Civmec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civmec Bundle

Unlock the critical external factors influencing Civmec's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are shaping opportunities and risks. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge.

Political factors

The Australian government's 2024-25 Federal Budget earmarks $60.5 billion for infrastructure over the four years leading up to FY2027-28. A significant portion, $16.5 billion, is designated for new and ongoing projects within the 2024-25 fiscal year itself, directly benefiting companies like Civmec involved in construction and engineering.

This ongoing commitment, with a focus on transport, housing, and renewable energy, creates a consistent demand for Civmec's services. Despite a slight dip in federal infrastructure investment compared to prior years, the commitment from state governments, such as Queensland's increased outlays, ensures a robust pipeline of work for the company.

Singapore's commitment to defence modernization is a significant tailwind for companies like Civmec. For Fiscal Year 2025, the nation's defence budget is slated to reach S$23.4 billion, marking a substantial 12.4% increase from the previous year. This expanded funding is earmarked for critical projects and the acquisition of advanced military hardware, including new vessels and submarines.

This robust investment directly bolsters Civmec's marine and defence sector operations. The procurement of sophisticated naval assets creates a pipeline of long-term, stable project opportunities for the company, aligning with its core competencies in shipbuilding and complex engineering.

The sustained focus on enhancing Singapore's defence capabilities ensures a predictable and ongoing demand for specialized services and manufacturing. This strategic direction provides Civmec with a solid foundation for continued growth and project secured in the coming years.

Government policies around Australia's mining and resources sectors are a big deal for companies like Civmec, as they directly influence their clients. These policies dictate how projects get approved and where investments flow, which in turn shapes the demand for heavy engineering and modular construction services.

The regulatory landscape, including government backing for resource extraction and processing, especially for critical minerals, is a key driver for Civmec's project pipeline. For instance, the Australian government's Critical Minerals Strategy, updated in 2023, aims to boost domestic processing and manufacturing, potentially creating more opportunities.

Any changes to these policies, such as stricter environmental standards or new export limitations, could impact the feasibility and scheduling of Civmec's projects. For example, shifts in carbon emissions targets for the resources sector could necessitate different engineering approaches or materials, affecting project costs and timelines.

Trade Relations and Geopolitical Stability

The broader geopolitical landscape and trade relations, particularly between Australia, Singapore, and key trading partners, can significantly influence the demand for Civmec’s services. For instance, the Australian government's focus on critical minerals and defence manufacturing, sectors where Civmec operates, is bolstered by international partnerships. In 2024, Australia's trade surplus with Singapore stood at AUD 11.8 billion, indicating strong economic ties that can translate into project opportunities.

Geopolitical tensions and rising trade barriers, as highlighted by the Monetary Authority of Singapore in their 2024 economic reviews, can create economic uncertainty and impact global demand for goods and services. This can affect Civmec's ability to secure projects in export-oriented sectors like resources, where global commodity prices are sensitive to international stability. A slowdown in global manufacturing output, potentially linked to trade disputes, could reduce demand for Civmec's fabrication and construction services.

Stable international relations are vital for consistent project flow and supply chain reliability. Civmec's reliance on imported components and materials means that disruptions due to geopolitical events or trade disputes can lead to project delays and increased costs. For example, supply chain disruptions in 2023 impacted various industries, and a similar pattern could emerge if international trade relations deteriorate further.

- Trade Agreements: Australia's participation in agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA) supports smoother trade and potential project opportunities for Civmec.

- Defence Spending: Increased defence spending by allied nations, influenced by geopolitical shifts, can create demand for Civmec's defence sector capabilities, as seen in the ongoing modernization efforts in the Indo-Pacific region.

- Resource Demand: Global demand for resources, driven by energy transitions and industrial growth, remains a key market for Civmec, but this demand is susceptible to trade policies and geopolitical stability affecting commodity markets.

- Supply Chain Resilience: Geopolitical instability can force companies like Civmec to reassess and diversify their supply chains to mitigate risks, potentially leading to shifts in sourcing strategies and project execution plans.

Regulatory Environment and Government Support for Local Industry

Government policies in Australia and Singapore that champion local content, procurement, and industry development offer a significant competitive edge for companies like Civmec. These initiatives, particularly those aimed at bolstering domestic manufacturing, fabrication, and employment within major projects, directly translate into expanded opportunities and a more conducive operational landscape. For instance, Australia's commitment to sovereign capability in defense manufacturing, with significant government investment planned through initiatives like the National Reconstruction Fund, directly benefits sectors where Civmec operates. Similarly, Singapore's focus on advanced manufacturing and its strategic infrastructure projects create a demand for local expertise and services.

