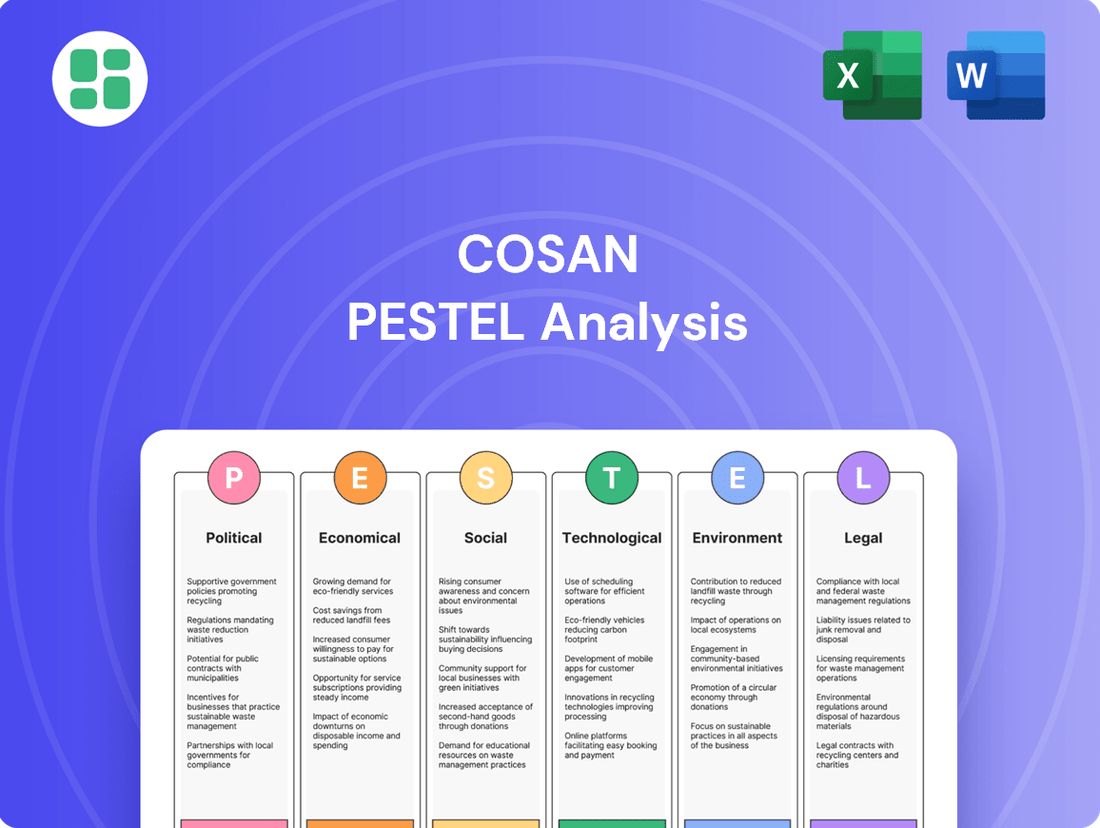

Cosan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosan Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Cosan's trajectory. This meticulously researched PESTLE analysis provides the strategic foresight needed to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a competitive advantage and make informed decisions.

Political factors

The Brazilian government's commitment to renewable energy and biofuels is robust, highlighted by the October 2024 enactment of the 'Fuel of the Future Law'. This landmark legislation is designed to foster sustainable, low-carbon transportation and formalize regulations for carbon capture and storage technologies. It establishes national initiatives for sustainable aviation fuel, green diesel, and biomethane, clearly demonstrating a powerful governmental drive towards decarbonization.

Cosan is positioned to capitalize significantly on these supportive policies and incentives. Its extensive involvement in the sugar, ethanol, and gas distribution sectors, primarily through its joint ventures Raízen and Compass, aligns directly with the government's strategic objectives. For instance, Raízen, a major player in ethanol production, saw its net revenue reach R$105.1 billion in the fiscal year ending March 2024, reflecting the growing market for biofuels.

Brazil's regulatory landscape for energy and logistics is dynamic, with new legislation and agencies continuously influencing operations. Agencies like ANEEL for electricity and ANP for biofuels are central to this evolving framework. For instance, the ongoing development of regulations for low-carbon hydrogen and offshore wind power, as seen in recent policy discussions throughout 2024 and into early 2025, aims to foster greater investment certainty.

The Brazilian government's commitment to enhancing logistics infrastructure, particularly port operations and railway networks, provides a significant tailwind for Cosan's Rumo subsidiary. This focus is evident in the 2024 National Logistics Plan, which targets reduced port bureaucracy and expanded digital connectivity, crucial for Rumo's extensive logistics assets.

Climate Commitments and International Standing

Brazil's updated Nationally Determined Contribution (NDC), submitted in November 2024, outlines a commitment to reduce greenhouse gas emissions by 37% below 2005 levels by 2035, with a goal of carbon neutrality by 2050. This aggressive stance, coupled with Brazil's 2024 G20 Presidency and hosting of COP30 in Belém in 2025, solidifies its role as a key player in global climate action.

