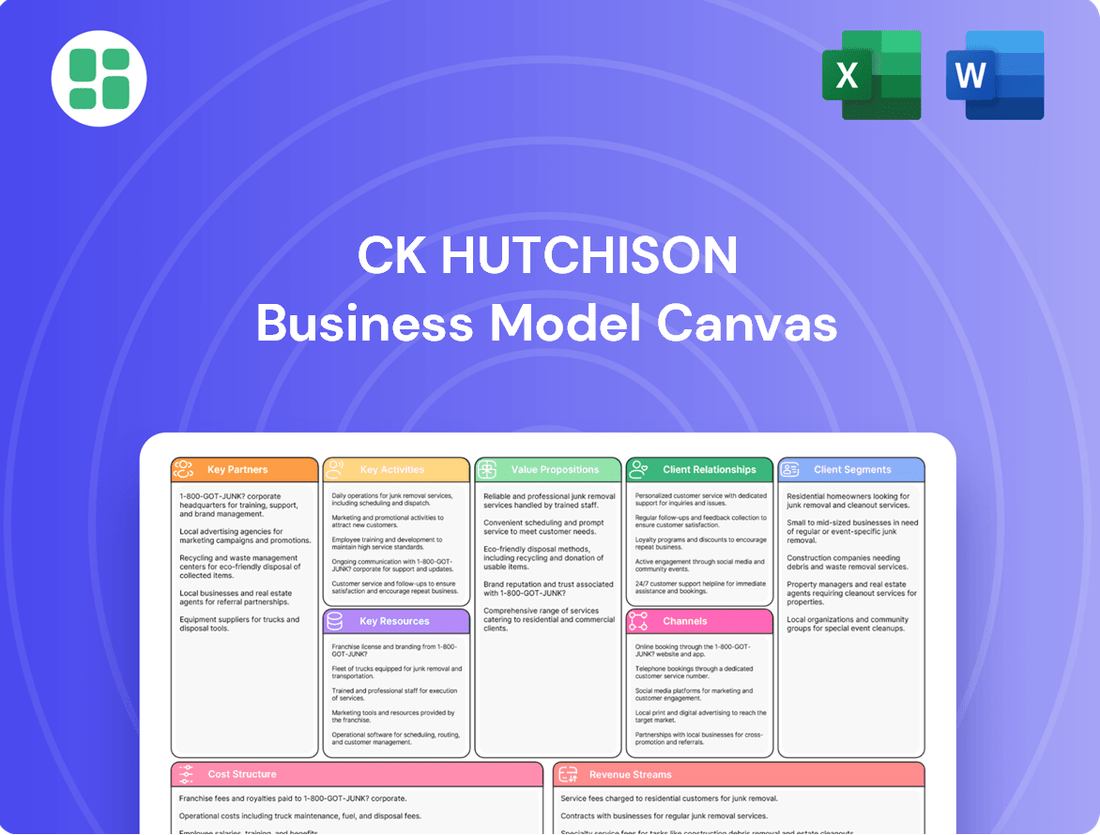

CK Hutchison Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Hutchison Bundle

Unlock the strategic genius behind CK Hutchison's diversified empire with our complete Business Model Canvas. This comprehensive breakdown reveals how they leverage their vast resources and customer base across multiple industries. Discover their key partners, revenue streams, and cost structures to understand their sustained success.

Ready to dissect CK Hutchison's winning formula? Our full Business Model Canvas offers an in-depth look at their customer relationships, value propositions, and competitive advantages. Download this essential tool to gain actionable insights for your own strategic planning.

Partnerships

CK Hutchison strategically partners with leading global shipping lines, a cornerstone of its business model. These alliances are vital for securing consistent cargo volumes, which directly fuels the operational efficiency and profitability of its port operations. For instance, in 2023, CK Hutchison Ports handled approximately 86.7 million TEUs (twenty-foot equivalent units) across its global network, underscoring the sheer scale of these shipping line collaborations.

These partnerships go beyond simple service agreements, often involving shared investments in port infrastructure and technology. This deepens operational integration, allowing for optimized vessel scheduling and cargo handling, thereby enhancing the overall competitiveness of CK Hutchison's port services. Such collaborative efforts are essential for navigating the complexities of global trade and ensuring reliable supply chains.

CK Hutchison actively engages in telecommunication network sharing agreements with other mobile network operators. These partnerships are crucial for infrastructure sharing, enabling roaming capabilities, and optimizing spectrum utilization across their operations.

These collaborations significantly reduce capital expenditure associated with extensive network build-out. For instance, in 2024, such agreements allowed operators to share costs for 5G deployment, a move projected to save billions globally.

The benefits extend to enhanced customer coverage, particularly in remote or less densely populated regions, and improved service quality during periods of high demand. This strategic approach is fundamental for maintaining competitiveness and achieving cost efficiencies in the dynamic telecommunications sector.

CK Hutchison frequently forms joint ventures with local governments, public utilities, and other infrastructure investors. These collaborations are crucial for winning major projects, managing intricate regulations, and distributing the substantial capital and operational risks inherent in sectors like energy, water, and transportation.

These strategic alliances enable CK Hutchison to tap into local knowledge and gain entry into new markets. For instance, in 2023, the company announced a significant joint venture for a renewable energy project in Southeast Asia, projected to cost upwards of $500 million, with its local government partner contributing substantial regulatory support and land access.

Retail Brand and Supplier Collaborations

CK Hutchison cultivates vital partnerships with global and local retail brands, suppliers, and distributors to fuel its vast retail network. These alliances are fundamental for securing a diverse product inventory, managing complex supply chains, and consistently meeting varied customer needs. Such collaborations are key to maintaining competitive pricing and ensuring product availability.

These strategic relationships allow CK Hutchison to offer a wide array of consumer goods, from electronics and fashion to health and beauty products. For example, in 2024, CK Hutchison's retail segments, such as Watsons and PARKnSHOP, continued to leverage these supplier relationships to introduce new product lines and seasonal offerings, driving foot traffic and online sales. The company's ability to secure favorable terms from its suppliers directly impacts its profit margins and market competitiveness.

