CK Hutchison SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Hutchison Bundle

CK Hutchison's diverse portfolio presents significant strengths, but also exposes it to unique market vulnerabilities and intense competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within its operating sectors.

Want the full story behind CK Hutchison's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CK Hutchison Holdings boasts a remarkably diversified global portfolio, spanning critical sectors like ports, retail, infrastructure, energy, and telecommunications. This strategic spread across varied industries acts as a powerful buffer against sector-specific downturns, ensuring a more stable revenue base. For instance, in 2023, the company reported revenue of approximately HKD 357 billion, with contributions from its diverse segments helping to offset any individual market pressures.

CK Hutchison benefits from leading market positions across its diverse business segments. Its Ports division stands as a global leader, operating a significant network of ports worldwide, underscoring its extensive reach and operational expertise in this critical infrastructure sector.

Furthermore, the company's retail segment, AS Watson Group, holds the distinction of being the world's largest international health and beauty retailer. This dominant presence in retail signifies strong brand equity and significant economies of scale, contributing to its competitive edge in the global marketplace.

CK Hutchison’s extensive global footprint is a significant strength, with operations reaching over 50 countries. This vast international presence includes managing 53 ports in 24 countries and maintaining retail operations across 30 markets, demonstrating a deep penetration into diverse economic landscapes.

This broad geographical reach allows CK Hutchison to capitalize on varied growth opportunities and economic strengths worldwide. It also facilitates the development of a robust, globally integrated operational network, enhancing resilience and market responsiveness.

Robust Infrastructure and Ports Performance

CK Hutchison's infrastructure and ports divisions represent a significant strength, consistently delivering robust profits. These divisions benefit from long-term investments, which translate into stable and predictable revenue streams. For instance, the Ports and Related Services segment saw increased revenue in 2024, fueled by higher cargo volumes and efficient operational management, demonstrating the underlying financial resilience these assets provide.

The company's commitment to these asset-heavy divisions underpins its overall financial health. This consistent performance is a key indicator of the company's ability to generate reliable earnings.

- Infrastructure division: Consistently generates strong profits through long-term, stable investments.

- Ports and Related Services: Showed robust performance in 2024 with revenue growth from increased throughput and effective cost controls.

- Financial Strength: Stability and growth in these key divisions contribute significantly to the company's financial stability.

Commitment to Technological Advancement

CK Hutchison demonstrates a significant commitment to technological advancement, notably investing in state-of-the-art facilities within its port operations. This includes the integration of automated systems and green technologies, aiming for both sustainability and enhanced efficiency. For instance, their investments in automated terminal systems contribute to faster turnaround times and reduced operational costs.

In its telecommunications segment, a key focus is the aggressive expansion of 5G networks and ongoing IT transformation initiatives. These efforts are designed to elevate service quality and enrich the overall customer experience. By prioritizing these technological upgrades, CK Hutchison aims to solidify its competitive position and drive operational excellence across its diverse business units.

- Port Automation: Investments in automated guided vehicles (AGVs) and automated stacking cranes (ASCs) are transforming terminal efficiency.

- 5G Network Expansion: Significant capital expenditure is allocated to rolling out advanced 5G infrastructure, enhancing connectivity and service offerings.

- IT Transformation: Programs are underway to modernize IT systems, improving data analytics capabilities and operational agility.

CK Hutchison's diversified business model is a significant strength, mitigating risks across its portfolio which includes ports, retail, infrastructure, energy, and telecommunications. This broad operational base ensures a more resilient financial performance, as evidenced by its 2023 revenue of approximately HKD 357 billion, where contributions from various segments helped balance market fluctuations.

The company holds leading market positions in key sectors, notably its Ports division, which operates an extensive global network, and AS Watson Group, the world's largest international health and beauty retailer. These dominant positions provide substantial competitive advantages and economies of scale.

CK Hutchison's extensive global reach, operating in over 50 countries, allows it to tap into diverse growth opportunities and build a resilient, integrated operational network. This geographical spread enhances its ability to respond effectively to varying economic conditions worldwide.

