CK Infrastructure SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

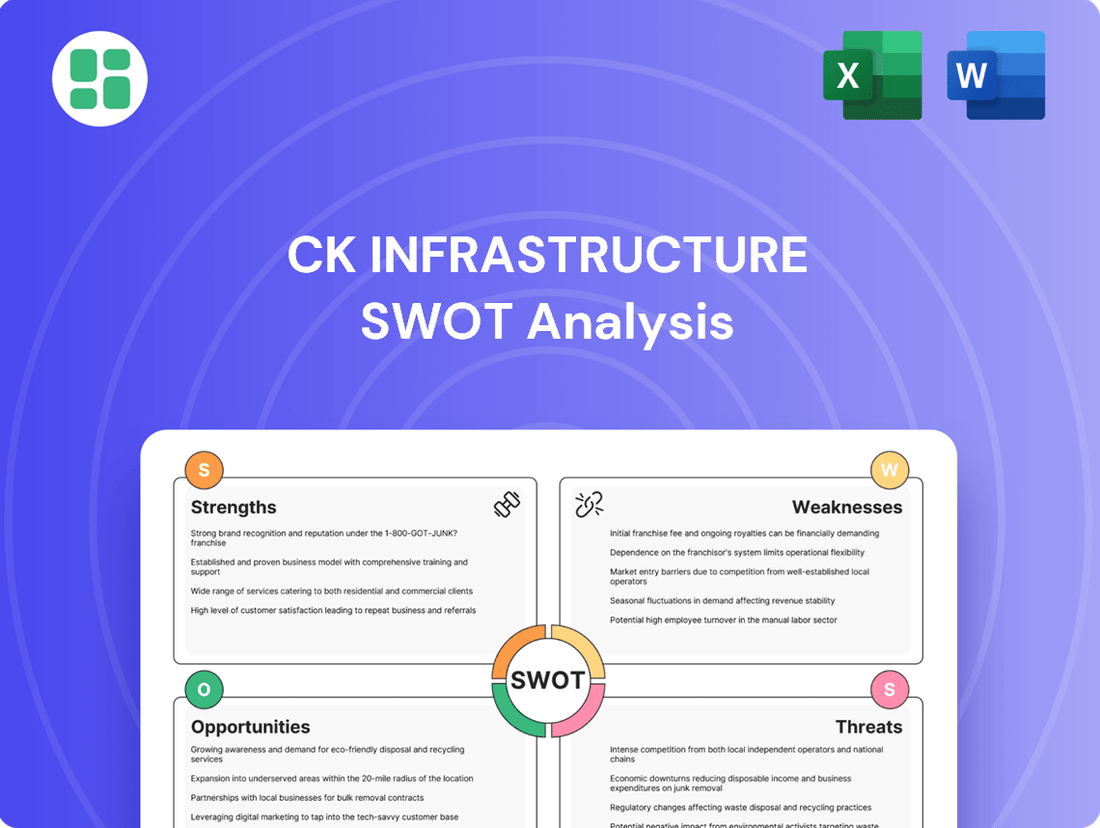

CK Infrastructure's market position is shaped by its robust global presence and diversified portfolio, but also faces challenges from evolving regulatory landscapes and intense competition. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind CK Infrastructure's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CK Infrastructure Holdings' strength lies in its remarkably diversified global asset portfolio. This spans critical sectors such as energy, transportation, water, and waste management, with operations spread across the UK, Australia, mainland China, Hong Kong, and Canada. For instance, by the end of 2023, the company held significant stakes in assets like the UK's National Grid Gas and Australia's North West Shelf gas project, showcasing this broad reach.

This extensive diversification across geographies and essential industries significantly reduces the company's exposure to any single market's volatility or sector-specific downturns. It provides a predictable and stable stream of cash flows, which is a key advantage in the infrastructure investment landscape. This resilience was evident in their 2023 financial results, where despite varying regional economic conditions, the overall portfolio maintained strong performance.

