Civmec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civmec Bundle

Civmec's competitive landscape is shaped by powerful industry forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Civmec’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability of skilled labor is a critical factor for Civmec, and the Australian construction sector is currently facing significant labor shortages. This scarcity, particularly for specialized engineers, fabricators, and tradespeople in areas like shipbuilding and heavy engineering, translates to considerable bargaining power for these skilled workers and their unions. In 2024, wage growth in the construction industry is expected to remain strong due to these persistent shortages.

The bargaining power of suppliers for Civmec is significantly influenced by the cost of essential raw materials like steel and concrete. While global supply chain issues have eased somewhat in 2024, persistent inflation in wages and regulatory compliance continues to drive up overall construction costs, giving suppliers more leverage.

Civmec's dependence on these core commodities means that any price volatility directly impacts project profitability. For instance, a 10% increase in steel prices, a common occurrence in recent years, can substantially erode margins if not passed on to clients. This reliance grants suppliers considerable power, particularly when their own supply is tight or when demand for construction services is exceptionally high.

The bargaining power of suppliers for specialized equipment and technology is significant for companies like Civmec, given the capital-intensive nature of heavy engineering and shipbuilding. Civmec relies on advanced machinery for modularisation, fabrication, and complex civil works, meaning they need cutting-edge tools to operate efficiently.

A limited pool of suppliers offering highly specialized equipment or proprietary technologies can significantly influence procurement costs and contract terms. For instance, in 2024, the global market for advanced welding robots used in shipbuilding saw consolidation, with a few key players dominating. This concentration of power means Civmec might face less flexibility in negotiations, potentially leading to higher upfront costs for essential machinery.

Supplier Power 4

The bargaining power of suppliers for Civmec is a significant factor, especially when specialized subcontractors are involved. In 2024, the demand for skilled labor and specialized services within the mining and infrastructure sectors remained robust, allowing key subcontractors to negotiate favorable terms. This is particularly true for those offering niche expertise or operating within geographically constrained markets where their availability is limited.

Civmec's reliance on these specialized subcontractors means that if a particular service is in high demand and few providers exist, those providers gain considerable leverage. This can translate into higher costs or stricter payment terms for Civmec, potentially impacting project profitability and scheduling. For instance, a shortage of certified welders for a critical offshore project in mid-2024 could give those welders' employing firms substantial negotiating power.

- High demand for specialized skills increases subcontractor leverage.

- Limited availability of niche expertise empowers suppliers.

- Subcontractor power can influence project costs and timelines for Civmec.

- Regional expertise can be a key driver of supplier bargaining power.

Supplier Power 5

The bargaining power of suppliers for Civmec is significantly shaped by its operational footprint, primarily in Australia and Singapore. This geographic concentration means that local supplier market dynamics, including availability and pricing, have a substantial impact on Civmec's costs. For example, in 2024, Australia continued to grapple with labor shortages impacting various sectors, including construction and manufacturing, which directly affects the cost and availability of materials and specialized services for companies like Civmec.

While global commodity prices have seen some stabilization, domestic supply chain challenges in Australia remain a key factor influencing supplier power. These challenges, particularly persistent labor shortages and logistical hurdles, contribute to cost escalations for raw materials and specialized labor, thereby increasing the bargaining leverage of suppliers who can reliably deliver.

- Geographic Concentration: Civmec's operations in Australia and Singapore make it susceptible to local supplier market conditions.

- Labor Shortages: Ongoing labor shortages in Australia in 2024 directly impact the cost and availability of essential supplies and services.

- Domestic Supply Chain Issues: Challenges within the Australian supply chain, beyond global commodity prices, empower local suppliers.

- Cost Escalation: These factors collectively contribute to increased costs for Civmec, enhancing supplier bargaining power.

Civmec's bargaining power with suppliers is influenced by the concentration of specialized equipment providers and subcontractors. In 2024, the market for advanced fabrication machinery saw a continued trend of consolidation, with fewer dominant players. This limited competition allows these suppliers to command higher prices and dictate terms, especially for proprietary technology critical to Civmec's operations in shipbuilding and heavy engineering.

