Cosan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosan Bundle

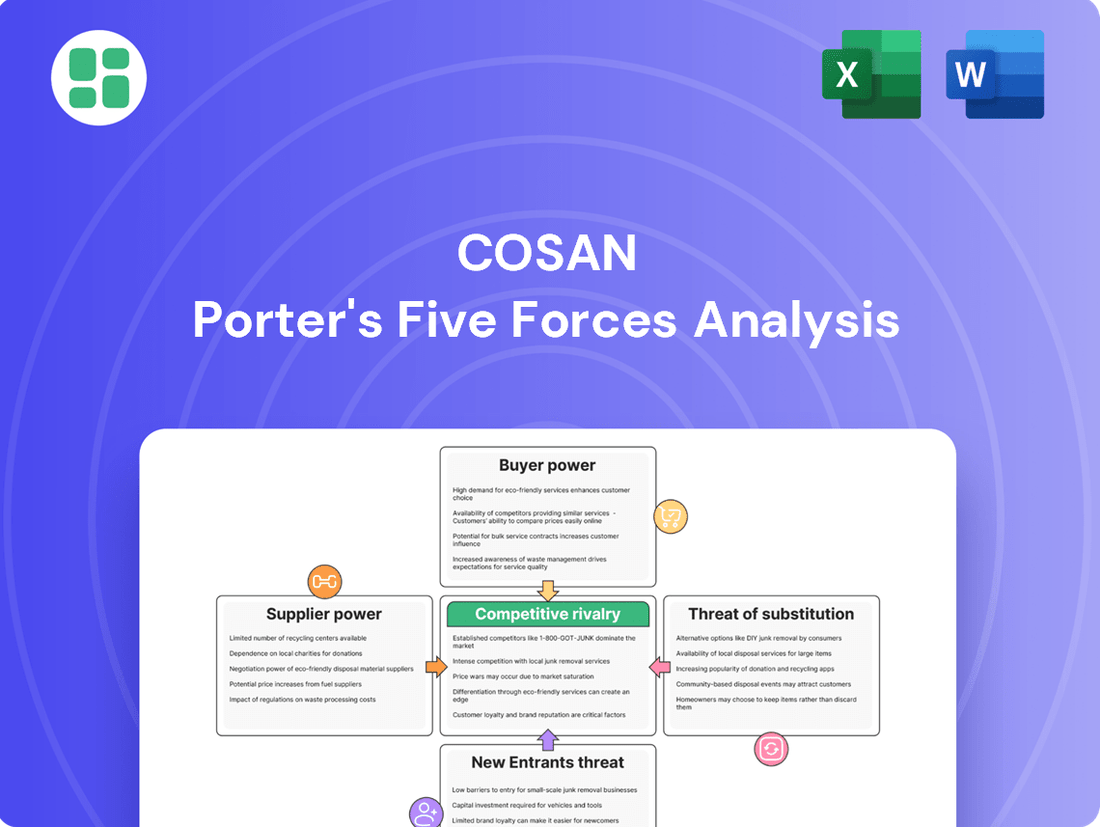

Cosan's competitive landscape is shaped by the interplay of buyer power, supplier leverage, and the threat of substitutes. Understanding these forces is crucial for navigating its dynamic market.

The full Porter's Five Forces Analysis delves deeper, revealing the intensity of each force and providing actionable insights into Cosan’s strategic positioning. Unlock this comprehensive report to gain a competitive edge and drive informed decision-making.

Suppliers Bargaining Power

Cosan's diverse operations mean it interacts with a wide range of suppliers. For its sugarcane segment, Raízen, it sources from a largely decentralized base of sugarcane growers. However, for its energy businesses like Raízen and Compass, it also deals with highly concentrated global suppliers in markets like oil and gas.

The bargaining power of these suppliers is directly tied to their market concentration and how easily Cosan can find alternative sources. For example, the global oil and gas markets can experience significant price volatility, directly impacting the input costs for Cosan's energy operations. In 2024, global crude oil prices fluctuated, with Brent crude averaging around $80-$85 per barrel for much of the year, highlighting the significant cost influence of these concentrated suppliers.

