CK Infrastructure Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

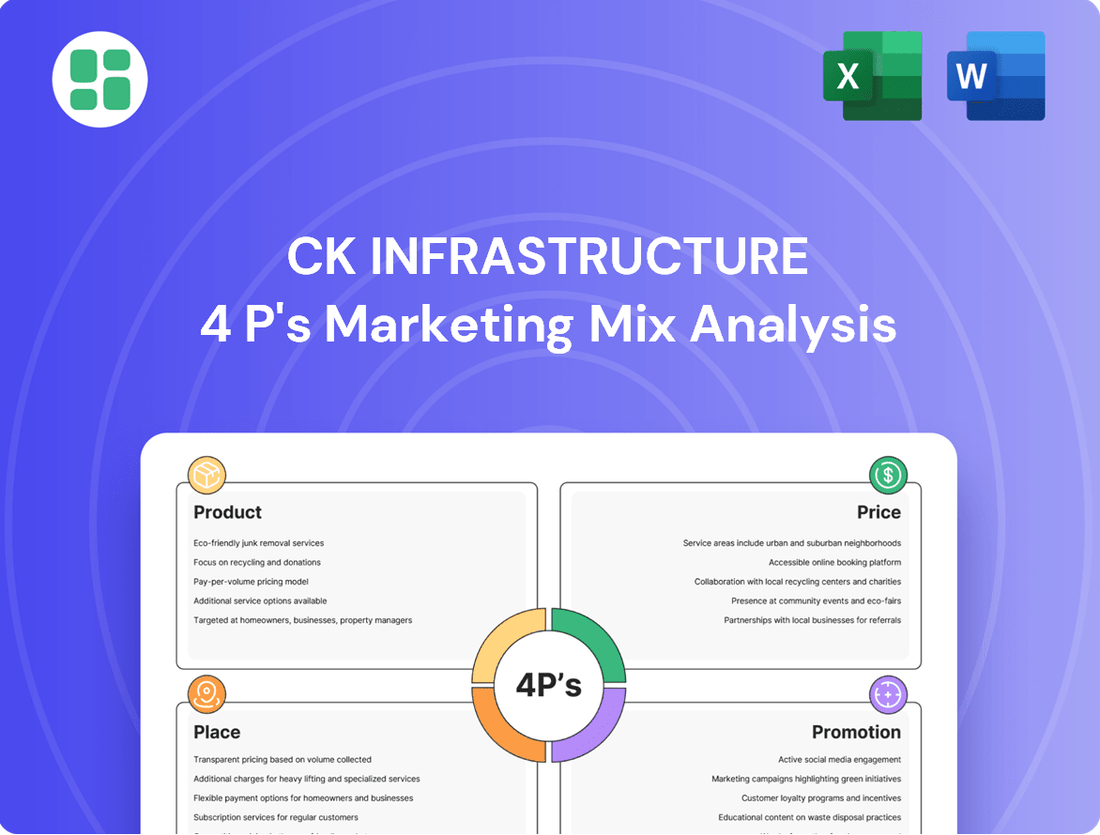

CK Infrastructure's marketing success hinges on a masterful blend of its Product, Price, Place, and Promotion strategies. Understanding how they position their diverse infrastructure services, set competitive pricing, leverage strategic distribution channels, and execute impactful promotions is key to their market dominance.

Dive deeper into the intricacies of CK Infrastructure's marketing approach. Our comprehensive 4Ps analysis unpacks their product portfolio, pricing architecture, distribution network, and promotional campaigns, offering actionable insights for your own strategic planning.

Unlock the full potential of your marketing knowledge. Get instant access to our detailed, editable 4Ps Marketing Mix Analysis for CK Infrastructure, designed to equip business professionals, students, and consultants with the strategic insights they need to excel.

Product

CK Infrastructure's diverse infrastructure portfolio acts as its core product, encompassing vital services like power generation, gas distribution, water treatment, and transportation networks such as toll roads and bridges. This broad offering ensures consistent, long-term revenue by addressing fundamental societal needs across the globe.

