CK Infrastructure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

CK Infrastructure operates in a dynamic sector shaped by intense competition and significant bargaining power from both suppliers and buyers. Understanding these forces is crucial for navigating its strategic landscape.

The complete report reveals the real forces shaping CK Infrastructure’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The infrastructure sector, including areas like power generation and water treatment, heavily depends on highly specialized equipment and advanced technology. When only a handful of companies supply these critical components, their influence grows significantly. This concentration means that CK Infrastructure (CKI) faces suppliers with substantial leverage, potentially driving up the cost of essential materials and services.

For instance, in 2024, the global market for advanced gas turbines, crucial for power generation, was dominated by a few key players. If CKI requires such specialized turbines, these dominant suppliers can dictate terms, impacting CKI's project budgets. This limited supplier pool restricts CKI's negotiation power and makes finding alternative, cost-effective vendors a significant challenge, potentially affecting project execution timelines and overall profitability.

The construction and maintenance of infrastructure projects by CK Infrastructure heavily rely on specific raw materials like specialized metals and advanced composites. For instance, the global demand for copper, a key component in electrical infrastructure, saw prices fluctuate significantly in 2024, impacting project costs. Suppliers who control these critical inputs can wield substantial power, influencing CK Infrastructure's expenses and the timely completion of its projects.

Suppliers who possess unique technology or offer highly specialized expertise in engineering and operations for intricate infrastructure projects wield considerable influence. CK Infrastructure might find it challenging and costly to switch from established technology or service providers due to the potential for significant financial outlays and operational disruptions. This reliance is amplified by the ongoing digital transformation within the infrastructure sector, where specialized knowledge is paramount.

Labor and Specialized Workforce

The availability of skilled labor and specialized technical professionals is a significant factor influencing the bargaining power of suppliers within CK Infrastructure's operations, particularly in rapidly evolving sectors like renewable energy and smart grid management. A scarcity of talent in these niche areas can empower the workforce, enabling them to negotiate for higher wages and better working conditions.

For instance, the global shortage of experienced renewable energy engineers and technicians, a trend that continued into 2024, means companies like CK Infrastructure must compete fiercely for essential human capital. This competition can drive up labor costs and potentially lead to project delays if specialized skills are not readily accessible, impacting operational efficiency and the timely delivery of infrastructure projects across CK Infrastructure's diverse portfolio.

- Talent Shortages: Continued global demand for skilled professionals in areas like offshore wind turbine maintenance and advanced battery storage management in 2024 put upward pressure on wages.

- Unionization: In certain regions, strong labor unions representing infrastructure workers can leverage collective bargaining to secure favorable terms, increasing labor costs for CK Infrastructure.

- Project Delays: A lack of specialized project managers or highly skilled construction crews for complex, multi-billion dollar infrastructure projects can lead to significant timeline extensions and cost overruns.

- Competitive Landscape: CK Infrastructure competes not only with other infrastructure firms but also with technology companies for talent with expertise in areas like cybersecurity for smart grids.

Access to Capital and Financing

While CK Infrastructure (CKI) is a significant investor, its large-scale projects frequently require external capital. Suppliers of this capital, including banks, private equity, and institutional investors, wield considerable influence, particularly when interest rates are high or credit markets are constrained. Their financing terms directly impact the feasibility and profitability of CKI's potential acquisitions and development ventures.

In 2024, the cost of capital for infrastructure projects has been a key consideration. For instance, the average yield on investment-grade corporate bonds, a proxy for some financing costs, saw fluctuations throughout the year, impacting the overall expense of undertaking new developments. This dynamic highlights the bargaining power of capital providers.

- Financing Costs: In early 2024, the average yield on BBB-rated corporate bonds hovered around 5.5% to 6.5%, a significant factor in project budgeting.

- Investor Demand: Strong demand from institutional investors for infrastructure assets in 2024, driven by their long-term yield expectations, can shift bargaining power towards CKI, but this is balanced by the need for favorable loan covenants.

- Credit Market Conditions: Tightening credit conditions in certain regions during 2024 meant that lenders could impose stricter terms, increasing their leverage in negotiations with CKI.

