CK Hutchison Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Hutchison Bundle

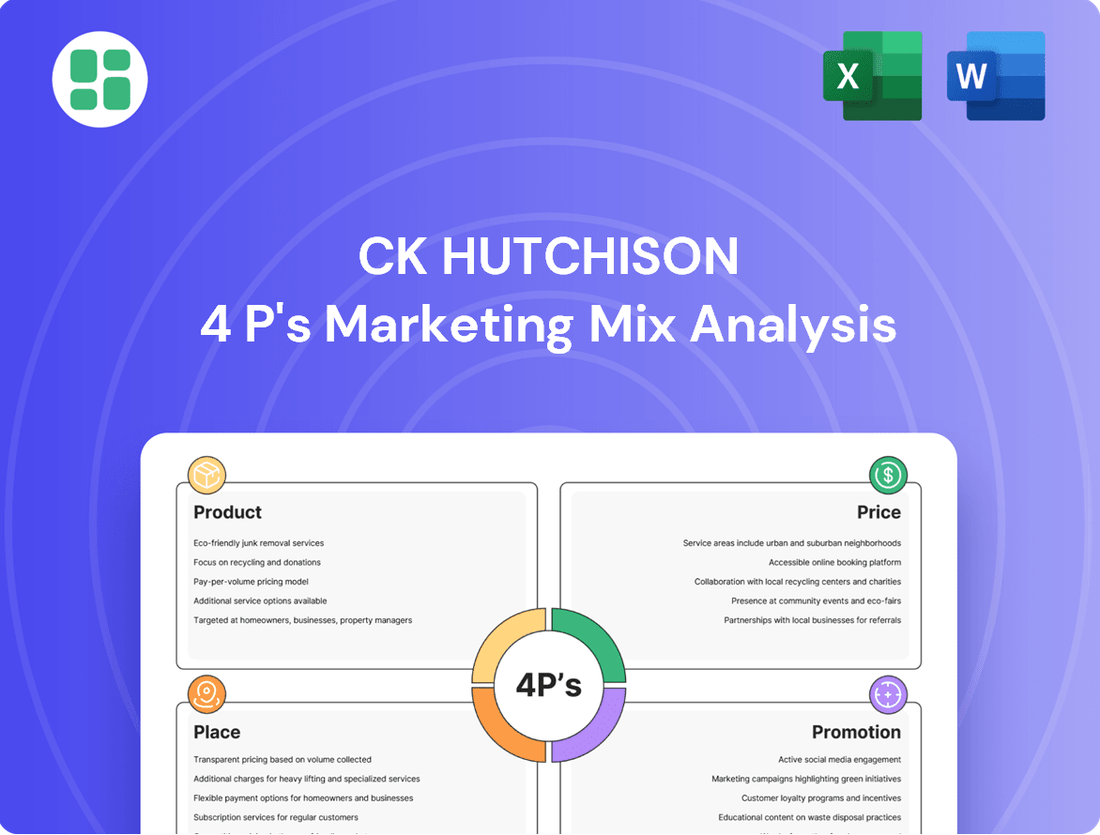

Discover how CK Hutchison masterfully orchestrates its Product, Price, Place, and Promotion strategies to dominate diverse global markets. This analysis unpacks their innovative product development, competitive pricing, expansive distribution networks, and impactful promotional campaigns.

Unlock the secrets behind CK Hutchison's marketing prowess by delving into the full 4Ps analysis. Gain actionable insights into their strategic choices, perfect for business professionals and students seeking to understand market leadership.

Ready to elevate your marketing understanding? Access the complete, editable CK Hutchison 4Ps Marketing Mix Analysis and gain a competitive edge.

Product

CK Hutchison's Ports and Related Services segment provides a wide array of port operations, encompassing container terminals, facilities for bulk and general cargo, and cruise ship terminals. This global network is a cornerstone of international trade and logistics, demonstrating significant scale and reach.

These services are bolstered by a strong commitment to technological advancement, with smart port strategies and automation being key drivers. For instance, in 2023, CK Hutchison's ports handled over 90 million TEUs (Twenty-foot Equivalent Units), showcasing their operational capacity and efficiency gains through these technological integrations.

