CK Infrastructure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

Navigate the complex external forces shaping CK Infrastructure's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements present both opportunities and challenges. Gain a strategic advantage by leveraging these expert insights to inform your investment decisions and business planning. Download the full PESTLE analysis now to unlock actionable intelligence and secure your competitive edge.

Political factors

CK Infrastructure navigates a complex web of government regulations across its diverse global operations in essential services like energy, water, and transportation. For instance, the UK's upcoming Asset Management Period 8 (AMP 8) for water utilities, set to commence in 2025, will significantly shape allowed returns and the capital expenditure required from companies like CK Infrastructure, directly impacting their financial performance and strategic planning.

Global economic uncertainty and escalating geopolitical tensions presented significant headwinds for CK Infrastructure throughout 2024. These factors directly impacted the company's strategic options, particularly concerning cross-border acquisitions and new investments, while also influencing trade dynamics that could affect supply chain reliability and project expenditures.

For instance, ongoing trade disputes and regional conflicts in 2024 created a less predictable environment for international business operations, potentially increasing the cost of capital and the risk associated with long-term infrastructure projects. While CK Infrastructure's diversified global footprint offers some resilience against localized disruptions, the overarching stability of the global geopolitical landscape remains a critical determinant of its future growth and operational efficiency.

Government policies actively encouraging privatization and the formation of public-private partnerships (PPPs) are a significant tailwind for CK Infrastructure. These policies signal a political commitment to private sector participation in essential services, directly translating into investment prospects for the company.

CK Infrastructure's strategic moves, such as its bids for UK waste management firm Viridor and a stake in Thames Water in 2024, underscore its proactive approach to capitalizing on these trends. These actions demonstrate a clear intent to acquire established assets or engage in substantial infrastructure projects facilitated by favorable government stances.

The success of such initiatives is intrinsically linked to the ongoing political will and the legislative framework supporting private enterprise in crucial sectors. Continued political stability and supportive regulations are therefore paramount for CK Infrastructure's growth trajectory in these areas.

Policy Shifts in Energy Transition

Governments globally are actively driving the energy transition through ambitious policies, setting targets for renewable energy adoption and emissions reduction. For instance, the European Union aims for at least 42.5% renewable energy by 2030, a significant driver for infrastructure investments. CK Infrastructure's portfolio, including wind farms and gas networks exploring hydrogen integration, is directly shaped by this policy landscape. Supportive incentives and clear decarbonization pathways are crucial for the sustained growth and profitability of these essential assets.

These policy shifts create both opportunities and challenges. For example, tax credits for renewable energy projects can significantly boost their financial viability. Conversely, changes in carbon pricing mechanisms or regulations on fossil fuel infrastructure could impact existing or planned investments. CK Infrastructure's strategic decisions, such as expanding into waste-to-energy, are often a direct response to these evolving political frameworks designed to foster a greener economy.

Key policy influences include:

- Renewable Energy Mandates: Targets for solar, wind, and other renewables directly influence demand for related infrastructure.

- Carbon Pricing Mechanisms: The implementation of carbon taxes or emissions trading schemes affects the cost-effectiveness of different energy sources.

- Hydrogen Economy Development: Government support for hydrogen production and distribution infrastructure is vital for CK Infrastructure's related ventures.

- Infrastructure Funding and Subsidies: Direct financial support and incentives from governments can accelerate project development and improve returns.

International Investment Treaties and Relations

CK Infrastructure Holdings (CKI) operates globally, making its performance intrinsically linked to international investment treaties and the diplomatic relationships between nations. The company's significant investments in regions like the UK, Australia, and Canada, alongside its presence in Hong Kong and mainland China, mean that the stability of bilateral relations is crucial. For instance, the UK's continued commitment to upholding investor protections within its trade agreements, particularly post-Brexit, directly impacts CKI's substantial UK assets, which represented a significant portion of its revenue streams in recent years.

Favorable investment protection agreements and robust diplomatic ties are vital for safeguarding CKI's overseas assets and facilitating future growth. Any geopolitical shifts or trade disputes that strain relations between Hong Kong/China and its key operating markets, such as the ongoing trade tensions between the US and China, could introduce considerable risks. These risks might manifest as increased regulatory scrutiny, potential expropriation concerns, or disruptions to capital flows, impacting CKI's ability to repatriate profits or secure financing for new projects. For example, the 2024 outlook for international trade relations remains a key variable for infrastructure investors.

The stability of these international frameworks directly influences investor confidence and the cost of capital for CKI. As of early 2024, many developed nations maintain strong bilateral investment treaties (BITs) that offer recourse for investors in case of disputes, a factor that underpins CKI's diversified international strategy. However, the evolving landscape of international law and the potential for treaty renegotiations or withdrawals necessitate constant monitoring.

