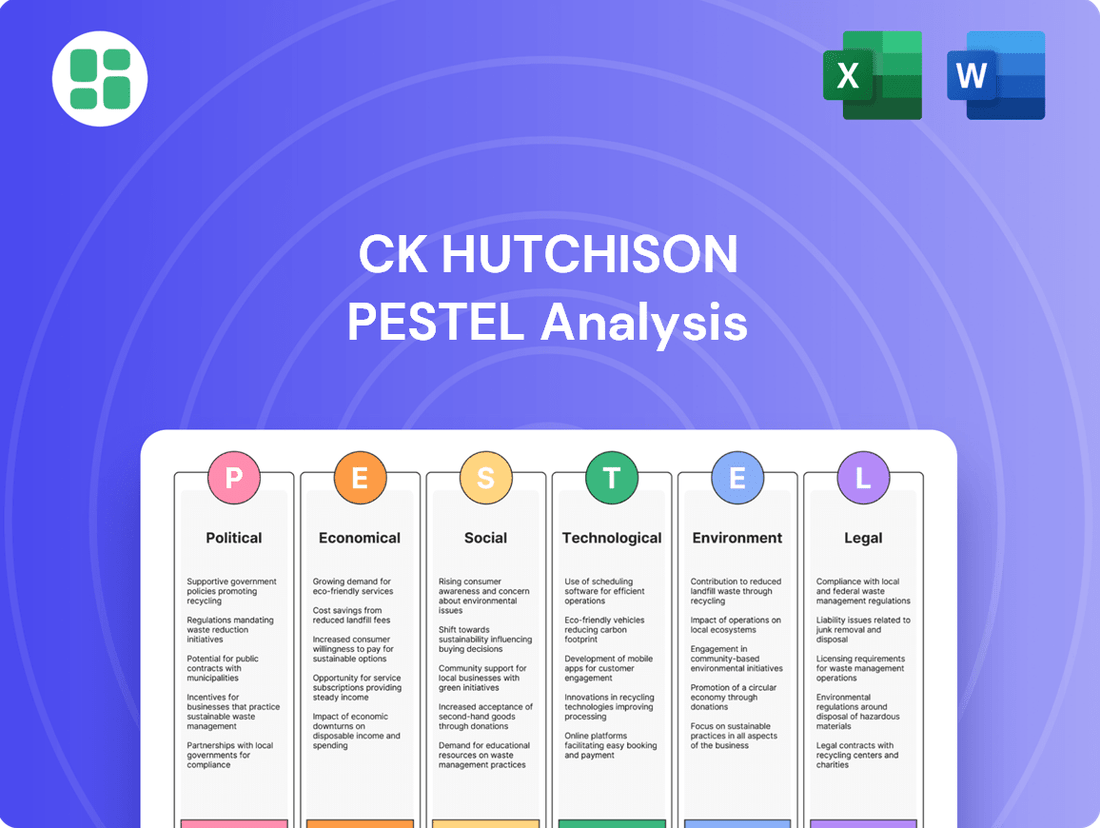

CK Hutchison PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Hutchison Bundle

Navigate the complex global landscape affecting CK Hutchison with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping the company's future. Gain a competitive edge by leveraging these crucial insights for your strategic planning. Download the full analysis now to unlock actionable intelligence and make informed decisions.

Political factors

CK Hutchison's extensive global operations in ports, retail, and telecommunications make it particularly vulnerable to geopolitical tensions and evolving trade policies. For instance, the ongoing trade friction between major economies can directly influence global shipping volumes, impacting CK Hutchison's port segment, which handled approximately 22.4 million TEUs in the first half of 2024. Tariffs and sanctions can also disrupt supply chains for its retail businesses, increasing costs and affecting product availability.

Political instability in regions where CK Hutchison has significant investments, such as Europe and Asia, poses a direct threat to business continuity and future investment plans. For example, the company's substantial telecommunications infrastructure across various markets means that regional political unrest can lead to operational disruptions and impact its revenue streams. The company's strategic decisions are therefore heavily influenced by the need to navigate these complex geopolitical landscapes and adapt to shifting international trade agreements.

CK Hutchison operates across highly regulated sectors like telecommunications, energy, and ports, making it susceptible to shifts in government policy. For instance, the European Union's Digital Services Act and Digital Markets Act, implemented in 2024, impose new obligations on digital platforms, potentially impacting CK Hutchison's telecom and infrastructure businesses by altering competition dynamics and data handling rules.

Changes in national and international regulations concerning market entry, tariffs, and data privacy present ongoing challenges. In 2024, many countries continued to review and update their telecommunications policies, with a focus on 5G spectrum allocation and net neutrality, which directly affect CK Hutchison's mobile operations and investment strategies.

Adapting to diverse and evolving policy landscapes across its global operations is a constant hurdle. For example, port operations are subject to varying maritime regulations and trade policies, while energy ventures face different environmental standards and renewable energy mandates, requiring continuous compliance and strategic adjustments.