CK Infrastructure's (CKI) bargaining power with suppliers is significantly influenced by the concentration of specialized technology providers and the availability of critical raw materials. When few suppliers offer essential components or materials, CKI faces higher costs and potential delays, as seen with the 2024 dominance of a few players in the advanced gas turbine market.

The reliance on suppliers with unique engineering expertise and the scarcity of skilled labor in niche infrastructure sectors like renewable energy further empower these suppliers. For example, the 2024 shortage of renewable energy engineers directly impacts CKI's ability to secure talent, driving up labor costs and potentially affecting project timelines.

| Supplier Characteristic | Impact on CKI | 2024 Data/Example |

|---|---|---|

| Concentration of Specialized Technology Providers | Increased costs, limited negotiation power | Dominance of a few players in advanced gas turbine market |

| Control over Critical Raw Materials | Price volatility, potential project delays | Fluctuating copper prices impacting electrical infrastructure costs |

| Unique Expertise & Technology | High switching costs, operational disruption risk | Digital transformation requiring specialized knowledge |

| Scarcity of Skilled Labor | Higher labor costs, project delays | Shortage of renewable energy engineers and technicians |

What is included in the product

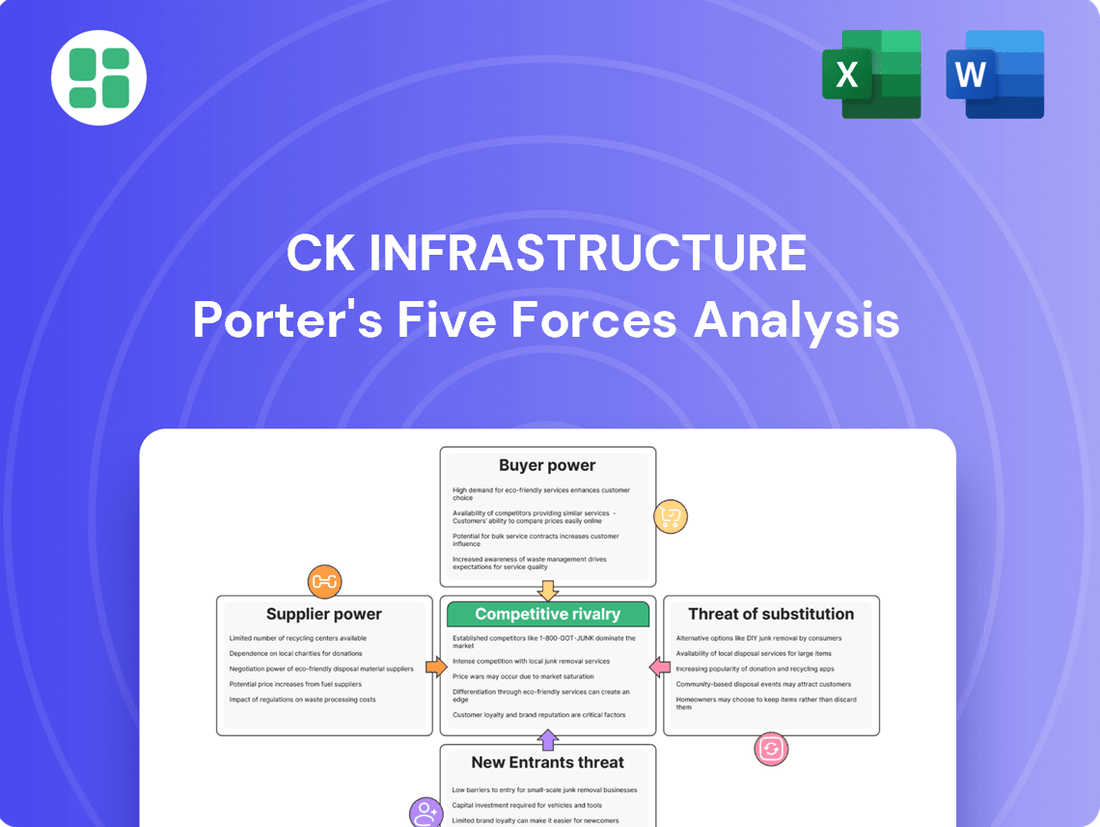

This analysis provides a comprehensive examination of the competitive forces impacting CK Infrastructure, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Easily identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on a single, intuitive dashboard.

