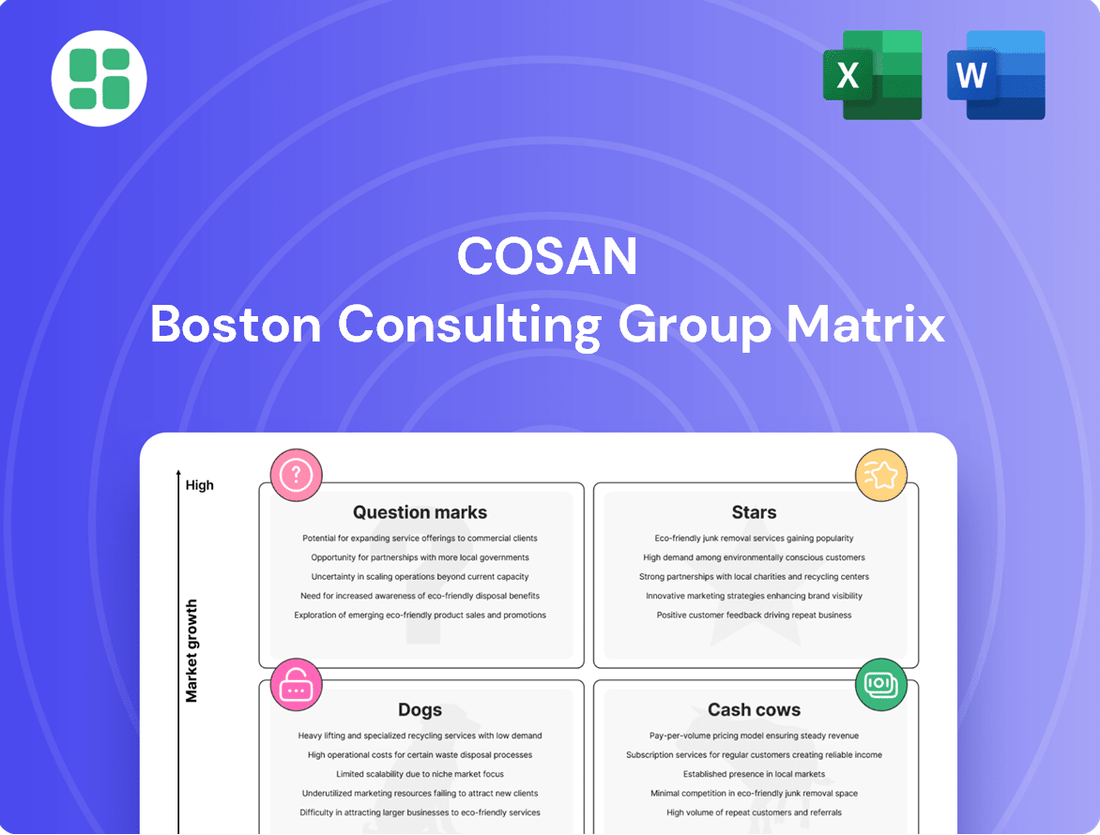

Cosan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosan Bundle

Curious about Cosan's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up. Understand which ventures are fueling growth and which might need a rethink.

Unlock the full potential of this analysis by purchasing the complete Cosan BCG Matrix. Gain detailed insights into each quadrant, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the actionable strategies waiting within the full report. Get your copy today and transform your understanding of Cosan's market dynamics!

Stars

Raízen, a significant player in Brazil's energy sector and a joint venture with Shell, is making substantial strides in its second-generation ethanol (E2G) production. The company is actively investing in expanding its E2G capacity, with new facilities undergoing testing and overall output on the rise. This strategic focus on E2G places Raízen at the forefront of the burgeoning global renewable energy market, a sector experiencing rapid growth fueled by worldwide decarbonization initiatives and increasingly stringent environmental regulations.

The company's commitment to this high-potential segment is underscored by its ambitious expansion plans. Raízen aims to boost its E2G production capacity by an impressive 260 million liters per year. This expansion is a clear indicator of Raízen's confidence in E2G as a key driver of future growth, aligning with the global shift towards sustainable energy solutions and cleaner transportation alternatives.

