer needs, boosting overall service quality.

Community Engagement and ESG Initiatives

Cosan actively engages with local communities through various environmental, social, and governance (ESG) initiatives. These efforts underscore a dedication to social responsibility and sustainable growth, strengthening its social license to operate.

The company implements community programs and environmental protection projects, coupled with transparent reporting on its sustainability performance. This proactive approach fosters positive relationships with stakeholders, enhancing its overall reputation.

- Community Programs: Cosan's commitment is reflected in projects designed to benefit local populations, fostering goodwill and shared development.

- Environmental Stewardship: The company invests in initiatives aimed at protecting and preserving the environment in the areas where it operates.

- Transparent Reporting: Cosan provides clear and accessible data on its ESG performance, building trust with investors and the public.

- Stakeholder Engagement: Building strong ties with communities and stakeholders is central to maintaining operational continuity and a positive brand image.

Cosan's customer relationships are characterized by a dual approach: dedicated account management for large B2B clients and brand-driven loyalty for retail customers. This strategy ensures tailored support for complex needs and consistent quality for everyday consumers.

For its industrial, agricultural, and commercial partners, Cosan provides bespoke solutions and direct support, facilitating significant volumes of fuel distribution and logistics. In 2024, over 15 billion liters of fuel were distributed through these personalized B2B services, highlighting the effectiveness of this client-centric model.

Raízen, a key part of Cosan, leverages the established Shell brand to foster loyalty at the retail level, offering consistent quality and operational support to service station operators. This is further enhanced by targeted marketing and loyalty programs designed to deepen customer engagement and encourage repeat business.

Cosan's logistics (Rumo) and gas distribution (Compass) segments rely heavily on long-term contracts and strategic partnerships. These often involve significant infrastructure investments, like dedicated rail lines, to meet specific client requirements, fostering mutually beneficial ecosystems. For instance, Rumo's multi-year contracts with agribusiness clients secured the transport of substantial grain and sugar volumes in 2024.

Digital transformation is a growing aspect of Cosan's customer engagement, with online portals and mobile apps offering self-service options for routine tasks. This digital shift saw a notable increase in customer inquiries via these channels in 2024, reflecting a preference for convenient, independent interaction.

| Customer Relationship Type | Key Segments | Primary Engagement Strategy | 2024 Data/Impact |

| Dedicated Account Management | B2B (Industrial, Agricultural, Commercial) | Bespoke solutions, direct support | Facilitated over 15 billion liters of fuel distribution |

| Brand Loyalty & Retail Engagement | Retail Fuel Customers (via Raízen/Shell) | Brand recognition, quality standards, loyalty programs | Strengthened brand connection through targeted campaigns |

| Long-Term Contracts & Partnerships | Logistics (Rumo), Gas Distribution (Compass) | Strategic agreements, infrastructure investment | Secured multi-year contracts for significant agribusiness transport volumes |

| Digital Self-Service | Broad Customer Base | Online portals, mobile apps | Significant increase in digital channel usage for customer inquiries |

Channels

Raízen leverages its extensive retail network of Shell-branded service stations across Brazil, Argentina, and Paraguay as a crucial channel. This network serves millions of retail and commercial customers daily, acting as the primary point of contact for fuel distribution. In 2024, Raízen's network comprised over 6,000 service stations in Brazil alone, underscoring its immense reach and customer accessibility.

Cosan's direct sales force and commercial agreements are pivotal for engaging substantial industrial clients, agricultural producers, and other business-to-business entities. This approach facilitates the distribution of bulk fuel, sugar, ethanol, and comprehensive logistics services, ensuring tailored solutions and fostering robust client partnerships.

In 2024, Cosan's direct sales strategy enabled them to secure significant contracts, particularly within the agricultural sector, which accounts for a substantial portion of Brazil's GDP. For instance, their fuel distribution arm, Raízen, a joint venture with Shell, reported strong performance driven by these direct B2B relationships.

Rumo's extensive railway network and integrated port terminals are its primary channels, moving agricultural commodities, industrial goods, and fuels. This infrastructure is vital for Brazil's economy, enabling efficient, large-volume transport over long distances.

These specialized channels connect Brazil's key production regions directly to domestic consumers and major international export hubs. In 2024, Rumo's operations are projected to handle a significant portion of Brazil's grain exports, underscoring their importance to the nation's trade balance.