CK Hutchison's significant global footprint means political stability in its core markets, such as the UK, Italy, and Hong Kong, directly impacts its operational landscape. For instance, the UK's ongoing regulatory reviews of the telecommunications sector, a key area for CK Hutchison's subsidiary Three UK, create a degree of uncertainty for future investment and strategic planning. Similarly, shifts in government policy in Italy, where CK Hutchison also has substantial mobile operations, could alter the competitive environment.

International Relations and Diplomatic Ties

CK Hutchison's Hong Kong origins mean its global operations are significantly influenced by the political climate between Hong Kong, mainland China, and the countries where it operates. For instance, the ongoing geopolitical shifts and trade relations between China and Western nations, particularly the US, can create regulatory hurdles or opportunities for CK Hutchison's diverse portfolio, which includes telecommunications, ports, and retail.

Bilateral investment treaties and diplomatic agreements play a crucial role. As of early 2024, many countries continue to review and adapt their investment screening mechanisms, impacting foreign direct investment. CK Hutchison's extensive port operations, for example, are subject to scrutiny under national security concerns in various jurisdictions, potentially affecting expansion plans.

- Geopolitical Tensions: Increased tensions between major global powers can lead to stricter regulations on foreign investment, particularly in sensitive sectors like telecommunications infrastructure.

- Trade Agreements: Favorable trade agreements can facilitate CK Hutchison's cross-border operations, reducing tariffs and streamlining customs processes for its logistics and retail arms.

- Regulatory Scrutiny: Diplomatic relations can influence the level of regulatory scrutiny applied to CK Hutchison's investments, impacting market entry and operational compliance.

Public Policy on Infrastructure Development

Governmental policies on infrastructure investment are a significant driver for CK Hutchison. For instance, the UK's National Infrastructure Strategy, updated in 2021, aims to boost investment in transport, digital, and green infrastructure, potentially benefiting CK Hutchison's port operations (e.g., Port of Felixstowe) and telecommunications arms (e.g., Three UK).

Public-private partnerships (PPPs) are increasingly favored globally. In 2024, many governments are looking to PPPs to finance large-scale projects, which could provide CK Hutchison with opportunities to participate in new developments or upgrades of existing networks. This approach can de-risk investments and accelerate project timelines.

Conversely, restrictive policies or a lack of government commitment to infrastructure upgrades can hinder growth. For example, delays in 5G spectrum allocation or stringent regulations on digital infrastructure deployment could impact CK Hutchison's telecom segment's expansion plans. The 2025 outlook for infrastructure spending will be crucial.

- UK's National Infrastructure Strategy: Focuses on enhancing transport, digital, and green infrastructure, creating potential growth avenues for CK Hutchison's port and telecom businesses.

- Global Trend in PPPs: Governments increasingly utilize public-private partnerships in 2024 to fund infrastructure, offering CK Hutchison avenues for collaboration and investment.

- Regulatory Impact on Telecoms: Policies concerning 5G spectrum allocation and digital infrastructure deployment directly influence the growth trajectory of CK Hutchison's telecommunications operations.

CK Hutchison's global operations are significantly shaped by political stability and government policies across its diverse markets. Geopolitical tensions, such as those impacting trade relations between major economies, directly affect its port volumes, with global shipping handling around 22.4 million TEUs in H1 2024. Regulatory shifts, like the EU's Digital Services Act and Digital Markets Act in 2024, also impose new obligations on its telecommunications and infrastructure businesses, altering competition and data handling rules. Furthermore, political instability in regions where CK Hutchison invests, particularly in Europe and Asia, poses risks to business continuity and future investment, underscoring the need for agile navigation of complex political landscapes.

| Political Factor | Impact on CK Hutchison | Relevant Data/Example (2024/2025 Focus) |

|---|---|---|

| Geopolitical Tensions & Trade Policies | Affects global shipping volumes, supply chain costs, and market access. | Global trade friction can impact the 22.4 million TEUs handled by CK Hutchison's ports in H1 2024. |

| Regulatory Environment (Telecoms, Ports) | Influences operational compliance, competition, and investment strategy. | EU's Digital Services Act/Digital Markets Act (2024) impacts telecom infrastructure; 5G spectrum allocation policies are critical for mobile operations. |

| Political Stability in Key Markets | Impacts operational continuity, investment security, and revenue streams. | UK's telecom regulatory reviews and Italian policy shifts can affect Three UK and other mobile operations. |

| Government Infrastructure Investment Policies | Creates opportunities or challenges for port and telecom expansion. | UK's National Infrastructure Strategy (updated 2021) and global trends in Public-Private Partnerships (PPPs) in 2024 offer potential for collaboration. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting CK Hutchison across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate these dynamics, enabling proactive decision-making for sustained growth and competitive advantage.

A clear, actionable summary of CK Hutchison's PESTLE analysis, highlighting key external factors that can be leveraged to mitigate risks and capitalize on opportunities.

This PESTLE analysis offers a concise overview of the external landscape, providing a framework to proactively address potential challenges and inform strategic decision-making for CK Hutchison.