- Brand Diversity: Partnerships with over 10,000 suppliers globally ensure a broad product assortment across CK Hutchison's retail brands.

- Supply Chain Efficiency: Collaborations focus on optimizing logistics and inventory management, aiming to reduce lead times and stockouts, particularly crucial in the fast-moving consumer goods sector.

- Innovation Access: By working closely with suppliers, CK Hutchison gains early access to new technologies and product innovations, enabling them to stay ahead of market trends.

- Cost Optimization: Strategic sourcing and volume purchasing through these partnerships contribute to significant cost savings, enhancing the company's overall financial performance.

Technology and Digital Solution Providers

CK Hutchison actively collaborates with technology and digital solution providers across its diverse business segments. These partnerships are crucial for integrating cutting-edge advancements, from smart port technologies to sophisticated retail analytics and cloud infrastructure for its telecommunications arm.

These collaborations are instrumental in driving innovation, enhancing operational efficiency, and improving customer experiences. For instance, in 2024, CK Hutchison continued to invest in digital transformation initiatives, leveraging partnerships to deploy advanced IoT solutions for its infrastructure businesses, aiming to optimize performance and create new value streams.

- Smart Port Solutions: Partnerships with tech firms to implement AI-driven logistics and automation, enhancing throughput and efficiency.

- Retail Analytics: Collaborations for advanced data analytics to personalize customer experiences and optimize inventory management in retail operations.

- Telecom Cloud Computing: Working with cloud providers to build robust and scalable infrastructure for its mobile and broadband services.

- IoT for Infrastructure: Integrating IoT technologies with partners to enable predictive maintenance and real-time monitoring of infrastructure assets.

CK Hutchison's Key Partnerships are multifaceted, spanning crucial alliances with global shipping lines, telecommunication operators, local governments, retail brands, and technology providers. These collaborations are fundamental to its operational success, cost management, and market penetration across its diverse business segments.

These partnerships are vital for securing cargo volumes, optimizing infrastructure, reducing capital expenditure, expanding market access, ensuring product diversity, and driving technological innovation. The strategic nature of these alliances directly contributes to CK Hutchison's competitive advantage and financial performance.

For example, in 2024, CK Hutchison's port operations benefited from ongoing agreements with major carriers, ensuring consistent throughput. Simultaneously, its telecommunications division leveraged network sharing to enhance 5G deployment efficiency, a trend that saw significant cost savings across the industry. The retail segment, including Watsons, continued to benefit from strong supplier relationships, introducing new product lines and driving sales through these collaborations.

What is included in the product

A comprehensive, pre-written business model tailored to CK Hutchison's diverse global strategy, detailing its telecommunications, retail, and infrastructure segments.

Covers customer segments, channels, and value propositions across its various international operations, reflecting its diversified portfolio.

The CK Hutchison Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, simplifying understanding and identifying areas for improvement.

It serves as a powerful tool for quickly identifying core components and potential bottlenecks within CK Hutchison's diverse business units, thereby alleviating the pain of navigating intricate organizational structures.

Activities

CK Hutchison's primary focus lies in the meticulous operation and strategic management of its extensive global port and terminal network. This encompasses everything from the smooth handling of cargo and efficient container stacking to the precise management of vessel traffic and the provision of comprehensive logistics solutions.

The company's success hinges on its ability to optimize port throughput and minimize turnaround times, directly impacting revenue generation and its standing in the highly competitive global trade arena. For instance, in 2023, CK Hutchison Ports handled a significant volume of containers across its worldwide operations, underscoring the scale and importance of these activities.

CK Hutchison actively manages its diverse retail footprint, encompassing health and beauty stores, supermarkets, and electronics outlets. This involves crucial tasks like optimizing inventory levels, ensuring effective product displays, and delivering exceptional customer service across all locations.

Strategic expansion and the continuous optimization of its retail network are paramount. For instance, during 2024, the company likely focused on identifying high-potential markets for new store openings while also evaluating the performance of existing stores to decide on potential closures or relocations, aiming for greater efficiency and market penetration.

The overarching objective is to elevate the customer experience and boost sales performance. This requires a keen understanding of shifting consumer preferences and market dynamics, enabling CK Hutchison to adapt its retail strategies proactively to maintain a competitive edge.

CK Hutchison's infrastructure investment and asset management involves acquiring, operating, and maintaining essential assets like energy, transportation, and water facilities. This strategy focuses on generating consistent, long-term revenue streams from critical public services.

Key activities encompass meticulous operational oversight, proactive maintenance, and strict adherence to regulatory frameworks across its diverse infrastructure holdings. This ensures the reliability and value of these vital assets.

For instance, in 2024, CK Infrastructure Holdings, a significant part of CK Hutchison's portfolio, demonstrated robust performance in its energy and utilities segment, contributing substantially to the group's overall stability and return on investment.

Telecommunications Network Operation and Service Delivery

CK Hutchison's telecommunications network operation and service delivery is the engine of its telecom segment. This involves the day-to-day running and upkeep of its vast mobile and broadband infrastructure. Key activities include rolling out new network technologies, ensuring smooth voice and data services, and providing robust customer support, alongside offering attractive value-added services.

The company actively invests in enhancing its network capabilities to stay ahead. For instance, the ongoing deployment of 5G technology is a significant focus, aiming to improve service quality and keep customers engaged. In 2024, major telecommunication companies continued to pour billions into 5G infrastructure, with global capital expenditures in this area projected to remain high.

- Network Deployment and Maintenance: Ensuring the operational integrity and expansion of mobile and broadband networks.

- Service Provision: Delivering core services like voice calls and data, alongside supplementary offerings.

- Customer Support: Providing assistance and resolving issues for the subscriber base.

- Network Upgrades: Investing in advanced technologies, such as 5G, to maintain a competitive edge.

Strategic Mergers, Acquisitions, and Divestments

CK Hutchison actively pursues strategic mergers, acquisitions, and divestments to refine its business portfolio and drive growth. These moves are crucial for entering new territories, strengthening its market presence, and maximizing shareholder returns.

