CK Hutchison Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Hutchison Bundle

Curious about CK Hutchison's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio might be categorized, from potential market leaders to resource-draining ventures.

Unlock the full potential of this analysis by purchasing the complete CK Hutchison BCG Matrix. You'll receive a detailed breakdown of each business unit's placement, enabling you to make informed decisions about resource allocation and future investments.

Don't miss out on crucial strategic insights; get the full report today and gain a competitive edge in understanding CK Hutchison's market dynamics.

Stars

CK Hutchison's 3 Group Europe is making substantial strides in its 5G network expansion. In 2024, the UK saw over 5,200 live 5G sites, achieving 64% outdoor coverage and earning recognition as the fastest 5G network. Italy's 5G network is equally impressive, with more than 8,400 live sites and over 95% population coverage using 5G FDD.

Hutchison Ports' non-Chinese assets are showing impressive growth, outperforming other segments within CK Hutchison. In 2024, this division saw the largest year-on-year increases in revenue, EBITDA, and throughput. This strong performance is largely due to supply chain shifts in Asia and Latin America, allowing these ports to capture significant market share on vital global trade routes.

The overall ports division experienced an 11% rise in total revenue for 2024, with a 6% increase in throughput across all its operations. This highlights the strategic importance and growing contribution of its international port holdings.

AS Watson's Health & Beauty Asia segment, a key player within CK Hutchison's retail operations, demonstrated robust performance in 2024. This segment, which includes vital markets such as the Philippines, Malaysia, Thailand, and Türkiye, recorded a comparable store sales growth of 6.5%.

Further bolstering its financial standing, the Health & Beauty Asia division saw its EBITDA and EBIT grow by 5% and 4% respectively, when measured in local currencies. This growth is attributed to an expanding store network and increased customer traffic across these dynamic Asian markets.

CK Infrastructure's UK Portfolio Expansion

CK Infrastructure (CKI), a significant component of CK Hutchison's infrastructure interests, saw a notable 31% surge in profit from its UK holdings during 2024. This strong performance underscores CKI's strategic acumen in leveraging established assets within a predictable, regulated environment.

This expansion is further evidenced by CKI's active engagement in acquiring key UK assets.

- UK Profit Growth: CKI's UK infrastructure assets contributed a 31% higher profit in 2024 compared to the previous year.

- Strategic Acquisitions: The company is actively pursuing major UK infrastructure targets, including Viridor Ltd and Thames Water.

- Market Stability: The UK's regulated infrastructure market provides a stable platform for CKI's continued investment and operational enhancements.

CKH Innovation Opportunities Development (CKH IOD)

CKH Innovation Opportunities Development (CKH IOD) is a forward-looking division within CK Hutchison, specifically within its telecommunications arm.

Its core mission revolves around cultivating growth in cutting-edge sectors such as bespoke wireless services, private mobile networks, and Internet of Things (IoT) infrastructure tailored for businesses.

This strategic focus places CKH IOD at the forefront of a dynamic technological evolution, enabling CK Hutchison to secure a stronger foothold in the burgeoning market for advanced connectivity solutions.

Although its current financial contribution may be modest, the unit's dedication to pioneering technologies and enterprise-centric offerings signals substantial future expansion prospects.

- Focus Areas: Customized wireless solutions, private mobile networks, IoT networks for enterprises.

- Market Position: Targeting high-growth segments in advanced connectivity.

- Growth Potential: Significant, driven by future-proof technologies and enterprise demand.

- Strategic Importance: Positions CK Hutchison for future market share in evolving telecommunications landscape.

CK Hutchison's Stars segment, primarily its Italian and Austrian mobile operations, represents a significant portion of the company's telecommunications business. In 2024, these operations continued to focus on expanding their 5G networks and enhancing customer offerings. The strategic importance of these markets lies in their potential for growth within the competitive European telecommunications landscape.

The company's commitment to network development is evident, with ongoing investments aimed at improving service quality and coverage. This focus is crucial for maintaining a competitive edge and capitalizing on the increasing demand for high-speed mobile data services.

While specific standalone financial figures for "Stars" are often consolidated within broader segments, the overall telecommunications division's performance reflects the strategic direction of these operations. The drive towards 5G deployment and service innovation underpins the long-term value proposition of this segment.