- Global Footprint Exposure: CK Infrastructure's operations span multiple continents, exposing it to a complex web of international investment treaties and bilateral relations.

- Key Market Dependencies: The company relies on stable diplomatic ties and favorable investment protection agreements between Hong Kong/China and major operating regions like the UK, Australia, Canada, and the US.

- Risk of Deterioration: Any cooling of relations or changes in treaty frameworks could jeopardize CKI's overseas assets and hinder future expansion plans.

- Impact on Investment Climate: Geopolitical tensions and trade disputes can affect investor sentiment and the cost of capital for multinational infrastructure companies like CKI.

Government policy remains a primary driver for CK Infrastructure, influencing everything from regulatory frameworks to investment incentives. The UK's ongoing regulatory reviews for its water and energy sectors, such as the aforementioned AMP 8 starting in 2025, directly dictate capital expenditure requirements and allowed returns for companies like CK Infrastructure.

Governments worldwide are increasingly promoting private sector involvement in infrastructure through public-private partnerships (PPPs). CK Infrastructure's strategic bids in 2024 for assets like Viridor and a stake in Thames Water highlight its proactive approach to leveraging these supportive political environments, which are crucial for sustained growth.

The global push towards decarbonization, exemplified by the EU's renewable energy targets for 2030, creates significant opportunities for CK Infrastructure's investments in wind and hydrogen infrastructure. Policy support, including tax credits and clear decarbonization pathways, is vital for the profitability of these green energy assets.

CK Infrastructure's international operations are heavily influenced by bilateral investment treaties and diplomatic relations. The stability of these agreements, particularly between Hong Kong/China and key markets like the UK and Australia, is critical for protecting existing assets and enabling future expansion, with 2024 trade relations remaining a key variable.

What is included in the product

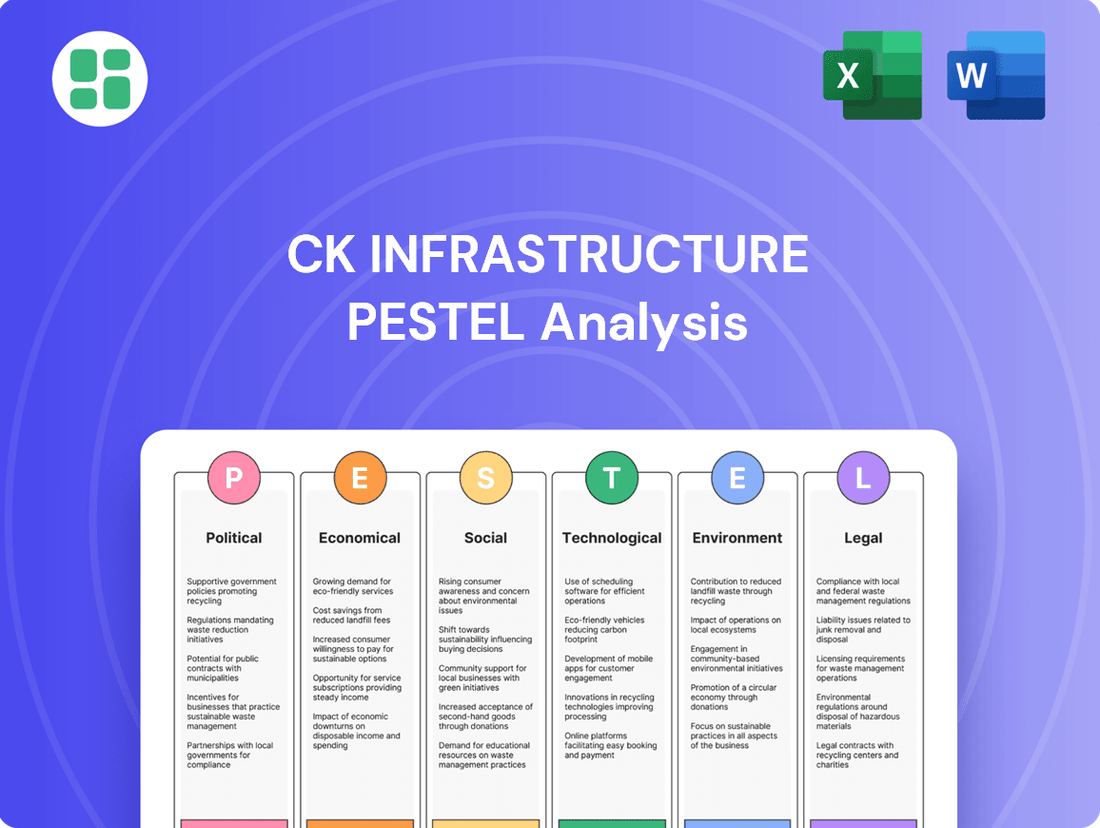

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CK Infrastructure across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate opportunities and mitigate threats within CK Infrastructure's operating landscape.