Cosan's strategic focus on renewable energy sources, such as biofuels and ethanol production, directly supports these national environmental targets. This alignment with Brazil's international climate commitments is likely to enhance its appeal to investors prioritizing Environmental, Social, and Governance (ESG) criteria, potentially unlocking new avenues for sustainable financing and partnerships.

- 2035 Target: 37% reduction in greenhouse gas emissions below 2005 levels.

- 2050 Goal: Achieve carbon neutrality.

- International Influence: G20 Presidency (2024) and COP30 host (2025).

- Cosan's Alignment: Focus on biofuels and sustainable logistics supports national climate goals.

Fiscal Policy and Taxation

Changes in Brazil's fiscal policy and taxation, especially those impacting the energy and logistics sectors, directly affect Cosan's profitability and investment strategies. The Brazilian government's efforts to balance economic expansion with fiscal prudence, coupled with persistently high interest rates, create a challenging macroeconomic landscape that influences company valuations.

Cosan's approach to debt management, including strategic asset divestments, is significantly shaped by these prevailing fiscal conditions. For instance, in early 2024, Brazil's Central Bank maintained its benchmark Selic rate at 11.75%, reflecting ongoing concerns about inflation and the need for fiscal discipline, which in turn impacts the cost of capital for companies like Cosan.

- Fiscal Policy Impact: Brazil's fiscal policies can alter corporate tax rates and incentives, directly affecting Cosan's net income and investment attractiveness.

- Taxation Changes: Modifications to energy and logistics-specific taxes can influence Cosan's operational costs and pricing strategies.

- Interest Rate Environment: High interest rates, such as the Selic rate, increase Cosan's borrowing costs and can depress the valuation of its future cash flows.

- Government Fiscal Balance: The government's pursuit of fiscal balance can lead to austerity measures or tax increases that indirectly impact Cosan's operating environment.

Brazil's strong commitment to renewable energy, exemplified by the October 2024 'Fuel of the Future Law', directly benefits Cosan's biofuel operations, particularly through its Raízen joint venture. This legislation promotes sustainable fuels and carbon capture, aligning perfectly with Cosan's strategic focus and supporting its market position in ethanol production, which saw Raízen achieve R$105.1 billion in net revenue for the fiscal year ending March 2024.

The government's infrastructure development plans, such as the 2024 National Logistics Plan, provide a significant advantage for Cosan's logistics arm, Rumo. This plan aims to streamline port operations and expand digital connectivity, crucial for Rumo's extensive rail and port assets.

Brazil's ambitious climate targets, including a 37% greenhouse gas reduction by 2035 and carbon neutrality by 2050, reinforced by its 2024 G20 Presidency and upcoming COP30 hosting in 2025, create a favorable environment for Cosan's ESG-aligned investments in biofuels and sustainable logistics.

Fiscal policies and high interest rates, such as the Selic rate maintained at 11.75% in early 2024, present challenges by increasing borrowing costs and impacting valuations, necessitating careful debt management and strategic financial planning for Cosan.

| Political Factor | Impact on Cosan | Supporting Data/Initiative |

| Renewable Energy Policy | Boosts biofuel and ethanol businesses (Raízen) | 'Fuel of the Future Law' (Oct 2024); Raízen FY24 Net Revenue: R$105.1 billion |

| Infrastructure Development | Enhances logistics operations (Rumo) | 2024 National Logistics Plan; focus on port efficiency and digital connectivity |

| Climate Change Commitments | Supports ESG investments and financing | Brazil's NDC (37% GHG reduction by 2035); COP30 host (2025) |

| Fiscal & Monetary Policy | Increases borrowing costs and affects valuations | Selic Rate (early 2024): 11.75%; need for fiscal discipline |

What is included in the product

This PESTLE analysis of Cosan examines how political, economic, social, technological, environmental, and legal factors shape its strategic landscape.

It offers a comprehensive overview of the macro-environmental forces impacting Cosan, providing actionable insights for strategic decision-making.

Provides a clear, actionable framework for understanding the external forces impacting Cosan, enabling proactive strategy development and mitigating potential risks.

Economic factors

Cosan's financial health is closely tied to global commodity prices, especially sugar, ethanol, and oil. These price swings directly influence the company's earnings and overall profitability.

For instance, Raízen, a key Cosan subsidiary, experienced reduced revenue in the first nine months of 2024 due to lower commodity prices. This highlights the direct impact of market fluctuations on Cosan's performance.

Despite Brazil's strong performance in 2024, setting a new sugar export record and achieving historic ethanol production, global economic factors continue to shape commodity markets, presenting ongoing challenges and opportunities for Cosan.

Brazil's macroeconomic environment presents a mixed picture for Cosan. While GDP growth has shown some resilience, inflation and high interest rates remain significant headwinds. For instance, Brazil's benchmark Selic rate stood at 10.50% as of May 2024, a level that increases borrowing costs for Cosan and its subsidiaries, impacting their debt management strategies.