Investments in infrastructure and ports consistently yield strong profits due to long-term, stable revenue streams. The Ports and Related Services segment, for example, saw revenue growth in 2024 driven by increased cargo volumes and efficient operations, underscoring the financial stability these assets provide.

CK Hutchison's commitment to technological advancement is a key differentiator. Investments in port automation, such as automated guided vehicles and stacking cranes, enhance efficiency and reduce costs. Simultaneously, the aggressive expansion of 5G networks and IT transformation initiatives in its telecommunications segment aim to improve service quality and customer experience.

| Segment | Key Strength | 2023 Performance Indicator |

|---|---|---|

| Ports | Global leadership, extensive network | Operates 53 ports in 24 countries |

| Retail (AS Watson) | World's largest health & beauty retailer | Presence in 30 markets |

| Infrastructure | Stable, long-term revenue streams | Consistent profit generation |

| Telecommunications | 5G network expansion, IT transformation | Focus on service quality and customer experience |

What is included in the product

This SWOT analysis provides a strategic overview of CK Hutchison's internal capabilities and external market dynamics, highlighting its strengths in diverse sectors and its opportunities for global expansion, while also addressing its weaknesses in certain markets and the threats posed by intense competition and regulatory changes.

Identifies key competitive advantages and potential threats to inform strategic adjustments.

Highlights areas for improvement and potential growth opportunities within CK Hutchison's diverse portfolio.

Weaknesses

CK Hutchison saw a significant dip in its net profit for 2024, with profit attributable to ordinary shareholders falling by 27%. This drop highlights ongoing difficulties in sustaining robust profitability, even with some stable operational segments. Such a trend is a key concern for investors, directly affecting their returns and the company's standing in the market.

CK Hutchison's exposure to geopolitical risks is a notable weakness. The company's involvement in the sale of its Panama Canal ports, a transaction valued at approximately $9.3 billion in 2023, became a focal point of international scrutiny. This deal faced significant headwinds from Chinese regulators and became entangled in the broader geopolitical tensions between the United States and China.

This entanglement can lead to substantial challenges, including prolonged regulatory delays, complex deal restructuring, and the potential for outright prohibition of future transactions. For instance, the ongoing trade disputes and technological restrictions between the US and China create an unpredictable operating environment, impacting CK Hutchison's ability to execute strategic international deals and potentially affecting its global supply chain and market access.

CK Hutchison's 2024 financial performance was notably affected by a substantial one-time non-cash impairment charge related to its Vietnam telecommunications operations. This significant write-down, while not impacting cash flow directly, substantially reduced reported profits for the period.

This impairment signals underlying issues or necessary strategic recalibrations within the Vietnam segment, presenting a clear weakness. Such charges can also negatively influence investor sentiment and perceptions of the business unit's long-term viability.

Rising Interest Costs and Tax Burden

CK Hutchison's financial performance in 2024 faced headwinds from escalating interest expenses on its substantial debt. This increased cost of borrowing directly impacts profitability, potentially reducing the net income generated from its various business segments.

Furthermore, the company experienced a higher effective tax rate in 2024, contributing to an increased overall tax burden. These combined financial pressures, rising interest costs and a heavier tax load, can compress profit margins even when revenues remain stable or show growth in certain areas.

- Higher Interest Expenses: Increased borrowing costs directly reduce net income.

- Increased Tax Burden: A higher effective tax rate further erodes profits.

- Margin Compression: These factors can squeeze profitability across divisions.

Earnings Volatility and Margin Pressure

CK Hutchison has experienced a noticeable dip in its earnings, with earnings per share falling from HK$2.65 in 2022 to an estimated HK$2.10 in 2024. This trend highlights persistent pressure on the company's profit margins across its varied business segments.

The fluctuating earnings performance can be attributed to various factors, including increased competition and regulatory changes impacting its telecommunications and retail operations. For instance, the European telecom market, a key revenue generator, has seen intensified price wars and significant capital expenditure requirements for 5G rollouts, directly impacting profitability.