Understanding and proactively adapting to these evolving policy frameworks is paramount for securing new contracts and maintaining a strong market position. The Australian government's emphasis on local industry participation in the renewable energy sector, for example, presents substantial growth avenues for fabricators and manufacturers. Civmec's ability to align its capabilities with these policy objectives, such as contributing to the construction of offshore wind farm infrastructure, is a key differentiator. The company's track record in delivering complex projects within these regulated environments demonstrates its capacity to leverage government support effectively.

Key government support mechanisms and their impact on Civmec include:

- Australian Industry Participation (AIP) Plan requirements: Mandating local content in major projects, driving demand for Australian fabrication and manufacturing services.

- Sovereign Capability Programs: Government funding and procurement strategies designed to build and sustain domestic industrial capacity, particularly in defense and critical infrastructure.

- Singapore's Advanced Manufacturing Initiatives: Policies fostering innovation and growth in high-value manufacturing, creating opportunities for specialized fabrication and engineering services.

- Renewable Energy Transition Support: Government incentives and project pipelines for renewable energy infrastructure, boosting demand for construction and fabrication services in this sector.

Government policies significantly shape Civmec's operating environment, with Australia's 2024-25 Federal Budget allocating $16.5 billion to infrastructure, directly benefiting the company's construction and engineering services. Singapore's defense budget for Fiscal Year 2025, set at S$23.4 billion, a 12.4% increase, fuels Civmec's marine and defense sector operations through increased demand for advanced military hardware acquisition and modernization projects.

The Australian government's Critical Minerals Strategy aims to boost domestic processing, creating opportunities for Civmec's heavy engineering services. Geopolitical stability, evidenced by Australia's AUD 11.8 billion trade surplus with Singapore in 2024, underpins strong economic ties and potential project flows, though trade barriers could introduce economic uncertainty.

Government support for local content, such as Australia's Australian Industry Participation plans and Singapore's advanced manufacturing initiatives, provides Civmec with a competitive advantage and expanded opportunities in sectors like defense and renewable energy infrastructure.

| Policy Area | Government Support/Initiative | Impact on Civmec | Relevant Data (2024/2025) |

|---|---|---|---|

| Infrastructure | Australian Federal Budget | Direct demand for construction & engineering | $16.5B allocated for FY24-25 |

| Defence | Singapore Defence Budget | Increased demand for marine & defence capabilities | S$23.4B projected for FY25 (+12.4% YoY) |

| Resources | Critical Minerals Strategy (Australia) | Opportunities in domestic processing & manufacturing | Focus on boosting local processing |

| Trade & Geopolitics | ASEAN-Australia-New Zealand FTA | Facilitates smoother trade & project flow | AUD 11.8B Australia-Singapore trade surplus (2024) |

| Local Content | Australian Industry Participation (AIP) | Competitive edge, expanded opportunities | Mandated local content in major projects |