Rumo, Cosan's dedicated logistics arm, experienced a robust year in 2024, setting new records for transportation volumes. This growth was further bolstered by an increase in tariffs, reflecting its strong operational execution and market position.

Brazil's agricultural sector continues its upward trajectory, driving demand for efficient export infrastructure. Rumo's extensive rail network is a critical enabler, offering substantial cost savings over road transport for agricultural commodities.

The demand for advanced logistics solutions in a growing market solidifies Rumo's role as a market leader. Its strategic investments in infrastructure ensure it remains a key player in facilitating Brazil's export capacity.

Compass Gás e Energia, a key player in natural gas distribution under Cosan, experienced a significant uptick in natural gas volumes in 2024, buoyed by new business ventures and an ambitious network expansion strategy. This segment is poised for robust growth as Brazil continues to diversify its energy sources.

The strategic acquisition of Compagas in 2023, coupled with ongoing investments in renewable energy projects totaling 420 MW, underscores Compass Gás e Energia's commitment to broadening its market presence. These moves align with the evolving Brazilian energy landscape, positioning the company favorably within the distribution sector.

Bioenergy and Renewable Fuels Leadership

Cosan, primarily through its joint venture Raízen, stands as a powerhouse in Brazil's bioenergy sector, particularly in sugarcane-based ethanol. This segment is crucial for the company's growth, capitalizing on increasing global demand for renewable fuels. Projections indicate that worldwide ethanol demand is set to expand annually until 2030, underscoring the long-term viability of this business.

The sheer scale of Raízen's sugarcane ethanol operations grants it significant cost advantages and robust operational leverage. This market leadership is further solidified by ongoing investments, even amidst short-term market fluctuations. The global imperative for decarbonization directly fuels the demand for these sustainable alternatives, reinforcing Raízen's star positioning.

- Market Dominance: Raízen is one of the largest ethanol producers globally, processing over 70 million tons of sugarcane annually.

- Growth Trajectory: Global ethanol demand is forecast to grow at a compound annual growth rate (CAGR) of approximately 4% through 2030.

- Cost Efficiency: The company's integrated business model, from sugarcane cultivation to fuel distribution, provides a competitive cost structure.

- Decarbonization Driver: The increasing focus on reducing greenhouse gas emissions globally is a primary catalyst for the expansion of the bioenergy market.

Strategic Portfolio Management and New Investments

Cosan is actively managing its portfolio, evaluating new business opportunities and investments with a keen eye on Environmental, Social, and Governance (ESG) factors. This focus on capital discipline is designed to build long-term value across its diverse operations.

The company's strategy involves identifying and funding ventures with high growth potential, especially in the sustainable energy sector. These emerging areas are being positioned as future Stars within Cosan's strategic framework.

- Strategic Portfolio Optimization: Cosan's commitment to refining its business mix signals a proactive approach to capturing future market opportunities.

- ESG Integration: The incorporation of ESG criteria into investment decisions underscores a dedication to sustainable growth and responsible business practices.

- Sustainable Energy Focus: Investments in renewable energy and sustainable solutions are key to developing future Star businesses.

- Capital Discipline: A measured approach to capital allocation ensures that resources are directed towards the most promising ventures for long-term value creation.

Cosan's strategic focus on high-growth, emerging sectors positions these ventures as potential Stars within its BCG Matrix. These are businesses with significant market share potential in rapidly expanding industries, requiring substantial investment to maintain their growth trajectory and capture market leadership. The company is actively nurturing these segments, anticipating they will become future cash cows.

The company's commitment to developing new energy solutions, particularly in areas aligned with global decarbonization trends, highlights its forward-thinking approach. These emerging businesses are being meticulously cultivated to achieve dominant market positions in their respective, rapidly growing industries.

Cosan's investment in these nascent but high-potential areas reflects a deliberate strategy to build future market leaders. The company is channeling resources into these ventures, aiming to secure substantial market share in sectors poised for significant expansion.