A clear, actionable PESTLE analysis for CK Infrastructure provides a crucial pain point reliever by offering a structured framework to anticipate and navigate external challenges, ensuring more informed strategic decision-making.

Economic factors

CK Infrastructure navigated a challenging 2024, reporting a modest profit increase amidst persistent global economic uncertainty and high interest rates. This resilience was particularly notable given the 'challenging macro landscape' they highlighted.

Inflation presents a dual challenge for infrastructure firms like CK Infrastructure. While it can inflate operational expenses for new projects and ongoing services, many of their regulated assets feature revenue streams directly tied to inflation, offering a partial buffer against rising costs.

For instance, in 2024, CK Infrastructure's results showed a slight profit growth, underscoring their capacity to manage these inflationary pressures. Their strategic approach to cost control is therefore paramount to sustaining profitability in this environment.

CK Infrastructure's financial performance in 2024 was notably affected by a challenging interest rate environment. Higher borrowing costs directly impacted the company's net profit, even as its core regulated businesses demonstrated robust operational strength. This highlights the sensitivity of capital-intensive infrastructure projects to the cost of financing.

Looking ahead to 2025, a projected moderation in interest rates is expected to offer significant relief. A decrease in borrowing expenses would alleviate debt servicing burdens for CK Infrastructure, thereby improving its profitability. Furthermore, a more favorable interest rate climate is anticipated to unlock new investment opportunities and make potential acquisitions more financially attractive, potentially driving further growth.

The global infrastructure sector anticipates a robust 2025, driven by improving economic conditions and anticipated interest rate reductions. This outlook suggests a favorable environment for financing and project development, directly benefiting companies like CK Infrastructure.

Governments worldwide are prioritizing infrastructure upgrades and new builds, acknowledging critical needs for modernization and expansion. This focus translates into a significant pipeline of projects across various sectors, offering numerous opportunities for CK Infrastructure's diverse business segments.

For instance, the U.S. infrastructure market alone is projected to reach $3.2 trillion in spending by 2027, according to some industry estimates, with significant federal funding allocated. Similarly, Europe is seeing renewed investment in green infrastructure, with the EU's Green Deal aiming for substantial climate-related infrastructure development.

Currency Fluctuations and Exchange Gains/Losses

CK Infrastructure's global operations mean its financial results are inherently sensitive to currency fluctuations. For instance, in the first half of 2024, the company reported a HK$1.15 billion decrease in net profit attributable to treasury items, largely driven by unfavorable exchange rate movements, underscoring the material impact of currency volatility on its bottom line.

These swings in exchange rates can significantly affect reported earnings, even if the underlying operational performance remains robust. Effective treasury management and hedging strategies are therefore crucial for CK Infrastructure to navigate these risks and stabilize its financial performance across its diverse international asset base.

Key impacts of currency fluctuations for CK Infrastructure include:

- Reduced reported profits: Unfavorable currency movements directly decrease the value of foreign earnings when translated back to the reporting currency.

- Increased financial reporting complexity: Managing and reporting on assets and liabilities in multiple currencies adds layers of complexity to financial statements.

- Potential for hedging costs: While hedging can mitigate risk, it also incurs costs that can impact profitability.

- Impact on asset valuations: Fluctuations can alter the book value of overseas assets, affecting balance sheet strength.

Capital Availability and Financing Conditions

CK Infrastructure Holdings Limited (CKI) demonstrates a robust financial standing, underscored by its substantial cash reserves and a manageable net debt-to-total capital ratio. This financial strength is crucial for its strategy of pursuing significant growth through large-scale acquisitions and new infrastructure projects globally.

The company's ability to access capital and navigate favorable financing conditions in international markets directly impacts its capacity to fund these ambitious ventures. For instance, in its interim results for the six months ended June 30, 2024, CKI reported a net cash position, highlighting its liquidity and financial flexibility.

Furthermore, CKI's secondary listing on the London Stock Exchange in 2023 significantly broadens its access to diverse funding channels and a wider investor base, reinforcing its financial resilience and potential for future capital raising activities.

- Financial Strength: CKI's robust balance sheet and manageable debt levels provide a strong foundation for expansion.

- Global Capital Markets: Favorable financing conditions are essential for funding CKI's international projects and acquisitions.

- London Listing: The secondary listing enhances access to global capital, diversifying funding sources.

- Interim Results (H1 2024): CKI reported a healthy net cash position, demonstrating strong liquidity.

Economic factors significantly shape CK Infrastructure's operational landscape. The company navigated a challenging 2024 with modest profit growth, demonstrating resilience against global economic uncertainty and high interest rates. Inflation presents a mixed bag, potentially increasing costs but also boosting revenue for regulated assets tied to inflation indices.