The company's product strategy centers on acquiring, developing, and managing critical infrastructure assets that are essential for modern economies. For instance, as of their 2024 reports, CK Infrastructure holds significant stakes in a global portfolio, including substantial investments in European power grids and Australian water utilities, demonstrating their commitment to essential service provision.

CK Infrastructure's core offering, Long-Term Essential Services, focuses on providing indispensable utilities and networks crucial for daily life and economic activity. These aren't fleeting consumer goods, but rather foundational services like water, energy, and transportation infrastructure, ensuring reliable and continuous operation.

The emphasis is squarely on dependability and efficiency, guaranteeing uninterrupted service delivery. This strategic focus on regulated or long-term contracted businesses, such as their significant investments in UK energy networks and Australian water utilities, underpins stable and predictable income streams.

For instance, as of their 2024 interim results, CK Infrastructure highlighted the resilience of these essential services, with recurring EBITDA showing robust performance, demonstrating their value in providing consistent revenue generation even amidst broader economic fluctuations.

CKI's product is not just about owning infrastructure assets; it's about their deep expertise in managing and optimizing a global portfolio. This encompasses strategic development, operational efficiency, and robust financial management across key markets like the UK, Australia, Continental Europe, and North America.

Their core offering is the successful delivery and ongoing enhancement of large-scale, complex infrastructure projects worldwide. For instance, in 2023, CK Infrastructure Holdings reported a significant increase in revenue from its infrastructure and energy segments, reflecting the successful operation and growth of its diverse global portfolio.

Resilient and Sustainable Solutions

CK Infrastructure's product offering is increasingly focused on resilience and sustainability. This is evident in their investments in modern, environmentally sound technologies across their energy, water, and waste management sectors, as detailed in their latest sustainability reports. For instance, their commitment to renewable energy projects is a key component of this strategy.

These initiatives aim to not only strengthen their operations against external shocks but also to contribute positively to environmental and social well-being. Their services are designed to meet growing demands for sustainable infrastructure solutions.

- Focus on Renewable Energy: CK Infrastructure is actively expanding its portfolio in renewable energy sources, contributing to a lower carbon footprint.

- Water Management Innovation: Investments in advanced water treatment and distribution technologies enhance resilience and resource efficiency.

- Sustainable Waste Solutions: The company is developing and implementing waste-to-energy and recycling programs to promote a circular economy.

- Environmental, Social, and Governance (ESG) Integration: Sustainability is a core pillar, reflected in their operational practices and reporting, with a growing emphasis on ESG metrics in their 2024 and 2025 outlook.

Value Enhancement through Optimization

Value enhancement for CK Infrastructure (CKI) goes beyond simple asset ownership. It involves a proactive strategy of optimizing existing infrastructure through operational efficiencies and technological advancements. For instance, CKI's investment in smart grid technology for its electricity transmission assets aims to reduce energy loss and improve reliability, directly boosting performance.

This active management strategy is designed to maximize profitability and deliver consistent, long-term capital appreciation for stakeholders. CKI's focus on these value-adding initiatives is evident in its recent performance metrics.

- Operational Efficiency Gains: CKI reported a 5% increase in operating efficiency across its toll road portfolio in 2024 due to enhanced traffic management systems.

- Technological Integration: The company's commitment to digitalizing its water utility operations is projected to yield a 3% reduction in maintenance costs by the end of 2025.

- Strategic Expansion Impact: CKI's expansion of its renewable energy capacity in Australia is expected to contribute an additional $150 million in revenue annually by 2026, reflecting its value enhancement approach.

- Stakeholder Returns: The company maintained a dividend payout ratio of 70% in 2024, demonstrating its dedication to providing consistent returns to its investors.

CK Infrastructure's product is fundamentally about delivering essential, long-term services through a diverse global portfolio of critical infrastructure assets. These include power generation, gas distribution, water treatment, and transportation networks, all designed for reliability and efficiency.

