Cosan Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosan Bundle

Cosan's marketing strategy is a masterclass in integrated execution, meticulously aligning its product offerings, pricing structures, distribution channels, and promotional efforts to capture market share. This comprehensive approach ensures every touchpoint reinforces their brand promise and drives consumer engagement.

Dive deeper into Cosan's strategic brilliance and unlock the secrets behind their success. Our full 4Ps Marketing Mix Analysis provides an in-depth, ready-made examination of their product innovation, pricing tactics, place in the market, and promotional campaigns—essential for business professionals, students, and consultants seeking actionable insights.

Product

Cosan, via its subsidiary Raízen, provides a robust energy and biofuel offering, encompassing sugar, ethanol, and bioenergy. This diverse product suite serves critical roles across numerous industries and consumer sectors, underscoring Cosan's significant position in the worldwide bioenergy landscape and its dedication to sustainable energy solutions.

As a global leader in bioenergy, Cosan boasts an extensive portfolio of renewable products. For instance, Raízen's sugarcane crushing capacity reached 73.4 million tons in the 2023/2024 harvest, demonstrating its scale. The company is also a major ethanol producer, contributing significantly to Brazil's renewable fuel supply.

Raízen, a significant joint venture with Shell, leverages its extensive fuel distribution and retail network to serve a broad customer base. This network encompasses Shell-branded service stations throughout Brazil, Argentina, and Paraguay, offering essential fuels like gasoline and diesel.

The retail segment goes beyond basic fuel provision, integrating convenience store offerings directly at service stations, catering to both individual consumers and business clients. This dual approach ensures widespread accessibility and a comprehensive customer experience.

In 2024, Raízen's fuel distribution segment showed robust performance, with over 6,000 service stations operating under the Shell brand in Brazil alone. This vast infrastructure facilitated the sale of approximately 25 billion liters of fuel, underscoring its market dominance and reach.

Beyond retail, Raízen's distribution capabilities extend to critical sectors such as aviation fuel supply at major airports and direct sales to a diverse array of B2B customers, demonstrating its integral role in various economic activities across South America.

Compass Gás e Energia, a vital part of Cosan's strategy, is at the forefront of natural gas distribution and energy infrastructure development in Brazil. They serve industrial, commercial, and residential clients through regulated gas distribution, aiming to broaden the market. In 2023, Compass reported significant growth in its gas distribution segment, with volumes increasing by over 15% compared to the previous year, reflecting strong demand and expansion efforts.

Beyond traditional gas, Compass is actively investing in a cleaner energy future. This includes developing renewable energy projects such as biogas and solar power generation. Their commitment to a safer energy transition is evident in their strategic partnerships and investments in distributed generation, aiming to offer more sustainable energy solutions to the Brazilian market.

Logistics and Infrastructure Solutions

Rumo S.A., a key player in Cosan's logistics and infrastructure segment, operates Brazil's most extensive independent rail network, crucial for transporting agricultural commodities such as grains and sugar. This network facilitates the efficient movement of goods from production hubs to major export terminals, providing a competitive edge and promoting environmentally friendly transportation with lower carbon emissions compared to other modes.

Cosan's commitment to logistics extends beyond rail, encompassing significant investments in port infrastructure. These integrated operations are vital for streamlining the supply chain, ensuring that commodities reach global markets effectively. For instance, Rumo's 2024 outlook anticipates continued growth in cargo volume, driven by Brazil's strong agricultural output.

The logistics and infrastructure solutions provided by Cosan, primarily through Rumo, are foundational to Brazil's agricultural export competitiveness. Their low-carbon transport options are increasingly valued in international markets.

- Rumo's extensive rail network spans over 13,000 kilometers across Brazil.

- The company handled approximately 70 million tons of cargo in 2023.

- Investment in port terminals enhances Cosan's integrated logistics offering.

- Rumo's operations are critical for connecting Brazil's agricultural heartland to global markets.

Lubricants and Agricultural Land Management

Moove, a significant player in the lubricants market, boasts a broad range of brands, including Mobil, positioning it as a major producer and distributor worldwide. This segment contributes significantly to Cosan's revenue, with the global lubricants market projected to reach approximately $170 billion by 2027, showing steady growth.

Radar's strategic management of agricultural land in Brazil is a key component of Cosan's diversified approach. By focusing on land appreciation and supporting the agribusiness sector, Radar aims to generate stable income and capitalize on Brazil's robust agricultural output. In 2023, Brazil's agribusiness exports alone surpassed $100 billion, highlighting the sector's economic importance.

