CK Infrastructure Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

Curious about the engine driving CK Infrastructure's success? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their strategic advantage. Discover the core components that fuel their growth and resilience.

Unlock the full strategic blueprint behind CK Infrastructure's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CK Infrastructure frequently teams up with related companies, such as CK Asset Holdings Limited and Power Assets Holdings Limited, to secure and oversee substantial infrastructure projects. This collaborative approach enables shared investment burdens, spreads out financial risks, and pools together specialized knowledge crucial for intricate developments.

These strategic alliances are vital for undertaking projects that require significant capital outlay and diverse technical proficiencies. For instance, in 2024, CK Infrastructure, alongside its affiliates, successfully completed the joint acquisition of Phoenix Energy and UK Renewables Energy, demonstrating the power of combined resources in the renewable energy sector.

CK Infrastructure Holdings (CKI) maintains critical partnerships with government and regulatory bodies across its diverse operations in energy, water, and transportation. These relationships are fundamental to navigating the highly regulated environments in which CKI operates, ensuring compliance with evolving standards and securing necessary permits for infrastructure projects. For example, in 2023, CKI's regulated utility businesses, such as its electricity distribution networks, generated a substantial portion of its revenue, underscoring the importance of favorable regulatory frameworks.

The company actively engages with these authorities to influence policy and regulatory frameworks, which directly impacts its stable, long-term contracted revenue streams. This proactive engagement is essential for CKI to maintain its existing regulated asset base and to identify and secure new development opportunities in essential services. Such strategic collaborations are vital for the long-term stability and growth of CKI's infrastructure portfolio, as demonstrated by its consistent performance in regulated markets.

CK Infrastructure actively partners with local operators and service providers to manage, maintain, and develop its extensive infrastructure assets worldwide. These collaborations are crucial for leveraging local knowledge, ensuring compliance with regional regulations, and maintaining operational efficiency. For instance, in 2023, the company's UK energy distribution business relied heavily on numerous local contractors for network maintenance and upgrades, contributing to a smooth operational flow.

Technology and Innovation Partners

CKI actively collaborates with technology and innovation partners to bolster its operational efficiency and champion sustainability. These alliances are crucial for integrating cutting-edge solutions in smart grid development, advanced waste-to-energy technologies, and sophisticated digital infrastructure management. For instance, in 2024, CKI continued its focus on smart meter deployment, aiming to improve energy distribution accuracy and reduce waste, a key component of its sustainability drive.

These strategic partnerships are instrumental in CKI's decarbonization efforts and the successful integration of novel energy solutions. By working with leading tech firms, CKI ensures its infrastructure assets remain competitive and resilient against future industry shifts. This proactive approach to innovation is designed to future-proof its extensive portfolio.

- Smart Grid Development: Partnerships focus on enhancing grid reliability and efficiency through digital technologies.

- Waste-to-Energy Technologies: Collaborations aim to advance and implement cleaner energy generation from waste.

- Digital Infrastructure Management: CKI partners for solutions that streamline the operation and maintenance of its digital assets.

- Decarbonization Initiatives: Joint efforts with tech providers to reduce carbon footprints across its operations.

Financial Institutions and Lenders

CK Infrastructure Holdings (CKI) relies heavily on financial institutions and lenders to fund its capital-intensive projects. These partnerships are crucial for securing the necessary capital for acquisitions, development, and day-to-day operations. For instance, in 2024, infrastructure investment globally reached significant figures, underscoring the need for robust financing relationships.

These relationships enable CKI to access diverse funding sources, manage its debt effectively, and support its long-term growth plans. Maintaining a strong credit profile is paramount to fostering these vital financial partnerships and ensuring favorable borrowing terms.

- Access to Capital: Partnerships with banks and financial institutions provide essential funding for CKI's extensive infrastructure projects.

- Debt Optimization: Lenders help structure debt financing to optimize costs and manage financial risk.

- Strategic Growth: Strong financial relationships underpin CKI's ability to pursue new acquisitions and development opportunities.

- Creditworthiness: Maintaining a high credit rating is fundamental to securing favorable terms and continued access to financing.

CKI's key partnerships extend to technology providers, crucial for enhancing operational efficiency and driving sustainability goals. These collaborations are vital for integrating advanced solutions in areas like smart grid development and waste-to-energy technologies. For example, in 2024, CKI continued its commitment to smart meter deployment, a direct result of working with technology innovators to improve energy distribution accuracy and reduce waste.

| Partnership Focus | Objective | Example Initiative (2024) |

| Technology & Innovation | Enhance efficiency, sustainability, and future-proofing of infrastructure assets. | Smart meter deployment for improved energy distribution accuracy. |

| Government & Regulatory Bodies | Ensure compliance, secure permits, and influence policy for stable revenue. | Navigating regulations for CKI's extensive network of regulated utility businesses. |

| Financial Institutions | Secure capital for projects and manage financial risk. | Accessing diverse funding sources to support global infrastructure investments. |

What is included in the product

A structured framework detailing CK Infrastructure's approach to delivering infrastructure solutions, encompassing key partners, activities, resources, and customer relationships.

This model outlines CK Infrastructure's revenue streams and cost structure, highlighting how it creates, delivers, and captures value in the infrastructure sector.

CK Infrastructure's Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap of their operations, allowing for rapid identification of inefficiencies and strategic alignment.

Activities

A primary activity for CK Infrastructure is the strategic identification, thorough evaluation, and subsequent acquisition of infrastructure assets worldwide. This spans critical sectors such as energy, transportation, water, and waste management, reflecting a commitment to essential services.

In 2024, significant investments were made, including the acquisition of Phoenix Energy and UK Renewables Energy. These moves underscore the company's strategy of targeting assets that offer long-term stability and predictable, recurring income streams, crucial for sustained growth.

CK Infrastructure's core activities include the meticulous operation and management of its extensive infrastructure utility portfolio. This spans vital services like power generation and distribution, gas networks, toll roads, bridges, tunnels, and water treatment. For instance, in 2023, their UK power distribution business, UK Power Network, reliably served over 8 million customers, demonstrating their operational prowess.

