Civmec SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civmec Bundle

Civmec's robust operational capabilities and strong industry relationships position it favorably, but understanding the full scope of its market challenges and potential threats is crucial for informed decision-making. Our comprehensive SWOT analysis dives deep into these dynamics, offering actionable insights.

Want the full story behind Civmec's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Civmec's strength as an integrated service provider is a significant advantage, offering clients a full spectrum of construction and engineering solutions. This includes everything from heavy engineering and shipbuilding to modularisation, SMP, EIC, precast concrete, and civil works.

By managing multiple project phases internally, Civmec significantly reduces the need for external subcontractors. This end-to-end capability, demonstrated in projects like the construction of the Australian Naval Shipyard in Western Australia, enhances project control and efficiency, ultimately benefiting clients.

This holistic approach allows Civmec to deliver streamlined project execution, as seen in their consistent project delivery records. For instance, in the fiscal year 2024, Civmec reported a strong order book, reflecting the market's confidence in their integrated service model.

Civmec's strength lies in its broad exposure across essential industries like resources, energy, infrastructure, marine, and defence. This diversification is a key risk mitigator; for instance, in the fiscal year ending June 30, 2024, Civmec reported a significant increase in its order book, reaching AUD 1.5 billion, demonstrating resilience across its varied service sectors.

Civmec's strategic advantage lies in its world-class, purpose-built facilities across Australia, including its flagship heavy engineering hub in Henderson, Western Australia. These sites, along with key operations in Newcastle, Gladstone, and Port Hedland, are complemented by robust in-house engineering design and manufacturing expertise. This integrated approach allows Civmec to efficiently manage and execute highly complex projects, even offering specialized end-to-end solutions like in-house materials handling balance machine services.

Robust Order Book and Financial Resilience

Civmec's financial strength is clearly demonstrated by its robust order book, which provides significant visibility into future earnings. As of March 2025, the company reported an order book exceeding A$760 million. This is further bolstered by an impressive A$13.2 billion in tendered works, highlighting a strong pipeline of both secured and prospective projects.

The company also exhibits considerable financial resilience. This is evidenced by consistent growth in net assets and a history of reliable dividend distributions to shareholders, underscoring its stable financial footing.

- Healthy Order Book: Exceeding A$760 million as of March 2025.

- Strong Pipeline: A$13.2 billion in tendered works indicates significant future project potential.

- Financial Resilience: Characterized by robust net asset growth and consistent dividend payouts.

Strong Client Relationships and Industry Reputation

Civmec's strength lies in its deep-rooted, long-standing relationships with prominent blue-chip clients. These established connections, built on trust and consistent performance, translate into significant repeat business from industry leaders such as Chevron, Rio Tinto, and the Royal Australian Navy. This client loyalty is a testament to Civmec's proven ability to deliver complex projects to a high standard.

The company's reputation as a Tier 1 contractor is a direct result of its unwavering commitment to quality workmanship and successful project execution. This strong industry standing not only ensures continued engagement with existing clients but also acts as a powerful magnet for attracting new contract awards, reinforcing its market position.

For instance, in the fiscal year 2023, Civmec reported a substantial order book, reflecting the ongoing demand driven by these strong client relationships. The company secured new contracts and extensions valued in the hundreds of millions, underscoring the tangible benefits of its established reputation and client loyalty.

- Long-term partnerships with major industry players like Chevron and Rio Tinto.

- Proven track record of successful project delivery, cementing its Tier 1 contractor status.

- High-quality workmanship leading to repeat business and new contract opportunities.

- Strong industry reputation as a reliable and capable service provider.

