CleanSpark Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

Understanding the competitive landscape for CleanSpark is crucial, as forces like buyer power and the threat of new entrants significantly shape its market. This brief overview only hints at the intricate dynamics at play within the Bitcoin mining sector.

The complete report reveals the real forces shaping CleanSpark’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Bitcoin mining industry, including companies like CleanSpark, faces a significant challenge due to the limited number of high-efficiency ASIC (Application-Specific Integrated Circuit) manufacturers. This concentration, with giants like Bitmain and MicroBT dominating the market, grants these suppliers considerable influence over pricing and availability.

CleanSpark's reliance on these specialized mining machines makes it vulnerable to supply chain disruptions and price hikes from these few manufacturers. For instance, in 2023, the cost of next-generation ASICs saw significant fluctuations, directly impacting the capital expenditure plans of major mining operations.

This limited choice empowers suppliers, allowing them to dictate terms and potentially increase costs for miners. Any production delays or strategic price adjustments by these dominant ASIC makers can directly affect CleanSpark's operational efficiency and its ability to scale its mining capacity.

Energy is a substantial operational expense for Bitcoin miners, positioning energy providers as critical suppliers. CleanSpark's strategy of sourcing sustainable and cost-effective power grants it some leverage, though regional energy market dynamics, including infrastructure constraints and local demand, can still pose challenges.

The company has secured over 1 gigawatt (GW) of power capacity through contracts, demonstrating a commitment to obtaining favorable pricing and ensuring operational stability. This substantial capacity under contract helps mitigate some of the inherent bargaining power of energy suppliers.

Suppliers for land, construction, and specialized data center equipment like immersion cooling systems possess moderate leverage over CleanSpark. The company's aggressive growth and substantial capital outlays necessitate dependable suppliers, even if these inputs aren't as critical as ASIC miners. For instance, in 2023, CleanSpark invested heavily in expanding its mining capacity, which directly impacts its need for these infrastructure components.

Dependence on Niche Technology

CleanSpark's reliance on specialized Bitcoin mining hardware, specifically Application-Specific Integrated Circuits (ASICs), significantly influences supplier bargaining power. The highly technical and rapidly evolving nature of these machines means that a limited number of manufacturers produce the most efficient models, often measured in Joules per Terahash (J/TH). Access to these cutting-edge ASICs is paramount for maintaining a competitive edge, particularly as Bitcoin halving events reduce block rewards, making energy efficiency a critical determinant of profitability.

The rapid pace of technological advancement in ASIC development means that older, less efficient hardware quickly becomes obsolete. This creates a strong dependence on suppliers who can consistently deliver the latest, most power-efficient machines. For instance, in 2023, the industry saw ASICs with efficiency ratings as low as 20 J/TH, a significant improvement over previous generations. CleanSpark, like other miners, must secure these advanced units to remain cost-effective.

- Supplier Concentration: The ASIC manufacturing market is dominated by a few key players, such as Bitmain and MicroBT, giving them considerable leverage.

- Technological Obsolescence: The constant need for upgraded hardware to maintain efficiency means miners are frequently in the market for new ASICs, reinforcing supplier power.

- Demand Fluctuations: While demand for ASICs can spike with rising Bitcoin prices, securing supply during these periods can be challenging and costly, further empowering suppliers.

- Lead Times and Availability: Obtaining the latest ASIC models often involves long lead times and pre-orders, especially for high-volume purchases, giving suppliers control over allocation.

Tariff and Geopolitical Risks

Recent tariffs on Chinese-made ASIC imports can directly impact CleanSpark's operational costs by increasing the price of essential mining hardware. While CleanSpark has secured a significant portion of its near-term miner needs domestically, ongoing geopolitical tensions and evolving trade policies pose a risk. These factors could strengthen supplier bargaining power by limiting access to alternative international sources or by imposing further import duties, potentially driving up procurement expenses.

- Tariff Impact: Tariffs on imported ASICs can directly increase hardware acquisition costs for CleanSpark.

- Geopolitical Leverage: Trade policies and geopolitical tensions can empower suppliers by restricting alternative sourcing options.

- Domestic Sourcing Mitigation: CleanSpark's focus on domestic sourcing for near-term needs aims to reduce immediate tariff exposure.