The combination of Moove's lubricant operations and Radar's agricultural land management creates a robust business model for Cosan. This diversification offers resilience against market fluctuations in individual sectors and provides exposure to different growth drivers.

- Moove's Global Reach: Operates as one of the largest lubricant producers and distributors, featuring brands like Mobil.

- Radar's Land Portfolio: Manages significant agricultural properties in Brazil, targeting land value appreciation and agribusiness support.

- Revenue Stability: Diversification across lubricants and agricultural land provides consistent revenue streams.

- Market Exposure: Offers exposure to distinct market dynamics within the energy and agricultural sectors.

Cosan's product strategy is deeply rooted in energy and agriculture, leveraging its subsidiaries to offer a comprehensive suite of essential goods and services. Raízen, a major player, provides sugar, ethanol, and bioenergy, with a sugarcane crushing capacity of 73.4 million tons in the 2023/2024 harvest, highlighting its scale in renewable fuels. Moove, meanwhile, dominates the lubricants market, distributing brands like Mobil, a sector projected to reach $170 billion by 2027. Radar strategically manages agricultural land, capitalizing on Brazil's agribusiness exports, which exceeded $100 billion in 2023.

| Subsidiary | Key Products | 2023/2024 Data/Projections | Market Context |

|---|---|---|---|

| Raízen | Sugar, Ethanol, Bioenergy | 73.4 million tons sugarcane crushed (2023/2024) | Major contributor to Brazil's renewable fuel supply. |

| Moove | Lubricants (e.g., Mobil) | Global lubricants market projected to reach $170 billion by 2027. | One of the largest lubricant producers and distributors globally. |

| Radar | Agricultural Land Management | Brazil's agribusiness exports surpassed $100 billion (2023). | Focuses on land appreciation and agribusiness support. |

What is included in the product

This analysis offers a comprehensive examination of Cosan's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

Streamlines complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for quick decision-making.

Place

Cosan's extensive retail and distribution network is a cornerstone of its market strategy, ensuring its products, like fuels and lubricants from Raízen and Moove, are readily available. This vast reach is primarily facilitated through a widespread presence of Shell-branded service stations and other retail outlets across Brazil, Argentina, and Paraguay.

The sheer scale of this network is impressive. For instance, Raízen alone operates over 1,762 Shell Select convenience stores and 615 OXXO stores. This robust infrastructure guarantees broad consumer access, effectively covering both bustling urban centers and more remote rural locations.

Rumo, Cosan's logistics arm, operates Brazil's most extensive independent rail network, a critical component of its integrated logistics strategy. This network efficiently moves commodities from Brazil's vast agricultural heartlands to its major export terminals.

By connecting key producing regions directly to the nation's primary ports, Rumo ensures swift and dependable transport of agricultural goods and other vital exports. This integration is crucial for maintaining Brazil's competitive edge in global commodity markets.

In 2024, Rumo's operations were central to Cosan's performance, with the company projecting significant growth in cargo volumes. For instance, Rumo handled over 70 million tons of cargo in the first half of 2024, a testament to its operational scale and efficiency.

Compass Gás e Energia utilizes a direct-to-customer model, distributing natural gas to residential, commercial, and industrial users via its established pipeline infrastructure. This ensures efficient delivery and direct engagement with a broad customer base.

For its energy solutions and logistics offerings, Cosan employs a business-to-business (B2B) channel, focusing on direct sales and securing long-term contracts with corporate and industrial clients. This strategy fosters deep client partnerships and predictable revenue streams.

In 2023, Compass Gás e Energia reported a significant increase in natural gas distribution volume, reaching over 17 billion cubic meters, underscoring the effectiveness of its direct sales approach. Cosan’s B2B energy solutions segment also saw robust growth, with new long-term contracts valued at over R$5 billion secured in the same year.

Strategic Geographic Presence

Cosan's strategic geographic presence is heavily concentrated in Latin America, particularly Brazil, a cornerstone for its agricultural and energy businesses. This regional focus allows it to capitalize on established infrastructure and market knowledge.

Beyond Brazil, Cosan extends its fuel distribution network into Argentina and Paraguay, reinforcing its regional leadership. Internationally, its Moove segment, which handles lubricants, has a broader reach, including operations in England, France, Spain, Portugal, the United States, and Asia.

- Brazil: Core market for Raízen (sugar, ethanol, energy) and Comgás (gas distribution).