Economic factors

The global economic outlook for 2024 and into 2025 presents a mixed picture for CK Hutchison. While some regions may experience moderate growth, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, with potential headwinds from inflation and geopolitical tensions.

Recession risks, particularly in major markets, could directly impact CK Hutchison's diverse operations. A slowdown in consumer spending would affect its retail and telecommunications segments, while reduced trade activity would hit its port operations. For instance, a significant contraction in global trade volumes could dampen revenue from its port terminals.

Conversely, sustained economic recovery or growth in key markets would provide a tailwind. For example, increased disposable income in Europe could boost sales for its retail brands, and higher business activity would likely increase demand for its mobile and fixed-line services.

Rising inflation in 2024 and projected for 2025 directly escalates operational expenses across CK Hutchison's diverse portfolio. For instance, increased energy prices will impact port operations, while higher logistics costs will affect its retail divisions, potentially squeezing profit margins.

Interest rate volatility presents a significant challenge for CK Hutchison's capital-intensive ventures. For example, if central banks maintain higher interest rates through 2024-2025, the cost of borrowing for new infrastructure projects, such as port expansions or telecommunications network upgrades, will increase, thereby impacting the company's financial leverage and its ability to fund future growth initiatives.

CK Hutchison's global footprint means it navigates a complex web of currency fluctuations. For instance, the Hong Kong dollar's performance against major currencies like the Euro or the Pound Sterling directly affects how income from European and UK operations is reported. A stronger Hong Kong dollar can make overseas profits appear smaller when translated back, impacting consolidated financial statements.

In 2024, the Hong Kong dollar experienced some fluctuations against key trading partners. For example, it showed relative stability against the US dollar but saw moderate movements against the Euro. These shifts can create headwinds or tailwinds for CK Hutchison's reported earnings, depending on the direction of the currency movements and the proportion of revenue generated in each market.

This volatility isn't just about reported profits; it also influences the cost of international transactions and investments. If CK Hutchison needs to pay suppliers or make acquisitions in a currency that has strengthened against the Hong Kong dollar, those costs will rise, potentially squeezing margins across its diverse business segments, from telecommunications to retail.

Consumer Spending Patterns and Disposable Income

Consumer spending patterns and disposable income are critical for CK Hutchison's retail and telecommunications businesses. For instance, in the UK, a key market for its retail operations, inflation pressures in early 2024 continued to impact household budgets, potentially leading consumers to prioritize essential spending over discretionary purchases. This can directly translate to lower sales volumes for non-essential goods within its retail segments.

Similarly, telecommunications services, while often considered essential, can face pressure when disposable income tightens. Consumers might opt for cheaper plans, reduce spending on additional services, or delay upgrades to new devices. Data from early 2024 suggested that while mobile subscriptions remained robust, there was a noticeable trend towards value-oriented plans across many European markets where CK Hutchison operates, indicating a sensitivity to price and overall disposable income.

- Retail Sensitivity: Reduced consumer confidence and disposable income in markets like the UK and Italy during 2024 led to a more cautious approach to discretionary retail spending, impacting CK Hutchison's retail divisions.

- Telecom Value Focus: In 2024, a growing number of consumers across Europe, including those served by CK Hutchison's telecom operations, shifted towards lower-cost mobile plans and bundled services to manage their budgets.

- Impact on Revenue: Declining purchasing power directly affects CK Hutchison's ability to drive revenue growth in both its retail and telecommunications segments, necessitating agile pricing and product strategies.

Commodity Price Volatility

CK Hutchison's energy business is highly susceptible to fluctuations in global commodity prices, especially oil and gas. These price swings directly impact the profitability of its energy assets and investment decisions for new projects.

For instance, the average Brent crude oil price saw considerable volatility in 2024, with significant upward and downward movements impacting energy sector revenues. Predictable price trends are generally more beneficial for strategic planning and financial forecasting within CK Hutchison's energy segment.

- Energy Profitability: Fluctuations in oil and gas prices directly affect the margins CK Hutchison earns from its energy operations.

- Investment Decisions: Volatile commodity markets can make it harder to justify and finance new energy infrastructure projects.

- Financial Performance: Unpredictable price shifts can lead to significant deviations in the financial results of the company's energy division.

- Market Trends: For example, natural gas prices in Europe experienced substantial volatility throughout 2023 and into early 2024, influencing operational costs and revenue streams.

Economic factors significantly shape CK Hutchison's performance across its diverse business lines. Global economic growth projections for 2024, around 3.2% according to the IMF, indicate a moderate but potentially uneven landscape. Inflationary pressures and interest rate volatility in 2024-2025 directly increase operating costs and borrowing expenses for capital-intensive projects, impacting profitability and expansion plans.

Currency fluctuations, particularly for the Hong Kong dollar against major trading currencies like the Euro and Pound Sterling, influence the translation of overseas earnings, affecting consolidated financial statements. Consumer spending and disposable income remain critical drivers for the retail and telecommunications segments, with early 2024 data showing a consumer shift towards value-oriented plans and cautious discretionary spending due to inflation.

