CleanSpark SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

CleanSpark's strengths lie in its robust mining infrastructure and expanding operational capacity, but it faces significant industry volatility as a key weakness. Opportunities abound with the growing demand for Bitcoin, yet regulatory uncertainties present a notable threat.

Want the full story behind CleanSpark's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CleanSpark has shown impressive financial growth, with revenues reaching $198.6 million in Q3 FY2025, a 91% increase year-over-year. This surge is supported by a net income of $257.4 million in the same quarter, highlighting significant improvements in operational efficiency and benefiting from a strong Bitcoin market.

CleanSpark boasts impressive operational efficiency, evidenced by its fleet's 16.07 J/Th energy consumption as of July 2025. This optimization directly translates to lower mining costs, with the company reporting a marginal cost of approximately $34,000 per Bitcoin in Q1 FY2025. These cost advantages are crucial for sustained profitability, especially when Bitcoin prices fluctuate.

The company's strategic advantage stems from its deep energy expertise and carefully selected facility locations, which further contribute to its ability to maintain competitive mining costs. This focus on efficiency allows CleanSpark to maximize the value derived from its mining operations and remain resilient in a dynamic market.

CleanSpark's aggressive expansion strategy has been a major strength, with the company achieving its target of 50 EH/s in operational hashrate in June 2025, ahead of its initial first-half 2025 schedule. This rapid scaling of its mining capacity, fueled by well-funded expansion plans, firmly establishes CleanSpark as a formidable and growing force within the competitive Bitcoin mining landscape.

Robust Bitcoin Treasury and Healthy Balance Sheet

CleanSpark's strategic accumulation of Bitcoin is a significant strength, with the company holding 12,703 BTC valued at over $1 billion as of July 2025. Notably, all of this Bitcoin was self-mined within the USA, showcasing operational control and cost efficiency.

The company's financial foundation is exceptionally strong, evidenced by a robust balance sheet featuring nearly $2.8 billion in assets and $1.2 billion in total liquidity as of Q1 FY2025. This substantial liquidity provides CleanSpark with considerable financial flexibility, enabling it to fund ongoing operations and pursue growth opportunities without the immediate need for dilutive equity issuances.

- Bitcoin Holdings: 12,703 BTC (as of July 2025), valued over $1 billion.

- Self-Mined Bitcoin: Entire treasury mined in the USA.

- Total Assets: Nearly $2.8 billion (as of Q1 FY2025).

- Total Liquidity: $1.2 billion (as of Q1 FY2025).

Strategic Focus on U.S. Infrastructure and Sustainable Energy

CleanSpark's deliberate focus on U.S. operations, branding itself as 'America's Bitcoin Miner,' offers a distinct advantage in navigating the evolving regulatory landscape. This domestic concentration can streamline compliance and foster stronger relationships with U.S. policymakers, potentially mitigating risks associated with international mining operations.

The company's commitment to sustainability is a key differentiator. By acquiring and operating high-efficiency miners, often powered by renewable energy sources, CleanSpark not only reduces its environmental footprint but also benefits from lower and more stable energy costs. This strategy is particularly relevant in 2024 and 2025, as energy prices remain a significant factor in mining profitability.

CleanSpark's participation in demand response programs further solidifies its sustainable approach. These programs allow the company to curtail energy consumption during peak demand periods, providing grid stability and generating additional revenue streams. This dual benefit of cost savings and revenue generation enhances its financial resilience.

- U.S. Focus: Exclusive operations within the United States provide potential regulatory advantages and alignment with domestic economic priorities.

- Sustainability: Acquisition of high-efficiency miners and utilization of sustainable energy sources reduce operational costs and environmental impact.

- Demand Response: Participation in grid balancing programs generates supplementary income and contributes to energy infrastructure stability.

