CK Infrastructure Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

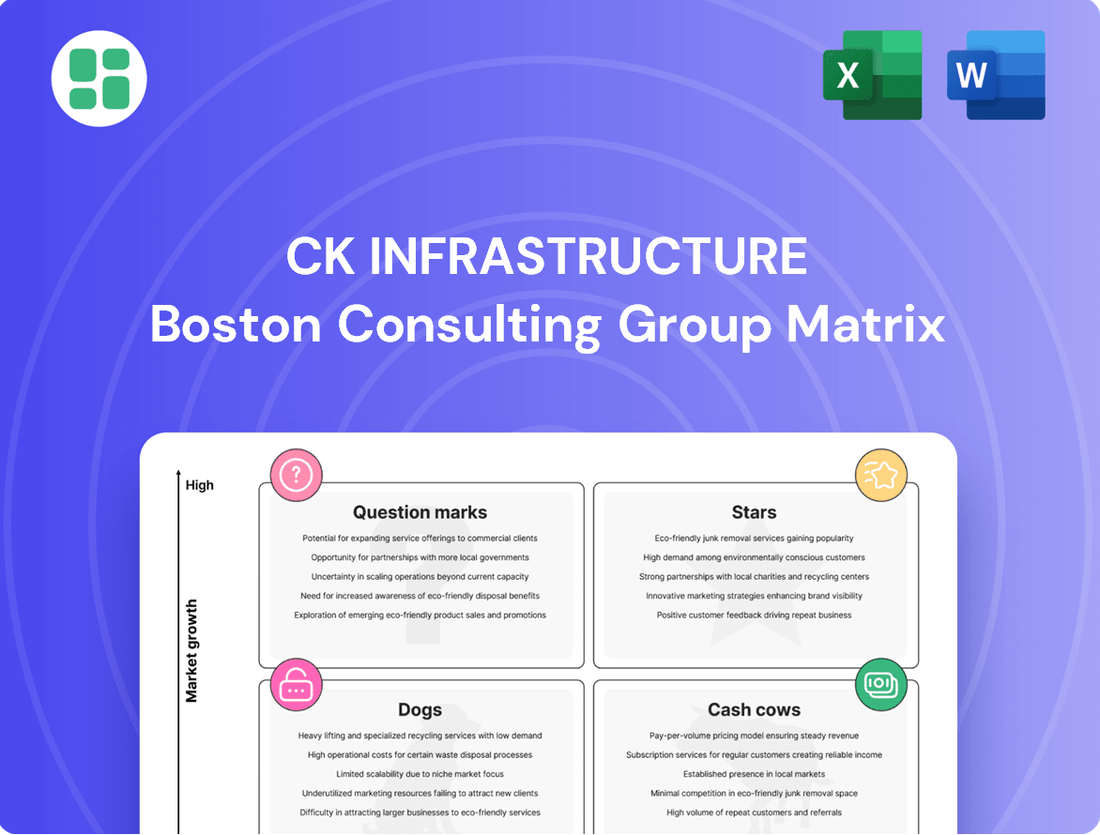

Curious about CK Infrastructure's strategic positioning? This BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these dynamics is crucial for informed investment and resource allocation. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to guide your next strategic move.

Stars

CK Infrastructure (CKI) has made substantial inroads into the UK renewable energy market, notably acquiring 32 onshore wind farms and the UU Solar portfolio in 2024. These strategic moves bolster CKI's position in a sector experiencing robust growth, fueled by global decarbonization initiatives and supportive government policies.

These UK renewable assets are anticipated to generate immediate revenue and consistent cash flow for CKI. This expansion solidifies CKI's standing as a key player in a high-growth segment, aligning with the broader trend of increasing investment in sustainable energy solutions.

Phoenix Energy, acquired in April 2024, stands as Northern Ireland's premier natural gas distributor, serving a substantial portion of the region's gas connections and population. Its operations are underpinned by a stable regulatory environment, positioning it favorably within the BCG matrix.