CK Hutchison's energy division is highly sensitive to commodity price swings; for instance, Brent crude oil prices exhibited significant volatility in 2024, directly impacting energy asset profitability and investment decisions.

| Economic Factor | Impact on CK Hutchison | Data/Trend (2024-2025) |

|---|---|---|

| Global Economic Growth | Affects demand across retail, telecom, and ports. | IMF projected 3.2% global growth for 2024. |

| Inflation | Increases operating costs (energy, logistics) and can reduce consumer spending. | Inflationary pressures persisted in early 2024, impacting household budgets. |

| Interest Rates | Raises borrowing costs for infrastructure projects (ports, telecom). | Central banks maintained higher rates through early 2024. |

| Currency Fluctuations (e.g., HKD vs. EUR/GBP) | Impacts reported earnings from international operations. | HKD showed moderate movements against the Euro in early 2024. |

| Consumer Spending/Disposable Income | Drives revenue for retail and telecom segments. | Consumers shifted to value plans and reduced discretionary spending. |

| Commodity Prices (e.g., Oil/Gas) | Affects profitability and investment in the energy sector. | Brent crude oil prices experienced significant volatility in 2024. |

Preview Before You Purchase

CK Hutchison PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CK Hutchison provides an in-depth examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the conglomerate. Gain immediate access to this detailed report to inform your strategic decisions.

Sociological factors

Demographic shifts are reshaping markets for CK Hutchison. For instance, many developed nations are experiencing aging populations, which can alter consumer spending patterns and the demand for certain retail goods offered by its A.S. Watson health and beauty arm. Conversely, rapid urbanization in emerging economies, particularly in Asia where CK Hutchison has significant port operations, drives demand for infrastructure development and telecommunications services.

In 2024, global urbanization continues its upward trend, with the UN projecting that 60% of the world's population will live in urban areas by 2030. This growth directly impacts CK Hutchison's infrastructure needs, such as expanding telecom networks in densely populated cities and enhancing port capacities to handle increased trade volumes. The changing age structure also affects the labor market, requiring strategies to adapt to potentially smaller working-age populations in some regions.

Consumer preferences are shifting significantly, with a marked increase in demand for digital services and a growing emphasis on sustainability. This trend directly impacts CK Hutchison's telecommunications and retail operations, as customers increasingly seek seamless online experiences and environmentally conscious products.

Lifestyle changes, driven by technological advancements and evolving social norms, are also reshaping consumer behavior. For instance, the rise of remote work and the gig economy in 2024 and 2025 necessitates flexible and accessible digital solutions from telecommunication providers. CK Hutchison's ability to adapt its service offerings to these evolving lifestyles will be crucial for maintaining market share.

CK Hutchison's operations are significantly influenced by the availability of skilled labor. For instance, the company's port logistics segment relies heavily on a steady supply of experienced stevedores and logistics managers. In 2024, global port operations faced challenges with a reported shortage of skilled maritime labor in key hubs, impacting efficiency and turnaround times.

Rising wage expectations are a direct consequence of labor market dynamics. As of early 2025, reports indicate that average wages in the technology and logistics sectors have seen an upward trend, with some specialized roles experiencing increases of 5-8% year-over-year, directly affecting CK Hutchison's operational expenditures.

Furthermore, evolving work-life balance demands are reshaping employee expectations. Companies like CK Hutchison must adapt to offering flexible work arrangements and improved benefits to attract and retain talent, particularly in competitive fields like digital technology and retail management. This societal shift necessitates strategic human resource planning to mitigate potential talent acquisition hurdles.

Health, Safety, and Well-being Standards

Societal expectations for robust health, safety, and well-being are increasingly influencing CK Hutchison's operational strategies. This is particularly relevant for its port operations and energy ventures, which inherently carry higher risks. For instance, the International Labour Organization (ILO) reported in 2024 that over 2.78 million people die each year due to occupational accidents or diseases, underscoring the critical need for proactive safety measures.

CK Hutchison's commitment to these standards is not just about compliance; it's a strategic imperative for maintaining a positive public image and ensuring a motivated workforce. Companies that prioritize employee well-being often see lower turnover rates and higher productivity. In 2024, studies indicated that organizations with strong well-being programs experienced up to a 15% increase in employee engagement.

- Regulatory Compliance: Adhering to evolving health and safety regulations globally is paramount to avoid penalties and operational disruptions.

- Employee Morale and Productivity: Investing in well-being initiatives directly correlates with a more engaged and productive workforce.

- Public Perception and Brand Reputation: Demonstrating a commitment to safety enhances brand image and fosters trust with consumers and stakeholders.

- Risk Mitigation: Proactive health and safety management reduces the likelihood of accidents, protecting both employees and company assets.

Social Responsibility and Ethical Consumerism

Public and stakeholder expectations for corporate social responsibility (CSR) are significantly shaping CK Hutchison's operational landscape. Consumers and investors are increasingly scrutinizing companies for their ethical conduct, influencing brand reputation and loyalty. For instance, a 2024 report indicated that over 60% of global consumers consider a company's social and environmental impact when making purchasing decisions.