In 2024, the company continued its focus on optimizing its diverse asset base. For instance, CK Hutchison was reportedly in advanced talks to divest a significant stake in its European port operations, a move aimed at unlocking capital and streamlining its infrastructure segment.

These strategic maneuvers are integral to CK Hutchison's business model, enabling it to:

- Adapt to evolving market dynamics and competitive landscapes.

- Capitalize on opportunities for synergy and expansion.

- Generate proceeds to reinvest in core or emerging business areas.

- Enhance overall financial performance and shareholder value.

CK Hutchison's key activities in its diverse portfolio include the efficient operation of global ports, strategic management of retail networks, and robust telecommunications service delivery. The company also focuses on infrastructure asset management and strategic corporate development through mergers and acquisitions.

In 2024, the company continued to invest heavily in its telecommunications segment, particularly in 5G network expansion. For example, global capital expenditures in 5G infrastructure remained a significant trend throughout the year, with major players committing billions to enhance their networks and service offerings.

CK Hutchison's port operations are critical, handling substantial container volumes worldwide. In 2023, the group's ports handled millions of TEUs, demonstrating the scale of its logistics and terminal management activities.

The company's infrastructure arm, CK Infrastructure Holdings, also showed strong performance in 2024, particularly in its energy and utilities sectors, contributing to the group's overall financial stability.

| Key Activity Area | 2023/2024 Focus/Data | Impact |

| Ports Operations | High container throughput, efficient turnaround times. 2023 saw significant global volumes handled. | Revenue generation, competitive positioning in global trade. |

| Retail Management | Optimizing inventory, customer service, and store network expansion/evaluation. | Sales performance, market penetration, customer experience enhancement. |

| Telecommunications | 5G network deployment and service enhancement. Billions invested globally in 5G in 2024. | Improved service quality, customer retention, competitive edge. |

| Infrastructure Assets | Acquisition, operation, and maintenance of energy, transport, and water facilities. Robust performance in energy/utilities in 2024. | Long-term, consistent revenue streams, asset value appreciation. |

| Corporate Development | Strategic M&A, divestments for portfolio refinement and growth. Potential divestment of European port stakes in 2024. | Capital unlocking, market strengthening, reinvestment opportunities. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis of CK Hutchison's business strategy. You will gain full access to this detailed framework, ready for your own strategic planning and insights.

Resources

CK Hutchison's extensive global port infrastructure is a cornerstone of its business. This includes a vast network of strategically located ports and terminals spanning numerous countries, offering critical hubs for international trade and logistics.

These physical assets are not just land; they encompass advanced operational capabilities like deep-water berths, high-capacity cranes, extensive storage facilities, and integrated logistics centers. This robust infrastructure directly supports its ports and related services segment, enabling efficient cargo handling and movement.

As of 2024, CK Hutchison operates in key global trade routes, managing a significant portion of container throughput. For instance, its operations in Europe, particularly through Hutchison Ports Europe, handle millions of TEUs annually, underscoring the sheer scale and importance of its port network in facilitating global commerce.

CK Hutchison's extensive retail store network, numbering in the thousands globally, is a cornerstone of its business model. This widespread physical presence allows for direct customer engagement and immediate product availability, a critical advantage in the retail sector. For instance, its European operations alone boast a significant number of retail outlets, contributing to its strong brand visibility and market penetration.

Complementing its vast retail footprint is a sophisticated supply chain infrastructure. This includes strategically located warehouses and distribution centers, coupled with advanced logistics capabilities. These elements are vital for ensuring efficient inventory management and timely delivery of goods to its numerous stores and customers, a testament to its operational prowess. In 2024, efficient logistics are paramount for maintaining competitive pricing and customer satisfaction.

CK Hutchison's infrastructure portfolio, a cornerstone of its business model, includes significant long-term assets like energy grids, water utilities, and transportation systems. These are often secured through concessions or regulated agreements, ensuring a stable and predictable revenue stream. For instance, the company's European infrastructure investments, including ports and energy networks, are designed for operational longevity, benefiting from established regulatory environments.

Advanced Telecommunications Networks and Spectrum Licenses

CK Hutchison's telecommunications segment relies heavily on its advanced network infrastructure, encompassing both mobile and fixed-line capabilities, as well as significant data center assets. These physical and digital resources are fundamental to delivering their services.

Crucial to their operations are the spectrum licenses, which are essentially the rights to use specific radio frequencies for wireless communication. These licenses are vital for providing mobile voice and data services, forming the backbone of their connectivity offerings.

The company is actively investing in the future, particularly in 5G technology and ongoing network upgrades. For instance, in 2024, CK Hutchison continued its rollout of 5G services across its various markets, aiming to enhance data speeds and network capacity to remain competitive.

Key resources for CK Hutchison's telecommunications business include:

- Extensive Mobile and Fixed-Line Network Infrastructure: Physical assets enabling connectivity.

- Data Centers: Facilities housing critical IT infrastructure for data storage and processing.

- Spectrum Licenses: Government-granted rights to utilize radio frequencies for wireless services.

- Ongoing Investment in 5G and Network Upgrades: Commitment to technological advancement for service improvement.

Global Workforce and Management Expertise

CK Hutchison's global workforce, exceeding 300,000 employees as of late 2024, represents a critical resource. This vast human capital is comprised of specialized management teams possessing deep sector knowledge across its diverse holdings, alongside a significant base of operational and technical staff.

The collective expertise within this workforce is instrumental in navigating the complexities of a multinational conglomerate. Their strategic insights and practical experience are vital for effective decision-making and the successful execution of business operations worldwide.

- Global Workforce Size: Over 300,000 employees globally.

- Expertise Spectrum: Includes specialized management, operational staff, and technical professionals.

- Strategic Value: Essential for managing a complex multinational conglomerate.

- Industry Depth: Management teams possess deep expertise across various industries.

CK Hutchison's key resources are multifaceted, spanning physical infrastructure, intellectual property, and human capital. Its extensive port operations, retail networks, and telecommunications infrastructure form the backbone of its diverse business segments. These tangible assets are complemented by crucial intangible resources like spectrum licenses and the deep expertise of its global workforce.