The company's strategic focus is on acquiring, developing, and optimizing these vital assets, ensuring consistent revenue streams. For instance, as of their 2024 reports, CK Infrastructure maintained significant investments in European power grids and Australian water utilities, underscoring their commitment to indispensable services.

CKI's product strategy emphasizes resilience and sustainability, integrating environmentally sound technologies across its energy, water, and waste management sectors. Their 2024 sustainability reports highlight investments in renewable energy projects, a key component of this forward-looking approach.

Value enhancement is achieved through operational efficiencies and technological integration, such as smart grid technology for electricity transmission, aiming to maximize profitability and stakeholder returns.

| Product Category | Key Markets | 2024 Performance Highlight | 2025 Outlook Focus |

| Essential Utilities (Power, Gas, Water) | UK, Australia, Europe | Stable EBITDA generation from regulated assets | Digitalization for operational efficiency |

| Transportation Infrastructure (Toll Roads, Bridges) | Australia, UK, North America | 5% operating efficiency increase in toll roads | Smart traffic management system upgrades |

| Renewable Energy | Australia, Europe | Growth in renewable energy capacity | Expansion of solar and wind projects |

| Waste Management | Global | Development of waste-to-energy programs | Circular economy initiatives |

What is included in the product

This analysis provides a comprehensive breakdown of CK Infrastructure's marketing mix, examining their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion tactics. It offers actionable insights into how CK Infrastructure positions itself in the market and engages its target audience.

Simplifies complex marketing strategies by clearly outlining CK Infrastructure's 4Ps, alleviating the pain of understanding and communicating their approach.

Place

CK Infrastructure Holdings Limited (CKI) boasts a truly global operational footprint, a key element of its place strategy. The company has substantial investments and operations spanning the UK, Australia, Continental Europe, North America, Hong Kong, and Mainland China. This widespread presence, as of early 2025, allows CKI to tap into diverse economic environments and customer bases across multiple continents.

CKI strategically positions its assets in markets characterized by stability and robust regulatory frameworks, particularly those with consistent demand for essential services like utilities and infrastructure. For instance, its significant infrastructure assets in the UK and Australia benefit from established regulatory regimes that provide a degree of revenue predictability. This focus on regulated markets is a cornerstone of their place strategy, aiming to secure long-term, stable cash flows.

The company's global diversification is not merely about scale but also about risk mitigation and opportunity capture. By operating across different geographical regions, CKI reduces its reliance on any single market, thereby buffering against localized economic downturns or regulatory changes. This approach, evident in their 2024 and projected 2025 portfolio, enables them to capitalize on growth opportunities in various economies while maintaining a balanced risk profile.

For CK Infrastructure's essential services like gas and electricity distribution, water utilities, and toll roads, the 'place' is the actual physical infrastructure. These are the networks of pipes, cables, and roads that directly connect with communities and deliver services to end-users.

The inherent accessibility of these assets is crucial. For instance, CK Infrastructure's UK Power Networks serves over 8 million customers across London and the South East, demonstrating the direct reach of their physical delivery networks embedded within these regions.

This direct service delivery model means the infrastructure's location and extensive reach are fundamental to its market presence and customer engagement. CK Infrastructure's Australian pipeline business, for example, manages over 6,000 kilometers of gas transmission pipelines, directly serving industrial and commercial customers across vast geographical areas.

CK Infrastructure Holdings Limited (CKI) strategically selects acquisition and investment locations by focusing on market stability, favorable regulatory frameworks, and robust growth prospects. This meticulous approach ensures that new infrastructure assets align with CKI's long-term vision and deliver sustainable returns. Their global footprint is a testament to this strategy, with a significant presence in key economic centers.

CKI's expansion is fueled by targeted investments in essential service sectors across various geographies. For instance, in 2023, CKI, through its subsidiary CK Hutchison, completed the acquisition of a significant stake in the UK's leading electricity distributor, demonstrating a commitment to investing in critical infrastructure in developed markets. This move not only diversifies their portfolio but also taps into the stable revenue streams characteristic of regulated utility businesses.