The company is actively pursuing sustainable growth through the adoption of automated green solutions. This focus on environmental responsibility, coupled with operational excellence, aims to ensure high-performing and reliable port operations for their diverse clientele, contributing to a more efficient global supply chain.

CK Hutchison's retail and consumer segment, primarily through its A.S. Watson Group, stands as the global leader in health and beauty retail. This powerhouse operates a vast network, offering an extensive range of health, beauty, and lifestyle products to millions of customers worldwide.

The strategy heavily emphasizes enhancing the customer journey, evident in ongoing store modernization efforts and a robust 'Offline plus Online' (O+O) integration. This approach aims to provide a seamless and convenient shopping experience, blending physical and digital touchpoints.

Product development is keenly focused on anticipating and satisfying shifting consumer tastes. A.S. Watson Group ensures a broad and high-quality product assortment tailored to the unique preferences of customers across its many international markets, reflecting a commitment to evolving demands.

CK Hutchison's infrastructure investments, primarily through CK Infrastructure Holdings Limited, encompass vital sectors like energy, water, waste management, and transportation. These are not just assets; they are essential services powering communities and economies. For instance, in 2024, CK Infrastructure's global operations served millions of customers, underpinning their strategy of providing reliable utility services.

The emphasis is on the long-term stability and essential nature of these infrastructure products. They generate predictable revenue streams, making them foundational to CK Hutchison's diversified portfolio. The company's commitment to maintaining and upgrading these critical networks ensures continued operational efficiency and service continuity for the populations they serve, a strategy that proved resilient through 2024's economic landscape.

Telecommunications Services

CK Hutchison's telecommunications services, largely operated by 3 Group Europe, offer a comprehensive suite of mobile and fixed-line solutions. This includes cutting-edge 5G network capabilities, high-speed broadband, and an array of digital services designed for modern consumers and businesses.

The strategic focus for this division involves continuous enhancement of network quality and expanding geographical coverage. Innovation is key, with a drive to introduce advanced data-centric applications and AI-powered solutions to meet evolving market demands and elevate customer experiences.

In 2023, 3 Group Europe continued its investment in network infrastructure, aiming to solidify its competitive edge. For instance, 3 UK reported significant progress in its 5G rollout, reaching over 50% of its customer base with 5G services by the end of 2023, demonstrating a commitment to technological advancement.

- Network Expansion: Continued investment in 5G and fibre broadband infrastructure across key European markets.

- Service Innovation: Development and deployment of AI-driven customer service tools and data analytics platforms.

- Customer Experience: Focus on improving service reliability, speed, and personalized offerings to enhance customer satisfaction.

- Market Position: Aiming to maintain and grow market share through competitive pricing and superior service delivery.

Finance and Investments

CK Hutchison's Finance and Investments segment represents a critical pillar of its 4P's strategy, acting as the engine for value creation through a diversified portfolio. This includes significant stakes in energy ventures and other publicly traded companies, all managed with a focus on generating robust returns and enhancing overall corporate value.

The returns and value derived from these financial and strategic investments are the tangible 'products' of CK Hutchison's astute financial stewardship. These assets are not merely held but actively managed to mitigate risk and provide a stable financial foundation, thereby supporting the expansion and operational needs of the group's diverse core businesses.

For instance, as of the first half of 2024, CK Hutchison's financial investments contributed significantly to its overall performance. The company reported a substantial portion of its profit before tax stemming from its investment portfolio, underscoring the strategic importance of this segment. This financial strength enables reinvestment and strategic acquisitions, further solidifying its market position.

- Portfolio Diversification: CK Hutchison actively manages a broad range of financial and strategic investments, including significant holdings in the energy sector and various listed entities, demonstrating a commitment to broad market participation and risk spreading.

- Value Generation: The primary 'product' from this segment is the financial return and capital appreciation generated through expert asset allocation and prudent financial management, directly contributing to the group's profitability and shareholder value.

- Strategic Support: These investments serve a dual purpose, not only generating direct financial returns but also providing crucial financial flexibility and stability that underpins the growth initiatives and operational resilience of CK Hutchison's core business units.

- Financial Performance Impact: In the first half of 2024, the company's investment income played a vital role in its financial results, highlighting the segment's contribution to the group's overall economic health and its capacity for future strategic maneuvers.