These elevated interest rates have compelled Cosan to focus on deleveraging and optimizing its capital structure. Despite the ongoing economic challenges in 2024, there are indications of improving momentum in Brazilian assets, which could signal potential future investment opportunities for the company as financial conditions potentially ease.

Significant investments in Brazil's logistics infrastructure, including railways and port operations, are crucial for Cosan's Rumo subsidiary. These developments directly impact the efficiency and cost-effectiveness of transporting agricultural commodities, a core business for Rumo.

Brazil's foreign trade continues its upward trajectory, with over 1.3 billion tons of goods moved in 2024. This substantial volume underscores the critical need for enhanced logistics to support economic growth and export competitiveness, directly benefiting Cosan's operations.

Cosan's commitment to capitalizing on these trends is evident in its projected capital expenditures. Specifically, Rumo's expansion projects, such as the significant development at Lucas do Rio Verde, signal a strategic focus on leveraging improved infrastructure to meet growing demand.

Energy Transition and Green Economy Incentives

The global shift towards sustainability presents a major economic tailwind for Cosan, particularly within its renewable energy and biofuels segments. Brazil's commitment to a green economy is evident, with renewable sources accounting for an impressive 88.2% of the nation's electricity generation in 2024, creating a fertile ground for Cosan's strategic investments.

These opportunities are further bolstered by robust financial support mechanisms. Institutions like Brazil's Development Bank (BNDES) are actively channeling significant funding into renewable energy projects, providing crucial capital for companies like Cosan to expand their green initiatives and capitalize on the energy transition.

- Renewable Energy Dominance: Brazil's electricity matrix was 88.2% renewable in 2024, underscoring a strong national focus.

- Biofuel Growth: Increasing global demand for sustainable fuels directly benefits Cosan's Raízen joint venture, a major player in sugarcane ethanol.

- Government Incentives: Programs and funding from entities like BNDES are designed to accelerate green economy development, offering financial advantages for Cosan's projects.

- Market Opportunities: The energy transition unlocks new revenue streams and market share potential for Cosan in areas like advanced biofuels and renewable energy infrastructure.

Consumer Demand and Spending Patterns

Consumer demand for fuel and gas is a direct driver for Cosan's operations, especially in its fuel distribution and gas utility segments. Economic stability and the purchasing power of consumers significantly influence how much fuel and gas they can afford and consume. For instance, in Brazil, a key market for Cosan, inflation rates and employment figures directly impact disposable income, affecting fuel consumption. In 2024, while economic recovery is anticipated, persistent inflation could still temper consumer spending on non-essential travel, impacting fuel demand.

The growing global and Brazilian focus on sustainability is reshaping consumer preferences. This shift is evident in the increasing demand for biofuels like ethanol and green diesel, supported by government policies such as Brazil's 'Fuel of the Future Law.' This legislation aims to boost the production and use of low-carbon fuels, potentially increasing demand for Cosan's biofuel offerings. For example, in the first quarter of 2024, ethanol consumption in Brazil saw a notable increase compared to the previous year, reflecting this trend.

Cosan's success hinges on its agility in adapting its product portfolio to these evolving consumer demands and regulatory landscapes. By aligning its offerings with the push for sustainable mobility, the company can capture a larger share of a growing market. This includes investing in advanced biofuel technologies and expanding its network for distributing these greener alternatives. The company's strategic investments in renewable energy and biofuels are designed to capitalize on this consumer-driven transition.

- Consumer Spending Impact: Consumer spending on fuel is directly tied to economic health, with factors like inflation and employment influencing purchasing power.

- Biofuel Demand Growth: Government initiatives like Brazil's 'Fuel of the Future Law' are fostering demand for sustainable options like ethanol and green diesel.

- Market Share Strategy: Cosan's ability to adapt its product range to consumer preferences for sustainable fuels is crucial for maintaining and growing its market position.

- Ethanol Consumption: In early 2024, Brazil experienced a rise in ethanol consumption, indicating a positive consumer shift towards biofuels.

The economic landscape for Cosan in 2024 and 2025 is shaped by fluctuating commodity prices, Brazil's macroeconomic conditions, and global sustainability trends. Despite challenges like high interest rates, such as Brazil's Selic rate at 10.50% in May 2024, opportunities arise from robust trade volumes and a strong push for renewable energy. Consumer demand for biofuels, supported by policies like the 'Fuel of the Future Law,' also presents a significant growth avenue for the company.

| Economic Factor | 2024/2025 Data Point | Impact on Cosan |

|---|---|---|

| Commodity Prices | Volatile, impacting sugar, ethanol, and oil revenue. | Directly affects profitability of subsidiaries like Raízen. |

| Brazilian Interest Rates | Selic rate at 10.50% (May 2024). | Increases borrowing costs, necessitating deleveraging. |

| Brazilian Trade Volume | Over 1.3 billion tons moved in 2024. | Highlights need for efficient logistics, benefiting Rumo. |

| Renewable Energy Share | 88.2% of Brazil's electricity generation in 2024. | Creates fertile ground for Cosan's green energy investments. |

| Ethanol Consumption | Notable increase in Q1 2024 vs. prior year. | Indicates growing consumer preference for biofuels. |

Preview Before You Purchase

Cosan PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cosan PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing critical insights for strategic decision-making.

