CleanSpark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

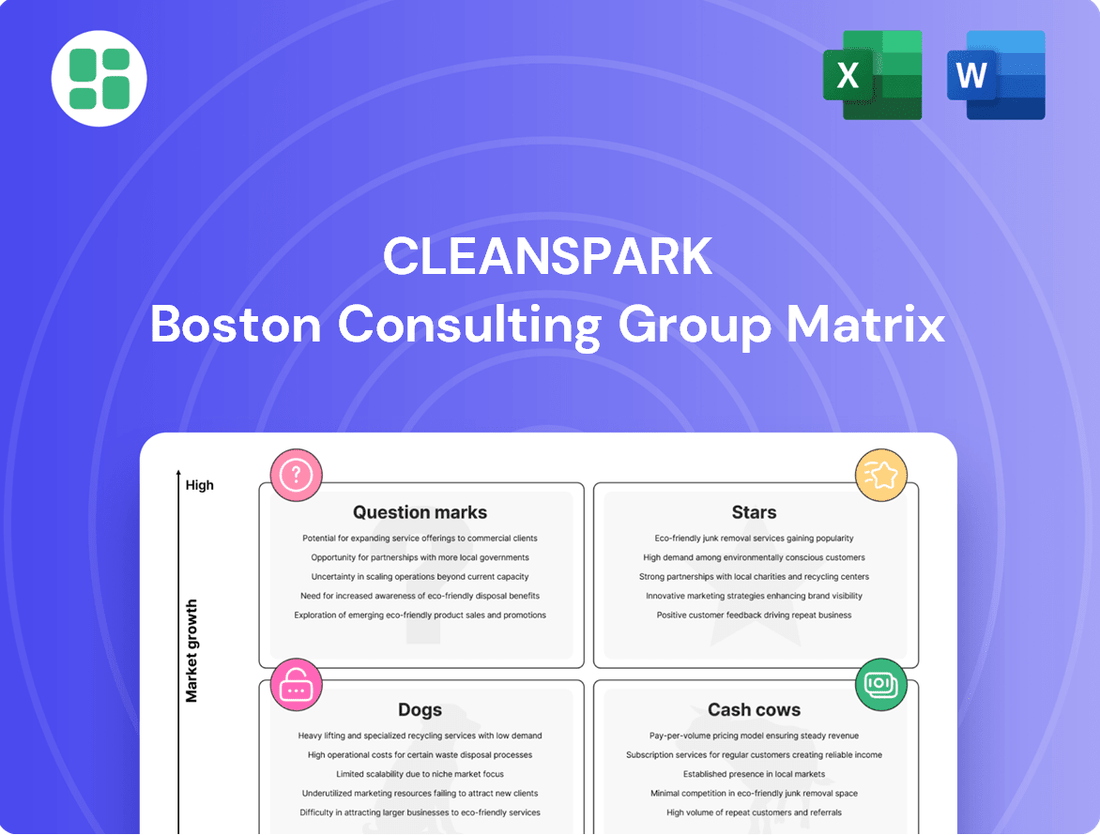

Unlock the strategic potential of CleanSpark's product portfolio with this essential BCG Matrix preview. Understand how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and identify key areas for growth and optimization.

Don't miss out on the full picture; purchase the complete BCG Matrix to gain detailed quadrant placements, actionable insights, and a clear roadmap for smart investment decisions in the dynamic energy sector.

Stars

CleanSpark's aggressive hashrate expansion is a key driver of its market position. By June 2025, the company is projected to reach 50 EH/s, with plans to exceed 60 EH/s, showcasing a significant leap in operational capacity.

This impressive growth, representing a nearly 300% surge since early 2024, is underpinned by a dual strategy of strategic acquisitions and organic development. Such rapid scaling demonstrates CleanSpark's commitment to capturing a larger share of the burgeoning Bitcoin mining landscape.

CleanSpark's strategic acquisitions, such as the GRIID deal in October 2024, are key to its growth. These moves, including facilities in Tennessee, Wyoming, and Mississippi, are designed to boost its hashrate and operational capacity rapidly. This aggressive expansion directly supports its position as a leader in the expanding Bitcoin mining sector.

