CleanSpark Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

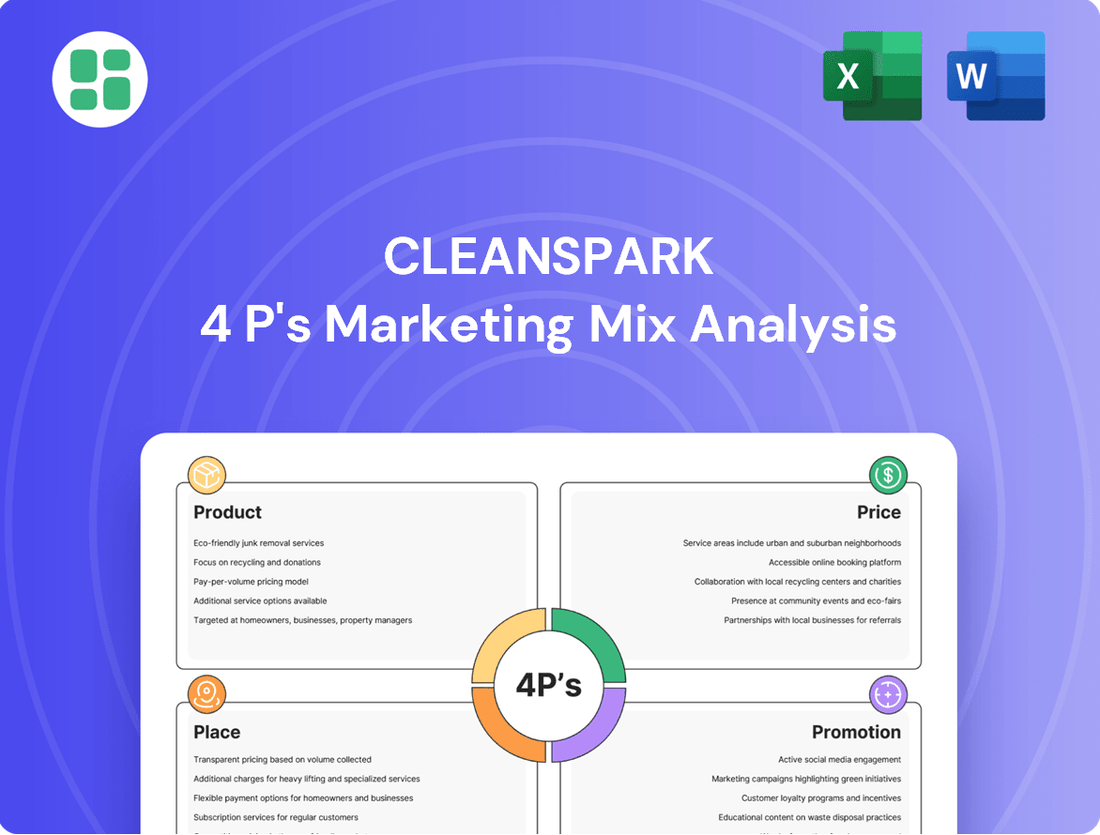

Discover how CleanSpark leverages its product innovation, competitive pricing, strategic distribution, and impactful promotions to dominate the Bitcoin mining industry. This analysis goes beyond surface-level observations, offering a comprehensive breakdown of each element.

Ready to elevate your own marketing strategy? Access the full, editable 4P's Marketing Mix Analysis for CleanSpark and gain actionable insights, real-world examples, and a structured framework you can apply immediately.

Product

CleanSpark's core offering is the efficient production of Bitcoin, utilizing cutting-edge mining hardware to achieve high output relative to energy consumed. This focus on efficiency is crucial for profitability in a competitive landscape.

The company consistently invests in the newest ASIC miners, such as the Antminer S21, to bolster its position in the global hash rate and enhance mining margins. For instance, as of Q1 2024, CleanSpark reported a fleet efficiency of 22.2 joules per terahash (J/TH), a significant improvement over industry averages.

CleanSpark's dedication to integrating sustainable energy into its operations is a significant differentiator, bolstering its Environmental, Social, and Governance (ESG) standing. This strategic choice appeals to investors prioritizing sustainability and can lead to long-term cost savings through the adoption of renewable energy. For instance, CleanSpark has actively pursued solar power for its facilities, aiming to reduce its carbon footprint and operational expenses.