The company's commitment to technological advancement, particularly in 5G, and its significant investments in infrastructure ensure continued competitiveness. As of 2024, CK Hutchison's operations demonstrate a strong reliance on these core resources to drive efficiency and market presence across its global ventures.

| Resource Category | Key Assets/Components | 2024 Relevance/Data Point |

|---|---|---|

| Infrastructure | Global Port Network | Millions of TEUs handled annually in Europe alone. |

| Infrastructure | Extensive Retail Store Network | Thousands of outlets globally, supporting direct customer engagement. |

| Infrastructure | Telecommunications Network & Data Centers | Ongoing 5G rollout and network upgrades across markets. |

| Human Capital | Global Workforce | Over 300,000 employees with diverse sector expertise. |

| Intellectual Property | Spectrum Licenses | Essential for mobile voice and data service provision. |

Value Propositions

CK Hutchison's ports division delivers exceptional global connectivity and streamlined logistics. This translates to dependable and prompt cargo management, significantly cutting down transit times and operational expenses for both shipping companies and cargo owners. In 2023, the company handled over 85 million TEUs across its global network, underscoring its vital role in international trade efficiency.

CK Hutchison’s retail segment excels by providing unparalleled convenience and a vast selection of products across its numerous stores. This accessibility, coupled with competitive pricing, forms a core part of its customer value proposition.

Customers enjoy a broad spectrum of goods, from health and beauty essentials to cutting-edge consumer electronics, all readily available. For instance, A.S. Watson, a key part of CK Hutchison’s retail arm, reported over 1.6 billion transactions in 2023, highlighting the sheer volume of customer engagement with its diverse offerings.

Furthermore, loyalty programs are actively employed to deepen customer relationships and enhance the overall value received. These initiatives, combined with the extensive store network, ensure that CK Hutchison’s retail operations remain a strong draw for consumers seeking both variety and affordability.

CK Hutchison's infrastructure division offers vital services like energy, water, and transportation, ensuring consistent availability for communities and businesses. This reliability underpins economic stability and public welfare, making these assets a cornerstone of their business model.

The long-term nature of these infrastructure assets, such as ports and telecommunications networks, provides a predictable revenue stream and significant security. For instance, CK Hutchison Ports, a major global operator, handled over 85 million TEU (twenty-foot equivalent units) in 2023, demonstrating the sheer scale and consistent demand for its essential services.

Reliable and Innovative Telecommunication Services

CK Hutchison's telecommunication services are built on a foundation of reliability and forward-thinking innovation, offering customers cutting-edge mobile and broadband solutions. This includes access to high-speed 5G connectivity, ensuring a seamless digital experience.

Customers enjoy the advantages of a vast network footprint, coupled with attractively priced service packages and a suite of supplementary digital offerings. The company prioritizes a superior user experience by maintaining consistent network performance and actively pursuing technological advancements.

- Extensive Network Coverage: CK Hutchison's telecom operations, such as those under the 3 brand, boast significant network reach. For instance, in 2024, 3 UK continued its 5G rollout, aiming for enhanced coverage in urban and rural areas.

- Competitive Pricing and Value: The company consistently offers competitive mobile and broadband plans, often bundled with attractive deals and discounts to attract and retain customers. This strategy is crucial in a highly competitive market.

- Technological Innovation: CK Hutchison actively invests in and deploys new technologies. Their commitment to 5G deployment is a prime example, aiming to deliver faster speeds and lower latency, thereby improving user experience and enabling new digital services.

- Digital Service Integration: Beyond core connectivity, the company integrates value-added digital services, such as streaming bundles or cloud storage, to enhance the overall customer proposition and create additional revenue streams.

Diversified Investment Portfolio for Stakeholders

For investors and shareholders, CK Hutchison presents a compelling value proposition through its highly diversified investment portfolio. This strategic spread across various resilient sectors, including telecommunications, infrastructure, retail, and ports, is designed to cushion against the volatility inherent in any single industry. By balancing mature, cash-generating businesses with those offering growth potential, CK Hutchison aims to deliver stable and attractive returns.

This diversification is a key element in mitigating investment risk. For instance, in 2023, CK Hutchison’s infrastructure segment provided a stable revenue stream, while its telecommunications arm continued to expand its 5G services, demonstrating the benefit of this varied business mix. The conglomerate structure facilitates efficient capital allocation, allowing management to strategically deploy resources to areas with the highest potential for growth and profitability.

The company's commitment to a broad sector exposure is evident in its operational footprint. As of the first half of 2024, CK Hutchison reported significant contributions from its European ports operations, alongside steady performance from its retail businesses. This multi-faceted approach ensures that the portfolio benefits from different economic cycles and market trends, enhancing overall shareholder value.

- Sector Diversification: Exposure to telecommunications, infrastructure, ports, retail, and energy, reducing reliance on any single market.

- Risk Mitigation: Balancing mature, stable businesses with growth-oriented ventures to smooth out returns.

- Strategic Capital Allocation: The conglomerate structure allows for flexible and informed deployment of capital across its diverse operations.

- Resilient Business Models: Focus on sectors with historically stable demand and essential services.

CK Hutchison’s ports division offers unparalleled global reach and operational efficiency for shipping clients. This translates to reduced transit times and costs, a critical advantage in international trade. In 2023, the company's ports handled over 85 million TEUs, highlighting their indispensable role in global supply chains.

| Value Proposition | Description | Supporting Data (2023/2024) |

|---|---|---|

| Logistics Efficiency | Streamlined cargo management and reduced transit times for global shipping. | Handled over 85 million TEUs in 2023. |

| Retail Accessibility & Variety | Vast product selection and convenient store access for consumers. | A.S. Watson recorded over 1.6 billion transactions in 2023. |

| Reliable Infrastructure Services | Consistent availability of essential services like energy and transport. | Ports handled over 85 million TEU in 2023, indicating consistent demand. |

| Advanced Telecommunications | High-speed connectivity, particularly 5G, and comprehensive digital solutions. | 3 UK continued 5G rollout in 2024, enhancing network coverage. |

| Investment Diversification | Exposure to multiple stable and growth sectors for balanced returns. | Significant contributions from European ports and steady retail performance in H1 2024. |

Customer Relationships

CK Hutchison prioritizes long-term, strategic partnerships within its ports and infrastructure divisions. These relationships are forged with significant shipping lines, industrial clients, and public sector organizations, fostering stability and predictable revenue streams.