The uniqueness of inputs significantly impacts supplier bargaining power. For Cosan, specialized inputs like specific grades of crude oil or proprietary logistics technology can give suppliers leverage, especially when switching to alternatives is costly and time-consuming. This is particularly relevant for energy-related operations where specialized equipment or feedstock is crucial.

High switching costs for essential inputs can lock Cosan into unfavorable terms. For instance, long-term contracts for natural gas supply, a key input for some of its energy production, can restrict Cosan's ability to renegotiate or find more competitive suppliers. This dependence limits flexibility and can directly affect operational costs and profitability.

Conversely, the bargaining power of suppliers diminishes when inputs are more commoditized. For sugarcane, a primary input for Cosan's biofuels segment, switching costs are generally lower. This means Cosan can more readily shift between suppliers if pricing or terms become unfavorable, thereby reducing supplier influence in this area. In 2024, the Brazilian sugarcane harvest saw robust yields, increasing supply and potentially softening prices for this key commodity.

If suppliers can credibly threaten to forward integrate, meaning they can enter Cosan's downstream markets, their bargaining power grows considerably. This is a key factor in assessing supplier influence.

While less common for typical agricultural inputs, major energy suppliers, for instance, could potentially invest in expanding their own distribution networks. However, this requires substantial capital investment, making it a significant barrier.

Given Cosan's substantial scale and established infrastructure, direct competition from the majority of its suppliers through forward integration appears less probable. This limits the threat for most of its supply chain.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails a supplier's bargaining power. If Cosan can readily source raw materials or components from multiple suppliers or alternative sources, it lessens the leverage any single supplier holds. For instance, while sugarcane is a primary feedstock for ethanol, advancements in second-generation ethanol production from various biomass sources could broaden Cosan's feedstock options, thereby diminishing the power of traditional sugarcane suppliers.

In the fuel distribution sector, the ability to source refined products globally or from a diverse range of refineries can effectively counter the bargaining power of any individual refiner. This diversification of supply options provides Cosan with greater flexibility and negotiation strength, ensuring more favorable terms and reducing dependence on a limited number of providers.

- Reduced Supplier Leverage: The presence of readily available substitute inputs directly weakens a supplier's ability to dictate terms and prices.

- Diversification of Feedstocks: For Cosan's ethanol operations, exploring second-generation ethanol from diverse biomass sources like agricultural waste or forestry residues offers a strategic hedge against reliance on sugarcane alone.

- Global Sourcing in Fuel Distribution: In fuel distribution, Cosan benefits from the option to source refined products from international markets, providing a buffer against the pricing power of domestic refiners.

- Technological Advancements: Innovations in alternative fuel production and material science can create new substitute inputs, further empowering companies like Cosan by expanding their procurement choices.

Cost of Inputs Relative to Cosan's Total Costs

The proportion of supplier costs relative to Cosan's total operational expenses is a key determinant of supplier bargaining power. For instance, in 2023, Cosan's Cost of Goods Sold (COGS) represented a substantial portion of its revenue, meaning fluctuations in input prices have a direct and significant impact on its bottom line.

High input costs, particularly for commodities like crude oil and natural gas which are fundamental to Cosan's fuel and gas distribution operations, directly affect profitability. The volatility of these commodity markets in 2024 means that suppliers of these essential inputs can exert considerable influence.

- Input Cost Proportion: In 2023, Cosan's COGS was approximately R$70 billion, highlighting the significant weight of input costs in its overall financial structure.

- Commodity Dependence: The fuel and gas segments are heavily reliant on crude oil and natural gas, making Cosan vulnerable to price swings dictated by global supply and demand.

- Cost Management Strategies: Cosan's ability to manage these input costs through hedging strategies or securing long-term supply agreements is critical for maintaining healthy profit margins amidst market fluctuations.