CK Hutchison's Ports and Related Services segment offers comprehensive port operations, including container, bulk cargo, and cruise terminals, forming a vital global logistics network. This segment is enhanced by smart port strategies and automation, with over 90 million TEUs handled in 2023, reflecting significant operational efficiency.

The company's retail arm, A.S. Watson Group, is a global leader in health and beauty, focusing on an enhanced customer journey through O+O integration and diverse product assortments tailored to local preferences. Their strategy prioritizes anticipating and meeting evolving consumer demands across international markets.

CK Infrastructure Holdings Limited provides essential services like energy, water, and transportation, serving millions of customers globally in 2024. These infrastructure assets are crucial for generating stable, predictable revenue streams and ensuring continued operational efficiency.

The telecommunications division, 3 Group Europe, offers advanced mobile and fixed-line solutions, including 5G and broadband. Their focus is on network quality and expansion, with 3 UK achieving 5G services for over 50% of its customer base by the end of 2023.

| Segment | Key Products/Services | 2023/2024 Highlights |

|---|---|---|

| Ports and Related Services | Container terminals, bulk cargo facilities, cruise ship terminals | Handled over 90 million TEUs in 2023; Smart port and automation initiatives |

| Retail and Consumer (A.S. Watson) | Health, beauty, and lifestyle products | Global leader; O+O integration; Diverse, localized product assortments |

| Infrastructure | Energy, water, waste management, transportation | Served millions of customers globally in 2024; Focus on stable revenue |

| Telecommunications (3 Group Europe) | Mobile and fixed-line, 5G, broadband | Over 50% of 3 UK customers had 5G services by end of 2023; Network expansion |

What is included in the product

This analysis provides a comprehensive breakdown of CK Hutchison's marketing strategies, detailing their Product, Price, Place, and Promotion tactics with real-world examples.

It's designed for professionals seeking to understand CK Hutchison's market positioning and competitive advantages.

Provides a clear, actionable framework for identifying and addressing marketing challenges within CK Hutchison's 4Ps strategy.

Simplifies complex marketing decisions by offering a structured approach to optimizing product, price, place, and promotion for improved market performance.

Place

CK Hutchison commands a formidable global port network, encompassing 53 ports strategically located in 24 countries. This extensive reach, stretching across Asia, the Middle East, Africa, Europe, the Americas, and Australasia, underscores its critical role in facilitating international trade and logistics.

The sheer scale of this network, by the end of 2024, positions CK Hutchison as a linchpin in global supply chains. Its ports serve as vital nodes for efficient distribution, warehousing, and intermodal transport, directly impacting the flow of goods worldwide and supporting the company's broader strategic objectives.

A.S. Watson Group, a key component of CK Hutchison, boasts an extensive retail store footprint, operating over 16,400 physical locations across 28 international markets as of early 2024. This vast network provides millions of customers with direct access to health, beauty, and lifestyle products, underscoring a significant physical presence in the retail landscape.

This expansive brick-and-mortar presence is strategically integrated with an 'Offline plus Online' (O+O) approach, ensuring broad product accessibility and customer convenience. The company actively invests in modernizing these stores to elevate the in-store customer experience, a crucial element in their marketing mix.

CK Hutchison's telecommunications segment boasts extensive network coverage, a key element of its marketing mix. This includes a robust 5G network rollout in key European markets and Hong Kong, facilitating broad access to high-speed mobile and broadband services. For instance, by the end of 2023, the company had achieved significant 5G population coverage in markets like Italy and Austria, reaching over 70% and 60% respectively, demonstrating a commitment to widespread accessibility.

Distributed Infrastructure Assets

CK Hutchison's distributed infrastructure assets are a cornerstone of its global operations, providing essential services across diverse geographies. These assets, including power, water, and transportation networks, are strategically positioned to serve local communities and industries directly. For instance, its European infrastructure portfolio, which includes ports and energy assets, demonstrates a commitment to localized service delivery vital for economic activity. The company's 2023 annual report highlighted significant investments in upgrading and expanding these networks to enhance reliability and capacity, reflecting their critical role in its business model.

The localized nature of these infrastructure businesses means they are deeply integrated into the specific economic and social fabric of the regions they serve. This strategic distribution ensures the consistent and dependable provision of public services, a key factor in maintaining strong community relationships and regulatory support. In 2024, CK Hutchison continued to focus on optimizing the performance of these distributed assets, aiming to improve operational efficiency and sustainability across its international footprint.