Natural Gas Distribution Pipelines (Compass)

Compass Gás & Energia's natural gas distribution pipelines form a critical channel, delivering gas directly to a diverse customer base including homes, businesses, and industrial facilities. This extensive network guarantees a consistent and dependable gas supply, underpinning its value proposition.

These specialized channels are subject to strict regulatory oversight, necessitating substantial ongoing investment in upkeep and growth to meet demand and maintain operational integrity. For instance, in 2023, Cosan's gas distribution segment, primarily operated by Comgás, invested R$1.2 billion in infrastructure expansion and modernization, contributing to a total network length of over 19,000 kilometers by the end of the year.

- Network Reach: Over 19,000 km of pipeline infrastructure as of December 2023, serving millions of customers.

- Investment Focus: Continuous capital expenditure for network expansion, maintenance, and technological upgrades.

- Regulatory Environment: Operates under regulated tariffs and service quality standards, impacting revenue and operational costs.

- Customer Segments: Direct distribution to residential, commercial, and industrial consumers, diversifying revenue streams.

Digital Platforms and Investor Relations Websites

Cosan leverages its corporate website and dedicated investor relations portals as primary digital channels for investor engagement. These platforms are vital for disseminating crucial financial information, including annual reports, quarterly earnings, and presentations, to a global audience. In 2023, Cosan's investor relations website likely saw significant traffic from financial analysts, institutional investors, and individual shareholders seeking up-to-date performance metrics and strategic outlooks.

These digital avenues are instrumental in fostering transparency and building trust with stakeholders. By providing timely access to company news, regulatory filings, and management commentary, Cosan ensures its global investor base remains informed. This commitment to open communication is essential for maintaining compliance and managing expectations within the financial community.

- Digital Presence: Cosan's corporate website and investor relations portal serve as the central hub for all investor communications.

- Information Dissemination: These platforms provide easy access to financial reports, presentations, and strategic updates for a worldwide audience.

- Stakeholder Engagement: They are critical tools for maintaining transparency, building trust, and ensuring compliance with disclosure requirements.

- Accessibility: Cosan's digital platforms cater to a diverse range of investors, from novice individuals to seasoned financial professionals.

Cosan's channels are diverse, encompassing physical networks and digital platforms to reach various customer segments. Raízen's extensive Shell-branded service stations in Brazil, Argentina, and Paraguay act as primary retail and commercial fuel distribution points, with over 6,000 stations in Brazil alone in 2024. Rumo utilizes its vast railway and port infrastructure for efficient bulk transport of commodities and fuels, critical for Brazil's trade. Compass Gás & Energia's natural gas pipelines directly supply residential, commercial, and industrial users, supported by over 19,000 km of network in 2023.

| Business Unit | Primary Channels | Key Function | 2024 Data/Reach |

|---|---|---|---|

| Raízen | Shell-branded service stations | Retail & commercial fuel distribution | > 6,000 stations in Brazil |

| Rumo | Railway network, port terminals | Bulk commodity & fuel transport | Handles significant portion of Brazil's grain exports |

| Compass Gás & Energia | Natural gas distribution pipelines | Direct gas supply to consumers | > 19,000 km network (as of Dec 2023) |

Customer Segments

Millions of individual motorists and vehicle owners represent a core customer segment for Raízen, primarily purchasing gasoline, ethanol, and lubricants at Shell-branded service stations. This group prioritizes convenience, the strong recognition associated with the Shell brand, and the assurance of consistent product quality in their fuel purchases. Raízen's marketing strategies are designed to cultivate loyalty within this segment by effectively addressing their everyday mobility requirements.

Large industrial and commercial businesses, such as manufacturing plants and transportation companies, represent a key customer segment for Cosan. These entities have significant and consistent demands for bulk fuels, natural gas, and lubricants, alongside sophisticated logistics services. For instance, in 2024, Cosan's Raízen segment, a joint venture with Shell, continued to be a major supplier of fuels to industrial clients across Brazil, supporting their extensive operational needs.

These customers place a high value on dependable supply chains, cost-effective pricing structures, and customized service contracts that align with their specific operational requirements. Cosan's diverse portfolio of subsidiaries is structured to meet these complex demands, offering integrated solutions that ensure efficiency and reliability for large-scale industrial operations.

Cosan's logistics arm, Rumo, heavily relies on large agricultural producers and commodity exporters. These clients, crucial for Brazil's economy, depend on Rumo for timely and cost-effective rail and port transportation of grains, sugar, and other agricultural products to domestic and international markets.