Cosan's diverse operations mean it interacts with a wide range of suppliers, from decentralized sugarcane growers to concentrated global energy suppliers. The bargaining power of these suppliers is influenced by market concentration, uniqueness of inputs, switching costs, potential for forward integration, and availability of substitutes. For Cosan, high input costs, especially for commodities like crude oil and natural gas, directly impact profitability, making cost management crucial.

| Factor | Impact on Cosan | 2024 Data/Context |

|---|---|---|

| Market Concentration | High concentration among energy suppliers grants them significant leverage. | Global oil prices fluctuated, averaging around $80-$85 per barrel for Brent crude. |

| Uniqueness of Inputs | Specialized inputs like specific crude grades give suppliers power. | Key for energy operations requiring specialized feedstock or equipment. |

| Switching Costs | High switching costs for essential inputs limit Cosan's flexibility. | Long-term natural gas contracts can restrict renegotiation. |

| Availability of Substitutes | Readily available substitutes weaken supplier influence. | Second-generation ethanol production broadens feedstock options. |

| Input Cost Proportion | Significant input costs directly affect profitability. | In 2023, Cosan's COGS was approximately R$70 billion. |

What is included in the product

Cosan's Porter's Five Forces analysis reveals the intensity of competition, the power of buyers and suppliers, the threat of new entrants and substitutes, all within its specific operational context.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each force with a dynamic, interactive dashboard.

Customers Bargaining Power

Cosan's customer base is diverse, ranging from everyday consumers at its fuel stations to significant industrial clients requiring gas and logistics services. This variety impacts bargaining power differently.

For retail fuel customers, price sensitivity is extremely high, and the ease of switching to a competitor means they hold considerable power. This dynamic fuels aggressive price competition among fuel distributors. In 2024, average gasoline prices in Brazil saw fluctuations, with retail stations needing to remain competitive to retain customers.

Industrial clients, such as those utilizing Cosan's gas or logistics, may face higher switching costs due to the integration of services into their operations. However, the sheer volume of their business grants them substantial negotiation leverage, allowing them to influence pricing and service terms.

Cosan's customer concentration varies greatly. In its fuel distribution segment, millions of individual consumers possess very little individual bargaining power, making them a fragmented base.

However, for segments like natural gas distribution or logistics services, large industrial clients, especially those with high consumption volumes, can wield significant influence. These major customers can negotiate for more favorable pricing and contract conditions, potentially impacting Cosan's margins. For instance, a large industrial user of natural gas might represent a substantial portion of a regional distribution network's revenue, giving them leverage.

Customers' ability to find alternatives significantly shapes their bargaining power. For Cosan, this means that if consumers can easily switch to other fuel providers or energy sources, they have more leverage. In 2024, the continued expansion of charging infrastructure for electric vehicles presents a growing long-term substitute threat to traditional fuel sales.

For instance, the sheer number of competing gas stations and fuel brands available to everyday drivers means Cosan must constantly compete on price and service to retain customers. Similarly, industrial clients have a range of alternative energy sources and logistics companies they can turn to, forcing Cosan to offer competitive pricing and reliable service quality.

Customer's Ability to Backward Integrate

If customers possess the financial muscle and operational wherewithal to produce what Cosan supplies themselves, their leverage grows significantly. Imagine a major industrial customer deciding to generate their own electricity or handle their own transportation if Cosan's pricing or service levels become unfavorable. This potential for in-house production acts as a constant pressure on Cosan to remain competitive and deliver superior value.

This threat of backward integration is a critical factor influencing Cosan's pricing strategies and service innovation. For instance, if a significant portion of Cosan's client base, particularly large energy consumers or logistics-dependent businesses, were to invest in their own production capabilities, Cosan would face a direct erosion of its market share. While specific data on Cosan's clients' current capabilities for backward integration isn't publicly detailed, the general trend in industries Cosan serves, such as energy and logistics, shows increasing investment in self-sufficiency by large corporations to control costs and supply chain reliability.