- Argentina & Paraguay: Key markets for fuel distribution through Raízen.

- Global Moove Operations: Presence in Europe, North America, and Asia for lubricants.

- 2024/2025 Outlook: Continued expansion within Latin America and strengthening international lubricant sales are anticipated, driven by demand in key sectors.

Digital Platforms and Supply Chain Optimization

Cosan leverages digital platforms to streamline its complex supply chains, enhancing operational efficiency. This focus on advanced logistics, including inventory optimization, ensures products are available when and where needed across its various business units. For instance, in 2024, Cosan continued investing in digital solutions to improve visibility and reduce lead times within its fuel distribution network.

This digital integration is crucial for maintaining a competitive edge and responding adeptly to market fluctuations. The company’s commitment to disciplined capital allocation, with a projected focus on portfolio quality in 2025, further underscores the importance of an optimized and digitally managed supply chain for achieving sustainable growth.

- Digital Supply Chain Management: Cosan utilizes digital tools to enhance logistics and inventory control across its operations.

- Operational Efficiency: The company prioritizes advanced logistics to ensure timely product availability and market responsiveness.

- 2025 Strategic Focus: Emphasis on disciplined capital allocation and portfolio quality supports sustainable growth through optimized operations.

- Data-Driven Inventory: Digital platforms enable data-driven decisions for better inventory management and reduced waste.

Cosan's place strategy is defined by its extensive and integrated distribution networks, ensuring broad market access for its diverse product portfolio. This multi-faceted approach caters to both retail consumers and industrial clients through strategically located assets and efficient logistics.

The company's retail presence, primarily through Raízen's Shell service stations and convenience stores, provides direct consumer access. Simultaneously, Rumo's rail infrastructure and Compass's gas pipelines offer critical B2B channels, connecting production to demand centers efficiently.

This geographical concentration in Latin America, especially Brazil, coupled with international expansion in lubricants, allows Cosan to leverage deep market penetration and established logistical advantages.

Cosan's commitment to digital supply chain management further optimizes product availability and responsiveness across its vast operational footprint.

| Business Unit | Primary Market Focus | Key Distribution Channels | 2024/2025 Data/Outlook |

|---|---|---|---|

| Raízen (Fuels & Retail) | Brazil, Argentina, Paraguay | Shell Service Stations, Convenience Stores (Shell Select, OXXO) | 1,762 Shell Select stores, 615 OXXO stores in Brazil (as of early 2024). Continued focus on retail expansion. |

| Rumo (Logistics) | Brazil | Rail Network | Handled over 70 million tons of cargo in H1 2024. Projected continued growth in cargo volumes. |

| Compass Gás e Energia | Brazil | Direct-to-customer pipeline infrastructure | Distributed over 17 billion cubic meters of natural gas in 2023. Ongoing infrastructure development. |

| Moove (Lubricants) | Global (Europe, North America, Asia) | Direct sales, B2B channels | Expanding international presence, targeting growth in lubricant sales in key global markets. |