What is included in the product

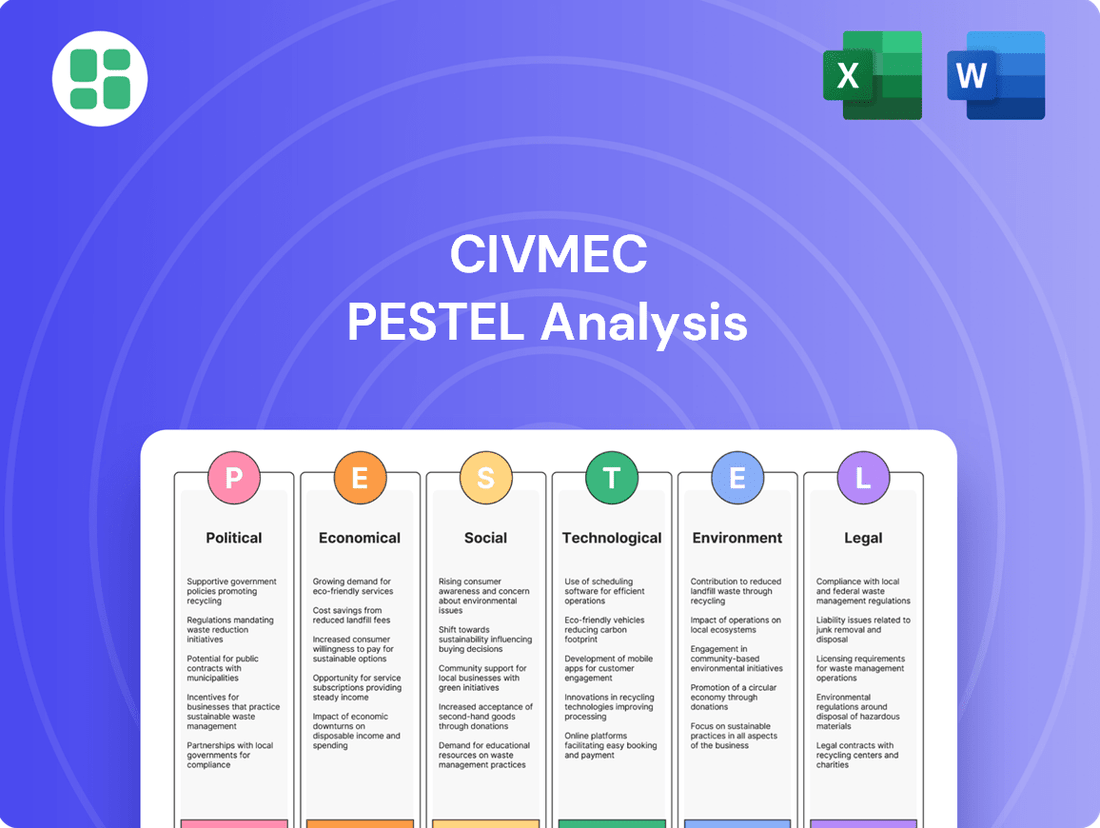

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Civmec, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions. It offers actionable insights for strategic decision-making by identifying key opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for Civmec.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the critical external influences impacting Civmec.

Economic factors

Australia's construction sector is poised for a notable expansion, with forecasts indicating a 3.8% growth in 2025. This uplift is primarily fueled by significant investments across critical areas like transport infrastructure, manufacturing facilities, housing developments, and the rapidly growing renewable energy sector.

Despite this positive outlook for construction, the broader Australian economy is demonstrating resilience, with GDP growth anticipated to strengthen. However, the construction industry itself continues to navigate headwinds, notably elevated borrowing costs and persistent inflationary pressures impacting both wages and regulatory compliance expenses.

Civmec's operational success and financial performance are intrinsically linked to the vitality and investment trends observed within these key economic drivers. The company's ability to capitalize on the projected growth in transport, manufacturing, housing, and renewables will be crucial in the coming year.

Economists surveyed by the Monetary Authority of Singapore (MAS) anticipate a more subdued economic performance for Singapore in 2025, with a lowered GDP growth forecast ranging from 0% to 2%. This recalibration reflects growing concerns over global trade uncertainty and persistent geopolitical tensions, which are key external drivers for the nation's economy.

Singapore's economic model is heavily dependent on international trade, making it particularly vulnerable to shifts in the global landscape. A projected global economic slowdown or the imposition of increased tariffs by major trading partners could significantly dampen demand for services, including those offered by engineering and marine sectors like Civmec.

The prevailing economic headwinds suggest a period of caution for new project development across the region. This cautious sentiment could translate into delayed investment decisions and a more conservative approach to capital expenditure by businesses, potentially impacting Civmec's pipeline of upcoming projects.

Fluctuations in global commodity prices, particularly for iron ore, metallurgical coal, and critical minerals, directly impact the profitability and investment decisions of Civmec's resources sector clients. For instance, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) forecasts a slight decrease in resource export earnings for 2025-26, suggesting potential headwinds.

However, the long-term outlook for critical minerals, essential for the global energy transition, presents significant new opportunities for companies like Civmec. Sustained high or volatile commodity prices can directly influence the commencement and scale of new mining and energy projects, impacting Civmec's project pipeline.

Inflation, Material Costs, and Labour Wages

The Australian construction sector is facing persistent economic challenges, with inflation and rising material costs significantly impacting overall project expenses. This trend continued through 2024, with input costs for building work remaining elevated. For Civmec, these economic factors directly influence project profitability, potentially leading to delays or scope adjustments.

Labour wages have also seen upward pressure due to a tight labour market and general inflation. In the year to March 2025, construction industry wage growth in Australia has been a notable factor contributing to increased operational costs. Civmec's ability to manage these economic headwinds hinges on robust cost control, securing supply chains, and adept labour negotiations.

- Inflationary pressures have kept construction input costs high throughout 2024.

- Material costs remain a significant concern for project profitability.

- Labour wage growth in the construction sector has accelerated, impacting operational expenses.

- Supply chain resilience and effective labour management are crucial for mitigating economic risks.

Interest Rates and Access to Capital

Rising interest rates significantly impact the cost of capital for large projects, a core area for Civmec. For instance, the Reserve Bank of Australia's cash rate reached 4.35% by November 2023, marking a substantial increase from the near-zero rates seen previously. This makes borrowing more expensive for Civmec's clients, potentially causing them to postpone or cancel major infrastructure, energy, and resources investments, which directly affects Civmec's project pipeline.