CleanSpark's strengths are rooted in its robust financial performance and operational efficiency. The company reported $198.6 million in revenue for Q3 FY2025, a significant 91% year-over-year increase, coupled with $257.4 million in net income for the same quarter. This growth is underpinned by a remarkably low energy consumption rate of 16.07 J/Th as of July 2025, leading to a marginal mining cost of approximately $34,000 per Bitcoin in Q1 FY2025.

| Metric | Value | As Of |

|---|---|---|

| Q3 FY2025 Revenue | $198.6 million | Q3 FY2025 |

| Q3 FY2025 Net Income | $257.4 million | Q3 FY2025 |

| Energy Consumption | 16.07 J/Th | July 2025 |

| Marginal Cost per BTC | ~$34,000 | Q1 FY2025 |

| Bitcoin Holdings | 12,703 BTC | July 2025 |

What is included in the product

Delivers a strategic overview of CleanSpark’s internal and external business factors, highlighting its strengths in Bitcoin mining, weaknesses in operational costs, opportunities in market expansion, and threats from regulatory changes and competition.

Offers a clear, actionable framework to identify and address CleanSpark's core challenges and capitalize on its strengths.

Weaknesses

CleanSpark's direct link to Bitcoin mining inherently exposes it to significant price volatility. For instance, in Q1 2024, while the company reported strong operational growth, the fluctuating Bitcoin price directly impacts its revenue streams and the valuation of its digital asset holdings, which can cause unpredictable swings in net income.

While CleanSpark actively seeks competitive energy prices, the broader industry is facing increasing energy costs. Reports from late 2024 and early 2025 indicate that energy expenses are consuming a larger portion of Bitcoin mining revenue, directly impacting gross margins for companies like CleanSpark.

This upward pressure on energy prices, potentially exacerbated by the expiration of favorable long-term contracts, could significantly challenge CleanSpark's profitability if not effectively managed through further efficiency gains or new energy sourcing strategies.

CleanSpark faces a considerable financial threat from U.S. Customs and Border Protection, which has assessed a potential tariff liability of up to $185 million. This assessment stems from imported mining rigs being classified as Chinese-origin, creating a significant financial overhang for the company.

This ongoing dispute represents a substantial risk that could erode recent profitability and necessitate significant investment in legal defense. The outcome of this tariff challenge will be a critical factor in CleanSpark's financial health moving forward.

High Capital Expenditure for Growth

CleanSpark's ambitious growth plans, including the development of new data centers and upgrades to its existing fleet, demand substantial capital outlays. This aggressive expansion strategy, while aimed at increasing mining capacity, places a significant strain on financial resources.

While CleanSpark has demonstrated strong financial health, its continued rapid expansion could necessitate future financing rounds. This might lead to an increase in its debt-to-equity ratio, potentially impacting its financial leverage and cost of capital.

- Aggressive Expansion: Significant capital is allocated to new data center builds and fleet modernization.

- Funding Needs: Continued rapid growth may require additional financing, potentially affecting the debt-to-equity ratio.

- Capital Intensity: The mining industry is inherently capital-intensive, requiring ongoing investment to maintain competitiveness.

Dependence on Hardware Suppliers and Supply Chain Risks

CleanSpark's reliance on external hardware suppliers for its advanced Bitcoin mining equipment presents a significant vulnerability. The company is dependent on a limited number of manufacturers for its high-efficiency miners, making it susceptible to supply chain disruptions.

Potential issues like increased equipment costs due to tariffs or shifts in manufacturer priorities, such as a greater focus on AI and High-Performance Computing (HPC) hardware, could directly impact CleanSpark's ability to acquire new miners. This could hinder its expansion plans and affect its operational capacity. For instance, in early 2024, global supply chain tensions continued to affect the availability of specialized electronic components, a trend that could persist.

- Supplier Dependence: CleanSpark sources its primary mining hardware from third-party manufacturers, creating a dependency that can limit negotiating power and supply certainty.

- Supply Chain Volatility: Geopolitical events, trade disputes, or natural disasters can disrupt the global supply chain for semiconductors and mining rigs, impacting delivery times and costs.