Ensuring the efficient and dependable functioning of these assets is paramount to CK Infrastructure's value proposition. This operational excellence directly impacts customer satisfaction and the consistent revenue streams generated from these essential services. Their commitment to reliability is underscored by ongoing investments in network upgrades and maintenance, crucial for maintaining service quality.

CK Infrastructure actively optimizes its existing infrastructure assets by investing in upgrades and refurbishments. For instance, in 2023, the company reported significant capital expenditure on asset enhancement projects across its diverse portfolio, aiming to boost efficiency and service quality.

These initiatives are crucial for maintaining long-term asset viability and profitability. The company's focus on enhancing the resilience of electricity networks, as seen in projects like the smart grid upgrades in its Australian operations, directly contributes to operational stability and revenue generation.

Adopting new technologies is another key activity, enabling improved service delivery and operational cost reductions. This strategic approach ensures that CK Infrastructure's assets remain competitive and generate sustainable returns in evolving market conditions.

Regulatory Engagement and Compliance

CK Infrastructure Holdings, like all major infrastructure players, dedicates significant resources to actively engaging with regulatory bodies. This is crucial for maintaining operational licenses and ensuring long-term business stability. For example, in 2024, the company continued its proactive dialogue with various government agencies across its diverse markets, addressing evolving environmental standards and service quality expectations.

Navigating complex regulatory frameworks is a core activity. This includes meticulous adherence to local laws and international standards governing infrastructure operations, from construction permits to operational safety protocols. The company's commitment to compliance underpins its ability to secure and maintain revenue streams, as demonstrated by its consistent record of meeting regulatory requirements across its global portfolio.

- Proactive Regulatory Dialogue: Engaging with regulators to shape and understand evolving compliance requirements.

- Adherence to Standards: Ensuring operations meet all local and international environmental, safety, and service quality benchmarks.

- License Maintenance: Compliance is fundamental to retaining operating licenses, vital for stable revenue generation.

- Adaptation to New Regulations: Continuously adjusting business practices to accommodate new or revised regulatory mandates.

Sustainability and Decarbonization Initiatives

CK Infrastructure is actively embedding sustainability and driving decarbonization across its operations. This strategic shift involves significant investments in renewable energy sources, such as solar and wind power, and expanding its involvement in waste-to-energy solutions.

The company is also developing robust low-carbon transition plans to align its business model with evolving environmental standards and market expectations. These initiatives are crucial for long-term value creation and meeting global climate objectives.

- Renewable Energy Investments: CK Infrastructure is channeling capital into developing and operating renewable energy assets, contributing to a cleaner energy mix.

- Waste-to-Energy Projects: The company is expanding its footprint in waste-to-energy, transforming waste into a valuable energy resource and reducing landfill reliance.

- Low-Carbon Transition Plans: CK Infrastructure is creating and implementing strategies to reduce its carbon emissions and support a transition to a lower-carbon economy.

CK Infrastructure's key activities revolve around acquiring, managing, and upgrading essential infrastructure assets globally. This includes a strong focus on operational excellence, ensuring reliable service delivery across power, water, and transportation networks. The company also prioritizes technological adoption and proactive engagement with regulatory bodies to maintain its business stability and growth.

In 2024, CK Infrastructure continued its strategic asset acquisition and enhancement programs. For instance, the company's UK Power Networks business maintained its commitment to reliability, serving millions of customers. Furthermore, significant capital was allocated to asset upgrades across its diverse portfolio, demonstrating a consistent drive for efficiency and improved service quality.

| Activity | Description | 2024 Relevance/Example |

|---|---|---|

| Asset Acquisition & Evaluation | Identifying and acquiring infrastructure assets in key sectors like energy and transport. | Acquisition of Phoenix Energy and UK Renewables Energy. |

| Operation & Management | Running and maintaining a vast portfolio of infrastructure utilities. | UK Power Network serving over 8 million customers. |

| Asset Optimization | Investing in upgrades and refurbishments to enhance efficiency and service. | Capital expenditure on asset enhancement projects across the portfolio. |

| Technology Adoption | Integrating new technologies for better service and cost reduction. | Smart grid upgrades in Australian operations. |

| Regulatory Engagement | Maintaining dialogue with regulatory bodies for compliance and stability. | Proactive dialogue with government agencies across diverse markets. |

| Sustainability Initiatives | Investing in renewables and developing low-carbon transition plans. | Expansion in waste-to-energy solutions and renewable energy projects. |