The foundation of these partnerships rests on mutual trust, bespoke service agreements, and an in-depth comprehension of each client's unique operational requirements. This client-centric approach ensures tailored solutions that address specific needs.

For instance, in 2024, CK Hutchison continued to leverage its extensive global network to offer integrated logistics solutions, a key differentiator that strengthens ties with major carriers. This focus on ongoing dialogue and customized service delivery is crucial for retaining its most valuable clientele.

CK Hutchison's retail arm prioritizes engaging a broad customer base by fostering loyalty through a multi-pronged approach. This includes implementing loyalty card schemes that reward repeat business and offering personalized promotional campaigns tailored to individual purchasing habits.

Digital platforms play a crucial role, enabling direct communication and exclusive offers to build a strong connection with consumers. For instance, in 2024, many large retailers saw significant growth in their loyalty program membership, with some reporting over 50% of transactions coming from loyalty members, indicating the effectiveness of these strategies in driving repeat purchases and brand affinity.

CK Hutchison's infrastructure ventures, particularly in areas like telecommunications and energy, forge deep contractual ties with regulated entities. These aren't casual arrangements; they are formal, often multi-year agreements with government bodies and utility providers. For instance, in 2024, many of their telecom infrastructure projects operate under concessions that can extend for decades, ensuring a stable revenue stream.

The core of these customer relationships revolves around strict adherence to service level agreements (SLAs) and unwavering regulatory compliance. Transparency in reporting is also a key component, as these partners demand clear visibility into operations and performance metrics. Failure to meet these stringent standards can result in penalties, making reliability the absolute priority.

Customer Service and Digital Self-Service in Telecommunications

CK Hutchison's telecommunications segment prioritizes robust customer service, operating through a multi-channel approach. This includes traditional call centers and retail outlets, alongside a significant investment in digital self-service platforms. The goal is to ensure prompt issue resolution and streamlined service management.

Digital channels are paramount for customer convenience and operational efficiency. For instance, by mid-2024, many leading telcos reported that over 70% of customer interactions were being handled through digital means, such as mobile apps and online portals. This trend reflects a strategic shift towards empowering customers with self-service capabilities.

- Multi-channel Support: Offering assistance via call centers, physical stores, and digital platforms to cater to diverse customer preferences.

- Digital Self-Service Focus: Expanding online portals and mobile apps for account management, troubleshooting, and service activation, aiming for over 70% digital interaction by mid-2024.

- Customer Convenience: Enhancing the ease with which customers can manage their services and resolve issues independently.

- Responsive Support: Ensuring timely and effective responses to inquiries across all customer touchpoints.

Investor Relations and Shareholder Communication

CK Hutchison prioritizes strong investor relations, ensuring transparent communication with its financial stakeholders. This commitment is demonstrated through the regular dissemination of financial performance data and strategic updates.

The company actively engages with investors via various channels to build confidence and address queries. These include the publication of detailed annual reports and interim financial statements, which are crucial for informed decision-making.

- Annual Reports: Providing comprehensive financial performance and strategic outlooks, such as the 2023 Annual Report detailing significant operational achievements.

- Investor Presentations: Offering insights into business segments and future growth strategies, often accompanying interim and full-year financial results.

- Annual General Meetings (AGMs): Facilitating direct engagement between management and shareholders to discuss performance and address concerns.

CK Hutchison cultivates enduring relationships with key partners in its infrastructure and ports businesses, focusing on large shipping lines and industrial clients. These are built on bespoke service agreements and a deep understanding of client operations, ensuring tailored solutions and stable revenue, as seen in 2024's integrated logistics offerings.

For its retail and telecommunications segments, CK Hutchison emphasizes customer loyalty and convenience. This involves loyalty programs, personalized promotions, and a significant push towards digital self-service, with over 70% of telco interactions handled digitally by mid-2024.

Investor relations are managed through transparent communication, including detailed annual reports and AGMs, fostering confidence among financial stakeholders. For instance, the 2023 Annual Report highlighted substantial operational successes, reinforcing investor trust.

| Segment | Relationship Type | Key Engagement Strategy | 2024 Data/Trend |

|---|---|---|---|

| Ports & Infrastructure | Strategic Partnerships | Bespoke service agreements, integrated logistics | Continued leveraging of global network for major carriers |

| Retail | Customer Loyalty | Loyalty card schemes, personalized promotions | Growth in loyalty program membership, driving repeat purchases |

| Telecommunications | Customer Service & Convenience | Multi-channel support, digital self-service | Over 70% of interactions via digital channels by mid-2024 |

| Investor Relations | Stakeholder Engagement | Transparent financial reporting, AGMs | Regular dissemination of performance data and strategic updates |

Channels

CK Hutchison's Global Network of Ports and Terminals functions as its primary channel, directly connecting it with customers through a vast physical infrastructure. This network comprises strategically positioned container terminals and multi-purpose ports across the globe, acting as vital conduits for international commerce and supply chains.

These facilities are where customers, such as shipping lines and cargo owners, engage directly for essential services like cargo handling, storage, and various maritime support. In 2023, CK Hutchison Ports handled approximately 86.9 million TEUs (twenty-foot equivalent units) across its global operations, underscoring the sheer volume and reach of these physical channels.

CK Hutchison's retail division heavily relies on its extensive global network of physical stores, encompassing thousands of locations worldwide. This vast brick-and-mortar presence includes well-known formats such as health and beauty stores, supermarkets, and electronics outlets.

