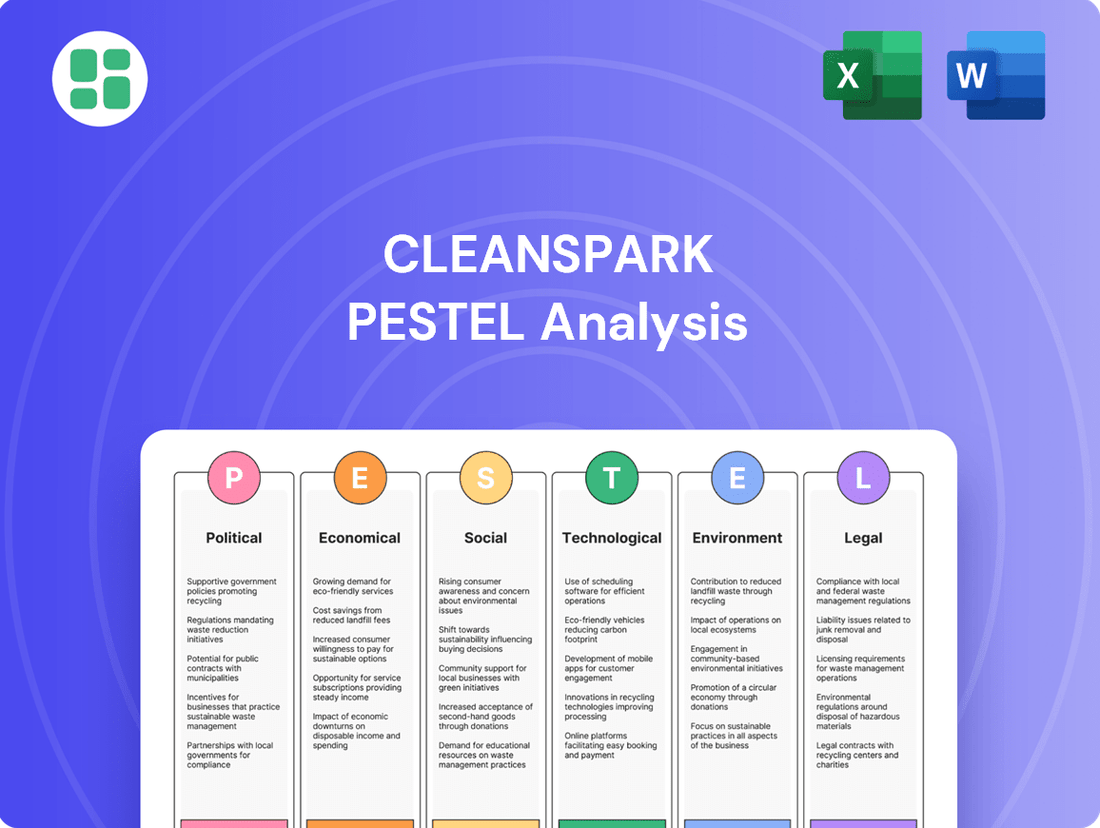

CleanSpark PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping CleanSpark's trajectory. Our expertly crafted PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on emerging opportunities. Don't get left behind; download the full version now for actionable intelligence.

Political factors

The United States government's stance on cryptocurrency, particularly Bitcoin mining, is a critical political factor for CleanSpark. Regulatory uncertainty or the introduction of unfavorable policies, such as increased energy consumption taxes or outright bans on mining operations, could significantly hinder CleanSpark's growth and profitability. For instance, in 2024, discussions around stricter environmental regulations for data centers, which include crypto miners, could lead to increased operational costs or necessitate relocation for companies like CleanSpark.

CleanSpark's business model, centered on distributed solar and energy storage, is highly sensitive to government energy policies. Federal tax credits, like the Investment Tax Credit (ITC), significantly influence project economics. For instance, the ITC, extended through the Inflation Reduction Act of 2022, offers a 30% credit for projects placed in service by 2032, directly reducing CleanSpark's capital expenditures and boosting project profitability.

State-level incentives, such as net metering policies and renewable portfolio standards (RPS), also play a vital role. States with favorable net metering, allowing solar owners to receive credit for excess electricity sent to the grid, enhance the financial viability of CleanSpark's residential and commercial installations. Conversely, policy shifts that reduce these benefits, or introduce unfavorable rate structures, could negatively impact demand and CleanSpark's revenue streams.

