Civmec Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civmec Bundle

Discover how Civmec masterfully blends its product offerings, pricing structures, distribution channels, and promotional activities to achieve market dominance. This analysis goes beyond surface-level observations, offering a strategic blueprint for success.

Unlock the complete 4Ps Marketing Mix Analysis for Civmec, providing actionable insights and a ready-to-use framework for your own strategic planning, benchmarking, or academic needs.

Product

Civmec's integrated engineering and construction services offer a full spectrum of capabilities, from initial heavy fabrication to on-site installation and long-term maintenance. This end-to-end approach ensures clients receive a cohesive and efficiently managed project lifecycle. For instance, in the 2024 financial year, Civmec reported a significant increase in its order book, reflecting strong demand for these comprehensive solutions across major industrial sectors.

Civmec's specialized sector solutions are a cornerstone of its marketing mix, directly addressing the distinct needs of industries like resources, energy, infrastructure, marine, and defence. This targeted approach ensures their services are finely tuned to the rigorous regulatory, technical, and operational requirements of each sector, fostering deep expertise.

For instance, in the resources sector, Civmec's ability to deliver complex fabrication and construction services is critical for projects like the Iron Ore Processing Facility for a major mining client, which contributed significantly to their FY23 revenue. This specialization allows them to develop highly relevant solutions, directly aligning with client objectives and industry-specific challenges.

Civmec's heavy engineering and modularization services are a cornerstone of its offering, focusing on structural steel, plate works, and large-scale modular fabrication. This off-site construction approach significantly boosts project efficiency and quality.

This capability is vital for large industrial undertakings, as demonstrated by Civmec's involvement in projects like the Western Turner Syncline (WTS) iron ore project, where modularization played a key role in delivering complex components efficiently. The company's commitment to innovation in this area supports reduced on-site construction time and enhanced safety protocols.

Shipbuilding & Defence Capabilities

Civmec's expansion into naval shipbuilding, notably through the Luerssen Australia acquisition, marks a significant leap in their product portfolio. This strategic move allows them to deliver offshore patrol vessels for the Royal Australian Navy, solidifying their role in Australia's defense sector.

Their specialized capabilities now encompass complex marine construction and maintenance, positioning Civmec to secure future naval programs. For instance, the Hunter Class Frigate program, a multi-billion dollar initiative, presents substantial long-term opportunities for companies with proven defense shipbuilding experience.

- Naval Shipbuilding Expansion: Acquisition of Luerssen Australia enhances marine construction and maintenance capabilities.

- Key Defence Contracts: Successfully delivering offshore patrol vessels for the Royal Australian Navy.

- Future Program Readiness: Positioned to compete for upcoming complex defense projects.

- Strategic Industry Role: Becoming a pivotal player in Australia's growing defense industry.

Maintenance & Capital Works

Civmec's Maintenance & Capital Works division is crucial for client asset longevity, extending beyond initial construction. This segment focuses on ensuring operational integrity through ongoing structural, mechanical, piping, electrical, and instrumentation upkeep, alongside targeted refurbishment projects. This generates a consistent revenue stream and deepens client partnerships.

For the fiscal year ending June 30, 2023, Civmec reported revenue of AUD $1.07 billion, with their Services segment, which includes maintenance and capital works, demonstrating resilience and contributing significantly to this total. The company's strategic focus on these long-term service agreements solidifies its position as a comprehensive asset lifecycle partner.

- Asset Lifecycle Support: Civmec provides essential maintenance and capital works, ensuring assets remain operational and valuable over their lifespan.

- Recurring Revenue: This segment generates predictable income through ongoing service contracts, offering financial stability.

- Client Relationship Deepening: Consistent service delivery fosters stronger, long-term relationships with clients.

- Diversified Service Offering: The inclusion of structural, mechanical, piping, electrical, and instrumentation services caters to a broad range of client needs.

Civmec's product offering is characterized by its integrated, end-to-end solutions spanning heavy fabrication, modularization, and on-site construction across key sectors like resources, energy, infrastructure, and defence. Their expansion into naval shipbuilding through the Luerssen Australia acquisition significantly broadens their complex marine construction and maintenance capabilities. The company's Maintenance & Capital Works division further solidifies their product by providing essential asset lifecycle support, ensuring operational integrity and fostering long-term client partnerships.

| Product/Service Area | Key Features | Sector Focus | Recent Performance Indicator |

|---|---|---|---|

| Integrated Engineering & Construction | End-to-end project management, heavy fabrication, modularization | Resources, Energy, Infrastructure | Significant increase in order book in FY24 |

| Naval Shipbuilding | Complex marine construction, offshore patrol vessel delivery | Defence | Luerssen Australia acquisition |

| Maintenance & Capital Works | Structural, mechanical, piping, electrical, instrumentation upkeep | All sectors | Contributed significantly to FY23 revenue of AUD $1.07 billion |

What is included in the product

This analysis provides a comprehensive examination of Civmec's Product, Price, Place, and Promotion strategies, offering deep insights into their marketing positioning and operational practices.