Sociological factors

Societal expectations are increasingly shifting towards sustainability, especially within the energy and mobility sectors. This growing demand directly influences consumer purchasing decisions, pushing companies to offer more environmentally friendly options.

Cosan, through its joint venture Raízen, is well-positioned to capitalize on this trend. Their significant investments in ethanol production and renewable energy initiatives demonstrate a clear alignment with the global move towards a low-carbon economy, making them a key player in this evolving market.

Brazil's widespread adoption of flex-fuel technology has been a significant driver in reducing carbon dioxide emissions. This innovation not only appeals to environmentally conscious consumers but also highlights the practical application of sustainable solutions in the automotive industry, a market where Cosan is a major participant.

Stakeholders, from investors to local communities, are increasingly demanding that companies like Cosan show genuine commitment to social responsibility and environmental, social, and governance (ESG) standards. This pressure shapes how businesses operate and are perceived in the market.

Cosan has proactively integrated ESG targets into its executive and employee compensation structures, signaling a deep-seated commitment to these principles. The company's ambition to be a leader in ESG management and transparent communication underscores its strategic focus on sustainability.

The company's consistent inclusion in the prestigious Dow Jones Sustainability World Index for 2023 and 2024 serves as concrete evidence of its ongoing dedication to robust ESG practices and its standing among global sustainability leaders.

The availability of a skilled workforce and evolving labor market dynamics in Brazil's energy, logistics, and agricultural sectors are crucial for Cosan's operations. For instance, in 2024, Brazil's unemployment rate hovered around 7.8%, indicating a competitive labor market for specialized skills.

Automation in logistics, a key area for Cosan, is boosting productivity but also necessitates a re-skilling of the workforce. Companies like Cosan are investing in training programs to adapt their employees to new technologies, ensuring they can manage automated systems effectively.

Cosan's commitment to employee development, diversity, equity, and inclusion is vital for attracting and retaining talent in this dynamic environment. By fostering an inclusive workplace, Cosan aims to build a robust and adaptable team capable of meeting future challenges.

Community Engagement and Impact

Cosan's extensive operations in sugar, ethanol, and logistics inherently involve deep engagement with local communities. By 2025, the company aims to solidify its commitment with a private social investment strategy, complete with measurable impact indicators, building upon existing corporate guidelines for community relations. This focus is crucial for securing its social license to operate, a vital element in preventing potential conflicts and fostering sustainable growth.

The company's commitment to responsible community engagement is underscored by its operational footprint. For instance, in the 2023-2024 harvest, Cosan processed approximately 60 million tons of sugarcane, directly impacting numerous rural communities. This scale necessitates robust social programs to ensure mutual benefit and maintain positive relationships.

- Social License to Operate: Cosan's ability to continue its operations relies heavily on maintaining the trust and support of the communities where it operates.

- Community Investment: A planned private social investment strategy by 2025 will focus on measurable impact, indicating a strategic approach to community development.

- Conflict Mitigation: Proactive and responsible community engagement is a key strategy to avoid potential social conflicts that could disrupt operations.

- Economic Impact: Cosan's operations create jobs and economic opportunities, making community relations a critical factor in local economic stability.

Urbanization and Changing Lifestyles

Brazil's ongoing urbanization significantly shapes energy demand and logistical requirements, directly affecting Cosan's operations. As more people flock to cities, the need for reliable fuel distribution and natural gas for homes and industries escalates. This urban shift also necessitates more sophisticated logistics and infrastructure, presenting both challenges and opportunities for Cosan's Compass Gás & Energia and Rumo segments.

The urban population in Brazil is projected to reach 88.3% by 2050, up from around 87.1% in 2023. This demographic trend fuels a growing demand for energy. For instance, natural gas consumption in Brazil saw a notable increase, with distributed gas sales reaching approximately 32.7 billion cubic meters in 2023, a 3.4% rise from the previous year, highlighting the expanding market for Compass Gás & Energia.

Furthermore, the concentration of economic activity in urban areas intensifies the need for efficient transportation and distribution networks. Rumo, Cosan's logistics arm, plays a crucial role in connecting agricultural production centers to these burgeoning urban markets. The company reported moving 73.7 million tons of cargo in 2023, demonstrating the scale of logistics required to support the nation's urban growth.

- Urban Population Growth: Brazil's urban population is expected to continue its upward trajectory, reaching 88.3% by 2050, driving increased energy consumption.

- Natural Gas Demand: Distributed natural gas sales in Brazil reached about 32.7 billion cubic meters in 2023, up 3.4% year-on-year, reflecting growing urban residential and industrial needs.

- Logistics Demand: Rumo transported 73.7 million tons of cargo in 2023, underscoring the critical need for robust logistics infrastructure to serve urban centers.