These physical stores serve as crucial touchpoints for direct customer engagement, allowing for tangible product interaction and immediate purchase fulfillment. They are fundamental to delivering a personalized and hands-on shopping experience, fostering brand loyalty and facilitating impulse buys.

By 2024, the company's retail operations, including its significant presence in Europe through brands like AS Watson, continue to leverage this extensive footprint. AS Watson, for instance, operates over 16,000 stores across 28 markets, demonstrating the sheer scale of CK Hutchison's retail channel strategy.

CK Hutchison leverages digital platforms and e-commerce websites extensively across its retail and telecommunications segments. These online channels are vital for customers to explore products, complete purchases, and manage their accounts. For instance, in 2024, the company's retail operations saw a significant portion of sales transactions initiated or completed online, reflecting the growing consumer preference for digital engagement.

These digital avenues significantly broaden CK Hutchison's market reach, allowing it to connect with a wider customer base beyond its physical store footprint. This digital presence is essential for serving the increasing number of consumers who prefer the convenience of online shopping and service management, a trend that continued to accelerate through 2024.

Dedicated Sales Teams and Business Development Units

CK Hutchison leverages dedicated sales teams and business development units to secure large-scale infrastructure projects, enterprise telecommunications solutions, and strategic port partnerships. These specialized teams directly engage with corporate clients, governments, and institutional partners, focusing on negotiating complex, long-term contracts and developing tailored solutions. This high-touch, relationship-driven channel is crucial for closing significant deals.

These units are instrumental in building and maintaining relationships with key stakeholders, ensuring CK Hutchison's offerings align with the specific needs of major clients. For instance, in 2024, the company continued to pursue opportunities in digital transformation and smart city initiatives, requiring deep engagement with public sector entities and large enterprises.

- Focus on high-value B2B and B2G segments

- Direct engagement for complex, bespoke solutions

- Relationship-driven approach for strategic partnerships

- Key for infrastructure and enterprise telecommunications deals

Call Centers and Customer Service Hotlines

Call centers and customer service hotlines are critical touchpoints for CK Hutchison, particularly within its telecommunications and retail operations. These channels offer direct engagement for technical support, billing inquiries, and service activation, ensuring customers receive immediate assistance. For instance, in 2024, telecommunications providers globally reported that 70% of customer inquiries were still handled via phone, highlighting its continued importance.

These hotlines are instrumental in resolving customer issues efficiently, from network connectivity problems to account management. This direct support fosters customer loyalty and reduces churn. In 2024, companies with robust customer service reported a 15% higher customer retention rate compared to those with weaker support structures.

CK Hutchison leverages these channels to gather valuable customer feedback, which can inform service improvements and product development. Effective complaint resolution through these channels directly impacts brand perception and overall customer satisfaction.

- Direct Support: Essential for immediate problem-solving in telecommunications.

- Complaint Resolution: Key to maintaining customer satisfaction and loyalty.

- Customer Feedback: Provides insights for service enhancement.

- High Engagement: Remains a primary channel for many customer interactions in 2024.

CK Hutchison's channels are diverse, encompassing physical ports, retail stores, digital platforms, direct sales teams, and call centers. These channels cater to different customer segments and service needs, from bulk cargo handling to individual consumer purchases and enterprise solutions. The company's strategy balances extensive physical presence with growing digital capabilities to maximize reach and customer engagement.

| Channel Type | Primary Segments Served | Key Functions | 2023/2024 Data Points |

|---|---|---|---|

| Global Ports Network | Shipping Lines, Cargo Owners | Cargo Handling, Storage, Maritime Support | 86.9 million TEUs handled (2023) |

| Physical Retail Stores | Individual Consumers | Product Interaction, Immediate Purchase, Brand Experience | AS Watson operates over 16,000 stores globally (2024) |

| Digital Platforms/E-commerce | Individual Consumers, Businesses | Product Exploration, Online Purchase, Account Management | Significant portion of retail sales initiated online (2024) |

| Direct Sales Teams/BD Units | Corporates, Governments, Institutions | Negotiating Contracts, Tailored Solutions, Strategic Partnerships | Pursuing digital transformation and smart city initiatives (2024) |

| Call Centers/Customer Service | Individual Consumers, Businesses | Technical Support, Billing Inquiries, Service Activation, Feedback | 70% of telecom inquiries handled via phone (2024); 15% higher customer retention for robust support (2024) |

Customer Segments

Global shipping lines and logistics companies are key customers, relying on CK Hutchison's extensive port network for efficient cargo handling and transit. These major international players, including giants like Maersk and CMA CGM, depend on these facilities to manage their vast supply chains. In 2024, global container throughput is projected to see continued growth, underscoring the critical role of such infrastructure.

CK Hutchison's retail operations, particularly through its Superdrug and Watsons brands, primarily cater to the mass market consumer. This segment represents the largest customer base, encompassing individuals from various age groups and income levels who are looking for everyday essentials and personal care items.

These consumers are drawn to the convenience, wide product selection, and competitive pricing offered by CK Hutchison's retail outlets. For instance, Watsons, a leading health and beauty retailer in Asia, served over 5.2 billion transactions in 2023, highlighting the sheer volume of mass market consumers it engages with.

The company's retail strategy is built around accessibility and value, ensuring a broad appeal to everyday shoppers. This focus on the mass market allows CK Hutchison to achieve significant scale and market penetration across its diverse geographical footprints.

Governments and public utilities are crucial customers for CK Hutchison's infrastructure segment. These entities, including national and local governments and municipalities, depend on CK Hutchison for the development and ongoing management of vital public services. For instance, in 2023, infrastructure projects supporting public services represented a significant portion of global infrastructure spending, with governments worldwide investing heavily in energy grids and transportation networks.

Individual Mobile and Broadband Subscribers (Telecommunications)

CK Hutchison's telecommunications arm deeply engages with individual mobile and broadband subscribers. This segment is broad, encompassing everyone from light users needing basic calls and texts to power users who stream, game, and work extensively on mobile data. The core value proposition revolves around dependable network performance and attractive pricing structures.