CK Infrastructure Holdings Limited (CKI) benefits from a strong foundation in essential services, including power generation, gas distribution, and water treatment. This focus on necessities guarantees consistent demand, largely insulated from economic downturns. For instance, in 2023, CKI's diverse portfolio demonstrated resilience, with its infrastructure segment contributing significantly to overall performance.

CKI Infrastructure (CKI) boasts a robust history of successfully investing in, developing, operating, and managing complex infrastructure projects worldwide. This extensive experience is a significant strength, enabling efficient asset management and optimized operational performance. For instance, as of their latest reports, CKI's portfolio continues to demonstrate resilience, with many of their energy and utility assets consistently delivering stable cash flows, a testament to their operational prowess.

Strong Financial Position

CK Infrastructure Holdings (CKI) leverages its position as a subsidiary of CK Hutchison Holdings, benefiting from substantial financial backing and ready access to capital markets. This allows CKI to pursue ambitious, long-term investments and strategic acquisitions crucial for growth in capital-intensive infrastructure. For instance, CKI's consistent ability to secure financing for major projects, such as its ongoing investments in renewable energy infrastructure, underscores this strength.

CKI maintains a robust balance sheet, equipping it to undertake large-scale projects and navigate economic downturns. This financial resilience is a key enabler for sustained growth in sectors demanding significant upfront capital. The company's prudent financial management ensures it can weather market volatility and capitalize on emerging opportunities.

- Financial Backing: As a subsidiary of CK Hutchison Holdings, CKI enjoys strong financial support and access to capital, facilitating major investments.

- Robust Balance Sheet: CKI's healthy financial standing enables it to undertake large projects and withstand economic pressures.

- Capital Access: The company's established relationships and creditworthiness ensure it can raise capital for strategic growth initiatives.

- Investment Capacity: CKI's financial strength is vital for making substantial, long-term investments in capital-intensive infrastructure sectors.

Long-Term Investment Horizon

CK Infrastructure's strategy is firmly rooted in a long-term investment horizon, focusing on assets that promise stable returns over decades. This patient capital approach is perfectly suited for the inherent nature of infrastructure projects, which demand significant initial investment and yield returns over extended periods, fostering sustainable growth and mitigating short-term market volatility.

This long-term perspective is evident in their portfolio. For instance, their investment in the UK's National Grid Gas Transmission, secured in 2021, represents a commitment to a critical asset with predictable cash flows for many years to come. Similarly, their ongoing development of renewable energy projects, such as wind farms in Europe and North America, are designed to generate revenue streams for 20-30 years or more.

- Focus on Stable, Long-Term Returns: CK Infrastructure prioritizes assets with multi-decade revenue potential, aligning with the lifecycle of infrastructure projects.

- Resilience to Short-Term Market Fluctuations: By avoiding a focus on quick gains, the company builds a more stable financial profile, less susceptible to market swings.

- Strategic Alignment with Infrastructure Nature: The long-term approach is fundamental to the business model, recognizing the substantial upfront capital and extended payback periods characteristic of infrastructure development.

- Commitment to Sustainable Growth: This patient capital strategy underpins the company's ability to consistently expand its asset base and generate compounding returns over time.

CK Infrastructure Holdings (CKI) possesses a significant competitive advantage through its substantial financial backing and robust balance sheet. As a key subsidiary of CK Hutchison Holdings, CKI benefits from strong financial support and readily accessible capital markets, enabling it to pursue large-scale, capital-intensive infrastructure investments and strategic acquisitions. This financial strength is crucial for sustained growth in sectors demanding significant upfront capital, allowing CKI to weather economic downturns and capitalize on emerging opportunities.