- Cost Increases: Tariffs on imported technology or rising raw material costs can lead to higher equipment prices, directly affecting CleanSpark's capital expenditure for new mining capacity.

- Competitive Demand: A surge in demand for advanced chips from sectors like AI could divert manufacturing capacity away from Bitcoin mining hardware, potentially reducing availability for CleanSpark.

CleanSpark's reliance on third-party suppliers for its advanced Bitcoin mining equipment creates a significant vulnerability, potentially impacting its ability to secure necessary hardware. This dependency exposes the company to supply chain disruptions and increased equipment costs, as seen with ongoing global tensions affecting specialized electronic components into early 2024.

The company faces potential cost increases due to tariffs on imported technology or rising raw material prices, which directly affect capital expenditures for new mining capacity. Furthermore, a surge in demand for advanced chips from sectors like AI could divert manufacturing capacity away from Bitcoin mining hardware, reducing availability for CleanSpark.

| Weakness | Description | Impact |

|---|---|---|

| Supplier Dependence | Reliance on third-party manufacturers for mining hardware. | Limits negotiating power and supply certainty. |

| Supply Chain Volatility | Susceptibility to disruptions from geopolitical events or trade disputes. | Impacts delivery times and costs of essential equipment. |

| Cost Increases | Potential for higher equipment prices due to tariffs or raw material costs. | Directly affects capital expenditure for expansion. |

| Competitive Demand for Chips | AI and HPC sectors competing for manufacturing capacity. | Reduces availability of advanced mining hardware for CleanSpark. |