- Earnings Per Share Decline: From HK$2.65 in 2022 to an estimated HK$2.10 in 2024.

- Margin Pressure: Evidenced by the declining EPS, indicating challenges in maintaining profitability.

- Investor Wariness: Inconsistent earnings can lead to lower stock valuations and reduced investor confidence.

- Competitive Landscape: Intense competition in key markets like European telecommunications strains margins.

CK Hutchison's profitability is hampered by significant interest expenses on its substantial debt, which directly reduce net income. Furthermore, an increased effective tax rate in 2024 further burdens the company, compressing profit margins even when revenues show stability.

The company's earnings per share have shown a decline, falling from HK$2.65 in 2022 to an estimated HK$2.10 in 2024, signaling ongoing pressure on profit margins. This decline is partly due to intense competition, particularly in the European telecommunications market, which necessitates high capital expenditures for 5G rollouts and contributes to margin erosion.

Geopolitical risks present a notable weakness, exemplified by the scrutiny surrounding the proposed sale of its Panama Canal ports. This deal faced significant hurdles from Chinese regulators and became entangled in US-China tensions, highlighting the potential for regulatory delays and transaction prohibitions in an unpredictable global environment.

A substantial one-time non-cash impairment charge related to its Vietnam telecommunications operations in 2024 significantly reduced reported profits, signaling underlying issues within that segment and potentially impacting investor sentiment regarding its long-term viability.

| Financial Metric | 2022 | 2024 (Est.) | Change |

|---|---|---|---|

| Earnings Per Share (HK$) | 2.65 | 2.10 | -20.8% |

| Net Profit Attributable to Ordinary Shareholders (Billions HK$) | 14.8 | 10.8 | -27.0% |