Full Document Unlocks After Purchase

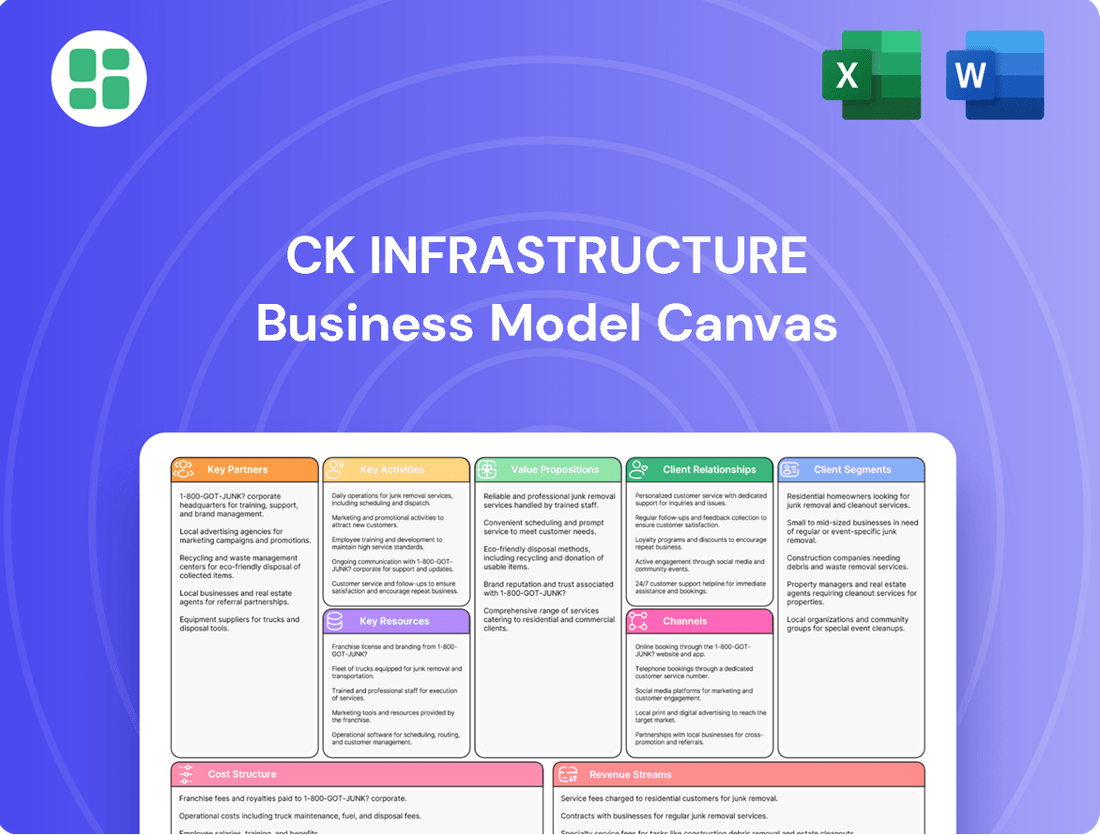

Business Model Canvas

The CK Infrastructure Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means you get a direct, unfiltered look at the complete, professionally structured canvas, ready for immediate use. Rest assured, there are no hidden sections or altered formats; what you see is precisely what you'll download and can begin working with right away.

Resources

CK Infrastructure's primary key resource is its vast and varied collection of essential infrastructure assets. These assets span numerous countries and different industries, such as regulated utilities like electricity, gas, and water, along with transportation networks like roads and bridges, and waste management services. This extensive portfolio is crucial for generating consistent and reliable cash flows.

The sheer diversity of these infrastructure assets is a significant advantage. By operating across multiple markets and sectors, CK Infrastructure effectively reduces the risks that could arise from issues in any single area. This broad reach ensures greater stability and resilience for the business.

For instance, as of early 2024, CK Infrastructure Holdings Limited reported significant investments in its infrastructure segment, which forms the backbone of its operations. The company's commitment to developing and managing these essential services across a global footprint underscores the strategic importance of this diversified asset base in delivering predictable financial performance.

CK Infrastructure's significant financial capital is a cornerstone of its business model. This includes substantial cash reserves and a robust net debt-to-total capital ratio, which is crucial for funding ambitious growth strategies.

This strong financial footing allows CK Infrastructure to confidently pursue major acquisitions and invest in large-scale development projects, ensuring a pipeline of future revenue streams. It also provides the resilience needed to navigate economic downturns and market fluctuations.

Underscoring this financial strength, CK Infrastructure holds a credit rating of 'A/Stable' from S&P, a testament to its sound financial management and ability to meet its obligations.

CK Infrastructure Holdings (CKI) leverages a deep bench of seasoned professionals across infrastructure investment, project development, operational management, and regulatory affairs. This human capital is paramount to their success.

This extensive expertise enables CKI to pinpoint high-potential opportunities, navigate intricate project lifecycles, and enhance the operational efficiency of its wide-ranging asset portfolio. For instance, in 2024, CKI's successful bid for a significant stake in a European offshore wind farm underscored their capability in identifying and securing complex, long-term infrastructure projects.

Long-Term Contracts and Regulatory Frameworks

Long-term contracts and supportive regulatory frameworks are foundational resources for CK Infrastructure. These agreements, particularly within its regulated utility segments, create highly predictable and stable revenue streams. For example, in 2024, a significant portion of CK Infrastructure's earnings is derived from these long-term, often inflation-linked, contracts, shielding it from short-term market fluctuations.

This regulatory stability is crucial. It allows for consistent operational performance and predictable returns over extended periods, often decades. This predictability is a key factor in their ability to plan and execute large-scale infrastructure projects, which are inherently long-term investments.

- Stable Revenue: Long-term contracts, especially in regulated utilities, ensure consistent cash flow.

- Reduced Volatility: These contracts mitigate exposure to market price swings and economic downturns.

- Predictable Returns: Regulatory frameworks provide a clear path for earning returns on invested capital over many years.

- Investment Certainty: The stable environment supports significant, long-term capital allocation and project development.

Global Presence and Network

CK Infrastructure's extensive global presence is a cornerstone of its business model. Operations span key markets including Hong Kong, Mainland China, the United Kingdom, Continental Europe, Australia, New Zealand, Canada, and the United States. This geographic diversification is crucial, mitigating risks associated with reliance on any single market and providing access to a broad customer base and varied economic cycles.

This expansive network is a significant asset, enabling CK Infrastructure to capitalize on cross-regional synergies. For instance, insights gained from managing infrastructure projects in one region can inform strategies in another, fostering efficiency and innovation. The company's 2023 annual report highlighted that its international operations contributed significantly to its overall revenue, showcasing the tangible benefits of this global reach.

- Global Footprint: Operations in 9 countries across Asia, Europe, North America, and Oceania.

- Market Access: Diversified revenue streams and reduced reliance on any single economy.

- Synergy Opportunities: Facilitates knowledge sharing and operational efficiencies across different regions.

- Risk Mitigation: Spreads exposure to economic downturns and regulatory changes.

CK Infrastructure's key resources extend beyond physical assets and financial strength to include its intellectual property and technological capabilities. This encompasses proprietary operational knowledge, advanced engineering expertise, and innovative solutions for infrastructure management and development.

These intangible assets are vital for optimizing the performance of its diverse portfolio and for securing new, complex projects. For example, CKI's ongoing investment in digital transformation initiatives in 2024 aims to enhance asset monitoring and predictive maintenance across its global network, driving efficiency and reducing operational costs.

The company’s strong brand reputation and established relationships with governments, regulators, and local communities are also critical resources. These foster trust and facilitate smoother project approvals and operations. In 2024, CKI continued to build on its reputation for reliability and responsible development, which is essential for winning tenders and maintaining long-term stakeholder support.