Societal expectations are increasingly shifting towards sustainability, especially within the energy and mobility sectors. This growing demand directly influences consumer purchasing decisions, pushing companies to offer more environmentally friendly options. Cosan, through its joint venture Raízen, is well-positioned to capitalize on this trend, with significant investments in ethanol production and renewable energy initiatives aligning with the global move towards a low-carbon economy.

Brazil's widespread adoption of flex-fuel technology has been a significant driver in reducing carbon dioxide emissions, appealing to environmentally conscious consumers and demonstrating practical sustainable solutions in the automotive industry, a market where Cosan is a major participant. Stakeholders, from investors to local communities, are increasingly demanding that companies like Cosan demonstrate genuine commitment to social responsibility and ESG standards, shaping operational practices and market perception.

Cosan has proactively integrated ESG targets into its compensation structures and aims for leadership in ESG management, evidenced by its inclusion in the Dow Jones Sustainability World Index for 2023 and 2024. The availability of a skilled workforce and evolving labor market dynamics are crucial, with Brazil's unemployment rate around 7.8% in 2024 indicating a competitive market for specialized skills, necessitating investment in training for automation and fostering diversity, equity, and inclusion to attract and retain talent.

Cosan's extensive operations in sugar, ethanol, and logistics involve deep engagement with local communities, with a planned private social investment strategy by 2025 focusing on measurable impact and building upon existing community relations guidelines to secure its social license to operate and mitigate potential conflicts. The company processed approximately 60 million tons of sugarcane in the 2023-2024 harvest, highlighting the scale of its operations and the necessity for robust social programs to ensure mutual benefit and positive relationships.

| Sociological Factor | Description | Cosan's Relevance/Action | Data Point/Example |

|---|---|---|---|

| Sustainability Demand | Growing consumer preference for eco-friendly products and services. | Cosan's investment in ethanol and renewables via Raízen. | Ethanol production is a core business for Raízen. |

| Flex-Fuel Adoption | Consumer acceptance of vehicles capable of running on ethanol or gasoline. | Brazil's high flex-fuel penetration supports ethanol demand. | Brazil is a global leader in flex-fuel vehicle adoption. |

| ESG Expectations | Increased pressure from stakeholders for corporate social and environmental responsibility. | Integration of ESG into compensation; Dow Jones Sustainability Index inclusion. | Included in DJSI World Index for 2023 and 2024. |

| Labor Market Dynamics | Availability and skill level of the workforce. | Investment in workforce training for automation and focus on DEI. | Brazil's unemployment rate around 7.8% in 2024. |

| Community Relations | Importance of maintaining positive relationships with local communities. | Planned private social investment strategy by 2025; focus on social license to operate. | Processed ~60 million tons of sugarcane in 2023-2024 harvest. |

Technological factors

Technological advancements in biofuel production, especially for ethanol and green diesel, are crucial for Cosan's energy business. Innovations in energy efficiency and reducing greenhouse gas emissions during production make products like ethanol more competitive and sustainable. For instance, in 2023, Brazil's sugarcane ethanol sector achieved a significant milestone, with production reaching 37.4 billion liters, a 16.4% increase from the previous year, largely driven by technological improvements.

The 'Fuel of the Future Law' in Brazil, enacted in 2023, is a key driver for research and development in sustainable fuels. This legislation specifically encourages advancements in areas like sustainable aviation fuel (SAF) and biomethane, which are areas Cosan is actively exploring to diversify its biofuel portfolio and meet growing global demand for cleaner energy sources.

The logistics and energy distribution sectors are undergoing a significant digital transformation, with AI and automation at the forefront. This shift promises to revolutionize how goods and fuel are moved and managed. For Cosan, this means opportunities to enhance its operations, particularly within its logistics arm, Rumo.

Rumo can capitalize on digital solutions such as electronic truck scheduling, automated access control systems, and real-time tracking sensors. These technologies are crucial for boosting operational responsiveness and overall efficiency, allowing for more agile management of complex supply chains.

The Brazilian logistics automation market is poised for substantial growth. Projections indicate a significant expansion, fueled by widespread 5G adoption and the increasing integration of advanced technologies like big data analytics and artificial intelligence, creating a fertile ground for innovation and investment.

Innovations in solar, wind, and biomass are reshaping Cosan's energy landscape. Brazil's solar capacity is expected to reach 19.2 GW by 2025, a significant technological leap. This expansion offers Cosan opportunities in both distributed generation and large-scale projects, aligning with its energy transition strategy.

Carbon Capture, Utilization, and Storage (CCUS)

Brazil's 'Fuel of the Future Law,' enacted in early 2024, is a significant step in regulating carbon capture, utilization, and storage (CCUS). This pioneering legislation provides a framework for geological storage of CO2, signaling a strong governmental push towards decarbonization initiatives.

For Cosan, this regulatory development opens up crucial opportunities. Engaging with CCUS technologies allows the company to explore new pathways for reducing its carbon footprint and meeting increasingly stringent future emission targets, potentially enhancing its sustainability profile.