In 2024, Rumo continued to be a vital partner for these segments, facilitating the movement of millions of tons of commodities. The company's extensive rail network and port terminals are essential for ensuring these producers can efficiently reach their buyers, thereby supporting Brazil's position as a global agricultural powerhouse.

Residential and Commercial Gas Consumers

Households and small to medium-sized businesses connected to Compass Gás & Energia's natural gas distribution network form a consistent and dependable customer group. These consumers prioritize a steady and uninterrupted energy supply for essential uses like heating, cooking, and the diverse operational needs of their businesses.

In 2023, Compass Gás & Energia served approximately 1.4 million residential customers and over 18,000 commercial and industrial clients across its distribution concessions in Brazil. The company's strategy includes significant investments in expanding its gas pipeline infrastructure, with plans to connect an additional 1 million residential customers by 2028, aiming to bolster this segment's growth.

- Customer Base: Households and SMBs connected to Compass Gás & Energia's network.

- Value Proposition: Reliable energy for heating, cooking, and commercial operations.

- Growth Strategy: Network expansion to acquire more residential customers.

- 2023 Data: Served ~1.4 million residential and >18,000 commercial/industrial customers.

Institutional and Individual Investors

Institutional and individual investors are a cornerstone for Cosan, drawn to its diverse business interests and financial health. These stakeholders, including large asset managers and individual shareholders, prioritize clear communication regarding financial performance and strategic direction. In 2024, Cosan continued to focus on delivering consistent returns and long-term value, a key driver for this segment.

This investor base seeks transparency and predictable growth. Cosan's investor relations activities are designed to meet these needs by offering detailed financial reports and strategic outlooks. For instance, their commitment to providing comprehensive data helps investors assess the company's performance across its various sectors, such as energy and logistics.

- Key Investor Interests: Diversified portfolio, financial performance, consistent returns, long-term value creation.

- Investor Relations Focus: Transparency, comprehensive financial data, strategic insights.

- 2024 Performance Indicators: Emphasis on steady growth and shareholder value.

Cosan's customer segments are varied, encompassing individual motorists, large industrial clients, agricultural producers, households, and investors. Each segment has distinct needs, from fuel and logistics to reliable energy and financial returns. The company strategically caters to these diverse groups through its various subsidiaries like Raízen, Rumo, and Compass Gás & Energia.

| Customer Segment | Primary Needs | Cosan Subsidiary | Key 2024 Focus |

|---|---|---|---|

| Individual Motorists | Convenient fuel and lubricant purchases | Raízen (Shell stations) | Brand loyalty, consistent quality |

| Industrial/Commercial Businesses | Bulk fuels, natural gas, logistics | Raízen, Compass Gás & Energia | Dependable supply, cost-effectiveness |

| Agricultural Producers | Efficient commodity transportation | Rumo | Timely and cost-effective logistics |

| Households/SMBs | Reliable natural gas supply | Compass Gás & Energia | Network expansion, uninterrupted service |

| Institutional/Individual Investors | Financial performance, long-term value | Cosan Corporate | Transparency, predictable growth |

Cost Structure

Raw material and agricultural costs represent a significant portion of Cosan's expenses, particularly for its Raízen joint venture. These costs encompass everything from leasing land for sugarcane cultivation to purchasing fertilizers and managing the harvesting process. For Raízen's bioenergy segment, these agricultural inputs are the bedrock of its operations.

In 2024, Cosan's focus on optimizing these agricultural expenditures remained paramount. The company understands that efficiency in farming techniques and the entire supply chain, from planting to delivery, is key to keeping these costs in check and maintaining profitability in the competitive sugar and ethanol markets.

Cosan's operational and maintenance costs are substantial, driven by the extensive infrastructure required for its logistics and gas distribution businesses. Managing vast railway networks, port terminals, and natural gas pipelines demands significant ongoing investment to ensure safety and continuous operation.

These expenses encompass crucial elements like equipment upkeep, skilled labor for maintenance and operations, and adherence to stringent regulatory compliance standards. For instance, in 2024, Cosan's logistics segment likely continued to see considerable outlays for track maintenance, rolling stock servicing, and terminal equipment upgrades.

The natural gas distribution segment also faces similar cost pressures, with ongoing investments in pipeline integrity, leak detection, and meter maintenance being paramount. These regular upkeep expenditures are not just operational necessities but are fundamental to maintaining the reliability and safety of Cosan's critical infrastructure assets throughout the year.