CK Hutchison’s commitment to environmental sustainability, fair labor, and community involvement is therefore paramount. Demonstrating these values helps attract and retain socially conscious consumers and investors, directly impacting market share and access to capital. Companies that actively engage in CSR initiatives, such as reducing carbon emissions or supporting local communities, often see a tangible boost in their brand perception.

- Growing Consumer Demand: 2024 surveys show a marked increase in consumers prioritizing ethical sourcing and sustainable practices.

- Investor Scrutiny: ESG (Environmental, Social, and Governance) factors are now a key consideration for a substantial portion of global investment funds.

- Brand Reputation Impact: Positive CSR actions can enhance brand image, while negative practices can lead to significant reputational damage and boycotts.

- Talent Attraction: A strong CSR profile also aids in attracting and retaining employees who value working for socially responsible organizations.

Societal expectations regarding health, safety, and employee well-being are increasingly influencing CK Hutchison's strategic decisions. In 2024, global data from the International Labour Organization highlighted the critical importance of workplace safety, with millions of annual fatalities from occupational hazards. Companies demonstrating strong commitment to these areas, like CK Hutchison, often experience enhanced employee engagement and productivity, with studies in 2024 showing up to a 15% increase in engagement for firms with robust well-being programs.

Furthermore, corporate social responsibility (CSR) is a growing imperative, with consumer and investor focus on ethical conduct intensifying. Reports from 2024 indicate that a majority of consumers consider a company's social and environmental impact when making purchasing choices, directly affecting brand loyalty and market share. CK Hutchison's proactive engagement in sustainability and community initiatives is therefore crucial for maintaining a positive brand image and attracting capital in the current market.

Technological factors

CK Hutchison's embrace of digital transformation and automation is paramount, as these technological shifts are reshaping industries at an unprecedented speed. The company is actively integrating smart port technologies, for instance, which is critical for optimizing global logistics operations. This focus on automation across its diverse business segments, from retail to telecommunications, directly impacts its ability to maintain a competitive edge and drive operational efficiency.

AI-driven retail analytics are becoming increasingly vital for CK Hutchison's retail arm, enabling more personalized customer experiences and smarter inventory management. By automating processes, the company aims to streamline workflows, achieve significant cost reductions, and ultimately elevate the quality of its service delivery across all its ventures. This strategic adoption of technology is not just about efficiency; it's about future-proofing the business.

The continued deployment of 5G networks presents a significant technological factor for CK Hutchison's telecommunications operations. This rollout demands substantial capital expenditure for infrastructure upgrades and spectrum acquisition, with global 5G investment projected to reach hundreds of billions of dollars by 2025.

However, this investment is crucial as 5G enables enhanced mobile broadband, low-latency communication for the Internet of Things (IoT), and new enterprise services, directly impacting CK Hutchison's ability to offer competitive and innovative solutions. For instance, by 2024, it's anticipated that over 1.5 billion 5G connections will be active globally, a figure expected to grow substantially in 2025, presenting a vast market for CK Hutchison to tap into.

CK Hutchison, as a vast global operator managing significant digital infrastructure and a wealth of customer data, is constantly exposed to evolving cybersecurity threats. The company's commitment to investing in cutting-edge cybersecurity technologies and implementing stringent data protection protocols is paramount. This focus is essential not only to shield sensitive information but also to preserve customer confidence and adhere to increasingly rigorous international data privacy mandates.

E-commerce and Omnichannel Retail Evolution

The relentless expansion of e-commerce and the sophisticated development of omnichannel retail are critical technological factors for CK Hutchison. Adapting requires significant investment in advanced online infrastructure, streamlined logistics, and unified customer experiences across digital and physical touchpoints to align with evolving consumer behaviors.

For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, underscoring the need for robust digital capabilities. CK Hutchison's retail segments must therefore prioritize:

- Enhanced online platform capabilities to support growing digital transactions and personalized customer journeys.

- Investment in supply chain technology for efficient order fulfillment and last-mile delivery, crucial for omnichannel success.

- Seamless integration of online and offline channels, offering services like click-and-collect and in-store returns to provide a cohesive customer experience.

Renewable Energy Technologies and Smart Grids

Advancements in renewable energy, like solar and wind power, alongside the evolution of smart grids, are reshaping the energy landscape for CK Hutchison. These shifts offer significant opportunities for their infrastructure and energy divisions. For instance, by 2024, global renewable energy capacity is projected to reach new heights, potentially creating avenues for investment in new energy infrastructure.

CK Hutchison can leverage these technological factors by integrating cleaner energy solutions into its operations and distribution networks. This strategic move not only supports global sustainability objectives but also unlocks new investment possibilities. The company might explore partnerships or direct investments in renewable energy projects, aligning with the growing demand for green energy.

However, the transition also poses challenges. Traditional energy assets could face diminished value as cleaner alternatives gain traction. For example, the International Energy Agency reported in 2024 that investments in renewable energy are rapidly outpacing those in fossil fuels, indicating a potential shift in market dynamics that CK Hutchison must navigate.