Higher financing costs also affect Civmec's own operational and expansion plans. Increased borrowing expenses can squeeze profit margins and limit the company's ability to invest in new equipment or strategic growth initiatives. The Australian economy, like many others, experienced elevated inflation throughout 2023 and into 2024, prompting central banks to maintain tighter monetary policy, thereby keeping interest rates elevated and access to capital more constrained.

- Increased Borrowing Costs: Higher interest rates directly translate to more expensive debt for both Civmec and its clients, potentially impacting project feasibility.

- Reduced Investment Appetite: Clients may scale back or delay large capital expenditures due to the elevated cost of financing.

- Impact on Project Pipeline: The deferral or cancellation of major projects in sectors like mining and infrastructure directly reduces demand for Civmec's services.

- Financing for Operations: Civmec's own ability to secure funding for working capital and expansion is made more challenging by tighter credit conditions.

Economic factors present a mixed but generally challenging environment for Civmec. While Australia's construction sector shows promise with a 3.8% growth forecast for 2025, driven by infrastructure and renewables, persistent inflation and elevated borrowing costs remain significant headwinds. These economic conditions directly impact project profitability and can lead to investment delays from clients.

The global economic outlook, particularly in trade-reliant economies like Singapore, adds another layer of uncertainty, with a subdued GDP growth forecast of 0-2% for 2025. This vulnerability to global trade disruptions could dampen demand for Civmec's services.

Commodity price volatility, especially for iron ore and coal, affects Civmec's resource sector clients, with ABARES forecasting a slight decrease in resource export earnings for 2025-26. However, the long-term demand for critical minerals offers potential growth avenues.

Elevated interest rates, with the RBA cash rate at 4.35% as of November 2023, increase the cost of capital for large projects, potentially causing clients to postpone or cancel investments. This also affects Civmec's own financing for operations and expansion.

| Economic Factor | Impact on Civmec | Supporting Data/Trend (2024-2025) |

| Australian Construction Growth | Positive driver for project pipeline | Forecasted 3.8% growth in 2025 |

| Inflation and Material Costs | Increased project expenses, reduced profitability | Input costs for building work remained elevated throughout 2024 |

| Labour Wage Growth | Higher operational costs | Notable upward pressure in construction sector (Year to March 2025) |

| Interest Rates | Higher cost of capital for clients and Civmec | RBA cash rate at 4.35% (November 2023), indicating tighter monetary policy |

| Global Economic Uncertainty | Potential dampening of demand for services | Singapore GDP growth forecast 0-2% for 2025 due to trade concerns |

| Commodity Prices | Influences investment decisions of resource clients | ABARES forecasts slight decrease in resource export earnings for 2025-26 |

Preview Before You Purchase

Civmec PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Civmec details political, economic, social, technological, legal, and environmental factors impacting the company, providing valuable strategic insights.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain a deep understanding of the external forces shaping Civmec's operations and future prospects.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a detailed breakdown of each PESTLE element, enabling informed decision-making for stakeholders.

Sociological factors

Australia's construction sector is grappling with a substantial deficit of skilled labor, with projections indicating a need for an additional 83,000 workers simply to meet housing construction targets. This scarcity directly affects project delivery schedules and inflates labor costs, presenting a considerable hurdle for companies like Civmec in their efforts to acquire and maintain a competent workforce.

The ongoing shortage necessitates proactive strategies such as enhanced workforce development programs, targeted training initiatives, and potentially leveraging skilled migration pathways to bridge the talent gap. These measures are crucial for ensuring project viability and mitigating the financial impact of increased wage demands and project delays.

Societal expectations and regulatory emphasis on occupational health and safety (OHS) are critical in heavy engineering and construction. For instance, in 2023, the Australian construction industry reported a lost-time injury frequency rate (LTIFR) of 4.5 per million hours worked, highlighting the ongoing importance of safety. Civmec's dedication to high OHS standards directly impacts its reputation, employee welfare, and legal standing.

A strong safety record is not just about compliance; it's a key differentiator for attracting and retaining skilled workers in a competitive market. Furthermore, by minimizing workplace incidents, Civmec reduces operational disruptions and potential financial penalties, contributing to overall business resilience. This focus on safety underpins the company's ability to secure and execute complex projects effectively.

Societal expectations and government mandates increasingly emphasize diversity and inclusion across all sectors, including construction and engineering. Civmec actively embraces this trend, reporting that women constitute over 10% of its total workforce and achieving a balanced 50/50 gender representation in its corporate positions.