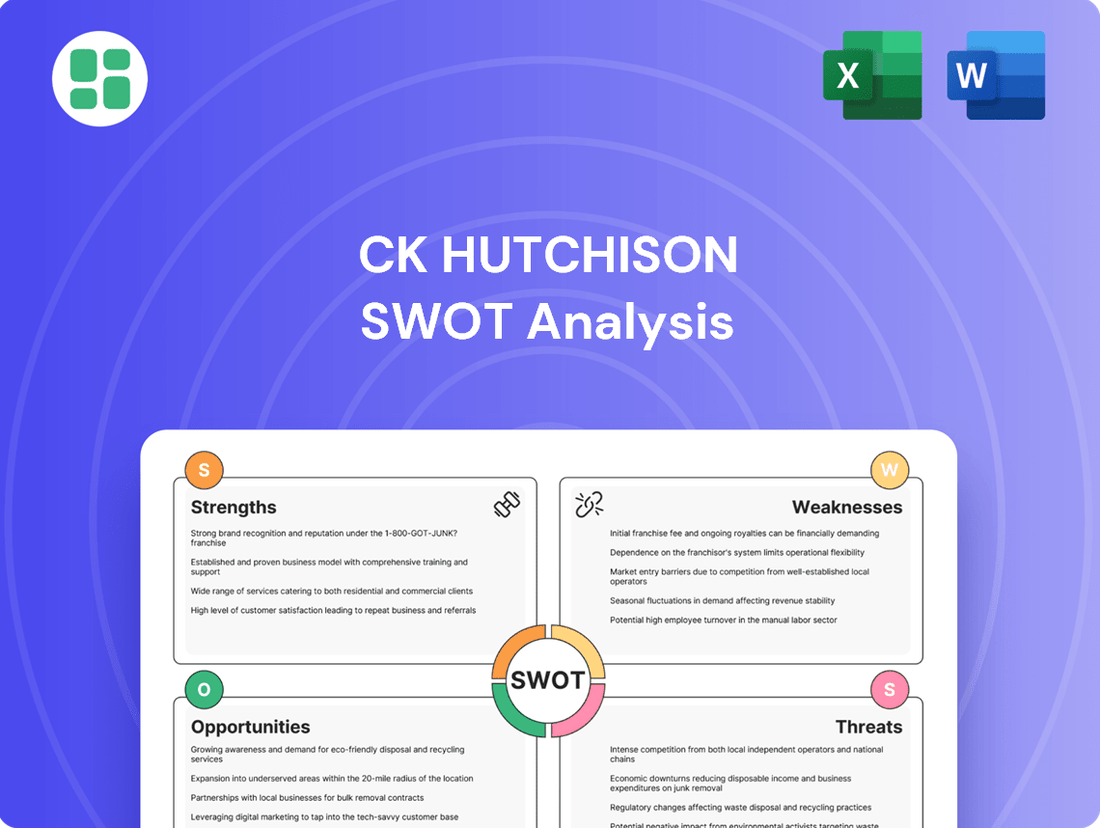

Preview Before You Purchase

CK Hutchison SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of CK Hutchison's strategic positioning.

This is a real excerpt from the complete document, showcasing the detailed analysis of CK Hutchison's Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version.

You’re viewing a live preview of the actual SWOT analysis file for CK Hutchison. The complete version, offering actionable insights, becomes available after checkout.

Opportunities

CK Hutchison's ongoing 5G network expansion across key European markets like the UK, Italy, Sweden, Denmark, Austria, and Ireland, alongside its operations in Hong Kong, is a major growth avenue. This widespread rollout is designed to boost subscriber numbers and increase the consumption of high-speed data services.

The company's strategic emphasis on IT transformation and data-centric digitization further amplifies the potential of its 5G investments. This focus is expected to drive innovation and unlock new revenue streams within its telecommunications segment.

CK Hutchison's potential completion of significant asset sales, like the previously discussed ports divestment, could unlock considerable capital. For instance, if the sale of its European telecom infrastructure assets were to proceed, it could generate billions. This financial flexibility is crucial for strategic repositioning.

This freed-up capital presents a prime opportunity for reinvestment into CK Hutchison's higher-growth segments, particularly telecommunications and infrastructure. By channeling funds into these areas, the company can aim to reaccelerate growth trajectories and improve overall long-term shareholder returns. This strategic reallocation optimizes the company's business mix.

CK Infrastructure is positioned to benefit from upcoming regulatory reviews in key markets. In the UK, the RIIO-2 framework for energy networks, which covers the period up to 2028, is already in place, but ongoing discussions and potential adjustments for future periods could offer opportunities. Similarly, Australia's Independent Pricing and Regulatory Tribunal (IPART) and New Zealand's Commerce Commission are expected to conduct reviews impacting allowed returns for regulated utilities. These resets, anticipated around 2025, could lead to improved revenue streams.

These regulatory resets are crucial as they directly influence the allowed rate of return on capital invested in infrastructure assets. For example, if regulators approve higher allowed returns, CK Infrastructure’s regulated businesses in these regions could see an uplift in their profitability. This provides a more predictable and potentially enhanced financial performance for the infrastructure segment.

Growth in E-commerce and Retail Innovations

CK Hutchison's retail arm, AS Watson Group, is experiencing significant growth, bolstered by its e-commerce efforts and a general uptick in consumer spending. This momentum is a clear opportunity to leverage further.

Continued strategic investments in online retail infrastructure, enhancing digital customer interaction, and streamlining supply chains are crucial. These moves will allow CK Hutchison to tap into the ever-growing e-commerce market, broadening its customer base and boosting its bottom line.

- AS Watson's Digital Sales Growth: AS Watson reported a substantial increase in its digital sales in 2023, with online channels contributing a growing percentage to overall revenue, particularly in key markets like Europe and Asia.

- E-commerce Penetration: The global e-commerce market is projected to continue its upward trajectory, with forecasts suggesting further penetration into traditional retail sectors through 2025, creating a fertile ground for expansion.

