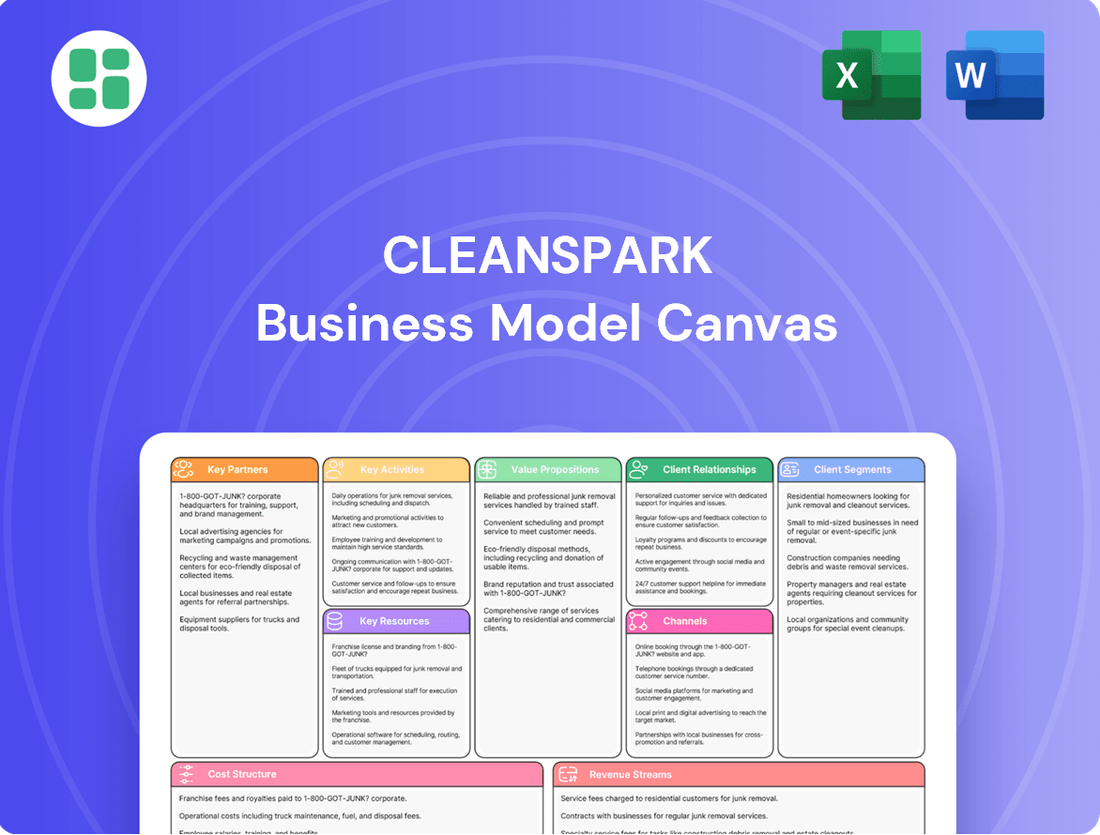

CleanSpark Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

Unlock the strategic blueprint behind CleanSpark's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market leadership.

Dive deeper into CleanSpark's operational framework with the full Business Model Canvas. Understand their key resources, activities, and cost structure to gain actionable insights for your own business ventures.

Ready to emulate CleanSpark's growth? Download the complete Business Model Canvas, featuring all nine building blocks, to accelerate your strategic planning and gain a competitive edge.

Partnerships

CleanSpark's business model hinges on strong alliances with energy providers and local utilities. These partnerships are vital for securing consistent and cost-effective electricity, the lifeblood of their Bitcoin mining operations.

These collaborations are instrumental in powering a network of data centers spread across multiple U.S. states. Having access to over 1 gigawatt of contracted power capacity underscores the significant scale and strategic importance of these energy relationships for CleanSpark's operational efficiency.

CleanSpark's strategic alliances with premier Bitcoin miner manufacturers, including prominent names like Bitmain, are crucial. These collaborations enable the acquisition of state-of-the-art, high-efficiency mining hardware, directly impacting the company's ability to scale its operations.

These partnerships are instrumental in CleanSpark's ongoing strategy to upgrade and expand its mining fleet. For instance, in the first quarter of 2024, CleanSpark took delivery of 10,000 Bitmain Antminer S21 units, a significant investment in maintaining a competitive hashrate and operational efficiency.

The consistent procurement of advanced mining equipment is a cornerstone of CleanSpark's production capacity and overall profitability. This access to cutting-edge technology ensures their mining infrastructure remains at the forefront of the industry, directly contributing to their financial performance.

CleanSpark actively pursues strategic acquisitions to bolster its operational capabilities and mining capacity. A prime example is the acquisition of GRIID Infrastructure Inc., which significantly expanded CleanSpark's footprint and hashrate. This M&A activity functions as a key partnership, integrating new mining facilities and computational power into their established infrastructure.

These mergers and acquisitions are instrumental in CleanSpark's rapid scaling strategy, enabling diversification of mining operations across various geographical locations. Notably, this includes expansion into regions like Tennessee, enhancing their network resilience and access to favorable energy markets.

Real Estate and Data Center Developers

CleanSpark's strategic alliances with real estate and data center developers are fundamental to its operational expansion. These partnerships are instrumental in securing and developing the physical sites necessary for its growing Bitcoin mining operations. This focus on infrastructure is key to supporting its ambitious hashrate growth objectives.

These collaborations are vital for both building entirely new mining facilities from the ground up, known as greenfield development, and for expanding the capacity of their existing sites. This approach allows CleanSpark to strategically position its operations in key locations across the United States.

- Strategic Site Acquisition: Partnerships facilitate access to prime real estate for new data center construction.

- Infrastructure Development: Collaborations support the build-out of necessary power and cooling infrastructure.

- Geographic Diversification: These relationships enable expansion into states like Georgia, Mississippi, Tennessee, and Wyoming, diversifying operational risk and leveraging regional advantages.