Civmec's integrated service model is a core strength, allowing it to manage projects from inception to completion across diverse sectors like resources, energy, and defence. This end-to-end capability reduces reliance on subcontractors and enhances project control, as evidenced by its strong performance in complex projects. The company's financial health is robust, with an order book exceeding A$760 million as of March 2025 and a further A$13.2 billion in tendered works, demonstrating significant future revenue potential and financial resilience through consistent asset growth and dividend payouts.

| Metric | Value (as of March 2025) | Significance |

|---|---|---|

| Order Book | A$760 million+ | Provides strong future revenue visibility. |

| Tendered Works | A$13.2 billion | Indicates substantial pipeline of prospective projects. |

| Client Relationships | Long-standing with industry leaders (e.g., Chevron, Rio Tinto) | Drives repeat business and reinforces Tier 1 contractor status. |

What is included in the product

Delivers a strategic overview of Civmec’s internal and external business factors, highlighting its capabilities and the market landscape.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Civmec's financial performance in the first half of fiscal year 2025 showed a notable downturn. Net profit saw a 16.9% decrease compared to the same period last year, landing at A$26.5 million, which was less than what analysts had predicted. This decline suggests that the company is facing headwinds that are impacting its bottom line.

Further compounding these concerns is the contraction in profit margins. The gross profit margin for 1HFY2025 slipped to 11.1%, a decrease from 12.3% in the prior year. Management attributed this squeeze to a change in the types of projects the company is undertaking and an increase in depreciation costs, signaling potential challenges in maintaining profitability even as revenue grows.

Civmec's order book saw a substantial dip, closing December 2024 at A$633 million. This marks a significant reduction from the A$1.002 billion recorded in the prior year. The company experienced a 20.9% decrease in its order book value quarter-on-quarter.

This contraction in the order book is largely attributed to the successful conclusion of several large-scale projects and a slowdown in securing new project awards, with some key awards facing delays or rescheduling. A smaller pipeline of future work can introduce uncertainty regarding revenue generation in the immediate future.

Civmec's significant presence in the resources and energy sectors, while a core competency, also presents a notable weakness due to the inherent cyclicality of these industries. Fluctuations in commodity prices and broader economic cycles can directly affect the demand for Civmec's services, leading to unpredictable project pipelines. For instance, a downturn in the iron ore market, a key sector for Civmec, could significantly reduce the number of new projects available, impacting revenue streams.

Non-Cash Earnings and Dividend Coverage

Analyst reports highlight a significant portion of Civmec's earnings stemming from non-cash items, potentially impacting the true cash generation. This means that while profits might look healthy on paper, the actual cash available for operations or shareholder returns could be lower than anticipated. For instance, in the first half of fiscal year 2024, Civmec reported a statutory net profit after tax of AUD 30.1 million, but a closer look at cash flow statements is crucial to understand the underlying cash conversion.

Furthermore, the dividend payout, though consistent, faces scrutiny regarding its coverage by free cash flows. This disparity suggests that dividends might be supported by factors other than readily available cash, raising questions about the sustainability of these payouts in the long run. Investors should monitor the company's ability to generate robust free cash flow to ensure dividend payments are adequately covered, especially considering the potential for economic headwinds impacting project revenues and cash collection cycles.

- Non-Cash Earnings: A substantial portion of reported profits may not be directly convertible to cash.

- Dividend Coverage: Dividend payouts may not always be fully supported by free cash flow generation.

- Financial Sustainability: Concerns exist regarding the long-term ability to fund distributions and reinvestment from actual cash generated.

- Investor Scrutiny: The market will likely focus on cash flow conversion and dividend cover ratios in future reporting periods.

Competitive Market Landscape

Civmec faces a crowded field in Australia and Singapore, with numerous local and global players vying for projects. This intense competition puts significant pressure on bid margins, forcing the company to constantly innovate and manage costs effectively to win contracts and stay profitable.

For instance, during the first half of fiscal year 2024, Civmec reported a competitive bidding environment impacting its profitability. The company's revenue for H1 FY24 was AUD 536.5 million, but the need to secure work in this challenging landscape means margins are often tightly managed.

- Intense Rivalry: Civmec competes with established construction giants and agile local firms in both its primary markets.

- Margin Squeeze: The need to win bids in a competitive market can lead to reduced profit margins on awarded contracts.

- Innovation Imperative: Continuous investment in new technologies and efficient processes is crucial to maintain a competitive edge.

- Cost Management Focus: Strict cost control is essential to ensure profitability amidst aggressive pricing from competitors.