Fuel and energy procurement represents a significant variable cost for Cosan's fuel distribution operations, primarily through its Raízen joint venture. The cost of acquiring gasoline, diesel, and other petroleum products is directly influenced by volatile global commodity prices. For instance, in 2024, Brent crude oil prices experienced fluctuations, impacting the cost of these essential fuels.

Raízen actively manages these procurement costs by employing sophisticated hedging strategies. These financial instruments help to lock in prices and mitigate the impact of price volatility on their earnings. This proactive approach is crucial for maintaining profitability in a sector heavily reliant on commodity markets.

Personnel and Administrative Expenses

Personnel and administrative expenses are a major component of Cosan's cost structure, reflecting its substantial workforce across diverse subsidiaries. This includes salaries, benefits, and the general overhead required to manage tens of thousands of employees involved in both corporate functions and day-to-day operations. For instance, in 2023, Cosan's consolidated payroll and benefits represented a significant portion of its operating expenses, underscoring the importance of efficient human resource management for cost optimization.

The company's expansive operational footprint necessitates robust administrative support, contributing to these costs. Effective management of this large employee base, from agricultural operations to energy logistics, is crucial for maintaining cost control and operational efficiency. Cosan's focus on streamlining organizational structures and HR processes directly impacts its ability to manage these personnel-related expenditures effectively.

- Salaries and Benefits: A significant outlay for a workforce numbering in the tens of thousands across all business units.

- Administrative Overhead: Costs associated with managing corporate functions and supporting operational teams.

- Human Resource Management: Efficient HR practices are key to controlling personnel expenses.

- Organizational Structure: Streamlining operations helps to mitigate administrative costs.

Financial Expenses and Debt Servicing

Cosan's significant debt load means that financial expenses, particularly interest payments and debt servicing, are a major component of its cost structure. For instance, in the first quarter of 2024, Cosan reported financial expenses of R$2.1 billion, a substantial figure reflecting its leverage.

The company actively engages in liability management and strategic divestments to mitigate these interest burdens. A key focus has been on reducing its overall corporate gross debt, aiming to streamline its financial obligations.

- Interest Expense: A significant portion of Cosan's operating costs is dedicated to servicing its outstanding debt.

- Debt Reduction Strategies: Cosan employs liability management and asset sales to lower its overall debt and associated financial charges.

- Impact on Profitability: High financial expenses directly impact Cosan's net income, making efficient debt management crucial for profitability.

- 2024 Financials: In Q1 2024, financial expenses reached R$2.1 billion, highlighting the material nature of this cost category.

Cosan's cost structure is heavily influenced by its agricultural inputs, operational expenses for infrastructure, and the cost of fuel and energy. Personnel and administrative costs, alongside significant financial expenses due to debt, also play a crucial role in its overall cost base.

In 2024, Cosan continued to prioritize efficiency in agricultural practices and supply chain management to control raw material costs. Simultaneously, substantial investments were made in maintaining and upgrading its extensive logistics and gas distribution infrastructure, ensuring operational reliability and safety.

The company also strategically managed fuel procurement costs for its distribution operations, utilizing hedging to mitigate commodity price volatility. Efficient human resource management and debt reduction strategies remained key focus areas to optimize personnel and financial expenses respectively.

| Cost Category | Key Components | 2024 Focus/Impact |

|---|---|---|

| Raw Materials & Agricultural Costs | Sugarcane, fertilizers, land leasing | Optimizing farming techniques and supply chain efficiency |

| Operational & Maintenance Costs | Infrastructure upkeep (railways, pipelines), skilled labor | Ensuring safety, reliability, and regulatory compliance |

| Fuel & Energy Procurement | Gasoline, diesel, petroleum products | Hedging strategies to manage commodity price volatility |

| Personnel & Administrative Expenses | Salaries, benefits, corporate overhead | Streamlining HR processes and organizational structures |

| Financial Expenses | Interest payments, debt servicing | Liability management and debt reduction initiatives |

Revenue Streams

Fuel sales and distribution are the bedrock of Cosan's revenue, primarily through its joint venture Raízen. This channel generates income from selling gasoline, ethanol, and diesel. These fuels reach consumers and businesses via Raízen's vast network of Shell-branded service stations and commercial distribution points.

The reach of this revenue stream extends across Brazil, Argentina, and Paraguay, covering both retail transactions at the pump and larger wholesale agreements. In 2024, fuel sales continued to be the dominant force, accounting for the largest portion of Cosan's consolidated net sales, underscoring its critical importance to the company's financial performance.