While the natural gas sector is generally considered mature, Phoenix Energy's strategic advantage lies in its significant market share and the potential for future integration of renewable gas sources. This forward-looking capability, coupled with its immediate profit contribution post-acquisition, solidifies its status as a star asset for CK Infrastructure.

CKI's Australian electricity distribution networks, including SA Power Networks and Powercor, are standout performers. These operations consistently rank high in regulatory benchmarking, showcasing their operational excellence.

Despite the mature nature of the electricity distribution market, CKI's Australian assets possess significant growth potential. Upcoming regulatory resets in 2025-2026 and the capability to facilitate swift power connections for large enterprises and clean energy initiatives solidify their strong market standing.

Regulated UK Electricity Distribution (UK Power Networks)

UK Power Networks (UKPN) stands as a dominant force in the UK electricity distribution landscape, serving over 8 million customers, making it the largest distributor by customer base. Its consistent operational excellence and leading performance metrics within the regulated sector solidify its position as a star in the BCG matrix. This strong market presence, combined with significant ongoing investment in network upgrades and maintenance, ensures reliable service and high customer satisfaction, contributing to its robust growth trajectory within regulatory frameworks.

- Market Leader: Serves over 8 million customers, the largest electricity distributor in the UK.

- Operational Excellence: Consistently achieves top performance ratings in the regulated electricity distribution sector.

- Investment Focus: Significant capital expenditure on network modernization and resilience, with planned investments of £3.5 billion for the RIIO-ED2 period (2023-2028).

- Customer Satisfaction: High levels of customer satisfaction reported, reflecting reliable service delivery.

Continental Europe (ista)

Ista, CK Infrastructure's (CKI) significant investment in Continental Europe, is a prime example of a Star in the BCG Matrix, particularly within the burgeoning energy management services sector. The company has demonstrated robust financial health and achieved record organic growth throughout 2024, underscoring its strong market position.

The strategic expansion of ista into electric vehicle (EV) charging infrastructure, exemplified by its acquisition of Chargemaker GmbH in Germany, highlights its commitment to capitalizing on high-growth trends. This move, coupled with an expanding international footprint, solidifies ista's status as a Star with substantial future potential in the dynamic energy services landscape.

- Record Organic Growth: ista reported its highest-ever organic growth rate in 2024, driven by increased demand for its energy management solutions.

- EV Charging Expansion: The acquisition of Chargemaker GmbH in Germany signifies a strategic push into the rapidly expanding EV charging market, a key growth driver.

- International Presence: ista continues to broaden its international reach, enhancing its ability to capture market share across diverse European economies.

- Strong Financial Performance: The company's financial results for 2024 reflect a healthy revenue stream and profitability, indicative of its Star status.

CKI's renewable energy acquisitions in the UK, including 32 onshore wind farms and the UU Solar portfolio in 2024, position these assets as Stars. Phoenix Energy, acquired in April 2024, also qualifies as a Star due to its dominant market share in Northern Ireland's natural gas distribution and its potential for renewable gas integration.

CKI's Australian electricity distribution networks, SA Power Networks and Powercor, are strong Stars, consistently performing well and showing growth potential through upcoming regulatory resets and facilitating clean energy initiatives.

UK Power Networks (UKPN) is a clear Star, holding the largest customer base in the UK electricity distribution sector and demonstrating operational excellence with significant investment in network upgrades, evidenced by £3.5 billion planned for the RIIO-ED2 period (2023-2028).