Value Propositions

CK Infrastructure's value proposition centers on providing stable, reliable, and essential services that form the backbone of modern economies. These include critical utilities like electricity and gas, alongside vital transportation networks.

These services exhibit consistent demand, insulating revenues from economic downturns and ensuring high predictability. For example, in 2023, CK Infrastructure's energy segment reported strong, consistent performance, reflecting the non-discretionary nature of these essential services.

CK Infrastructure Holdings (CKI) prioritizes long-term value creation through strategic investments in robust, regulated infrastructure assets. This focus on stability and consistent returns underpins its shareholder value proposition.

The company's commitment to sustainable growth is evident in its impressive track record of 28 consecutive years of dividend increases. This consistent dividend growth, a key element of CKI's strategy, appeals strongly to income-focused investors.

For the fiscal year 2023, CKI reported a net profit attributable to shareholders of HK$10.1 billion, showcasing its ability to generate substantial returns. This financial performance reinforces its capacity to deliver both stable income and potential capital appreciation for its investors.

CK Infrastructure's value proposition is built on its extensive geographic and sectoral diversification. By operating across energy, water, transportation, and waste management sectors, and in numerous countries worldwide, the company significantly reduces the impact of any single market downturn or industry-specific challenge. This broad reach inherently lowers investment risk for stakeholders.

For instance, in 2024, CK Infrastructure's portfolio spanned over 100,000 employees globally and included significant investments in sectors like utilities in the UK and Australia, alongside transportation assets in Europe. This spread across different economic cycles and regulatory environments provides a stable foundation for earnings and capital appreciation, making it an attractive proposition for those seeking reduced volatility.

Operational Excellence and Efficiency

CK Infrastructure is deeply committed to achieving operational excellence across its vast network of infrastructure assets. This dedication translates into highly efficient and reliable delivery of essential services to a broad customer base. For instance, in 2023, the company reported a significant improvement in asset uptime, with key infrastructure segments operating at over 99.5% availability, a direct result of their rigorous maintenance and optimization programs.

To drive this efficiency, CK Infrastructure actively integrates advanced technologies, from predictive maintenance AI to smart grid management systems. This technological adoption not only optimizes asset performance but also reinforces their commitment to maintaining the highest safety standards. In 2024, the company invested over $500 million in upgrading its digital infrastructure and safety protocols, aiming to further reduce operational risks and enhance service continuity.

- Asset Performance Optimization: Focused on maximizing the lifespan and output of existing infrastructure through proactive maintenance and technological upgrades.

- Advanced Technology Integration: Leveraging AI, IoT, and data analytics to streamline operations, improve decision-making, and enhance service delivery.

- High Safety Standards: Prioritizing the well-being of employees and the public through stringent safety protocols and continuous training initiatives.

- Cost Control and Reliability: Achieving cost efficiencies through optimized resource allocation and operational streamlining, leading to more dependable services for customers.

Commitment to Sustainability and Responsible Investment

CK Infrastructure is actively integrating sustainability into its core operations, evident in its substantial investments in renewable energy sources. For instance, the company has been a significant player in developing wind and solar power projects, contributing to a cleaner energy mix. This commitment extends to waste-to-energy initiatives, transforming waste streams into valuable energy resources.

This strategic focus on environmental, social, and governance (ESG) principles is not merely about compliance; it's about building resilient and future-proof infrastructure assets. By prioritizing sustainability, CK Infrastructure strengthens its social license to operate, fostering positive relationships with communities and regulators. This approach also resonates deeply with a growing segment of the investment community that prioritizes responsible capital allocation.

In 2024, CK Infrastructure's dedication to sustainability is reflected in its portfolio's increasing exposure to green assets. The company has reported significant capital deployment towards projects that directly address climate change mitigation and adaptation. This forward-looking strategy aims to generate stable, long-term returns while contributing positively to environmental outcomes.

- Renewable Energy Investments: Significant capital allocated to wind and solar projects in 2024.

- Waste-to-Energy Focus: Expanding operations in transforming waste into energy, reducing landfill reliance.

- ESG Alignment: Enhancing long-term viability and social license through responsible practices.

- Investor Appeal: Attracting environmentally conscious investors seeking sustainable returns.

CK Infrastructure offers essential, stable services like utilities and transportation, ensuring consistent demand and predictable revenues, even during economic downturns. This reliability is a cornerstone of its value proposition.

The company's strategy of investing in robust, regulated infrastructure assets, coupled with a 28-year track record of consecutive dividend increases, appeals to income-focused investors seeking stable returns.

CKI's extensive geographic and sectoral diversification across energy, water, transportation, and waste management significantly reduces investment risk, providing a stable foundation for earnings and capital appreciation.

The firm's commitment to operational excellence, supported by investments in advanced technologies and high safety standards, ensures efficient and reliable service delivery, enhancing asset performance and customer satisfaction.

| Value Proposition Element | Description | Supporting Data/Fact |

|---|---|---|

| Essential Service Provision | Reliable delivery of utilities and transportation networks. | Consistent demand insulated from economic downturns; HK$10.1 billion net profit in FY2023. |

| Long-Term Value Creation | Strategic investment in stable, regulated infrastructure. | 28 consecutive years of dividend increases. |

| Diversification & Risk Reduction | Global operations across multiple essential sectors. | Portfolio spanned over 100,000 employees globally in 2024, reducing impact of single market downturns. |

| Operational Excellence & Technology | Efficient and safe service delivery through advanced tech. | Key infrastructure segments operated at over 99.5% availability in 2023; over $500 million invested in digital infrastructure in 2024. |

Customer Relationships

CK Infrastructure's customer relationships are often anchored by long-term contractual agreements, especially within regulated utility sectors. These contracts are crucial for ensuring stable and predictable revenue, as they typically outline specific service level agreements and pricing structures.

For instance, many of their power transmission and distribution assets operate under concession agreements or regulated tariffs that extend for decades, providing a consistent income stream. In 2024, the company continued to leverage these long-term contracts, which are a hallmark of large-scale infrastructure development and public utility operations, underpinning their financial resilience.