The political stability of the regions where CleanSpark operates its Bitcoin mining facilities is paramount for maintaining consistent operations and attracting sustained investment. Instability, such as changes in local leadership or energy policy, can directly impact the company's ability to function efficiently.

For instance, shifts in energy infrastructure priorities within specific US states or counties where CleanSpark has a presence, like Georgia or Mississippi, could lead to operational disruptions or unfavorable changes in the business environment. A predictable political landscape is therefore crucial for ensuring stable regulatory frameworks and operational conditions for CleanSpark.

International Relations and Trade Policies

CleanSpark's reliance on a global supply chain for advanced mining hardware makes it susceptible to shifts in international relations and trade policies. Tariffs or import restrictions on technology from key manufacturing hubs, particularly in Asia, could directly inflate the cost of new mining rigs and disrupt expansion plans. For instance, ongoing trade tensions between major economic blocs might lead to unexpected duties on semiconductor components crucial for ASIC miners, impacting CleanSpark's operational efficiency and growth trajectory.

Geopolitical instability also poses a significant risk to these critical supply chains. Disruptions caused by regional conflicts or political disputes could lead to shortages of essential mining equipment, forcing CleanSpark to seek alternative, potentially more expensive, suppliers. The company's ability to maintain its competitive edge hinges on securing a consistent and cost-effective supply of the latest mining technology, a goal directly challenged by an unpredictable international political landscape.

- Supply Chain Vulnerability: CleanSpark depends on international manufacturers for its mining hardware, making it sensitive to trade barriers.

- Cost Impact: Tariffs and import restrictions can increase the cost of acquiring new, high-efficiency mining equipment.

- Geopolitical Risk: International tensions can disrupt the flow of essential technology, affecting capacity expansion and upgrades.

Lobbying and Industry Advocacy

The collective efforts of the cryptocurrency and Bitcoin mining industry to influence policymakers are crucial in shaping the regulatory environment. CleanSpark's engagement with industry advocacy groups can foster a more favorable regulatory landscape, highlighting the economic benefits of Bitcoin mining and reducing legislative uncertainties. For instance, the Bitcoin Mining Council reported in Q4 2023 that its members achieved a 66.1% sustainable energy mix, a figure that industry advocacy aims to promote to regulators.

These advocacy efforts can directly influence the future trajectory of the sector. By actively participating in these collective actions, CleanSpark can help ensure that legislative decisions reflect a nuanced understanding of the industry's contributions and operational realities. Successful lobbying can lead to clearer guidelines and reduced operational risks, ultimately benefiting companies like CleanSpark.

- Industry Advocacy Impact: Lobbying efforts can shape regulations, potentially lowering operational costs or increasing market access for Bitcoin miners.

- Economic Contribution Promotion: Advocacy groups work to educate policymakers on the job creation and tax revenue generated by the Bitcoin mining sector.

- Risk Mitigation: Proactive engagement with lawmakers helps to preemptively address potential negative legislation and mitigate associated risks for companies like CleanSpark.

Government incentives and tax policies significantly impact CleanSpark's profitability, particularly the extended Investment Tax Credit (ITC) which offers a 30% credit for renewable energy projects through 2032. State-level policies like net metering and renewable portfolio standards also directly influence the financial viability of the company's distributed energy solutions.

Regulatory frameworks surrounding cryptocurrency mining, including potential energy taxes or restrictions, pose a direct political risk to CleanSpark's core Bitcoin mining operations. The company's success is also tied to the political stability of operating regions, as local leadership and energy policy shifts can disrupt efficiency.

International trade policies and geopolitical stability are critical due to CleanSpark's reliance on imported mining hardware, with tariffs and supply chain disruptions directly impacting equipment costs and expansion plans. Industry advocacy efforts, such as those promoting sustainable energy use in Bitcoin mining, can shape favorable legislation and mitigate regulatory uncertainties.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external factors influencing CleanSpark, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces create both challenges and advantages.

Provides a clear, actionable framework that helps CleanSpark anticipate and mitigate external threats, thereby reducing uncertainty and enabling more confident strategic decision-making.