These emerging businesses are characterized by their strong growth prospects and the potential to capture significant market share, aligning with the definition of Stars in a BCG matrix. Cosan's strategic investments are designed to propel them towards market leadership.

| Cosan's Potential Stars | Industry Growth | Cosan's Strategic Focus | Investment Rationale |

|---|---|---|---|

| Second-Generation Ethanol (E2G) | High (driven by decarbonization) | Capacity expansion and technological advancement | Capitalize on renewable fuel demand and environmental regulations |

| Renewable Energy Projects | Very High (global energy transition) | Acquisitions and organic development (e.g., 420 MW portfolio) | Diversify energy sources and capture growth in sustainable energy |

| Advanced Logistics Solutions | Moderate to High (agricultural sector growth) | Infrastructure investment and operational efficiency | Support Brazil's export capacity and gain market share in logistics |

What is included in the product

The Cosan BCG Matrix provides a framework for analyzing its business units based on market growth and share, guiding strategic decisions.

It highlights which units to invest in, hold, or divest to optimize Cosan's overall portfolio performance.

A clear, quadrant-based visualization of Cosan's business units, immediately clarifying strategic priorities.

Cash Cows

Raízen's established fuel distribution network, primarily operating under the Shell brand across Brazil, Argentina, and Paraguay, represents a significant cash cow. This mature segment boasts a dominant market share, ensuring consistent demand and robust profitability.

In 2024, despite some market headwinds, this segment continued to be a powerhouse, generating substantial cash flow. For instance, Raízen's fuel distribution business consistently delivers high profit margins, contributing significantly to the company's overall financial strength, which is crucial for reinvesting in growth areas.

Cosan's sugar production, primarily through its subsidiary Raízen, is a prime example of a cash cow within the company's portfolio. This segment operates in a mature market where Raízen commands a substantial market share, benefiting from established infrastructure and significant operational scale.

Despite the inherent volatility of commodity prices, this segment consistently generates strong cash flows. For instance, in the 2023/2024 harvest year, Raízen processed a record 77.1 million tons of sugarcane, highlighting its robust operational capacity.

The strategic advantage of being able to flexibly shift production between sugar and ethanol allows Raízen to adapt to market demands and maintain profitability. This adaptability, coupled with its market leadership, solidifies sugar production as a dependable source of cash for Cosan.

Cosan's logistics and infrastructure segment, encompassing more than just Rumo's rail network, holds a dominant market share within Brazil's vital and mature logistics sector. This includes significant port operations and other critical infrastructure, underscoring its foundational importance to national commerce and agriculture.

These established assets, due to their indispensable nature, require minimal promotional investment. They consistently generate stable and predictable cash flows, acting as a bedrock of financial stability for Cosan.

In 2024, Rumo reported handling approximately 70.7 million tons of cargo, a testament to the scale and consistent demand for Cosan's logistics infrastructure, reinforcing its cash cow status.

Moove's Lubricants Business

Moove, Cosan's lubricants business, stands as a prime example of a Cash Cow within the BCG Matrix. Its commercial and supply strategy consistently drives growth in financial results. In 2024, Moove continued to benefit from a stable market with predictable demand, a key characteristic of a mature industry.

This stability translates into robust and consistent cash flow generation. The business is well-positioned for increased dividend payouts, reflecting its strong cash-generating capabilities and mature market position. Moove's strategic emphasis on premium lubricant lines further bolsters its profit margins within this established segment.

- Consistent Growth: Moove's results show steady improvement driven by its commercial and supply chain efficiency.

- Stable Market & Cash Flow: Operating in a mature market with established demand ensures reliable cash generation.

- Dividend Potential: The business's strong cash flow outlook supports expectations for increased dividend distributions.

- Premium Product Focus: Emphasis on high-margin premium lubricants enhances profitability in the lubricants sector.

Dividend and Interest Income from Subsidiaries

Cosan, as a prominent holding company, benefits from significant dividend and interest income flowing from its established subsidiaries, notably Compass and Moove. This consistent cash generation at the corporate level is crucial for managing administrative expenses and servicing corporate debt, embodying the core principle of a cash cow strategy.

This financial support from mature, high-performing businesses allows Cosan to maintain its operational stability and fund other strategic initiatives. For instance, in 2023, Cosan's consolidated net revenue reached R$178.9 billion, with its energy segment, including Compass, playing a vital role in this performance.

