Civmec Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civmec Bundle

Unlock the comprehensive strategic blueprint behind Civmec's success with our full Business Model Canvas. This detailed document breaks down how Civmec effectively delivers value, manages key resources, and builds vital partnerships to thrive in its industry. Gain actionable insights for your own business planning.

Partnerships

Civmec's key partnerships with government and defence organisations, notably the Commonwealth of Australia, are foundational to its success in major defence initiatives. These collaborations are critical for large-scale projects like the LAND8710 Phase 2 Landing Craft Heavy, underscoring Civmec's role in building Australia's sovereign defence capabilities.

These strategic alliances often translate into substantial, long-term contracts, securing a consistent revenue stream and reinforcing Civmec's position within the national defence ecosystem. For instance, the company secured a significant contract for the LAND8710 Phase 1 project, valued at approximately AUD 100 million, highlighting the scale of government involvement.

Civmec's business model heavily relies on its deep-rooted connections with major players in the resources and energy sectors. These aren't just casual acquaintances; they are long-standing partnerships with industry titans such as Rio Tinto, Fortescue, BHP, Woodside, Chevron, and Alcoa. These established relationships are the bedrock of Civmec's operations, ensuring a steady stream of projects.

These crucial partnerships typically take the form of master service agreements, panel contracts, and long-term maintenance agreements. This structure provides Civmec with a predictable and consistent pipeline of work, a vital element for sustained growth and operational planning. For instance, in the fiscal year 2023, Civmec secured significant multi-year contracts with key clients, bolstering its order book.

The ongoing collaboration with these industry leaders is a testament to Civmec's proven reliability and specialized expertise within the demanding resources and energy industries. This sustained trust translates into repeat business and a strong reputation, further solidifying Civmec's position as a preferred partner for large-scale projects and ongoing operational support.

Civmec's strategic joint ventures are crucial for securing large-scale projects, like the significant naval shipbuilding contracts or the Perth Sporting and Entertainment Precinct Project. These partnerships allow Civmec to access capabilities and resources beyond its standalone capacity, thereby expanding its project portfolio and market penetration.

Original Equipment Manufacturers (OEMs)

Civmec is actively deepening its relationships with Original Equipment Manufacturers (OEMs) to become a key supplier. This strategic move focuses on designing and producing critical heavy material handling equipment, such as stackers, reclaimers, and shiploaders. These partnerships are crucial for both delivering new machinery and undertaking extensive refurbishment projects for existing assets, showcasing a commitment to the full lifecycle of equipment.

This expansion into OEM supply is a significant vertical integration for Civmec. By taking on more of the design and manufacturing process directly, they are capturing greater value within the supply chain. For example, in the 2024 financial year, Civmec reported significant growth in its manufacturing segment, which directly benefits from these OEM collaborations.

- OEM Collaboration: Partnering with OEMs for the design and manufacture of specialized heavy material handling equipment.

- New Equipment Supply: Directly supplying stackers, reclaimers, and shiploaders to clients.

- Refurbishment Services: Offering refurbishment and upgrade services for existing OEM-supplied assets.

- Vertical Integration: Strengthening supply chain control and value capture through direct manufacturing.

Subcontractors and Key Suppliers

Civmec relies heavily on a strong network of subcontractors and key suppliers to execute its complex projects. This ensures they have the necessary specialized skills, materials, and labor to meet diverse client needs. For instance, in the fiscal year 2023, Civmec reported that its cost of sales, which includes significant subcontractor and supplier expenses, was approximately AUD 969 million.

Maintaining these relationships is crucial for operational efficiency and cost management. By having reliable partners, Civmec can secure competitive pricing and ensure timely delivery of essential components and services, directly impacting project profitability and adherence to schedules. This strategic approach to supply chain management is fundamental to their ability to undertake large-scale infrastructure and mining projects.

- Subcontractor Integration: Civmec partners with specialized firms for areas like welding, electrical, and mechanical installations, augmenting their in-house capabilities.

- Supplier Reliability: Key suppliers provide critical materials such as structural steel, concrete, and specialized equipment, ensuring project continuity.

- Cost and Schedule Impact: Effective management of these partnerships directly influences Civmec's ability to control project costs and meet delivery deadlines, as evidenced by their consistent project execution performance.

Civmec's key partnerships extend to Original Equipment Manufacturers (OEMs), enabling them to design and produce critical heavy material handling equipment like stackers and reclaimers. These collaborations are vital for both supplying new machinery and refurbishing existing assets, demonstrating a commitment to the full equipment lifecycle. For the fiscal year 2024, Civmec noted substantial growth in its manufacturing division, directly benefiting from these OEM relationships.

The company also relies on a robust network of subcontractors and suppliers for specialized skills, materials, and labor, essential for complex projects. In FY23, Civmec's cost of sales, including these expenses, was approximately AUD 969 million, highlighting the scale of these partnerships. Effective management of these relationships is critical for cost control and timely project delivery.

Strategic joint ventures are another cornerstone, allowing Civmec to secure large-scale projects, such as naval shipbuilding, by pooling capabilities and resources. These ventures expand Civmec's project portfolio and market reach, demonstrating their ability to leverage external expertise for significant undertakings.

| Partnership Type | Key Partners | Strategic Importance | Example/Impact |

|---|---|---|---|

| Government & Defence | Commonwealth of Australia | Securing major defence initiatives, building sovereign capabilities | LAND8710 Phase 2 Landing Craft Heavy contract |

| Resources & Energy | Rio Tinto, Fortescue, BHP, Woodside, Chevron, Alcoa | Consistent project pipeline, long-term revenue | Master service agreements, panel contracts |

| OEMs | Various heavy equipment manufacturers | Design and manufacture of material handling equipment, vertical integration | Growth in manufacturing segment (FY24) |

| Subcontractors & Suppliers | Specialized firms, material providers | Access to specialized skills, materials, labor; cost and schedule management | Cost of sales (FY23) approx. AUD 969 million |

| Joint Ventures | Project-specific partners | Accessing capabilities beyond standalone capacity, securing large-scale projects | Naval shipbuilding, Perth Sporting and Entertainment Precinct Project |

What is included in the product

Civmec's business model focuses on providing integrated, end-to-end engineering, construction, and maintenance services across key sectors like mining, oil & gas, and infrastructure.