What You See Is What You Get

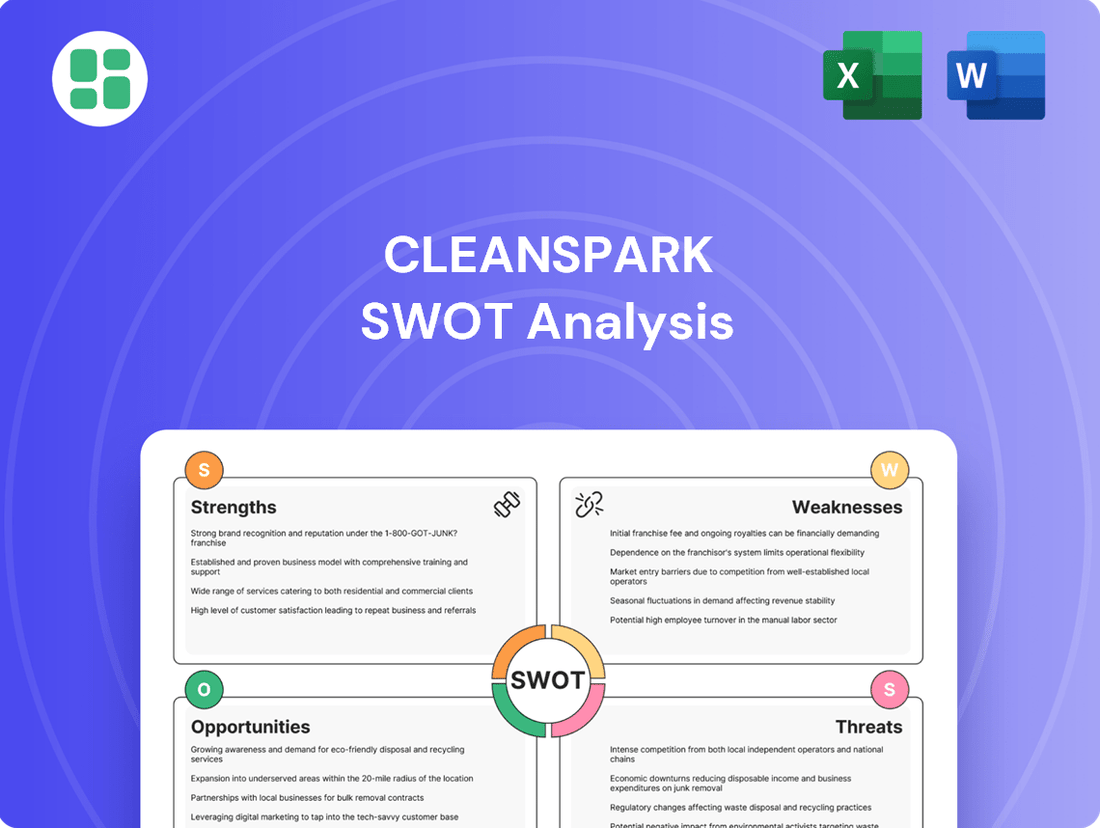

CleanSpark SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual SWOT analysis for CleanSpark, offering a clear view of its internal strengths and weaknesses, alongside external opportunities and threats. The complete, detailed report is unlocked immediately after purchase.

Opportunities

CleanSpark is strategically positioned for significant hashrate expansion, aiming to surpass 50 EH/s with active projects in Wyoming, Tennessee, and Georgia. This expansion is underpinned by over one gigawatt of power secured through contracts, enabling the company to bolster its presence on the global Bitcoin network and solidify its market leadership.

The Bitcoin mining sector is experiencing a significant consolidation phase, and CleanSpark has a proven track record of successful strategic acquisitions, like its purchase of GRIID Infrastructure Inc. This acquisition alone added approximately 1.7 EH/s of hashing power, significantly boosting CleanSpark's operational capacity. This presents a prime opportunity for CleanSpark to continue expanding its footprint and market share through opportunistic mergers and acquisitions, especially if the market environment becomes more favorable for growth.

CleanSpark's significant Bitcoin treasury, estimated at over 10,000 BTC as of early 2024, provides a powerful tool for financial flexibility. This substantial asset base allows the company to fund operational expenses, capital expenditures, and strategic growth initiatives without the dilution often associated with equity offerings. For instance, using Bitcoin to cover a portion of their 2024 operational budget can preserve shareholder value.

The establishment of a dedicated digital asset management team signals a proactive approach to maximizing the value of its Bitcoin holdings. This team is exploring advanced strategies, including derivatives, to potentially generate alpha and enhance financial resilience. Such strategies could involve hedging against price volatility or creating income streams, further diversifying CleanSpark's financial toolkit beyond simple HODLing.

Growing Institutional Adoption and Bitcoin Market Maturation

The increasing acceptance of Bitcoin by institutions, particularly with the launch of spot Bitcoin Exchange Traded Funds (ETFs) in early 2024, is a significant tailwind for CleanSpark. This institutional demand directly translates into potential price appreciation for Bitcoin, which in turn bolsters CleanSpark's mining revenue and the value of its Bitcoin holdings. The market's growing maturity suggests a more stable environment for future growth.

Consider these key points:

- Increased Demand: Spot Bitcoin ETFs, approved in January 2024, saw substantial inflows, with total assets under management reaching over $50 billion by May 2024, indicating strong institutional appetite.

- Revenue Impact: Higher Bitcoin prices resulting from this demand directly enhance CleanSpark's mining profitability and the value of its treasury, which held approximately 2,400 BTC as of Q1 2024.

- Market Stability: A more mature Bitcoin market, characterized by greater regulatory clarity and broader adoption, can lead to more predictable operational environments and investment opportunities for mining companies like CleanSpark.

Advancements in Energy Infrastructure and Efficiency Programs

CleanSpark's involvement in developing energy infrastructure and participating in demand response programs, like its collaboration with the Tennessee Valley Authority (TVA), presents a significant opportunity. These initiatives can lead to better management of energy expenses and contribute to a more sustainable power grid. For example, in 2023, CleanSpark reported that its participation in demand response programs with the TVA resulted in significant cost savings, though specific figures were not publicly disclosed.

The emergence of blockchain-specific electricity tariffs in states such as Wyoming offers another avenue for growth. These specialized tariffs have the potential to lower power costs for energy-intensive operations like Bitcoin mining. This could directly translate into reduced operational expenses and improved profitability for CleanSpark's mining facilities. For instance, Wyoming's legislative efforts in 2023 aimed at creating favorable conditions for blockchain technology, including energy cost considerations, underscore this potential.