Civmec's profitability is under pressure, as seen in its first half of fiscal year 2025 results. The company's net profit dropped by 16.9% to A$26.5 million, falling short of analyst expectations. This decline is partly due to a reduction in gross profit margins, which fell to 11.1% from 12.3% year-on-year, attributed to a shift in project mix and higher depreciation costs.

The company's order book significantly contracted, ending December 2024 at A$633 million, a substantial decrease from A$1.002 billion in the prior year. This 20.9% quarter-on-quarter drop in order book value reflects the completion of major projects and delays in securing new ones, creating uncertainty for future revenue streams.

| Metric | 1HFY2025 | 1HFY2024 | Change |

|---|---|---|---|

| Net Profit (A$) | 26.5 million | 31.9 million | -16.9% |

| Gross Profit Margin (%) | 11.1% | 12.3% | -1.2 pp |

| Order Book (A$) | 633 million | 1,002 million | -36.8% |

What You See Is What You Get

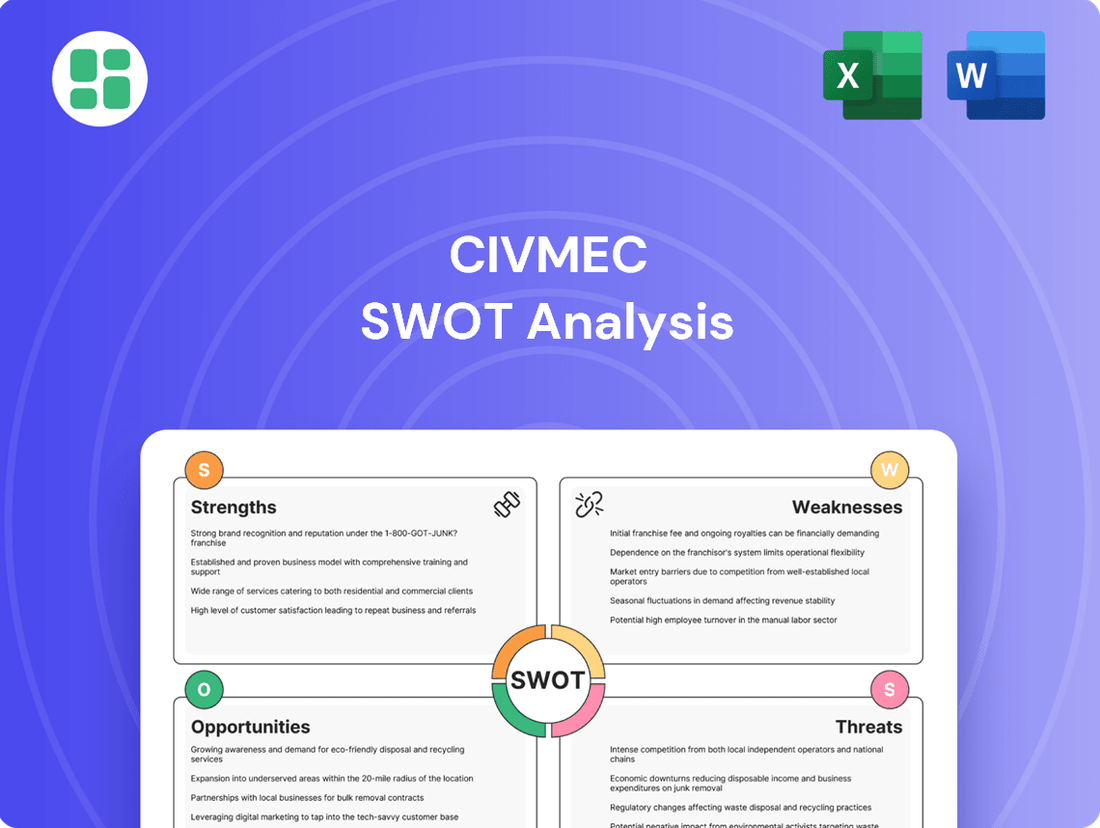

Civmec SWOT Analysis

This is the actual Civmec SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into Civmec's strategic position.