- Scalability: Working with experienced developers ensures that facilities can be scaled efficiently to meet increasing demand and hashrate targets.

Financial Institutions and Lenders

CleanSpark cultivates relationships with financial institutions and lenders to secure essential capital for its growth initiatives. These partnerships are crucial for financing everything from expanding its mining operations to managing its overall financial health. For instance, in 2024, CleanSpark continued to leverage these relationships to support its strategic objectives, including significant investments in its infrastructure and operational capacity.

While CleanSpark has strategically pursued non-dilutive funding methods, such as its zero-coupon convertible notes, its ties with traditional financial players remain vital. These relationships provide the flexibility to pursue substantial operational and strategic projects, ensuring it doesn't solely depend on equity markets for funding. This diversified approach to capital acquisition is key to its sustained expansion and market position.

- Access to Capital: Financial institutions provide the necessary funding for CleanSpark's capital-intensive operations, including equipment purchases and facility expansions.

- Balance Sheet Management: Lenders assist in managing the company's balance sheet through various financing instruments, enhancing financial stability.

- Strategic Flexibility: Partnerships enable CleanSpark to execute major strategic initiatives and operational upgrades without solely relying on equity financing.

- Growth Funding: These relationships are instrumental in securing funds for significant expansion projects, a critical component of CleanSpark's business model.

CleanSpark's key partnerships are foundational to its operational success and growth strategy. These alliances span energy providers, hardware manufacturers, real estate developers, and financial institutions, each contributing critical elements to its Bitcoin mining business.

Collaborations with energy providers, like those securing over 1 gigawatt of contracted power, ensure consistent and cost-effective electricity. Partnerships with manufacturers such as Bitmain provide access to advanced mining hardware, exemplified by the Q1 2024 delivery of 10,000 Antminer S21 units, which are crucial for maintaining a competitive hashrate and operational efficiency.

Strategic acquisitions, like that of GRIID Infrastructure Inc., function as key partnerships, integrating new mining facilities and computational power. These relationships also extend to real estate and data center developers, facilitating the construction and expansion of mining sites across states like Georgia, Mississippi, Tennessee, and Wyoming, supporting ambitious hashrate growth objectives.

Financial partnerships with institutions and lenders are vital for securing capital, enabling CleanSpark to fund its capital-intensive operations, equipment purchases, and facility expansions, ensuring strategic flexibility and sustained growth.

| Partnership Type | Key Collaborators | Impact on CleanSpark | Example/Data Point |

|---|---|---|---|

| Energy Providers | Various Utility Companies | Secures consistent, cost-effective electricity for mining operations. | Over 1 gigawatt of contracted power capacity. |

| Hardware Manufacturers | Bitmain, MicroBT | Provides access to state-of-the-art, high-efficiency mining hardware. | Delivery of 10,000 Bitmain Antminer S21 units in Q1 2024. |

| Acquisitions/M&A | GRIID Infrastructure Inc. | Expands operational footprint and hashrate, diversifies operations. | Integration of new mining facilities and computational power. |

| Real Estate/Data Center Developers | Specialized Development Firms | Facilitates securing and developing physical sites for mining operations. | Expansion into states like Tennessee and Georgia. |

| Financial Institutions | Banks, Lenders | Provides essential capital for growth initiatives and operational financing. | Continued leverage of relationships for strategic objectives in 2024. |

What is included in the product

A detailed breakdown of CleanSpark's operational strategy, it outlines their core customer segments, value propositions, and the channels through which they deliver their energy solutions.

This model serves as a foundational document for understanding CleanSpark's approach to market, highlighting key partnerships and revenue streams.

Provides a clear, structured framework to identify and address the specific challenges and inefficiencies within CleanSpark's operations, acting as a diagnostic tool to pinpoint areas for improvement.

Streamlines the process of understanding and articulating CleanSpark's value proposition and operational strategies, making it easier to communicate complex business elements and identify solutions to existing problems.

Activities

CleanSpark's primary activity is running a substantial fleet of advanced Bitcoin mining hardware. This involves meticulously managing and fine-tuning its data centers to boost Bitcoin output and sustain a robust operational hashrate, which recently hit 50 EH/s.

The company is dedicated to mining in an efficient and environmentally conscious manner, a strategy that significantly bolsters its revenue streams and operational success.

CleanSpark actively develops and manages energy infrastructure, a critical component of its Bitcoin mining operations. This involves securing reliable and cost-effective power sources, with a significant focus on sustainable energy. For instance, in 2024, the company continued to expand its portfolio of energy solutions, aiming to reduce reliance on traditional grid power and its associated costs.

A key aspect of this activity is optimizing energy usage within their data centers. By implementing advanced cooling technologies and efficient hardware, CleanSpark strives to minimize electricity consumption per unit of computing power. This focus on energy efficiency directly translates to lower operating expenses, a vital factor in maintaining profitability in the competitive cryptocurrency mining landscape.

The company also explores the integration of microgrid solutions and other innovative energy technologies. This strategy not only enhances operational resilience but also bolsters their environmental credentials. By leveraging cleaner energy sources and efficient management, CleanSpark aims to achieve a lower carbon footprint, aligning with growing industry trends and investor expectations for sustainability.

CleanSpark's core operation revolves around continuously acquiring the latest, most efficient Bitcoin mining hardware. This isn't a one-time purchase; it's an ongoing process to keep their fleet competitive. For instance, in Q1 2024, they announced the purchase of an additional 10,000 advanced S21 miners, significantly boosting their operational efficiency and hashrate.

Once these new miners arrive, they are strategically deployed. This means installing them in their existing data centers or setting up new facilities to maximize their contribution to the company's overall Bitcoin mining capacity. This strategic deployment is crucial for maintaining a leading edge in the highly competitive Bitcoin mining industry.

Digital Asset Management and Treasury Optimization

CleanSpark actively manages its Bitcoin treasury, holding a substantial portion of its self-mined Bitcoin as a strategic reserve. This approach allows for disciplined capital management, avoiding reliance on equity offerings for operational funding.