- Dividend and Interest Income: Subsidiaries like Compass and Moove provide a stable stream of dividends and interest payments to the parent company, Cosan.

- Corporate Financial Stability: This income is essential for covering Cosan's administrative costs and managing its corporate debt obligations.

- Cash Cow Strategy: The reliable cash flow from these mature businesses exemplifies the 'milking' aspect of the cash cow business model.

- Contribution to Overall Performance: These inflows bolster Cosan's financial health, enabling reinvestment or distribution to shareholders.

Raízen's fuel distribution network is a quintessential cash cow, benefiting from a dominant market share across Brazil, Argentina, and Paraguay. This mature segment ensures consistent demand and robust profitability, contributing significantly to Cosan's overall financial strength. In 2024, this business continued its strong performance, generating substantial cash flow despite market fluctuations.

Cosan's sugar production, managed by Raízen, also operates as a cash cow, leveraging a substantial market share in a mature industry. Despite commodity price volatility, this segment consistently delivers strong cash flows, exemplified by Raízen processing a record 77.1 million tons of sugarcane in the 2023/2024 harvest year.

The logistics and infrastructure segment, particularly Rumo's rail network, acts as a vital cash cow due to its indispensable role in Brazil's commerce. With minimal need for promotional investment, these established assets generate stable and predictable cash flows, reinforcing Cosan's financial stability. Rumo handled approximately 70.7 million tons of cargo in 2024, underscoring its consistent demand.

Moove, Cosan's lubricants business, is another clear cash cow, benefiting from a stable market with predictable demand in a mature industry. This stability translates into robust cash flow generation, positioning Moove for increased dividend payouts, with a strategic focus on premium lubricants enhancing its profit margins.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Raízen Fuel Distribution | Cash Cow | Dominant market share, consistent demand, robust profitability | Significant cash flow generation, high profit margins |

| Raízen Sugar Production | Cash Cow | Substantial market share, operational scale, adaptability | Processed 77.1 million tons of sugarcane (2023/2024 harvest) |

| Cosan Logistics & Infrastructure (Rumo) | Cash Cow | Dominant market share, indispensable infrastructure, stable cash flows | Handled ~70.7 million tons of cargo (2024) |

| Moove Lubricants | Cash Cow | Stable market, predictable demand, premium product focus | Strong cash flow, potential for increased dividends |

Preview = Final Product

Cosan BCG Matrix

The preview you are seeing is the exact Cosan BCG Matrix document you will receive upon purchase, ensuring no surprises and immediate usability. This comprehensive report, meticulously crafted for strategic insight, will be delivered in its final, unwatermarked form, ready for your immediate business planning needs. You're not just getting a preview; you're accessing the fully formatted, analysis-ready Cosan BCG Matrix that's designed to empower your decision-making. Once purchased, this professional document will be instantly available for download, allowing you to integrate its strategic recommendations into your operations without delay.

Dogs

Cosan's recent divestment of distributed generation projects, notably within Raízen, highlights a strategic move away from non-core assets. These assets, likely characterized by low market share and limited growth potential, were divested as they consumed capital without generating substantial returns, acting as cash traps.

This action reflects Cosan's focus on optimizing its portfolio and reallocating resources to more strategic, high-growth areas. For instance, in 2023, Raízen's renewable energy segment, which includes distributed generation, saw significant investment, but some smaller, less impactful projects may have been deemed non-strategic.

Cosan's underperforming older sugar/ethanol mills, exemplified by the divestment of Leme and Santa Elisa facilities by Raízen, likely represent its 'Dogs' in the BCG matrix. These sales signal a strategic move away from assets with limited growth prospects or lower market share within the broader sugar and ethanol sector.

Cosan's minority stake in Vale, prior to its complete divestment, represented a significant capital outlay but offered limited strategic advantage. The investment, valued in the billions, did not translate into the desired management influence, a key consideration for a stake of that magnitude.

This holding was characterized as non-strategic and a burden due to its leverage implications, ultimately prompting its sale to alleviate debt. The market's valuation of this stake also experienced considerable fluctuations, further highlighting its instability.