CleanSpark's product, Scalable Bitcoin Production Capacity, focuses on rapidly increasing its Bitcoin output. This is achieved through a strategy of acquiring and expanding its mining facilities, directly boosting its hash rate. For instance, as of Q1 2024, CleanSpark announced the acquisition of a new facility in Mississippi, adding 100 petahashes per second (PH/s) to its operations. This expansion is a key driver for investors looking at the company's Bitcoin production volume.

Energy Infrastructure Development

CleanSpark's commitment to energy infrastructure development goes beyond simply mining Bitcoin. They actively invest in and build out the essential power systems to ensure reliable and cost-effective operations. This strategic approach is crucial for managing the significant energy demands of their large-scale Bitcoin mining facilities.

By securing power purchase agreements (PPAs) and constructing dedicated substations, CleanSpark aims to achieve greater control over their energy supply and costs. For instance, in 2023, the company highlighted its efforts to secure favorable energy rates, a key component of their infrastructure strategy. This vertical integration enhances operational resilience and provides a predictable cost structure, which is vital in the volatile energy market.

The benefits of this infrastructure focus are tangible:

- Enhanced Operational Reliability: Direct control over energy supply minimizes disruptions.

- Long-Term Cost Stability: PPAs and self-built infrastructure can lock in lower energy prices.

- Strategic Advantage: Reduces dependence on fluctuating grid prices and availability.

- Support for Scalability: Ensures sufficient and stable power for future expansion of mining operations.

Optimized Operational Performance

CleanSpark's product extends beyond the physical hardware to encompass highly optimized mining operations. This focus on maximizing uptime and reducing operational costs directly translates into a more robust and reliable Bitcoin production capability, driving overall profitability.

The company's commitment to operational excellence is evident in its efficient management of its mining fleet. This strategic approach ensures that their infrastructure is consistently performing at peak capacity, a critical factor in the competitive cryptocurrency mining landscape.

- Maximizing Uptime: CleanSpark aims for industry-leading uptime percentages to ensure continuous Bitcoin generation.

- Reducing Operational Costs: Efficiency in energy consumption and maintenance keeps their cost per Bitcoin competitive.

- Fleet Management: Advanced systems monitor and optimize the performance of their entire mining rig inventory.

- Reliable Production: These operational efficiencies contribute to a more predictable and profitable Bitcoin output.

CleanSpark's product strategy centers on scalable and efficient Bitcoin production, driven by continuous investment in advanced ASIC mining hardware like the Antminer S21. This commitment to technological superiority ensures they maintain a competitive edge in hash rate and operational efficiency, as demonstrated by their fleet efficiency of 22.2 J/TH in Q1 2024.

Their product offering also includes robust energy infrastructure development, securing reliable and cost-effective power through PPAs and dedicated substations. This focus on energy independence, exemplified by their pursuit of solar power, enhances operational stability and supports future expansion plans.

Furthermore, CleanSpark excels in operational optimization, maximizing mining uptime and minimizing costs through advanced fleet management. This dedication to efficiency ensures consistent Bitcoin generation and profitability, making their production capacity a key value proposition.

| Product Aspect | Description | Key Metric/Example (as of Q1 2024) |

|---|---|---|

| Scalable Bitcoin Production Capacity | Rapidly increasing Bitcoin output through facility acquisition and expansion. | Acquisition of Mississippi facility adding 100 PH/s. |

| Advanced Mining Hardware | Utilizing cutting-edge ASIC miners for high output and efficiency. | Fleet efficiency of 22.2 J/TH. |

| Energy Infrastructure Development | Investing in power systems for reliable and cost-effective operations. | Pursuit of solar power integration. |

| Optimized Mining Operations | Maximizing uptime and reducing operational costs for robust Bitcoin production. | Focus on industry-leading uptime percentages. |

What is included in the product

This analysis offers a comprehensive deep dive into CleanSpark's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's ideal for managers, consultants, and marketers seeking a complete breakdown of CleanSpark’s marketing positioning, with each element thoroughly explored with examples and strategic implications.