The company has implemented a derivatives strategy to enhance returns on its Bitcoin holdings. For instance, in Q1 2024, CleanSpark reported generating $2.4 million in Bitcoin-related gains and $3.1 million from its derivatives strategy, contributing significantly to its financial flexibility.

- Treasury Management: Holding self-mined Bitcoin as a strategic reserve.

- Derivatives Strategy: Generating additional returns on Bitcoin holdings.

- Financial Discipline: Funding operations without relying on equity offerings.

- Q1 2024 Performance: $2.4 million in Bitcoin gains and $3.1 million from derivatives.

Operational Efficiency and Cost Optimization

CleanSpark's commitment to operational efficiency is evident in its continuous efforts to reduce the energy consumed per terahash (J/Th) for Bitcoin mining. This focus directly impacts profitability by lowering a significant operational expense. For instance, in Q1 2024, CleanSpark reported a remarkable fleet efficiency of 22.3 J/Th, a substantial improvement that enhances their cost to mine.

Maximizing uptime is another critical activity. High operational uptime ensures that mining infrastructure is consistently generating revenue, contributing directly to improved margins. This dedication to keeping their facilities running smoothly is a key driver for their financial performance.

The company actively manages energy costs, a variable that can heavily influence Bitcoin mining profitability. By securing favorable energy rates and employing efficient mining hardware, CleanSpark aims to maintain a low cost to mine Bitcoin, thereby securing a competitive advantage.

- Fleet Efficiency: Aiming for industry-leading J/Th to lower energy consumption per Bitcoin mined.

- Uptime Maximization: Ensuring consistent operation of mining facilities to maximize revenue generation.

- Energy Cost Management: Negotiating favorable energy rates and utilizing energy-efficient hardware.

- Cost to Mine Reduction: Integrating efficiency gains to achieve a lower overall cost per Bitcoin.

CleanSpark's key activities include operating and expanding its Bitcoin mining fleet, which recently reached 50 EH/s. They also focus on developing and managing energy infrastructure, prioritizing cost-effective and sustainable power sources to reduce operational expenses.

The company continuously acquires and deploys the latest, most efficient mining hardware, such as the 10,000 advanced S21 miners purchased in Q1 2024, to maintain a competitive edge.

Furthermore, CleanSpark actively manages its Bitcoin treasury, holding reserves and employing a derivatives strategy to generate additional returns, as evidenced by $3.1 million in derivatives gains in Q1 2024.

Operational efficiency is paramount, with a focus on reducing energy consumption per terahash (J/Th) and maximizing facility uptime, achieving a fleet efficiency of 22.3 J/Th in Q1 2024.

| Activity | Description | Key Metric/Example |

|---|---|---|

| Bitcoin Mining Operations | Operating and expanding a large fleet of advanced Bitcoin mining hardware. | Reached 50 EH/s operational hashrate. |

| Energy Infrastructure Management | Developing and managing energy solutions, focusing on cost-effective and sustainable power. | Securing reliable power to reduce reliance on traditional grid. |

| Hardware Acquisition & Deployment | Continuously acquiring and deploying the latest, most efficient mining hardware. | Purchased 10,000 advanced S21 miners in Q1 2024. |

| Treasury & Derivatives Management | Holding Bitcoin reserves and using derivatives to enhance returns. | Generated $3.1 million from derivatives strategy in Q1 2024. |

| Operational Efficiency | Reducing energy consumption and maximizing uptime. | Achieved fleet efficiency of 22.3 J/Th in Q1 2024. |

What You See Is What You Get

Business Model Canvas

The CleanSpark Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive business model you'll be acquiring. Once your order is complete, you'll gain full access to this professionally structured and ready-to-use document, ensuring no surprises and complete transparency.

Resources

CleanSpark's primary physical resource is its substantial fleet of cutting-edge Bitcoin mining machines. These high-efficiency units are the bedrock of their Bitcoin generation operations, embodying a significant capital outlay.

The company's strategy hinges on the ongoing procurement and deployment of these advanced miners to expand and sustain its hashrate. For instance, as of the first quarter of 2024, CleanSpark reported operating over 80,000 S21 miners, a testament to their investment in efficiency.

These machines are not just tools; they are the engine of CleanSpark's revenue, directly impacting their ability to mine Bitcoin profitably. The efficiency of these machines, measured in joules per terahash (J/TH), is a key competitive advantage, with their latest models achieving figures as low as 18 J/TH.

CleanSpark's strategically located data centers are the backbone of its mining operations. The company boasts numerous facilities spread across key U.S. states like Georgia, Mississippi, Tennessee, and Wyoming. These sites are crucial for providing the essential infrastructure, cooling systems, and robust security needed to keep their extensive mining rigs running efficiently.

The selection of these particular states for their data centers isn't random. CleanSpark prioritizes locations offering competitive energy prices, a critical factor in the cost-intensive world of Bitcoin mining. This strategic placement allows them to optimize operational expenses and effectively support their large-scale mining endeavors, ensuring a strong foundation for growth and profitability.

CleanSpark's access to over 1 gigawatt of contracted power capacity is a cornerstone of its operations. This substantial energy supply, often sourced from sustainable providers, is crucial for powering its energy-intensive bitcoin mining activities.

The company's strategic advantage is amplified by its in-house expertise in energy infrastructure development. This capability allows CleanSpark to not only optimize its current power consumption but also to efficiently establish new mining sites, ensuring a reliable and cost-effective energy foundation.

Bitcoin Treasury and Digital Assets

CleanSpark's significant treasury of self-mined Bitcoin, exceeding $1 billion as of early 2024, acts as a substantial liquid asset and a key financial resource. This digital asset hoard offers considerable financial flexibility, enabling operational funding and strategic future investments.

This Bitcoin reserve is a direct, tangible outcome of their core mining operations, serving as both a store of value and a readily deployable financial tool.

- Treasury Value: Over $1 billion in self-mined Bitcoin as of early 2024.

- Liquidity: Provides significant financial flexibility for operations and investments.