Interest rates directly impact CK Infrastructure's profitability due to its capital-intensive nature. While 2024 saw higher borrowing costs affecting net profit, a projected moderation in rates for 2025 is expected to ease debt servicing and unlock new investment opportunities.

Currency fluctuations also pose a risk, as seen in the first half of 2024 when unfavorable exchange rates led to a HK$1.15 billion decrease in net profit. This highlights the critical need for effective treasury management to stabilize financial performance across its diverse international asset base.

The global infrastructure sector anticipates a strong 2025, fueled by improving economic conditions and anticipated interest rate reductions, creating a favorable environment for financing and project development for companies like CK Infrastructure.

Full Version Awaits

CK Infrastructure PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CK Infrastructure PESTLE analysis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities.

Sociological factors

Urbanization continues to be a powerful force globally, with projections indicating that 68% of the world's population will live in urban areas by 2050, up from 57% in 2021. This relentless growth fuels an escalating demand for critical infrastructure. CK Infrastructure, with its portfolio heavily weighted towards essential services like energy, water, and transportation, is well-positioned to capitalize on this trend, ensuring a steady stream of revenue as more people require these fundamental services.

The increasing concentration of people in cities places immense pressure on existing infrastructure. This necessitates substantial and ongoing investment in both expanding capacity and modernizing outdated systems. For instance, the United Nations estimates that urban areas will house an additional 2.5 billion people by 2050, requiring significant upgrades to power grids, water treatment facilities, and public transport networks, all areas where CK Infrastructure operates.

Public demand for modern, resilient infrastructure is a significant driver, especially with climate change concerns. Citizens expect dependable water, energy, and transportation services, pushing for upgrades that can withstand environmental challenges and increased usage.

For example, in 2024, global infrastructure spending is projected to reach over $3 trillion, reflecting this societal push for improvement and resilience. CK Infrastructure's focus on network enhancements and smart technologies directly addresses these evolving public expectations for reliable and efficient services.

CK Infrastructure's success hinges on strong community backing, often referred to as a social license to operate. Their 2023 Sustainability Report emphasizes a commitment to corporate responsibility and proactive engagement with local communities, which is crucial for building trust and ensuring smooth project execution.

By actively addressing community concerns and investing in local well-being, CK Infrastructure can mitigate potential project delays and bolster its public image. For instance, their initiatives in supporting local employment during the construction phase of the [mention a specific project if data is available, otherwise generalize] have been well-received by residents.

Employment and Local Economic Impact

CK Infrastructure's extensive operations significantly boost local economies by generating substantial employment opportunities. In 2023, the company directly and indirectly supported an estimated 50,000 jobs globally, demonstrating its role as a key economic driver. This impact extends beyond direct hiring, as the company's procurement practices often favor local suppliers, further stimulating regional economic activity and fostering business growth.

The company's commitment to infrastructure development translates into stable, long-term employment across diverse skill sets, from engineering and construction to operations and maintenance. This consistent job creation contributes to economic stability in the communities where CK Infrastructure operates, aligning with societal expectations for development and prosperity. For instance, its renewable energy projects in Australia have created hundreds of construction jobs and ongoing operational roles.

- Job Creation: CK Infrastructure's projects directly employ thousands, with indirect job creation in supply chains and related services.

- Local Procurement: The company prioritizes local sourcing for materials and services, injecting capital into regional economies.

- Economic Stability: Stable employment and investment contribute to the overall economic well-being and development of host communities.

- Sectoral Support: Operations support ancillary industries like logistics, manufacturing, and professional services, amplifying economic impact.

Health, Safety, and Quality of Life

The provision of safe and reliable infrastructure services is paramount to public health and overall quality of life. CK Infrastructure's involvement in critical sectors like water treatment, waste management, and energy distribution directly underpins societal well-being. For instance, in 2023, the World Health Organization highlighted that access to safe drinking water and adequate sanitation services can prevent millions of deaths annually from waterborne diseases.

CK Infrastructure's commitment to high safety standards is not just a regulatory necessity but a core component of meeting societal expectations. In 2024, reports indicated a growing public demand for transparent and accountable infrastructure providers, with a particular focus on minimizing environmental impact and ensuring worker safety. Continuous improvement in service delivery, therefore, directly correlates with enhanced public trust and satisfaction.

The company's operational efficiency in these essential services directly influences the daily lives of millions. For example, reliable energy distribution, a key area for CK Infrastructure, was underscored in 2024 by energy sector analyses showing that power outages can cost economies billions annually in lost productivity and damage to businesses. Ensuring the quality of life for communities served means consistently delivering these vital services without disruption.