Opportunities

Civmec is well-positioned to benefit from the Australian government's significant investment in its defence and marine sectors. The multi-billion dollar expansion of Fleet Base West and the Henderson Precinct creates substantial opportunities for naval shipbuilding and related infrastructure projects.

The company is strategically poised to capture future defence contracts, with potential involvement in over A$25 billion in upcoming works. This includes significant shipbuilding programs like LAND8710, highlighting a robust pipeline of future revenue streams.

Civmec is seeing robust expansion in its maintenance and capital works divisions, evidenced by new contract wins and extended agreements. For instance, the company secured a significant multi-year contract for maintenance services in the mining sector during the first half of fiscal year 2024, underscoring this trend.

The strategic placement of new facilities in Port Hedland and Gladstone is a key enabler, allowing Civmec to effectively address the escalating demand for maintenance and fabrication services in vital resource hubs. This expansion is projected to contribute approximately 20% to the company's revenue in these segments for FY2025, bolstering its recurring income base.

Civmec's strategic acquisition of Luerssen Australia in July 2025, a move that secured the SEA1180 program for the Royal Australian Navy, is a significant opportunity. This integration not only bolsters Civmec's standing in the vital maritime defence industry but also brings crucial in-house design capabilities into the fold, streamlining project execution and innovation.

Furthermore, the parent company's re-domicile to Australia presents a compelling chance to better align with domestic manufacturing mandates. This strategic shift is expected to unlock improved access to lucrative Australian defence contracts, capitalizing on the nation's growing focus on sovereign industrial capability.

Buoyant Tendering Activity and Market Demand

Civmec is experiencing strong tendering activity across its key sectors. The company has priced opportunities approaching A$12-13 billion, indicating a healthy pipeline of potential projects. This robust demand suggests significant potential for future contract wins and revenue generation.

The outlook for the energy sector is particularly promising, with an estimated A$43.5 billion in opportunities expected through to 2028. Similarly, the resources sector is projected to offer around A$64 billion in opportunities over the same period. These figures highlight substantial market demand that Civmec is well-positioned to capitalize on.

- Robust Tendering Pipeline: Priced opportunities currently stand at A$12-13 billion.

- Energy Sector Growth: Forecasted A$43.5 billion in opportunities to 2028.

- Resources Sector Demand: Projected A$64 billion in opportunities to 2028.

- Sustainable Growth Potential: Strong market demand supports order book replenishment and revenue growth.

Expansion in OEM Materials Handling Market

Civmec stands as Australia's sole provider of comprehensive, in-house materials handling equipment services, covering the entire lifecycle. This unique capability positions them as a credible Original Equipment Manufacturer (OEM) in a sector with substantial growth potential.

The demand for new and refurbished materials handling machines in Australia is robust, with forecasts indicating a need for over 30 units in the coming decade. This translates to a significant market pipeline, estimated at A$2.8 billion, presenting a prime opportunity for Civmec to capture substantial market share.

This presents a dual opportunity for Civmec:

- Securing new equipment contracts: Leveraging their OEM status to win orders for the supply of new materials handling machines.

- Driving refurbishment and maintenance revenue: Capitalizing on the existing fleet requiring upgrades and ongoing servicing.

Civmec is strategically positioned to capitalize on Australia's significant investments in defence and marine infrastructure, with over A$25 billion in upcoming naval shipbuilding and related projects. The company's robust tendering pipeline, currently valued at A$12-13 billion, indicates strong future revenue potential across key sectors. Furthermore, the energy and resources sectors are projected to offer substantial opportunities, with an estimated A$43.5 billion and A$64 billion respectively through to 2028, respectively. Civmec's unique position as Australia's sole provider of comprehensive, in-house materials handling equipment services, coupled with a projected market need for over 30 new units valued at A$2.8 billion in the next decade, presents a significant avenue for growth.

| Sector | Estimated Opportunities (AUD) | Timeframe |

|---|---|---|

| Defence & Marine | > A$25 billion | Upcoming Projects |

| Energy | A$43.5 billion | To 2028 |

| Resources | A$64 billion | To 2028 |

| Materials Handling Equipment | A$2.8 billion | Next Decade |

Threats

Project delays and rescheduling present a significant threat to CIVIC, as evidenced by the company's order book decline in the first half of fiscal year 2025. These disruptions directly impact revenue recognition and cash flow, creating periods of reduced operational activity.