- Customer Capability: The ability of major clients to invest in and operate facilities for energy generation or logistics.

- Cost Control: Customers may integrate backward to reduce their operational expenses if Cosan's services become too costly.

- Supply Chain Security: In-house production can offer clients greater control and reliability over their essential inputs and services.

- Competitive Pressure: The mere possibility of backward integration forces Cosan to maintain competitive pricing and service quality.

Information Availability and Product Differentiation

Customers armed with readily available information on pricing and product alternatives significantly increase their bargaining power. In markets where products are largely indistinguishable, like the fuel sector, high price transparency directly empowers consumers to seek the best deals.

For Cosan, differentiating its energy and logistics services is key to counteracting this. By offering superior service, attractive loyalty programs, or bundled solutions that go beyond the basic product, Cosan can build perceived value that reduces customers’ focus solely on price.

- Information Access: Increased consumer access to pricing and product comparisons amplifies customer leverage.

- Commoditization Impact: In markets like fuel, where products are commoditized, price becomes a primary differentiator, enhancing customer power.

- Cosan's Differentiation Strategy: Cosan can mitigate customer power by focusing on service quality, loyalty initiatives, and integrated energy and logistics solutions.

Cosan faces significant customer bargaining power, particularly from price-sensitive retail fuel consumers and large industrial clients. The ease with which consumers can switch fuel providers in 2024, coupled with the growing availability of electric vehicle alternatives, amplifies their leverage. Industrial customers, while potentially facing higher switching costs, command power through their substantial purchase volumes, influencing pricing and service terms for natural gas and logistics. This dynamic necessitates Cosan's focus on competitive pricing and service differentiation to retain its diverse customer base.

| Customer Segment | Bargaining Power Factors | Impact on Cosan |

|---|---|---|

| Retail Fuel Consumers | High price sensitivity, ease of switching, availability of alternatives (e.g., EVs) | Intense price competition, pressure on margins |

| Industrial Clients (Gas, Logistics) | High volume purchases, potential for backward integration, negotiation leverage | Ability to influence pricing and contract terms, risk of losing significant revenue |

| Overall Customer Base | Information transparency, commoditization of services | Need for strong differentiation, loyalty programs, and value-added services |

Preview the Actual Deliverable

Cosan Porter's Five Forces Analysis

This preview showcases the comprehensive Cosan Porter's Five Forces Analysis you will receive immediately upon purchase. You're looking at the actual, professionally written document, detailing the competitive landscape for Cosan, including threats from new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry. This exact file, fully formatted and ready for your strategic decision-making, will be available for instant download after completing your purchase.

Rivalry Among Competitors

Cosan navigates a competitive landscape that shifts depending on the specific sector. In fuel distribution, the presence of significant national players like Vibra Energia and Ipiranga, which together held substantial market shares in 2023, fuels intense rivalry.

The sugar and ethanol market sees Cosan competing with other large-scale producers, creating a dynamic environment where scale and efficiency are paramount.

In contrast, gas distribution often features regional monopolies or duopolies, presenting a different competitive dynamic. The logistics sector, however, is characterized by a more fragmented market with numerous players of varying sizes, though competition can still be fierce.

The maturity of the industries Cosan operates in significantly shapes its competitive rivalry. In more mature sectors, such as traditional fuel distribution, slower market growth often leads to intensified competition as companies fight harder for existing market share. This can manifest as price wars or increased marketing efforts to retain customers.

Conversely, Cosan's involvement in growth areas like renewable energy or specialized logistics presents a different competitive landscape. While these sectors might experience less immediate price-based rivalry, competition is fierce for market development, securing new contracts, and driving innovation. For example, the Brazilian ethanol market, a key area for Cosan, has seen steady growth, but competition remains robust among major players.

Data from 2024 indicates that while the overall Brazilian energy market continues to evolve, traditional fuel distribution faces pressure from shifting consumer preferences and regulatory changes, increasing rivalry. Cosan's strategic focus on expanding its presence in biofuels and logistics aims to capitalize on higher growth segments, potentially mitigating some of the intense competition found in more saturated markets.