- Strategic Asset: Represents a direct output and store of value from mining activities.

- Funding Source: Can be utilized for operational needs or future growth initiatives.

Human Capital and Operational Expertise

CleanSpark's human capital is a cornerstone, with its operational staff, engineers, and management teams holding deep expertise in Bitcoin mining, energy management, and data center operations. This collective knowledge is vital for the company's success.

The company's operational playbook, refined through experience, allows for efficient execution of mining strategies and disciplined capital management. This playbook is a key driver for strategic growth and operational excellence.

- Deep Domain Expertise: Teams possess specialized knowledge in Bitcoin mining, energy, and data center management.

- Operational Playbook: A structured approach to efficient execution and growth.

- Innovation and Adaptability: The ability to evolve and implement new strategies is a significant intangible asset.

CleanSpark's key resources are its advanced Bitcoin mining fleet, strategically located data centers, substantial power capacity, significant Bitcoin treasury, and skilled human capital. These elements collectively enable efficient and profitable Bitcoin mining operations.

The company's fleet is central, with over 80,000 S21 miners operating by Q1 2024, achieving efficiency as low as 18 J/TH. Their data centers are situated in states like Georgia and Mississippi, chosen for competitive energy prices. A critical asset is access to over 1 gigawatt of contracted power capacity, supported by in-house energy infrastructure expertise.

Financially, CleanSpark held over $1 billion in self-mined Bitcoin by early 2024, providing liquidity and flexibility. Their human capital comprises experts in mining, energy, and data centers, guided by a refined operational playbook for efficiency and growth.

| Resource Category | Key Assets/Capabilities | Data/Facts (as of early 2024/Q1 2024) |

|---|---|---|

| Mining Hardware | High-efficiency Bitcoin miners | Over 80,000 S21 miners deployed; Efficiency as low as 18 J/TH |

| Infrastructure | Strategically located data centers | Facilities in Georgia, Mississippi, Tennessee, Wyoming |

| Energy Access | Contracted power capacity | Over 1 gigawatt; In-house energy infrastructure development |

| Financial Assets | Self-mined Bitcoin treasury | Exceeding $1 billion in value |

| Human Capital | Expertise and operational playbook | Skilled teams in mining, energy, data centers; Refined operational strategies |

Value Propositions

CleanSpark delivers highly efficient and scalable Bitcoin production, a key value proposition for investors and industry participants. They achieved an operational hashrate of 50 EH/s utilizing solely American infrastructure, positioning them as a significant player in the Bitcoin mining landscape.

This substantial scale not only makes CleanSpark a leading producer but also offers a compelling avenue for those looking to gain exposure to the cryptocurrency market. Their commitment to operational excellence underpins consistent output, even when faced with fluctuating network difficulty.

CleanSpark's commitment to sustainable and responsible mining practices is a significant draw for investors focused on environmental, social, and governance (ESG) criteria. This focus on clean energy sources and environmentally conscious operations sets them apart in the competitive Bitcoin mining landscape.

By utilizing low-carbon data centers and prioritizing energy efficiency, CleanSpark directly addresses the growing demand for greener digital asset operations. For instance, in the first quarter of 2024, CleanSpark reported that 95% of its energy consumption came from renewable sources, a testament to this core value proposition.

CleanSpark is focused on boosting profits and creating more value for its investors. They achieve this through smart operations and careful handling of their money. This approach means they can fund their day-to-day business using the Bitcoin they mine each month, a feat they’ve managed without needing to sell more stock since November 2024.

The company has seen impressive financial results, with record revenues and net income reported. These numbers show they are effectively turning their mining operations into strong financial performance.

Strategic Use of U.S.-Based Infrastructure

CleanSpark's strategic use of U.S.-based infrastructure is a cornerstone of its value proposition, directly appealing to investors and customers who prioritize domestic operations and supply chain security. This focus on American energy and jobs positions the company as a distinct leader in the mining sector, resonating with a specific market segment.

This commitment to domestic operations offers significant advantages, including enhanced supply chain stability and alignment with national economic interests. By emphasizing its U.S. footprint, CleanSpark cultivates a brand identity as America's Bitcoin Miner, fostering trust and potentially attracting capital from those seeking to support domestic technological advancement and employment.

- Domestic Operations: Exclusively utilizes U.S.-based infrastructure for mining, ensuring greater control and reliability.

- Supply Chain Stability: Reduces reliance on foreign entities, offering a more secure and predictable operational environment.

- Economic Alignment: Supports American energy initiatives and job creation, appealing to socially conscious investors.

- Brand Identity: Markets itself as America's Bitcoin Miner, differentiating from international competitors.

Resilient and Diversified Operations

CleanSpark's operational resilience is significantly bolstered by its diversified footprint across multiple U.S. states, including Nevada, Georgia, and California. This geographic spread acts as a natural hedge against localized disruptions, whether they stem from regional energy market fluctuations or specific regulatory shifts.

The company's vertically integrated model further enhances this resilience. By controlling key aspects of its operations, from development to maintenance, CleanSpark can better navigate market volatility and ensure consistent performance. This integration allows for greater efficiency and adaptability in a dynamic industry.

- Geographic Diversification: Operations spread across key U.S. states mitigate regional risks.

- Vertical Integration: Control over the value chain enhances operational flexibility and efficiency.

- Risk Mitigation: Reduces exposure to localized energy issues and regulatory changes.

- Market Adaptability: Proven ability to maintain strong performance amidst industry volatility.

CleanSpark provides efficient and scalable Bitcoin production, a core value proposition for investors seeking exposure to digital assets. Their operational hashrate reached 50 EH/s using entirely U.S. infrastructure, establishing them as a major Bitcoin producer and a reliable avenue for market participation.

The company's commitment to sustainable mining is a significant draw for ESG-conscious investors. By prioritizing clean energy sources, CleanSpark addresses the increasing demand for environmentally responsible digital asset operations. In Q1 2024, 95% of their energy consumption came from renewables.