- Geographic Reach: Operations span numerous countries, with a focus on essential services like power, water, and transportation.

- Localized Service Delivery: Assets are situated to directly serve specific communities and industrial needs.

- Investment Focus: Continued capital allocation in 2023-2024 towards upgrading and expanding infrastructure networks for enhanced reliability.

- Strategic Importance: These distributed assets are fundamental to CK Hutchison's business, supporting economic activity and community needs globally.

Strategic Global Partnerships

CK Hutchison actively cultivates strategic global partnerships and joint ventures to broaden its market presence and refine distribution networks across its diverse business segments. These alliances, which can involve local businesses or multinational groups, are crucial for entering new territories and utilizing pooled resources effectively. This strategy significantly boosts operational efficiency and market penetration, as demonstrated in significant international undertakings.

For instance, CK Hutchison's involvement in the Panama ports, a venture involving multiple international partners, highlights the strategic advantage of such collaborations in navigating complex global markets. These partnerships allow the company to share risks, access specialized expertise, and gain a deeper understanding of local regulatory and business environments, thereby accelerating growth and solidifying its global footprint.

- CK Hutchison's strategic alliances are key to its international expansion, enabling access to new markets and optimized distribution.

- The company leverages joint ventures with local and international entities to share resources and enhance operational efficiency.

- Partnerships are vital for navigating complex global ventures, such as significant infrastructure projects, improving market penetration.

CK Hutchison's place strategy is defined by its extensive global reach and localized service delivery. Its port operations span 24 countries, while A.S. Watson Group maintains over 16,400 retail stores across 28 markets as of early 2024. This broad physical presence is complemented by significant investments in telecommunications infrastructure, including a robust 5G rollout in key European markets and Hong Kong, achieving over 70% population coverage in Italy by the end of 2023.

| Business Segment | Key Place Metrics | Geographic Scope | Data Point (as of early 2024/end 2023) |

|---|---|---|---|

| Ports | Number of Ports | 24 Countries | 53 Ports |

| Retail (A.S. Watson) | Number of Stores | 28 Markets | Over 16,400 Stores |

| Telecommunications | 5G Population Coverage (Italy) | Europe | Over 70% |

Full Version Awaits

CK Hutchison 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CK Hutchison 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies. You'll gain immediate access to this fully completed analysis, ready for your review.

Promotion

CK Hutchison's integrated corporate communications strategy is designed to foster transparency and build investor confidence. They regularly update the global financial community through investor presentations, annual reports, and financial results announcements, ensuring stakeholders are informed about performance and strategic direction. For example, in their 2024 interim report, CK Hutchison detailed significant investments in infrastructure and digital services, underscoring their commitment to long-term value creation across their diverse business segments.

The company actively engages with key financial stakeholders, including analysts and fund managers, to articulate their long-term vision and growth strategies. This proactive communication aims to align market expectations with the company's operational execution and financial outlook. By providing clear insights into their diversified portfolio, which spans telecommunications, infrastructure, and retail, CK Hutchison seeks to attract and retain investment, as evidenced by their consistent efforts to communicate strategic milestones and financial achievements to the market.

A.S. Watson Group leverages digital platforms extensively, integrating online and offline (O+O) strategies to enhance customer engagement across its retail brands. This approach is crucial for capturing the modern beauty and health consumer. For instance, in 2023, A.S. Watson reported over 130 million members in its loyalty programs globally, showcasing the scale of their digital reach and customer retention efforts.

Social media campaigns and personalized digital marketing are key components of this O+O strategy, aimed at driving foot traffic to physical stores and boosting e-commerce sales. These initiatives create a cohesive and engaging shopping experience, ensuring customers can interact with brands seamlessly across all touchpoints. By Q1 2024, A.S. Watson's e-commerce platforms saw a significant uplift in traffic, with mobile engagement metrics showing a steady increase year-over-year.

CK Hutchison's telecommunications promotion heavily emphasizes its network's superior quality, speed, and expansive coverage. This is often substantiated by industry accolades and positive customer satisfaction metrics, reinforcing their commitment to excellence.

Marketing efforts spotlight the advantages of 5G technology, underscoring reliable connectivity for both personal and business needs. For instance, in 2024, 3 Hong Kong reported a significant expansion of its 5G network, reaching over 99% of populated areas, a key differentiator in a saturated market.