In markets where products are largely standardized, such as basic fuels or sugar, competition often boils down to price. Cosan actively combats this through its Raízen brand, employing loyalty programs and value-added services to differentiate its fuel offerings. This strategy aims to build customer preference beyond mere cost, fostering a more stable competitive landscape.

For its gas and logistics segments, Cosan focuses on differentiating through superior service quality, unwavering reliability, and the provision of integrated solutions. These elements are crucial in building higher customer switching costs. By offering a more comprehensive and dependable service package, Cosan makes it less appealing for clients to move to competitors, thereby mitigating the intensity of direct price-based rivalry.

Exit Barriers and Overcapacity

High exit barriers, particularly those stemming from substantial sunk costs in specialized infrastructure like refineries, pipelines, and extensive railway networks, can trap companies in markets even when demand falters. This reluctance to exit often fuels persistent overcapacity, intensifying price competition as firms fight to maintain operational utilization. Cosan's considerable asset base, spread across energy and logistics, suggests significant exit barriers are present across its diversified operations.

The presence of these high exit barriers means that during economic downturns or periods of reduced demand, companies like Cosan may be compelled to engage in aggressive pricing strategies to keep their assets running. This can depress industry profitability for all players involved. For instance, in the logistics sector, Cosan's extensive railway network represents a major fixed investment that is difficult and costly to divest, encouraging continued operation even at lower margins.

- High Sunk Costs: Cosan's investments in refineries and extensive logistics infrastructure create significant barriers to exiting these markets.

- Overcapacity Risk: The inability or unwillingness to exit due to sunk costs can lead to prolonged periods of overcapacity in the industry.

- Intensified Price Competition: Overcapacity forces companies to compete fiercely on price to maintain asset utilization, impacting profitability across the sector.

Strategic Objectives and Diversity of Competitors

Cosan's competitive landscape is shaped by the diverse strategic objectives of its rivals. Some competitors are aggressively pursuing market share, potentially sacrificing short-term profitability, while others focus on maximizing margins or investing heavily in innovation. This divergence creates a dynamic and often unpredictable competitive environment.

The nature of these strategic goals directly influences rivalry intensity. For instance, a competitor prioritizing market share in the fuel distribution sector might engage in aggressive pricing strategies, directly impacting Cosan's profitability. Conversely, a focus on innovation by another player could necessitate increased R&D spending from Cosan to maintain its competitive edge.

Cosan navigates a market populated by a variety of entities:

- State-owned enterprises often have mandates that extend beyond pure profit, such as ensuring energy security or regional development, influencing their strategic decisions.

- Large private conglomerates may leverage cross-subsidization from other business units, allowing them to absorb losses in certain segments where Cosan operates.

- Specialized players, particularly in niche areas like biofuels or logistics, might have a singular focus on technological advancement or operational efficiency, posing a different kind of competitive threat.

For example, in the Brazilian ethanol market, while Cosan is a major player, it faces competition from other large producers like Raízen (a joint venture between Cosan and Shell) and smaller, more agile independent producers, each with varying strategic priorities regarding production volume, export markets, and investment in new technologies.

Cosan faces intense competition across its diverse business segments. In fuel distribution, major players like Vibra Energia and Ipiranga, which collectively held a significant market share in Brazil in 2023, drive aggressive rivalry. The sugar and ethanol market is similarly competitive, with Cosan contending against other large-scale producers where efficiency is key.

The strategic divergence among competitors, from those prioritizing market share to those focused on innovation, creates a dynamic and often unpredictable environment. For instance, in the crucial Brazilian ethanol sector, Cosan competes with both large entities and smaller, agile producers, each with distinct strategic aims regarding volume, exports, and technological investment.

Cosan's competitive rivalry is amplified by high exit barriers, such as substantial investments in specialized infrastructure like refineries and extensive logistics networks. These barriers, evident in Cosan's considerable asset base, can lead to overcapacity and intensified price competition as firms strive to maintain asset utilization, impacting sector-wide profitability.