- Personalized Customer Experiences: Innovations in AI and data analytics allow for more personalized online shopping experiences, a trend AS Watson can capitalize on to enhance customer loyalty and drive repeat purchases.

- Omnichannel Integration: Further integrating online and offline retail channels, offering services like click-and-collect and in-store returns for online purchases, can significantly improve customer convenience and operational efficiency.

Leveraging Global Trade and Supply Chain Dynamics

CK Hutchison's Ports division demonstrated robust growth in 2024, with a notable increase in cargo throughput. This surge was particularly evident in its Asian and Latin American operations, reflecting a broader trend of supply chain diversification and relocation by global businesses. This performance highlights a significant opportunity for CK Hutchison to further leverage these shifting trade dynamics.

The company can capitalize on this by continuing to invest in the modernization and efficiency of its strategically positioned ports. Optimizing operations at key hubs will allow CK Hutchison to solidify its role as a critical node in the global maritime logistics network, attracting more business as companies seek reliable and efficient transit points.

- Increased throughput in 2024: CK Hutchison's Ports division saw a substantial rise in cargo volumes, indicating strong demand.

- Benefiting from supply chain shifts: Relocations of manufacturing and distribution centers are directly boosting traffic at Asian and Latin American ports.

- Strategic port locations: The company's geographically advantageous ports are well-positioned to capture increased global trade flows.

- Investment in efficiency: Further enhancements in port infrastructure and technology can solidify CK Hutchison's competitive edge.

CK Hutchison's ongoing 5G network expansion across Europe and Asia presents a significant opportunity for subscriber growth and increased data consumption. This is further bolstered by IT transformation and data-centric digitization initiatives aimed at driving innovation and new revenue streams within its telecommunications segment.

The potential sale of non-core assets, such as infrastructure, could unlock substantial capital, estimated to be in the billions, providing financial flexibility for strategic reinvestment into high-growth areas like telecommunications and infrastructure, thereby reaccelerating growth and improving shareholder returns.

CK Infrastructure is poised to benefit from upcoming regulatory reviews in key markets, with anticipated resets in allowed returns for regulated utilities in Australia and New Zealand around 2025, potentially leading to improved profitability.

AS Watson Group's strong performance, driven by e-commerce growth and increased consumer spending, offers a clear avenue for further expansion through strategic investments in online retail, enhanced digital customer engagement, and streamlined supply chains.

CK Hutchison's Ports division experienced robust growth in 2024, with increased cargo throughput in Asia and Latin America, reflecting shifts in global supply chains. Continued investment in port modernization and efficiency can solidify its position in global maritime logistics.

Threats

Ongoing geopolitical tensions, such as those surrounding the Panama Canal ports sale, present a substantial threat to CK Hutchison. These international dynamics can create significant operational and financial risks, impacting supply chains and market access.

Increased scrutiny from Chinese regulators, including potential demands for state-owned entity participation in deals, could significantly hinder CK Hutchison's ability to execute strategic transactions. This regulatory environment may lead to protracted approval processes and necessitate costly concessions, impacting deal viability and profitability.

The uncertainty stemming from these geopolitical and regulatory interventions can deter potential investors and complicate future cross-border M&A activities. For instance, the protracted review of the proposed acquisition of certain assets by a consortium including CK Hutchison in 2024 highlights the challenges of navigating complex international regulatory landscapes.

CK Hutchison navigates a landscape of intense rivalry across its varied business segments. In telecommunications, it contends with giants like Vodafone, while its ports division faces formidable competition from players such as A.P. Moller-Maersk. This broad competitive pressure can squeeze profit margins and necessitate constant strategic adaptation.

CK Hutchison faces significant headwinds from global economic volatility, with potential supply chain disruptions anticipated in early 2025. Rising inflation directly translates to higher operating expenses across its diverse business segments.

Economic slowdowns pose a dual threat: reduced consumer spending in its retail operations and diminished demand for its crucial telecommunications and infrastructure services. This combination can exert considerable downward pressure on overall revenue and profitability.