Ista, CKI's European energy management services business, is a Star, achieving record organic growth in 2024 and strategically expanding into the high-growth EV charging market through acquisitions like Chargemaker GmbH.

| Asset | Market Position | Growth Potential | Key 2024/2025 Data |

|---|---|---|---|

| UK Wind & Solar | Growing renewable sector | High (decarbonization trends) | Acquired 32 wind farms & UU Solar in 2024 |

| Phoenix Energy | Dominant gas distributor (NI) | Moderate (renewable gas integration) | Acquired April 2024 |

| Australian Electricity Networks | High regulatory performance | High (regulatory resets, clean energy links) | Regulatory resets 2025-2026 |

| UK Power Networks (UKPN) | Largest UK electricity distributor | High (network upgrades) | £3.5bn planned for RIIO-ED2 (2023-2028) |

| Ista | Leading energy management (Europe) | High (EV charging expansion) | Record organic growth 2024, acquired Chargemaker GmbH |

What is included in the product

The CK Infrastructure BCG Matrix analyzes its business units based on market growth and share, guiding investment decisions.

A clear visual representation of CK Infrastructure's portfolio, instantly identifying Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

Northern Gas Networks (NGN) and Wales & West Utilities (WWU) represent established, regulated gas distribution networks within the UK. These operations benefit from supportive regulatory environments that foster stable and predictable cash flows, a hallmark of mature businesses with strong market positions.

Operating in markets characterized by low growth but high market share, NGN and WWU consistently contribute significant profits to CK Infrastructure Holdings (CKI). Their operational efficiency, coupled with the nature of long-term contracts inherent in utility services, ensures steady and reliable returns for the parent company.

For instance, in 2023, CKI's infrastructure segment, which includes these gas networks, reported a substantial contribution to the group's overall performance, underscoring the cash-generating power of these regulated assets. The predictable revenue streams from these essential services make them key cash cows within CKI's portfolio.

Northumbrian Water, a vital UK water utility, functions as a quintessential cash cow for CK Infrastructure (CKI). Its operations are firmly rooted in a mature, heavily regulated market, providing essential services that translate into a predictable and steady income. This stability is further bolstered by its consistent financial performance and its distinction as one of the World's Most Ethical Companies, highlighting its robust market standing and consistent cash-generating capability.

CK Infrastructure Holdings Limited (CKI) benefits significantly from its substantial stake in Power Assets Holdings Limited (PAH). PAH operates as a major global utility company, boasting a portfolio of stable, regulated assets. This strategic investment acts as a cornerstone for CKI's cash flow generation, providing a reliable and consistent stream of profits.

PAH's diversified energy infrastructure assets are primarily located in mature markets, which contributes to their predictable revenue streams. For instance, as of the end of 2023, PAH's significant investments in regulated utility businesses across Australia, the UK, and Hong Kong continued to demonstrate robust performance, underpinning CKI's financial stability.

Australian Gas Infrastructure Group (AGIG)

Australian Gas Infrastructure Group (AGIG), encompassing Australian Gas Networks and Multinet Gas Networks, operates within Australia's established gas distribution and transmission sector. This mature market offers predictable revenue streams, positioning AGIG as a stable contributor to its parent company's portfolio.

AGIG's strategic investments in upgrading its infrastructure to accommodate future energy sources, such as hydrogen blending, reinforce its role as a long-term cash generator. These upgrades ensure continued operational efficiency and relevance in a changing energy landscape.

- AGIG's core business in gas distribution and transmission provides a stable, mature market with consistent returns.

- Investments in hydrogen-compatible infrastructure solidify its long-term cash-generating potential.

- The group operates in a sector characterized by high barriers to entry and regulated pricing, contributing to its predictable cash flows.

Canadian Infrastructure Portfolio (e.g., Canadian Power)

CKI's Canadian infrastructure assets, particularly in power generation, are considered cash cows. These mature, essential services provide consistent and reliable cash flow, a hallmark of a strong cash cow business. Despite potential market-related ups and downs in specific segments, the foundational stability of these operations ensures their ongoing contribution to the company's financial health.

For instance, CK Power, a key part of CKI's Canadian holdings, operates a diversified portfolio of renewable and conventional power generation facilities. In 2024, the company continued to benefit from long-term power purchase agreements, which lock in revenue streams and minimize exposure to volatile energy prices. This strategic focus on stable, contracted assets underpins the cash cow status of its Canadian power segment.