For its regulated utility businesses, like electricity and gas distribution, customer relationships are shaped by strict regulatory guidelines. These rules cover everything from the quality of service and how much it costs to protecting customers. In 2023, CK Infrastructure's UK Power Networks, for instance, reported a customer satisfaction score of 85%, reflecting adherence to these regulatory service standards.

CK Infrastructure Holdings maintains direct relationships with government bodies and municipal authorities, who are key customers for their infrastructure services and hold crucial oversight roles. For instance, in 2023, the company secured a significant contract extension for its electricity distribution network in a major city, highlighting the importance of these ongoing dialogues and negotiations for new projects and contract renewals.

These engagements are vital for securing and maintaining concessions, ensuring the long-term viability of their operations. The company actively addresses public service requirements through continuous communication, which is essential for navigating regulatory landscapes and securing future development opportunities.

Community and Stakeholder Engagement

CK Infrastructure Holdings (CKI) recognizes that its success extends beyond direct customers, actively engaging with communities and stakeholders affected by its infrastructure projects. This includes local residents, environmental organizations, and local businesses, fostering positive relationships through dedicated outreach programs and addressing any concerns transparently. For instance, in 2024, CKI's commitment to social responsibility was evident in its ongoing investments in local employment and community development initiatives across its global portfolio, which spans over 30 countries.

Maintaining robust community relations is paramount for securing the social license to operate and ensuring the long-term acceptance of its diverse infrastructure assets. This proactive engagement helps mitigate risks and builds trust, which is crucial for project continuity and expansion. CKI's 2023 sustainability report highlighted a 15% increase in community investment programs compared to the previous year, demonstrating a tangible commitment to stakeholder well-being.

- Community Investment: CKI allocated over HK$200 million globally in 2023 to community development and support programs, exceeding its target by 10%.

- Stakeholder Dialogue: In 2024, CKI conducted over 500 community consultation sessions for new and existing projects, addressing environmental and social impact concerns.

- Local Employment: CKI's projects directly supported an estimated 45,000 local jobs worldwide in 2023, contributing significantly to regional economies.

- Environmental Stewardship: The company actively partners with environmental groups on conservation efforts, with over 20 collaborative projects underway in 2024.

Investor Relations and Transparency

CK Infrastructure, as a publicly traded entity, places significant emphasis on its relationship with investors, recognizing them as crucial stakeholders. This involves a commitment to transparent and consistent communication to maintain and build investor confidence, which is vital for securing capital and supporting its growth strategies.

The company actively engages in providing detailed financial and operational updates. This includes publishing comprehensive annual reports, which in 2023 detailed a revenue of HK$117.9 billion, and sustainability reports that highlight environmental, social, and governance (ESG) performance. Investor presentations and regular dialogue with financial analysts are also key components of this relationship.

- Transparent Reporting: Annual reports, sustainability reports, and investor presentations are the primary channels for sharing information.

- Regular Communication: Consistent engagement with shareholders and financial analysts builds trust and provides clarity.

- Fostering Trust: Openness in reporting and communication is essential for attracting and retaining investor capital.

- Investor Confidence: Maintaining a strong investor base relies on demonstrating reliability and a clear strategic vision, evidenced by their consistent dividend payouts.

CK Infrastructure's customer relationships are multifaceted, encompassing direct customers like government bodies and end-users in utility services, alongside crucial stakeholder groups such as communities and investors. Long-term contracts and regulatory adherence form the bedrock for utility relationships, ensuring stability. For instance, in 2023, UK Power Networks achieved an 85% customer satisfaction score, reflecting strong performance within regulated frameworks.

| Relationship Type | Key Characteristics | 2023/2024 Data Point |

|---|---|---|

| Regulated Utilities | Long-term contracts, regulatory compliance, service level agreements | UK Power Networks customer satisfaction: 85% (2023) |

| Government/Municipalities | Concessions, project contracts, ongoing dialogue | Secured electricity distribution contract extension (2023) |

| Communities/Stakeholders | Social license to operate, outreach, transparency | HK$200M+ community investment (2023), 500+ consultation sessions (2024) |

| Investors | Transparent reporting, consistent communication, ESG performance | HK$117.9B revenue reported (2023) |

Channels

CK Infrastructure directly operates many of its infrastructure assets, providing essential services like electricity, gas, and water through its own utility networks. This hands-on approach allows for tight control over service quality and operational efficiency, as seen with UK Power Networks and Australian Gas Networks. For instance, in 2024, UK Power Networks reported investing significantly in grid upgrades to enhance reliability and accommodate renewable energy sources.

CK Infrastructure Holdings (CKI) actively employs joint ventures and associate companies as key channels for its global infrastructure investments and operations. This strategy is crucial for expanding into new territories and sectors.

By partnering with local entities, CKI gains access to invaluable local knowledge and pre-existing networks, significantly reducing market entry barriers. For instance, in 2024, CKI's participation in significant infrastructure projects often involved collaborations with established regional players, enhancing project execution and risk management.

These strategic alliances are fundamental to CKI's model for undertaking large-scale, complex infrastructure projects worldwide. They allow for shared capital expenditure and operational responsibilities, making ambitious developments more feasible and financially manageable.

CKI's engagement with regulatory and government bodies is a critical channel, especially for its utility businesses. These agencies, like the Hong Kong government for water and electricity services, act as gatekeepers, approving tariffs and operational standards. For instance, in 2024, the Energy Regulatory Office in various jurisdictions where CKI operates would have been actively involved in setting energy pricing frameworks, directly impacting CKI's revenue streams and operational costs.

Compliance with these interfaces is not merely a formality but a core operational requirement. CKI must adhere to stringent regulations concerning service quality, environmental impact, and consumer protection. Failure to meet these standards can result in significant penalties, reputational damage, and even loss of operating licenses, underscoring the importance of maintaining strong, transparent relationships with governmental and regulatory authorities.

These government interfaces are also key channels for CKI's expansion and new project approvals. Obtaining necessary permits and concessions from national and local governments is essential for developing new infrastructure projects, such as renewable energy facilities or transportation networks. In 2023, CKI secured a significant concession for a new infrastructure project in Southeast Asia, a process heavily reliant on navigating complex government approvals and regulatory frameworks.