Further opportunities lie in CleanSpark's ability to leverage its expertise in energy efficiency. By optimizing its own energy consumption and potentially offering these solutions to others, the company can enhance its competitive edge.

- Energy Infrastructure Development: CleanSpark's active role in building and managing energy infrastructure can secure more stable and cost-effective power for its operations.

- Demand Response Participation: Engaging in programs like those with the TVA allows CleanSpark to earn revenue by adjusting its energy consumption during peak demand periods, improving grid stability and its own financial performance.

- Blockchain-Specific Tariffs: The potential for lower electricity rates through specialized tariffs in regions like Wyoming can directly reduce mining operational costs, boosting profitability.

- Energy Efficiency Solutions: Implementing and potentially commercializing energy efficiency technologies can create additional revenue streams and reduce overall operating expenses.

CleanSpark's strategic expansion, targeting over 50 EH/s with secured power contracts, positions it to capitalize on increased Bitcoin network difficulty and potential price appreciation. The company's substantial Bitcoin treasury, exceeding 10,000 BTC in early 2024, provides significant financial flexibility for growth and operational funding. Furthermore, the growing institutional adoption of Bitcoin, evidenced by the success of spot Bitcoin ETFs launched in January 2024, creates a favorable market environment for mining operations.

CleanSpark's strategic acquisitions, like the purchase of GRIID Infrastructure Inc. which added 1.7 EH/s, demonstrate its capability to expand market share during industry consolidation. The company's proactive digital asset management team explores strategies like derivatives to enhance the value of its Bitcoin holdings, potentially generating alpha. Its involvement in energy infrastructure development and demand response programs, such as those with the Tennessee Valley Authority, offers opportunities for cost savings and revenue generation.

| Opportunity Area | Key Factor | Impact on CleanSpark |

|---|---|---|

| Hasrate Expansion | Targeting >50 EH/s with 1 GW+ power secured | Increased Bitcoin mining capacity and network participation |

| Bitcoin Treasury | Over 10,000 BTC held (early 2024) | Financial flexibility for CAPEX, OPEX, and strategic initiatives |

| Institutional Adoption | Spot Bitcoin ETFs (Jan 2024) driving demand | Potential for Bitcoin price appreciation, boosting revenue and treasury value |

| Strategic Acquisitions | Successful integration of GRIID (1.7 EH/s added) | Market share growth and operational capacity enhancement |

| Energy Management | Demand response programs (TVA) | Reduced energy costs and potential revenue streams |

Threats

The Bitcoin mining sector, including companies like CleanSpark, is navigating a landscape of heightened regulatory attention. Concerns often center on the industry's substantial energy usage and its environmental footprint, alongside regulations governing the import of critical mining hardware. For instance, in 2024, discussions around energy standards for data centers, which include crypto miners, intensified in several jurisdictions, potentially leading to new operational requirements.

Such evolving regulations pose a tangible threat. Adverse policy shifts, such as the imposition of tariffs on mining equipment or stricter energy consumption mandates, could directly inflate CleanSpark's operational expenses. This could hinder its ambitious expansion strategies and negatively affect its profitability, making proactive compliance and adaptation crucial for sustained success.

The April 2024 Bitcoin halving significantly cut miner block rewards, directly impacting revenue per Bitcoin. This event, a programmed reduction in new Bitcoin supply, means miners now earn half the BTC for validating transactions compared to the previous period.

Simultaneously, Bitcoin network difficulty has seen consistent upward trends, reaching new all-time highs throughout 2024. For instance, the difficulty adjustment on May 11, 2024, saw an increase of 4.87%, reflecting the growing hashrate and the competitive landscape for miners.

These combined pressures necessitate continuous investment in more efficient mining hardware and operational optimization for companies like CleanSpark to maintain profitability and production volumes in this evolving environment.