Cleanspark's 4P's Marketing Mix Analysis provides a clear roadmap to address common challenges in product positioning and customer engagement.

This analysis cuts through market complexity, offering actionable strategies to optimize pricing and distribution for maximum impact.

Place

CleanSpark's 'place' in its marketing mix centers on its strategically positioned Bitcoin mining farms, primarily situated within the United States. These locations are meticulously selected for their access to dependable and cost-effective energy, a crucial factor for optimizing operational efficiency and enabling scalable capacity. For instance, as of Q1 2024, CleanSpark operated over 100,000 S19j Pro miners, with a significant portion of their infrastructure benefiting from these favorable energy markets, contributing to their competitive cost per megawatt-hour.

CleanSpark's strategy of establishing direct energy grid connections, often secured by long-term power purchase agreements (PPAs), is a cornerstone of its operational efficiency. This approach provides a predictable and cost-controlled energy supply, vital for its energy-intensive bitcoin mining activities.

By directly interfacing with energy providers, CleanSpark significantly reduces its exposure to the volatile energy market. For instance, in Q1 2024, the company reported an average energy cost of $0.04 per kilowatt-hour, a figure that benefits from these direct agreements and is considerably lower than many industry averages, thereby bolstering its mining profitability.

While CleanSpark's physical mining operations are tied to specific geographic locations, the mined Bitcoin itself is a purely digital asset. This means that once mined, it's instantly transferred to the company's secure digital wallets, eliminating traditional distribution channels. This inherent digital nature ensures global accessibility and immediate liquidity for the mined Bitcoin.

This digital distribution allows CleanSpark to readily convert its mined Bitcoin into fiat currency or hold it as a treasury asset. For instance, in Q1 2024, CleanSpark reported holding 1,557 BTC on its balance sheet, valued at approximately $65,000 per BTC at the time, showcasing the immediate utility of their digital product.

Supply Chain for Miner Acquisition

CleanSpark's 'place' strategy extends to its global supply chain for acquiring cutting-edge Bitcoin mining hardware. This involves securing high-efficiency machines from leading manufacturers, ensuring a consistent flow of the latest technology to power their operations. For instance, in early 2024, CleanSpark announced significant ASIC orders, including the latest generation models, to bolster their fleet. This strategic procurement is crucial for maintaining a competitive edge and facilitating ongoing growth.

Efficient logistics and timely delivery are paramount for CleanSpark's expansion plans. The ability to quickly deploy new mining rigs to their operational sites directly impacts their capacity to mine Bitcoin and capitalize on market opportunities. Their commitment to this aspect of the supply chain was evident in Q1 2024 when they successfully integrated a substantial number of new machines, contributing to their increased hashrate. This operational efficiency is a key differentiator.

- Global Sourcing: CleanSpark sources advanced ASIC miners from manufacturers like Bitmain and MicroBT.

- Logistical Prowess: The company prioritizes efficient shipping and customs clearance for rapid deployment.

- Technological Advancement: Acquiring the latest, most energy-efficient hardware is central to their strategy.

- Fleet Expansion: In 2024, CleanSpark aimed to significantly increase its total hashrate through hardware acquisitions.

Proximity to Energy Infrastructure Development

CleanSpark's strategy for 'Place' in its marketing mix heavily emphasizes developing energy infrastructure in close proximity to its bitcoin mining operations. This is crucial for ensuring a stable and cost-effective power supply, a key component for efficient mining. For instance, their expansion plans often include building or upgrading substations and power lines to directly support their facilities.

This integrated approach to infrastructure development allows CleanSpark to optimize power resources as their mining capacity scales. By controlling or having direct access to essential energy infrastructure, they can mitigate risks associated with grid instability and fluctuating energy prices. This proactive development of the 'Place' element is designed to directly support and enhance their operational efficiency and growth trajectory.

- Proximity Advantage: Developing energy infrastructure near mining sites reduces transmission losses and costs.

- Capacity Alignment: Ensures power availability scales with increasing mining hardware deployment.

- Operational Control: Greater control over power delivery and quality for consistent mining performance.

- Cost Optimization: Direct infrastructure development can be more cost-effective than relying solely on third-party providers in remote areas.