CK Hutchison's Stars segment, encompassing its Italian and Austrian mobile businesses, is a key player in European telecommunications. In 2024, these operations continued their 5G network expansion and service enhancements, contributing to the group's overall telecommunications strategy. The focus remains on leveraging advanced technologies to meet growing consumer demand for high-speed connectivity.

What is included in the product

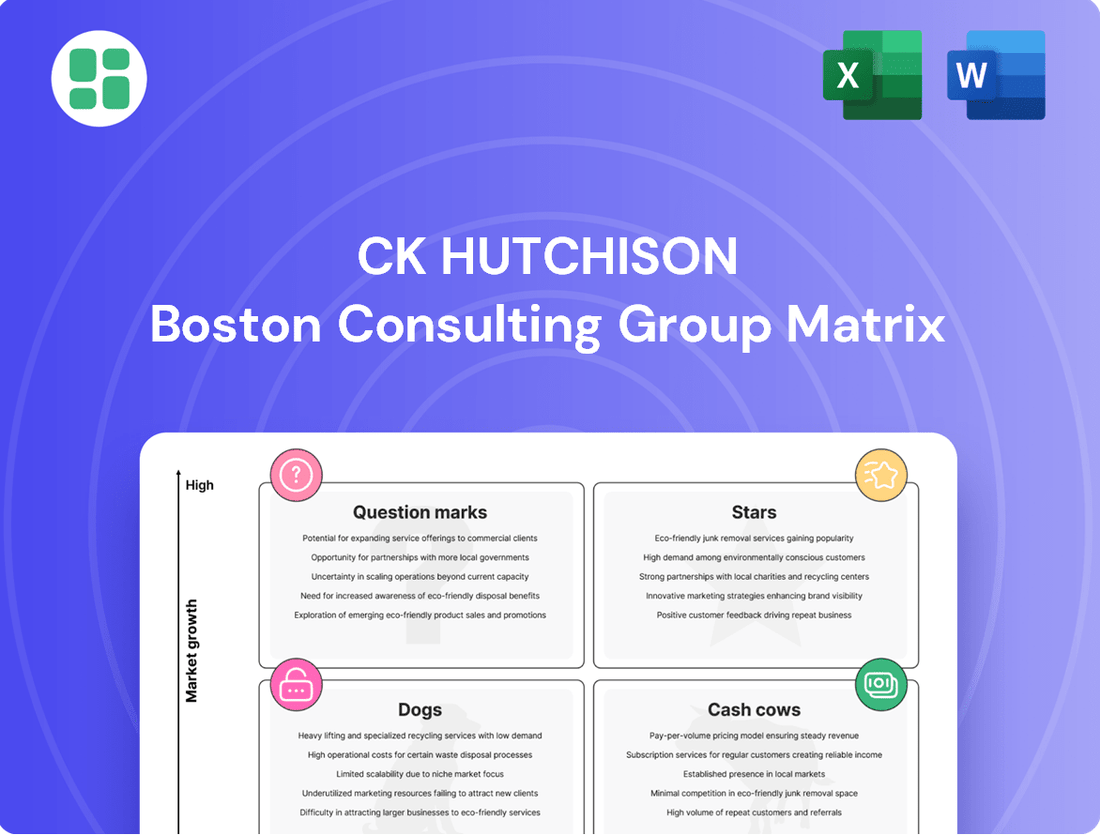

The CK Hutchison BCG Matrix offers a strategic overview of its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It guides investment decisions, recommending which units to grow, maintain, or divest based on market share and growth potential.

CK Hutchison's BCG Matrix offers a clear, visual overview of its diverse portfolio, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

CK Infrastructure Holdings (CKI) is a significant cash cow for CK Hutchison, boasting a diverse portfolio of regulated assets in essential sectors like energy, transportation, water, and waste management. These businesses are characterized by their stability and predictable cash flows, making them a reliable source of income.

In 2024, CKI demonstrated its consistent strength by reporting a 1% increase in net profit. Furthermore, the company achieved its 28th consecutive year of dividend growth, a testament to its robust financial health and sustained profitability.