Regulatory Frameworks and Local Partnerships

Operating within highly regulated sectors like infrastructure means CK Infrastructure's (CKI) 'place' is intrinsically tied to the legal and regulatory landscapes of each market. This requires cultivating robust relationships with local governments, regulatory bodies, and community stakeholders. For instance, CKI's significant investments in the UK's water sector are subject to stringent Ofwat regulations, impacting pricing and investment plans. Navigating these intricate local environments and obtaining essential approvals are paramount for market entry and maintaining operational stability.

CKI's strategic approach to 'place' emphasizes localized partnerships to ensure smooth operations and expansion. Their success in securing long-term concessions, such as the 50-year concession for the Sydney Airport in Australia, underscores the importance of strong governmental and community ties. These collaborations are vital for securing necessary permits, managing environmental impact assessments, and fostering social license to operate, which are critical for project development and continuity.

- UK Water Sector Regulation: CKI's UK water assets, like Northumbrian Water, operate under price controls set by Ofwat, influencing their revenue streams and capital expenditure plans through 2025.

- Australian Infrastructure Concessions: The 50-year Sydney Airport concession highlights CKI's ability to secure long-term operating rights through effective local partnerships and regulatory navigation.

- Renewable Energy Approvals: CKI's renewable energy projects, such as wind farms in Europe, require navigating complex local planning permissions and environmental impact assessments, often involving extensive consultation with local communities.

Decentralized Operational Management

CK Infrastructure's 'Place' strategy within its marketing mix embraces a decentralized operational management model. While overarching strategic direction is centralized, the actual day-to-day running of its varied infrastructure assets, from toll roads to energy facilities, is delegated to local teams and subsidiaries. This localized management is crucial for adapting to specific regional market dynamics and customer preferences.

This decentralized approach allows CK Infrastructure to be highly responsive to the unique conditions and demands present at each operational site. For instance, in 2024, CK Infrastructure's investments in renewable energy projects across Australia saw local management teams tailoring operational schedules to optimize solar and wind generation based on real-time weather patterns and grid demand, directly impacting efficiency and revenue generation.

The 'place' is thus effectively managed at the point of service delivery, fostering greater operational efficiency and deeper engagement with local stakeholders. This includes:

- Localized Expertise: Local teams possess intimate knowledge of regional regulations, labor markets, and community expectations, enabling more effective problem-solving.

- Customer Responsiveness: Proximity to customers allows for quicker adaptation to service needs and feedback, enhancing customer satisfaction.

- Asset Optimization: Decentralized management facilitates tailored maintenance and upgrade schedules, maximizing the performance and lifespan of diverse infrastructure assets.

- Risk Mitigation: Localized operational control can help in swiftly addressing and mitigating site-specific risks, from environmental to security concerns.

CK Infrastructure's 'Place' strategy centers on its extensive global network of essential physical assets, from utilities to transportation. This physical presence is strategically located in stable markets with favorable regulatory environments, ensuring predictable revenue streams. The company's approach involves direct service delivery through these networks, emphasizing accessibility and extensive reach to end-users across various regions.

CKI's global diversification, spanning the UK, Australia, Continental Europe, North America, Hong Kong, and Mainland China as of early 2025, is a key element of its place strategy. This broad operational footprint allows CKI to tap into diverse economic conditions and customer bases, mitigating risks associated with over-reliance on any single market. Their focus remains on acquiring and operating assets in stable regions with robust regulatory frameworks, such as the UK and Australia, to secure consistent demand and predictable cash flows.

| Geographic Focus | Key Infrastructure Assets | Operational Reach (Example) | Regulatory Environment Focus |

| United Kingdom | Electricity Distribution (UK Power Networks), Water Utilities (Northumbrian Water) | UK Power Networks: Over 8 million customers | Ofwat price controls, stable utility regulation |

| Australia | Airport Operations (Sydney Airport), Gas Pipelines | Australian Pipelines: Over 6,000 km of gas transmission pipelines | Long-term concessions, established infrastructure frameworks |

| Continental Europe | Renewable Energy Projects (e.g., wind farms) | Various wind farm locations across European countries | Local planning permissions, environmental regulations |

What You Preview Is What You Download

CK Infrastructure 4P's Marketing Mix Analysis

The preview shown here is the actual CK Infrastructure 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. You are viewing the exact version of the analysis you'll receive, fully complete and ready to use. This comprehensive document details CK Infrastructure's strategies across Product, Price, Place, and Promotion.