What You See Is What You Get

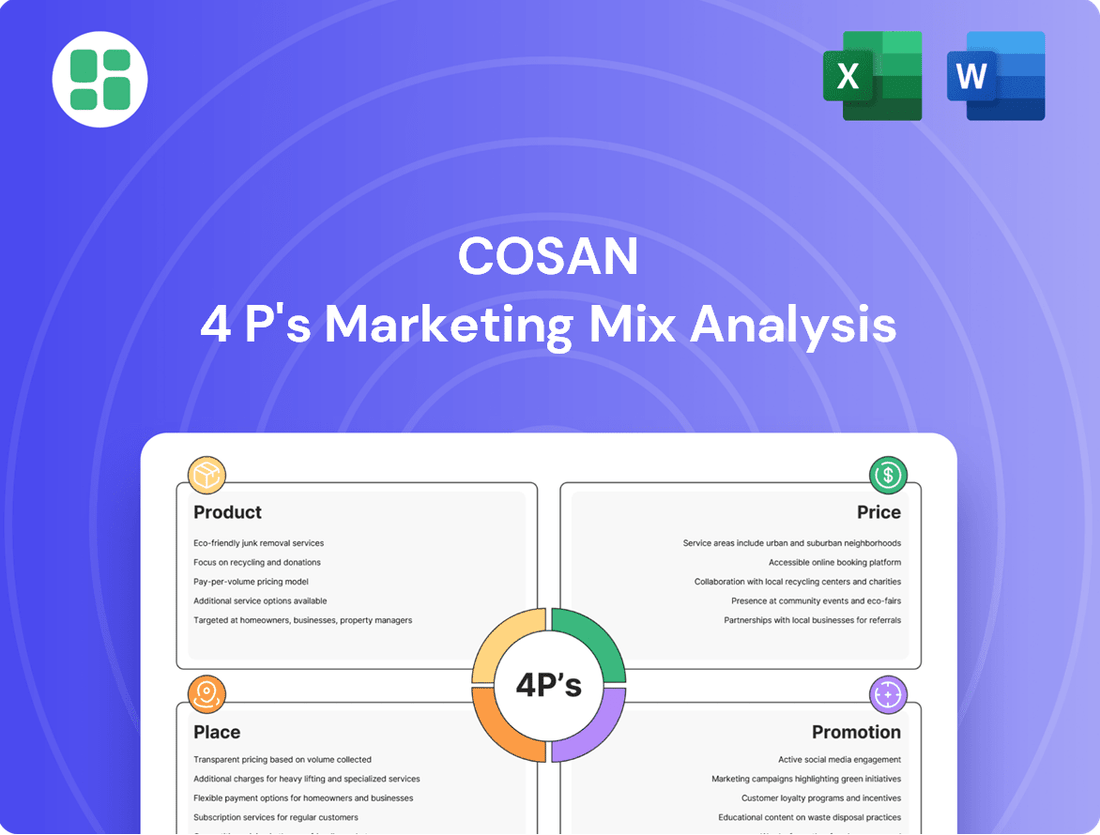

Cosan 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Cosan 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain immediate access to this finished, ready-to-use report upon completing your transaction.

Promotion

Cosan actively cultivates a strong corporate brand, positioning itself as a frontrunner in sustainable energy and logistics across Latin America. This focus is deeply embedded in its 'Vision ESG 2030' strategy, which directs the company's approach to critical environmental, social, and governance (ESG) issues and highlights its role in driving the energy transition.

The company's commitment extends to integrating sustainable, ethical, and transparent practices throughout its operational framework. For instance, in 2023, Cosan reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, underscoring its tangible progress toward its sustainability goals.

Cosan's diverse subsidiaries implement distinct marketing strategies. Raízen, for example, leverages the established Shell brand for its extensive network of fuel stations and convenience stores, a strategy that has proven effective in capturing a significant market share. In 2023, Raízen's fuel distribution segment saw strong performance, contributing to Cosan's overall revenue growth.

Moove, a global lubricants player, recently unveiled a new visual identity. This rebranding aims to better communicate its expanded global objectives and reinforce its position in the international market. This strategic move is expected to enhance brand recognition and customer engagement in the competitive lubricants sector.

Rumo, focused on logistics and rail transportation, tailors its marketing to attract agricultural and industrial clients, emphasizing efficiency and reach. Compass Gás e Energia targets the natural gas market with specific value propositions for industrial and commercial users. These subsidiary-specific initiatives allow for precise market penetration and customer relationship management.

Cosan prioritizes transparency with its investors, consistently publishing detailed financial reports and holding regular earnings calls. This commitment ensures that stakeholders, from individual investors to financial professionals, have access to up-to-date information. For instance, in their 2024 first-quarter earnings call, Cosan highlighted strong operational performance, with a significant increase in EBITDA compared to the previous year, demonstrating their dedication to clear financial communication.

The company's investor relations strategy includes making annual reports, financial statements, and sustainability reports readily available. This comprehensive disclosure allows a broad audience, including academic researchers and business strategists, to conduct thorough analyses. Cosan also provides unaudited financial information and maintains an updated corporate events calendar, further facilitating informed decision-making by the financial community.

Public Relations and Stakeholder Engagement

Cosan actively manages its public image through robust public relations, emphasizing its societal and environmental contributions. This proactive approach involves clear communication about its operations and impact. For instance, in its 2023 sustainability report, Cosan detailed significant investments in renewable energy projects, aiming to reduce its carbon footprint by 15% by 2028.

The company prioritizes transparent reporting on its Environmental, Social, and Governance (ESG) performance, fostering trust with its stakeholders. This commitment is evident in its regular financial filings, which include detailed metrics on emissions, water usage, and community engagement initiatives. Cosan's 2024 first-quarter earnings report highlighted a 5% increase in community investment programs across its operational regions.