CleanSpark's commitment to operational excellence is evident in its remarkably efficient mining fleet. In 2024, the company consistently achieved fleet efficiencies as low as 16.15 Joules per Terahash (J/Th). This puts them at the forefront of the industry, allowing for maximum Bitcoin production with minimal energy consumption.

Growing Bitcoin Treasury

CleanSpark's strategy of accumulating self-mined Bitcoin positions its growing treasury as a Stars category asset within the BCG framework. By May 2025, the company achieved a significant milestone, holding over 12,500 BTC. This substantial digital asset reserve strengthens their financial standing in a volatile yet high-growth market.

This expanding Bitcoin treasury offers considerable financial flexibility and acts as a natural hedge against potential operational downturns. It underscores CleanSpark's commitment to leveraging its mining operations to build a robust asset base.

- Growing Bitcoin Holdings: CleanSpark's treasury surpassed 12,500 BTC by May 2025.

- Strategic Asset Accumulation: The company actively builds its Bitcoin reserves from self-mined coins.

- Financial Strength: The growing treasury enhances the company's balance sheet and financial resilience.

- Market Position: Bitcoin is considered a high-growth digital commodity, fitting the Stars category.

'America's Bitcoin Miner' Branding and U.S. Focus

CleanSpark's deliberate branding as 'America's Bitcoin Miner' highlights a strategic commitment to U.S.-based operations. This focus taps into a growing sentiment for domestic production and potentially favorable regulatory environments. By concentrating on the United States, CleanSpark is positioning itself as a key player in a strategically vital region for the burgeoning Bitcoin mining industry, aiming to capture significant market share.

This U.S.-centric approach is not just about branding; it translates into tangible operational advantages. For example, as of Q1 2024, CleanSpark reported a significant increase in its self-mining hashrate, demonstrating the effectiveness of its U.S. facility expansion. The company's commitment to expanding its U.S. footprint is evident in its recent acquisitions and development of new sites within the country, reinforcing its 'America's Bitcoin Miner' identity.

- U.S. Operational Focus: CleanSpark's emphasis on domestic Bitcoin mining operations aims to leverage potential regulatory advantages and growing national interest in secure, American-based digital asset infrastructure.

- Market Positioning: By identifying as 'America's Bitcoin Miner,' the company seeks to differentiate itself in a competitive global market, appealing to investors and stakeholders prioritizing geographic stability and national economic contribution.

- Growth Strategy: This branding supports CleanSpark's expansion strategy, which includes acquiring and developing mining facilities within the United States to bolster its operational capacity and hashrate.

- Data-Driven Advantage: CleanSpark's U.S. focus allows for greater control over energy sourcing and operational efficiency, crucial factors in the cost-sensitive Bitcoin mining sector, as evidenced by their consistent improvements in energy cost per terahash.

CleanSpark's growing Bitcoin treasury, which surpassed 12,500 BTC by May 2025, positions its accumulated digital assets as a Star in the BCG matrix. This substantial reserve, built through strategic self-mining, provides significant financial flexibility and acts as a hedge against market volatility. The accumulation of Bitcoin, a high-growth digital commodity, aligns with the characteristics of a Star, indicating strong market share and high growth potential for this specific asset within CleanSpark's portfolio.

| Metric | Value (as of May 2025) | Category |

| Bitcoin Holdings | > 12,500 BTC | Star |

| Growth Driver | Self-mining accumulation | Star |

| Financial Impact | Enhanced flexibility & hedge | Star |

What is included in the product

The CleanSpark BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which areas to grow, maintain, or divest for optimal resource allocation.

Clear visualization of CleanSpark's portfolio to identify growth opportunities.

Strategic allocation of resources based on market share and growth potential.

Cash Cows

CleanSpark's Georgia facilities are its established cash cows. These sites, having undergone multiple expansions, are optimized for consistent Bitcoin production and cash flow. With initial heavy investments already made, they now benefit from efficient operations and favorable, low-cost power agreements, allowing them to generate steady returns.

Long-term Power Purchase Agreements (PPAs) are a cornerstone for CleanSpark's operational efficiency, particularly for their low-carbon energy sources. These agreements lock in predictable energy costs, a major factor in Bitcoin mining expenses, directly contributing to consistent, high profit margins from their established mining facilities.