Customers Bargaining Power

CK Infrastructure's customer base presents a mixed bag regarding bargaining power. For its regulated utility operations, which often serve millions of individual households, customer influence is largely dispersed. However, in its infrastructure concession businesses, the situation shifts dramatically, with a few large government entities or industrial clients holding significant sway over contract terms and pricing.

This contrast is critical. While the sheer volume of individual utility customers in markets like the UK or Australia limits any single user's impact, a major industrial user or a national government overseeing a large infrastructure project can indeed negotiate more favorable terms. For instance, in 2024, CK Infrastructure's portfolio includes concessions where the primary customers are government bodies responsible for long-term infrastructure development, giving them considerable leverage in setting service level agreements and pricing structures.

CK Infrastructure's customers, especially in regulated utility sectors like energy and water, exhibit significant price sensitivity. However, government bodies heavily influence pricing, limiting CKI's ability to adjust rates based on this sensitivity. For instance, in many jurisdictions, utility price hikes require regulatory approval and are often capped by inflation or predetermined investment return formulas, as seen in the UK's regulated energy market where price controls are a constant factor.

While switching core utility providers like electricity or water can be challenging for households due to extensive infrastructure, some commercial or industrial clients of CK Infrastructure, particularly in competitive segments like certain transportation services, may experience lower switching costs. This means if alternative providers offer comparable quality or more favorable terms, these customers can more readily change suppliers, thereby amplifying their bargaining power.

Customer Information and Transparency

Customer information and transparency significantly bolster the bargaining power of clients dealing with CK Infrastructure. Increased access to data through public reporting and regulatory disclosures means customers, particularly large institutional or government entities, are better equipped to understand pricing, service quality, and what competitors offer. This knowledge allows them to negotiate more advantageous terms with CKI.

For instance, in 2024, the growing emphasis on Environmental, Social, and Governance (ESG) reporting means infrastructure clients are scrutinizing utility providers and project developers more closely. CK Infrastructure's ability to clearly articulate its value proposition and operational efficiency becomes paramount in these negotiations. Customers can leverage this transparency to demand better pricing or service level agreements.

- Informed Negotiation: Customers can compare CKI's pricing and service offerings against publicly available data and competitor benchmarks.

- Demand for Value: Increased transparency compels CKI to demonstrate tangible value and cost-effectiveness to retain clients.

- Leveraging Disclosures: Regulatory and ESG disclosures provide customers with detailed insights into CKI's operations, enabling more pointed negotiations.

- Market Awareness: Widespread information access empowers customers to understand market dynamics and negotiate from a position of strength.

Potential for Backward Integration by Customers

The potential for customers to integrate backward, meaning they could develop their own infrastructure solutions, can give them negotiating power. For instance, a large industrial client might explore building its own power generation or water treatment facilities if it feels CK Infrastructure's terms are unfavorable. While building core infrastructure is incredibly expensive and uncommon for customers, this theoretical threat can influence contract discussions, particularly for specialized services.

For example, in 2024, the global trend towards energy independence saw several large industrial conglomerates in Asia and Europe actively exploring or investing in captive renewable energy projects to reduce reliance on utility providers. This strategic shift, even if not fully realized for core infrastructure, signals a willingness to control essential services, thereby increasing customer leverage in negotiations with infrastructure providers like CK Infrastructure.

- Customer Leverage: The possibility of customers developing their own infrastructure, like captive power plants, grants them bargaining power.

- Capital Intensity: While backward integration is capital-intensive and rare for core infrastructure, the threat itself is a negotiating tool.

- Bespoke Contracts: This leverage is particularly potent in negotiations for customized service agreements with large clients.

- Market Trends: In 2024, industrial clients increasingly explored captive energy solutions, highlighting a growing customer inclination towards self-sufficiency and enhanced negotiation positions.

CK Infrastructure's customer bargaining power varies significantly by segment. In regulated utilities, dispersed individual customers have minimal individual power, but collective action or regulatory intervention can influence pricing. Conversely, large government entities or industrial clients in infrastructure concessions wield substantial influence due to the concentrated nature of these relationships and the critical importance of the services provided.