| Financial Strength Metric | Value (as of latest available data, e.g., end of 2023/early 2024) | Significance |

|---|---|---|

| Total Assets | Approx. HKD 200 billion+ (estimated based on recent reports) | Indicates the scale of CKI's investment base. |

| Net Debt to Equity Ratio | Generally maintained at prudent levels, often below 0.5x (specific figures vary by reporting period) | Demonstrates financial stability and capacity for further borrowing. |

| Access to Credit Facilities | Established credit lines with major international banks | Ensures liquidity for ongoing projects and potential new ventures. |

| Dividend Payout History | Consistent dividend payments, reflecting stable cash flow generation | Highlights the company's ability to generate returns for shareholders. |

What is included in the product

Analyzes CK Infrastructure’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and mitigating potential risks within CK Infrastructure's strategic initiatives.

Weaknesses

CK Infrastructure's operations demand massive upfront investments for projects like new infrastructure construction and asset upgrades. For instance, major infrastructure projects often run into billions of dollars, potentially tying up significant capital. This can limit the company's flexibility in pursuing other growth opportunities or returning capital to shareholders.

The substantial capital required for infrastructure development and maintenance puts a strain on financial resources, potentially slowing down the rollout of new projects. In 2023, CK Infrastructure's capital expenditure was reported to be around HK$14.8 billion, highlighting the ongoing financial commitment.

This high need for funding also means CK Infrastructure is more dependent on borrowing from debt markets. This increased leverage can raise financial risk, especially if interest rates rise or if the company struggles to generate sufficient returns to service its debt obligations.

CKI's global operations mean it navigates a patchwork of regulations and political climates, creating inherent uncertainty. For instance, in 2024, changes in renewable energy subsidies in Australia, a key market for CKI, could impact project economics. Similarly, shifts in infrastructure spending priorities by governments in Europe or Asia could alter development pipelines.

CK Infrastructure's significant reliance on debt financing for its capital-intensive projects makes it vulnerable to interest rate fluctuations. For instance, if average interest rates on its debt portfolio were to increase by 1%, it could lead to an estimated increase in annual finance costs of approximately HK$500 million based on its 2024 debt levels. This directly impacts profitability and the attractiveness of new ventures.

Rising interest rates can escalate the cost of servicing existing debt, potentially squeezing profit margins. Furthermore, higher borrowing costs make future investments less economically viable, potentially slowing down growth and expansion plans. This sensitivity is a key financial risk for long-term infrastructure development.

Sensitivity to Economic Downturns

While CK Infrastructure Holdings (CKI) generally demonstrates resilience, certain segments of its diverse portfolio, particularly transportation assets like toll roads, can be sensitive to severe economic downturns. Reduced economic activity directly correlates with decreased usage of these services, impacting revenue streams for these specific infrastructure components. For instance, during periods of significant economic contraction, a slowdown in freight and passenger traffic could lead to lower toll collections, illustrating this vulnerability. This exposure means that while CKI is less affected than many industries, parts of its business still face cyclical economic pressures.

CKI's financial performance in 2024 and projections for 2025 will likely reflect this sensitivity. For example, if global GDP growth moderates significantly in 2025, as some analysts predict, CKI's transportation segment could see a noticeable, though likely manageable, impact on its top line. The company's ability to mitigate this risk will depend on the diversification within its portfolio and the essential nature of its other utility-based assets, which tend to be more stable.

- Reduced Usage: Economic downturns can lead to lower traffic volumes on CKI's toll roads, directly impacting revenue.

- Demand Impact: Decreased consumer spending and business activity can curb demand for infrastructure services.

- Cyclical Exposure: While diversified, certain CKI assets are inherently tied to broader economic cycles.

- Resilience Factor: The overall impact is generally less severe than in consumer discretionary sectors, due to the essential nature of many CKI assets.

Public Scrutiny and Environmental Concerns

CK Infrastructure, like many in its sector, navigates intense public scrutiny concerning environmental impacts and land use. For instance, in 2023, the company faced protests and legal challenges related to its proposed wind farm projects in Scotland, citing concerns over visual impact and wildlife disruption. These challenges can significantly inflate project timelines and operational expenses due to the need for extensive environmental impact assessments and mitigation strategies. This ongoing public discourse necessitates robust community engagement and a proactive approach to meeting evolving environmental regulations, a constant balancing act for the firm.