- Future Vulnerability: Continued geopolitical instability could still empower suppliers if alternative international sources become less accessible or more expensive.

The bargaining power of ASIC manufacturers for CleanSpark is substantial due to market concentration and technological demands. Limited suppliers of high-efficiency hardware mean miners like CleanSpark are heavily reliant on these few entities for their core operational assets.

In 2023, the cost of advanced ASICs saw considerable volatility, directly impacting CleanSpark's capital expenditure. This dependence on cutting-edge, yet scarce, mining machines allows manufacturers to dictate terms and pricing, influencing CleanSpark's profitability and growth plans.

CleanSpark's strategy to secure over 1 GW of power capacity mitigates some supplier leverage in energy markets. However, regional energy dynamics and infrastructure limitations can still influence costs, even with substantial contracted capacity.

| Supplier Type | Key Suppliers | Leverage Factors | CleanSpark Mitigation |

|---|---|---|---|

| ASIC Manufacturers | Bitmain, MicroBT | Market concentration, technological advancement, limited production capacity | Securing future hardware orders, exploring diverse sourcing options |

| Energy Providers | Regional Power Companies | Energy market dynamics, infrastructure, local demand | Securing long-term power purchase agreements (PPAs), diversifying energy sources |

| Data Center Equipment | Specialized Infrastructure Providers | Need for specialized cooling and construction, capital expenditure | Long-term supplier relationships, bulk purchasing |

What is included in the product

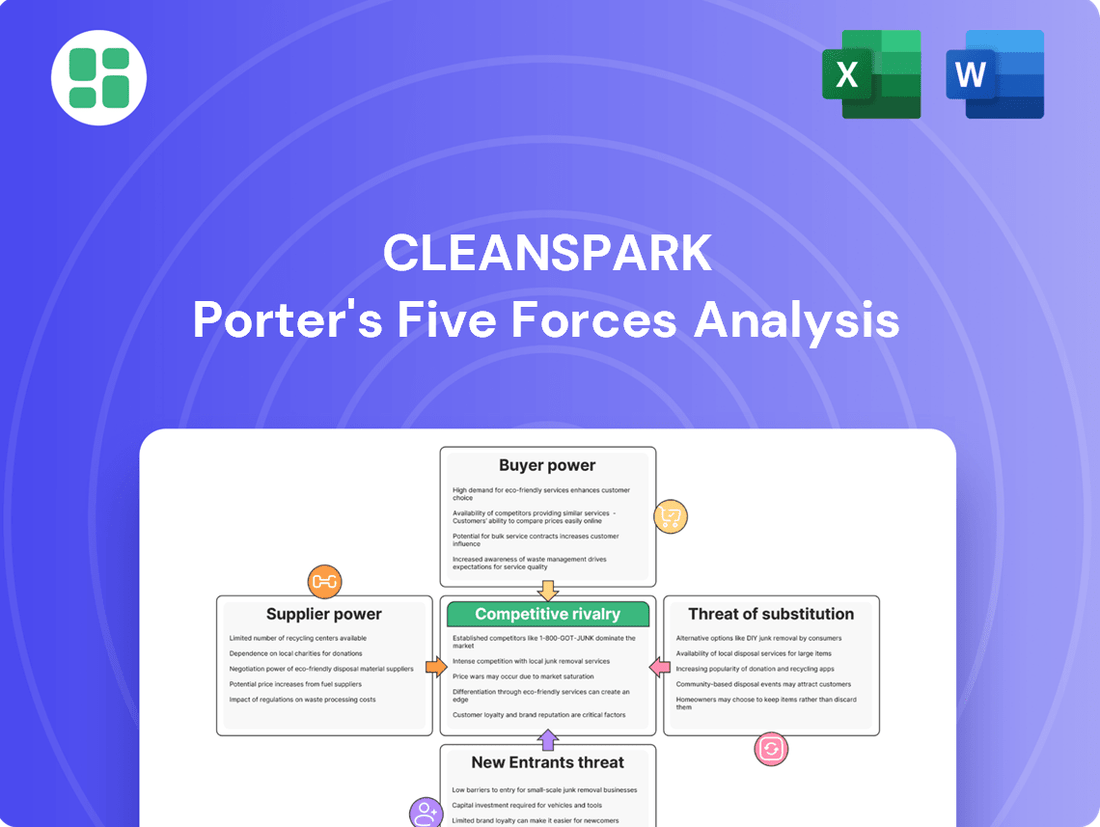

Analyzes the competitive forces impacting CleanSpark, including buyer and supplier power, threat of new entrants and substitutes, and industry rivalry, to understand its market position and strategic opportunities.