In 2024, major infrastructure clients, often government bodies, can negotiate terms due to their significant capital commitments and long-term contracts. For example, a government concession for a major toll road or airport typically involves extensive negotiation over tariffs, service standards, and revenue sharing, giving the government considerable leverage.

The potential for customers to switch providers or integrate backward, while often limited by high switching costs and capital intensity in core infrastructure, still represents a theoretical threat that can enhance their bargaining position. This is particularly true for specialized services where alternative solutions might be more feasible, allowing clients to negotiate for better value or pricing in 2024.

| Customer Segment | Bargaining Power Level | Key Influencing Factors (2024) | Examples |

|---|---|---|---|

| Individual Utility Consumers | Low | Dispersed, high switching costs, regulatory price controls | Residential electricity, water, gas customers |

| Large Industrial/Commercial Users (Utilities) | Medium | Volume purchasing, potential for captive solutions, price sensitivity | Major factories, data centers, large commercial complexes |

| Government Entities (Concessions) | High | Contractual power, long-term agreements, public interest considerations | National governments, municipal authorities for transport, utilities |

| Large Corporate Clients (Specialized Services) | Medium to High | Contract value, potential for backward integration, market availability of alternatives | Major logistics firms, large real estate developers |

Preview the Actual Deliverable

CK Infrastructure Porter's Five Forces Analysis

This preview showcases the comprehensive CK Infrastructure Porter's Five Forces analysis, detailing the competitive landscape and strategic positioning within the infrastructure sector. The document you see here is the exact, professionally formatted report you will receive instantly upon purchase, offering actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The infrastructure sector, including giants like CK Infrastructure, operates with formidable fixed costs. This necessitates a relentless pursuit of scale and high asset utilization to ensure profitability. For instance, major infrastructure projects often involve billions in upfront capital for construction and equipment, demanding continuous operation to spread these costs.

This capital-intensive nature fuels industry consolidation. Companies seek to absorb smaller competitors to expand their market share and achieve crucial operational efficiencies. This trend is evident globally, where a few dominant players increasingly control significant portions of the market, intensifying the rivalry among these larger entities.

CK Infrastructure navigates a competitive arena populated by global infrastructure giants like Brookfield Asset Management and Macquarie Group, alongside numerous state-owned entities and a growing contingent of private equity firms. These players often possess substantial capital reserves, influencing project bidding and asset acquisition globally.

While global infrastructure spending is projected to reach $15 trillion by 2024, driven by digital and green initiatives, growth in established, mature markets for traditional infrastructure can be more subdued. This slower expansion means companies like CK Infrastructure often face heightened competition for a finite pool of existing assets or new development opportunities.

In these mature markets, the rivalry intensifies as players compete for market share rather than capitalizing on broad market expansion. This dynamic can result in more aggressive bidding strategies and downward pressure on profit margins for infrastructure developers and operators.

High Exit Barriers

High exit barriers are a defining characteristic of the infrastructure sector, significantly influencing competitive rivalry. The substantial, long-term investments required for assets like power grids, toll roads, and utilities, coupled with intricate regulatory environments, make it exceedingly difficult for companies to simply walk away. This commitment locks players into the market.

For instance, in 2024, the global infrastructure market continued to see significant capital allocation, with major projects often spanning decades. Divesting such assets can incur substantial financial penalties, unamortized costs, and damage a company's reputation, discouraging quick exits. This reality means that even during periods of lower profitability, competitors like CK Infrastructure are compelled to remain active, thus perpetuating a high level of competitive intensity.

- Significant Capital Lock-in: Infrastructure projects demand massive, long-term capital outlays, creating substantial financial commitment.

- Regulatory Entanglement: Complex and often lengthy regulatory approval processes for asset sales further impede easy exit.

- Reputational Costs: Abruptly abandoning long-term infrastructure commitments can severely damage a company's standing with governments and the public.

- Sustained Competitive Pressure: The inability to exit easily forces existing players to compete vigorously, even in less profitable market segments.