This focus on diversity not only strengthens Civmec's public image but also expands its access to a wider range of skilled professionals. Furthermore, a more diverse workforce is often linked to enhanced innovation and more effective problem-solving capabilities, providing a competitive edge.

Community Engagement and Social License to Operate

Large-scale construction and engineering projects, like those undertaken by Civmec, profoundly impact local communities. Securing a social license to operate necessitates robust community engagement, ensuring projects are accepted and executed smoothly. Positive relationships, particularly with Indigenous groups, are paramount for this acceptance.

Civmec demonstrates a commitment to this by actively engaging with Indigenous communities and formally acknowledging Traditional Custodians across its operational areas. This proactive approach helps foster trust and mutual respect, vital for long-term project sustainability and community well-being.

- Indigenous Partnerships: Civmec's commitment to Indigenous engagement is a key aspect of its social license, fostering collaborative relationships.

- Community Acceptance: Strong community ties are essential for the smooth execution and acceptance of large-scale engineering projects.

- Operational Harmony: Acknowledging Traditional Custodians signifies respect and contributes to a harmonious operational environment.

Demographic Shifts and Urbanisation

Australia's population is projected to reach 30.8 million by 2030, with a significant portion concentrating in urban centers. This ongoing urbanisation fuels demand for infrastructure, including transportation networks and utilities, directly benefiting companies like Civmec involved in civil works and precast concrete manufacturing. Similarly, Singapore's continued focus on urban redevelopment and housing projects, driven by its dense population, presents sustained opportunities for Civmec's specialized construction services.

These demographic trends translate into a robust, long-term demand for Civmec's core competencies. As populations grow and concentrate, the need for new and upgraded infrastructure, from roads and bridges to energy facilities, escalates. Civmec's expertise in civil construction and precast solutions positions it to capitalize on this sustained need for foundational development across both Australia and Singapore.

- Australia's population growth: Expected to reach 30.8 million by 2030, increasing urban infrastructure needs.

- Singapore's urban density: Continual urban redevelopment projects require extensive construction services.

- Civmec's service alignment: Expertise in civil works and precast concrete directly addresses these demographic-driven demands.

- Long-term demand driver: Urbanisation and population growth provide a stable foundation for Civmec's strategic growth.

Societal expectations around safety remain paramount in heavy engineering, with the Australian construction industry reporting a lost-time injury frequency rate (LTIFR) of 4.5 per million hours worked in 2023. Civmec's commitment to rigorous occupational health and safety (OHS) standards is crucial for attracting talent and ensuring operational continuity, directly impacting its reputation and financial performance.

Technological factors

The Australian construction sector is increasingly embracing digital tools like Building Information Modeling (BIM), digital twins, AI, and AR. These advancements are improving how projects are visualized, how teams collaborate, and overall efficiency, with a notable impact on reducing errors and streamlining operations. For instance, the Australian government has mandated BIM for all federally funded projects from 2025, signaling a strong push towards digital integration.

Civmec's strategic adoption of these digital technologies can lead to substantial improvements in project execution and cost management. By leveraging BIM for better design coordination and digital twins for real-time monitoring, the company can anticipate and mitigate potential issues, thereby enhancing project delivery timelines and financial predictability.

Advances in automation and robotics are significantly reshaping fabrication and construction. These technologies promise higher productivity, improved safety, and a way to address ongoing labor shortages. For instance, AI-guided robots can now manage complex, repetitive tasks, boosting efficiency and consistency in heavy engineering and modularization, areas where Civmec operates.

The adoption of automated material handling systems and advanced robotic welding in 2024 and projected into 2025 is crucial for companies like Civmec to maintain their competitive edge. These innovations not only streamline operations but also ensure a higher degree of precision and quality in fabricated components, directly impacting project timelines and cost-effectiveness.

Modular and prefabricated construction is a growing trend in Australia, driven by the need to combat increasing labour expenses and lengthy project schedules. These techniques involve building components away from the main construction site, which significantly boosts efficiency in terms of both physical space and time management. This approach offers a clear advantage for companies like Civmec that already possess modularisation expertise.

By embracing off-site manufacturing, Civmec can expect to see improvements in how quickly projects are completed. Furthermore, this method enhances quality control because it takes place in a more controlled factory environment. Crucially, it also reduces the inherent risks associated with traditional on-site construction activities, making projects safer and more predictable.

The Australian construction industry saw significant growth in prefabricated building projects leading up to 2024. For instance, the market for prefabricated buildings in Australia was projected to grow at a compound annual growth rate (CAGR) of over 6% between 2023 and 2028, indicating strong demand for these efficient methods.