It's designed for professionals seeking a grounded understanding of Civmec's market approach, suitable for reports, benchmarking, and strategic planning.

Simplifies complex marketing strategies into actionable insights, addressing the pain of overwhelming data for effective decision-making.

Place

Civmec's strategic facility placement is a cornerstone of its market offering, with major hubs in Henderson (WA), Newcastle (NSW), Gladstone (QLD), and Port Hedland (WA). These locations are meticulously chosen to offer unparalleled logistical advantages, directly serving Australia's vital industrial and resource sectors. For example, Henderson boasts the title of Australia's largest heavy engineering facility, complete with extensive wharf access, enabling the seamless execution of large-scale fabrication and complex marine projects.

Civmec's strategic dual listing on both the Australian Securities Exchange (ASX) and the Singapore Exchange (SGX) significantly broadens its access to capital markets. This dual presence enhances its international profile, attracting a wider pool of investors from both Australia and the rapidly growing Asian markets. As of the latest available data, this strategy has facilitated capital raising and increased financial visibility, crucial for a company operating in sectors with substantial project funding requirements.

Civmec's direct project-based delivery model is central to its operations, ensuring services reach clients precisely where they are needed for major construction and engineering undertakings. This hands-on approach fosters deep client partnerships, enabling the customization of solutions to meet the distinct demands of each project.

This direct engagement allows Civmec to manage project specifics intimately, from initial planning through to final execution. For instance, their involvement in the 2024 expansion of the Roy Hill mine in Western Australia exemplifies this, with Civmec teams on-site managing fabrication and construction directly, ensuring seamless integration with the client's operational flow.

Proximity to Key Industrial Sectors

Civmec's strategic facility placement is a direct response to its core markets. Being close to major resources, energy, infrastructure, marine, and defence sectors is crucial for their operations.

This proximity offers significant logistical benefits, reducing the cost and time associated with transporting large components and personnel. For instance, their Port Hedland facility is situated at the heart of the world's largest iron ore export hub, a testament to this strategy.

This geographical advantage directly translates into enhanced project efficiency and quicker response times for their clients. Their operational footprint in Western Australia, a key mining and resources region, underscores this commitment to being where their customers are.

- Strategic Location: Facilities are located near major industrial sectors.

- Logistical Savings: Proximity reduces transportation costs and time for large components.

- Enhanced Efficiency: Minimizes travel for personnel, boosting project responsiveness.

- Key Hub Access: Example: Port Hedland facility at the world's largest iron ore export port.

Global Reach through Project Mobility

Civmec's operational model, though rooted in Australia and Singapore, possesses a distinct global reach facilitated by its project-based mobility. This allows the company to deploy specialized engineering and construction teams, along with critical equipment, to international sites as project demands dictate. This inherent flexibility is key to undertaking complex, large-scale projects that extend beyond their core geographical markets, showcasing their ability to adapt their expertise to diverse global industrial settings.

This project mobility is a significant advantage, enabling Civmec to tap into international opportunities and leverage its skills across different regions. For instance, in the fiscal year 2023, Civmec reported revenue of AUD 1.1 billion, demonstrating a strong operational capacity that can be scaled and deployed globally. Their proven track record in sectors like mining, oil and gas, and defense, valued at over AUD 500 million in secured work for FY24 in early 2024, underscores the transferability of their expertise.

- Global Project Deployment: Ability to mobilize specialized teams and equipment to international sites.

- Diversified Revenue Streams: Revenue of AUD 1.1 billion in FY23 indicates substantial operational capacity for global reach.

- Transferable Expertise: Proven capabilities in key industrial sectors are applicable worldwide.

- Secured Future Work: Over AUD 500 million in secured work for FY24 suggests ongoing international project engagement.