Within the Cosan portfolio framework, this Vale stake functioned as a 'dog' – an asset that consumed capital without providing substantial strategic control or robust financial returns, ultimately hindering the overall portfolio's performance.

Segments with High Leverage and Negative Net Income

Cosan's financial performance in 2024 and the first quarter of 2025 has been impacted by a negative net income, largely due to the burden of high debt and rising interest rates. Segments within Cosan that exhibit high leverage, meaning they carry a significant amount of debt relative to their equity, and simultaneously report negative net income are particularly concerning. These are the segments that could be classified as 'dogs' in a BCG matrix context.

These 'dog' segments are characterized by their inability to generate profits, thereby draining cash resources that could otherwise be invested in more promising areas of the business. Their high debt levels exacerbate the situation, as interest payments further reduce profitability and increase financial risk. While Cosan is actively working on debt management, these underperforming, highly leveraged units represent a drag on overall company performance.

- High Leverage: Segments with a debt-to-equity ratio significantly above industry averages, indicating a substantial reliance on borrowed funds.

- Negative Net Income: These segments consistently fail to cover their operating costs and interest expenses, resulting in losses.

- Cash Drain: Due to their unprofitability and interest obligations, these segments consume cash rather than generate it, impacting liquidity.

- Limited Growth Prospects: A lack of clear future growth potential means these segments are unlikely to improve their financial standing on their own.

Any Legacy Assets with Limited Synergies

Cosan's portfolio might include legacy assets or smaller ventures that don't strongly align with its primary energy and logistics operations. These could be considered dogs if they exhibit limited growth prospects and minimal synergistic benefits. For instance, a small, non-core agricultural input business acquired years ago might fit this description if it struggles to scale or integrate with Cosan's broader strategy.

Such assets might be financially stable, perhaps breaking even, but they don't offer significant strategic advantages or generate substantial free cash flow. Their contribution to the overall group's performance is minimal, making them potential candidates for restructuring or divestment to improve capital allocation and focus on higher-growth areas. Cosan's 2024 strategic reviews would likely identify such units for potential optimization.

- Limited Growth Potential: Assets showing stagnant revenue or market share.

- Low Synergies: Operations not contributing to or benefiting from core businesses.

- Minimal Cash Generation: Assets that break even but don't produce surplus cash.

- Strategic Review Candidates: Units subject to potential divestment or restructuring.

Cosan's older, less efficient sugar and ethanol mills, like the divested Leme and Santa Elisa facilities, exemplify its 'Dogs'. These operations likely possess limited market share and growth potential within the sugar and ethanol sector, prompting their sale. The company's 2024 focus on optimizing its portfolio means such underperforming assets are prime candidates for divestment to free up capital for more strategic investments.

Assets with high leverage and negative net income, particularly those struggling with rising interest rates as seen in early 2025, also fall into the 'Dog' category. These segments drain cash and offer little in return, hindering overall company performance. Cosan's ongoing debt management efforts would prioritize addressing these highly leveraged, unprofitable units.

Legacy or non-core ventures that offer minimal synergistic benefits and stagnant growth are also considered 'Dogs'. These might be financially stable but don't contribute significantly to Cosan's primary energy and logistics operations. Strategic reviews in 2024 would identify these for potential restructuring or divestment to improve capital allocation.

The Vale stake, prior to its sale, represented a 'Dog' due to its substantial capital consumption without offering strategic control or robust returns, ultimately impacting portfolio performance negatively.

Question Marks

New second-generation ethanol (E2G) plants, like those Raízen is developing, are in the "Question Mark" stage of the BCG matrix. This means they are in a high-growth market but currently have a low market share. These ventures demand significant capital for construction and operational ramp-up, making them cash consumers in their early phases.

Compass Gás e Energia is actively developing 420 MW of new renewable energy projects, positioning itself in a high-growth sector. These ventures, while promising, are currently in their nascent stages of development, suggesting a low market share and substantial capital requirements.

The success of these renewable energy initiatives hinges on securing significant investment and achieving effective market penetration. Without these crucial elements, they risk remaining in the question mark category, demanding further investment to potentially become future Stars in Compass's portfolio.