SSubstitutes Threaten

The availability of alternative products that satisfy the same customer needs presents a significant threat to Cosan. For its fuel segment, the increasing adoption of electric vehicles (EVs) and the development of hydrogen fuel cell technology represent a long-term, potentially disruptive substitute threat. By the end of 2024, global EV sales are projected to surpass 15 million units, a substantial increase that directly impacts demand for traditional fossil fuels.

In the sugar market, Cosan faces direct substitution from artificial sweeteners and alternative natural sweeteners. These options cater to growing consumer preferences for low-calorie or perceived healthier alternatives, directly impacting the demand for traditional sugar. For instance, the global market for sugar substitutes was valued at approximately $9.5 billion in 2023 and is expected to grow, posing a continuous challenge to sugar volumes.

The attractiveness of substitutes for Cosan's products hinges on their price and performance relative to Cosan's offerings. For instance, a significant drop in the operational cost of electric vehicles (EVs), coupled with comparable driving ranges to traditional gasoline-powered cars, would directly increase the threat to Cosan's fuel sales. In 2024, the total cost of ownership for EVs continued to decline, with some studies indicating parity with internal combustion engine vehicles in certain segments, a trend that bears close watching.

Customer willingness to switch to substitutes is a significant factor. For Cosan, this is evident in the growing interest in electric vehicles, which directly impacts demand for traditional fuels. In 2023, global electric vehicle sales surpassed 13 million units, a substantial increase from previous years, indicating a clear shift in consumer preference.

Environmental concerns are a major driver for this substitution. As awareness of climate change grows, consumers are increasingly seeking greener alternatives. This trend is further amplified by government regulations and incentives promoting renewable energy and sustainable transportation, directly challenging Cosan's fossil fuel-centric businesses.

Health considerations also play a role, particularly in Cosan's sugar business. The demand for sugar substitutes, driven by health-conscious consumers and concerns about sugar intake, can erode market share. The global market for sugar substitutes was projected to reach over $10 billion by 2024, highlighting the competitive landscape.

Cosan must proactively adapt its portfolio to align with these evolving consumer preferences and regulatory shifts. Investing in and promoting renewable energy solutions and exploring innovative, healthier product alternatives will be crucial for mitigating the threat of substitutes and ensuring long-term competitiveness.

Switching Costs for Customers to Adopt Substitutes

High switching costs significantly dampen the threat of substitutes for Cosan's offerings. For instance, a business needing to transition its entire fleet of internal combustion engine vehicles to electric vehicles would face considerable capital expenditures. This includes the purchase of new vehicles and potentially the installation of charging infrastructure.

Similarly, industrial companies that have heavily invested in infrastructure designed for specific energy sources, like natural gas pipelines or specialized refining equipment, would incur substantial costs to reconfigure their operations for alternative energy inputs. These investments create a strong lock-in effect, making it economically unviable for many customers to switch away from Cosan's established energy solutions.

Cosan's strategy of providing integrated solutions further erects barriers to substitution. By offering a comprehensive package that might include fuel supply, logistics, and potentially even fleet management services, Cosan makes it more complex and costly for customers to disentangle themselves and piece together a comparable offering from different providers. This interconnectedness naturally raises the perceived switching costs.

Consider the automotive sector in 2024: while electric vehicle adoption is growing, the upfront cost of converting a commercial fleet can still be a major hurdle. For example, a fleet of 100 delivery vans could represent millions in capital investment for new EVs and charging stations, a cost that many businesses are still evaluating very carefully against the ongoing operational savings.

- High Capital Outlay: Converting a large fleet of gasoline-powered vehicles to electric alternatives can cost millions, deterring many businesses.

- Industrial Reconfiguration: Modifying industrial processes to accommodate new energy sources often requires significant investment in new equipment and infrastructure.

- Integrated Solution Lock-in: Cosan's bundled services create complexity and cost for customers seeking to switch to alternative providers for individual components.