The reliance on a concentrated supplier base for specialized services, such as complex welding or offshore installation expertise, also grants suppliers significant leverage. For instance, in 2024, the demand for niche offshore engineering skills in Australia remained exceptionally high, leading to increased rates and stricter contractual conditions from those few firms possessing the necessary certifications and experience.

| Supplier Type | 2024 Market Dynamics | Impact on Civmec |

|---|---|---|

| Specialized Equipment Manufacturers | Market consolidation; few dominant players | Higher procurement costs, less negotiation flexibility |

| Niche Subcontractors (Offshore) | High demand, limited certified providers | Increased service rates, stricter contract terms |

| Raw Material Suppliers (Steel) | Global price volatility, domestic supply chain issues | Potential for cost escalation, margin pressure |

What is included in the product

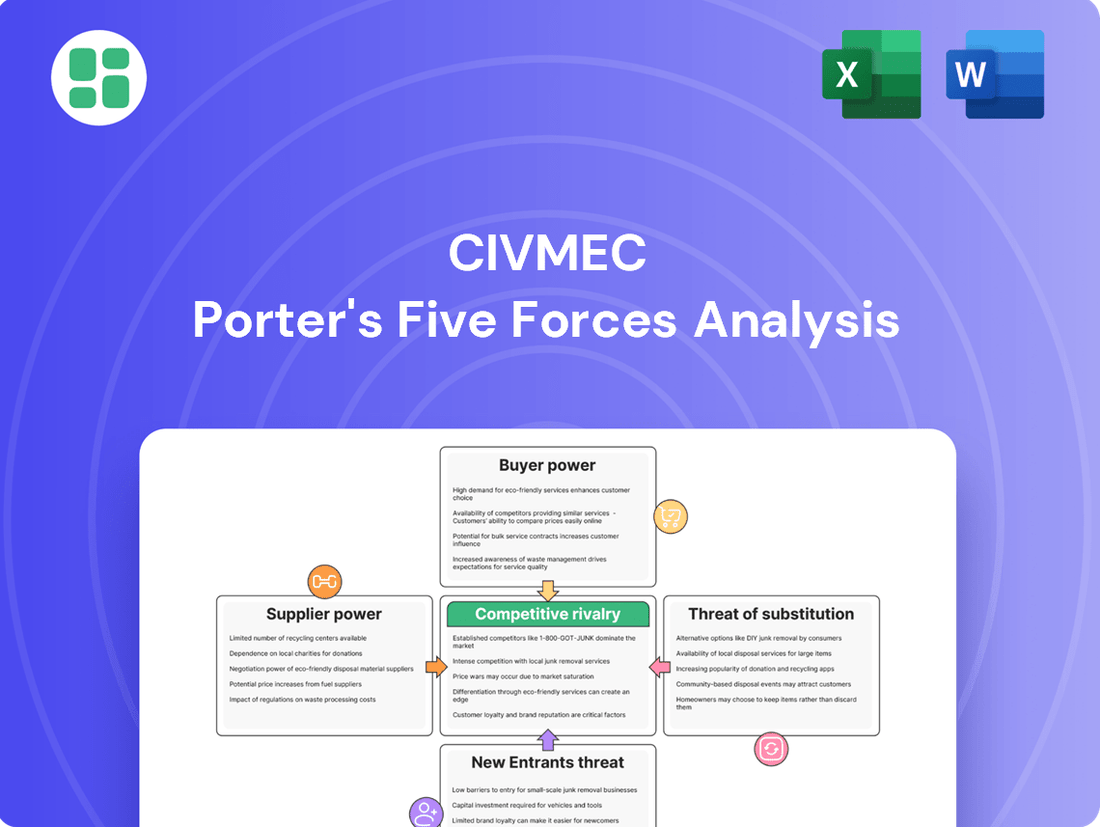

This analysis dissects the competitive forces impacting Civmec, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its operating sectors.

Instantly identify and address competitive pressures by visualizing the impact of each of Porter's Five Forces on Civmec's strategic positioning.

Customers Bargaining Power

Civmec's buyer power is influenced by its clientele, which includes major players in resources, energy, infrastructure, marine, and defense, alongside government bodies. These substantial clients, possessing significant financial clout and dedicated procurement departments, are well-positioned to drive hard bargains on project specifics, cost, and delivery schedules.

Civmec's project-based business model inherently grants significant bargaining power to its customers. Major contracts often represent a substantial slice of Civmec's annual revenue, meaning clients can exert considerable influence over terms and pricing. This is particularly evident when considering that Civmec's order book in FY2025 experienced notable fluctuations, highlighting the impact of securing or losing key projects.