CleanSpark focuses on maximizing profits and shareholder value through operational efficiency and prudent financial management. They fund operations using mined Bitcoin, avoiding stock dilution since November 2024, and have reported record revenues and net income, demonstrating strong financial performance.

Their strategic use of U.S.-based infrastructure appeals to investors prioritizing domestic operations and supply chain security. This focus on American energy and jobs differentiates CleanSpark as America's Bitcoin Miner, fostering trust and attracting capital seeking to support domestic technological advancement.

| Metric | Q1 2024 (as of March 31, 2024) | Q2 2024 (as of June 30, 2024) |

|---|---|---|

| Operational Hashrate | 4.4 EH/s | 5.1 EH/s |

| Bitcoin Mined | 1,008 BTC | 1,145 BTC |

| Energy Mix (Renewable) | 95% | 96% |

Customer Relationships

CleanSpark actively engages its investor base through detailed quarterly earnings calls, comprehensive financial reports, and timely press releases. This commitment to transparency ensures that individual investors, financial professionals, and business strategists receive clear updates on operational progress, financial health, and strategic direction.

For instance, in the first quarter of 2024, CleanSpark reported a significant increase in revenue, demonstrating the positive impact of their transparent communication on investor confidence and market perception.

CleanSpark explicitly states its commitment to delivering superior returns and preserving shareholder value. This focus is a cornerstone of their customer relationships, ensuring investors feel confident in their long-term strategy.

This commitment is actively demonstrated through disciplined capital management. For instance, in 2024, CleanSpark consistently funded its operations through Bitcoin production, avoiding equity dilution and directly benefiting existing shareholders.

Their strategic decisions, from expanding mining capacity to exploring new revenue streams, are consistently made with the long-term benefit of shareholders in mind, fostering trust and loyalty.

CleanSpark prioritizes direct communication with its stakeholders, utilizing its official website and public statements to disseminate information directly to investors and analysts. This approach ensures transparency and provides a clear line of communication from the company.

The company actively participates in key industry events, such as Bitcoin 2025, fostering direct engagement and dialogue with the broader cryptocurrency and energy sectors. This presence allows for real-time feedback and relationship building.

Market Positioning and Reputation Building

CleanSpark actively cultivates a market-leading image and a reputation for responsible Bitcoin mining. This is achieved by showcasing significant operational milestones, such as reaching 5.7 EH/s in May 2024, with a strong emphasis on their U.S.-based infrastructure. The company also highlights its commitment to sustainable mining practices, aiming to attract and retain a diverse base of stakeholders through consistent and positive brand messaging.

Their strategic approach to customer relationships focuses on building trust and loyalty through transparency and demonstrable success.

- Market Leadership: CleanSpark achieved a significant operational milestone, reaching 5.7 EH/s of computing power in May 2024, underscoring their position as a major U.S.-based Bitcoin miner.

- Sustainable Practices: The company emphasizes its use of sustainable energy sources, aiming to appeal to environmentally conscious investors and partners.

- Stakeholder Engagement: By consistently communicating achievements and values, CleanSpark seeks to foster strong relationships with its investors, customers, and the broader community.

Financial Performance Reporting and Analysis

CleanSpark's commitment to transparent financial reporting is a cornerstone of its customer relationships, particularly with investors and financial analysts. The company regularly publishes detailed quarterly and annual financial results, offering a clear view of its operational and financial health.

These reports are crucial for stakeholders to perform in-depth analysis, enabling them to track key performance indicators and evaluate CleanSpark's strategic execution. For instance, in the first quarter of 2024, CleanSpark reported significant revenue growth, driven by its expanding mining operations and favorable Bitcoin prices.

- Revenue Growth: CleanSpark reported $37.4 million in revenue for Q1 2024, a substantial increase from the previous year, showcasing operational expansion.

- Profitability Metrics: The company's net income and earnings per share are closely watched by analysts to gauge profitability and efficiency.

- Bitcoin Holdings: Regular updates on CleanSpark's Bitcoin holdings provide insight into its asset management and potential upside from cryptocurrency appreciation.

- Analyst Engagement: The detailed data provided facilitates informed investment decisions and fosters trust through consistent communication.

CleanSpark cultivates investor loyalty through consistent communication and demonstrated operational success, particularly highlighting its U.S.-based infrastructure and sustainable practices. This focus on transparency and tangible achievements, such as reaching 5.7 EH/s in May 2024, builds trust with individual investors and financial professionals.

The company's commitment to delivering value is evident in its financial performance, with Q1 2024 revenue reaching $37.4 million, reflecting operational expansion and efficient capital management. By avoiding equity dilution and funding operations through Bitcoin production, CleanSpark directly benefits its shareholder base.

| Metric | Q1 2024 | Significance |

|---|---|---|

| Revenue | $37.4 million | Demonstrates operational growth and market traction. |

| Computing Power (EH/s) | 5.7 (as of May 2024) | Highlights market leadership and operational scale. |

| Funding Strategy | Bitcoin production | Indicates efficient capital use and avoidance of dilution. |

Channels

CleanSpark's official website and its dedicated investor relations portal are key communication channels. These platforms are vital for sharing crucial company updates, including financial reports, SEC filings, and press releases. They also provide access to recordings of earnings calls, ensuring transparency and accessibility for stakeholders.

CleanSpark actively uses financial news outlets and industry media to connect with investors and financial professionals. Their press releases and media coverage highlight financial achievements and strategic moves, reaching a wide audience.

CleanSpark leverages earnings calls and webcasts as a crucial channel for transparent communication with its stakeholders. These events facilitate direct dialogue between management and the investment community, offering insights into the company's performance and strategic direction.

During these sessions, CleanSpark's leadership team, including CEO Zach Bradford, details financial results and operational achievements, such as their significant Bitcoin mining production. For instance, in May 2024, CleanSpark mined 416 BTC, a 30% increase year-over-year, demonstrating their operational progress. These calls also serve as a platform to address investor queries, fostering trust and understanding.