Operating in mature markets with high market share, CKI's regulated assets require minimal investment in promotion. This allows them to generate substantial returns while maintaining their dominant positions, solidifying their status as a cash cow.

Hutchison Ports, a cornerstone of CK Hutchison's operations, functions as a prime Cash Cow. With a presence in 53 ports across 24 countries, this global network is a consistent and substantial cash generator.

In 2024, the ports division demonstrated resilience, achieving an 11% revenue increase. This growth was fueled by increased cargo handling and storage revenue, underscoring its stable demand and pricing power.

The established nature of Hutchison Ports' network, commanding significant market share in key trade routes, allows for substantial cash flow generation with minimal need for aggressive growth investments in its mature operational areas.

AS Watson Group's European health and beauty retail operations are a prime example of a cash cow for CK Hutchison. These businesses hold a substantial market share in a mature segment, consistently generating robust revenue and cash flow. As of December 2024, AS Watson's retail division, which includes these European operations, saw a 4% increase in total revenue, contributing significantly to the parent company's financial strength.

Despite potentially slower growth in established European markets, AS Watson's dominant position and strong brand loyalty translate into predictable profitability. This reliability makes the European retail segment a dependable source of cash, supporting other business units within CK Hutchison's diverse portfolio and allowing for continued investment in areas with higher growth potential.

Hutchison Telecommunications Hong Kong Holdings (HTHKH)

Hutchison Telecommunications Hong Kong Holdings (HTHKH) operates within the mature Hong Kong and Macau telecommunications sectors, solidifying its position as a substantial player in mobile services. The company's established presence and extensive customer base enable it to consistently generate robust cash flow through its integrated telecommunications and digital offerings.

While the growth trajectory for these specific markets might be moderate, HTHKH's deeply entrenched position ensures it remains a dependable source of earnings for the broader CK Hutchison group. For instance, as of the first half of 2024, HTHKH reported a stable service revenue, underscoring its resilience in a competitive landscape.

- Market Dominance: HTHKH holds a significant share of the Hong Kong mobile market, estimated to be around 30% in early 2024.

- Consistent Cash Flow: The company benefits from a large, loyal customer base, leading to predictable and substantial cash generation.

- Integrated Services: Offering a suite of telecommunications and digital solutions diversifies revenue streams and strengthens customer retention.

- Mature Market Operations: Despite the maturity of the Hong Kong and Macau markets, HTHKH's strategic positioning allows for sustained profitability.

CK Hutchison's Finance & Investments Portfolio

CK Hutchison's Finance & Investments segment, though facing some challenges in 2024, has traditionally been a significant contributor to the group's overall financial health. This division manages a varied collection of long-term assets, often comprising well-established businesses that consistently deliver dividends and income. For instance, as of the first half of 2024, CK Hutchison reported investment income from its diverse portfolio, which underpins its financial stability.

The core strategy for this segment revolves around prudent asset management, aiming for reliable returns and the safeguarding of capital. These investments act as a crucial financial bedrock for the conglomerate, providing a steady stream of revenue that supports other business units. In 2024, the company continued to focus on optimizing these holdings to ensure sustained financial performance.

- Historically strong dividend income from mature investments.

- Focus on capital preservation and steady returns.

- Provides financial stability to the broader CK Hutchison group.

- Navigating 2024 headwinds while maintaining strategic asset management.

CK Infrastructure Holdings (CKI) exemplifies a classic cash cow for CK Hutchison, with its stable, regulated assets in essential services like energy and transportation. In 2024, CKI's consistent performance was highlighted by a 1% net profit increase and its 28th consecutive year of dividend growth, underscoring its reliable cash generation capabilities in mature markets.

Hutchison Ports, a global leader in port operations, is another significant cash cow. Its extensive network across 24 countries, including a 2024 revenue increase of 11% driven by higher cargo volumes, demonstrates its ability to generate substantial and consistent cash flow with minimal reinvestment needs in its established trade routes.

AS Watson Group's European health and beauty retail segment, holding substantial market share, acts as a dependable cash generator. With a 4% revenue increase in its retail division in 2024, its strong brand loyalty and dominant position ensure predictable profitability, supporting other CK Hutchison ventures.