Civmec's strategic placement of facilities near key industrial and resource hubs, such as Henderson, Newcastle, Gladstone, and Port Hedland, is paramount. This proximity significantly reduces logistical costs and project timelines by minimizing the distance for transporting large components and personnel. Their presence in Port Hedland, for example, situates them at the epicenter of global iron ore exports, a clear advantage for serving the mining sector. This geographical strategy directly enhances operational efficiency and client responsiveness.

| Facility Location | Strategic Advantage | Key Industries Served |

|---|---|---|

| Henderson, WA | Australia's largest heavy engineering facility, extensive wharf access | Marine, Resources, Defence |

| Newcastle, NSW | Proximity to Hunter Valley coal and other industrial activities | Resources, Infrastructure |

| Gladstone, QLD | Key port for LNG and coal exports | Resources, Energy |

| Port Hedland, WA | Heart of the world's largest iron ore export hub | Resources (Mining) |

What You See Is What You Get

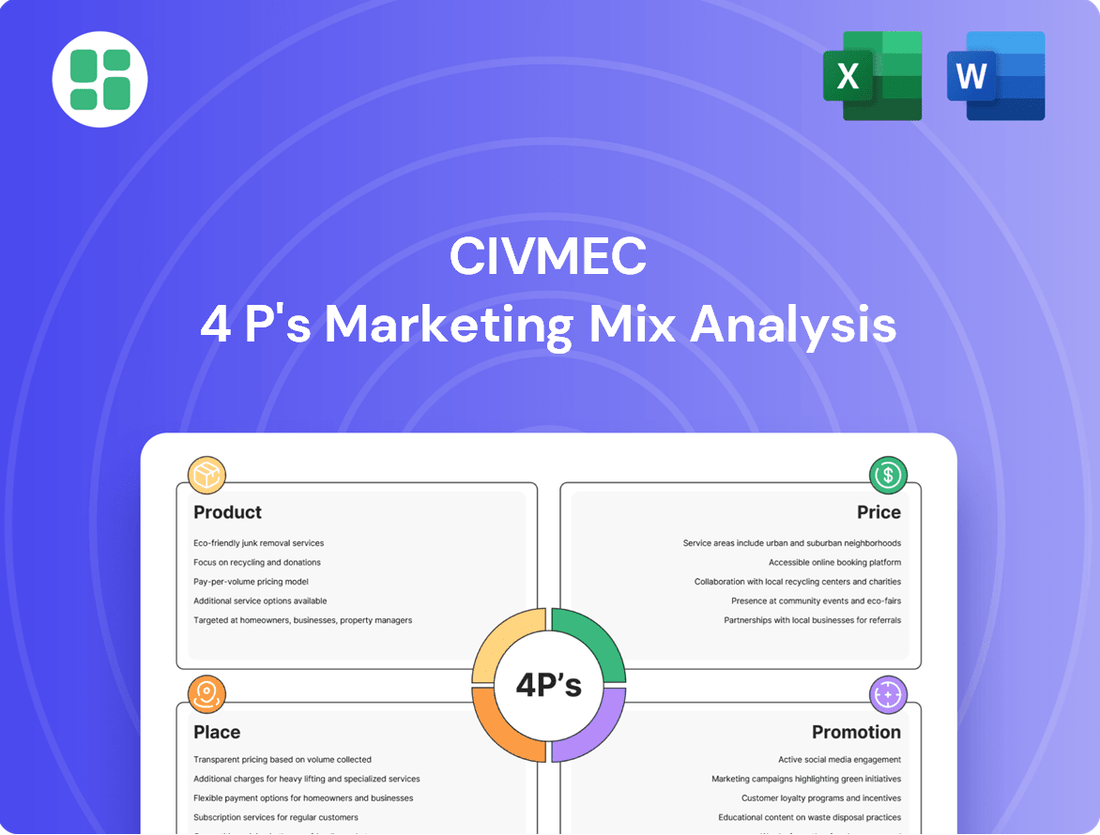

Civmec 4P's Marketing Mix Analysis

The preview you see here is the actual, fully completed Civmec 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. This means you get the complete, ready-to-use report without any hidden surprises or missing information. You can proceed with confidence, knowing exactly what you're getting.

Promotion

Civmec's promotional strategy deeply values cultivating enduring relationships with its Tier 1 clients, a cornerstone of their success. This focus on strong client bonds directly translates into substantial repeat business and valuable referrals, underscoring the effectiveness of their B2B approach.

By consistently delivering exceptional project outcomes, Civmec has built a reputation for unwavering reliability and trust within the engineering and construction sectors. This proven track record serves as a potent, organic form of promotion, actively securing their pipeline of future contracts.

Civmec highlights its extensive history of successfully delivering major projects, emphasizing its proven capabilities and deep expertise. This track record is a cornerstone of their promotional efforts, building trust and demonstrating reliability to potential clients.