Civmec faces significant buyer power, particularly in sectors like defence and large infrastructure. Clients in these areas frequently utilize competitive tender processes, compelling Civmec to aggressively price its services and showcase its capabilities to win contracts. This dynamic puts pressure on profit margins as the company must demonstrate superior value to secure business.

The Australian government's substantial investment in defence infrastructure, exceeding AUD 30 billion for projects like the Future Submarine Program and the AUKUS security pact, presents a major opportunity. However, these large-scale government projects come with exceptionally stringent requirements and highly competitive bidding processes, further amplifying buyer power and demanding exceptional performance and cost-efficiency from Civmec.

Buyer Power 4

Civmec faces significant buyer power, particularly from its large clients in sectors like mining and infrastructure. These major clients can leverage their scale to negotiate favorable terms, often by bringing certain engineering and construction services in-house or by having the ability to switch between a limited number of qualified competitors. This dynamic directly impacts Civmec's ability to set prices independently.

While Civmec prides itself on offering comprehensive, integrated solutions, large customers often possess the capability and inclination to unbundle these services. They might solicit separate bids for fabrication, construction, or maintenance, thereby playing providers against each other. This fragmentation of the supply chain further enhances customer leverage.

- Limited Pricing Power: Large clients' ability to insource or switch suppliers constrains Civmec's pricing flexibility.

- Service Unbundling: Major customers can break down projects, seeking bids for individual components from various firms.

- Competitive Landscape: The presence of a few large, capable engineering and construction firms intensifies competition for these clients.

- Client Concentration: Civmec's reliance on a few substantial clients in 2024, for instance, means these entities hold considerable sway in negotiations.

Buyer Power 5

Civmec's strong relationships with major clients like Rio Tinto and Fortescue, built on long-term contracts and repeat business, suggest a degree of customer loyalty. However, this loyalty doesn't negate the inherent bargaining power these large entities wield.

These clients expect competitive pricing, exceptional quality, and the capacity to handle massive, intricate projects. This means Civmec must continuously demonstrate value to retain these crucial partnerships, keeping buyer power significant.

- Client Concentration: Civmec's reliance on a few major clients like Rio Tinto and Fortescue amplifies their bargaining power.

- Project Scale: The ability of these clients to commission large-scale, complex projects gives them leverage in negotiations.

- Competitive Landscape: While Civmec operates in a specialized field, the presence of other capable engineering and fabrication firms can also empower buyers.

- Switching Costs: For large clients, the cost and disruption associated with switching to a different provider can be substantial, creating a counter-balance to their power, though not eliminating it.

Civmec's customers, particularly large entities in resources, energy, and defense, possess considerable bargaining power. Their ability to influence project terms, pricing, and delivery schedules is amplified by their significant financial clout and the substantial portion of Civmec's revenue that major contracts represent. This dynamic is evident in the competitive tender processes common in sectors like defense, where Civmec must aggressively price its services to secure business.

| Client Type | Bargaining Power Factors | Impact on Civmec |

|---|---|---|

| Large Resources & Energy Companies | Project scale, potential for insourcing, ability to switch suppliers | Constrains pricing flexibility, necessitates value demonstration |

| Government (Defense & Infrastructure) | Stringent requirements, competitive bidding, substantial investment scale | Demands exceptional performance and cost-efficiency, intensifies competition |

| Major Clients (e.g., Rio Tinto, Fortescue) | Client concentration, long-term relationships, repeat business | Amplifies their sway in negotiations, requires continuous value delivery |

What You See Is What You Get

Civmec Porter's Five Forces Analysis

This preview showcases the complete Civmec Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the industry. You're viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring you receive a ready-to-use resource without any hidden surprises.

Rivalry Among Competitors

The construction and engineering sectors in Australia and Singapore are quite mature, meaning there are many established companies already in play. This maturity naturally leads to a high degree of competition, as these existing players vie for business.

Civmec faces stiff competition from other integrated service providers that offer similar capabilities in heavy engineering, shipbuilding, and civil construction. This means that securing significant contracts often involves a tough bidding process against numerous capable rivals.

In 2024, the Australian construction industry, a key market for Civmec, experienced a moderate growth rate, yet the intense competition for large-scale infrastructure projects remained a defining characteristic. For instance, major defence shipbuilding contracts, a core area for Civmec, saw multiple international and domestic firms bidding, highlighting the crowded landscape.