Cosan's strategic investments in CCUS align with global climate objectives and can yield substantial competitive advantages. By embracing these technologies, the company positions itself at the forefront of sustainable energy solutions, potentially attracting green investment and improving operational efficiency.

- Regulatory Framework: The 'Fuel of the Future Law' establishes the first dedicated regulations for CCUS in Brazil, creating a more predictable environment for investment.

- Decarbonization Strategy: CCUS offers Cosan a tangible method to achieve its decarbonization goals, crucial for long-term business viability and stakeholder expectations.

- Competitive Edge: Early adoption and integration of CCUS can differentiate Cosan in the market, offering a competitive edge in an evolving energy landscape.

Energy Storage Solutions and Smart Grids

The evolution of energy storage and smart grid technologies is paramount for Brazil's energy sector, especially for incorporating renewable sources like solar and wind. These advancements promise a more stable and efficient electricity supply, which directly impacts energy distribution companies.

While Brazil's regulatory framework for energy storage is still developing, the National Electric Energy Agency (ANEEL) has prioritized discussions on storage mechanisms within its 2024 and 2025 agendas. This indicates a growing recognition of storage's importance for grid modernization.

Cosan, with its significant presence in energy distribution through entities like Comgás and Moove, stands to gain considerably from these technological shifts. A smarter, more resilient grid, supported by advanced storage, can lead to improved operational efficiency and potentially new service offerings.

- Regulatory Focus: ANEEL's 2024-2025 agenda includes key discussions on energy storage regulations, signaling a move towards market integration.

- Grid Modernization: Smart grids enhance reliability by better managing supply and demand, crucial for integrating intermittent renewables.

- Cosan's Position: Cosan's energy distribution arms can leverage improved grid stability for operational gains and service expansion.

- Market Potential: The successful implementation of storage solutions could unlock new revenue streams and optimize energy delivery networks.

Technological advancements are reshaping Cosan's core businesses. Innovations in biofuel production, like enhanced sugarcane ethanol yields, are critical. For instance, Brazil's sugarcane ethanol production reached 37.4 billion liters in 2023, a 16.4% year-on-year increase, showcasing the impact of technology.

The 'Fuel of the Future Law,' enacted in 2023, is a key technological catalyst, promoting research in sustainable aviation fuel and biomethane, areas Cosan is actively pursuing for portfolio diversification.

Digital transformation, particularly AI and automation in logistics, presents significant opportunities for Cosan's Rumo segment. Implementing solutions like automated scheduling and real-time tracking can boost efficiency. The Brazilian logistics automation market is expected to grow substantially, driven by 5G and AI integration.

Innovations in renewables, such as solar and wind, are also transforming Cosan's energy operations. Brazil's solar capacity is projected to reach 19.2 GW by 2025, offering avenues for distributed and large-scale generation projects.

The 'Fuel of the Future Law' also provides a framework for carbon capture, utilization, and storage (CCUS) in Brazil, a pioneering move that allows Cosan to explore CO2 geological storage and reduce its carbon footprint, aligning with sustainability goals.

Energy storage and smart grid technologies are vital for integrating renewables. While Brazil's storage regulations are developing, the National Electric Energy Agency (ANEEL) prioritized storage discussions in its 2024-2025 agenda, highlighting its importance for grid modernization and potential benefits for Cosan's distribution arms.

Legal factors

Brazil's energy sector operates under a stringent regulatory framework, with the National Electric Energy Agency (ANEEL) overseeing electricity and the National Agency of Petroleum, Natural Gas and Biofuels (ANP) governing fuels. Cosan's significant investments in gas and energy distribution, through its subsidiary Compass Gás & Energia, are directly shaped by these concession agreements and the tariff-setting methodologies employed by these agencies.

For Cosan, regulatory stability and predictable policy are paramount. The capital-intensive nature of energy infrastructure demands long-term certainty. For instance, changes in ANP's fuel pricing policies or ANEEL's electricity tariff adjustments can significantly impact Cosan's revenue streams and profitability. In 2023, Brazil's energy sector saw ongoing discussions around regulatory reforms aimed at modernizing the market, which could present both opportunities and challenges for companies like Cosan.

Companies like Cosan, operating in sectors with potential environmental impact, must adhere to stringent environmental licensing and maintain registration with the Brazilian Institute of Environment and Renewable Natural Resources (IBAMA). This is a foundational requirement for their operations.

A significant development in July 2025 saw Brazil's Congress approve a bill that has sparked debate regarding potential relaxations in environmental safeguards for large-scale projects. This legislative shift introduces a dynamic and potentially challenging legal environment for companies to navigate.

Cosan's ability to successfully manage its operations and mitigate reputational damage hinges on its proactive approach to complying with these evolving environmental regulations. Staying ahead of legal changes is crucial for maintaining operational integrity and stakeholder trust.

The legal landscape for biofuels in Brazil, particularly through RenovaBio established by Law No. 13,576/2017, offers significant incentives for enhancing energy efficiency and cutting greenhouse gas emissions in biofuel production. This framework directly impacts Cosan's operations by encouraging cleaner production methods.