Effortlessly visualize competitive intensity with an interactive Porter's Five Forces diagram, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

The bargaining power of customers within CleanSpark's decentralized Bitcoin network is effectively nil. CleanSpark's primary "customer" is the network itself, where miners contribute hash rate to secure transactions and earn Bitcoin rewards. The protocol, not individual miners, dictates the terms of these rewards.

This inherent structure means there's no single customer or group of customers capable of negotiating lower fees or demanding preferential treatment from CleanSpark. The Bitcoin protocol's fixed reward halving schedule and block reward issuance mean that the economic incentives are predetermined and outside the influence of any individual participant.

The output of Bitcoin mining is Bitcoin itself, a digital asset whose price is dictated by the broader global market forces of supply and demand, not by the actions of any single mining company like CleanSpark. This means CleanSpark has no leverage to negotiate prices or influence the value of its mined Bitcoin with end-users or institutional buyers.

Consequently, CleanSpark's revenue is intrinsically linked to the fluctuating market price of Bitcoin and its operational capacity, measured by its share of the global Bitcoin mining hash rate. For instance, as of early 2024, Bitcoin's price has seen significant volatility, directly impacting the revenue potential for miners. CleanSpark's ability to generate revenue is therefore entirely dependent on external market dynamics.

CleanSpark operates with a unique revenue model, generating income from newly mined Bitcoin and transaction fees. This means its direct customer base, in the traditional sense, is non-existent. Unlike companies selling tangible goods or services, CleanSpark's revenue streams are tied to the underlying Bitcoin protocol itself, not to individual consumer choices.

This structure inherently limits the bargaining power of customers because there are no end-users making purchasing decisions that could influence CleanSpark's offerings or pricing. The company's revenue is a function of mining efficiency and network activity, rather than direct sales negotiations. For instance, in 2023, CleanSpark mined 3,478 Bitcoin, demonstrating its output is driven by operational capacity and network conditions, not consumer demand for a specific product.

Impact of Bitcoin Halving

The bargaining power of customers in the Bitcoin mining industry, particularly for companies like CleanSpark, is significantly influenced by the network's inherent structure. Periodic Bitcoin halving events, which reduce the block reward, systematically decrease the payout for the computational effort miners provide to the network. This means miners cannot negotiate with the network itself for higher rewards; instead, they must focus on operational efficiency and scale to remain profitable.

For instance, the most recent halving in April 2024 reduced the block reward from 6.25 BTC to 3.125 BTC. This effectively halves the revenue per block for all miners. To counter this, miners like CleanSpark must achieve lower operating costs per Bitcoin mined.

- Halving Impact: The April 2024 halving cut the block reward to 3.125 BTC, directly impacting miner revenue.

- Efficiency Imperative: Miners must increase hash rate efficiency to maintain profitability against reduced rewards.

- No Customer Negotiation: Miners cannot negotiate with the Bitcoin network as a 'customer' for better terms.

- Focus on Cost Reduction: The primary response to diminished payouts is improving operational economics, not price negotiation.

Market-Driven Profitability

CleanSpark's profitability is intrinsically tied to its operational efficiency, particularly energy costs and hardware performance, and the prevailing market price of Bitcoin. This means the company's financial success is less about direct customer negotiation and more about navigating external market forces.

The bargaining power of customers, in CleanSpark's context, isn't wielded by individual purchasers of their services or products. Instead, it's effectively externalized to the broader cryptocurrency market, specifically the price fluctuations of Bitcoin.

- Bitcoin Price Influence: CleanSpark's revenue is directly correlated with the market price of Bitcoin. As of early 2024, Bitcoin has seen significant price appreciation, which directly boosts CleanSpark's profitability.

- Operational Efficiency as a Buffer: While customer bargaining power is low, CleanSpark's focus on optimizing energy costs and hardware efficiency in its mining operations acts as a critical factor in maintaining margins.