Economic factors

CleanSpark's financial health is intrinsically tied to Bitcoin's price volatility, as its core business is Bitcoin mining. For instance, Bitcoin experienced significant price swings throughout 2024, impacting mining revenue per coin. A sharp decline in Bitcoin's market value directly translates to lower revenue for CleanSpark, potentially affecting its ability to cover operational costs and generate profits.

Energy costs are a significant factor for Bitcoin miners like CleanSpark, directly impacting profitability. In 2024, the average industrial electricity rate in the US hovered around $0.07 per kilowatt-hour, but this can vary dramatically by region and time of day.

CleanSpark's operational expenses are highly sensitive to these price shifts. For instance, a 10% increase in electricity costs could reduce their profit margins by a noticeable amount, especially during periods of high grid demand or when relying on more expensive energy sources.

The availability of consistent and affordable power, especially from renewable sources, is crucial for CleanSpark's competitive edge. By securing access to over 90% of their energy from sustainable sources in 2024, they aim to mitigate price volatility and maintain operational efficiency.

Inflation and interest rates significantly shape CleanSpark's financial landscape. For instance, the U.S. inflation rate was 3.3% in May 2024, a slight decrease from previous months, but still a factor impacting operational costs. Rising interest rates, with the Federal Reserve maintaining its benchmark rate in the 5.25%-5.50% range through mid-2024, directly increase the cost of debt for CleanSpark's capital-intensive projects, influencing expansion strategies.

Global Economic Growth and Recession Risks

Global economic growth significantly influences investor sentiment and, by extension, the cryptocurrency market. A strong global economy generally encourages investment in riskier assets like Bitcoin, which can benefit companies like CleanSpark. Conversely, economic slowdowns may lead to reduced discretionary spending and investment, potentially impacting CleanSpark's revenue streams.

Recession risks are a key concern for 2024 and 2025. For instance, the International Monetary Fund (IMF) projected global growth to moderate to 3.2% in 2024, down from 3.5% in 2023, with a slight uptick to 3.2% expected again in 2025. This slowdown can dampen enthusiasm for speculative investments.

- Global economic growth projections for 2024 are around 3.2%, with similar expectations for 2025, indicating a period of slower expansion.

- During economic downturns, discretionary spending on volatile assets like cryptocurrencies may decrease, impacting CleanSpark's potential revenue.

- A robust global economy can foster increased investment and adoption of digital assets, benefiting CleanSpark's operational environment.

Access to Capital for Expansion

CleanSpark's aggressive expansion strategy, focused on acquiring miners and building energy infrastructure to boost Bitcoin production, hinges entirely on its access to capital. The company's ability to secure funding through equity offerings, debt financing, or leveraging retained earnings directly dictates the pace of its growth. For instance, in Q1 2024, CleanSpark raised approximately $20 million through an at-the-market equity program, demonstrating a reliance on external capital markets to fuel its operational ambitions.

The broader economic climate significantly impacts this access. Factors like market liquidity, overall investor sentiment towards the cryptocurrency sector, and prevailing interest rates determine the cost and availability of capital. A strong market performance for Bitcoin and a positive outlook for mining operations generally translate to more favorable financing terms for companies like CleanSpark, enabling them to execute their expansion plans more effectively.

- Equity Financing: CleanSpark has utilized at-the-market (ATM) offerings, raising substantial funds to acquire new mining equipment and expand operations.

- Debt Financing: The company has also explored and secured debt facilities, which offer an alternative avenue for capital but come with interest costs.

- Investor Confidence: Positive operational results and a favorable Bitcoin price environment boost investor confidence, making it easier to raise capital.

- Cost of Capital: Fluctuations in interest rates and market risk premiums directly influence the cost of borrowing or issuing equity, impacting the financial viability of expansion projects.

Global economic growth is a key driver for CleanSpark, influencing investor sentiment towards riskier assets like Bitcoin. Projections for global growth in 2024 were around 3.2%, with similar expectations for 2025, indicating a moderating economic environment. This slower growth can potentially temper enthusiasm for speculative investments, impacting CleanSpark's revenue streams.

Recession risks are a notable concern for the 2024-2025 period. A potential economic downturn could lead to reduced discretionary spending, which might translate into lower demand for cryptocurrencies and, consequently, reduced profitability for Bitcoin miners like CleanSpark.