Furthermore, the recent Federal Law No. 15,042/2024 has officially established the Brazilian Greenhouse Gas Emissions Trading System (SBCE), ushering in a regulated carbon market. This development presents both new avenues for revenue generation through carbon credits and necessitates strict compliance measures for Cosan's biofuel business.

Labor Laws and Social Compliance

Brazilian labor laws significantly shape Cosan's operational landscape, influencing everything from hiring practices to employee benefits across its vast network. The company must navigate a complex web of regulations concerning minimum wage, working hours, and social security contributions, which directly impact its cost structure and workforce management.

Ensuring compliance with these stringent labor statutes, which include mandates for workplace safety and health benefits, is paramount for Cosan's social license to operate and its reputation. For instance, in 2023, Brazil's minimum wage was adjusted, affecting direct labor costs for many of Cosan's operational roles.

- Compliance Burden: Cosan faces significant administrative and financial obligations to adhere to Brazil's comprehensive labor code.

- Operational Costs: Fluctuations in labor costs, driven by legislative changes or economic factors, directly influence Cosan's profitability.

- Workforce Management: Adapting HR policies to comply with evolving labor regulations, such as those related to remote work or diversity mandates, is an ongoing challenge.

Antitrust and Competition Laws

Cosan, as a major player in Brazil's energy and logistics sectors, faces significant scrutiny under antitrust and competition laws. Regulatory bodies like Brazil's Administrative Council for Economic Defense (CADE) actively monitor market concentration to prevent monopolistic practices and ensure a level playing field for all businesses. For instance, CADE's review of major mergers and acquisitions, such as those potentially involving fuel distribution or sugar and ethanol production, directly impacts Cosan's growth strategies.

Changes in antitrust regulations or a heightened focus on market dominance could influence Cosan's ability to pursue strategic acquisitions, form new partnerships, or expand its operations into new markets. The company's substantial market share in areas like fuel distribution, where Raízen (a Cosan joint venture) is a leading player, means it is particularly sensitive to shifts in competition policy.

- Market Share Sensitivity: Raízen, a key Cosan venture, holds a significant portion of Brazil's fuel distribution market, making it a focal point for competition authorities.

- Regulatory Oversight: CADE's ongoing monitoring of market concentration in sectors like energy and logistics directly affects Cosan's strategic maneuvers.

- Impact on Expansion: Stricter antitrust enforcement could limit Cosan's capacity for future acquisitions and market penetration.

Brazil's legal framework for energy, biofuels, and labor directly shapes Cosan's operational landscape and strategic decisions. The nation's stringent environmental regulations, overseen by bodies like IBAMA, necessitate careful compliance for all projects. Furthermore, recent legislative changes in 2024, including the establishment of a regulated carbon market, present new compliance requirements and revenue opportunities for Cosan's biofuel segment.

The company must navigate complex labor laws, which impact hiring, wages, and workplace safety, with adjustments to minimum wage in 2023 directly affecting operational costs. Cosan's significant market presence also subjects it to antitrust scrutiny by CADE, influencing its expansion and partnership strategies, particularly within its Raízen joint venture.

| Legal Factor | Description | Impact on Cosan | Relevant Legislation/Body |

|---|---|---|---|

| Energy Regulation | Oversight of electricity and fuel sectors. | Affects tariff-setting and concession agreements for gas and energy distribution. | ANEEL, ANP |

| Environmental Compliance | Licensing and registration for operations with environmental impact. | Requires adherence to evolving regulations and potential challenges from legislative shifts. | IBAMA, Law No. 13,576/2017 (RenovaBio) |

| Labor Laws | Regulations on hiring, wages, and workplace safety. | Influences cost structure and workforce management; 2023 minimum wage adjustments impacted direct labor costs. | Brazilian Labor Code |

| Antitrust Laws | Monitoring market concentration and preventing monopolistic practices. | Impacts strategic acquisitions and market expansion, especially for Raízen's fuel distribution dominance. | CADE |

| Carbon Market | Establishment of a regulated emissions trading system. | Creates new revenue streams via carbon credits and necessitates strict compliance for biofuels. | Federal Law No. 15,042/2024 (SBCE) |

Environmental factors

Brazil's commitment to combating climate change is evident in its ambitious targets, aiming for a 59% to 67% reduction in net greenhouse gas emissions by 2035 from 2005 levels and achieving carbon neutrality by 2050. This national imperative directly influences companies like Cosan.

Cosan's strategic direction, particularly its 'Vision ESG 2030,' is designed to actively support the energy transition and promote the adoption of clean and renewable energy sources. This proactive stance is essential for aligning with Brazil's broader environmental objectives.

The company's focus on reducing its carbon intensity and engaging in the carbon market is vital for contributing to the achievement of these national climate goals. Such initiatives demonstrate a tangible commitment to sustainability and regulatory compliance.

Cosan's extensive sugar and ethanol operations in Brazil are inherently water and land intensive. For instance, sugarcane cultivation, the primary feedstock, demands significant water resources, making efficient water management crucial for operational sustainability and cost control, especially in regions prone to drought.