The competitive rivalry within the engineering and construction sector, as exemplified by companies like Civmec, is often intense due to the industry's capital-intensive nature. High fixed costs associated with specialized equipment and facilities mean that companies are motivated to secure projects to ensure their assets are consistently utilized. This can drive aggressive bidding, where firms may accept lower profit margins to maintain operational flow, impacting overall industry profitability.

Competitive rivalry in the large-scale project sector, especially within resources, energy, and defence, is fierce due to a limited pool of highly qualified contractors. This scarcity of specialized expertise means that companies like Civmec, capable of undertaking complex, high-value projects, face intense competition from a few major players vying for the same lucrative contracts. For instance, in the Australian mining sector, major projects often see bids from a handful of established engineering and construction firms, driving down margins.

Competitive Rivalry 4

Civmec operates in a fiercely competitive landscape, where securing new contracts is paramount due to fluctuating order books and potential project delays. Recent financial reports highlight this pressure, with a decline in net profit suggesting that margins are being squeezed in the pursuit of new business.

The need to constantly win new work means that companies like Civmec are often in direct competition, driving down prices and impacting profitability. This intense rivalry is a defining characteristic of the sector.

- Intense Competition: Companies are constantly bidding for a limited pool of major projects, leading to aggressive pricing strategies.

- Order Book Volatility: Fluctuations in project wins and delays directly impact revenue and profitability, necessitating continuous business development.

- Margin Pressure: The drive to secure contracts in a competitive market can lead to reduced profit margins on awarded projects.

- Industry Consolidation: Larger players may acquire smaller competitors to gain market share and operational efficiencies.

Competitive Rivalry 5

Competitive rivalry within the heavy engineering and shipbuilding sector remains intense. While Civmec differentiates itself through specialized capabilities like its in-house balanced machine offerings and significant shipbuilding expertise, other players are actively competing for market share.

The acquisition of Luerssen Australia by Civmec in 2023, for instance, was a strategic move to bolster its presence in the defense sector. However, this also highlights the broader trend of companies seeking to strengthen their positions in lucrative government contracts. For example, the Hunter-class frigate program, a significant undertaking for Australia, involves multiple large engineering firms vying for substantial work packages.

- Civmec's acquisition of Luerssen Australia in 2023 aimed to enhance its defense capabilities.

- The Australian naval shipbuilding plan represents a major opportunity, attracting significant competition from established and emerging engineering firms.

- Rival firms are investing in advanced manufacturing and specialized skills to compete for large-scale projects.

- The market demands high levels of technical proficiency and a proven track record, intensifying the pressure on all participants.

Competitive rivalry in Civmec's operating sectors, particularly construction and heavy engineering in Australia and Singapore, is intense. The mature nature of these markets means numerous established companies vie for contracts, often leading to aggressive bidding and margin pressure. In 2024, the Australian construction sector saw continued fierce competition for large infrastructure and defence projects, with multiple domestic and international firms competing for significant work packages.

| Sector | Key Competitors | 2024 Market Characteristic |

|---|---|---|

| Australian Construction | Downer EDI, CIMIC Group, Lendlease | High competition for infrastructure projects; moderate growth |

| Australian Defence Shipbuilding | BAE Systems Australia, ASC Pty Ltd, Navantia Australia | Intense bidding for major naval programs; high demand for specialized skills |

| Singapore Construction & Engineering | Sembcorp Industries, Keppel Offshore & Marine, Hyundai Engineering & Construction | Mature market with established players; focus on large-scale industrial and infrastructure projects |

SSubstitutes Threaten

Traditional on-site construction methods continue to be a substantial substitute for modular and precast concrete solutions, even with the speed and cost benefits of prefabrication. Despite the growth in modular construction, traditional approaches still hold a dominant position in the industry, largely due to ingrained practices and the perceived adaptability for custom projects.

For instance, in 2023, the global construction market was valued at approximately $11.7 trillion, with traditional methods still accounting for the vast majority of this figure, reflecting the inertia and established infrastructure supporting them.

The threat of substitutes for Civmec is moderate. Large clients, particularly in industrial or government sectors, possess the capability to bring certain services in-house if they deem it cost-effective or strategically advantageous. For instance, a major mining company with substantial internal engineering capacity might elect to handle its own routine maintenance or smaller fabrication projects, thereby decreasing its reliance on external contractors like Civmec.

The threat of substitutes for Civmec's services, primarily in concrete and heavy steel fabrication, is moderate. Alternative materials and construction techniques, such as advanced timber framing or pre-fabricated modular construction, can offer competitive solutions for certain projects, potentially impacting demand for Civmec's core offerings.