Economic downturns pose a significant threat to Civmec. For instance, a projected slowdown in global GDP growth for 2024 could dampen demand for resources and infrastructure projects, directly impacting Civmec's pipeline. Market volatility, particularly in commodity prices, can also lead to project deferrals or cancellations, affecting revenue streams.

The construction and engineering sector is crowded, with many companies vying for projects. This means Civmec faces stiff competition from both local and global firms, which can drive down prices. For instance, in the Australian market, major players like CIMIC Group and Downer EDI are significant competitors, often engaging in competitive bidding processes.

This intense rivalry often translates into aggressive pricing strategies. Companies may lower their bids to win contracts, which can put considerable pressure on profit margins. This makes it difficult for Civmec to achieve higher profitability on new projects and secure the most lucrative deals in the current market.

Fluctuations in Client Investment

Civmec's reliance on the capital expenditure and maintenance budgets of its resource and energy sector clients presents a significant threat. A downturn in global commodity prices or shifts in client investment strategies can directly shrink Civmec's project pipeline. For instance, a projected slowdown in mining capital expenditure in Australia for 2024-2025, driven by inflationary pressures and interest rate hikes, could lead to reduced project awards for Civmec.

Fluctuations in client investment can manifest in several ways:

- Reduced project pipeline: Clients may defer or cancel planned capital projects due to economic uncertainty.

- Lower project values: Even if projects proceed, clients might opt for scaled-down versions, impacting Civmec's revenue per project.

- Increased competition for fewer projects: A shrinking market leads to more companies vying for available work, potentially driving down margins.

- Delayed payments: Clients facing financial strain might extend payment terms, affecting Civmec's cash flow.

Workforce Availability and Cost Pressures

While broader economic trends might indicate a growing workforce, the construction and engineering sectors, including companies like Civmec, can still struggle to find enough skilled labor. This is especially true for specialized roles requiring specific certifications or experience. For instance, in early 2024, reports indicated ongoing shortages in areas like welding and project management within the Australian construction industry, a key market for Civmec.

These labor shortages, or even just the increasing cost of wages to attract and retain talent, directly translate into higher operational expenses for Civmec. This can put a strain on project budgets, potentially impacting profitability and even leading to delays if critical personnel cannot be secured in time. By mid-2024, many engineering firms were reporting wage inflation above general inflation rates as they competed for a limited pool of qualified professionals.

- Skilled Labor Gaps: Persistent shortages in specialized trades and engineering disciplines remain a concern, impacting project execution.

- Wage Inflation: Competition for talent is driving up labor costs, potentially eroding profit margins for Civmec.

- Project Delays: Difficulty in sourcing sufficient skilled personnel can lead to extended project timelines.

Persistent skilled labor shortages in specialized trades and engineering roles continue to pose a significant threat, potentially leading to project delays and increased operational costs for Civmec. By mid-2024, wage inflation in the engineering sector was reportedly exceeding general inflation rates, driven by intense competition for a limited pool of qualified professionals.

Intense competition within the construction and engineering sector, particularly from established players like CIMIC Group and Downer EDI in Australia, can lead to aggressive pricing strategies. This pressure on bids can significantly impact Civmec's profit margins, making it challenging to secure the most lucrative contracts in the current market.

Economic downturns and volatility in commodity prices present a substantial risk, as they can lead to project deferrals or cancellations. A projected slowdown in global GDP growth for 2024, coupled with potential reductions in mining capital expenditure in Australia for 2024-2025, could directly shrink Civmec's project pipeline and affect revenue.

SWOT Analysis Data Sources

This Civmec SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to ensure an accurate and insightful assessment.