- Market Dynamics Dictate Terms: The company's ability to set prices or negotiate terms is largely dictated by the competitive landscape and the overall demand for Bitcoin mining services, rather than specific customer demands.

- Limited Direct Customer Leverage: Unlike traditional businesses where customers might negotiate bulk discounts or specific service terms, CleanSpark's customer base (those buying Bitcoin or services related to mining) has minimal direct leverage over the company's core profitability drivers.

The bargaining power of customers for CleanSpark is virtually nonexistent due to the nature of Bitcoin mining. CleanSpark's primary output is Bitcoin, a commodity whose price is set by global markets, not by individual buyers. Miners like CleanSpark operate within the Bitcoin protocol, which dictates rewards based on network participation and has predetermined halving events, such as the April 2024 reduction of the block reward from 6.25 BTC to 3.125 BTC.

This means CleanSpark cannot negotiate pricing with its "customers" in the traditional sense. Instead, profitability hinges on operational efficiency and the market price of Bitcoin. For example, in Q1 2024, CleanSpark reported mining 4,165 Bitcoin, with revenue heavily influenced by Bitcoin's price surge during that period.

| Metric | Value (Q1 2024) | Impact on Customer Bargaining Power |

|---|---|---|

| Bitcoin Mined | 4,165 BTC | Output is a commodity, price set by market, not customers. |

| Average BTC Price | ~$47,000 | Directly impacts revenue; no customer negotiation on this price. |

| Operational Efficiency Focus | Emphasis on low energy costs per TH/s | Mitigates impact of reduced block rewards, not customer demands. |

Preview the Actual Deliverable

CleanSpark Porter's Five Forces Analysis

This preview shows the exact CleanSpark Porter's Five Forces analysis you'll receive immediately after purchase, covering industry rivalry, buyer and supplier power, threat of new entrants, and threat of substitutes. You'll gain a comprehensive understanding of the competitive landscape impacting CleanSpark's operations and strategic positioning. No surprises, no placeholders—just the complete, professionally formatted analysis ready for your review.

Rivalry Among Competitors

The Bitcoin mining landscape is fiercely competitive, with major players like Marathon Digital, Riot Platforms, Hut 8, and Core Scientific aggressively scaling their operations. CleanSpark, a notable participant, reached an impressive 50 EH/s of operational hash rate by June 2025, demonstrating its significant capacity.

However, this growth is mirrored across the industry, as competitors are also rapidly increasing their hashing power. This constant expansion fuels a high hash rate competition, where efficiency and scale are paramount for survival and profitability in the Bitcoin mining sector.

Competitive rivalry in the Bitcoin mining sector is intensely focused on operational efficiency, with fleet efficiency (measured in Joules per Terahash) and energy expenses being paramount. CleanSpark highlights its ability to mine Bitcoin at a low cost, bolstered by an average fleet efficiency of 16.07 J/TH. This efficiency is a critical differentiator, particularly for maintaining profitability after Bitcoin halving events, which reduce block rewards.

The capacity to secure capital for acquiring new, more efficient ASICs and expanding data center infrastructure is a crucial element in the competitive landscape of Bitcoin mining. CleanSpark has shown robust financial health, covering all operational costs through its Bitcoin production and growing its treasury without resorting to equity offerings since November 2024. This self-sufficiency in funding provides a significant advantage over competitors who may rely on external financing, which can be volatile.

Sustainable Energy Adoption and ESG Focus

The increasing emphasis on sustainable energy and a robust ESG profile is intensifying competitive rivalry. CleanSpark's commitment to powering its operations with sustainable energy aligns with this trend, potentially attracting environmentally aware investors and securing more cost-effective energy sources over time. For instance, as of early 2024, the global investment in renewable energy projects continued its upward trajectory, with significant capital flowing into solar and wind power, sectors directly relevant to energy-intensive operations like bitcoin mining.

This focus on sustainability can differentiate companies, as seen in the growing number of institutional investors prioritizing ESG metrics in their portfolios. Companies demonstrating strong ESG performance, including a clear strategy for renewable energy integration, are increasingly favored. This competitive pressure encourages all players in the energy and technology sectors to adopt greener practices.

- Growing Investor Demand for ESG: A significant portion of institutional capital is now allocated based on ESG criteria, pushing companies to adopt sustainable practices.