- Stable Cash Generation: CK Power's portfolio, featuring assets like hydroelectric and wind farms, consistently generates substantial cash flow due to long-term contracts.

- Essential Service: The critical nature of power infrastructure ensures consistent demand, even during economic downturns, bolstering its cash cow characteristics.

- Operational Efficiency: Mature assets benefit from optimized operations and established maintenance protocols, contributing to predictable earnings and cash flow.

- Limited Growth Potential: While highly profitable, the Canadian power segment's growth is often constrained by regulatory environments and the maturity of existing infrastructure, typical of cash cows.

Cash cows within CK Infrastructure's portfolio, such as its UK gas networks and Australian gas infrastructure, are characterized by their operation in mature, regulated markets. These businesses benefit from high market share and stable, predictable cash flows, essential for funding other ventures.

For example, in 2023, CK Infrastructure's infrastructure segment, which includes these cash-generating assets, demonstrated strong performance. The consistent revenue streams from these essential services highlight their role as reliable profit generators for the parent company.

These mature operations often have limited growth potential but excel at generating substantial cash, which is crucial for CK Infrastructure's overall financial strategy and investment capacity.

| Asset | Market Maturity | Cash Flow Predictability | Contribution to CKI |

|---|---|---|---|

| UK Gas Networks (NGN, WWU) | High | High | Significant |

| Northumbrian Water | High | High | Significant |

| Power Assets Holdings (PAH) | High | High | Core Cash Flow Driver |

| Australian Gas Infrastructure Group (AGIG) | High | High | Stable Contributor |

| Canadian Power Generation (CK Power) | High | High | Consistent Returns |

What You See Is What You Get

CK Infrastructure BCG Matrix

The CK Infrastructure BCG Matrix preview you see is the identical, fully completed document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no missing sections—just the comprehensive strategic analysis ready for your immediate use. You'll gain access to the exact same professionally formatted report, meticulously crafted to provide clear insights into CK Infrastructure's portfolio. This is your direct pathway to acquiring a ready-to-implement strategic planning tool without any further modifications or delays.

Dogs

CKI's toll road operations in Mainland China are currently positioned as a 'dog' in the BCG matrix. In the first half of 2024, these operations saw a decline in traffic volume, leading to a reduced profit contribution. This segment operates within a low-growth market, facing potential market share erosion due to heightened competition and the rise of alternative transportation methods.

The infrastructure materials manufacturing sector in Mainland China is currently facing significant headwinds, characterized by subdued pricing and declining sales volumes. This performance points towards a challenging market environment, likely marked by intense competition or a general slowdown in demand.

This business unit's position suggests it holds a low market share within a market that is either stagnant or experiencing severe competition. Consequently, it's likely categorized as an underperforming asset, generating minimal profits and potentially necessitating ongoing, unproductive capital infusions simply to sustain its operations.

For instance, in 2024, the Chinese construction materials market, a key indicator for this sector, saw a year-on-year contraction of 3.5% in real terms, with average selling prices for key commodities like cement and steel dropping by an estimated 5-7% due to overcapacity and weak project pipelines.

Certain Canadian power assets within CK Infrastructure's portfolio showed weaker performance in 2024. This was largely due to decreased power prices in Alberta, influenced by mild weather conditions and a greater influx of renewable energy supply.

While these assets are in a mature market and not slated for immediate sale, their ongoing underperformance, without strategic operational adjustments or market repositioning, could lead to their classification as 'dogs' in the BCG matrix.

Older, Less Efficient Waste Management Facilities

While CK Infrastructure Holdings (CKI) boasts a robust portfolio, certain older waste management facilities, particularly waste-to-energy plants or treatment sites, could be categorized as dogs if they aren't being modernized or are burdened by stricter regulations without offsetting revenue growth. These assets may hover around break-even or even drain cash, offering limited potential for future expansion. For instance, while CKI's overall infrastructure segment performed well, specific older facilities might not keep pace with evolving environmental standards.