Advanced Materials and Manufacturing

Innovation in materials science, particularly for precast concrete and other construction materials, presents significant opportunities for Civmec. These advancements can enhance durability, sustainability, and overall project efficiency. For instance, research into advanced composite materials and self-healing concrete could drastically reduce maintenance needs and extend structural lifespans, a key consideration for large-scale infrastructure projects.

Focusing on recycled materials and energy-efficient designs aligns with growing global demand for sustainable construction practices. By integrating these elements, Civmec can tap into a market segment prioritizing environmental responsibility. The Australian construction industry, for example, has seen a rise in green building certifications, with projects increasingly seeking materials with lower embodied carbon. Civmec's precast concrete division is well-positioned to leverage these trends through improved material composition and cutting-edge production techniques.

Key benefits for Civmec include:

- Enhanced Durability: New material formulations can lead to structures with longer service lives, reducing lifecycle costs for clients.

- Sustainability Gains: Utilizing recycled content and developing energy-efficient designs appeals to environmentally conscious clients and regulatory bodies.

- Improved Production Efficiency: Advanced manufacturing processes for precast elements can streamline construction timelines and reduce on-site labor requirements.

- Competitive Advantage: Early adoption of material innovations can differentiate Civmec in a competitive market, attracting projects with stringent performance and sustainability criteria.

Cybersecurity for Critical Infrastructure

As construction projects increasingly integrate digital technologies and data, cybersecurity for critical infrastructure becomes paramount. This is especially true for sectors like defence and energy, where operational continuity is vital. For instance, the Australian Cyber Security Centre reported a significant increase in cyber threats targeting critical infrastructure in 2024, highlighting the growing risk landscape.

Protecting sensitive project data, operational technology (OT), and intellectual property is crucial for maintaining client trust and ensuring operational integrity. A breach could have severe consequences, impacting project timelines and financial performance. Civmec must therefore prioritize robust cybersecurity protocols to safeguard its digital assets against these evolving threats.

Key considerations for Civmec include:

- Implementing advanced threat detection and response systems to identify and mitigate cyberattacks in real-time.

- Regularly updating and patching software across all digital platforms to address known vulnerabilities.

- Conducting comprehensive cybersecurity training for all employees to foster a security-aware culture.

- Developing and testing incident response plans to ensure a swift and effective reaction to any security breaches.

Technological advancements are reshaping the construction landscape, with digital tools like BIM and AI boosting efficiency and collaboration. The Australian government's mandate for BIM on federal projects from 2025 underscores this digital shift. Automation and robotics are also transforming fabrication, promising higher productivity and addressing labor shortages, with AI-guided robots proving adept at complex tasks in heavy engineering.

Legal factors

New Australian regulations commencing January 2025 will mandate climate-related financial disclosures for large and medium-sized companies. This means businesses like Civmec will need to report on sustainability, including climate risks and opportunities, within their annual reports.

This legal evolution requires a transparent approach to greenhouse gas emissions and strategies for climate adaptation and mitigation. Civmec, being a publicly listed entity, must establish strong systems for gathering, overseeing, and confirming climate-related data to meet these new compliance standards.

The National Construction Code (NCC) 2025 in Australia is bringing in tougher rules for building codes, quality checks, and energy efficiency. These changes are designed to make buildings stronger, safer, and more environmentally friendly, focusing on things like better insulation and waterproofing.

Civmec needs to make sure all its projects meet these new legal and safety standards. For instance, the NCC 2025 will likely increase the focus on thermal performance, potentially requiring higher insulation R-values, and stricter waterproofing protocols to prevent moisture-related issues. Failing to comply could lead to significant delays and rework, impacting project timelines and budgets.

Australia's security of payment reforms, particularly those mandating trust accounts for subcontractor payments on projects exceeding $1 million, are designed to bolster financial stability across the construction supply chain. These legal shifts, which gained significant traction in states like New South Wales and Victoria throughout the early 2020s, aim to prevent subcontractors from bearing the brunt of payment defaults.

For a company like Civmec, adherence to these evolving legal frameworks is crucial. Ensuring contractual agreements and payment processes are fully compliant not only safeguards relationships with subcontractors but also mitigates the risk of costly payment disputes and potential legal challenges, thereby protecting project timelines and financial health.

Labour Laws and Industrial Relations

Civmec's operations in Australia and Singapore are significantly influenced by labour laws and industrial relations. Navigating evolving regulations around employment, worker rights, and workplace safety is paramount for compliance. For instance, Australia's Fair Work Act 2009 and Singapore's Employment Act 1968 set the baseline for these practices.