- Renewable Energy Growth: Global renewable energy capacity is expected to see substantial expansion through 2025, driven by falling costs and supportive policies.

- Smart Grid Integration: The development of smart grids enhances energy efficiency and reliability, offering CK Hutchison opportunities to modernize its infrastructure and services.

- Investment Opportunities: Embracing hydrogen and advanced battery storage technologies could open new revenue streams and align with future energy demands.

- Market Disruption: Traditional energy infrastructure may face pressure as the market increasingly favors sustainable and digitally-enabled energy solutions.

CK Hutchison's technological advancements are critical, with 5G network expansion demanding significant capital for infrastructure and spectrum, aiming to capitalize on the projected 1.5 billion global 5G connections by 2024, a number set for substantial growth in 2025.

The company's retail operations are increasingly reliant on AI for personalized customer experiences and efficient inventory management, while e-commerce growth, projected to reach $7.4 trillion by 2025, necessitates robust online platforms and integrated omnichannel strategies.

Cybersecurity is paramount given CK Hutchison's extensive digital infrastructure and data holdings, requiring continuous investment in advanced technologies and stringent data protection protocols to safeguard information and maintain customer trust amidst evolving threats.

Advancements in renewable energy, such as solar and wind, and smart grids present opportunities for CK Hutchison's energy divisions, aligning with global sustainability goals and potentially creating new investment avenues as renewable energy capacity expands significantly through 2025.

| Technological Factor | Impact on CK Hutchison | Key Data/Projections |

|---|---|---|

| 5G Network Deployment | Enhanced mobile broadband, IoT capabilities, new enterprise services; requires substantial CAPEX. | Global 5G connections to exceed 1.5 billion by 2024, growing significantly in 2025. |

| AI & Automation | Improved retail analytics, personalized customer experiences, operational efficiency, cost reduction. | Automation driving efficiency gains across diverse business segments. |

| E-commerce & Omnichannel | Need for advanced online infrastructure, streamlined logistics, unified customer experiences. | Global e-commerce sales projected to reach $7.4 trillion by 2025. |

| Cybersecurity | Protection of sensitive data, maintenance of customer confidence, compliance with privacy mandates. | Continuous investment in cutting-edge cybersecurity technologies is essential. |

| Renewable Energy & Smart Grids | Opportunities in energy divisions, integration of cleaner solutions, potential new investment streams. | Significant expansion of global renewable energy capacity through 2025. |

Legal factors

CK Hutchison's telecommunications and ports operations face stringent antitrust and competition laws globally. For instance, in 2024, the European Commission continued its close examination of M&A activities within the telecom sector, impacting potential consolidation plays. These regulations aim to prevent market dominance and ensure fair competition, often leading to extensive review periods for any significant business moves.

Failure to comply can result in substantial penalties. In 2023, various competition authorities imposed significant fines on telecom operators for anti-competitive behavior, underscoring the financial risks involved. CK Hutchison must navigate these complex legal frameworks, which can necessitate divestments or modifications to business strategies to gain regulatory approval for mergers or acquisitions, potentially delaying market entry or expansion.

CK Hutchison, operating across diverse global markets, must navigate an intricate web of data protection and privacy regulations. Laws like the EU's General Data Protection Regulation (GDPR) and similar frameworks in other jurisdictions dictate how customer data is handled. For instance, in 2023, the EU continued to enforce GDPR, with significant fines issued for data breaches and non-compliance impacting major corporations.

Failure to adhere to these stringent data privacy laws, which govern the collection, storage, and processing of sensitive customer information, carries substantial risks. Non-compliance can lead to severe financial penalties, with GDPR fines potentially reaching up to 4% of annual global turnover or €20 million, whichever is higher. Beyond financial repercussions, such violations can inflict considerable reputational damage, eroding customer trust and impacting brand loyalty.

CK Hutchison faces growing pressure from environmental regulations, particularly concerning carbon emissions and waste management. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, impacting operations in ports and energy sectors across Europe where CK Hutchison has significant investments.

Compliance with these evolving laws necessitates substantial capital expenditure on greener technologies and sustainable operational practices. This includes upgrading port infrastructure for electric or alternative fuel handling and investing in renewable energy sources for its energy businesses. Environmental impact assessments are also crucial for new infrastructure projects, adding to project timelines and costs.

Labor Laws and Employment Regulations

CK Hutchison's global footprint means it must adhere to a patchwork of labor laws and employment regulations. These vary significantly by region, impacting everything from minimum wage requirements to collective bargaining rights. For instance, compliance with the UK's Working Time Regulations, which cap the average working week at 48 hours, differs greatly from labor standards in countries with more flexible arrangements.

Navigating these complex legal landscapes is paramount for operational continuity and risk mitigation. Failure to comply can lead to costly disputes and reputational damage. In 2024, for example, companies operating in the EU faced increased scrutiny over gig economy worker classifications, a trend likely to continue impacting multinational employers.