Key considerations for this customer base include the quality of network coverage, especially in urban and rural areas, and the perceived value for money. Subscribers are often drawn to bundled offers that combine mobile services with broadband internet, alongside access to various digital content and services. For instance, in 2024, the global average monthly data usage per smartphone user was projected to exceed 20 GB, highlighting the demand for robust mobile broadband.

- Broad Customer Base Caters to a wide spectrum of individual users, from basic to heavy data consumers.

- Key Value Drivers Focuses on reliable connectivity, competitive pricing, and bundled digital services.

- Network Performance Emphasis Service quality and extensive network coverage are critical for subscriber acquisition and retention.

- Data Consumption Trends Responds to increasing data demands, with global mobile data traffic expected to grow significantly in the coming years.

Institutional Investors and Public Shareholders

CK Hutchison, as a publicly traded conglomerate, serves institutional investors like pension funds and mutual funds, alongside individual public shareholders. These groups are keenly focused on the company's financial health, dividend payouts, and its capacity for long-term value enhancement. Transparency in corporate governance is also a paramount concern for this segment.

For instance, in 2024, CK Hutchison's financial reporting would be scrutinized by these stakeholders for metrics such as revenue growth, profitability, and return on equity. The stability and growth of dividends are key indicators of the company's performance and attractiveness to shareholders.

- Financial Performance: Investors monitor key financial indicators like revenue, profit margins, and earnings per share.

- Dividend Policy: The consistency and growth of dividend payouts are crucial for income-focused investors.

- Long-Term Value Creation: Shareholders assess strategies and investments aimed at increasing the company's intrinsic value over time.

- Corporate Governance: Adherence to ethical practices and transparent reporting builds trust and confidence among all shareholders.

CK Hutchison's infrastructure segment serves governments and public utilities, providing essential services like ports and energy networks. These entities rely on CK Hutchison for critical infrastructure development and management. Global infrastructure spending continues to rise, with governments prioritizing investments in transportation and energy, reflecting the ongoing demand for these services.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Global Shipping Lines & Logistics | Efficient cargo handling, port access | Continued growth in container throughput |

| Mass Market Consumers (Retail) | Convenience, value, product variety | Billions of transactions annually (e.g., Watsons) |

| Individual Subscribers (Telecom) | Reliable connectivity, data, value pricing | Increasing mobile data usage per user |

| Institutional & Public Shareholders | Financial performance, dividends, governance | Scrutiny of financial reporting and value creation |

Cost Structure

CK Hutchison's cost structure is heavily influenced by significant capital expenditure on its diverse infrastructure. This includes substantial investments in developing and maintaining its global port operations, which are critical for international trade and logistics. For example, in 2023, the company continued to invest in its port network, enhancing capacity and efficiency across key global hubs.

Furthermore, the telecommunications segment requires ongoing, large-scale capital outlays for network expansion, 5G deployment, and technological upgrades. These investments are crucial for remaining competitive in a rapidly evolving market. The company's utility businesses also necessitate considerable CapEx for maintaining and modernizing power grids and other essential services, ensuring reliable operations.

CK Hutchison's operational costs are extensive, encompassing employee compensation, energy consumption, property upkeep, and general administrative expenses across its varied sectors like ports, retail, and telecommunications.

For instance, in 2023, CK Hutchison reported total operating expenses of HK$347.7 billion, highlighting the significant investment required to run its global operations.

Maintaining profitability hinges on rigorous cost management and streamlining operations, particularly given the sheer magnitude of its worldwide business activities.

CK Hutchison dedicates significant resources to marketing and sales, especially in its competitive retail and telecommunications sectors. These expenses cover broad advertising campaigns, attractive promotional offers, and the costs associated with maintaining customer loyalty programs, all designed to capture and hold market share.

Furthermore, substantial investment is made in sales force remuneration and training to ensure effective customer engagement and conversion. For instance, in 2024, telecommunications companies like CK Hutchison's subsidiaries often allocate a notable percentage of their revenue, sometimes upwards of 10-15%, to customer acquisition and retention marketing efforts to counter aggressive competitor strategies.

Regulatory Compliance and Licensing Fees

CK Hutchison's significant investments in telecommunications and infrastructure necessitate substantial outlays for regulatory compliance and licensing. These ongoing costs are critical for maintaining operational licenses and adhering to diverse national and international telecommunications and infrastructure regulations.

The company incurs considerable expenses for annual licensing fees and concession payments, which are essential for operating its port terminals and retail businesses in various jurisdictions. For instance, in 2023, the group's revenue was HKD 344.4 billion, with significant portions derived from these regulated sectors, underscoring the importance of these compliance costs.

- Regulatory Compliance: Costs associated with meeting diverse national and international operational standards in telecom, infrastructure, and retail.

- Licensing Fees: Annual payments required to maintain operating licenses in each sector and country of operation.

- Concession Payments: Fees paid for the right to operate infrastructure, such as port terminals, under specific agreements.

- Ongoing Audits and Reporting: Expenses related to ensuring continuous adherence to regulatory frameworks and submitting required reports.

Financing Costs and Debt Servicing

CK Hutchison, as a vast global conglomerate, faces substantial financing costs. These are primarily driven by interest payments on its considerable debt load, which is essential for funding its capital-intensive operations across diverse sectors like telecommunications, ports, and retail.

For instance, in 2023, CK Hutchison reported finance costs of approximately HKD 11.5 billion. This figure underscores the significant impact of debt servicing on the company's overall cost structure.

- Financing Costs: Interest expenses on debt are a material component of CK Hutchison's cost structure, reflecting its reliance on external funding for expansion and operations.

- Debt Management: Efficiently managing its debt portfolio and securing financing at competitive rates are critical for mitigating these costs and ensuring financial stability.

- Capital Intensity: The capital-intensive nature of its core businesses, such as infrastructure development in telecommunications and port operations, necessitates ongoing access to significant capital, thereby increasing financing needs.

- 2023 Finance Costs: The company incurred approximately HKD 11.5 billion in finance costs during 2023, highlighting the scale of its debt servicing obligations.