The Bitcoin mining landscape is notoriously competitive, with both seasoned operators and emerging companies aggressively pursuing market share. This rivalry often squeezes profit margins, demanding peak operational efficiency and a continuous investment in cutting-edge mining hardware. For instance, in early 2024, the global Bitcoin hashrate reached new all-time highs, indicating a significant increase in the number of miners competing for block rewards.

Fluctuating Energy Prices and Availability

CleanSpark's profitability is directly tied to energy costs, and while the company actively pursues competitive rates, significant operational risk persists. Unpredictable surges in electricity prices or interruptions in supply can drastically reduce mining margins and disrupt operations, particularly in areas with volatile energy markets. For instance, during Q1 2024, CleanSpark reported that its average cost of electricity was approximately $0.07 per kilowatt-hour, but this figure is subject to regional fluctuations and contract terms.

These energy price swings can directly impact CleanSpark's cost of revenue and, consequently, its net income. A sustained increase in energy prices, even by a few cents per kWh, could erode the competitive advantage derived from efficient operations. The company's strategy involves securing long-term power purchase agreements where possible to mitigate some of this volatility, but not all operations are covered by such agreements.

- Energy Cost Sensitivity: CleanSpark's mining operations are highly energy-intensive, making the cost of electricity a primary driver of profitability.

- Market Volatility Impact: Fluctuations in wholesale electricity prices can lead to unpredictable increases in operating expenses, directly affecting margins.

- Operational Uptime Risk: Disruptions in energy supply, whether due to grid issues or price unavailability, can halt mining activities and reduce overall production efficiency.

- Geographic Exposure: Operations in regions with less stable energy markets present a higher risk profile compared to those with regulated or fixed-price energy contracts.

Hardware Obsolescence and Technological Shifts

The relentless march of technology poses a significant threat, as older Bitcoin mining hardware rapidly loses efficiency and becomes obsolete. CleanSpark faces the constant challenge of substantial capital expenditure to acquire newer, more powerful machines, a necessity to stay competitive. For instance, the latest ASIC miners released in 2024 offer hash rates up to 140 TH/s, a substantial leap from earlier models, making older hardware economically unviable much faster.

This rapid obsolescence necessitates continuous reinvestment, impacting profitability and free cash flow. Furthermore, a potential shift in focus by hardware manufacturers towards other high-demand computing sectors like Artificial Intelligence (AI) or High-Performance Computing (HPC) could constrain the supply of specialized Bitcoin mining hardware, driving up costs and potentially limiting expansion opportunities for companies like CleanSpark.

- Hardware Efficiency Gap: Newer ASIC models in 2024/2025 can boast energy efficiency ratings of 20-25 J/TH, compared to older models that might be 30-40 J/TH or higher, directly impacting operational costs.

- Capital Expenditure Strain: The need to constantly upgrade means significant upfront investment; a fleet of 10,000 new generation miners could cost upwards of $30-40 million.

- Supply Chain Vulnerability: A pivot by major chip manufacturers to AI could reduce the availability of essential components for mining ASICs, creating supply bottlenecks.

The Bitcoin mining industry faces a significant threat from evolving regulatory landscapes, particularly concerning energy consumption and hardware imports, with potential for increased operational costs. The April 2024 halving event drastically reduced block rewards, impacting revenue, while rising network difficulty in 2024, with May seeing a 4.87% increase, intensifies competition and necessitates efficiency upgrades.

CleanSpark's profitability is highly sensitive to energy costs, with Q1 2024 average electricity prices around $0.07/kWh, subject to market volatility. Rapid technological advancements render older mining hardware obsolete quickly, requiring substantial capital expenditure for upgrades, with new 2024 models offering up to 140 TH/s, potentially straining cash flow and facing supply chain risks if manufacturers shift focus to AI.

SWOT Analysis Data Sources

This CleanSpark SWOT analysis is built on a foundation of verified financial filings, comprehensive market intelligence, and expert industry evaluations. These data sources ensure a precise and informed assessment of the company's strategic position.