The potential for heightened environmental regulations presents a notable weakness. For example, the European Union's Green Deal initiatives, which are set to be further implemented and potentially strengthened through 2025, could impose stricter emissions standards and land restoration requirements on infrastructure development. Such measures, while beneficial for sustainability, can translate into substantial compliance costs and potential project delays if not anticipated and managed effectively. CK Infrastructure must continually adapt its planning and operational frameworks to align with these increasingly stringent environmental mandates.

Key challenges stemming from public scrutiny and environmental concerns include:

- Project Delays: Public opposition and environmental reviews can add months or even years to project lifecycles, impacting revenue generation.

- Increased Costs: Meeting stricter environmental standards and addressing community concerns often requires additional investment in mitigation measures and legal counsel.

- Reputational Risk: Negative publicity surrounding environmental issues can damage brand image and affect investor confidence.

- Regulatory Uncertainty: Evolving environmental laws and policies create an unpredictable operating landscape, demanding constant vigilance and adaptation.

CK Infrastructure's substantial capital requirements create a significant weakness, demanding heavy reliance on debt financing. This leverage exposes the company to interest rate fluctuations; for instance, a 1% increase in average interest rates on its 2024 debt levels could raise annual finance costs by an estimated HK$500 million. This financial structure can limit flexibility and impact profitability, especially if economic conditions or borrowing costs deteriorate.

The company's global footprint means navigating diverse and often unpredictable regulatory and political landscapes. For example, potential changes in renewable energy subsidies in key markets like Australia in 2024 could impact project economics. This regulatory uncertainty necessitates constant adaptation and can lead to unforeseen project challenges or revised financial projections.

Certain assets, particularly transportation infrastructure like toll roads, exhibit sensitivity to economic downturns. Reduced economic activity can lead to lower traffic volumes and consequently, reduced revenue streams for these segments. While CKI's overall diversification offers a buffer, these cyclical exposures remain a notable weakness, particularly if broader economic contractions occur in 2025.

CKI faces ongoing challenges related to public scrutiny and evolving environmental regulations. Protests and legal challenges, as seen with wind farm projects in 2023, can cause project delays and increase operational expenses due to extensive environmental impact assessments and mitigation efforts. Stricter environmental mandates, such as those from the EU's Green Deal, could further escalate compliance costs through 2025.

| Weakness Category | Specific Challenge | Impact Example (2023-2025) | Financial Implication |

| Capital Intensity & Debt Reliance | High upfront investment, significant debt leverage | HK$14.8 billion capex in 2023; potential HK$500M annual cost increase per 1% rate hike | Increased financial risk, reduced flexibility |

| Regulatory & Political Uncertainty | Navigating diverse global regulations and political shifts | Impact of 2024 Australian subsidy changes on renewable projects | Project delays, altered project economics |

| Economic Sensitivity | Exposure of transportation assets to economic downturns | Potential slowdown in toll road traffic during economic contraction | Reduced revenue for specific segments |

| Environmental & Public Scrutiny | Public opposition, stricter environmental standards | Protests against wind farms (2023); EU Green Deal compliance costs | Project delays, increased operational costs, reputational risk |

Preview the Actual Deliverable

CK Infrastructure SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final CK Infrastructure SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Governments globally are channeling massive funds into infrastructure, with projections indicating over $94 trillion in spending by 2040, a significant increase from previous estimates. This presents a golden opportunity for CK Infrastructure (CKI) to leverage its expertise in developing and managing essential services like utilities and transportation networks. The sheer scale of these planned investments, particularly in renewable energy and digital infrastructure, creates a robust and sustained pipeline of potential projects for CKI to pursue through public-private partnerships and direct investment models.