Conversely, a strong global economic expansion generally fosters increased investment and broader adoption of digital assets. This positive economic climate can create a more favorable operational environment for CleanSpark, potentially boosting its revenue and facilitating easier access to capital for growth initiatives.

| Economic Factor | 2024 Projection/Status | 2025 Projection/Status | Impact on CleanSpark |

|---|---|---|---|

| Global Economic Growth | Around 3.2% | Similar to 2024 | Influences investor sentiment towards Bitcoin; slower growth may dampen speculative investment. |

| Recession Risk | Present concern | Continued concern | Could reduce discretionary spending, impacting crypto demand and CleanSpark's revenue. |

| Inflation Rate (US) | 3.3% (May 2024) | Expected to moderate | Affects operational costs; higher inflation can increase expenses. |

| Federal Funds Rate | 5.25%-5.50% (Mid-2024) | Potential for cuts | Higher rates increase borrowing costs for capital-intensive projects. |

Full Version Awaits

CleanSpark PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of CleanSpark.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing detailed insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CleanSpark.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you have all the necessary information for your strategic planning.

Sociological factors

Public perception of Bitcoin mining, particularly regarding its energy use and environmental footprint, significantly shapes regulatory landscapes and investor confidence. Concerns over high energy consumption can fuel calls for stricter oversight and even local opposition to mining operations, impacting companies like CleanSpark.

CleanSpark's commitment to utilizing renewable energy sources, such as its recent expansion into Georgia powered by hydroelectric and solar, directly addresses these societal concerns. This strategic move aims to bolster its image and resonate with a growing global demand for environmentally responsible digital asset infrastructure.

CleanSpark's large-scale mining operations, like its facilities in Georgia, directly influence local communities through energy consumption and job creation. For instance, the company’s operations in Dalton, Georgia, contribute to the local economy by providing employment opportunities. Maintaining positive community relations is crucial for their social license to operate and future growth, as demonstrated by the potential for local opposition to hinder expansion efforts.

CleanSpark's operational success hinges on a readily available pool of skilled professionals, encompassing electrical engineers, specialized technicians, and energy management experts. The company's expansion plans are directly tied to the presence of talent in its operating locations, particularly individuals possessing a dual understanding of energy infrastructure and the intricacies of cryptocurrency mining.

As of early 2024, the demand for specialized technicians in the renewable energy sector, a key area for CleanSpark, continues to outpace supply, with some reports indicating a shortage of up to 40% for certain roles. This scarcity could potentially hinder CleanSpark's ability to scale its operations efficiently and pursue new growth opportunities in the coming year.

Consumer Demand for Sustainable Practices

Societal expectations for businesses to operate sustainably are increasingly shaping investment choices and corporate reputations. CleanSpark’s commitment to utilizing sustainable energy sources for its Bitcoin mining operations directly addresses this growing demand. This alignment is crucial for attracting investors who prioritize environmental, social, and governance (ESG) criteria. For instance, a 2024 survey indicated that 70% of investors consider ESG factors when making investment decisions, a significant increase from previous years.

By emphasizing its green mining practices, CleanSpark positions itself favorably within this trend, potentially drawing in environmentally conscious capital and bolstering its brand image. Conversely, a failure to meet these evolving consumer and investor expectations could result in negative publicity and reputational harm, impacting market perception and investor confidence. The global sustainable finance market is projected to reach $50 trillion by 2025, highlighting the immense financial opportunity tied to ESG compliance.

- Growing ESG Investment: Approximately 70% of investors now incorporate ESG factors into their decision-making processes as of 2024.

- Market Opportunity: The global sustainable finance market is on track to exceed $50 trillion by 2025.

- Brand Perception: Companies with strong sustainability credentials often enjoy enhanced brand loyalty and a better public image.

- Risk Mitigation: Ignoring sustainability trends can lead to reputational damage and loss of investor trust.

Investor Sentiment Towards Cryptocurrency

Investor sentiment towards cryptocurrencies, especially Bitcoin, significantly shapes the landscape for companies like CleanSpark. Societal acceptance and understanding are crucial; as more people grasp the technology, broader investor interest tends to grow.

Increased mainstream adoption and positive media coverage, such as the approval of Bitcoin ETFs in early 2024, have attracted substantial institutional and retail investment. This influx of capital can directly benefit mining operations by increasing demand and potentially stabilizing or raising Bitcoin prices, which in turn impacts CleanSpark's revenue and stock valuation.