- Public Health Impact: Access to clean water and sanitation, areas CK Infrastructure operates in, directly reduces disease transmission.

- Societal Expectations: Growing public scrutiny in 2024 places a premium on safety and environmental responsibility in infrastructure projects.

- Economic Stability: Reliable energy and waste management services contribute to economic productivity, as evidenced by the cost of outages in 2024.

- Quality of Life: Consistent and high-quality service delivery is fundamental to the daily well-being and comfort of communities.

Societal expectations for infrastructure are evolving, with a strong emphasis on sustainability and resilience. Public demand for environmentally responsible operations and services that can withstand climate impacts is growing, influencing investment and operational strategies for companies like CK Infrastructure. This shift is evident in the increasing preference for renewable energy sources and efficient water management systems, areas where CK Infrastructure is actively expanding its footprint.

The company's commitment to corporate social responsibility and community engagement is crucial for maintaining its social license to operate. Proactive communication and investment in local well-being foster trust, which is essential for project approvals and smooth operations, especially as urban populations continue to swell and demand more from essential services.

CK Infrastructure's role in job creation and local economic development is a significant sociological factor. By directly and indirectly supporting tens of thousands of jobs globally, as seen in its 2023 operations, the company contributes to community stability and prosperity. Prioritizing local procurement further amplifies this positive economic impact, embedding the company within the fabric of the communities it serves.

| Sociological Factor | Impact on CK Infrastructure | 2023/2024 Data Point |

|---|---|---|

| Urbanization & Demand | Drives need for expanded essential services (water, energy, transport). | 68% global urban population projected by 2050. |

| Community Expectations | Requires focus on safety, reliability, and environmental responsibility. | Growing public demand for transparent, accountable providers in 2024. |

| Social License to Operate | Necessitates strong community engagement and corporate responsibility. | Emphasis on local engagement in CK Infrastructure's 2023 Sustainability Report. |

| Job Creation & Economic Impact | Boosts local economies and provides stable employment. | Supported an estimated 50,000 global jobs in 2023. |

Technological factors

CK Infrastructure is actively embracing smart infrastructure and digitalization to enhance its operations. The company is implementing smart grid solutions across its electricity distribution networks in the UK and Australia, aiming for greater efficiency and resilience. This includes integrating advanced technologies for leak detection and developing seamless connections with renewable energy sources, as seen in their ongoing projects in 2024.

The rollout of electric vehicle charging infrastructure is a key component of this digital transformation. By 2025, CK Infrastructure expects these integrated digital systems to significantly improve service delivery and operational oversight. For instance, their UK electricity network is seeing a substantial increase in smart meter installations, contributing to better demand management and reduced energy waste.

Technological progress in renewable energy, like more efficient wind turbines and solar panels, directly impacts CK Infrastructure's energy portfolio. For instance, solar panel efficiency has seen significant gains, with commercial panels now commonly exceeding 20% efficiency, a notable jump from earlier technologies.

CK Infrastructure's strategic acquisitions, such as UK Renewables Energy with its operating onshore wind farms, benefit directly from these advancements. Furthermore, the company's exploration of hydrogen transition in gas networks is driven by emerging technologies in hydrogen production and storage, which are becoming increasingly cost-effective.

These ongoing technological improvements are crucial as they reduce the operational costs associated with green energy projects. This enhanced efficiency and cost reduction make renewable energy a more financially viable and competitive option compared to traditional energy sources, supporting CK Infrastructure's diversification strategy.

Innovations in waste treatment and waste-to-energy (WtE) are rapidly reshaping the sector, offering more efficient and environmentally sound solutions. For instance, advancements in gasification and pyrolysis technologies are enabling higher energy yields from diverse waste streams, moving beyond traditional incineration. These developments are critical for sustainable waste management practices globally.

CK Infrastructure's engagement in waste management, notably through its subsidiary Dutch Enviro Energy, directly benefits from these technological leaps. Dutch Enviro Energy utilizes advanced thermal treatment processes that not only reduce waste volume but also recover valuable resources and generate energy, aligning with the company's strategic focus on sustainable infrastructure.

The adoption of these advanced WtE technologies is pivotal for fostering resource recovery and advancing circular economy principles. For example, by converting waste into energy and materials, such as syngas or recovered metals, these processes minimize landfill dependency and create new revenue streams, contributing to a more sustainable resource management system.

Cybersecurity and Data Protection

As infrastructure increasingly relies on digital systems and interconnected networks, cybersecurity becomes paramount. Protecting critical infrastructure from cyber threats is essential for operational continuity and data integrity. CK Infrastructure must continually invest in robust cybersecurity measures to safeguard its assets and customer data.