The global imperative to transition towards green energy presents significant opportunities for CK Infrastructure Holdings (CKI). The increasing demand for renewable power generation, coupled with advancements in energy storage and smart grid technologies, directly aligns with CKI's strategic focus on sustainable infrastructure. This global shift is expected to drive substantial investment, with the International Energy Agency projecting global renewable energy capacity to more than triple by 2030, reaching over 11,000 GW.

CKI's existing investments in energy and waste management sectors are well-positioned to capitalize on this trend. By expanding its portfolio into areas like solar, wind, and battery storage, CKI can tap into high-growth markets driven by decarbonization policies and corporate sustainability commitments. For instance, the global energy storage market alone was valued at approximately $150 billion in 2023 and is projected to grow at a compound annual growth rate of over 20% through 2030.

The global smart city market is projected to reach $2.5 trillion by 2026, a significant increase from previous years, driven by urbanization and the need for efficient resource management. This trend directly fuels demand for the integrated digital infrastructure that CK Infrastructure (CKI) is well-positioned to provide.

CKI's established presence in utilities, telecommunications, and transportation allows it to leverage existing assets and expertise to develop and manage sophisticated smart city components. This includes intelligent traffic management systems and advanced energy grids, offering a natural progression for their infrastructure services.

By focusing on smart city development, CKI can tap into new revenue streams through enhanced service offerings and the integration of cutting-edge technologies. This strategic direction aligns with the evolving needs of urban environments, promising substantial growth opportunities.

Strategic Acquisitions and Partnerships

The global infrastructure sector remains highly fragmented, presenting CK Infrastructure Holdings (CKI) with significant opportunities to acquire established assets or forge partnerships for major development initiatives. CKI’s robust financial standing and proven operational capabilities position it to effectively consolidate market share and expand into new territories. For instance, in 2024, CKI continued to explore strategic opportunities, building on its history of successful integrations, such as its substantial investments in UK infrastructure.

These inorganic growth avenues are crucial for accelerating the expansion of CKI's diverse portfolio and boosting overall profitability.

- Acquisition of Complementary Infrastructure Assets: CKI can target companies or projects that align with its existing business segments, such as utilities, transportation, or energy, to achieve synergies and economies of scale.

- Joint Ventures for Large-Scale Projects: Partnering with local or international entities allows CKI to share risks and capital requirements for mega-projects, increasing its capacity to undertake ambitious developments.

- Geographic Expansion through M&A: Acquisitions provide a faster route to market entry and growth in new regions compared to organic development, leveraging local expertise and established operations.

- Consolidation of Market Share: By acquiring competitors or market leaders, CKI can enhance its competitive position, gain pricing power, and improve operational efficiencies in its core markets.

Emerging Market Infrastructure Needs

Developing economies globally present a substantial opportunity for infrastructure development. These regions often grapple with significant deficits in essential services like power, water, transportation, and telecommunications. For instance, the Asian Development Bank projected that developing Asia alone would require $1.7 trillion annually in infrastructure investment through 2030 to maintain economic growth. CK Infrastructure's (CKI) proven track record in managing complex projects across varied international landscapes, including emerging markets, positions it favorably to address these critical needs.

CKI's strategic advantage lies in its ability to navigate the unique challenges and leverage the growth potential inherent in these markets. While emerging markets may present higher operational and political risks, they also offer the prospect of outsized returns due to the sheer scale of unmet demand for infrastructure. This aligns with CKI's long-term investment horizon, focusing on essential services that provide stable, long-term cash flows. For example, CKI's investments in regions like Australia and the UK have demonstrated its capacity to deliver value, and similar opportunities are emerging in rapidly urbanizing areas across Asia and Africa.

- Significant Infrastructure Gap: Developing nations require trillions in infrastructure investment annually to meet basic needs and support economic expansion.

- CKI's Expertise: CKI possesses extensive experience in diverse operating environments, making it well-suited for emerging market projects.