Building strong relationships with communities and other stakeholders is a cornerstone of Cosan's strategy. This includes open dialogue and collaborative projects that benefit local populations. In 2024, Cosan launched a new educational partnership program in Brazil, aiming to support over 10,000 students in underserved areas.

Cosan's dedication to transparency and adherence to regulatory standards is a key element of its stakeholder engagement. This is clearly demonstrated through its comprehensive financial disclosures and compliance with international reporting frameworks. The company's commitment to ethical business practices underpins its efforts to maintain a positive reputation and long-term stakeholder value.

B2B Relationship Management and Industry Partnerships

Cosan's B2B relationship management and industry partnerships are fundamental to its operations in logistics, gas, and large-scale energy. This strategy emphasizes direct engagement with clients, fostering tailored communication and solution-driven sales approaches. Long-term contract negotiations are crucial for securing and retaining major business partners, ensuring stability and predictable revenue streams.

Raízen, a key Cosan entity, exemplifies this by concentrating on its core competencies in ethanol, sugar, bioenergy, and fuel distribution. This focus allows for operational simplification and efficiency, directly benefiting its B2B relationships through reliable and streamlined service delivery. For instance, Raízen's fuel distribution network relies on strong partnerships with large industrial clients and transportation companies, often secured through multi-year agreements.

Cosan's approach to industry partnerships is evident in its collaborations within the energy sector. These alliances are vital for developing and scaling new energy solutions, such as biofuels and renewable energy projects. Such partnerships often involve joint ventures or strategic alliances that leverage shared expertise and resources, as seen in the development of advanced ethanol production technologies.

- B2B Focus: Cosan prioritizes direct relationships for its logistics, gas, and energy solutions, emphasizing tailored communication and solution-oriented sales.

- Long-Term Contracts: Securing and maintaining major clients relies heavily on negotiating long-term agreements, providing revenue stability.

- Raízen's Strategy: Raízen simplifies operations in sugar, ethanol, bioenergy, and fuel distribution, strengthening its B2B partnerships through efficiency.

- Industry Alliances: Cosan actively forms strategic partnerships within the energy sector to develop and scale new energy solutions, leveraging shared expertise.

Cosan's promotional efforts are multifaceted, encompassing corporate branding, subsidiary-specific marketing, and robust investor relations. The company emphasizes its leadership in sustainable energy and logistics, backed by its ESG 2030 strategy and tangible emission reductions, such as a 15% decrease in Scope 1 and 2 emissions by 2023 against a 2020 baseline.

Subsidiaries like Raízen leverage established brands such as Shell for fuel stations, contributing to strong market performance, while Moove recently updated its visual identity to reflect global ambitions. Rumo and Compass Gás e Energia tailor their marketing to specific industrial and agricultural clients, highlighting efficiency and market reach.

Cosan maintains transparency through detailed financial reports and earnings calls, ensuring stakeholders have access to current data. For instance, the first quarter of 2024 saw a significant increase in EBITDA, demonstrating operational strength and clear financial communication.

The company also actively manages its public image by highlighting societal and environmental contributions, including investments in renewable energy projects. In 2024, a new educational partnership program was launched in Brazil, aiming to support over 10,000 students.

| Subsidiary | Key Marketing Focus | Recent Promotional Activity/Data |

|---|---|---|

| Raízen | Leveraging Shell brand, fuel distribution strength | Strong performance in fuel distribution segment in 2023 |

| Moove | Global lubricants, new visual identity | Rebranding to better communicate expanded global objectives |

| Rumo | Logistics efficiency and reach for agricultural/industrial clients | Tailored marketing emphasizing operational advantages |

| Compass Gás e Energia | Natural gas market, value propositions for industrial/commercial users | Specific value propositions for targeted market segments |

Price

Cosan's pricing for biofuels and sugar, primarily through its joint venture Raízen, is intrinsically tied to the volatile global commodity markets. This means prices for sugar and ethanol are not static, but rather fluctuate based on international supply and demand dynamics, as well as the impact of currency exchange rates.

Raízen's financial performance, therefore, hinges directly on the prevailing global prices for these commodities. For instance, in the 2023/2024 harvest, sugar prices saw significant strength, with New York sugar futures trading around $23-$25 per pound for much of the period, directly benefiting Raízen's revenue streams.

Cosan's Compass Gás e Energia operates in a sector governed by regulated tariffs for natural gas distribution. These tariffs are established by state regulatory bodies, meaning Compass must adhere to specific pricing structures determined by these agencies. This regulatory oversight significantly impacts the company's revenue predictability and pricing stability.