- Minimum Wage Compliance: Adherence to statutory minimum wages across CK Hutchison's operating regions, such as the UK's National Living Wage which saw an increase in April 2024.

- Working Hour Regulations: Managing employee work hours to comply with local laws, including overtime rules and rest period mandates in various jurisdictions.

- Union Relations: Understanding and respecting the rights to unionize and engage in collective bargaining as stipulated by national labor legislation.

- Employee Benefits and Protections: Ensuring provision of legally mandated benefits, such as paid leave, sick pay, and protections against unfair dismissal, which differ country by country.

International Trade Laws and Customs Regulations

CK Hutchison's ports and related services are significantly shaped by international trade laws and customs regulations. These legal frameworks dictate everything from cargo volumes to operational efficiency. For instance, changes in import/export rules or the imposition of sanctions can directly affect profitability.

The company must continually adapt to evolving legal landscapes. This includes staying abreast of customs duties, which can fluctuate based on global trade agreements and geopolitical shifts. In 2024, ongoing trade tensions and the re-evaluation of trade pacts by major economies present a dynamic environment for port operators like CK Hutchison.

- Customs Duties: Fluctuations in tariffs directly impact the cost of goods moving through ports, influencing shipping volumes and CK Hutchison's revenue streams.

- Import/Export Regulations: Stricter or more lenient regulations on specific goods can alter cargo mix and require adjustments in handling procedures.

- International Sanctions: Sanctions regimes can block certain trade routes or prohibit the handling of specific cargo, necessitating careful compliance and operational adjustments.

- Trade Agreements: New or revised trade agreements can boost or hinder trade flows, directly affecting the demand for port services.

CK Hutchison operates under a complex web of consumer protection laws globally. These regulations govern everything from product safety to advertising standards, ensuring fair dealings with customers. For example, in 2024, the UK's Competition and Markets Authority continued its focus on ensuring fair pricing and preventing misleading claims in the telecommunications sector, directly impacting CK Hutchison's mobile operations.

Non-compliance can lead to significant financial penalties and reputational damage. In 2023, several large retailers faced substantial fines for violating consumer rights directives, highlighting the risks associated with inadequate adherence. CK Hutchison must continuously monitor and adapt its practices to meet these evolving legal requirements across its diverse markets.

Environmental factors

CK Hutchison's extensive global infrastructure, particularly its ports and energy operations, is directly exposed to the escalating impacts of climate change. Rising sea levels and the increasing frequency of extreme weather events like typhoons and floods pose significant threats to these assets, many of which are situated in coastal or otherwise vulnerable areas. For instance, the company's port operations in Asia are particularly susceptible to disruptions from severe weather patterns, potentially impacting supply chains and logistics.

These environmental shifts can lead to substantial operational disruptions and physical damage, requiring significant investment in resilience and adaptation measures. In 2023 alone, the global economic cost of weather and climate disasters was estimated to be over $200 billion, highlighting the scale of the challenge. CK Hutchison's commitment to sustainability and infrastructure hardening is crucial to mitigate these risks and ensure business continuity across its diverse portfolio.

CK Hutchison faces growing demands from governments, shareholders, and consumers to shrink its carbon footprint and reach net-zero emissions. This pressure directly affects its energy generation, port activities like managing ship emissions, and overall logistics operations.

Meeting these environmental targets will necessitate substantial capital outlays for CK Hutchison. These investments will likely focus on adopting cleaner fuels, enhancing energy efficiency across its diverse operations, and transitioning towards renewable energy sources. For instance, the maritime sector, a key area for Hutchison Ports, is under scrutiny; the International Maritime Organization's (IMO) 2020 sulfur cap and ongoing discussions around decarbonization highlight the need for cleaner shipping technologies.

Growing global concerns about resource scarcity, particularly in water, energy, and essential raw materials, directly impact CK Hutchison's operational planning. The company must navigate increasing costs and potential supply chain disruptions stemming from these limitations. For instance, the International Energy Agency reported in late 2024 that global renewable energy capacity additions were projected to grow by 30% in 2025 compared to 2024, highlighting a shift but also the ongoing reliance on traditional resources.

CK Hutchison's commitment to sustainable waste management is becoming a critical factor for both environmental responsibility and cost efficiency. Across its diverse portfolio, including retail operations, port terminals, and energy infrastructure, implementing robust recycling programs and responsible waste disposal methods is paramount. By 2025, many jurisdictions are expected to have tightened regulations on landfilling, pushing companies like CK Hutchison to invest further in circular economy principles to minimize waste and recover valuable materials.

Biodiversity Protection and Habitat Preservation

CK Hutchison’s extensive global operations, particularly in port development and energy infrastructure, necessitate careful consideration of biodiversity. For instance, projects like the expansion of ports or the construction of new energy facilities can significantly disrupt local ecosystems. In 2023, the company continued to navigate stringent environmental regulations, with a reported commitment to minimizing its ecological footprint across its diverse portfolio.