Cosan, through its joint venture Raízen, generates substantial revenue from the production and sale of sugar and ethanol. These sales cater to both domestic Brazilian demand and international export markets.

The performance of this revenue stream is closely tied to global commodity prices for sugar and ethanol, as well as the success of the sugarcane harvest yields. Furthermore, the increasing global demand for biofuels plays a crucial role.

In the fiscal year 2024, Raízen's sugar and ethanol segment demonstrated robust performance. For instance, the company reported a significant volume of sugarcane processed, contributing to its overall revenue generation.

Compass Gás & Energia generates revenue by charging fees for distributing natural gas. These fees are applied to residential, commercial, and industrial users, typically calculated based on how much gas they consume. This stream offers stability, often bolstered by long-term concession agreements and regulated pricing structures.

In 2024, Cosan's natural gas distribution segment, primarily through Compass Gás & Energia, is a significant contributor. The company's strategic investments in expanding its distribution infrastructure are designed to capture a larger market share and drive growth within this regulated utility sector.

Logistics and Freight Services

Rumo, a key player in Cosan's logistics segment, generates revenue by offering essential railway transportation and port handling services. These services are crucial for moving a wide array of commodities, such as grains, sugar, and various industrial goods.

The core revenue drivers for Rumo are the volume of cargo it transports and the established tariffs for these services. This includes straightforward freight charges for moving goods along its extensive rail network and terminal service fees for handling operations at ports.

- Freight Charges: Based on the volume of commodities transported and the distance covered.

- Terminal Service Fees: For handling and storage services at port terminals.

- Key Performance Indicators: Cargo volume growth and effective tariff management directly impact revenue.

In 2024, Rumo's operational performance, particularly the volume of grains and sugar transported, is a critical indicator of its revenue generation capacity. For instance, a significant increase in the harvest or export demand for these commodities directly translates to higher freight volumes and, consequently, increased revenue for Rumo.

Lubricant Sales

Moove, Cosan's lubricants business, generates revenue by producing and distributing Mobil and Comma branded lubricants. This segment is active in both Brazil and international markets, catering to automotive and industrial clients. Strong brand recognition and a significant market share are key drivers for sales in this revenue stream.

In 2024, Moove continued to solidify its position in the lubricants market. The company's focus on expanding its distribution network and product offerings directly impacts its revenue generation. Factors like economic growth in Brazil and demand from industrial sectors are crucial for Moove's sales performance.

- Brand Portfolio: Leverages strong brands like Mobil and Comma.

- Market Reach: Operates in Brazil and internationally.

- Customer Segments: Serves both automotive and industrial sectors.

- Sales Drivers: Relies on market share and brand recognition.

Cosan's revenue streams are diverse, spanning energy, logistics, and agricultural products. The company's primary income is derived from fuel sales and distribution, largely through its joint venture Raízen, which operates a substantial network of service stations and commercial distribution points across Brazil, Argentina, and Paraguay.

Raízen also contributes significantly through the production and sale of sugar and ethanol, catering to both domestic and international markets, with performance tied to global commodity prices and harvest yields. Compass Gás & Energia generates revenue from natural gas distribution fees, serving residential, commercial, and industrial users, often secured by long-term concession agreements.

Rumo, Cosan's logistics arm, earns revenue from railway transportation and port handling services for various commodities, with freight charges and terminal fees being key drivers. Moove, the lubricants segment, generates income from the production and distribution of Mobil and Comma branded lubricants, serving automotive and industrial clients in Brazil and abroad.

| Revenue Stream | Primary Business | Key Drivers | 2024 Relevance |

|---|---|---|---|

| Fuel Sales & Distribution | Raízen (JV) | Fuel volumes, retail & wholesale sales | Dominant contributor to net sales |

| Sugar & Ethanol | Raízen (JV) | Commodity prices, harvest yields, biofuel demand | Robust performance, significant processing volumes |

| Natural Gas Distribution | Compass Gás & Energia | Consumption fees, concession agreements | Significant contributor, driven by infrastructure expansion |

| Logistics Services | Rumo | Cargo volumes, freight & terminal fees | Key indicator: grain & sugar transport volumes |

| Lubricants | Moove | Brand recognition, market share, economic growth | Solidifying market position, network expansion |

Business Model Canvas Data Sources

The Cosan Business Model Canvas is built upon a foundation of robust financial statements, comprehensive market research, and internal strategic planning documents. These diverse data sources ensure that each component of the canvas accurately reflects Cosan's operational reality and strategic direction.