CleanSpark's mastery of energy infrastructure, particularly its ability to operate at peak power during off-peak, lower-cost electricity periods, directly fuels its cash cow status. This strategic advantage ensures maximum uptime and minimal operating expenses.

This consistent operational efficiency across their existing mining facilities, a core component of their portfolio, translates into robust profit margins. For instance, in Q1 2024, CleanSpark reported a significant increase in their mining gross margin, demonstrating the impact of their energy management strategies.

Vertically Integrated Operational Control

CleanSpark's vertically integrated operational control is a significant strength, allowing them to manage their entire infrastructure from mining hardware to energy solutions. This comprehensive oversight directly translates to better margin protection and enhanced scaling flexibility for their existing operations.

By reducing reliance on third-party providers, CleanSpark achieves greater cost efficiency. This control is crucial for their established bitcoin mining farms, enabling them to reliably generate substantial cash flow. For instance, in the first quarter of 2024, CleanSpark reported a significant increase in their bitcoin holdings and operational efficiency, demonstrating the benefits of this integrated model.

- Enhanced Margin Protection: Direct control over infrastructure minimizes external cost fluctuations.

- Scaling Flexibility: Ability to adapt and expand operations efficiently without third-party dependencies.

- Cost Efficiency: Reduced operational expenses through in-house management of the entire stack.

- Reliable Cash Generation: Established mining farms consistently produce cash due to optimized operations.

Strategic Use of Bitcoin-Backed Credit Facilities

CleanSpark's strategic use of a $200 million Bitcoin-backed credit facility with Coinbase positions its Bitcoin holdings as a cash cow. This allows them to generate liquidity for operational needs and growth initiatives without diluting existing shareholder equity. By leveraging their substantial Bitcoin reserves, CleanSpark can fund its mature operations efficiently.

This approach effectively transforms their Bitcoin assets into a source of readily available capital. For instance, as of Q1 2024, CleanSpark reported holding approximately 15,000 BTC, valued significantly higher than the credit facility amount, showcasing the robust collateral backing.

- Bitcoin as a Cash Cow: CleanSpark leverages its significant Bitcoin holdings, like the ~15,000 BTC held in early 2024, as a stable asset to generate liquidity.

- Strategic Funding: A $200 million credit facility with Coinbase allows access to capital for operations and growth without issuing new equity.

- Preserving Shareholder Value: This method avoids dilution, directly benefiting existing shareholders by maintaining their ownership percentage.

- Operational Efficiency: The credit facility provides funds to support the ongoing needs of CleanSpark's mature Bitcoin mining operations.

CleanSpark's established Georgia facilities are prime examples of its cash cows within the BCG matrix. These sites benefit from optimized operations and cost-effective power agreements, ensuring consistent Bitcoin production and steady cash flow generation. Their maturity means initial capital expenditures have already been made, allowing them to operate with high efficiency and profitability.

The company's strategic management of energy infrastructure, particularly its ability to leverage off-peak electricity rates, significantly boosts the cash cow status of its existing operations. This focus on minimizing energy costs, a substantial component of mining expenses, directly contributes to robust profit margins from these mature facilities.

CleanSpark's substantial Bitcoin holdings, such as the approximately 15,000 BTC reported in early 2024, also function as a cash cow, especially when leveraged through credit facilities. This allows the company to access liquidity for operational needs and growth without diluting shareholder equity, effectively turning its digital assets into a source of capital for its established, cash-generating businesses.

What You’re Viewing Is Included

CleanSpark BCG Matrix

The CleanSpark BCG Matrix document you are currently previewing is the identical, fully completed report you will receive immediately after your purchase. This means you'll get the same comprehensive analysis and strategic insights without any watermarks or placeholder content. It's ready for immediate integration into your business strategy discussions and decision-making processes.

Dogs

Older generation mining machines in CleanSpark's fleet that haven't been upgraded or replaced are considered question marks on the BCG matrix. These machines consume significantly more energy per terahash, leading to lower profitability, particularly after Bitcoin halving events increase mining difficulty.

Underperforming or high-cost minor sites are those smaller operations that don't add much to the company's total mining power or profitability. These might be in less ideal locations or have higher electricity expenses, making their output less efficient. For instance, a site with a significantly higher cost per kilowatt-hour compared to the company's average could be a prime candidate for this category.