CleanSpark's 'place' strategy leverages strategically located Bitcoin mining facilities in the United States, prioritizing access to affordable and reliable energy. This focus on energy cost optimization is critical for their operational efficiency and scalability. For example, as of Q1 2024, the company's operational efficiency was bolstered by over 100,000 S19j Pro miners, many of which benefited from these favorable energy markets, contributing to a competitive cost per megawatt-hour.

The company's direct grid connections and long-term power purchase agreements (PPAs) are central to ensuring a stable and cost-controlled energy supply for their energy-intensive operations. This direct interface minimizes exposure to volatile energy markets. In Q1 2024, CleanSpark reported an average energy cost of $0.04 per kilowatt-hour, significantly lower than many industry averages, directly boosting mining profitability.

The mined Bitcoin itself is a digital asset, allowing for instant transfer to secure digital wallets, bypassing traditional distribution channels and offering global accessibility and immediate liquidity. This digital nature enables CleanSpark to efficiently convert mined Bitcoin to fiat or hold it as a treasury asset, as demonstrated by their Q1 2024 holdings of 1,557 BTC.

| Metric | Q1 2024 Value | Significance |

|---|---|---|

| Miner Fleet Size | Over 100,000 S19j Pro | Indicates substantial operational capacity |

| Average Energy Cost | $0.04 per kWh | Demonstrates cost advantage through direct agreements |

| BTC Holdings | 1,557 BTC | Highlights immediate liquidity and treasury strategy |

Same Document Delivered

CleanSpark 4P's Marketing Mix Analysis

The preview shown above is identical to the final version of the CleanSpark 4P's Marketing Mix Analysis you'll download. You are viewing the exact, fully completed document that will be instantly accessible after your purchase, ensuring no surprises. Buy with full confidence knowing you're getting the real deal, ready for immediate use.

Promotion

CleanSpark actively engages its investor base through comprehensive investor relations, including detailed financial reporting and quarterly earnings calls. This commitment ensures transparency and provides key stakeholders with up-to-date information on the company's financial health and strategic direction.

The company's investor presentations and regular updates are vital for conveying its progress in the energy sector, particularly its advancements in microgrid and distributed energy solutions. These communications are designed to resonate with a diverse audience of individual investors, financial professionals, and business strategists.

For instance, CleanSpark's Q1 2024 earnings report highlighted a significant revenue increase, demonstrating the effectiveness of its operational strategies and market positioning. Such data-driven disclosures are fundamental to building investor confidence and attracting further capital for growth initiatives.

CleanSpark strategically leverages public relations to craft a compelling narrative centered on its rapid growth, operational advancements, and dedication to sustainable energy solutions. This proactive approach aims to solidify its position as a leader in the sector.

By actively engaging with prominent financial news outlets and specialized industry publications, CleanSpark enhances its brand visibility and cultivates credibility. This media presence is crucial for attracting and reassuring potential investors and fostering valuable business partnerships.

In the first quarter of 2024, CleanSpark reported a significant 145% increase in revenue compared to the same period in 2023, a testament to its expanding market presence and the effectiveness of its communication strategies in highlighting operational successes.

CleanSpark emphasizes its commitment to Environmental, Social, and Governance (ESG) principles, notably its utilization of sustainable energy for Bitcoin mining operations. This focus resonates with investors increasingly valuing ethical business conduct and sets CleanSpark apart in a competitive landscape.

In 2023, CleanSpark reported that 95% of its energy consumption for Bitcoin mining came from sustainable sources, a significant figure that underscores its dedication to environmental responsibility.

This proactive communication about ESG initiatives is crucial for attracting capital from ESG-focused funds, which saw substantial inflows in 2024, demonstrating a clear market demand for sustainable investments.

Industry Conferences and Partnerships

CleanSpark actively participates in major cryptocurrency and energy industry conferences, such as the Bitcoin mining conferences and renewable energy expos. These events are crucial for demonstrating their technological advancements and operational efficiency to a global audience of investors and potential collaborators. For instance, in 2024, CleanSpark executives presented at multiple industry-leading events, highlighting their sustainable mining practices and energy solutions.