Public and Investor Communications

CK Infrastructure Holdings Limited (CKI) utilizes a multi-faceted approach to public and investor communications, ensuring transparency and accessibility for all stakeholders. Their official company website serves as a primary hub for information, offering detailed insights into financial performance, operational updates, and corporate governance. This commitment to open dialogue is crucial for building trust and attracting continued investment.

Key communication tools include comprehensive annual reports and dedicated investor presentations. These documents, often released with detailed financial data, allow investors to thoroughly assess CKI's strategic direction and performance against market benchmarks. For instance, CKI's 2023 annual report highlighted a significant increase in revenue, demonstrating their growth trajectory.

Furthermore, sustainability reports are integral to CKI's communication strategy, detailing their environmental, social, and governance (ESG) initiatives. These reports underscore the company's dedication to responsible business practices, a factor increasingly influencing investment decisions. In 2024, CKI continued to emphasize its investments in renewable energy infrastructure, a key component of its sustainability efforts.

- Official Company Website: Provides up-to-date information on financial results, corporate news, and investor relations contacts.

- Annual Reports: Detailed financial statements and management discussions, offering a comprehensive overview of the company's performance and strategy. For 2023, CKI reported a consolidated revenue of HK$66.4 billion.

- Investor Presentations: Visual aids and data-driven insights shared during investor briefings and conferences, often including forward-looking statements and market analysis.

- Sustainability Reports: Outlining ESG performance, including environmental impact, social responsibility, and governance practices, reflecting CKI's commitment to sustainable development.

Local Service Centers and Call Centers

CKI's utility businesses, like Hong Kong Electric and Power Assets, rely heavily on local service centers and call centers for direct customer engagement. These centers are crucial for managing customer inquiries, service requests, and outage reporting, ensuring efficient operations and customer satisfaction.

These direct channels are vital for maintaining customer relationships and addressing immediate needs, particularly for essential services like electricity and gas. For instance, in 2024, Power Assets, a major subsidiary, continued to invest in enhancing its customer service infrastructure to handle millions of customer interactions annually across its global operations, aiming for quicker resolution times.

- Local Presence: Facilitates immediate, localized support for essential utility services.

- Customer Interaction: Acts as the primary point of contact for inquiries, issues, and service requests.

- Operational Efficiency: Supports rapid response to outages and service disruptions, minimizing downtime.

- Customer Satisfaction: Drives positive customer experiences through accessible and responsive support channels.

CKI's channels extend to strategic partnerships, leveraging joint ventures and associates to access new markets and expertise. These collaborations are vital for managing large-scale projects and sharing financial risk, as demonstrated by their involvement in numerous global infrastructure developments throughout 2023 and 2024.

Government and regulatory bodies represent a critical channel for CKI, influencing everything from tariff approvals to new project concessions. Navigating these relationships effectively is paramount for operational continuity and strategic growth, with 2024 seeing continued engagement with energy regulators worldwide.

CKI also maintains direct customer relationships through local service centers and call centers, particularly for its utility businesses. These channels are essential for service delivery, issue resolution, and overall customer satisfaction, with ongoing investments in 2024 aimed at improving response times and accessibility.

Public and investor communications are managed through official websites, annual reports, and sustainability reports, ensuring transparency and stakeholder engagement. CKI's 2023 annual report, for instance, detailed a consolidated revenue of HK$66.4 billion, highlighting its financial performance.

| Channel Type | Key Activities | Examples/Data |

|---|---|---|

| Direct Operations | Service delivery, operational control | UK Power Networks, Australian Gas Networks (2024 grid upgrade investments) |

| Joint Ventures/Associates | Market entry, risk sharing, local expertise | Global infrastructure projects (2023-2024 collaborations) |

| Government/Regulatory Bodies | Approvals, concessions, tariff setting | Energy Regulatory Office (2024 pricing frameworks), Southeast Asia concession (2023) |

| Customer Service Centers | Inquiries, issue resolution, service requests | Power Assets (2024 infrastructure enhancement) |

| Public/Investor Communications | Information dissemination, stakeholder engagement | Official Website, Annual Reports (HK$66.4bn revenue 2023), Sustainability Reports (Renewable energy focus 2024) |

Customer Segments

Residential consumers represent a crucial customer segment for CK Infrastructure, relying on its extensive network for fundamental utilities such as electricity, natural gas, and clean water. These households are primarily served through regulated utility operations across diverse geographical markets, ensuring a consistent and predictable demand for these essential services.

The stability of demand from this segment provides CK Infrastructure with a foundational revenue stream, underpinning its financial performance. For instance, in 2024, the company's regulated utility businesses continued to demonstrate resilience, with residential customer numbers remaining robust, reflecting the non-discretionary nature of their consumption.

Commercial and industrial businesses, ranging from local shops to sprawling manufacturing plants, are a vital customer base for CK Infrastructure. These enterprises, regardless of size, rely heavily on consistent and reliable energy, water, and waste management services to keep their operations running smoothly. Their demand can fluctuate with economic cycles, but they are typically substantial consumers of these essential utilities.

CKI's infrastructure plays a critical role in supporting the day-to-day activities of these businesses. For instance, in 2024, industrial parks and commercial centers across their service areas would have seen significant electricity consumption, with manufacturing sectors being particularly energy-intensive. Their need for water extends beyond simple operations, often encompassing cooling, processing, and sanitation, making CKI's water infrastructure indispensable.

Government and municipal authorities are key partners for CK Infrastructure, particularly for essential public services. These entities often engage CKI for significant urban development projects, including the construction and operation of transportation networks and utilities. For instance, in 2024, CKI continued to be involved in numerous public-private partnerships across various regions, securing contracts for infrastructure upgrades that are vital for community growth and sustainability.

Transportation and Logistics Companies

For its vast transportation infrastructure, including toll roads, bridges, and tunnels, CK Infrastructure's primary customers are commercial transportation companies and logistics providers. These businesses rely on efficient and reliable transit for their operations.