- Growth Potential: These markets offer substantial long-term growth prospects for essential infrastructure services due to high demand.

- Risk-Reward Profile: While carrying higher risks, emerging markets can yield higher returns on essential infrastructure investments.

CKI is well-positioned to benefit from the global push towards decarbonization and renewable energy. The International Energy Agency projects that renewable energy capacity will more than triple by 2030, reaching over 11,000 GW. CKI's existing investments in energy and waste management, coupled with its focus on sustainable infrastructure, align perfectly with this trend. The global energy storage market, valued at approximately $150 billion in 2023, is expected to grow at over 20% annually through 2030, offering substantial opportunities for CKI to expand into solar, wind, and battery storage.

The increasing global demand for smart city solutions presents another significant avenue for growth. The smart city market is projected to reach $2.5 trillion by 2026, driven by urbanization and the need for efficient resource management. CKI's established presence in utilities, telecommunications, and transportation allows it to leverage existing assets and expertise to develop integrated digital infrastructure for smart cities, including intelligent traffic management and advanced energy grids.

The fragmented nature of the global infrastructure sector offers CKI opportunities for strategic acquisitions and partnerships. CKI's strong financial position and operational capabilities enable it to consolidate market share and expand into new territories, building on its history of successful integrations. For instance, in 2024, CKI continued to explore strategic opportunities, reinforcing its presence in key markets like the UK.

Developing economies represent a vast untapped market for infrastructure development, with the Asian Development Bank estimating that developing Asia alone requires $1.7 trillion annually in infrastructure investment through 2030. CKI's extensive experience in managing complex projects in diverse international landscapes, including emerging markets, positions it to address the critical deficits in essential services and capitalize on the high demand and potential for outsized returns.

Threats

Rising global interest rates present a significant hurdle for CK Infrastructure (CKI). For instance, as of early 2024, central banks in major economies like the US and UK have maintained elevated rates to combat persistent inflation. This directly increases the cost of capital for CKI's new development projects and makes refinancing existing debt more expensive, potentially impacting profitability and cash flow from operations.

Inflationary pressures further compound these challenges. Higher costs for materials, labor, and energy can erode the real value of CKI's revenue streams and increase operational expenditures. This squeeze on margins is particularly impactful for infrastructure projects with long-term revenue contracts, where price adjustments may not fully offset escalating operating costs, thereby affecting the overall financial viability of these long-term assets.

The infrastructure sector's appeal, characterized by stable, long-term returns, continues to attract substantial capital. This influx of funds from sovereign wealth funds, pension funds, and private equity firms is intensifying competition for prime assets. For instance, in 2024, global infrastructure investment saw robust activity, with deal volumes remaining high, indicating sustained investor interest.

This increased competition directly impacts valuations, pushing asset prices higher. Consequently, CK Infrastructure Holdings (CKI) may face challenges in acquiring new projects at attractive entry points, potentially compressing future returns. The heightened bidding environment can diminish the investment appeal of otherwise desirable infrastructure opportunities, requiring CKI to be highly strategic in its acquisition approach.

Technological disruption poses a significant threat to CK Infrastructure Holdings (CKI). Emerging technologies like autonomous vehicles could directly impact toll road revenue streams, a key segment for CKI. For example, a widespread shift to autonomous public transport or ride-sharing could reduce the number of privately owned vehicles on toll roads, thereby lowering collection rates.

Furthermore, advancements in decentralized energy generation and storage, such as widespread adoption of rooftop solar coupled with battery systems, could challenge traditional utility models. This might affect the predictable revenue from CKI's power distribution assets. In 2024, renewable energy installations continued to grow globally, with significant investments in distributed generation, highlighting the pace of this shift.

CKI must therefore proactively invest in and adapt its asset base to remain competitive and avoid obsolescence. This involves anticipating shifts in transportation and energy consumption patterns and exploring opportunities in new technological frontiers to ensure long-term resilience and profitability.