Acquisition-Driven Growth Strategy

CK Infrastructure's growth is significantly fueled by its acquisition strategy, positioning it as a direct contender in the competitive M&A landscape for infrastructure assets. This approach necessitates outbidding well-capitalized rivals for prime opportunities.

The company actively participates in the market for infrastructure assets, where competition for attractive targets is fierce. This dynamic means CK Infrastructure is often in bidding wars with other major infrastructure players.

- Intense M&A Competition: CK Infrastructure's reliance on acquisitions places it in direct competition with other well-capitalized entities in the global infrastructure M&A market.

- Bidding for Assets: The company frequently engages in bidding processes for infrastructure assets, facing pressure from numerous domestic and international competitors.

- 2024 Acquisition Trends: Recent strategic acquisitions by CK Infrastructure in 2024 underscore the ongoing and robust competition for high-quality infrastructure assets across various sectors.

The competitive rivalry within the infrastructure sector, impacting CK Infrastructure, is characterized by a limited number of large, well-capitalized players and substantial barriers to entry. This leads to intense competition for existing assets and new projects, particularly in mature markets where growth is slower. The high fixed costs and capital intensity of infrastructure projects also drive consolidation and aggressive bidding strategies, as companies strive for scale and efficiency.

| Competitor Type | Examples | Competitive Impact |

|---|---|---|

| Global Infrastructure Funds | Brookfield Asset Management, Macquarie Group | Significant capital reserves, global reach, aggressive bidding |

| State-Owned Enterprises | Various national infrastructure companies | Government backing, long-term strategic focus, access to public projects |

| Private Equity Firms | Numerous specialized funds | Increasingly active in M&A, seeking yield and growth |

SSubstitutes Threaten

The growing accessibility and declining costs of renewable energy, such as solar and wind power, present a substantial threat of substitution for CK Infrastructure's traditional energy assets. By the end of 2023, global renewable energy capacity additions reached a record high, demonstrating a clear market shift away from fossil fuels.

This trend is further amplified by supportive government policies and increasing consumer demand for cleaner energy solutions, which directly impacts the long-term market position of conventional power generation and gas distribution networks. For instance, many countries have set ambitious renewable energy targets for 2030, signaling a sustained move towards these alternatives.

New technologies in infrastructure management, like smart grids and autonomous maintenance, present a significant threat of substitutes. These innovations can offer alternative, often more efficient, ways to deliver essential services. For instance, advancements in distributed energy resources and microgrids could reduce reliance on traditional, large-scale power transmission infrastructure, a core business for CK Infrastructure (CKI).

While CKI might adopt some of these technologies, independent providers of these solutions can emerge as substitutes. These new players might offer services that bypass the need for CKI's conventional infrastructure assets. Consider the growing market for smart water metering and leak detection systems, which can reduce the need for extensive pipe network upgrades and replacements, impacting CKI's water utilities segment.

The competitive pressure from substitutes is amplified as these technologies mature and become more cost-effective. For example, the global smart grid market was valued at approximately $27.9 billion in 2023 and is projected to grow, indicating a strong trend toward alternative service delivery models. This growth suggests that entities not heavily invested in traditional infrastructure may gain an advantage.

The increasing prevalence of decentralized infrastructure solutions presents a significant threat of substitution for traditional, centralized networks. For instance, the global microgrid market was valued at approximately USD 30.5 billion in 2023 and is projected to reach USD 74.3 billion by 2030, indicating a strong shift towards localized energy generation and distribution.

These localized alternatives, encompassing everything from community solar farms to on-site water treatment, offer compelling advantages like enhanced resilience against large-scale grid failures and potentially lower operational costs for end-users. As of early 2024, several regions are seeing increased investment in these modular systems, driven by a desire for greater energy independence and tailored solutions.

Customers are increasingly drawn to the prospect of greater control over their utility services and the potential for cost savings, making these decentralized options a viable substitute for the extensive, centralized infrastructure typically provided by companies like CK Infrastructure.

Behavioral Shifts and Conservation Efforts

Shifts in consumer behavior, spurred by growing environmental consciousness and economic considerations, can significantly impact CK Infrastructure. For instance, widespread adoption of energy conservation measures, such as increased insulation and smart home technology, directly reduces electricity demand. In 2023, global energy intensity saw a slight improvement, indicating a trend towards using less energy per unit of economic output, which can dampen the need for new power generation and transmission infrastructure.