- Underperforming Assets: Older waste-to-energy plants with lower operational efficiency compared to newer technologies.

- Regulatory Pressure: Facilities facing increased compliance costs without commensurate revenue adjustments.

- Limited Growth Prospects: Assets unlikely to generate significant returns or market share gains in the near to medium term.

- Cash Consumption: Operations that require ongoing investment to maintain functionality rather than drive growth.

Divested or Non-Strategic Smaller Assets

CK Infrastructure Holdings (CKI) might periodically divest smaller, non-core assets. This strategic move is common for large infrastructure investors aiming to streamline operations and focus on high-growth areas. While specific recent divestments of 'dogs' aren't publicly detailed, the principle remains: shedding underperforming or low-market-share holdings to optimize the portfolio.

These divestments, though not labeled as such, align with the 'dog' quadrant of the BCG matrix. They represent assets that offer limited growth potential and a small market share within CKI's broader portfolio. For instance, if CKI were to sell a minor utility operation in a mature, low-demand region, it would fit this category.

- Divestment Rationale: Assets are divested when they no longer align with CKI's strategic objectives or fail to meet return expectations.

- Portfolio Optimization: This process allows CKI to reallocate capital towards more promising infrastructure projects with higher growth and market share potential.

- Financial Impact: While specific figures for 'dog' divestments are not readily available, such actions can improve overall portfolio profitability and efficiency.

- Strategic Alignment: The focus remains on strengthening core businesses and pursuing acquisitions that enhance market position and future growth prospects.

CKI's 'dog' assets represent business units with low market share in slow-growing or declining sectors. These segments often struggle with profitability and may require ongoing investment without significant returns. For example, certain older waste management facilities, facing stricter environmental regulations and limited growth, could fall into this category. The company may strategically divest these underperforming assets to optimize its portfolio.

| CKI Business Unit Example | BCG Category | 2024 Performance Indicator | Market Growth Outlook | Strategic Consideration |

|---|---|---|---|---|

| Older Waste Management Facilities | Dog | Increased compliance costs, limited revenue growth | Low | Potential divestment or modernization |

| Certain Canadian Power Assets | Dog | Decreased power prices in Alberta | Mature/Low | Operational adjustments or repositioning |

| Infrastructure Materials Manufacturing (China) | Dog | Subdued pricing, declining sales volumes (-3.5% market contraction) | Low/Declining | Focus on efficiency, potential restructuring |

Question Marks

CK Infrastructure Holdings (CKI) is strategically positioning itself in emerging renewable energy technologies, which fall under the question mark category of the BCG matrix. These are sectors with high growth potential but currently low market share for CKI.

Investments in advanced energy storage, like next-generation battery technologies, and the burgeoning green hydrogen infrastructure represent CKI's foray into these developing markets. While the global renewable energy storage market was valued at approximately USD 25 billion in 2023 and is projected to grow substantially, CKI's initial stake in these specific segments is likely small.

The significant capital expenditure required to scale up operations in these nascent fields, coupled with the evolving regulatory landscape and technological advancements, positions these as question marks. CKI's commitment to sustainability and decarbonization beyond established wind and solar projects underscores its interest in these future-oriented technologies.

CK Infrastructure (CKI) actively seeks new global acquisition targets, and venturing into developing economies with burgeoning infrastructure demands represents a significant strategic move. These new market entries, where CKI has little to no existing footprint, are classic question marks in the BCG matrix, demanding considerable upfront capital to build a competitive position.

For instance, CKI's potential expansion into Southeast Asian nations like Vietnam or the Philippines, driven by their projected infrastructure spending of over $100 billion annually through 2030, would fall into this category. Such investments are high-risk, high-reward, requiring careful market analysis and substantial commitment to overcome nascent market challenges and establish a foothold.