Promotion

CK Infrastructure Holdings Limited (CKI) prioritizes investor relations and financial reporting as a core promotional pillar, primarily targeting institutional investors and the broader financial markets. This commitment is demonstrated through the consistent delivery of detailed annual reports, interim financial statements, and engaging investor presentations.

These materials serve as the primary channel for transparently communicating CKI's financial performance, strategic objectives, and the inherent value of its diverse asset portfolio. For instance, CKI's 2023 annual report highlighted a revenue of HK$66.4 billion, underscoring its substantial operational scale and market presence.

The company actively engages in regular earnings calls and investor briefings, providing a platform for direct dialogue and addressing market queries. This proactive approach aims to cultivate investor confidence and attract sustained capital by clearly articulating CKI's growth trajectory and commitment to shareholder value.

CK Infrastructure prioritizes public relations to cultivate a robust corporate reputation, essential for its infrastructure services that directly impact communities. This proactive approach involves skillfully managing media relations and consistently communicating the company's significant contributions to economic growth and societal betterment. For instance, in 2023, CK Infrastructure reported a strong commitment to community engagement, with investments in local development projects totaling over HK$500 million across its global operations, underscoring this PR focus.

CK Infrastructure actively engages with governments and regulatory bodies across its global operations, a crucial aspect of its marketing mix. This proactive approach ensures alignment with evolving policies and compliance with diverse regulatory frameworks, such as those governing infrastructure projects in Australia and the UK. For instance, in 2023, the company continued its dialogue on renewable energy policies, aiming to foster an environment conducive to its substantial investments in this sector.

Sustainability and ESG Communications

CK Infrastructure (CKI) is increasingly highlighting its dedication to Environmental, Social, and Governance (ESG) principles. This is evident through their comprehensive sustainability reports and public disclosures, showcasing responsible corporate citizenship. This strategy directly appeals to the growing segment of socially conscious investors who prioritize ethical business practices.

By actively communicating their initiatives, CKI aims to bolster its brand image and attract sustainable investment. Their efforts in mitigating environmental impact and contributing positively to local communities are key components of this communication strategy. For instance, CKI's 2024 sustainability report detailed a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2020 baseline.

- ESG Focus: CKI emphasizes ESG through dedicated reports and public statements.

- Investor Appeal: This approach targets socially conscious investors.

- Brand Enhancement: Efforts in environmental and community contributions improve brand perception.

- Data Point: Achieved a 15% reduction in Scope 1 and 2 GHG emissions by 2024 from a 2020 baseline.

Industry Conferences and Thought Leadership

CK Infrastructure Holdings (CKI) actively engages in key industry conferences, forums, and summits. This participation allows CKI to connect with industry leaders, share valuable insights, and solidify its reputation as a thought leader in the global infrastructure space. For instance, CKI executives frequently present at events like the Global Infrastructure Investor Summit and regional infrastructure forums, discussing trends and opportunities in sectors like utilities and transportation.

These engagements are crucial for CKI's networking efforts, fostering relationships with potential partners, investors, and even future acquisition targets. By showcasing its expertise and strategic vision, CKI enhances its industry profile. This professional presence directly supports future business development initiatives and strengthens its competitive positioning in a rapidly evolving market.

- Thought Leadership: CKI executives contribute to discussions on sustainable infrastructure development and digital transformation at major industry events.

- Networking Opportunities: Participation at events like the Infrastructure Investor Global Summit facilitates direct engagement with key stakeholders.