In 2023, the Brazilian energy sector saw ongoing discussions and adjustments to regulatory frameworks. For instance, the Agência Nacional de Energia Elétrica (ANEEL), while primarily focused on electricity, influences the broader energy regulatory landscape, impacting how distribution companies like Compass navigate tariff setting. Compass's reliance on these regulated tariffs is a core element of its pricing strategy within the marketing mix.

Cosan's fuel and lubricant pricing, managed through Raízen and Moove respectively, is a dynamic balancing act. It's intensely competitive, with strategies often geared towards gaining or maintaining market share. Brand positioning also plays a significant role in how prices are set.

Value-added services at Raízen's fuel stations, like convenience stores and car washes, allow for premium pricing. Similarly, Moove's focus on high-quality lubricants supports a strategy where superior product performance justifies a higher price point.

Raízen's revenue growth in 2024, for instance, was bolstered by increased demand in the fuel market and strategic business expansion, demonstrating how volume and market reach directly impact top-line performance and pricing power.

Contract-Based Pricing for Logistics Services

Rumo, a key player in Cosan's logistics, employs contract-based pricing for its services, primarily rail transport and port operations. These contracts, often long-term, are structured around client volumes, transit distances, and agreed-upon service levels, creating a predictable revenue stream. Pricing is also sensitive to Rumo's network efficiency and overall transport demand.

Rumo's operational efficiency directly impacts its pricing power and profitability. For instance, in the first quarter of 2024, Rumo reported record margins, driven by increased volumes and optimized operations. This performance underscores how operational improvements translate into better contract terms and financial results.

- Record Margins: Q1 2024 saw Rumo achieve notable margin improvements.

- Volume Driven Growth: Higher transport volumes are a key factor in Rumo's revenue and pricing strength.

- Contractual Stability: Long-term contracts provide a solid foundation for revenue, mitigating short-term market volatility.

Capital Allocation and Debt Management Impact

Cosan's financial health and how it manages its money, including its debt and any assets it sells, subtly affects how its different businesses set prices. For instance, selling off parts of the company, like its stake in Vale, is a move to improve its financial structure and pay down debt. This can free up more options for pricing in the future and give it more room to invest.

Looking ahead to 2025, Cosan is aiming for a more focused approach to where it puts its money, prioritizing quality assets to support steady growth. This strategic financial management is key to maintaining competitive pricing across its diverse operations.

- Financial Optimization: Cosan's strategic asset sales, like the Vale stake, are designed to strengthen its balance sheet and reduce leverage.

- Debt Reduction: By shedding non-core assets, the company aims to lower its debt burden, potentially leading to improved credit ratings and lower borrowing costs.

- Future Investment Capacity: A healthier financial position and reduced debt can enhance Cosan's ability to fund future growth initiatives and strategic acquisitions.

- Pricing Flexibility: Improved capital structure and financial stability can provide greater flexibility in pricing strategies across its various business segments.

Cosan's pricing strategy is multifaceted, reflecting the diverse nature of its operations. For Raízen's biofuels and sugar, prices are largely dictated by global commodity markets, with sugar futures around $23-$25 per pound in 2023/2024. Compass Gás e Energia operates under regulated tariffs set by state agencies, offering more stability. Fuel and lubricant pricing, managed by Raízen and Moove, balances competition with brand positioning, where premium products command higher prices.

| Business Segment | Pricing Driver | Key Data/Observation (2023-2025) |

|---|---|---|

| Biofuels & Sugar (Raízen) | Global Commodity Markets | Sugar futures ~$23-25/lb (2023/2024); Ethanol prices influenced by oil and domestic demand. |

| Natural Gas Distribution (Compass) | Regulated Tariffs | Tariff adjustments influenced by regulatory bodies like ANEEL; focus on predictable revenue streams. |

| Fuels & Lubricants (Raízen/Moove) | Market Competition & Brand Value | Pricing reflects market share goals and premium positioning for high-quality lubricants; value-added services enable premium pricing. |

| Logistics (Rumo) | Contractual Agreements & Efficiency | Contract-based pricing tied to volume, distance, and service levels; Q1 2024 saw record margins driven by operational efficiency. |

4P's Marketing Mix Analysis Data Sources

Our Cosan 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also integrate insights from industry-specific market research and competitive intelligence to provide a robust understanding of their strategies.