These conferences offer a vital avenue for CleanSpark to forge strategic partnerships within the blockchain and energy sectors. By engaging directly with financial analysts, industry leaders, and other stakeholders, the company can solidify its market position and explore new business development opportunities. Their presence at these gatherings in late 2024 and early 2025 has been instrumental in building relationships that support future growth.

- Showcasing Expertise: CleanSpark leverages these platforms to present its innovations in Bitcoin mining and energy management, reinforcing its reputation as a leader.

- Networking Opportunities: Conferences facilitate direct interaction with potential partners, investors, and key industry players, fostering valuable business connections.

- Talent Acquisition: These events also serve as a recruitment ground, allowing CleanSpark to attract top talent in engineering, finance, and operations.

- Market Visibility: Participation enhances brand awareness and provides direct engagement with the financial community, crucial for investor relations.

Digital Presence and Corporate Website

CleanSpark's corporate website acts as a vital information nexus, offering in-depth details on its operations, financial performance, and environmental, social, and governance (ESG) initiatives. This digital platform ensures that a broad audience, including financial analysts, investors, and other interested parties, can easily access current and comprehensive data.

A robust digital footprint is crucial for maintaining transparency and accessibility in today's market. CleanSpark leverages its online presence to disseminate key information, fostering trust and facilitating informed decision-making among its stakeholders.

- Website Functionality: Serves as the primary source for company news, investor relations materials, and product information.

- Information Accessibility: Provides easy access to SEC filings, quarterly earnings reports, and sustainability disclosures.

- Stakeholder Engagement: Facilitates communication with investors, media, and the general public through updated content and contact channels.

- Brand Representation: Showcases the company's mission, values, and technological advancements in the Bitcoin mining and energy sectors.

CleanSpark's promotional efforts are multifaceted, focusing on transparent investor relations, strategic public relations, and active industry engagement. The company leverages financial news outlets and industry publications to build brand visibility and credibility, directly impacting investor confidence and partnership opportunities.

In Q1 2024, CleanSpark reported a 145% revenue increase, underscoring the effectiveness of its communication strategies in highlighting operational successes and attracting capital. Their commitment to ESG principles, with 95% of 2023 Bitcoin mining energy from sustainable sources, further appeals to a growing segment of environmentally conscious investors.

Participation in key industry conferences in 2024 and early 2025 allows CleanSpark to showcase technological advancements and forge strategic partnerships, reinforcing its leadership in sustainable Bitcoin mining and energy solutions.

The company's corporate website serves as a critical hub for information, providing accessible data on operations, financial performance, and ESG initiatives, crucial for informed decision-making by a diverse stakeholder base.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Revenue | $65.4 million | $26.7 million | +145% |

| Sustainable Energy Usage (2023) | 95% | N/A | N/A |

Price

CleanSpark's pricing strategy is deeply rooted in its commitment to operational efficiency and rigorous cost management, especially concerning energy expenses and hardware procurement. This focus allows them to achieve a lower cost per Bitcoin mined, bolstering profitability even when Bitcoin prices are volatile.

For instance, in Q1 2024, CleanSpark reported a total operating cost of $4,780 per Bitcoin, a significant improvement from previous periods. This efficiency directly influences their ability to maintain competitive operations and potentially offer favorable terms or reinvest profits effectively.

CleanSpark's primary revenue stream is directly tied to the market price of Bitcoin, making its 'price' component exceptionally volatile. The company's financial health is therefore intrinsically linked to Bitcoin's value against fiat currencies, a market known for significant fluctuations. For instance, Bitcoin experienced a notable surge in early 2024, reaching all-time highs above $70,000, which directly benefited Bitcoin miners like CleanSpark by increasing the dollar value of their mined assets.

Energy procurement is a significant factor in CleanSpark's operational costs, directly impacting its effective price of production. The company's ability to secure strategic power purchase agreements and access low-cost, sustainable energy sources is paramount for maintaining competitive mining margins.

For instance, in Q1 2024, CleanSpark reported an average energy cost of $0.06 per kilowatt-hour (kWh) across its operations. This figure highlights the critical nature of managing these expenses to ensure profitability in the competitive Bitcoin mining landscape.