This strategic focus on network performance and service reliability aims to carve out a distinct position in fiercely competitive telecommunications landscapes, appealing to users who prioritize seamless and high-speed mobile experiences.

Sustainability and ESG Reporting

CK Hutchison actively communicates its dedication to sustainability through detailed reports and engagement with Environmental, Social, and Governance (ESG) rating bodies. This focus underscores initiatives like carbon emission reduction, renewable energy adoption, and ethical operations across its diverse businesses.

The company's commitment is demonstrated through specific targets and achievements, such as aiming for a 50% reduction in absolute Scope 1 and 2 greenhouse gas emissions by 2030 from a 2020 baseline. This proactive approach aims to bolster its corporate image and attract investors prioritizing environmental and social responsibility.

- ESG Reporting: CK Hutchison publishes comprehensive sustainability reports detailing its performance against ESG benchmarks.

- Environmental Initiatives: The company highlights progress in reducing its carbon footprint and increasing the use of renewable energy sources. For instance, its renewable energy consumption reached 30% of its total electricity usage in 2023.

- Ethical Practices: Emphasis is placed on maintaining high standards of business ethics, supply chain responsibility, and employee well-being.

- Investor Appeal: This transparent promotion of sustainability efforts aims to resonate with a growing segment of investors and stakeholders who value corporate social responsibility.

Strategic Public Relations and Stakeholder Management

CK Hutchison's strategic public relations and stakeholder management are crucial, especially given its global reach and diverse operations. For instance, in 2023, the company continued to navigate regulatory environments across numerous jurisdictions, impacting its telecom and infrastructure segments. This proactive engagement helps secure approvals for significant deals and maintain operational licenses.

The company actively communicates with governments and regulatory bodies to address concerns related to market competition, data privacy, and infrastructure development. This dialogue is vital for smooth business operations and mitigating potential risks associated with its multinational presence.

CK Hutchison's stakeholder management also extends to local communities where its businesses operate. By fostering positive relationships, the company aims to ensure social license to operate and address community needs, which is particularly relevant for its infrastructure projects.

Key aspects of their PR and stakeholder management in 2024/2025 include:

- Navigating regulatory approvals for telecom infrastructure upgrades and potential mergers/acquisitions.

- Engaging with governments on digital infrastructure investment and cybersecurity standards.

- Communicating sustainability initiatives and social impact to local communities and investors.

- Managing public perception during significant asset transactions or divestments.

CK Hutchison's promotional strategy for its diverse portfolio centers on highlighting technological leadership and customer benefits. For its telecommunications arm, this means emphasizing network quality and 5G advancements, as seen in 3 Hong Kong's 2024 network expansion reaching over 99% of populated areas. A.S. Watson Group, conversely, focuses on its extensive O+O (online and offline) retail model, leveraging its 130 million global loyalty program members in 2023 to drive engagement and sales across digital and physical channels.

The company also actively promotes its commitment to Environmental, Social, and Governance (ESG) principles, detailing progress in sustainability reports. By 2023, renewable energy comprised 30% of their total electricity usage, aligning with their goal of a 50% reduction in Scope 1 and 2 emissions by 2030 from a 2020 baseline. This dual focus on operational excellence and corporate responsibility aims to build brand value and attract socially conscious investors.

Price

A.S. Watson Group, a key retail arm of CK Hutchison, champions a value-driven pricing strategy. They focus on delivering quality health, beauty, and lifestyle goods at prices that resonate with a wide consumer base.

This approach is a careful blend of promotional offers, robust loyalty programs, and the strategic use of private label brands. These elements work in concert to draw in new shoppers and foster long-term customer loyalty.

Their pricing decisions are deeply informed by market demand, the competitive landscape, and the perceived worth of their vast product assortment. For instance, in 2024, A.S. Watson reported strong performance, with sales growth reflecting the success of these value-focused initiatives across its numerous international markets.

CK Hutchison's infrastructure assets, like utilities, operate under strict regulatory pricing. These frameworks, often involving long-term contracts, ensure stable revenues by setting prices that allow for fair returns while upholding public service duties. This approach reflects the substantial capital and operational expenses necessary to maintain essential services.