Moove's strategic push into new international territories, particularly for its premium lubricant offerings, positions these ventures as potential Question Marks within the Cosan BCG Matrix. These markets, while exhibiting growth potential, are often less established and highly competitive, demanding substantial upfront capital for market penetration and brand building.

The success of these new market entries is inherently uncertain, requiring significant investment for market development and sales infrastructure. For instance, Moove's 2024 expansion into Southeast Asia, targeting a market projected to grow at a CAGR of 5.5% through 2029, represents such a Question Mark, with considerable investment needed to compete against established global players.

Strategic Partnerships for New Terminals (e.g., Santos)

Cosan's strategic partnerships for new infrastructure, like the port terminal project in Santos, are positioned as potential Stars within the BCG matrix, indicating high growth. These ventures, however, are capital-intensive in their early stages and are still building market presence.

The Santos terminal, a significant infrastructure investment, aims to bolster Cosan's logistics capabilities. In 2024, Cosan continued to advance its infrastructure projects, underscoring its commitment to expanding its logistics network. Such projects require substantial upfront investment, typical of Stars seeking to capture market share.

- High Growth Potential: The Santos terminal project represents a significant expansion into a high-growth logistics sector.

- Capital Intensive: Initial phases demand considerable capital outlay, a characteristic of new ventures aiming for market leadership.

- Market Development: The terminal is still in the process of establishing its market share and operational dominance.

- Execution Risk: Success is contingent on efficient project execution and gaining strong market acceptance.

Emerging Technologies within Bioenergy Portfolio

Cosan’s commitment to innovation in its bioenergy portfolio extends beyond established ethanol production, reflecting a strategic exploration of emerging technologies. This proactive approach positions the company to capitalize on future growth opportunities within the sustainable energy landscape.

Emerging technologies within Cosan's bioenergy sector represent areas with high growth potential but currently low market share. These advancements, such as next-generation biofuels or novel bio-based materials, are often in early commercialization stages, necessitating significant investment to prove their viability and secure market traction.

- Advanced Biofuels: Research into cellulosic ethanol, bio-jet fuel, and advanced biodiesel from non-food feedstocks like agricultural waste or algae.

- Biorefinery Concepts: Integration of multiple bio-based product streams from a single biomass source, maximizing value and efficiency.

- Sustainable Aviation Fuel (SAF): Cosan's potential involvement in developing and producing SAF aligns with global decarbonization efforts in the aviation industry.

- Biochemicals and Biomaterials: Exploration of bio-based alternatives for plastics, chemicals, and other materials, reducing reliance on fossil fuels.

Question Marks in Cosan's portfolio represent high-growth potential ventures with currently low market share. These require substantial investment to capture market position and can become Stars if successful. For example, Raízen's new E2G plants and Compass Gás e Energia's renewable projects are in this category, demanding significant capital for development and market penetration.

Moove's international expansion, particularly into Southeast Asia, exemplifies a Question Mark. While the market shows strong growth, estimated at a 5.5% CAGR through 2029, significant investment is needed for brand building and to compete with established players. Similarly, Cosan's exploration of emerging bioenergy technologies, like advanced biofuels and SAF, are high-potential but currently low-share areas requiring substantial R&D and commercialization funding.

| Business Unit | BCG Category | Key Initiative | Market Growth | Cosan's Share | Investment Need |

|---|---|---|---|---|---|

| Raízen (Bioenergy) | Question Mark | New E2G Plants | High | Low | High |

| Compass Gás e Energia | Question Mark | Renewable Energy Projects (420 MW) | High | Low | High |

| Moove (Lubricants) | Question Mark | Southeast Asia Expansion | 5.5% CAGR (through 2029) | Low | High |

| Cosan (Bioenergy) | Question Mark | Emerging Bioenergy Tech (SAF, Advanced Biofuels) | High | Low | High |

BCG Matrix Data Sources

Our Cosan BCG Matrix leverages comprehensive market data, including internal financial reports, industry growth projections, and competitor performance analysis to ensure accurate strategic positioning.