- 2024 Fleet Conversion Costs: The initial investment for a fleet of 100 electric delivery vans, including charging infrastructure, can easily exceed several million dollars.

Evolution of Technology and Innovation

The threat of substitutes for Cosan is significantly influenced by the rapid evolution of technology and innovation across various energy and agricultural sectors. New technologies can emerge that offer comparable or superior performance to existing products and services, potentially diverting customers and impacting Cosan's market share.

Innovations in areas like advanced battery technology for electric vehicles and more efficient renewable energy generation, such as solar and wind power, present direct substitutes for fossil fuels and traditional energy sources that Cosan is involved with. For instance, the global electric vehicle market is projected to reach over $1.5 trillion by 2030, indicating a substantial shift away from internal combustion engines. Similarly, advancements in green hydrogen production could offer an alternative to biofuels and other energy carriers.

Cosan's strategic investment in Raízen, a major player in the Brazilian sugar, ethanol, and energy sectors, is a proactive measure to mitigate this threat. By being a leading producer of biofuels, particularly ethanol, Cosan positions itself at the forefront of a renewable energy solution. In 2023, Raízen reported producing approximately 3.7 billion liters of ethanol, showcasing its significant role in this market. This integration allows Cosan to benefit from the growth in demand for sustainable alternatives rather than being solely disrupted by them.

- Technological Disruption: Innovations in electric vehicles and renewable energy generation create substitutes for traditional fuels.

- Biofuel Leadership: Cosan’s stake in Raízen, a major biofuel producer, addresses this threat by participating in the growth of sustainable alternatives.

- Market Shift: The increasing adoption of EVs and renewables signals a long-term trend that necessitates adaptation in the energy sector.

The threat of substitutes for Cosan is substantial, driven by evolving consumer preferences and technological advancements. In the energy sector, the accelerating adoption of electric vehicles (EVs) directly challenges demand for traditional fossil fuels. By the close of 2024, global EV sales are expected to exceed 15 million units, a clear indicator of this shift. Simultaneously, the sugar market faces substitution from artificial and natural sweeteners, fueled by health consciousness. The global market for sugar substitutes was valued around $9.5 billion in 2023, underscoring the competitive pressure.

Cosan's strategic positioning in biofuels, particularly through its stake in Raízen, is a key factor in mitigating this threat. Raízen's substantial ethanol production, reporting approximately 3.7 billion liters in 2023, places Cosan at the forefront of renewable energy solutions. This integration allows the company to capitalize on the growing demand for sustainable alternatives rather than being solely disrupted by them. The projected growth of the global EV market to over $1.5 trillion by 2030 further emphasizes the need for such strategic diversification.

| Segment | Substitute Threat | Key Data Point (2023-2024) | Mitigation Strategy |

|---|---|---|---|

| Fuel | Electric Vehicles (EVs), Hydrogen Fuel Cells | Global EV sales projected to surpass 15 million units by end of 2024. | Investment in renewable energy solutions. |

| Sugar | Artificial & Natural Sweeteners | Global sugar substitute market valued at ~$9.5 billion in 2023. | Focus on innovation and healthier product alternatives. |

| Energy (Overall) | Renewable Energy Technologies | Global EV market projected to reach over $1.5 trillion by 2030. | Leading role in biofuel production via Raízen (3.7 billion liters ethanol in 2023). |

Entrants Threaten

Entering Cosan's core sectors, like fuel distribution or logistics, demands substantial upfront capital for infrastructure, such as terminals, pipelines, and fleets. For instance, building a new fuel distribution network can easily cost hundreds of millions of dollars.

Cosan leverages significant economies of scale in its operations, particularly in fuel logistics and sugar production. This scale allows them to reduce per-unit costs, making it challenging for new, smaller players to match their pricing and efficiency without a comparable investment.