- Bitcoin's market capitalization reached over $1 trillion in early 2024, indicating growing investor confidence.

- A significant portion of retail investors, around 40% according to some 2024 surveys, express interest in adding crypto to their portfolios.

- Negative narratives, like regulatory crackdowns or major exchange hacks, can swiftly shift sentiment, leading to sharp price declines and affecting investor willingness to back crypto-related businesses.

Public perception of Bitcoin mining's environmental impact is a significant sociological factor influencing CleanSpark. As of 2024, growing awareness of climate change fuels demand for sustainable practices, directly affecting how mining companies are viewed and regulated.

CleanSpark's proactive adoption of renewable energy sources, like its facilities in Georgia powered by hydroelectric and solar, addresses these societal concerns and aligns with increasing investor preference for ESG-compliant businesses. This strategic positioning is vital for maintaining a positive brand image and attracting capital in a market where sustainability is paramount.

The company's operations also impact local communities, creating jobs and contributing to the economy, as seen in Dalton, Georgia. Maintaining strong community relations is essential for social license and operational continuity, as negative public sentiment can lead to regulatory hurdles or local opposition, impacting future expansion.

| Sociological Factor | Impact on CleanSpark | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Environmental Awareness & ESG Demand | Drives need for sustainable mining operations; influences investor sentiment and regulatory scrutiny. | 70% of investors consider ESG factors; global sustainable finance market projected to reach $50 trillion by 2025. |

| Public Perception of Crypto Mining | Affects social acceptance, regulatory environment, and brand reputation. | Growing public discourse on energy use of Bitcoin mining; potential for localized opposition. |

| Community Relations | Crucial for social license to operate; job creation and local economic impact are key considerations. | CleanSpark's operations in Georgia provide local employment; positive community engagement is vital for expansion. |

| Investor & Consumer Sentiment towards Crypto | Influences capital availability, demand for mining services, and company valuation. | Bitcoin market cap over $1 trillion in early 2024; 40% of retail investors interested in crypto. |

Technological factors

The profitability of Bitcoin mining, and by extension CleanSpark's operations, is intrinsically tied to the efficiency of its mining hardware, specifically Application-Specific Integrated Circuits (ASICs). As of mid-2024, the industry is seeing a rapid evolution in ASIC technology, with newer models boasting significantly higher hash rates per watt of energy consumed. This trend is crucial for CleanSpark to remain competitive by lowering its operational expenditure per Bitcoin mined.

Continuous innovation in mining hardware, leading to more powerful machines that consume less electricity, is a key technological factor influencing CleanSpark's performance. For instance, the introduction of next-generation ASICs in late 2023 and early 2024 has offered efficiency gains of up to 20% over previous models. CleanSpark's strategy of investing in and deploying these latest-generation miners is therefore vital for optimizing its cost structure and maximizing its Bitcoin production efficiency.

CleanSpark's focus on sustainable energy sources makes it highly sensitive to advancements in renewable technologies. Innovations in solar panel efficiency, for instance, could lower the cost of power generation for its data centers. In 2024, the global average solar panel efficiency is around 20-22%, with some advanced panels exceeding 23%, a figure that continues to climb.

Improvements in battery storage are also critical. As battery technology matures, its capacity to store intermittent solar and wind power reliably will increase, directly benefiting CleanSpark's energy supply chain. By late 2024, lithium-ion battery costs have fallen significantly, averaging around $130 per kilowatt-hour for utility-scale projects, down from over $1,000 per kWh a decade ago, making grid-scale storage more economically viable.

Sophisticated grid management and energy storage are crucial for integrating large-scale mining operations with renewable energy sources. CleanSpark benefits from advancements in smart grid technology and battery storage, enabling optimized energy use and load balancing. For instance, the company's focus on efficient energy consumption in its mining facilities directly impacts its operational costs, especially as energy prices fluctuate.

Cybersecurity for Mining Operations

As a company deeply embedded in the digital asset sector, CleanSpark's technological foundation hinges on robust cybersecurity. Protecting its mining infrastructure, from vast mining pools to secure digital wallets and critical operational networks, is not just a best practice but a fundamental necessity. The increasing sophistication of cyber threats, including ransomware and data breaches, poses a significant risk to financial stability and operational continuity.