The persistent shortage of skilled labour across both regions underscores the importance of fair labour practices, competitive remuneration, and robust safety protocols. Civmec's ability to attract and retain qualified personnel directly impacts project execution and cost-efficiency. In 2023, Australia faced significant skills gaps in trades and technical roles, a trend projected to continue into 2024.

- Compliance with Australian and Singaporean labour legislation is mandatory.

- Skilled labour shortages in 2024 necessitate competitive wages and safe working environments to attract and retain talent.

- Changes in industrial relations can directly affect project costs and delivery timelines for Civmec.

Corporate Governance and Compliance Standards

Civmec's dual listing on the Australian Securities Exchange (ASX) and the Singapore Exchange (SGX) necessitates adherence to stringent corporate governance and compliance standards in both jurisdictions. This dual regulatory environment requires meticulous attention to financial reporting accuracy, transparent shareholder communication, and unwavering ethical conduct. For instance, Australian companies must comply with the ASX Corporate Governance Council's Principles and Recommendations, while Singapore-listed entities fall under the purview of the Singapore Code of Corporate Governance. In 2024, companies are increasingly focused on environmental, social, and governance (ESG) reporting, with Civmec expected to align its practices accordingly to meet evolving investor expectations and regulatory scrutiny.

Maintaining robust governance structures is paramount for fostering investor confidence and mitigating regulatory risks. Civmec's commitment to these standards directly impacts its ability to attract capital and operate smoothly across different markets. For example, a company's compliance with continuous disclosure obligations on the ASX, such as promptly announcing material information, is critical. Similarly, in Singapore, adherence to rules regarding director duties and board independence is vital. Failure to comply can result in significant penalties and reputational damage, underscoring the importance of Civmec's proactive approach to governance.

The company's governance framework is designed to ensure accountability and ethical decision-making at all levels. This includes:

- Board Oversight: Implementing independent board committees to oversee audit, remuneration, and nominations, ensuring checks and balances.

- Financial Transparency: Adhering to International Financial Reporting Standards (IFRS) for consolidated financial statements, providing a clear financial picture to stakeholders.

- Shareholder Rights: Upholding shareholder rights through fair treatment, access to information, and opportunities for participation in general meetings.

- Risk Management: Establishing comprehensive risk management frameworks to identify, assess, and mitigate legal and compliance risks across its operations.

Australia's upcoming climate disclosure regulations, effective January 2025, will require companies like Civmec to report on climate-related risks and opportunities. This necessitates robust systems for data collection and verification to ensure compliance with new transparency standards for greenhouse gas emissions and adaptation strategies.

The National Construction Code (NCC) 2025 introduces stricter building standards, focusing on enhanced safety, quality, and energy efficiency. Civmec must ensure all projects adhere to these updated codes, which may include higher insulation requirements and improved waterproofing, to avoid project delays and cost overruns.

Security of payment reforms, mandating trust accounts for subcontractor payments on projects over $1 million, are designed to improve financial stability in the construction sector. Civmec's compliance with these evolving legal frameworks is vital to prevent payment disputes and safeguard project finances.

Civmec's operations are governed by labour laws in Australia and Singapore, including the Fair Work Act 2009 and Singapore's Employment Act 1968. The persistent shortage of skilled labour in 2024, particularly in technical trades, highlights the need for competitive wages and safe working conditions to attract and retain talent, directly impacting project execution and costs.

Environmental factors

Australian environmental laws are tightening, particularly concerning local land use, development, and environmental impact assessments for significant projects. This means companies like Civmec face increasingly complex permitting procedures and must adapt to changing rules for waste, pollution, and biodiversity.

For instance, the federal government's proposed Nature Positive reforms, expected to be legislated in 2024-2025, aim to streamline environmental approvals while strengthening environmental outcomes, potentially increasing compliance burdens for major infrastructure developments.

Civmec's proactive approach to environmental compliance, including robust waste management strategies and biodiversity protection plans, is crucial for securing project approvals and avoiding potential fines, which can be substantial under current legislation.

Australia and Singapore are progressively tightening their climate change policies, with both nations committed to ambitious net-zero emissions targets. This regulatory shift directly impacts industries like Civmec's, demanding a proactive approach to sustainability.

Civmec itself has established clear environmental goals, aiming for net-zero emissions by 2050 and a significant reduction of over 50% in Scope 1 and 2 emissions by 2030. Achieving these benchmarks will require the integration of sustainable practices and investment in cleaner technologies throughout their operational framework.

The construction industry is seeing a significant push towards sustainability, with a growing demand for recycled materials, energy-saving designs, and green building certifications such as Green Star ratings. This trend is directly influenced by evolving regulations.

The National Construction Code (NCC) 2025 is set to implement more rigorous energy efficiency requirements for both new construction projects and renovations. For instance, the NCC 2025 aims to improve thermal performance by an average of 15-20% compared to previous versions, impacting insulation and glazing standards.