By showcasing landmark achievements in sectors such as heavy engineering, shipbuilding, and intricate infrastructure development, Civmec effectively communicates its capacity to handle demanding and complex assignments. These examples serve as tangible proof of their operational excellence and technical proficiency.

For the fiscal year 2024, Civmec reported a robust order book of approximately AUD 1.5 billion, underscoring the market's confidence in their ability to execute large-scale projects. This financial indicator directly supports their claims of a strong industry reputation and a successful track record.

Civmec prioritizes clear and consistent investor communication, releasing quarterly financial results and detailed annual reports. In the first half of FY24, they reported a revenue of AUD 339.3 million, demonstrating their commitment to keeping stakeholders informed about operational performance and strategic direction.

Investor presentations and regular updates further solidify this commitment, ensuring financial stakeholders understand Civmec's progress and outlook. This proactive approach fosters investor confidence, contributing to a positive market perception of the company's stability and growth potential.

Participation in Industry Forums & Events

Civmec's engagement in industry forums and events is a crucial element of its marketing strategy, particularly within specialized sectors like defence and mining. These events serve as vital platforms for showcasing their extensive capabilities, from fabrication to maintenance, and for fostering direct connections with potential clients and strategic partners. For instance, participation in events like the Avalon Airshow or Austal's supplier days allows Civmec to demonstrate its advanced manufacturing and engineering solutions to a highly targeted audience.

These gatherings are instrumental in generating leads and solidifying market positioning. By highlighting new service offerings, such as their expanded defence manufacturing capacity, and showcasing technological advancements, Civmec can directly address the needs of key decision-makers. The company's presence at these events directly supports its business development efforts, enabling them to secure significant contracts and collaborations that drive revenue growth. For example, in the fiscal year 2023, Civmec reported a substantial order book, partly attributed to the visibility and networking opportunities provided by such industry engagements.

- Defence Sector Focus: Civmec actively participates in defence expos, like the Australian Defence Force (ADF) industry events, to present its shipbuilding and maintenance capabilities.

- Mining & Infrastructure Presence: The company also engages in mining and infrastructure conferences, demonstrating its expertise in large-scale project delivery and complex fabrication.

- Networking and Lead Generation: These forums facilitate direct interaction with potential clients, prime contractors, and government bodies, crucial for securing future work.

- Capability Showcase: Events provide a stage to exhibit Civmec's advanced manufacturing technologies, skilled workforce, and commitment to quality and safety standards.

Digital Presence and Corporate Website

Civmec's digital presence, anchored by its corporate website, acts as a vital promotional tool. It offers a comprehensive overview of their diverse services, showcasing key projects and extensive facilities. This platform is instrumental in engaging a global audience, detailing their capabilities to attract clients and skilled professionals.

The website effectively communicates Civmec's value proposition, serving as a primary channel for investor relations and corporate news. By regularly updating with media releases and project highlights, they amplify their promotional reach, reinforcing their brand image and market positioning.

- Global Reach: The corporate website allows Civmec to connect with potential clients and talent worldwide.

- Information Hub: It provides detailed insights into services, projects, and facilities.

- Investor Relations: A dedicated section keeps stakeholders informed about corporate performance and news.

- Talent Attraction: Showcasing capabilities and company culture helps in recruiting top talent.

Civmec's promotional efforts are deeply rooted in demonstrating proven capabilities and fostering strong client relationships, which are critical for securing repeat business and referrals in the B2B environment.

The company leverages its extensive project history, particularly in complex sectors like defence and infrastructure, as tangible proof of its reliability and technical expertise, thereby building significant trust within the industry.

Civmec actively uses industry forums, events, and a robust digital presence, including its corporate website, to showcase its advanced manufacturing, engineering solutions, and commitment to quality, effectively reaching a global audience and key decision-makers.

For FY24, Civmec's order book stood at approximately AUD 1.5 billion, reflecting strong market confidence, while their H1 FY24 revenue reached AUD 339.3 million, demonstrating consistent operational performance and transparent investor communication.

Price

Civmec's pricing for its extensive project portfolio is fundamentally rooted in project-based contracts. This approach means each large-scale engineering and construction job is priced individually, often through competitive tender processes. For instance, during the 2023 financial year, Civmec secured significant contracts, demonstrating their ability to price competitively for complex projects.