CK Hutchison's competitive telecommunications tariffs are a cornerstone of its market strategy. The company actively deploys a range of pricing plans, from prepaid options to premium postpaid bundles, often incorporating attractive introductory offers and discounts to capture market share. This aggressive pricing aims to both acquire new customers and retain its existing base, a crucial tactic in a sector characterized by high churn rates.

In 2024, the telecommunications industry saw continued price wars, with major players like CK Hutchison's Three UK offering unlimited data plans starting from around £15 per month, a significant draw for budget-conscious consumers. These strategies are designed to boost subscriber numbers and, consequently, the Average Revenue Per User (ARPU), even while managing the substantial investments needed for 5G network expansion and maintenance.

Negotiated Port Service Fees

Negotiated port service fees are a critical component of CK Hutchison's pricing strategy, directly impacting profitability and market competitiveness. These fees are not static; they are meticulously crafted through contractual agreements and established tariffs covering a range of essential port operations.

The pricing structure for services like cargo handling, warehousing, and vessel berthing is dynamic, influenced by several key variables. Factors such as the sheer volume of cargo processed, the specific nature of the goods being handled, and the length of time cargo remains in storage all play a significant role in determining the final fee. Furthermore, the inclusion of specialized value-added logistics services can also adjust these rates.

CK Hutchison actively works to fine-tune these negotiated fees. The overarching goal is to strike a balance, ensuring robust profitability for the company while simultaneously maintaining a sharp competitive edge within the demanding global shipping landscape. For instance, in 2024, major port operators like DP World reported significant revenue growth from terminal operations, underscoring the importance of effective fee negotiation in driving financial performance.

- Cargo Volume: Higher throughput generally leads to more favorable per-unit rates through negotiation.

- Cargo Type: Handling specialized or hazardous materials often incurs higher fees due to increased safety and operational requirements.

- Storage Duration: Extended storage periods are typically priced on a tiered basis, increasing with time.

- Value-Added Services: Fees for services like container stuffing, stripping, or customs brokerage are added to base handling charges.

Strategic Asset Divestment and Valuation

CK Hutchison’s strategic asset divestments, exemplified by its global port operations, see the 'price' dictated by multifaceted negotiations, prevailing market conditions, and crucial geopolitical factors. For instance, in 2023, the company continued to explore strategic options for parts of its infrastructure portfolio, with valuations reflecting global economic sentiment and specific regional risks.

The primary objective behind these valuations is to unlock significant shareholder value, concurrently aiming to reduce the company's overall debt burden. This financial restructuring allows for the strategic reallocation of capital towards core business segments identified as having higher growth potential, thereby optimizing the company's future trajectory.

These substantial divestment transactions necessitate sophisticated financial modeling and rigorous risk assessment. For example, the valuation of infrastructure assets often involves discounted cash flow (DCF) analysis, considering factors like regulatory environments, long-term contracts, and potential infrastructure upgrades needed to maintain competitiveness.

- Valuation Drivers: Market demand, asset performance, and buyer appetite significantly influence pricing.

- Debt Reduction: Divestments directly contribute to deleveraging, enhancing financial flexibility.

- Capital Reallocation: Proceeds are strategically reinvested into high-growth sectors like telecommunications and renewable energy.

- Geopolitical Impact: International trade policies and regional stability are key considerations in port asset valuations.

CK Hutchison's retail pricing, particularly through A.S. Watson, emphasizes value, leveraging promotions and private labels. Telecommunications pricing is aggressive, with competitive plans like unlimited data from £15 in 2024 to attract and retain subscribers. Port service fees are negotiated, factoring in cargo volume and type, with extended storage incurring tiered charges.

| Business Segment | Pricing Strategy Focus | 2024/2025 Data Point |

|---|---|---|

| Retail (A.S. Watson) | Value-driven, promotions, private labels | Sales growth reflecting successful value initiatives. |

| Telecommunications | Competitive tariffs, introductory offers | Three UK unlimited data plans from ~£15/month. |

| Ports & Services | Negotiated fees, volume/type dependent | Major port operators reporting significant revenue growth from terminal operations. |

4P's Marketing Mix Analysis Data Sources

Our CK Hutchison 4P's Marketing Mix Analysis is constructed using a robust blend of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry research and competitive intelligence. This approach ensures a thorough understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.