Non-core or divested business segments for CleanSpark, if any existed, would fall into the Dogs category of the BCG Matrix. These are ventures that likely consumed capital and management attention without delivering significant returns or market share. For instance, if CleanSpark previously explored energy storage solutions or other ancillary services that didn't gain traction, these would be considered Dogs.

Such segments are characterized by low growth and low market share. Imagine a scenario where CleanSpark invested in a small-scale energy trading platform that failed to attract users or generate revenue; this would be a prime example of a Dog. In 2023, CleanSpark reported significant investments in its core Bitcoin mining operations, with capital expenditures primarily directed towards expanding its mining capacity. Data from their Q4 2023 earnings call indicated a strong focus on optimizing existing mining infrastructure rather than diversifying into unproven ventures.

Unutilized or Dormant Infrastructure Assets

Unutilized or dormant infrastructure assets represent a significant concern for CleanSpark within the context of a BCG Matrix analysis. These could include land parcels, substantial power capacity, or other infrastructure that the company has acquired but has not yet brought into productive use. This situation arises from various factors, such as unexpected operational hurdles or a redirection of strategic focus.

These underperforming assets are essentially capital sinks, locking up financial resources without contributing to revenue generation or operational efficiency. For instance, if CleanSpark acquired a large tract of land for a new mining facility that faced permitting delays, that land would be considered a dormant asset. Such assets can negatively impact the company's return on investment and overall financial health.

- Dormant Assets: Land, power capacity, or infrastructure acquired but not yet operational.

- Capital Tie-up: These assets consume capital without generating returns.

- Strategic Re-evaluation: Shifting priorities or unforeseen challenges can lead to dormancy.

- Impact on ROI: Unutilized assets can drag down the company's overall return on investment.

Ineffective Demand Response Program Participation

If participation in demand response programs, like those offered by the Tennessee Valley Authority (TVA), were to become unprofitable due to adverse grid conditions or penalties for failing to meet requirements, it could be classified as a 'Dog' in the BCG matrix. This scenario would transform a currently beneficial activity into a financial burden.

For instance, if grid operators impose stricter compliance standards or if the financial incentives offered for demand reduction decrease significantly, the cost-benefit analysis for CleanSpark's involvement could shift negatively. In 2023, the TVA's demand response programs aimed to reduce peak demand, but the profitability of such programs is highly sensitive to market dynamics and regulatory changes.

- Unprofitable Participation: Demand response programs could become unprofitable if grid conditions worsen or penalties for non-compliance increase.

- Shift in Conditions: A change in the economic viability of these programs could turn them into a net cost for CleanSpark.

- TVA Example: Programs with entities like the TVA are subject to market fluctuations and regulatory adjustments that could impact profitability.

- Potential Drain: What is currently a revenue stream or cost offset could become a drain on resources if the program's economics deteriorate.

Older generation mining machines, unoptimized minor sites, and non-core business segments that yield low returns and market share are considered CleanSpark's Dogs on the BCG matrix. These assets, including dormant infrastructure like unused land or power capacity, represent a drain on capital and operational efficiency. For example, if CleanSpark's participation in demand response programs becomes unprofitable due to market shifts or stricter regulations, it would also fall into this category.

These 'Dogs' are characterized by low growth and low market share, consuming resources without contributing significantly to the company's overall performance. CleanSpark's 2023 capital expenditures focused heavily on core mining operations, indicating a strategic move away from less profitable ventures. For instance, a mining site with a significantly higher cost per kilowatt-hour than the company average would be a prime candidate for re-evaluation or divestment.

The company's focus on upgrading its fleet and optimizing existing infrastructure in 2023 suggests a deliberate effort to phase out or improve underperforming assets. Identifying and managing these 'Dog' assets is crucial for improving overall profitability and resource allocation.

Unutilized infrastructure, such as land acquired for future projects that face delays, can tie up capital without generating returns, negatively impacting the company's return on investment.

Question Marks

CleanSpark's venture into immersion-cooled Bitcoin mining data centers in Wyoming marks a significant step into a potentially high-growth sector. However, these deployments are still in their nascent stages, meaning the full impact on their scalability and profitability remains to be seen. While the technology itself is promising for enhanced efficiency, the market share CleanSpark has secured with this specific innovation is currently unproven.