Civmec's success in securing projects from environmentally aware clients and maintaining a competitive advantage hinges on its capacity to integrate these sustainable construction methods and adhere to these increasingly stringent green building benchmarks.

Waste Management and Resource Efficiency

Effective waste management and resource efficiency are paramount for large-scale construction and engineering operations like those undertaken by Civmec. This involves a concerted effort to minimize waste at its source, maximize recycling initiatives, and ensure the most efficient use of all materials. By adopting these practices, Civmec not only reduces its environmental footprint but also strengthens its regulatory compliance and can achieve significant operational cost savings.

Civmec’s commitment to sustainability is reflected in its operational strategies. For instance, in the 2023 financial year, the company reported a focus on improving material utilization across its projects, aiming to divert a substantial portion of waste from landfills through recycling and reuse programs. While specific percentages vary by project, the industry benchmark for waste diversion in major infrastructure projects is often targeted above 75%.

- Waste Reduction: Implementing strategies to minimize waste generation during fabrication and construction phases.

- Recycling Initiatives: Prioritizing the recycling of materials such as steel, concrete, and plastics.

- Resource Optimization: Enhancing the efficient use of raw materials and energy throughout project lifecycles.

- Regulatory Compliance: Adhering to stringent environmental regulations regarding waste disposal and resource management.

Water Resource Management and Biodiversity Protection

Civmec's operations, especially those in remote or ecologically sensitive locations, necessitate stringent water resource management and biodiversity protection protocols. For instance, their work on projects like the Roy Hill iron ore mine in the Pilbara region of Western Australia, an area known for its unique ecosystems, demands meticulous attention to water usage and waste management.

Compliance with environmental regulations is paramount. This includes adhering to strict guidelines on water abstraction, wastewater discharge quality, and minimizing any negative impact on local flora and fauna. Failure to comply can result in significant penalties and project delays, impacting financial performance and operational continuity.

Demonstrating robust environmental stewardship is crucial for Civmec's reputation and future business prospects. In 2023, the company highlighted its commitment to sustainability through various initiatives, aiming to enhance its social license to operate. This focus on responsible practices helps secure new contracts and maintain positive relationships with stakeholders, including government bodies and environmental groups.

- Water Usage Monitoring: Implementing advanced systems to track water consumption across all project sites, ensuring efficiency and compliance with allocation permits.

- Biodiversity Impact Assessments: Conducting thorough environmental impact assessments before commencing projects in sensitive areas, identifying potential risks to biodiversity and developing mitigation strategies.

- Wastewater Treatment: Investing in and utilizing state-of-the-art wastewater treatment facilities to ensure discharged water meets or exceeds regulatory standards, protecting local waterways.

- Rehabilitation Programs: Engaging in site rehabilitation and restoration activities post-project completion to minimize long-term environmental footprint and support biodiversity recovery.

Australia's environmental laws are becoming stricter, especially concerning land use and impact assessments for major projects, increasing the complexity of permitting and compliance for companies like Civmec.

The federal government's Nature Positive reforms, expected in 2024-2025, aim to streamline approvals while enhancing environmental outcomes, potentially increasing compliance burdens for large developments.

Civmec's commitment to sustainability, including net-zero emissions by 2050 and a 50% reduction in Scope 1 and 2 emissions by 2030, aligns with tightening climate policies in Australia and Singapore.

The push for sustainable construction, driven by regulations like the NCC 2025's enhanced energy efficiency requirements, favors companies like Civmec that adopt green building practices and material efficiency.

| Environmental Factor | Impact on Civmec | Mitigation/Strategy |

|---|---|---|

| Stricter Environmental Laws | Increased compliance complexity, potential for delays and fines. | Proactive adherence to regulations, robust environmental management systems. |

| Climate Change Policies (Net-Zero Targets) | Demand for reduced emissions, investment in cleaner technologies. | Setting emissions reduction targets (e.g., 50% by 2030), integrating sustainable practices. |

| Green Building Demand | Opportunity for competitive advantage, need for sustainable materials and design. | Adopting sustainable construction methods, achieving green building certifications. |

| Water Resource Management & Biodiversity | Need for careful management in sensitive areas, risk of penalties for non-compliance. | Implementing water usage monitoring, conducting biodiversity impact assessments, site rehabilitation. |

PESTLE Analysis Data Sources

Our Civmec PESTLE analysis is meticulously constructed using data from reputable government publications, leading industry associations, and respected financial institutions. This ensures each factor, from regulatory changes to market dynamics, is grounded in current and authoritative information.