Innovations in sustainable materials like geopolymer concrete present a long-term, albeit currently nascent, substitute for traditional concrete. While adoption challenges remain, the increasing focus on environmental impact could see these alternatives gain traction, particularly in sectors prioritizing green building practices.

4

The threat of substitutes for integrated engineering and project management services is moderate but growing. New digital engineering tools and advanced project management software are emerging, allowing clients to manage complex projects with greater in-house capability, potentially reducing their reliance on external providers like Civmec.

The increasing integration of IT and AI within the construction sector is also a factor. These technologies can automate or streamline certain design and oversight functions, which could shrink the scope of work traditionally handled by established engineering firms. For instance, AI-powered design software can generate multiple design options rapidly, potentially reducing the need for extensive human-led conceptualization phases.

While the complexity of large-scale industrial projects still necessitates specialized expertise, the accessibility of sophisticated digital tools means that clients may choose to insource more project management and even some design elements. This trend could fragment the value chain, with clients potentially unbundling services that Civmec currently offers as an integrated package.

Key considerations regarding substitutes include:

- Emergence of advanced digital project management platforms that offer end-to-end solutions for planning, execution, and monitoring.

- AI-driven design and simulation tools that can perform complex engineering tasks, potentially reducing the need for traditional engineering consultancies.

- Increased client capacity for in-house project management due to readily available and user-friendly software solutions.

- The potential for specialized software providers to offer modular solutions that address specific project phases, bypassing integrated service providers.

5

The threat of substitutes for Civmec is moderate. For routine maintenance and smaller repair tasks, clients may choose to engage smaller, local contractors or utilize their in-house maintenance crews. This can fragment the demand for the comprehensive, integrated services that Civmec offers, particularly in the mining and infrastructure sectors.

This tendency is evident in the market where specialized, smaller firms can often provide cost-effective solutions for specific, non-complex jobs. For instance, a mine might contract a local welding shop for a minor structural repair instead of engaging Civmec for a full project scope. This can lead to a dilution of Civmec's revenue streams from smaller, recurring maintenance contracts, impacting their overall service package penetration.

In 2024, the Australian construction and maintenance market saw continued activity from a range of smaller, specialized service providers. While large-scale projects, Civmec's forte, remained robust, the smaller job segment demonstrated a persistent preference for localized, agile solutions. This highlights the ongoing challenge for integrated providers to capture the entirety of a client's maintenance needs.

- Smaller, local contractors can offer competitive pricing for routine maintenance.

- In-house operational teams can manage minor repair works, bypassing external providers.

- This fragmentation in the market for smaller jobs can reduce demand for Civmec's integrated service offerings.

- Clients may opt for specialized firms for specific, less complex tasks, impacting Civmec's market share in those niches.

The threat of substitutes for Civmec's core offerings in heavy industrial fabrication and construction is generally moderate. While alternative materials like advanced timber or modular construction exist, they often cater to different project types or scales. Furthermore, the capability for large clients to bring some services in-house, particularly for routine maintenance or smaller projects, presents a direct substitute, fragmenting demand. In 2024, the Australian market continued to show a preference for specialized, local firms for these smaller tasks, impacting the market share of integrated providers.

| Substitute Type | Impact on Civmec | Example | 2024 Market Trend Relevance |

|---|---|---|---|

| Traditional Construction | Moderate | On-site concrete pouring for custom builds | Still dominant in many sectors, but modular gains traction |

| In-house capabilities | Moderate | Major mining company handling its own minor repairs | Clients increasingly leverage internal teams for non-core tasks |

| Specialized Contractors | Moderate | Local welding shop for small structural repairs | Fragmented demand for routine maintenance jobs |

| Alternative Materials (e.g., advanced timber) | Low to Moderate | Engineered wood for certain infrastructure projects | Niche adoption, not yet a broad substitute for heavy steel/concrete |

Entrants Threaten

The threat of new entrants for Civmec is generally considered moderate. High capital investment is a significant barrier, as establishing facilities for heavy engineering, shipbuilding, and modularisation requires substantial financial outlay. For instance, Civmec's own significant investment in regional facilities and advanced manufacturing capabilities underscores this high cost.

The threat of new entrants for Civmec is moderate, primarily due to the significant barriers to entry in the specialized engineering and construction sector. A key hurdle is the requirement for highly specialized expertise and a skilled workforce, which takes considerable time and investment to develop.