CK Infrastructure's (CKI) smart infrastructure and digitalization initiatives are positioned within a high-growth market. Investments in areas like IoT for network optimization and smart grid solutions represent a strategic move to capture future market share.

These ventures, while demanding substantial upfront capital, offer the potential for significant, albeit uncertain, returns. For instance, the global smart grid market was projected to reach over $100 billion by 2024, indicating the scale of opportunity CKI is targeting.

Strategic Bids for Large, Challenged Assets (e.g., Thames Water)

CK Infrastructure Holdings (CKI) was reportedly exploring a bid for Thames Water in February 2025. This move positions Thames Water as a potential 'question mark' within CKI's portfolio, given its significant debt and current operational challenges.

The acquisition represents a high-risk, high-reward scenario. Success hinges on a successful turnaround, which could unlock substantial growth potential in a critical UK market. However, the considerable capital investment required, coupled with negative market perception and existing operational issues, presents significant hurdles.

Thames Water's situation is indicative of the complexities involved in acquiring large, distressed assets.

- Debt Burden: Thames Water has faced scrutiny over its substantial debt, reported to be around £14.7 billion as of March 2024.

- Regulatory Environment: The UK water sector operates under strict regulation, impacting pricing and investment decisions.

- Operational Performance: Recent performance indicators, including leakage rates and customer service, have been areas of concern.

- Market Perception: Negative sentiment surrounding the company's financial health and operational practices could deter investors.

Expansion of EV Charging Infrastructure (via ista or new ventures)

CKI's expansion into EV charging, exemplified by the acquisition of Chargemaker GmbH, positions it within a dynamic and rapidly growing sector. While this move signifies a strategic entry, the overall market share for CKI in EV charging may still be modest when contrasted with its established utility operations. For instance, the global EV charging market was valued at approximately USD 22.4 billion in 2023 and is projected to reach USD 125.5 billion by 2030, indicating substantial growth potential but also intense competition.

Significant further investments are necessary to scale CKI's EV charging networks globally. This is characteristic of a question mark in the BCG matrix, demanding substantial capital outlay to capture a meaningful market share in a sector still solidifying its competitive landscape. The capital expenditure required for building out charging infrastructure, including hardware, software, and grid integration, can be considerable.

- Market Growth: The EV charging market is experiencing exponential growth, with projections indicating a compound annual growth rate (CAGR) of over 25% in the coming years.

- Investment Needs: Scaling charging networks requires significant upfront capital for equipment, installation, and maintenance.

- Competitive Landscape: The sector is attracting numerous players, from established energy companies to dedicated EV charging startups, intensifying competition.

- Regulatory Environment: Government incentives and regulations play a crucial role in shaping the pace of EV infrastructure development.

CK Infrastructure's ventures into emerging technologies like advanced energy storage and green hydrogen infrastructure are prime examples of question marks. These sectors offer high growth potential, but CKI's current market share is minimal, demanding substantial investment to establish a competitive position.

Similarly, CKI's expansion into developing economies, such as potential investments in Vietnam's infrastructure, represents new markets where the company has little existing presence. These are capital-intensive endeavors with uncertain outcomes, characteristic of question marks.

CKI's strategic moves into EV charging infrastructure, like the acquisition of Chargemaker GmbH, also fall into this category. Despite significant market growth, CKI's current share is modest, requiring further investment to scale and compete effectively in this dynamic sector.

| Initiative | Market Growth Potential | CKI Market Share | Investment Requirement | Risk/Reward Profile |

| Renewable Energy Storage | High | Low | High | High/High |

| Green Hydrogen Infrastructure | High | Low | High | High/High |

| Developing Economy Infrastructure (e.g., Vietnam) | High | Negligible | Very High | High/High |

| EV Charging Infrastructure | Very High | Low | High | High/High |

BCG Matrix Data Sources

Our CK Infrastructure BCG Matrix leverages comprehensive data from public company filings, infrastructure project databases, and economic growth indicators to provide a robust strategic overview.