Adverse Regulatory Changes

Governments globally are increasingly scrutinizing infrastructure projects, potentially leading to adverse regulatory changes that could impact CK Infrastructure Holdings Limited (CKI). New environmental standards or altered concession terms in key markets like Australia or the UK could directly affect CKI's profitability and future investment plans. For instance, a shift towards more stringent emissions regulations for its power generation assets could necessitate significant capital expenditure, thereby increasing operational costs and potentially reducing returns on investment. The company's substantial investments in regulated utilities mean that policy shifts, such as changes in allowed rates of return or pricing mechanisms, pose a direct threat to its revenue streams and overall financial performance.

These regulatory shifts introduce considerable uncertainty into CKI's long-term financial planning and project valuations. For example, a hypothetical increase in carbon pricing mechanisms, if implemented across several of CKI's operating regions, could add substantial operational expenses. Furthermore, changes to foreign investment rules in certain jurisdictions could hinder CKI's ability to acquire or expand its infrastructure portfolio. The company must remain agile and prepared to adapt its strategies to navigate these evolving regulatory landscapes, which could impact its 2024 and 2025 financial outlook.

- Increased Compliance Costs: Stricter environmental or safety regulations can lead to higher operational expenses for CKI's diverse infrastructure assets.

- Reduced Profitability: Changes in pricing regulations for utilities or toll roads could directly impact revenue and profit margins.

- Investment Uncertainty: Unfavorable policy shifts can deter future investments or lead to revaluation of existing assets, impacting market sentiment.

- Concession Term Alterations: Modifications to existing concession agreements, particularly in regulated sectors, pose a risk to long-term revenue stability.

Geopolitical Instability and Protectionism

Operating globally means CK Infrastructure (CKI) faces risks from geopolitical instability and increasing protectionism. Trade disputes and political unrest in key markets, such as those seen in recent years impacting global supply chains and investment flows, can significantly disrupt CKI's international projects. For instance, the ongoing trade tensions between major economic blocs could lead to increased tariffs on materials or equipment, directly impacting project costs and timelines.

These geopolitical shifts can manifest as asset nationalization, where governments take control of foreign-owned assets, or as stricter regulations on foreign direct investment. Such actions can jeopardize CKI's existing investments and hinder future expansion plans in affected regions. The rise of economic nationalism globally, as evidenced by various countries prioritizing domestic industries, presents a direct challenge to CKI's cross-border operational model.

The consequences of such instability are severe, potentially leading to:

- Disruptions to project execution and delivery schedules.

- Devaluation or loss of assets in affected countries.

- Increased operational costs due to new trade barriers or regulatory hurdles.

- Challenges in repatriating profits or accessing capital markets.

CKI faces intensified competition for infrastructure assets, with global investment in the sector remaining robust through 2024. This elevated investor interest, driven by institutional capital, inflates asset prices, making it harder for CKI to secure new projects at favorable valuations, potentially dampening future returns.

Technological advancements, such as autonomous vehicles and decentralized energy, threaten to disrupt CKI's revenue streams from toll roads and utilities. The increasing adoption of distributed solar and battery storage, for instance, could undermine traditional utility models, impacting the predictability of income from CKI's power assets.

Governmental scrutiny and potential regulatory shifts in key markets like Australia and the UK pose significant threats. Stricter environmental standards or changes to concession terms, including allowed rates of return for regulated utilities, could necessitate increased capital expenditure and reduce profitability, impacting CKI's 2024-2025 financial outlook.

Geopolitical instability and rising protectionism globally present risks to CKI's international operations. Trade disputes and economic nationalism can lead to higher project costs, disrupted schedules, and even asset nationalization, jeopardizing existing investments and future expansion plans.

SWOT Analysis Data Sources

This CK Infrastructure SWOT analysis is built upon a robust foundation of data, including internal financial records, comprehensive market research reports, and expert opinions from industry leaders to ensure a thorough and actionable assessment.