Compounding this, the Australian construction and engineering sector is currently experiencing labor shortages. For instance, data from the Australian Bureau of Statistics in early 2024 indicated ongoing challenges in finding skilled tradespeople. This makes it exceptionally difficult for new companies to rapidly assemble a competent team capable of handling Civmec's complex, large-scale projects, thereby limiting their ability to compete effectively.

The threat of new entrants for companies like Civmec is generally moderate, largely due to the significant capital investment and specialized expertise required. Securing large government and private sector contracts, particularly in sectors like defense and resources where Civmec operates, necessitates established client relationships and a proven track record of successful project delivery. For instance, Civmec's long-standing partnerships and demonstrated capabilities act as a substantial barrier for newcomers lacking this history.

4

The threat of new entrants for Civmec is moderate, largely due to significant regulatory hurdles and the substantial capital investment required. Industries Civmec operates in, such as defence and mining, are heavily regulated, demanding extensive compliance with safety, environmental, and quality standards. For example, the defence sector requires adherence to strict security clearances and manufacturing protocols, which can take years and millions of dollars to establish. In 2024, Civmec continued to benefit from its established reputation and certifications, which act as significant barriers to entry for newcomers.

Navigating the complex permitting and licensing procedures in both Australia and Singapore presents another substantial challenge. These processes are time-consuming and costly, often requiring specialized expertise. Civmec's long-standing presence and experience in these jurisdictions provide a distinct advantage, reducing the time and expense associated with compliance for established players.

- High Capital Investment: Setting up the necessary infrastructure, specialized equipment, and skilled workforce for large-scale fabrication and maintenance projects demands significant upfront capital, deterring many potential new entrants.

- Stringent Regulatory Compliance: Meeting rigorous industry-specific regulations, certifications (e.g., ISO standards, defence accreditations), and environmental standards requires substantial investment in time and resources, creating a high barrier.

- Established Relationships and Reputation: Civmec's track record and existing relationships with major clients in sectors like mining and defence provide a competitive edge that new entrants would struggle to replicate quickly.

- Skilled Workforce Requirements: Access to a highly skilled and certified workforce for complex engineering and fabrication tasks is critical and often scarce, posing a challenge for new companies looking to enter the market.

5

The threat of new entrants for integrated construction and engineering firms like Civmec is relatively low. Establishing access to critical supply chains and developing robust logistics networks is a significant hurdle. New players would find it challenging to replicate the reliable and cost-effective supply chains that established companies have painstakingly built over time, especially for the large-scale material procurement required in this sector.

For instance, Civmec's operational efficiency is heavily reliant on its established relationships with suppliers and its sophisticated logistics capabilities, which are difficult for newcomers to quickly match. The capital investment required to build out similar infrastructure and secure preferential supplier agreements is substantial, acting as a strong deterrent.

- Supply Chain Dominance: Established firms possess long-standing supplier relationships, ensuring consistent material availability and favorable pricing.

- Logistics Expertise: Years of experience have honed efficient and cost-effective logistics operations, a major barrier for new entrants.

- Capital Intensity: The significant upfront investment in infrastructure and supplier networks makes entry prohibitively expensive for most.

- Economies of Scale: Existing players benefit from economies of scale in procurement and operations, allowing them to offer more competitive pricing.

The threat of new entrants for Civmec remains moderate, primarily due to substantial barriers like high capital investment for specialized facilities and the need for a highly skilled workforce. Securing complex contracts in sectors such as defence and resources, where Civmec operates, also requires established relationships and a proven track record, which are difficult for newcomers to quickly build.

Regulatory compliance and complex permitting processes in key markets like Australia and Singapore add further layers of difficulty for potential new entrants. These hurdles demand significant time, resources, and specialized expertise, which established players like Civmec have already navigated, creating a distinct advantage. For instance, in 2024, Civmec continued to leverage its established certifications and security clearances in the defence sector, a significant barrier for any new company seeking to enter that space.

Furthermore, the established supply chains and logistics networks of firms like Civmec are difficult and expensive for new entrants to replicate. These networks are crucial for the large-scale material procurement and efficient project execution characteristic of Civmec's operations, making it challenging for new players to compete on cost and reliability.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Civmec leverages data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from relevant government publications and economic databases to ensure a comprehensive understanding of the competitive landscape.