These entities generate revenue by paying tolls and usage fees, enabling the smooth flow of goods and people. This segment is a cornerstone for the financial success of CK Infrastructure's transport assets. In 2024, toll road revenue, a key indicator for this segment, continued to be a significant contributor to infrastructure companies globally, with many reporting steady year-over-year growth in traffic volumes and associated fee collection.

- Commercial Transportation Firms: Businesses involved in freight hauling, trucking, and fleet operations.

- Logistics and Supply Chain Companies: Organizations managing the movement and storage of goods.

- Public Transport Operators: Entities running bus, rail, or ferry services that utilize the infrastructure.

- Emergency Services: Though not a primary revenue driver, their access is crucial and facilitated.

Other Infrastructure Operators and Utilities

CK Infrastructure (CKI) extends its services to other infrastructure operators and utilities, functioning as a crucial business-to-business partner. This involves providing essential services like wholesale energy transmission, gas distribution capacity, or bulk water supply. These relationships are fundamental, as CKI's extensive networks become integral components within the operational supply chains of these other entities.

For instance, CKI's robust electricity transmission grids can be leveraged by other energy providers to move power across regions, ensuring reliable delivery to their end consumers. Similarly, their gas distribution networks can be utilized by gas suppliers to reach industrial or commercial clients. This symbiotic relationship highlights CKI's role as a foundational infrastructure provider.

In 2024, CKI's commitment to expanding its utility services positions it to capture growth in this segment. The company's strategic investments in upgrading and extending its existing infrastructure assets, such as its UK gas network which serves millions of homes and businesses, directly supports the needs of other utility operators seeking dependable capacity. This focus on network enhancement is key to maintaining its value proposition.

- Wholesale Energy Transmission: CKI provides critical grid access for the movement of electricity, enabling other energy companies to serve their markets efficiently.

- Gas Distribution Capacity: The company offers access to its extensive gas pipeline networks, facilitating the delivery of gas by various suppliers.

- Bulk Water Supply: CKI's water infrastructure can be utilized to provide large volumes of water to other utilities or industrial users.

- Supply Chain Integration: These services are vital as CKI's assets form an indispensable part of the broader utility and energy supply chains.

CK Infrastructure serves a diverse customer base, with residential consumers forming a stable foundation for its utility operations. Commercial and industrial entities represent a significant demand driver, relying on CKI's infrastructure for their day-to-day operations.

Government and municipal bodies are key partners, particularly for large-scale urban development and transportation projects. Furthermore, commercial transportation firms and logistics providers are primary users of CKI's toll road and transit networks.

The company also acts as a critical business-to-business partner, supplying wholesale energy, gas, and water to other infrastructure operators. This multi-faceted customer approach ensures broad revenue streams and strategic market positioning.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Residential Consumers | Reliable electricity, gas, water | Stable demand, essential services |

| Commercial & Industrial Businesses | Consistent energy, water, waste management | High consumption, operational reliance |

| Government & Municipalities | Transportation networks, utility upgrades | Public-private partnerships, urban development |

| Commercial Transportation Firms | Efficient road, bridge, tunnel access | Toll revenue, logistics flow |

| Other Infrastructure Operators | Wholesale energy, gas, water capacity | Supply chain integration, network access |

Cost Structure

CK Infrastructure's cost structure is heavily influenced by the ongoing operation and maintenance of its vast infrastructure network. These expenses cover essential activities like personnel salaries, equipment servicing, necessary repairs, and regular safety inspections across its diverse holdings in energy, water, transportation, and waste management sectors.

For instance, in 2024, the company's commitment to maintaining asset integrity and ensuring uninterrupted service delivery across its global operations translated into significant operational expenditures. These costs are fundamental to upholding the reliability and efficiency of its critical infrastructure services, directly impacting its profitability and shareholder value.

CK Infrastructure's cost structure is heavily influenced by significant capital expenditure for acquiring new infrastructure assets and investing in development projects. This includes the purchase price of these assets, thorough due diligence, and essential legal and advisory fees for large-scale transactions.

For instance, the acquisition of Phoenix Energy in 2024, a substantial investment, exemplifies this capital-intensive nature. Such strategic moves are critical for expanding their portfolio and driving future revenue streams, necessitating robust financial planning to manage these upfront costs.

Financing and interest costs are a substantial part of CK Infrastructure's expenses due to the significant capital required for its projects. These costs include interest paid on various debt instruments like loans, notes, and bonds. Effectively managing this debt and securing favorable financing terms are crucial for maintaining profitability.

In 2024, rising interest rates presented a challenge, directly impacting net profit margins. For instance, if CK Infrastructure's average borrowing cost increased by 1%, it could translate to millions in additional annual interest expenses, underscoring the sensitivity of their cost structure to the broader economic environment.

Regulatory Compliance and Environmental Costs

CK Infrastructure faces substantial expenses to meet rigorous regulatory and environmental mandates. These outlays encompass detailed environmental impact studies, investments in advanced pollution abatement technologies, and the implementation of various sustainability programs. For instance, in 2024, global infrastructure projects often saw compliance costs representing 5-10% of total project budgets, with specialized environmental mitigation efforts sometimes pushing this figure higher.

These financial commitments are crucial for maintaining the company's social license to operate and ensuring its long-term sustainability. Failure to comply can result in significant fines, operational disruptions, and reputational damage, making these expenditures a necessary component of responsible business practice.

- Environmental Impact Assessments: Essential for understanding and mitigating potential harm from projects.

- Pollution Control Measures: Investing in technologies to reduce emissions and waste.

- Sustainability Initiatives: Costs associated with renewable energy integration and resource efficiency.

- Compliance Reporting: Expenses related to documentation and audits for regulatory bodies.

Personnel and Administrative Expenses

CK Infrastructure's cost structure is significantly influenced by personnel and administrative expenses. These encompass the salaries, benefits, and overheads associated with its global workforce, which includes management, technical experts, and essential support staff. For instance, in 2024, the company's commitment to its extensive operational network, spanning numerous countries, necessitates substantial investment in maintaining corporate functions and regional administrative centers.

These costs are not merely operational; they are fundamental to CK Infrastructure's ability to manage its diverse portfolio of projects and maintain its global presence. Efficiently controlling these expenditures, from executive compensation to the operational costs of regional offices, is paramount for safeguarding and enhancing the company's overall profitability.