- Cost Advantages of Renewables: The declining cost of renewable energy sources, such as solar and wind power, presents a competitive advantage for firms that can leverage them.

- Regulatory and Societal Pressure: Increasing global regulations and societal expectations are compelling businesses to reduce their carbon footprint and improve their environmental impact.

- Technological Advancements: Innovations in energy storage and grid management are making sustainable energy solutions more viable and scalable for industrial operations.

Geographic Diversification and Infrastructure

Competitive rivalry in the Bitcoin mining sector is intensified by the strategic importance of facility location. Companies vie for access to the cheapest electricity and the most accommodating regulatory landscapes, directly impacting operational costs and profitability. This geographical advantage is a key differentiator.

CleanSpark's proactive approach to geographic diversification significantly bolsters its competitive standing. By establishing operations across multiple states, including Georgia, Mississippi, Tennessee, and Wyoming, the company mitigates risks associated with localized energy price fluctuations or regulatory changes. This distributed footprint is a core element of its competitive strategy.

Furthermore, CleanSpark's investment in its own energy infrastructure, such as the recent acquisition of a 100 MW Bitcoin mining facility in Mississippi, which is powered by a 150 MW solar farm, directly addresses the critical need for low-cost, reliable energy. This vertical integration not only secures a competitive energy cost but also provides a degree of operational control that rivals may lack.

- Strategic Locations: Companies focus on regions with affordable electricity and supportive regulations.

- CleanSpark's Footprint: Operations in Georgia, Mississippi, Tennessee, and Wyoming enhance resilience.

- Infrastructure Investment: Development of energy assets like solar farms provides cost advantages.

- Competitive Edge: Diversification and infrastructure control directly impact profitability and market position.

The Bitcoin mining industry is characterized by intense competition, with companies constantly striving for greater efficiency and scale. CleanSpark's operational hash rate reached 50 EH/s by June 2025, a testament to its growth, but this expansion is mirrored across the sector, driving a high-stakes race for hashing power.

Profitability hinges on operational efficiency, particularly fleet efficiency measured in Joules per Terahash (J/TH) and energy costs. CleanSpark's average fleet efficiency of 16.07 J/TH provides a significant cost advantage, crucial for navigating reduced block rewards post-halving events.

| Metric | CleanSpark (June 2025) | Industry Trend |

|---|---|---|

| Operational Hash Rate | 50 EH/s | Rapidly increasing across major players |

| Fleet Efficiency | 16.07 J/TH | Key differentiator for cost control |

| Capital Access | Self-funded operations since Nov 2024 | External financing can be volatile |

SSubstitutes Threaten

The threat of substitutes for Bitcoin mining is remarkably low. Bitcoin mining is intrinsically linked to the Bitcoin blockchain's Proof-of-Work consensus mechanism, making it the sole method for validating transactions and securing the network. As long as Bitcoin continues to operate using this fundamental process, mining remains an indispensable activity, with no viable alternative process that can fulfill its role.

The primary indirect substitute for Bitcoin mining comes from alternative cryptocurrencies, particularly those employing Proof-of-Stake (PoS) or other less energy-intensive consensus mechanisms. These PoS coins offer a different approach to blockchain security and transaction validation, potentially attracting investors and users seeking more environmentally friendly or capital-efficient digital assets. For instance, by the end of 2024, Ethereum's transition to PoS has significantly reduced its energy consumption, presenting a compelling alternative for those concerned about the environmental impact of mining.

Cloud mining services offer an alternative for individuals to participate in cryptocurrency mining without the capital expenditure and technical challenges of owning hardware. These services allow users to rent mining power, effectively buying access to Bitcoin exposure. For instance, in 2023, the global cloud mining market was valued at approximately $2.3 billion, demonstrating its growing appeal.

However, for a major industrial miner like CleanSpark, cloud mining represents a distinct business model within the broader cryptocurrency landscape, not a direct substitute for its core operations. CleanSpark's strategy focuses on owning and optimizing its large-scale, energy-efficient mining infrastructure, which provides a different value proposition and operational control compared to renting hashing power.