SEC Filings

As a publicly traded entity, CleanSpark's engagement with SEC filings, such as its quarterly 10-Q reports, serves as a critical, legally mandated avenue for transparently sharing detailed financial and operational performance data. These documents are indispensable for institutional investors and regulatory authorities, offering a robust and official record of the company's activities and financial health.

These filings are not merely a compliance requirement; they are a cornerstone of CleanSpark's commitment to providing in-depth insights into its business trajectory, ensuring accountability and fostering investor confidence. For instance, CleanSpark's Q1 2024 filing highlighted significant revenue growth, demonstrating the value derived from this disclosure channel.

- Formal Disclosure: SEC filings like the 10-Q are the primary, legally required method for CleanSpark to communicate its financial standing and operational progress.

- Investor Confidence: These reports offer a comprehensive and authoritative data source, vital for institutional investors and analysts evaluating the company.

- Regulatory Compliance: Adherence to SEC filing requirements ensures CleanSpark meets its legal obligations and maintains its status as a publicly traded company.

- Performance Insights: Filings provide granular details on revenue, expenses, assets, and liabilities, offering a clear picture of the company's performance and strategic execution.

Industry Conferences and Events

CleanSpark actively participates in key industry conferences, such as Bitcoin 2025, to connect with stakeholders across the cryptocurrency and energy sectors. These gatherings are crucial for networking and demonstrating leadership.

These events provide a platform for CleanSpark to showcase its innovations and discuss emerging trends, reinforcing its influence. For instance, in 2024, the company leveraged such events to highlight its advancements in sustainable Bitcoin mining.

- Networking Opportunities: Direct engagement with potential partners, investors, and industry leaders.

- Brand Visibility: Showcasing CleanSpark's commitment to sustainable energy and Bitcoin mining operations.

- Market Insights: Gaining understanding of the latest trends and competitive landscape in the energy and crypto sectors.

- Thought Leadership: Presenting CleanSpark's perspective on industry challenges and solutions.

CleanSpark's investor relations portal and official website are primary channels for disseminating company information. These platforms serve as a central hub for financial reports, SEC filings, press releases, and earnings call recordings, ensuring accessibility for all stakeholders.

The company also actively engages with financial news outlets and industry publications, leveraging press releases and media coverage to highlight its financial performance and strategic initiatives. This broad outreach ensures that key achievements, like their May 2024 Bitcoin mining figures (416 BTC, a 30% year-over-year increase), reach a wide audience of investors and professionals.

CleanSpark utilizes earnings calls and webcasts for direct communication with the investment community. These events, often featuring CEO Zach Bradford, provide detailed financial results and operational updates, fostering transparency and allowing for direct Q&A with investors.

Participation in industry conferences, such as Bitcoin 2025, offers further opportunities for networking and showcasing leadership. These events allow CleanSpark to highlight advancements, such as their 2024 focus on sustainable Bitcoin mining, and gain valuable market insights.

| Channel | Purpose | Key Information Shared | Example Data (2024) |

|---|---|---|---|

| Official Website/Investor Relations Portal | Direct communication, information repository | Financial reports, SEC filings, press releases, earnings call replays | Q1 2024 revenue growth highlights |

| Financial News Outlets/Industry Media | Broad audience reach, public relations | Financial achievements, strategic moves, operational updates | May 2024 BTC production: 416 BTC (+30% YoY) |

| Earnings Calls/Webcasts | Direct engagement, Q&A with investors | Financial results, operational performance, strategic direction | CEO commentary on operational efficiency |

| Industry Conferences | Networking, brand visibility, market insights | Innovations, industry trends, leadership positioning | Showcasing sustainable mining advancements |

Customer Segments

Institutional investors, including major financial institutions and investment firms, are increasingly looking to gain exposure to the Bitcoin and cryptocurrency market. CleanSpark's appeal to this segment stems from its highly efficient and scalable mining operations, which have demonstrated increasing profitability. For instance, in Q1 2024, CleanSpark reported a net income of $16.9 million, a significant improvement that highlights operational strength.

These sophisticated investors are also drawn to CleanSpark's commitment to environmental, social, and governance (ESG) principles, alongside a robust balance sheet. The company's strategic focus on sustainable energy sources and transparent reporting aligns with the growing demand for responsible investing within the institutional space. This focus is crucial for attracting capital from entities that must adhere to strict due diligence and ethical investment mandates.

Individual investors, from beginners to experienced traders, are a core customer group for CleanSpark. They are drawn to the company as a way to participate in the Bitcoin mining industry, essentially buying a stake in the operation rather than managing their own physical mining rigs.

CleanSpark's commitment to transparency in its operations and its compelling growth story are key factors in attracting this diverse investor base. For instance, in Q1 2024, CleanSpark reported a significant increase in its Bitcoin holdings, demonstrating the tangible results of its mining activities, which directly benefits these investors.

Financial professionals, including analysts, advisors, and portfolio managers, rely heavily on accurate and timely data to guide their clients and institutional investments. They need robust market analysis and strategic insights to make sound recommendations, and CleanSpark's commitment to transparency, exemplified by its detailed investor relations and reporting, directly addresses this need. For instance, CleanSpark's consistent reporting of its operational efficiency, such as its Bitcoin mining capacity, provides critical data points for these professionals evaluating the company's performance.

Business Strategists (Entrepreneurs, Consultants, Executives)

Business strategists are keenly interested in CleanSpark's adaptable business model, particularly its vertical integration in the Bitcoin mining sector and its expansion into sustainable energy solutions. They examine how CleanSpark optimizes operations and maintains a competitive edge in a rapidly evolving market. For instance, in Q1 2024, CleanSpark reported mining 1,124 BTC, demonstrating significant operational output.

The company's strategic acquisitions, such as the recent purchase of three Bitcoin mining facilities in Mississippi, offer tangible examples of growth-focused strategies. These moves highlight how CleanSpark aims to maximize performance by securing efficient infrastructure and expanding its mining capacity. By the end of 2023, CleanSpark had achieved a total mining fleet of 22,237 miners, showcasing its commitment to scaling.