- Brand Elevation: Presenting at these forums raises CKI's profile, signaling its expertise and forward-thinking approach to potential business partners.

- Market Intelligence: Conferences provide CKI with real-time insights into market trends, regulatory changes, and emerging technologies.

CK Infrastructure Holdings (CKI) leverages strategic public relations and government engagement to foster a positive operating environment and enhance its brand. By actively communicating its contributions to economic development and societal progress, CKI builds trust with communities and stakeholders. For example, CKI's 2023 public relations efforts highlighted over HK$500 million invested in global community development projects.

The company's commitment to ESG principles is a key promotional element, attracting socially conscious investors and bolstering its corporate image. CKI's 2024 sustainability report noted a 15% reduction in Scope 1 and 2 greenhouse gas emissions against a 2020 baseline, demonstrating tangible environmental progress.

CKI actively participates in industry conferences and forums to establish thought leadership and network with key players. These engagements, such as presentations at the Global Infrastructure Investor Summit, showcase CKI's expertise and strategic vision, reinforcing its market position.

| Promotional Activity | Key Objective | 2023/2024 Data Point |

| Investor Relations & Financial Reporting | Attract capital, build confidence | HK$66.4 billion revenue (2023) |

| Public Relations & Community Engagement | Enhance reputation, build trust | >HK$500 million invested in community projects (2023) |

| Government & Regulatory Engagement | Ensure compliance, foster favorable policies | Continued dialogue on renewable energy policies (2023) |

| ESG Communication | Attract ethical investors, improve brand | 15% GHG emission reduction (Scope 1 & 2, vs 2020) by 2024 |

| Industry Conferences & Forums | Thought leadership, networking | Executive presentations at Global Infrastructure Investor Summit |

Price

For many of CK Infrastructure's (CKI) utility operations, like gas distribution and water treatment, pricing is primarily set by regulatory authorities. These regulated tariff structures are designed to ensure cost recovery, allow for a reasonable return on invested capital, and incentivize operational efficiency, thereby creating dependable revenue streams.

While this regulatory oversight restricts CKI's pricing flexibility, it offers significant advantages in terms of long-term revenue stability and predictability. For example, in 2023, CKI's regulated asset base across its utility segments provided a foundation for consistent cash flow generation, underpinning its overall financial performance.

For infrastructure assets such as toll roads and bridges, pricing is frequently determined by long-term concession agreements established with governmental or public entities. These contracts meticulously detail toll rates, mechanisms for adjusting these rates over time, and performance-based incentives, ensuring predictable revenue streams.

CK Infrastructure's pricing strategy for its infrastructure assets is fundamentally rooted in these concession agreements. For example, the pricing for its Australian infrastructure portfolio, like the Sydney Harbour Bridge, is governed by agreements that allow for regulated toll increases, often tied to inflation or specific economic indicators, thereby securing a return on the substantial capital invested over decades. In 2024, such agreements continue to be the bedrock of their pricing model, providing stability and long-term revenue visibility.

CK Infrastructure's pricing strategy is designed to deliver a consistent and appealing return for its investors, acknowledging the significant, long-term capital commitments inherent in infrastructure projects. This approach meticulously balances operational expenditures, the cost of borrowing, and the returns shareholders expect, all within the framework of regulated or contractual pricing structures.

The pricing for CK Infrastructure's services and assets is a direct reflection of their fundamental worth as essential, stable utilities. For instance, in 2024, the company's focus on stable, contracted revenues from its diverse portfolio, including energy networks and transportation assets, underpins its ability to offer predictable returns, contributing to its attractiveness as an investment.

Capital Expenditure and Operating Cost Recovery

CK Infrastructure's pricing strategy is fundamentally designed to recoup the massive capital outlays necessary for constructing and maintaining its vast infrastructure networks. This includes accounting for depreciation, essential maintenance, and the crucial investments needed for future technological advancements and service enhancements. For instance, in 2023, CK Infrastructure reported capital expenditures of approximately HK$20.1 billion, underscoring the scale of investment required.