CK Hutchison's cost structure is dominated by capital expenditures for its infrastructure-heavy businesses, including ports and telecommunications networks. Operational expenses are also substantial, covering employee costs, energy, and administration across its global operations. Marketing and sales efforts, particularly in competitive sectors like telecom, represent another significant cost area, with companies often spending 10-15% of revenue on customer acquisition in 2024.

Regulatory compliance and licensing fees are ongoing necessities, with the group's 2023 revenue of HKD 344.4 billion reflecting the scale of these regulated sectors. Financing costs are also a major component, with HKD 11.5 billion in finance costs reported for 2023, underscoring the impact of debt servicing.

| Cost Category | Key Drivers | 2023 Impact (HKD) |

|---|---|---|

| Capital Expenditure | Infrastructure development (ports, telecom networks) | Continued significant investment |

| Operational Expenses | Employee compensation, energy, administration | HK$347.7 billion (Total Operating Expenses) |

| Marketing & Sales | Customer acquisition, promotions, loyalty programs | Up to 10-15% of revenue in telecom (industry trend) |

| Regulatory & Licensing | Compliance, license fees, concession payments | Essential for operations in regulated sectors |

| Financing Costs | Interest on debt for capital-intensive operations | HK$11.5 billion (Finance Costs) |

Revenue Streams

CK Hutchison's ports division, a significant revenue generator, earns income through various port-related services. These include charges for handling cargo, such as per-container fees, as well as revenue from warehousing and storage. Additionally, fees for vessel services and other logistics solutions contribute to this stream.

This revenue is intrinsically tied to the ebb and flow of global trade. For instance, in 2023, the company's ports and related businesses handled a substantial volume of containers, directly impacting throughput and, consequently, service fee revenues.

CK Hutchison's retail segment, a significant revenue generator, thrives on the direct sale of diverse goods. This includes health and beauty items, consumer electronics, and groceries, all accessible through its vast physical store presence and robust online channels. The success of this stream hinges on both the sheer volume of sales and the strategic mix of products offered to cater to varied customer needs.

CK Hutchison generates significant revenue from its telecommunications segment through monthly subscription fees for mobile and broadband services. This includes charges for voice calls, text messages, and internet access, forming the bedrock of their recurring income.

Beyond basic subscriptions, data usage charges are a crucial revenue driver. As consumers increasingly rely on mobile data for streaming, browsing, and social media, CK Hutchison monetizes this by charging for data consumption, especially for exceeding plan limits or for premium data packages.

Value-added services also contribute to revenue. These can include things like international roaming packages, entertainment bundles, cloud storage, and device insurance, offering customers enhanced experiences and generating additional income streams.

The company's financial performance in this area is heavily influenced by its subscriber base size and the average revenue per user (ARPU). For instance, in 2023, CK Hutchison's telecommunications operations, primarily through its 3 Group, served millions of customers, with ARPU varying across different markets but generally showing a trend towards growth driven by data consumption and bundled services.

Infrastructure Concession Fees and Utility Charges

CK Hutchison's infrastructure division secures consistent income through long-term concession deals, utility fees for services like energy and water, and set tariffs for its transportation assets. These revenue streams are frequently subject to regulatory oversight, which helps ensure predictable cash flows and offers a degree of protection against market fluctuations.

In 2024, for instance, the company's infrastructure operations are designed to leverage these regulated revenue models. For example, its port operations, often managed under concession agreements, benefit from established fee structures. Similarly, utility charges within its real estate or infrastructure developments provide a steady income base.

- Concession Agreements: Generate predictable income from long-term contracts for operating infrastructure, such as ports or telecommunications towers.

- Utility Charges: Provide recurring revenue from essential services like electricity, water, and waste management supplied to tenants or users of its infrastructure.

- Tariffs: Establish fixed charges for the use of transportation assets, ensuring a consistent revenue stream based on usage or access.

- Regulatory Stability: These revenue streams are often regulated, leading to more stable and predictable financial performance compared to less regulated sectors.

Investment Income and Dividends from Associates

Beyond its core telecommunications and infrastructure businesses, CK Hutchison benefits from investment income and dividends derived from its significant stakes in associated companies and joint ventures. This revenue stream underscores the company's strategic approach to portfolio management, capturing returns from its diverse investments.

In 2024, CK Hutchison's financial performance was bolstered by these investment activities. For instance, its share of profits from associates and joint ventures contributed meaningfully to the group's overall profitability, reflecting the success of its strategic partnerships and investments in various sectors.

- Investment Income: Revenue generated from dividends and interest received from equity investments.

- Share of Profits from Associates: CK Hutchison's portion of the net income reported by companies where it holds significant influence but not control.

- Joint Venture Contributions: Profits allocated to CK Hutchison from collaborative business ventures.

- Portfolio Diversification: These streams highlight the company's strategy to diversify revenue beyond its primary operational segments, enhancing financial resilience.

CK Hutchison's diverse revenue streams are crucial to its financial strength. The company leverages its global port operations, extensive retail network, and robust telecommunications services for consistent income. Furthermore, its infrastructure concessions and strategic investments contribute significantly to its overall profitability.

| Revenue Stream | Primary Source | 2023/2024 Data Point |

|---|---|---|

| Ports & Related Services | Cargo handling, warehousing, vessel services | Significant container throughput volumes in 2023, directly impacting revenue. |

| Retail | Sales of health & beauty, electronics, groceries | Broad product mix across physical and online channels drives sales volume. |

| Telecommunications | Monthly subscriptions, data usage, value-added services | Millions of subscribers served by 3 Group in 2023, with growing ARPU. |

| Infrastructure | Concessions, utility fees, transportation tariffs | Regulated revenue models provide predictable cash flows, exemplified by port concessions in 2024. |

| Investment Income | Dividends, interest, share of profits from associates/JVs | Meaningful contribution to group profitability from strategic partnerships in 2024. |

Business Model Canvas Data Sources

The CK Hutchison Business Model Canvas is informed by a blend of financial reports, internal operational data, and extensive market research. This multi-faceted approach ensures a comprehensive understanding of customer needs, competitive landscapes, and revenue streams.