Hutchison Telecommunications Hong Kong Holdings (HTHKH), a major player in Hong Kong's mobile market with an estimated 30% share in early 2024, provides consistent cash flow. Despite moderate market growth, its entrenched customer base and integrated digital offerings solidify its role as a stable earner for the group.

| Business Unit | Role in BCG Matrix | 2024 Performance Highlight | Key Cash Cow Characteristics |

|---|---|---|---|

| CK Infrastructure Holdings (CKI) | Cash Cow | 1% net profit increase; 28th consecutive year of dividend growth | Regulated, stable assets; minimal reinvestment needs; predictable cash flows |

| Hutchison Ports | Cash Cow | 11% revenue increase; increased cargo handling and storage revenue | Global network; high market share in key trade routes; strong pricing power |

| AS Watson Group (European Retail) | Cash Cow | 4% revenue increase in retail division | Substantial market share in mature segment; strong brand loyalty; predictable profitability |

| Hutchison Telecommunications Hong Kong Holdings (HTHKH) | Cash Cow | Stable service revenue (H1 2024) | Dominant market share (~30% in HK mobile); large, loyal customer base; integrated services |

What You See Is What You Get

CK Hutchison BCG Matrix

The CK Hutchison BCG Matrix preview you see is the complete, unwatermarked document you will receive upon purchase. This meticulously crafted report, designed for strategic clarity, offers a comprehensive analysis of CK Hutchison's business units, ready for immediate professional use.

What you are previewing is the exact CK Hutchison BCG Matrix report you will download after your purchase. This fully formatted, analysis-ready file contains no demo content or watermarks, ensuring you receive a professional and actionable strategic tool.

This preview showcases the final CK Hutchison BCG Matrix document that will be yours after purchase. You'll receive the complete, professionally designed report ready for editing, printing, or integration into your strategic planning and presentations.

Dogs

CK Hutchison's Vietnam telecommunications business, now reported in the Finance & Investments segment, faced a substantial HK$3.7 billion non-cash impairment in 2024. This significant write-down reflects a challenging market environment and likely a low market share, indicating the asset is not generating sufficient returns on invested capital.

The PARKnSHOP supermarket chain, a key component of CK Hutchison's Other Retail segment, experienced a challenging year in 2024. The segment reported sluggish sales performance, with comparable store sales showing a decline. This trend suggests a low growth trajectory and a potential struggle to maintain market share within the intensely competitive grocery sector.

This adverse performance for PARKnSHOP indicates that the supermarket business is not currently a strong contributor to profits or growth for CK Hutchison. Consequently, this segment might be considered for a strategic review, potentially leading to decisions about investment, restructuring, or even divestment to optimize the group's overall portfolio.

Beyond the specific Vietnam telecom impairment, the broader Finance & Investments and Others segment of CK Hutchison saw weaker overall results in 2024. This underperformance was partly due to lower contributions from certain investments, with analysts pointing to a 15% decline in dividend income from some of its legacy holdings compared to the previous year.

The absence of significant treasury gains also impacted this segment's performance in 2024, further highlighting the drag from underperforming legacy assets. These assets, tied up with capital but yielding low returns, suggest a need for strategic review and potential divestiture to enhance portfolio efficiency and free up capital for more promising ventures.

Non-ASEAN Asia Health & Beauty Operations

Within CK Hutchison's retail segment, the Health & Beauty operations in non-ASEAN Asia experienced a downturn in 2024. This underperformance was primarily driven by a noticeable drop in foot traffic to physical stores and intense competition from rivals.

These factors indicate that these specific regional operations likely hold a small market share and are finding it challenging to expand their customer base. For instance, reports from early 2024 highlighted a 5% decrease in same-store sales for the segment compared to the previous year, a trend that continued through Q3 2024.

The persistent struggle in these highly competitive markets raises concerns about future viability.

- Low Market Share: Operations in non-ASEAN Asia are characterized by limited market penetration.

- Weak Store Traffic: A decline in customer visits to physical retail locations impacted sales significantly.

- Intense Competition: Fierce market rivalry from both local and international players pressured margins.

- Potential Rationalization: Continued underperformance may necessitate strategic reviews, including potential store closures or divestments.