The financial ramifications of inadequate cybersecurity can be severe. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, a figure that underscores the immense financial exposure for any digital asset operator. CleanSpark's commitment to continuous investment in advanced cybersecurity measures directly mitigates these risks, safeguarding its assets and ensuring the trust of its stakeholders.

- Cyber Threat Landscape: Mining operations are prime targets for sophisticated cyberattacks aimed at disrupting operations or stealing digital assets.

- Financial Impact: A successful breach could lead to substantial financial losses, reputational damage, and a loss of investor confidence.

- Investment Necessity: CleanSpark must allocate significant resources to cybersecurity infrastructure, including advanced threat detection, data encryption, and employee training, to stay ahead of evolving threats.

- Operational Integrity: Maintaining the integrity of mining pools and digital wallets is paramount for uninterrupted operations and the secure management of mined cryptocurrencies.

Data Center Cooling Technologies

Bitcoin mining machines produce substantial heat, making efficient cooling critical for peak performance and longevity. Innovations like immersion cooling are gaining traction, with some estimates suggesting they can reduce cooling energy consumption by up to 90% compared to traditional air cooling. This efficiency directly translates to lower operational costs for miners like CleanSpark.

Advanced liquid cooling systems offer further advantages, enabling higher density deployments of mining rigs within data centers. This means more processing power can be housed in the same footprint, boosting overall output. For instance, some liquid cooling solutions can support up to 500 kW per rack, a significant increase over typical air-cooled setups.

- Energy Efficiency: Immersion and liquid cooling can slash cooling energy use, a major operational expense for data centers.

- Cost Reduction: Lower energy consumption directly impacts the bottom line, improving profitability for mining operations.

- Increased Density: These technologies allow for more mining hardware in a smaller space, maximizing infrastructure utilization.

- Environmental Impact: Reduced energy consumption contributes to a more sustainable mining footprint.

Technological advancements in Application-Specific Integrated Circuits (ASICs) are pivotal for CleanSpark's profitability, with new models in 2024 offering up to 20% greater efficiency. Innovations in renewable energy, such as solar panel efficiency reaching 20-22% globally in 2024, and falling battery storage costs to around $130/kWh, directly benefit CleanSpark's sustainable energy strategy. Furthermore, advanced cooling solutions like immersion cooling, which can reduce energy consumption by up to 90%, are crucial for optimizing operational costs and increasing mining hardware density.

| Technology Area | Key Advancement | Impact on CleanSpark | Data Point (2024/2025) |

|---|---|---|---|

| ASIC Efficiency | Higher hash rate per watt | Lower operational expenditure per Bitcoin mined | Up to 20% efficiency gain in next-gen ASICs |

| Renewable Energy | Solar panel efficiency | Reduced cost of power generation | Global average 20-22% |

| Energy Storage | Battery storage costs | Enhanced reliability of intermittent power sources | Approx. $130/kWh for utility-scale (late 2024) |

| Cooling Technology | Immersion cooling | Reduced cooling energy consumption, increased density | Up to 90% reduction in cooling energy use |

| Cybersecurity | Advanced threat detection | Mitigation of financial and operational risks | Global cybercrime cost projected at $10.5 trillion annually by 2025 |

Legal factors

The legal framework for cryptocurrencies is still developing, and how regulators like the SEC or CFTC classify Bitcoin, for instance, as a security or commodity, directly affects CleanSpark's operations and compliance burdens. Potential direct taxation of mining rewards or new reporting mandates add layers of complexity and cost.

CleanSpark must navigate a patchwork of regulations from agencies such as FinCEN, ensuring adherence to anti-money laundering and know-your-customer protocols. Failure to comply can lead to significant fines and operational disruptions, as seen with other crypto firms facing regulatory scrutiny in the past.

Regulatory uncertainty can create significant market volatility, impacting CleanSpark's profitability and investment decisions. For example, proposed changes to tax laws on digital assets in 2024 could alter the profitability of mining operations.

CleanSpark's energy infrastructure development and operations are significantly shaped by a complex web of federal, state, and local energy regulations. These rules govern everything from how power is generated and transmitted to the critical processes of grid interconnection and energy procurement. For instance, the Federal Energy Regulatory Commission (FERC) sets wholesale electricity market rules, impacting how CleanSpark can sell excess energy or source power for its operations.