Many of Cosan's core businesses, such as fuel distribution through Raízen and gas distribution via Comgás, operate within heavily regulated environments. For instance, Comgás, a major player in Brazil's natural gas market, requires extensive concessions and must comply with stringent safety and environmental regulations set by the government. These regulatory frameworks, including licensing requirements and price controls, significantly increase the cost and complexity for any potential new entrant, effectively acting as a substantial barrier.

Newcomers face significant hurdles in replicating Cosan's extensive distribution channels. For instance, Raízen, a key Cosan subsidiary, boasts a vast network of over 6,000 fuel stations across Brazil, a scale that requires immense capital and time to match.

Securing reliable supply chains is equally challenging. Cosan's operations in the sugar and ethanol sector depend on long-term contracts and established relationships with sugarcane producers, a complex ecosystem difficult for new entrants to penetrate.

In 2024, the energy sector saw continued consolidation, with major players like Cosan leveraging their existing infrastructure to maintain market share, further raising the barrier for new entrants seeking to establish comparable distribution and supply chain capabilities.

Brand Loyalty and Product Differentiation

Brand loyalty significantly dampens the threat of new entrants for Cosan. While certain products are indeed commodities, brands like Raízen, which distributes Shell-branded fuel in Brazil, have cultivated strong customer loyalty over decades. For instance, in 2023, Raízen reported a significant market share in the Brazilian fuel distribution sector, underscoring the entrenched nature of its brand.

New players entering the market would face the considerable challenge of replicating this established brand equity. They would require substantial marketing expenditures and a considerable timeframe to build comparable recognition and effectively differentiate their offerings to draw customers away from established brands like Raízen. This barrier is particularly high in consumer-facing segments where trust and familiarity play a crucial role in purchasing decisions.

- Brand Equity: Cosan's brands, particularly Raízen, benefit from years of investment in marketing and customer service, creating a strong competitive advantage.

- Customer Loyalty: Established brands foster repeat business, making it difficult for new entrants to gain market share without significant incentives.

- Differentiation Costs: New entrants must invest heavily in product development, marketing, and distribution to create offerings that stand out from Cosan's established brands.

- Market Penetration Time: Building brand recognition and customer trust takes considerable time, delaying the return on investment for new market participants.

Incumbency Advantages and Retaliation

Existing players like Cosan benefit from significant incumbency advantages. These include deep market knowledge honed over years, strong, established relationships with customers, and often, more efficient cost structures due to economies of scale and experience curve effects. For instance, Cosan's extensive logistics network, built over decades in the Brazilian energy sector, represents a substantial barrier for newcomers.

New entrants must also contend with the very real threat of retaliation from established companies. Incumbents are likely to defend their market share vigorously, potentially through aggressive pricing tactics, increased advertising spend, or by leveraging their existing distribution channels to make it difficult for new players to gain traction. This credible threat of retaliation can significantly dampen the attractiveness of entering the market.

- Incumbency Advantages: Cosan leverages its extensive experience in the Brazilian energy market, possessing superior market knowledge and established customer loyalty.

- Cost Structures: Decades of operation allow Cosan to benefit from experience curve effects and economies of scale, leading to potentially lower per-unit costs compared to new entrants.

- Threat of Retaliation: Newcomers face the risk of aggressive responses from Cosan, such as price wars or increased marketing campaigns, designed to protect its market position.

- Barriers to Entry: The combination of established advantages and the threat of retaliation creates substantial barriers, making it challenging for new companies to enter and compete effectively.

The threat of new entrants in Cosan's sectors is significantly mitigated by substantial capital requirements, particularly for infrastructure development in fuel distribution and logistics, often running into hundreds of millions of dollars. Cosan's established economies of scale in operations like fuel logistics and sugar production allow for cost efficiencies that new, smaller players struggle to match. Furthermore, stringent government regulations and licensing in areas like natural gas distribution, as seen with Comgás, add considerable complexity and cost for potential new entrants.

Porter's Five Forces Analysis Data Sources

Our Cosan Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, regulatory filings, and industry-specific market research reports to capture the competitive landscape accurately.