The cost of each project is meticulously calculated, encompassing all direct and indirect expenses. This includes the procurement of materials, wages for skilled labor, rental or ownership costs for specialized equipment, and essential overheads. A carefully considered profit margin is then added, reflecting the value and expertise Civmec brings to each unique undertaking.

This bespoke pricing strategy directly addresses the inherent variability in scope, technical complexity, and associated risks across different projects. For example, the pricing for a mining infrastructure project will differ significantly from that of an offshore oil and gas facility, necessitating tailored cost estimations and risk assessments to ensure profitability and client satisfaction.

Civmec's pricing strategy reflects the substantial value embedded in its integrated, high-quality engineering solutions, positioning it competitively within specialized sectors. The company aims to secure projects that promise targeted profit margins, demonstrating a focus on profitability over sheer volume.

For instance, in the fiscal year 2023, Civmec reported a net profit after tax of $47.8 million, a significant increase from $34.4 million in FY2022, underscoring its ability to achieve its margin objectives even while navigating competitive tenders.

Civmec's project pricing is a delicate balance, heavily swayed by volatile commodity prices, which directly impact material expenses. For instance, fluctuations in steel prices, a key input for many of their projects, can significantly alter project bids. Labor costs, including wages and skilled worker availability, also play a crucial role, especially in a competitive market. In 2024, the demand for skilled labor in the engineering and construction sectors remained robust, potentially pushing these costs upward.

Equipment depreciation and maintenance are ongoing expenses that are factored into the overall project cost. The longer a project runs, the more these costs accumulate. Furthermore, the specific technical demands of a project, requiring specialized equipment or advanced engineering expertise, will naturally command higher pricing. Accurately forecasting these variables is paramount for Civmec to maintain healthy profit margins, a challenge underscored by the increasing complexity of modern infrastructure projects.

Civmec also accounts for potential risks that could impact project timelines and budgets. Unforeseen events such as adverse weather conditions, which can cause delays, or client-requested scope changes, necessitate contingency planning. These risk assessments are integrated into the pricing structure, ensuring that the company is adequately compensated for potential disruptions and can adapt to evolving project requirements, a strategy vital for profitability in the dynamic construction industry.

Long-Term Agreements & Maintenance Contracts

Civmec leverages long-term agreements and maintenance contracts to secure a stable revenue base, diversifying from its project-based construction work. These agreements can take various forms, such as fixed-price contracts for defined scopes or time-and-materials for ongoing support, ensuring predictable income streams.

These recurring revenue contracts are crucial for financial stability, complementing the lumpier income from major construction projects. For instance, Civmec's focus on maintenance and support services, often secured through multi-year agreements, provides a consistent revenue buffer.

- Predictable Revenue: Long-term agreements offer a steadier income compared to sporadic large projects.

- Risk Mitigation: Diversifies income streams, reducing reliance on single large contracts.

- Customer Retention: Fosters ongoing relationships and opportunities for upselling services.

- Operational Efficiency: Allows for better resource planning and allocation for maintenance teams.

Order Book & Tendering Activities Impact

Civmec's pricing power is directly tied to its substantial order book and active tendering pipeline. The company's ability to secure significant work, such as the A$12-13 billion in identified opportunities, allows for disciplined pricing by reflecting robust market demand and managing competitive pressures effectively.

This strong pipeline acts as a buffer, enabling Civmec to maintain its pricing structure. However, the timing of project awards and potential reschedulings can introduce variability into activity levels, which could, in turn, affect future pricing flexibility.

- Order Book Strength: A healthy order book provides leverage in pricing negotiations.

- Tendering Pipeline: Actively pursuing opportunities worth A$12-13 billion indicates strong future revenue potential.

- Pricing Discipline: Robust demand supports maintaining or increasing prices.

- Risk of Delays: Project award delays can impact operational tempo and pricing power.

Civmec's pricing strategy is deeply project-specific, with bids meticulously crafted based on detailed cost estimations, including materials, labor, and equipment, plus a strategic profit margin. This bespoke approach ensures that pricing reflects the unique technical demands and risks of each contract. For instance, in FY23, Civmec achieved a net profit after tax of $47.8 million, demonstrating their success in achieving targeted margins on complex projects, even amidst competitive tendering processes.

| Metric | FY2023 | FY2022 |

| Net Profit After Tax (NPAT) | $47.8 million | $34.4 million |

| Identified Opportunities | A$12-13 billion | N/A |

4P's Marketing Mix Analysis Data Sources

Our Civmec 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, industry-specific market research, and public financial disclosures. We meticulously review product portfolios, pricing structures, distribution networks, and promotional activities to ensure accuracy.