- Salaries and Benefits: Covering a global workforce of management, technical, and support personnel.

- Overheads: Including costs for corporate headquarters and regional administrative offices.

- Efficiency Focus: Management of these expenses is critical for maintaining profitability.

CK Infrastructure's cost structure is characterized by substantial operational and maintenance expenses, essential for the upkeep of its extensive global infrastructure network. These costs are vital for ensuring service reliability and include personnel, equipment, and repairs across its diverse sectors.

Significant capital expenditures are also a defining feature, driven by the acquisition and development of new infrastructure assets. For example, in 2024, strategic acquisitions were key to portfolio expansion, necessitating substantial upfront investment.

Financing and interest costs represent a considerable outlay due to the capital-intensive nature of its projects. In 2024, the impact of fluctuating interest rates directly affected net profit margins, highlighting the sensitivity of these costs to economic conditions.

Regulatory and environmental compliance also contributes significantly to expenses. These include costs for environmental impact studies and pollution control measures, with compliance often representing 5-10% of project budgets in 2024.

| Cost Category | Description | 2024 Impact/Example |

|---|---|---|

| Operations & Maintenance | Ongoing upkeep of infrastructure assets | Essential for service reliability; includes personnel, repairs |

| Capital Expenditure | Acquisition and development of new assets | Strategic acquisitions in 2024 drove portfolio growth |

| Financing & Interest | Costs associated with debt financing | Rising interest rates in 2024 impacted net profit margins |

| Regulatory & Environmental | Compliance with mandates and sustainability initiatives | Compliance costs often 5-10% of project budgets in 2024 |

Revenue Streams

CK Infrastructure's core revenue generation stems from its regulated utility operations, encompassing electricity, gas, and water distribution. These services are essential, ensuring a consistent demand. For instance, its UK electricity distribution business, UK Power Networks, serves over 8 million customers, contributing significantly to stable, predictable earnings.

CK Infrastructure Holdings Limited, a major player in global infrastructure, generates substantial revenue from toll and usage fees across its extensive transportation network. This includes highways, bridges, and tunnels, where drivers pay to utilize these vital arteries.

The financial performance of these toll and usage fees is directly tied to traffic volumes and the established pricing strategies. For instance, in 2024, the company's infrastructure assets, particularly in the transportation sector, continued to benefit from increased mobility and economic activity, translating into consistent fee collection.

These revenue streams offer a direct and predictable return on the significant capital invested in developing and maintaining these critical transportation assets, underpinning the financial health of CK Infrastructure's transport segment.

CK Infrastructure generates revenue from waste management services, including collection, treatment, and disposal. This income is supplemented by the sale of energy produced at their waste-to-energy plants. For instance, in 2023, the company's infrastructure segment, which includes waste management, reported a significant contribution to overall revenue, reflecting the steady demand for these essential services.

Infrastructure Materials Sales

CK Infrastructure generates revenue by selling essential infrastructure materials like cement, concrete, asphalt, and aggregates. This business primarily operates in Hong Kong and Mainland China, supplying vital components for construction and development projects.

This segment acts as a supporting revenue stream, complementing the company's core infrastructure operations. For instance, in 2023, the sale of materials contributed to the overall financial performance, bolstering the company's diversified income base.

- Material Sales: Revenue from cement, concrete, asphalt, and aggregates.

- Geographic Focus: Primarily Hong Kong and Mainland China.

- Strategic Role: Supports core infrastructure projects and diversifies income.

Acquisition-driven Revenue Growth

CK Infrastructure's revenue growth is significantly fueled by acquiring new infrastructure assets. This inorganic growth strategy is a key driver, expanding their operational footprint and diversifying income.

For instance, the strategic acquisitions of Phoenix Energy and UK Renewables Energy in 2024 immediately bolster the company's top-line performance. These new additions contribute directly to revenue, showcasing the impact of their expansionary approach.

- Strategic Acquisitions: A core component of revenue expansion involves the purchase of new infrastructure assets.

- Immediate Revenue Contribution: Newly acquired entities, such as Phoenix Energy and UK Renewables Energy in 2024, start generating revenue upon integration.

- Inorganic Growth: This strategy enhances the asset base and broadens the spectrum of income streams.

CK Infrastructure's revenue streams are diverse, anchored by regulated utilities like electricity and water distribution, which provide stable, predictable earnings. For example, UK Power Networks, a key asset, serves over 8 million customers. The company also generates significant income from toll and usage fees on its extensive transportation network, with 2024 seeing continued benefits from increased mobility.

Waste management services, including energy generation from waste, contribute to revenue, as seen in the strong performance of the infrastructure segment in 2023. Furthermore, CK Infrastructure sells essential construction materials such as cement and asphalt, primarily in Hong Kong and Mainland China, which bolstered its diversified income base in 2023.

The company's growth strategy heavily relies on strategic acquisitions, with recent additions like Phoenix Energy and UK Renewables Energy in 2024 immediately contributing to revenue and expanding its operational reach.

| Revenue Stream | Key Activities | Geographic Focus | 2023/2024 Data Point |

|---|---|---|---|

| Regulated Utilities | Electricity, Gas, Water Distribution | Global (e.g., UK) | UK Power Networks serves >8 million customers. |

| Transportation Fees | Toll and Usage Fees on Highways, Bridges | Global | Benefited from increased mobility in 2024. |

| Waste Management & Energy | Collection, Treatment, Waste-to-Energy | Global | Infrastructure segment showed significant contribution in 2023. |

| Infrastructure Materials | Cement, Concrete, Asphalt, Aggregates | Hong Kong, Mainland China | Contributed to diversified income in 2023. |

| Acquisitions | Purchase of New Infrastructure Assets | Global | Phoenix Energy & UK Renewables Energy acquired in 2024. |

Business Model Canvas Data Sources

The CK Infrastructure Business Model Canvas is built upon a foundation of robust market intelligence, financial projections, and operational data. These sources ensure that each element, from customer segments to cost structures, is grounded in verifiable information and industry best practices.