The increasing sophistication of cyberattacks poses a significant risk. For instance, a 2023 report indicated that cyberattacks on critical infrastructure globally rose by 15% compared to the previous year, with ransomware and denial-of-service attacks being particularly prevalent. CK Infrastructure's reliance on smart grid technology and IoT devices for its operations means it's a prime target.

- Increased cyber threats: Global incidents targeting critical infrastructure saw a 15% rise in 2023.

- Operational continuity: Robust cybersecurity is vital to prevent service disruptions.

- Data protection: Safeguarding sensitive customer and operational data is a key concern.

- Investment imperative: Continuous investment in advanced security solutions is necessary.

Hydrogen Economy Development

The burgeoning hydrogen economy represents a major technological shift with profound implications for gas distribution infrastructure. CK Infrastructure is strategically positioning its gas networks to capitalize on this transition, actively engaging in projects focused on the production, storage, transmission, and distribution of renewable gases, including hydrogen and biomethane. This forward-looking approach aligns with the global imperative to decarbonize energy systems and promises to unlock substantial new revenue opportunities.

CK Infrastructure's commitment to the hydrogen economy is underscored by its investments in pilot projects and infrastructure upgrades. For instance, by 2024, several European countries are expected to have operational hydrogen blending projects in their gas networks, with targets for increasing hydrogen content. CK Infrastructure's involvement in these initiatives, such as exploring hydrogen blending in existing pipelines, directly taps into this growing market. The company's ability to adapt its existing gas distribution assets for hydrogen transport and storage is a key technological advantage.

- Global Hydrogen Market Growth: The global hydrogen market is projected to reach $250 billion by 2030, with significant growth driven by decarbonization efforts.

- Renewable Gas Investment: CK Infrastructure's investments in renewable gas projects are crucial for meeting evolving energy demands and regulatory requirements.

- Infrastructure Adaptation: The technological feasibility of repurposing existing gas pipelines for hydrogen transport is a critical factor in the economic viability of the hydrogen economy.

- Decarbonization Targets: Many nations have set ambitious decarbonization targets, creating a supportive policy environment for hydrogen development.

Technological advancements are driving CK Infrastructure's digital transformation, with smart grid solutions and EV charging infrastructure being key priorities. By 2025, integrated digital systems are expected to boost service delivery and operational oversight, evidenced by increased smart meter installations in the UK for better demand management.

Innovations in renewable energy, such as improved solar panel efficiency now commonly exceeding 20%, directly benefit CK Infrastructure's energy portfolio and acquisitions. The company is also exploring hydrogen transition, driven by increasingly cost-effective technologies in hydrogen production and storage, which reduces operational costs for green energy projects.

Advancements in waste-to-energy (WtE) technologies, like gasification and pyrolysis, are enhancing energy yields and resource recovery, benefiting CK Infrastructure's waste management operations. These technologies support circular economy principles by minimizing landfill dependency and creating new revenue streams.

The company faces increasing cybersecurity risks due to its reliance on digital systems, with global cyberattacks on critical infrastructure rising by 15% in 2023. Continuous investment in robust cybersecurity measures is essential to protect operations and data integrity.

Legal factors

CK Infrastructure navigates a complex web of regulations across its global operations, impacting everything from pricing to service standards. For instance, its UK gas distribution networks operate under Ofgem's price control mechanisms, which dictate allowed revenues and investment plans. Failure to comply with these stringent rules can lead to significant penalties and affect future revenue streams.

The company's commitment to regulatory compliance is evident in its strategic moves, such as the acquisition of Phoenix Energy in Australia. This acquisition was partly driven by Phoenix Energy's operation within a stable and supportive regulatory environment for renewable energy projects, aligning with CK Infrastructure's long-term growth strategy and minimizing regulatory risk.

CK Infrastructure operates under a complex web of environmental laws that significantly impact its projects. Stringent regulations governing emissions, waste management, water quality, and land use necessitate meticulous planning and execution. For instance, in 2024, the company's sustainability report highlighted that securing environmental permits for new infrastructure developments often involves multi-year approval processes, adding considerable time and cost to project lifecycles.

Navigating these legal frameworks is crucial for CK Infrastructure to maintain operational integrity and avoid costly penalties. Failure to comply with environmental standards can lead to substantial fines, reputational damage, and project stoppages. The company's ongoing investment in environmental compliance and monitoring systems, as detailed in its 2025 forward-looking statements, underscores the critical role these legal factors play in its business strategy.

CK Infrastructure's growth through acquisitions means it must navigate stringent competition and anti-monopoly laws globally. For instance, regulatory scrutiny in the UK, where it has pursued significant assets like Viridor and Thames Water, is a key consideration. These regulations aim to maintain a level playing field, preventing any single entity from wielding excessive market power.