Expanding CleanSpark's mining operations into entirely new, unestablished geographic markets would classify as a Question Mark in the BCG matrix. These potential ventures offer significant growth opportunities, reflecting the burgeoning demand for Bitcoin mining services globally. For instance, while CleanSpark has already established a presence in states like Wyoming, venturing into regions with less developed infrastructure or regulatory frameworks for cryptocurrency mining presents a classic Question Mark scenario.

Such strategic moves would necessitate substantial capital investment to establish operations, secure energy resources, and navigate local regulations, mirroring the high investment requirements typical of Question Mark products or services. The company’s current market share in these nascent territories would be negligible, underscoring the high risk and high reward associated with these expansion efforts. CleanSpark's Q1 2024 earnings report highlighted a significant increase in their Bitcoin holdings, demonstrating their commitment to growth, which would fuel such future explorations.

CleanSpark's investment in proprietary software for mining optimization could be categorized as a Question Mark. This type of advanced technology, going beyond basic fleet management, holds significant promise for boosting operational efficiency and profitability within the mining sector.

While the potential is clear, the actual market adoption and the direct impact of such specialized software on CleanSpark's overall market share are still in their formative stages. For instance, in 2024, the global mining software market was valued at approximately $2.5 billion, with a projected compound annual growth rate (CAGR) of over 10%, indicating a growing but still fragmented landscape for new entrants.

Diversification into Other Blockchain Services

CleanSpark has primarily focused on Bitcoin mining, but exploring adjacent blockchain services could unlock new revenue streams. Areas like hosting services for other digital assets or offering specialized blockchain infrastructure could represent significant growth opportunities. These ventures, while in their early stages for many companies, tap into a rapidly expanding market with relatively low current penetration for CleanSpark.

While CleanSpark's core business remains Bitcoin mining, strategic considerations for diversification into other blockchain services are crucial for long-term growth. These nascent efforts could include offering hosting solutions for a wider range of digital assets or providing essential blockchain infrastructure services to other projects. The potential for high growth in these areas is evident, though they represent new market segments with limited current engagement for the company.

- Hosting Services: Offering to mine or secure other proof-of-work cryptocurrencies, leveraging existing infrastructure.

- Blockchain Infrastructure: Providing services like node operation or data storage for other blockchain networks.

- Potential Market Growth: The broader blockchain services market is anticipated to see substantial expansion in the coming years, offering a fertile ground for diversification.

Large-Scale Renewable Energy Development for Third Parties

Expanding CleanSpark's energy infrastructure development to serve third-party clients would position it as a Question Mark in the BCG matrix. This move targets the rapidly growing renewable energy sector, a market projected to see significant expansion in the coming years. For instance, the global renewable energy market was valued at over $1 trillion in 2023 and is expected to grow substantially by 2030.

However, CleanSpark would be entering this market as a new player with a currently low market share in third-party development. This presents both an opportunity and a challenge, requiring substantial investment and strategic execution to gain traction.

- Market Growth: The renewable energy sector is experiencing robust growth, driven by global decarbonization efforts and supportive government policies.

- New Entrant Risk: CleanSpark would face established competitors with existing infrastructure and client relationships.

- Investment Requirement: Significant capital expenditure would be necessary to build out the necessary development capabilities and expertise.

- Potential for High Returns: Successful penetration of this market could lead to substantial revenue streams and diversification beyond bitcoin mining.

CleanSpark's exploration into new geographic markets for Bitcoin mining, such as less regulated or developing regions, represents a classic Question Mark. These ventures offer high growth potential due to increasing global demand but come with unproven market share and significant upfront investment. For example, while CleanSpark has a strong presence in states like Georgia, expanding into areas with nascent mining infrastructure in 2024 would require substantial capital and regulatory navigation.

The company's development of proprietary mining optimization software also falls into the Question Mark category. While this technology promises enhanced efficiency in a competitive market valued at roughly $2.5 billion in 2024, its actual market adoption and impact on CleanSpark's share are still developing. This innovation aims to improve operational performance, a key differentiator in the evolving mining landscape.

Diversifying into adjacent blockchain services, like hosting for other digital assets or providing blockchain infrastructure, also positions CleanSpark as a Question Mark. These areas tap into a rapidly expanding market, but CleanSpark's current engagement is minimal, presenting high growth opportunities with inherent new entrant risks.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.