Similarly, heightened awareness around water scarcity leads to greater water-saving practices by households and businesses. This reduction in per capita water consumption can slow the growth in demand for water treatment and distribution networks. Data from the US Environmental Protection Agency (EPA) in 2024 highlighted a continued focus on water efficiency initiatives, suggesting a sustained pressure on traditional water infrastructure expansion plans.

These behavioral changes, while not offering a direct product replacement, act as a potent substitute threat by diminishing the overall demand for CK Infrastructure's core services.

- Reduced Demand: Increased energy conservation and water-saving habits directly lower consumption.

- Slower Growth: Diminished need for expanded capacity impacts revenue projections.

- Systemic Impact: These are long-term, fundamental shifts affecting traditional infrastructure models.

Public Transportation and Urban Planning Initiatives

For CK Infrastructure's toll roads and bridges, the rise of public transportation and urban planning initiatives presents a significant threat of substitutes. Expanded high-speed rail networks and more frequent bus services can divert commuters, directly impacting traffic volume on toll roads. For instance, in 2024, many metropolitan areas continued to invest heavily in public transit upgrades; for example, the East Coast Rail Link project in the UK aims to significantly cut travel times between major cities, potentially reducing reliance on road travel.

Urban planning that prioritizes walkability and cycling infrastructure also acts as a substitute. Cities actively promoting these alternatives can decrease the need for private vehicle use, thereby lowering toll revenue. In 2024, cities like Copenhagen and Amsterdam continued to lead in cycling infrastructure development, with further expansion plans announced, demonstrating a growing trend that could affect road usage in these regions.

- Public Transportation Growth: Increased investment in high-speed rail and expanded bus services offers alternatives to private vehicle use on tolled routes.

- Urban Planning Impact: Initiatives promoting walkability and cycling reduce demand for car travel, particularly in dense urban centers.

- Revenue Diversion: These substitutes directly threaten revenue streams for toll-based infrastructure by decreasing traffic volumes.

- 2024 Trends: Continued significant investment in public transit and cycling infrastructure in major global cities underscores the ongoing relevance of this threat.

The threat of substitutes for CK Infrastructure's traditional energy assets is substantial due to the increasing accessibility and declining costs of renewable energy sources like solar and wind power. Global renewable energy capacity additions reached a record high by the end of 2023, indicating a significant market shift away from fossil fuels.

Government policies supporting renewables and growing consumer demand for cleaner energy solutions directly impact the long-term market position of conventional power generation and gas distribution networks. Many countries have set ambitious renewable energy targets for 2030, signaling a sustained move towards these alternatives.

New technologies in infrastructure management, such as smart grids and autonomous maintenance, offer more efficient ways to deliver essential services, posing a threat to CKI's core business. For instance, advancements in distributed energy resources and microgrids could reduce reliance on traditional, large-scale power transmission infrastructure.

The global smart grid market was valued at approximately $27.9 billion in 2023 and is projected to grow, indicating a strong trend toward alternative service delivery models that may bypass CKI's conventional infrastructure.

Entrants Threaten

The infrastructure sector, including areas where CK Infrastructure operates like utilities and transportation, requires substantial upfront capital. For instance, major infrastructure projects often run into billions of dollars, covering everything from land acquisition and construction to ongoing operational costs. This sheer scale of investment acts as a significant deterrent for new companies looking to enter the market, as securing such vast funding is a considerable hurdle.

New entrants into the infrastructure sector, particularly those looking to compete with established players like CK Infrastructure, encounter substantial barriers in the form of extensive regulatory hurdles and licensing requirements. These processes are often complex, time-consuming, and demand significant financial investment and specialized expertise to navigate successfully across different jurisdictions and operational sectors.

CK Infrastructure, having operated for many years, possesses deep-rooted relationships and a proven track record in managing these intricate regulatory frameworks. This established proficiency serves as a formidable deterrent for potential new entrants, as the sheer time, cost, and specialized knowledge required to gain approvals and maintain compliance can be prohibitive, effectively limiting the threat of new competition.