Regulatory Shifts Against PoW

Increasing regulatory scrutiny and environmental concerns surrounding Proof-of-Work (PoW) mining's energy consumption present a significant threat. Governments and international bodies are exploring policies that could favor less energy-intensive blockchain technologies, potentially increasing operational hurdles and costs for PoW miners like CleanSpark.

This regulatory pressure acts as a form of substitution threat by making alternative, more sustainable blockchain consensus mechanisms more attractive. For instance, the growing adoption of Proof-of-Stake (PoS) by major networks like Ethereum demonstrates a clear shift towards greener alternatives.

- Potential for carbon taxes or energy usage caps on PoW mining operations.

- Increased compliance costs for miners to meet evolving environmental standards.

- Investor preference shifting towards companies with more sustainable operational models.

- Emergence of alternative digital assets and blockchain solutions that bypass PoW entirely.

Other Digital Asset Investment Avenues

Investors have numerous ways to gain exposure to digital assets beyond just investing in mining companies. For instance, they can directly purchase cryptocurrencies like Bitcoin or Ethereum, or invest in Bitcoin Exchange-Traded Funds (ETFs) which offer a more regulated and accessible entry point. In 2024, the total market capitalization of cryptocurrencies fluctuated significantly, demonstrating the dynamic nature of these alternative investment avenues. The rise of decentralized finance (DeFi) also presents another avenue, allowing participation in lending, borrowing, and yield farming without traditional intermediaries.

These alternative investment options can divert capital that might otherwise flow into the digital asset mining sector. For example, the approval and subsequent trading of Bitcoin ETFs in early 2024 saw substantial inflows, indicating a strong investor appetite for these products. This diversification of investor capital means that the success of mining companies like CleanSpark is not solely dependent on direct investment in their stock, but also on the broader appeal and accessibility of the digital asset market as a whole.

- Direct Cryptocurrency Purchases: Investors can buy and hold digital assets directly on various exchanges.

- Bitcoin ETFs: Exchange-Traded Funds offer a regulated way to gain exposure to Bitcoin's price movements.

- Decentralized Finance (DeFi): Participation in DeFi protocols allows for earning yields and engaging with digital assets in novel ways.

- Capital Diversion: The availability of these substitutes can reduce the amount of investment directed towards digital asset mining companies.

The threat of substitutes for Bitcoin mining is generally low due to its unique role in securing the Bitcoin network. However, alternative cryptocurrencies using less energy-intensive methods, like Ethereum's Proof-of-Stake, present an indirect substitute. Furthermore, investors can gain exposure to digital assets through direct purchases or Bitcoin ETFs, diverting capital from mining companies.

| Substitute Type | Description | Impact on Mining Companies | 2024 Relevance |

|---|---|---|---|

| Alternative Cryptocurrencies (PoS) | Digital assets using less energy-intensive consensus mechanisms. | Can attract investor capital and developer talent away from PoW. | Ethereum's continued PoS dominance reinforces this trend. |

| Direct Crypto Investment | Buying Bitcoin or other digital assets directly. | Reduces demand for mining-related investments. | Bitcoin ETFs saw significant inflows in early 2024, highlighting this alternative. |

| Cloud Mining | Renting hashing power instead of owning hardware. | Offers an alternative participation method for individuals, not a direct substitute for large miners. | The market was valued at approximately $2.3 billion in 2023, showing continued interest. |

Entrants Threaten

The Bitcoin mining sector demands substantial upfront capital for advanced ASIC miners and expansive data center facilities. This high capital expenditure acts as a significant barrier, deterring potential new entrants who may lack the necessary financial resources to establish a competitive operation.

For instance, CleanSpark's ambitious expansion goal to 50 EH/s in operational hashrate is fully funded, underscoring the considerable financial commitment needed to compete effectively at scale in this industry.

Securing access to reliable and affordable energy is a significant hurdle for new companies entering the Bitcoin mining space. Entrants must contend with the complexities of energy markets, which often involves negotiating lengthy power purchase agreements and potentially substantial upfront investments in energy infrastructure.

CleanSpark, having already secured over 1 gigawatt (GW) of energy capacity under contract, has established a considerable advantage. This pre-existing infrastructure and contractual security significantly lowers the barrier for CleanSpark itself, while simultaneously increasing the difficulty for potential new competitors who lack such established energy relationships and infrastructure.