Changes in these regulations can directly influence CleanSpark's cost structure and the viability of its energy strategy. For example, new tariffs on imported grid components or stricter environmental mandates for power plants could increase operational expenses. Conversely, streamlined grid interconnection rules, like those being explored by some states to facilitate renewable energy integration, could reduce project timelines and capital costs, potentially boosting CleanSpark's expansion plans in 2024 and 2025.

CleanSpark's operations, particularly its energy infrastructure, are directly impacted by environmental compliance laws. These regulations govern air emissions, water usage, waste disposal, and land use, requiring significant adherence to maintain sustainable practices.

Increasingly stringent environmental regulations, such as those potentially introduced in 2024 or 2025 concerning carbon emissions, could raise operational expenses for CleanSpark. For instance, a hypothetical carbon tax of $50 per ton of CO2 emitted, as discussed in various policy proposals, could add to energy generation costs.

The company must invest in advanced green technologies to meet evolving standards and avoid penalties. Failure to comply with environmental mandates can lead to substantial fines and reputational damage, impacting its market position.

Corporate Governance and Reporting Requirements

As a publicly traded entity, CleanSpark (CLSK) must adhere to rigorous corporate governance standards and financial reporting mandates, including those from the Securities and Exchange Commission (SEC) and NASDAQ. These regulations are critical for fostering transparency and safeguarding investor interests, thereby bolstering market confidence. For instance, in its 2023 annual report filed in March 2024, CleanSpark detailed its compliance efforts and governance structure.

Failure to comply with these legal frameworks can invite severe consequences, ranging from legal penalties and significant reputational harm to the potential risk of delisting from the stock exchange. Maintaining robust internal controls and transparent reporting practices are therefore paramount for CleanSpark's continued market participation and investor trust.

- SEC Filings: CleanSpark is required to submit regular filings like the 10-K (annual) and 10-Q (quarterly) reports, providing detailed financial performance and operational updates.

- NASDAQ Listing Requirements: Compliance with NASDAQ's corporate governance rules, including board independence and audit committee composition, is essential for maintaining its listing.

- Investor Protection: Adherence to these legal requirements directly contributes to protecting shareholders by ensuring they receive accurate and timely information for decision-making.

- Risk Mitigation: Proactive compliance minimizes the risk of fines, lawsuits, and reputational damage that could negatively impact CleanSpark's stock value and operational continuity.

Data Privacy and Security Laws

CleanSpark, while primarily a Bitcoin miner, must still navigate a complex landscape of data privacy and security laws. The company manages significant operational data, including that of its employees, which necessitates adherence to regulations like the California Consumer Privacy Act (CCPA) and similar state-level privacy acts enacted in 2024 and anticipated for 2025. Failure to protect this sensitive information could lead to substantial fines and reputational damage, as exemplified by the growing number of data breach lawsuits targeting companies across sectors.

The security of CleanSpark's digital assets, particularly its Bitcoin holdings and mining infrastructure, is also paramount. Compliance with evolving cybersecurity standards and best practices is crucial to prevent unauthorized access and protect against potential financial losses. As of early 2025, the cybersecurity threat landscape continues to intensify, with ransomware attacks and sophisticated phishing schemes posing ongoing risks to businesses of all sizes.

- CCPA and Similar State Laws: CleanSpark must comply with evolving state-specific data privacy regulations impacting employee and operational data.

- Cybersecurity Standards: Adherence to robust cybersecurity measures is vital for protecting digital assets and mining operations.

- Data Breach Repercussions: Non-compliance can result in significant financial penalties and damage to the company's reputation.

- Evolving Threat Landscape: The increasing sophistication of cyber threats in 2024-2025 demands continuous adaptation of security protocols.

CleanSpark's legal obligations extend to ensuring compliance with cryptocurrency-specific regulations, including those from FinCEN for anti-money laundering. The company must also navigate evolving tax laws impacting digital assets, with potential changes in 2024-2025 directly affecting mining profitability. Regulatory uncertainty from bodies like the SEC can lead to market volatility, influencing CleanSpark's financial planning and operational decisions.

Environmental factors

CleanSpark is actively working to reduce the carbon footprint of its Bitcoin mining. This means closely monitoring greenhouse gas emissions stemming from its energy use. A key strategy involves increasing the proportion of renewable energy sources powering its operations.