Existing players within the infrastructure sector, such as CK Infrastructure, possess a formidable advantage due to substantial economies of scale. This scale translates into lower per-unit costs across asset management, daily operations, and bulk procurement of materials and services, enhancing overall efficiency and profitability. For instance, CK Infrastructure's extensive global network allows for optimized supply chains and operational synergies that are difficult for newcomers to replicate.

New entrants face a significant hurdle in matching these established cost advantages. To even approach the efficiency of incumbents, they would require massive initial capital outlays to build comparable infrastructure and operational capacity. Furthermore, acquiring the necessary operational experience and developing the expertise to manage complex infrastructure projects efficiently presents a steep learning curve, making it challenging to compete effectively on price or service quality from the outset.

Long Project Development Timelines and Payback Periods

The sheer length of time required to develop infrastructure projects, often stretching over multiple years and even decades for payback, acts as a significant deterrent to potential new entrants. This extended investment horizon means new players need substantial patience and a deep well of capital, resources that established companies like CK Infrastructure already possess. For instance, major infrastructure projects such as new airport terminals or high-speed rail lines can easily have development and construction phases exceeding five to ten years before any revenue generation even begins.

This characteristic creates a formidable barrier to entry, as it requires a long-term commitment and a tolerance for delayed returns. Newcomers are less likely to enter markets where capital is tied up for such extended periods, especially if they are seeking more immediate financial gratification. CK Infrastructure's established track record and financial stability position it favorably against such challenges.

Consider these points:

- Extended Development Cycles: Infrastructure projects frequently involve multi-year planning, design, and construction phases, delaying revenue streams.

- Long Payback Periods: The time it takes for an infrastructure investment to generate sufficient returns to recover its initial cost can span decades, a significant hurdle for new investors.

- Capital Intensity and Patience: Entering this sector demands not only vast amounts of capital but also a strategic patience that many potential competitors may lack.

- Established Player Advantage: Companies like CK Infrastructure, with their deep financial resources and long-term outlook, are better equipped to navigate these extended investment cycles.

Established Networks and Concession Agreements

CK Infrastructure's strong position in utilities and transportation is significantly bolstered by its long-term concession agreements and deeply embedded national networks. For potential new entrants, the sheer difficulty in replicating or accessing these established infrastructures presents a formidable barrier. New players would typically need to navigate complex government tender processes or acquire existing operators, a costly and time-consuming endeavor that deters many.

For instance, securing new concessions in regulated utility sectors often involves extensive due diligence and competitive bidding, as seen in recent infrastructure projects globally. In 2024, many developed nations continue to rely on established concession models for major infrastructure upgrades, favoring experienced operators with proven track records. This reliance on existing frameworks and the high capital requirements for new concessions effectively limit the threat of new entrants.

- Concession Agreements: CK Infrastructure benefits from long-term concessions in sectors like utilities and transportation, making it hard for new companies to enter.

- Network Effects: Established national networks provide significant advantages, creating high switching costs for customers and operational efficiencies for incumbents.

- Government Tenders: Access to new infrastructure projects often requires winning government tenders, a process favoring established players with strong reputations and financial backing.

- High Capital Requirements: The substantial investment needed to build or acquire equivalent infrastructure deters new entrants, effectively protecting CK Infrastructure's market share.

The threat of new entrants for CK Infrastructure is generally low due to massive capital requirements and extensive regulatory landscapes. These barriers, coupled with long development cycles and established networks, make it extremely difficult for newcomers to compete effectively. For example, the global infrastructure market is projected to reach $14.7 trillion by 2025, with significant portions requiring substantial upfront investment.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Billions of dollars required for projects like utilities and transport. | Prohibitive for most new companies. |

| Regulatory Hurdles | Complex licensing and compliance across jurisdictions. | Time-consuming, costly, and requires specialized expertise. |

| Economies of Scale | Established players have lower per-unit costs. | New entrants struggle to match pricing and efficiency. |

| Long Development Cycles | Multi-year planning and construction before revenue. | Requires significant patience and sustained capital. |

Porter's Five Forces Analysis Data Sources

Our CK Infrastructure Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, government infrastructure spending data, and publicly available financial statements of key players.