The threat of new entrants in the Bitcoin mining sector, particularly concerning technological expertise and operational efficiency, remains a significant barrier. Operating large-scale mining facilities efficiently demands specialized technical knowledge in managing sophisticated hardware, implementing advanced cooling solutions like immersion cooling, and optimizing power consumption. CleanSpark, for instance, has cultivated a reputation for its operational efficiency, a factor that presents a steep learning curve for any new player aiming to compete effectively.

Regulatory Uncertainty and Compliance

The cryptocurrency mining sector faces a significant threat from new entrants due to regulatory uncertainty and the associated compliance burdens. Emerging policies regarding energy consumption, taxation, and operational standards can quickly change the cost-effectiveness and legality of mining, creating a substantial barrier for those looking to enter the market without established compliance infrastructure. For instance, in 2024, several jurisdictions continued to debate or implement stricter environmental regulations impacting energy-intensive industries like crypto mining, forcing new players to invest heavily in understanding and adhering to these evolving rules.

New entrants must contend with the substantial upfront investment required to navigate and comply with a patchwork of regulations that vary by region. This includes understanding potential tariffs on imported mining hardware and adapting to environmental mandates that might necessitate costly upgrades or changes in operational location. The unpredictable nature of these regulations means new companies risk significant capital expenditure on infrastructure that could become non-compliant or economically unviable due to policy shifts.

- Regulatory Uncertainty: The evolving landscape of cryptocurrency mining regulations, including potential tariffs and environmental standards, poses a significant challenge for new entrants.

- Compliance Costs: New entrants must invest in understanding and adhering to complex and often changing compliance requirements, which can be substantial.

- Policy Shifts: The risk of policy shifts, such as new environmental regulations or tax laws, can impact the viability of operations for new mining companies.

Economies of Scale and Existing Player Dominance

Established players in the Bitcoin mining industry, including CleanSpark, leverage significant economies of scale. This advantage is evident in their ability to negotiate lower prices for mining hardware and secure more favorable energy contracts, directly impacting their cost per Bitcoin mined. For instance, in Q1 2024, CleanSpark reported an average cost of electricity of 6.7 cents per kilowatt-hour, a rate likely difficult for smaller, newer entrants to match.

The ongoing consolidation within the sector further erects barriers to entry. Larger, well-capitalized companies can absorb market fluctuations and invest in next-generation, more efficient mining equipment, creating a competitive moat. This trend makes it increasingly challenging for smaller operations to gain traction and compete on cost or operational efficiency.

- Economies of Scale: Large miners like CleanSpark benefit from bulk purchasing of ASICs and discounted energy rates, reducing their operational costs.

- Industry Consolidation: Mergers and acquisitions are concentrating market share among established players, increasing capital requirements for new entrants.

- Capital Intensity: The high cost of advanced mining hardware and infrastructure necessitates substantial upfront investment, deterring smaller competitors.

- Operational Expertise: Experienced operators possess refined strategies for energy management, hardware maintenance, and network optimization, which are difficult for newcomers to replicate quickly.

The Bitcoin mining industry presents a considerable threat from new entrants, primarily due to the immense capital required for advanced hardware and energy infrastructure. Established companies like CleanSpark have secured significant energy contracts, with CleanSpark having over 1 GW under contract, making it difficult for newcomers to match these favorable terms. Furthermore, the sector's ongoing consolidation, driven by larger, well-funded entities, concentrates market power and raises the bar for new participants seeking to achieve economies of scale.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of ASIC miners and data centers. | Deters entrants lacking substantial financial backing. |

| Energy Access & Cost | Securing reliable, affordable power is complex. | New entrants struggle to match pre-negotiated rates like CleanSpark's 6.7 cents/kWh in Q1 2024. |

| Operational Expertise | Requires specialized knowledge in hardware and efficiency. | New entrants face a steep learning curve to achieve competitive efficiency. |

| Regulatory Landscape | Evolving policies create compliance challenges. | New entrants must invest heavily in understanding and adhering to varying regulations. |

Porter's Five Forces Analysis Data Sources

Our CleanSpark Porter's Five Forces analysis is built upon a foundation of diverse data sources, including company annual reports, SEC filings, and industry-specific market research reports. This ensures a comprehensive understanding of the competitive landscape.