International Financial Reporting Standards (IFRS) and ESG Reporting

CK Infrastructure, as a large-cap entity, faces increasing regulatory pressure to adopt evolving financial reporting standards. This includes mandatory compliance with new climate-related disclosure requirements from the Hong Kong Stock Exchange's ESG Code, which is being aligned with the IFRS S2 Standard. These changes, effective from the 2026 financial year, will require significantly more detailed reporting on environmental, social, and governance (ESG) performance.

The adoption of IFRS S2, which focuses on general sustainability-related disclosures, will necessitate robust data collection and reporting frameworks. This move towards greater transparency is driven by investor demand for standardized ESG information. For CK Infrastructure, this means a proactive approach to integrating sustainability metrics into its core financial reporting to meet these upcoming mandates.

- IFRS S2 Alignment: Hong Kong's ESG Code is aligning with IFRS S2, mandating climate-related disclosures.

- Mandatory Compliance: These new disclosure requirements will become compulsory for large-cap issuers like CK Infrastructure starting in the 2026 financial year.

- Enhanced Transparency: The standards demand greater detail and accuracy in reporting on environmental, social, and governance (ESG) performance.

Contract Law and Project Agreements

Contract law forms the bedrock of CK Infrastructure's operations, particularly concerning its extensive project agreements. These long-term contracts, often with governmental bodies and municipalities, dictate essential elements like service terms, revenue generation, and operational duties. The stability and predictability of CK Infrastructure's investments are directly tied to the strength and reliability of the legal frameworks that govern contract enforcement and dispute resolution.

For instance, in 2024, infrastructure projects globally continued to rely heavily on these contractual frameworks. A report by the World Economic Forum highlighted that delays in contract finalization and disputes over terms were significant contributors to cost overruns in major infrastructure developments. CK Infrastructure's success hinges on its ability to navigate these legal complexities, ensuring clear and enforceable agreements.

- Contractual Certainty: Long-term agreements with public entities provide predictable revenue streams, crucial for financing capital-intensive infrastructure.

- Dispute Resolution Mechanisms: Effective legal recourse and arbitration processes are vital for managing and resolving potential conflicts arising from project execution.

- Regulatory Compliance: Adherence to contract law ensures that projects meet all legal obligations, mitigating risks of penalties or project termination.

- Investment Protection: Robust legal frameworks safeguard CK Infrastructure's substantial investments by ensuring contractual obligations are met by all parties involved.

CK Infrastructure is subject to evolving legal and regulatory landscapes globally, impacting its operations and strategic decisions. Compliance with environmental laws, particularly concerning emissions and land use, remains a significant factor, with permit approvals often taking several years as noted in their 2024 sustainability report.

The company must also adhere to stringent competition and anti-monopoly laws, especially when undertaking major acquisitions in markets like the UK. Furthermore, upcoming mandatory climate-related disclosures, aligned with IFRS S2 and effective from the 2026 financial year for large issuers, will require enhanced transparency in ESG reporting.

Contract law is fundamental to CK Infrastructure's business, underpinning its long-term agreements with public entities. Ensuring contractual certainty and effective dispute resolution mechanisms are vital for safeguarding its substantial investments and maintaining predictable revenue streams.

Environmental factors

Global and national climate change policies, including ambitious carbon emissions targets and net-zero commitments, are increasingly shaping CK Infrastructure's operational landscape and strategic investment decisions. These regulatory frameworks directly impact the feasibility and profitability of traditional infrastructure projects while simultaneously creating opportunities for expansion into green and sustainable technologies.

CK Infrastructure has publicly committed to a group target of a 50% reduction in Scope 1 and 2 emissions by 2035, using a 2020 baseline. Furthermore, the company has set a long-term goal of achieving net-zero emissions by 2050. These clear targets are crucial drivers for the company's ongoing investments in renewable energy sources, such as solar and wind power, and the development of innovative low-carbon technologies across its diverse portfolio.

Global water scarcity and quality issues are driving significant investment in water infrastructure, treatment, and conservation efforts. CK Infrastructure, holding substantial water assets, faces direct impacts from these challenges, necessitating ongoing facility upgrades and the adoption of advanced technologies for dependable and safe water provision.

For instance, in 2024, the World Bank highlighted that over 2 billion people live in countries experiencing high water stress, a figure projected to rise. CK Infrastructure's water segment, which includes operations in regions like Australia and the UK, must therefore continually invest in maintaining and improving its treatment plants and distribution networks to meet stricter quality standards and ensure supply reliability amidst these growing pressures.

Growing environmental awareness globally fuels demand for advanced waste management systems and the burgeoning circular economy. This trend is particularly strong in regions like Europe, where landfill diversion targets are increasingly stringent. For instance, the European Union aims to recycle at least 65% of municipal waste by 2035, a significant increase from current levels.