High Operating and Capital Expenditure in Telecom

The telecommunications industry demands significant and continuous investment in infrastructure, including the ongoing rollout of 5G technology and spectrum auctions. For instance, in 2023, major European operators collectively spent billions on 5G spectrum, a trend expected to continue. These high capital expenditures, alongside substantial operating costs driven by network maintenance and fierce market competition, place considerable pressure on profitability and free cash flow generation for companies like CK Hutchison.

CK Hutchison faces a significant threat from the persistent need for high capital and operating expenditures within the telecom sector. The company's ongoing investment in network modernization, including 5G expansion, alongside the acquisition of new spectrum licenses, represents a substantial financial commitment. For example, the global telecom industry's capital expenditure was projected to reach over $200 billion in 2024, highlighting the scale of these demands.

- Network Upgrades: Continued investment is necessary to maintain competitive network performance and introduce new services, such as enhanced 5G capabilities.

- Spectrum Acquisition: Securing and retaining sufficient spectrum is crucial for service delivery, often involving costly auctions.

- Operating Costs: High energy consumption, maintenance, and staffing contribute to significant ongoing operational expenses.

- Competitive Pressure: Intense competition can limit pricing power, making it harder to recoup substantial infrastructure investments.

Cyber Security Risks and Data Breaches

CK Hutchison, with its vast global digital footprint, faces substantial cyber security risks. These threats, ranging from sophisticated phishing schemes to outright data breaches, pose a significant danger to its operations and sensitive customer information. The potential fallout includes severe financial penalties, damage to its hard-earned reputation, and critical disruptions to its business activities.

The consequences of a successful cyber attack can be far-reaching and costly. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report. For a conglomerate like CK Hutchison, a breach could impact its diverse business segments, from telecommunications to retail, leading to significant financial losses and a loss of customer confidence. This necessitates ongoing, substantial investment in advanced cyber security infrastructure and comprehensive employee training programs to mitigate these ever-evolving threats.

- Exposure to Sophisticated Cyber Threats: CK Hutchison's multinational operations and extensive digital infrastructure make it a prime target for cybercriminals employing tactics like phishing, ransomware, and malware.

- Financial and Reputational Ramifications: A data breach can result in direct financial losses through theft, recovery costs, and regulatory fines, alongside severe reputational damage that erodes customer trust and market standing.

- Operational Disruption: Cyber incidents can halt or impair critical business functions, impacting service delivery in sectors like telecommunications and logistics, leading to lost revenue and customer dissatisfaction.

- Need for Continuous Investment: To counter these risks, CK Hutchison must allocate significant resources to state-of-the-art security technologies and regular, effective cybersecurity awareness training for all employees.

CK Hutchison faces significant regulatory hurdles and geopolitical instability, impacting its global operations and strategic transactions. Increased scrutiny from Chinese regulators and the complexity of international deal reviews, as seen in 2024 asset acquisition reviews, pose substantial threats to deal execution and profitability.

Intense competition across its diverse segments, from telecom rivals like Vodafone to ports operators such as A.P. Moller-Maersk, pressures profit margins and demands constant strategic adaptation. This broad competitive landscape can limit pricing power and hinder the recoupment of substantial infrastructure investments.

The company is also vulnerable to global economic volatility, with potential supply chain disruptions and rising inflation impacting operating expenses. Economic slowdowns further threaten reduced consumer spending and diminished demand for its core services, negatively affecting revenue and profitability.

High capital and operating expenditures, particularly in the telecommunications sector for 5G expansion and spectrum acquisition, represent a significant financial burden. The global telecom industry's projected capital expenditure exceeding $200 billion in 2024 underscores these demands, while ongoing operational costs and competitive pressures strain cash flow.

Cybersecurity risks are a major concern for CK Hutchison's extensive digital footprint, with sophisticated threats like ransomware and data breaches posing financial and reputational dangers. The average cost of a data breach in 2023 was $4.45 million, highlighting the potential financial impact and the necessity for continuous investment in security measures.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from CK Hutchison's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.