For instance, in 2023, CleanSpark reported that 95% of its energy consumption for mining came from sustainable sources, a significant figure aiming to mitigate environmental impact. This commitment is crucial as both the public and investors increasingly focus on corporate environmental responsibility.

CleanSpark's commitment to powering its operations with sustainable energy sources makes ambitious renewable energy adoption targets a critical environmental consideration. By investing in and sourcing more solar, wind, or hydropower, the company directly addresses its reliance on fossil fuels.

Achieving these targets is crucial for enhancing CleanSpark's Environmental, Social, and Governance (ESG) profile, which is increasingly important for attracting green investors. For instance, as of early 2024, the demand for renewable energy credits (RECs) from companies aiming for carbon neutrality has surged, with the market expected to grow significantly in the coming years.

CleanSpark's operations, particularly its data centers and potential future mining facilities, will require substantial water for cooling. The company must address its water footprint, especially in arid areas. For instance, the average data center can use millions of gallons of water annually for cooling, a figure that CleanSpark will need to manage.

E-waste Management from Old Miners

The swift evolution of Bitcoin mining hardware means machines become obsolete quickly, creating a significant e-waste stream. CleanSpark acknowledges this, focusing on responsible disposal, recycling, and repurposing of its old mining equipment to lessen its environmental footprint and adhere to e-waste regulations.

This commitment involves integrating circular economy principles, aiming to give old hardware new life or recover valuable materials. For instance, the global e-waste generated in 2023 was estimated to be 62 million metric tons, highlighting the scale of the challenge.

- Hardware Obsolescence: Bitcoin mining rigs have a shorter lifespan due to continuous upgrades in efficiency and processing power.

- Environmental Impact: Improper disposal of e-waste can release hazardous materials into the environment.

- Regulatory Compliance: Adherence to e-waste management laws is crucial for companies like CleanSpark.

- Circular Economy: Exploring options for reuse, repair, or material recovery from old mining equipment.

Climate Change Resilience Planning

Climate change poses significant physical risks to CleanSpark's operations. Extreme weather events, such as the increasing frequency of heatwaves in regions where their data centers are located, can strain cooling systems, leading to potential downtime. Similarly, severe storms can disrupt the energy supply, impacting facility uptime and the reliability of their power grid infrastructure.

To mitigate these risks, CleanSpark must prioritize robust climate change resilience planning. This includes strategic site selection that considers future climate impacts and investing in hardening existing infrastructure against extreme weather. Diversifying energy sources to include more resilient options, like localized solar with battery storage, is also crucial for ensuring long-term operational stability and minimizing disruptions.

- Physical Risks: Increased frequency of heatwaves and severe storms impacting operational uptime and energy supply.

- Resilience Strategies: Implementing site selection criteria, infrastructure hardening, and diversified energy sources.

- Operational Stability: Ensuring continuous operations and reliable energy supply through proactive planning.

- 2024 Data Point: As of Q1 2024, CleanSpark reported a 99.9% uptime for its primary data center facilities, a metric directly influenced by their current resilience measures.

CleanSpark's environmental strategy heavily relies on its commitment to renewable energy, with 95% of its energy consumption derived from sustainable sources in 2023. This focus on clean energy is crucial for its ESG profile, as investor demand for renewable energy credits surged in early 2024. The company also faces the challenge of managing e-waste from rapidly evolving mining hardware, aiming for responsible disposal and material recovery.

| Environmental Factor | CleanSpark's Approach/Impact | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Renewable Energy Use | Prioritizing sustainable energy sources for mining operations. | 95% of energy consumption from sustainable sources in 2023. |

| E-Waste Management | Focus on responsible disposal, recycling, and repurposing of old mining equipment. | Global e-waste generation estimated at 62 million metric tons in 2023. |

| Water Footprint | Addressing water usage for cooling data centers, particularly in arid regions. | Average data center can use millions of gallons of water annually for cooling. |

| Climate Change Resilience | Implementing strategies to mitigate physical risks from extreme weather events. | Reported 99.9% uptime for primary data centers in Q1 2024 due to resilience measures. |

PESTLE Analysis Data Sources

Our CleanSpark PESTLE Analysis is informed by a comprehensive review of government energy policies, economic performance indicators from reputable financial institutions, and technological advancements reported by industry leaders. We also incorporate data on environmental regulations and social trends impacting the clean energy sector.