The 'price' for CK Infrastructure's services must be set at a level that not only covers these extensive capital and operational expenses but also generates sufficient returns to ensure long-term sustainability and service quality. This allows for continuous reinvestment, vital for upgrading aging assets and expanding capacity to meet growing demand. The company's commitment to reinvestment is evident in its ongoing projects, such as the significant upgrades to its energy networks.

Key cost recovery elements embedded in pricing include:

- Depreciation: Allocating the cost of assets over their useful lives.

- Maintenance: Covering routine upkeep and repairs to ensure operational integrity.

- Future Upgrades: Funding for modernization and capacity expansion.

- Financing Costs: Repaying debt incurred for capital projects.

Market Demand and Competitive Landscape (Indirect)

While CK Infrastructure's core businesses like power and water are heavily regulated, the underlying demand for these essential services significantly shapes their perceived value. This demand, especially in growing economies, provides leverage in negotiations with regulators regarding tariff adjustments. For instance, continued population growth in regions where CK operates, projected to increase by an average of 1.5% annually through 2025, underpins the essential nature of their services.

In areas with less stringent regulation or for new ventures, market appetite for infrastructure projects directly impacts pricing. CK Infrastructure's ability to secure favorable financing and investment returns is tied to the attractiveness of these markets. For example, in the renewable energy sector, where competition is increasing, market demand for sustainable power solutions influences the acceptable returns on investment for new solar or wind farm projects. Global investment in renewable energy infrastructure reached an estimated $500 billion in 2024, indicating strong market appetite.

- Essential Service Demand: Population growth in key operational regions supports sustained demand for regulated utilities.

- Regulatory Negotiations: Strong demand provides a basis for discussions on tariff adjustments with regulatory bodies.

- Market Appetite for New Projects: Investor interest in infrastructure, particularly renewables, influences pricing models for new developments.

- Competitive Influence: In less regulated segments, competition and market demand dictate acceptable investment returns.

CK Infrastructure's pricing is predominantly dictated by regulatory frameworks for its utility segments and concession agreements for infrastructure assets, ensuring stability and predictable revenue streams. For instance, in 2023, the company's regulated asset base provided a solid foundation for consistent cash flow. These structures allow for cost recovery, a reasonable return on investment, and incentives for efficiency, balancing operational costs with shareholder expectations.

The company's pricing strategy is built to recoup substantial capital outlays for construction and maintenance, covering depreciation, upkeep, and future upgrades. In 2023, CK Infrastructure's capital expenditures were approximately HK$20.1 billion, highlighting the significant investment required. This ensures long-term sustainability and service quality through continuous reinvestment.

Demand for essential services and market appetite for infrastructure projects significantly influence pricing. Strong demand, supported by projected population growth of 1.5% annually through 2025 in key regions, strengthens regulatory negotiation power. Global investment in renewable energy infrastructure reached an estimated $500 billion in 2024, showcasing market demand and influencing pricing for new developments.

| Pricing Factor | Description | Example/Data Point |

|---|---|---|

| Regulatory Tariffs | Set by authorities for utilities, ensuring cost recovery and return on investment. | CKI's utility operations in 2023 relied on regulated asset base for stable cash flow. |

| Concession Agreements | Contracts for infrastructure assets detailing toll rates and adjustments. | Sydney Harbour Bridge tolls adjusted based on agreements tied to inflation. |

| Capital Expenditure Recovery | Pricing covers construction, maintenance, and future upgrades. | CKI's 2023 capital expenditure was ~HK$20.1 billion. |

| Demand & Market Appetite | Essential service demand and investor interest influence pricing. | Projected 1.5% annual population growth supports utility demand; $500 billion invested in renewables in 2024. |

4P's Marketing Mix Analysis Data Sources

Our CK Infrastructure 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, industry-specific market research, and competitive landscape assessments. We leverage insights from infrastructure project announcements, pricing structures, supply chain information, and public relations activities to provide a robust overview.