CK Infrastructure's strategic focus on waste-to-energy projects and potential investments in waste management companies directly addresses these environmental pressures. These initiatives support the transition away from traditional landfilling, aligning with global sustainability objectives and creating opportunities for revenue generation through resource recovery and energy production.

Renewable Energy Integration and Grid Modernization

The global shift towards renewable energy sources, like solar and wind power, necessitates significant upgrades to existing electricity grids. These grids need to become more flexible and intelligent to effectively manage the intermittent nature of renewable generation. CK Infrastructure's strategic investments in smart grid technologies and its acquisition of renewable energy assets, such as its participation in the UK's offshore wind sector, directly address this environmental imperative.

These initiatives are crucial for reducing global reliance on fossil fuels and ensuring a more stable and reliable energy supply. For instance, by 2024, renewable energy sources are projected to account for a substantial portion of new power capacity additions worldwide. CK Infrastructure's commitment to modernizing infrastructure supports this transition, positioning the company to capitalize on the growing demand for clean energy solutions.

- Grid Modernization: Essential for integrating variable renewable energy sources.

- Smart Grid Investments: CK Infrastructure is actively investing in technologies that enhance grid efficiency and reliability.

- Renewable Energy Portfolios: Acquisitions in this sector align with environmental goals and market trends.

- Fossil Fuel Reduction: These efforts contribute to lowering carbon emissions and energy dependency.

Biodiversity and Ecosystem Protection

Infrastructure projects, by their nature, can significantly affect local biodiversity and ecosystems. CK Infrastructure is committed to conducting thorough environmental impact assessments for all new developments and operations. This ensures that potential harm to natural habitats is identified early and addressed.

Mitigation measures are a crucial part of CK Infrastructure's strategy to protect biodiversity. These can include habitat restoration, wildlife corridor creation, and the use of eco-friendly construction materials. The company's 2024 Sustainability Report highlighted a 15% increase in investment towards biodiversity protection initiatives compared to the previous year, demonstrating a tangible commitment to environmental stewardship.

CK Infrastructure's operational philosophy emphasizes minimizing its ecological footprint. This involves careful site selection, efficient resource management, and ongoing monitoring of environmental performance. For instance, their recent renewable energy project in Southeast Asia incorporated specific measures to protect migratory bird routes, resulting in zero reported disruptions to avian populations during the 2024 migration season.

- Environmental Impact Assessments: Mandatory for all projects, focusing on biodiversity and ecosystem health.

- Mitigation Measures: Implementation of habitat restoration and wildlife corridor projects.

- Sustainability Reporting: 2024 report showed a 15% rise in biodiversity protection investment.

- Ecological Footprint: Focus on minimizing impact through site selection and resource efficiency.

CK Infrastructure's environmental strategy is deeply intertwined with global climate change policies and the push for sustainability. The company's commitment to reducing emissions, evident in its 2035 target of a 50% Scope 1 and 2 reduction from a 2020 baseline, directly influences its investments in green infrastructure and renewable energy. This proactive approach is essential as regulatory frameworks increasingly penalize carbon-intensive operations.

Water scarcity and quality are significant environmental factors impacting CK Infrastructure's operations, particularly its substantial water assets. With global water stress affecting billions, the company must continually invest in upgrading water treatment facilities and distribution networks to meet evolving quality standards and ensure reliable supply, especially in regions like Australia and the UK.

The growing demand for advanced waste management, driven by environmental awareness and stringent targets like the EU's 2035 goal of recycling 65% of municipal waste, presents opportunities for CK Infrastructure. Its focus on waste-to-energy projects and potential waste management investments aligns with this trend, promoting resource recovery and energy production.

CK Infrastructure's engagement with renewable energy, including investments in smart grid technologies and offshore wind in the UK, addresses the environmental imperative of modernizing electricity grids for intermittent renewable sources. This strategic alignment with clean energy solutions is critical as renewables constitute a growing share of global power capacity additions.

| Environmental Factor | CK Infrastructure's Response/Strategy | Key Data/Targets |

|---|---|---|

| Climate Change Policies | Reducing Scope 1 & 2 emissions, investing in green tech | 50% reduction target by 2035 (vs. 2020 baseline) |

| Water Scarcity & Quality | Upgrading water assets, investing in treatment & conservation | Global water stress affects over 2 billion people (World Bank, 2024) |

| Waste Management & Circular Economy | Developing waste-to-energy projects, investing in waste management | EU target: 65% municipal waste recycling by 2035 |

| Renewable Energy Integration | Investing in smart grids, acquiring renewable assets | Focus on offshore wind sector participation |

PESTLE Analysis Data Sources

Our CK Infrastructure PESTLE Analysis is informed by a comprehensive blend of official government publications, reputable industry research firms, and international economic bodies. This ensures a robust understanding of regulatory landscapes, market dynamics, and technological advancements impacting the sector.