Hash and Network Difficulty

The hash price, representing the revenue generated per unit of hash rate, is a critical factor impacting mining profitability. CleanSpark's approach focuses on maximizing its hash rate deployment to capitalize on these fluctuating network economics.

The difficulty of the Bitcoin network, which adjusts approximately every two weeks to maintain a consistent block discovery time, directly influences the cost of mining. As of early July 2025, the Bitcoin network difficulty is estimated to be around 75-80 trillion. This dynamic difficulty level means CleanSpark must continuously optimize its operations to maintain profitability.

- Hash Price Dynamics: In June 2025, the Bitcoin hash price hovered around $0.07-$0.08 per TH/s per day, a figure that fluctuates with Bitcoin's market price and the network's overall hash rate.

- Difficulty Adjustments: The network difficulty saw its last adjustment in late June 2025, increasing by approximately 3-5% to maintain the ~10-minute block target.

- CleanSpark's Optimization: CleanSpark's strategy aims to leverage efficient mining hardware and strategic energy procurement to offset the impact of rising difficulty and maintain a competitive hash price advantage.

Capital Allocation and Investment Returns

From an investor's viewpoint, CleanSpark's stock price is a direct reflection of how the market values its future ability to mine Bitcoin, how efficiently it operates, and its potential for growth. For instance, as of early 2024, CleanSpark's stock has shown significant volatility, influenced by Bitcoin's price movements and the company's operational updates.

The company's strategic decisions regarding capital allocation, such as acquiring new mining equipment or expanding its data center infrastructure, are crucial. These investments directly shape how investors perceive CleanSpark's future value and, consequently, their potential returns. For example, CleanSpark announced in January 2024 the acquisition of an additional 10,000 S21 Antminer units, a significant capital deployment aimed at boosting its Bitcoin production capacity.

- Market Valuation: CleanSpark's stock price is tied to its projected Bitcoin output and operational efficiency, with investor sentiment heavily influenced by the fluctuating price of Bitcoin itself.

- Capital Deployment Impact: Investments in new mining hardware, like the 10,000 S21 Antminers acquired in early 2024, directly impact the company's production capacity and, therefore, its perceived investor value.

- Efficiency as a Driver: Operational efficiency, measured by metrics like cost per Bitcoin mined, is a key factor in determining the attractiveness of CleanSpark's stock to investors seeking returns.

- Future Growth Potential: The market prices in CleanSpark's ability to scale its operations and capitalize on future Bitcoin market opportunities, making capital allocation decisions critical for share price appreciation.

CleanSpark's pricing strategy is fundamentally linked to the volatile Bitcoin market, where the value of its mined assets fluctuates daily. The company's ability to maintain profitability hinges on its low operational costs, particularly energy expenses, which were around $0.06 per kWh in Q1 2024. This cost structure allows CleanSpark to remain competitive even during periods of lower Bitcoin prices.

The effective price of Bitcoin mining for CleanSpark is influenced by network difficulty, which is projected to be between 75-80 trillion by July 2025. This increasing difficulty necessitates continuous operational optimization to maintain a favorable hash price, which was approximately $0.07-$0.08 per TH/s per day in June 2025.

Investor perception of CleanSpark's stock price is directly tied to its mining efficiency and future Bitcoin production capacity. Strategic capital deployments, such as the acquisition of 10,000 S21 Antminer units in early 2024, are key drivers of this valuation, reflecting the market's confidence in the company's growth potential.

| Metric | Q1 2024 | June 2025 (Est.) | July 2025 (Est.) |

|---|---|---|---|

| Operating Cost per BTC | $4,780 | N/A | N/A |

| Average Energy Cost | $0.06/kWh | N/A | N/A |

| Bitcoin Network Difficulty | N/A | 75-80 Trillion | 75-80 Trillion |

| Hash Price | N/A | $0.07-$0.08 / TH/s/day | N/A |

4P's Marketing Mix Analysis Data Sources

Our CleanSpark 4P's Marketing Mix Analysis is constructed using a diverse range of verifiable data sources. This includes official company filings, investor relations materials, and direct communication from CleanSpark itself. We also incorporate industry-specific reports and market intelligence to provide a comprehensive view.