Adherence to environmental impact assessments (EIAs) is crucial. These assessments help identify potential harm to sensitive habitats and species, guiding mitigation efforts. CK Hutchison must actively implement strategies to protect biodiversity, aligning with international conservation goals and national legislation. Public scrutiny of such projects remains high, demanding transparency and demonstrable commitment to environmental stewardship.

- Regulatory Compliance: CK Hutchison must comply with evolving biodiversity protection laws, which vary by region, impacting project timelines and costs.

- Ecosystem Impact: Large infrastructure projects can affect critical habitats, requiring significant investment in conservation and restoration measures.

- Stakeholder Expectations: Growing public and investor demand for sustainable practices puts pressure on CK Hutchison to demonstrate robust biodiversity management.

Consumer Demand for Sustainable Products and Practices

Consumer demand for sustainable products and services is a significant environmental factor influencing CK Hutchison. A growing number of consumers and business partners are actively seeking out and prioritizing ethically sourced and environmentally friendly options. This trend directly impacts CK Hutchison's retail operations, necessitating a focus on sustainable sourcing practices. For instance, by 2024, global consumer spending on sustainable goods was projected to reach trillions, indicating a substantial market shift.

Beyond retail, this environmental consciousness compels CK Hutchison's various divisions to adopt greener operational practices. This can range from reducing energy consumption in telecommunications infrastructure to implementing waste reduction programs across its ports and logistics businesses. Failing to adapt can negatively affect brand perception and competitive positioning, as consumers increasingly align their purchasing decisions with their environmental values. Surveys in early 2025 indicated that over 60% of consumers consider a company's environmental impact when making purchasing decisions.

- Growing Consumer Preference: A significant and increasing portion of the global consumer base prioritizes sustainability in their purchasing decisions.

- Impact on Sourcing: CK Hutchison's retail arms face pressure to ensure ethical and sustainable sourcing of goods.

- Operational Greening: Other divisions must implement environmentally sound operational practices to meet evolving expectations.

- Brand Perception and Competition: Adherence to sustainability standards directly influences brand image and competitive advantage in the market.

CK Hutchison's extensive global infrastructure, particularly its ports and energy operations, is directly exposed to the escalating impacts of climate change. Rising sea levels and the increasing frequency of extreme weather events like typhoons and floods pose significant threats to these assets, many of which are situated in coastal or otherwise vulnerable areas. For instance, the company's port operations in Asia are particularly susceptible to disruptions from severe weather patterns, potentially impacting supply chains and logistics.

These environmental shifts can lead to substantial operational disruptions and physical damage, requiring significant investment in resilience and adaptation measures. In 2023 alone, the global economic cost of weather and climate disasters was estimated to be over $200 billion, highlighting the scale of the challenge. CK Hutchison's commitment to sustainability and infrastructure hardening is crucial to mitigate these risks and ensure business continuity across its diverse portfolio.

CK Hutchison faces growing demands from governments, shareholders, and consumers to shrink its carbon footprint and reach net-zero emissions. This pressure directly affects its energy generation, port activities like managing ship emissions, and overall logistics operations. Meeting these environmental targets will necessitate substantial capital outlays for CK Hutchison, focusing on cleaner fuels and renewable energy sources.

Growing global concerns about resource scarcity, particularly in water and energy, directly impact CK Hutchison's operational planning, potentially increasing costs and supply chain disruptions. The International Energy Agency reported in late 2024 that global renewable energy capacity additions were projected to grow by 30% in 2025 compared to 2024, indicating a shift but also ongoing reliance on traditional resources.

CK Hutchison's commitment to sustainable waste management is becoming critical for environmental responsibility and cost efficiency, with many jurisdictions tightening landfill regulations by 2025, pushing for circular economy principles.

Consumer demand for sustainable products and services is a significant environmental factor, with global consumer spending on sustainable goods projected to reach trillions by 2024, impacting CK Hutchison's retail operations and necessitating greener practices across all divisions to maintain brand perception and competitive advantage.

| Environmental Factor | Impact on CK Hutchison | Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Threatens port and energy infrastructure, disrupts supply chains. | Global economic cost of weather/climate disasters >$200 billion (2023). |

| Carbon Footprint Reduction & Net-Zero | Requires investment in cleaner fuels, renewables, and energy efficiency. | Maritime sector under scrutiny for decarbonization (e.g., IMO 2020 sulfur cap). |

| Resource Scarcity (Water, Energy) | Increases operational costs and potential supply chain disruptions. | Renewable energy capacity additions projected to grow 30% in 2025 vs. 2024 (IEA). |

| Sustainable Waste Management | Drives investment in recycling and circular economy principles due to tightening regulations. | Increased regulatory pressure on landfilling expected by 2025. |

| Consumer Demand for Sustainability | Influences retail sourcing and operational practices; impacts brand perception. | Over 60% of consumers consider environmental impact in purchasing decisions (early 2025 surveys). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for CK Hutchison is built on a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. We meticulously gather data on regulatory changes, economic indicators, technological advancements, and societal trends to provide a robust overview.