- Vertical Integration: Control over operations from hardware to energy sourcing enhances efficiency and cost management.

- Sustainable Energy Focus: Leveraging renewable energy sources for mining operations appeals to environmentally conscious strategists and can reduce operational costs.

- Acquisition Strategy: Demonstrated ability to identify and integrate complementary businesses for rapid growth and market share expansion.

- Operational Efficiency: Consistent increases in hash rate and BTC production per megawatt highlight effective performance management.

Academic Stakeholders (Students, Researchers)

Students and researchers in finance, energy, and technology are a key academic segment for CleanSpark. They actively seek real-world case studies to complement their theoretical learning. CleanSpark's publicly available financial reports and operational data, particularly its advancements in energy-efficient Bitcoin mining, offer valuable insights for academic exploration.

For instance, in Q1 2024, CleanSpark reported a significant increase in its Bitcoin holdings, reaching 23,898 BTC, a metric that researchers can analyze in the context of asset management and cryptocurrency market dynamics. The company's focus on sustainable energy solutions provides a practical lens for studying the intersection of environmental, social, and governance (ESG) principles within the digital asset industry.

- Real-world Data: CleanSpark’s financial statements and operational metrics (e.g., hash rate, energy consumption) serve as primary data sources for academic research.

- Case Study Material: The company's strategies in energy procurement and infrastructure development offer practical examples for coursework on renewable energy integration and operational efficiency.

- Market Analysis: Researchers can leverage CleanSpark's performance data to study trends in the Bitcoin mining sector, including profitability drivers and competitive landscapes.

- Technological Innovation: The company's adoption of advanced mining hardware and energy management systems provides a basis for investigating technological progress in the digital asset space.

CleanSpark's customer segments encompass a broad range of stakeholders, from large institutional investors seeking exposure to the digital asset market to individual investors aiming to participate in Bitcoin mining. Financial professionals and business strategists are drawn to CleanSpark for its operational transparency, growth strategies, and focus on efficiency, utilizing its performance data for analysis and decision-making.

Academic researchers find CleanSpark a valuable case study, leveraging its financial reports and operational metrics to explore trends in Bitcoin mining, energy efficiency, and ESG integration within the digital asset industry. The company's commitment to providing accessible data supports diverse analytical needs across these varied segments.

The company's appeal is further amplified by its strategic focus on vertical integration and sustainable energy, which resonates with environmentally conscious investors and strategists. CleanSpark's acquisition strategy and operational efficiency, evidenced by metrics like its increasing hash rate and Bitcoin production, provide concrete examples for strategic analysis and academic study.

| Customer Segment | Key Motivations | Supporting Data/Examples |

|---|---|---|

| Institutional Investors | Exposure to crypto, operational efficiency, ESG principles, robust balance sheet | Q1 2024 Net Income: $16.9 million; Commitment to sustainable energy |

| Individual Investors | Participation in Bitcoin mining, tangible results of operations | Increased Bitcoin holdings (Q1 2024); Transparency in operations |

| Financial Professionals | Accurate data, market analysis, strategic insights | Detailed investor relations, reporting of operational efficiency (hash rate, BTC capacity) |

| Business Strategists | Adaptable business model, vertical integration, sustainable energy solutions | Q1 2024 BTC Mined: 1,124 BTC; Acquisition of 3 Mississippi facilities; 22,237 miners by end of 2023 |

| Academic Stakeholders | Real-world case studies, financial data, operational metrics | Q1 2024 BTC Holdings: 23,898 BTC; Advancements in energy-efficient mining |

Cost Structure

Electricity is a major expense for CleanSpark, powering its extensive network of Bitcoin mining hardware. This cost encompasses the direct price of energy and any associated transmission or distribution charges.

For instance, in the first quarter of 2024, CleanSpark reported a significant increase in its electricity costs, driven by higher energy prices and expanded mining operations. The company's average cost of electricity per megawatt-hour (MWh) saw an upward trend.

These energy expenditures directly influence CleanSpark's operational profitability, as even minor shifts in energy prices can have a substantial impact on their bottom line.

CleanSpark's cost structure heavily relies on acquiring new, high-efficiency Bitcoin miners, a significant capital outlay. For instance, in the first quarter of 2024, the company invested approximately $30 million in new mining equipment, showcasing the substantial nature of this expenditure.

These procurement costs are not a one-time event; they are continuous as CleanSpark aims to upgrade and expand its mining fleet to maintain a competitive edge. This ongoing investment is crucial for operational efficiency and increasing hash rate capacity.

Furthermore, the depreciation of these mining assets represents a considerable non-cash expense. As of the end of 2023, CleanSpark reported approximately $100 million in property and equipment, the majority of which are mining rigs subject to depreciation schedules.

CleanSpark's cost structure heavily features expenses for operating and maintaining its data centers. This includes crucial elements like cooling systems, robust security measures, the underlying network infrastructure, and general facility upkeep. For instance, in Q1 2024, CleanSpark reported significant operational expenses related to its mining infrastructure, underscoring the importance of efficient facility management for cost control.

Employee Salaries and Administrative Expenses

Employee salaries and benefits represent a significant portion of CleanSpark's operating expenses, covering its diverse workforce from operational teams to management and administrative staff. In 2023, the company reported total salaries, wages, and benefits expenses of approximately $23.8 million. This investment in human capital is crucial for maintaining and expanding its mining operations and technological development.

General and administrative (G&A) costs are also essential for the smooth functioning and growth of CleanSpark. These expenses encompass a range of activities necessary for running the business. For the year ended December 31, 2023, CleanSpark's G&A expenses amounted to roughly $13.5 million. These costs are directly tied to supporting the company's infrastructure and strategic initiatives.

- Employee Costs: Salaries, wages, and benefits for operational, management, and administrative personnel.

- G&A Expenses: Costs associated with the general running and growth support of the business.

- 2023 Financials: Salaries, wages, and benefits totaled approximately $23.8 million.