The company's commitment to sustainable agricultural practices is vital, aligning with initiatives like the RenovaBio program, which incentivizes the production of biofuels with lower carbon footprints. In 2023, RenovaBio aimed to certify 28 billion liters of decarbonized biofuel, a target Cosan actively contributes to through its ethanol production.

Protecting biodiversity and preventing deforestation are paramount environmental considerations for Cosan. Brazil's ongoing efforts to combat deforestation, particularly in the Amazon and Cerrado biomes, directly impact agricultural expansion and land use policies, requiring Cosan to adhere to strict environmental regulations and promote conservation within its supply chains.

Effective waste management and the push towards a circular economy are critical for large industrial players like Cosan. These initiatives are not just about environmental responsibility but also about operational efficiency and long-term value creation.

Cosan is actively exploring circular economy principles within its extensive operations. This means a strategic focus on reducing waste at the source and ensuring resources are utilized as efficiently as possible across its diverse business units, from energy to logistics.

For example, in 2023, Cosan's Raízen joint venture, a major player in the sugar, ethanol, and energy sectors, reported advancements in its bio-energy initiatives, which inherently support circular economy concepts by transforming byproducts into valuable energy sources, contributing to a more sustainable operational model.

Pollution Control and Emission Reduction

Cosan’s operations, particularly in the energy and agriculture sectors, face stringent requirements for controlling air and water pollution. The company's commitment to reducing its environmental impact is evident in its investments in energy efficiency and renewable energy sources, aiming to lower its overall carbon footprint.

In 2023, Cosan reported significant progress in its sustainability initiatives. For instance, its Raízen joint venture, a major player in the sugar, ethanol, and energy sectors, continued to expand its renewable energy portfolio. Raízen’s sugarcane ethanol production for the 2023 harvest season contributed to displacing an estimated 2.5 million tons of CO2 equivalent compared to gasoline.

Compliance with environmental regulations is paramount. Cosan and its subsidiaries must adhere to various environmental licenses and continuously monitor emissions. This includes regular reporting on air quality, water discharge, and waste management, ensuring alignment with national and international environmental standards. For example, in 2024, the company is expected to publish its updated sustainability report detailing specific emission reduction targets and achievements across its diverse business units.

- Emission Reduction Targets: Cosan is working towards specific greenhouse gas emission reduction targets, aligning with global climate goals.

- Renewable Energy Investments: The company continues to invest in renewable energy sources, such as solar and wind power, to diversify its energy mix and reduce reliance on fossil fuels.

- Water Management: Strict protocols are in place for managing water resources and ensuring the quality of discharged water from its industrial facilities.

- Environmental Compliance: Adherence to all environmental licenses and regulations is a core operational principle, with ongoing monitoring and reporting.

Transition to Renewable Energy Sources

Brazil's accelerated shift towards renewable energy, particularly solar and wind, is reshaping its entire electricity sector. This transition, with renewables accounting for a growing share of the energy matrix, presents a dynamic environment for Cosan. While the company is a dominant player in biofuels, this broader energy evolution demands strategic portfolio adjustments.

The increasing integration of renewables, however, introduces complexities such as energy curtailment. This occurs when excess renewable energy cannot be distributed due to limitations in grid capacity, posing a challenge for efficient energy management and potentially impacting the value of energy assets.

- Renewable Energy Growth: Brazil's installed renewable energy capacity saw significant growth, with solar and wind power leading the expansion in 2024.

- Grid Infrastructure Challenges: Insufficient grid modernization remains a bottleneck, leading to curtailment events, particularly in regions with high renewable energy generation.

- Cosan's Adaptation: Cosan's strategic focus on energy transition, including investments in new energy sources and grid solutions, is crucial for navigating these evolving market dynamics.

Brazil's environmental regulations are becoming increasingly stringent, pushing companies like Cosan to prioritize sustainability and compliance. The nation's commitment to reducing greenhouse gas emissions, targeting a 59% to 67% reduction by 2035, directly influences Cosan's operational strategies and investments in cleaner technologies.

Cosan's 'Vision ESG 2030' actively supports Brazil's energy transition, focusing on renewable energy adoption and carbon intensity reduction. This aligns with national objectives and the RenovaBio program, which incentivized the production of 28 billion liters of decarbonized biofuel in 2023, a target Cosan significantly contributes to.

Water and land intensity in sugarcane cultivation, Cosan's core business, necessitates efficient water management, especially in drought-prone areas. Protecting biodiversity and preventing deforestation are also critical, requiring adherence to strict land use policies and conservation efforts within its supply chains.

Cosan's commitment to circular economy principles is evident in its waste management initiatives and the transformation of byproducts into energy sources. For instance, Raízen's bio-energy projects in 2023 exemplify this by converting sugarcane byproducts into valuable energy, contributing to a more sustainable operational model.

PESTLE Analysis Data Sources

Our Cosan PESTLE analysis is built on a robust foundation of data from official government publications, international financial institutions like the World Bank and IMF, and leading industry-specific research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Cosan.