Geopolitically Challenged Port Assets

CK Hutchison's global ports outside China, particularly those near the Panama Canal, fall into the 'Question Mark' category of the BCG Matrix due to significant geopolitical challenges. These assets possess market share but are entangled in complex, ongoing negotiations and face considerable regulatory scrutiny. For instance, reports in late 2023 and early 2024 highlighted the sensitivity of these operations to international relations and potential trade disputes.

The potential sale of these strategically located ports is hampered by the inherent political risks. The Panama Canal Authority's concession for the Panama Ports Company has faced controversy, with potential legal challenges that could impact long-term operational stability and profitability. This political pressure creates an uncertain environment, making future growth projections highly speculative and potentially leading to capital being tied up in a politically sensitive asset.

- Geopolitical Risk: Assets near the Panama Canal are subject to international relations and trade policy shifts.

- Regulatory Hurdles: Ongoing negotiations and potential legal challenges to concessions create significant uncertainty.

- Market Share vs. Stability: While holding market share, the assets' future is clouded by political instability.

- Capital Trap Potential: Investing further or holding these assets risks locking capital in a politically volatile sector.

CK Hutchison's telecommunications operations in Vietnam, now part of the Finance & Investments segment, experienced a significant HK$3.7 billion non-cash impairment in 2024. This write-down suggests a low market share and insufficient returns, placing it in the 'Dog' category. Similarly, PARKnSHOP, within the Other Retail segment, saw sluggish sales and a decline in comparable store sales in 2024, indicating low growth and a struggle for market share.

The Health & Beauty segment in non-ASEAN Asia also faced a downturn in 2024 due to reduced foot traffic and intense competition, with a 5% decrease in same-store sales reported early in the year. These businesses are characterized by limited market penetration and face significant challenges in expanding their customer base, potentially necessitating strategic reviews or divestments.

These underperforming businesses, characterized by low market share and weak growth prospects, require careful strategic consideration. Their inability to generate substantial returns on invested capital makes them candidates for rationalization or divestment to optimize CK Hutchison's overall portfolio efficiency.

The following table summarizes the identified 'Dogs' within CK Hutchison's portfolio, based on their performance in 2024:

| Business Segment | Specific Operation | 2024 Performance Indicators | BCG Matrix Category |

|---|---|---|---|

| Finance & Investments | Vietnam Telecommunications | HK$3.7 billion non-cash impairment; low market share | Dog |

| Other Retail | PARKnSHOP Supermarkets | Sluggish sales, declining comparable store sales | Dog |

| Retail | Health & Beauty (non-ASEAN Asia) | Reduced foot traffic, intense competition, 5% same-store sales decline | Dog |

Question Marks

CK Infrastructure's aggressive pursuit of major acquisitions, including the potential GBP7 billion bid for UK waste management firm Viridor Ltd and an initial GBP7 billion offer for a majority stake in Thames Water, positions these ventures as potential Stars or Question Marks within the CK Hutchison BCG Matrix. These moves signify a strategic push into sectors with considerable growth prospects, though the ultimate market capture and profitability remain to be seen.

CKH Innovation Opportunities Development (CKH IOD) is actively investing in high-potential areas like private mobile networks and enterprise IoT solutions. These represent emerging technology markets with substantial growth prospects.

While these sectors are poised for expansion, CK Hutchison's presence is still in its formative stages. Significant capital allocation towards R&D and market entry is crucial for CKH IOD to capture substantial market share in these developing fields.

For instance, the global private LTE and 5G market was valued at approximately USD 2.5 billion in 2023 and is projected to reach over USD 10 billion by 2028, indicating a strong growth trajectory for CKH IOD's focus areas.

AS Watson's strategic push into the Middle East, specifically the UAE, Qatar, Saudi Arabia, and Bahrain since 2020, positions its Health & Beauty franchise as a Stars category. This region offers substantial growth potential, driven by a young, affluent population and increasing consumer spending on wellness and personal care. For instance, the GCC beauty and personal care market was projected to reach $10.6 billion in 2023, indicating a robust demand environment.