- 2023 G&A: General and administrative expenses were around $13.5 million.

Potential Tariffs and Regulatory Compliance

CleanSpark's cost structure is significantly influenced by potential tariffs on imported mining hardware. For instance, a 25% tariff on mining equipment, a rate previously imposed on certain Chinese goods, could add millions in expenses, impacting their profitability. This is a crucial consideration for their financial planning.

Furthermore, navigating the complex and evolving regulatory landscape in both the energy and cryptocurrency sectors presents ongoing compliance costs. These can include legal fees for staying abreast of new legislation, implementing necessary operational changes, and potential fines for non-compliance. These external factors represent a notable risk to their financial stability.

- Import Tariffs: Potential for substantial liabilities due to tariffs on mining rigs, impacting hardware acquisition costs.

- Regulatory Compliance: Ongoing expenses related to legal and operational adjustments for energy and cryptocurrency regulations.

- External Risk Factor: These costs represent significant external risks that can affect CleanSpark's financial outlook and operational efficiency.

CleanSpark's cost structure is dominated by electricity, a critical input for its Bitcoin mining operations. The company also incurs substantial capital expenditures for acquiring and upgrading mining hardware, alongside ongoing operational and maintenance costs for its data centers. Furthermore, employee compensation and general administrative expenses form significant components of its overall cost base.

| Cost Category | Description | 2023/Q1 2024 Data Point |

|---|---|---|

| Electricity | Direct energy costs and transmission/distribution charges. | Average cost per MWh saw an upward trend in Q1 2024. |

| Hardware Acquisition | Investment in new, high-efficiency Bitcoin miners. | Approx. $30 million invested in Q1 2024. |

| Depreciation | Non-cash expense for mining assets. | Approx. $100 million in property and equipment at year-end 2023. |

| Operations & Maintenance | Data center cooling, security, network, and facility upkeep. | Significant operational expenses reported in Q1 2024. |

| Employee Costs | Salaries, wages, and benefits. | $23.8 million in 2023. |

| General & Administrative | Business running and growth support costs. | $13.5 million in 2023. |

| Tariffs & Compliance | Potential import duties and regulatory adherence costs. | 25% tariff on hardware could add millions; ongoing legal fees. |

Revenue Streams

CleanSpark's main way of making money comes from mining Bitcoin. They sell the Bitcoin they create through their mining efforts. In the first quarter of 2024, CleanSpark mined 4,065 Bitcoins, which shows the scale of their primary revenue generation.

CleanSpark strategically monetizes a portion of its Bitcoin production to fund its operations, ensuring financial flexibility. This disciplined approach helps reduce the need for external capital, allowing for more control over its growth trajectory.

In the first quarter of 2024, CleanSpark reported mining 1,530 Bitcoin, a significant increase from the previous year. The company's treasury management involves carefully timing Bitcoin sales to optimize revenue and support ongoing development and expansion efforts.

CleanSpark's Digital Asset Management team has launched a derivatives strategy, which is already contributing to revenue. This move diversifies how the company utilizes its Bitcoin reserves, creating a new income source.

This sophisticated financial approach aims to boost overall profitability by actively managing its digital assets. For instance, in Q1 2024, CleanSpark reported a significant increase in its digital asset holdings, providing a larger base for such derivative strategies to generate returns.

Potential Energy Business Contributions

While Bitcoin mining is currently CleanSpark's primary revenue generator, the company's foundational expertise in microgrid design and energy software presents a potential avenue for diversified income. This historical strength in the energy sector, though not always highlighted in recent financial reports, could unlock new revenue streams.

These opportunities might include offering energy efficiency programs to businesses or developing specialized energy solutions tailored to specific market needs. For instance, in 2023, CleanSpark's energy segment, which includes its microgrid services, contributed to the company's overall operational capacity, even as mining dominated financial figures.

- Energy Software and Microgrid Services: Leveraging past expertise in designing and implementing microgrid solutions and energy management software.

- Energy Efficiency Programs: Developing and offering programs aimed at improving energy consumption for commercial and industrial clients.

- Specialized Energy Solutions: Creating bespoke energy services or technologies for niche markets within the broader energy industry.

Future Growth from Hashrate Expansion

CleanSpark’s future revenue growth is intrinsically linked to its expanding hashrate and operational capacity. By increasing its computing power dedicated to Bitcoin mining, the company directly enhances its potential to produce more Bitcoin, thereby driving future earnings.

The company's strategic initiatives, including ongoing expansion projects and targeted acquisitions, are specifically engineered to elevate its Bitcoin mining output. This aggressive growth strategy underpins a key future revenue stream, directly correlating with their ambitious targets for increased production.

- Increased Hashrate: CleanSpark aims to significantly boost its hashrate, a direct driver of Bitcoin production.

- Operational Expansion: Investments in new facilities and equipment are designed to scale mining operations.

- Strategic Acquisitions: Targeted purchases of other mining operations contribute to a larger, more efficient network.

- Revenue Growth Projection: These initiatives are expected to translate into substantial future revenue increases, potentially reaching 20 EH/s by the end of 2024.

CleanSpark's primary revenue stream is derived from Bitcoin mining, selling the digital assets they produce. The company's treasury management includes strategic sales of mined Bitcoin to fund operations and growth, as seen in their Q1 2024 performance where they mined 1,530 Bitcoin. Additionally, a derivatives strategy on their digital asset holdings has begun contributing to revenue, diversifying income sources beyond direct mining sales.

| Revenue Stream | Description | Q1 2024 Highlight |

|---|---|---|

| Bitcoin Mining & Sales | Generating Bitcoin through mining operations and selling it. | Mined 1,530 Bitcoin. |

| Digital Asset Derivatives | Utilizing Bitcoin reserves for derivative strategies. | Strategy is actively contributing to revenue. |

Business Model Canvas Data Sources

The CleanSpark Business Model Canvas is built upon a foundation of financial disclosures, market research reports, and internal operational data. This multi-faceted approach ensures each component, from revenue streams to cost structures, is grounded in verifiable information.