Digital Transformation and E-commerce Initiatives Across Retail

CK Hutchison is actively pursuing digital transformation and e-commerce growth within its diverse retail segments. This strategic pivot aims to meet evolving consumer preferences for online shopping and secure a stronger position in the digital marketplace. The company recognizes the necessity of adapting to the rapid shift towards digital channels, a trend that has only accelerated in recent years.

While the broader e-commerce landscape shows robust expansion, CK Hutchison's newer digital ventures might still be in their nascent stages, possessing a smaller market share. This necessitates continued, focused investment to foster growth, enhance competitiveness, and achieve significant scale in these online spaces. For instance, the global e-commerce market was valued at approximately $6.3 trillion in 2024, indicating substantial potential for players who can effectively capture consumer attention.

- Digital Investment Focus: CK Hutchison is likely channeling resources into enhancing online platforms, improving customer digital experiences, and developing new e-commerce capabilities across its retail brands.

- Market Share Dynamics: Newer digital initiatives may exhibit lower initial market penetration, characteristic of "question marks" in a BCG matrix, requiring strategic investment to climb the market share ladder.

- Growth Potential: The high-growth nature of the digital retail sector presents a significant opportunity for these investments to mature into high-performing assets if managed effectively.

- Adaptation Strategy: These digital efforts are crucial for CK Hutchison to remain relevant and competitive against digitally native retailers and evolving consumer shopping habits.

Hutchison Asia Telecom (HAT) Group's Joint Ventures in Emerging Markets

Hutchison Asia Telecom (HAT) Group's involvement in emerging markets, such as its significant stake in Indonesia's Indosat Ooredoo Hutchison (IOH), positions it within the BCG matrix's question mark category. IOH boasts over 100 million customers, indicating substantial market presence in a high-growth region.

The joint venture structure, while enabling market entry, introduces complexities regarding CK Hutchison's direct control and future growth trajectory. Intense competition within these emerging telecom landscapes further amplifies the uncertainty surrounding HAT's market share expansion and overall profitability from these ventures.

- High Growth Potential: Emerging markets offer significant upside for telecom operators.

- Customer Base: IOH serves over 100 million customers, demonstrating scale.

- Strategic Uncertainty: Joint venture structures and competition create ambiguity for market control and expansion.

- Investment Needs: Realizing full potential requires continued strategic investment.

CK Hutchison's digital transformation initiatives, particularly in e-commerce, represent potential question marks. While the global e-commerce market was valued at approximately $6.3 trillion in 2024, many of CK Hutchison's newer digital ventures likely hold a smaller market share, necessitating focused investment for growth.

These digital efforts are crucial for staying competitive against digitally native retailers and adapting to evolving consumer habits. The success of these ventures hinges on effectively capturing consumer attention and building scale in the online space.

The company is likely investing in enhancing online platforms and customer digital experiences. This strategic pivot aims to secure a stronger position in the rapidly expanding digital marketplace.

The Hutchison Asia Telecom (HAT) Group's involvement in emerging markets, such as its stake in Indonesia's Indosat Ooredoo Hutchison (IOH), also places it in the question mark category. IOH boasts over 100 million customers, indicating substantial market presence in a high-growth region, though complexities from joint ventures and intense competition create uncertainty.

| Business Unit | BCG Category | Key Characteristics | Market Data/Context |

|---|---|---|---|

| CKH IOD (Private Mobile Networks/IoT) | Question Mark | Emerging technology markets, significant growth prospects, formative stage, requires substantial capital for R&D and market entry. | Global private LTE/5G market valued at ~USD 2.5 billion in 2023, projected to exceed USD 10 billion by 2028. |

| CK Hutchison Digital Retail Ventures | Question Mark | Newer digital initiatives, potentially lower initial market penetration, high-growth sector, requires strategic investment to achieve scale. | Global e-commerce market valued at ~USD 6.3 trillion in 2024. |

| Hutchison Asia Telecom (HAT) Group (e.g., IOH) | Question Mark | Involvement in emerging markets, substantial customer base, joint venture complexities, intense competition. | IOH serves over 100 million customers in a high-growth region. |

BCG Matrix Data Sources

Our CK Hutchison BCG Matrix is built on a foundation of robust data, integrating financial disclosures, detailed market research, and competitor analysis to provide a clear strategic view.