It details their customer segments, value propositions, and revenue streams, offering a clear roadmap for their operational strategy and growth.

The Civmec Business Model Canvas acts as a pain point reliever by providing a structured, one-page snapshot that simplifies complex strategic planning.

It alleviates the pain of fragmented information and lengthy documentation, offering a clear, actionable framework for understanding and communicating Civmec's core business drivers.

Activities

Civmec's core strength lies in its extensive heavy engineering and fabrication capabilities. This includes the production of structural steel, intricate plate works, large tanks and vessels, and specialized materials handling equipment, all executed within their advanced manufacturing hubs like the Henderson facility.

These state-of-the-art facilities, such as the Henderson plant, are equipped to handle massive projects, showcasing significant production capacity. For instance, in the fiscal year 2023, Civmec reported revenue from its manufacturing and construction segment of AUD 1.1 billion, underscoring the scale of its fabrication operations.

These robust fabrication skills are fundamental to Civmec's ability to supply critical, complex components across diverse industrial sectors, including mining, oil and gas, and infrastructure development, ensuring high-quality delivery for demanding projects.

Civmec's core activities revolve around shipbuilding, a critical component of their business model, especially within the marine and defence industries. A prime example of this is their ongoing involvement in the Offshore Patrol Vessel (OPV) program, showcasing their capability in complex naval construction.

Complementing their shipbuilding prowess, Civmec offers extensive modularisation services. This strategic approach is applied to both onshore and offshore projects, significantly boosting construction efficiency and upholding stringent quality control by enabling the pre-assembly of substantial structures before their final on-site installation.

Civmec's key activities in Structural, Mechanical, Piping (SMP) and Electrical & Instrumentation (E&I) works are central to its value proposition, offering integrated on-site services. This includes the assembly and erection of structures, precise mechanical installations and alignments, and comprehensive piping installation with pre-commissioning support. For instance, Civmec secured a significant contract in 2024 for the structural steel fabrication and erection for a major mining project, highlighting their core capabilities.

Further expanding on their E&I services, Civmec provides essential electrical, instrumentation, and control solutions. This encompasses the installation of critical infrastructure and ongoing maintenance, ensuring operational continuity for clients. Their expertise in these areas allows them to deliver end-to-end solutions for even the most complex industrial projects, a testament to their integrated service model.

Civil Works and Precast Concrete Production

Civmec's civil works division is a cornerstone of its operations, engaging in a broad spectrum of construction projects. This includes the development of essential infrastructure like roads and bridges, alongside specialized civil concrete works tailored for major industrial facilities. These projects are crucial for supporting large-scale industrial development and ensuring operational readiness.

Complementing its on-site civil construction, Civmec also boasts significant capabilities in precast concrete production. This in-house manufacturing of concrete elements enhances project efficiency and guarantees a high standard of quality for their builds. It also represents a strategic diversification, broadening their service portfolio beyond core heavy engineering activities.

- Civil Construction Scope: Undertakes road, bridge, and site-specific civil concrete works for industrial plants.

- Precast Concrete Production: Manufactures precast concrete elements to improve project efficiency and quality.

- Service Diversification: Expands offerings beyond heavy engineering through integrated civil capabilities.

- Project Support: Provides foundational civil infrastructure essential for large industrial operations.

Maintenance and Asset Services

Civmec's Maintenance and Asset Services are crucial for generating recurring revenue by supporting the operational longevity of client assets, primarily in the energy and resources industries. This segment encompasses vital services such as industrial insulation, surface treatment, and refractory works, ensuring the continued efficiency and safety of critical infrastructure.

These ongoing support services are designed to provide a stable income stream, complementing Civmec's project-based work. The company's strategic expansion of regional maintenance facilities, including a significant presence in Western Australia, is a testament to its commitment to enhancing its service delivery capabilities and client accessibility in key operational areas.

- Recurring Revenue: Civmec's maintenance services, including shutdowns and refurbishments, provide a consistent revenue stream from existing clients.

- Sector Focus: A significant portion of these services are delivered to the energy and resources sectors, aligning with Civmec's core market strengths.

- Service Breadth: Key offerings include industrial insulation, surface treatment, and refractory works, demonstrating a comprehensive approach to asset care.

- Geographic Expansion: The development of regional maintenance facilities, particularly in Western Australia, strengthens Civmec's capacity to serve its client base efficiently.

Civmec's key activities are multifaceted, encompassing heavy engineering and fabrication, shipbuilding, modularisation, and integrated on-site services like Structural, Mechanical, Piping (SMP) and Electrical & Instrumentation (E&I). They also provide essential civil works, including road and bridge construction, and precast concrete production, alongside maintenance and asset services for the energy and resources sectors.

| Key Activity | Description | FY23 Revenue Contribution (Segment) |

|---|---|---|

| Heavy Engineering & Fabrication | Production of structural steel, plate works, tanks, vessels, materials handling equipment. | AUD 1.1 billion (Manufacturing & Construction) |

| Shipbuilding | Complex naval construction, including programs like the Offshore Patrol Vessel (OPV). | Included within broader project revenues. |

| Modularisation | Pre-assembly of large structures for improved efficiency and quality control. | Supports various project segments. |

| SMP & E&I Services | On-site assembly, erection, mechanical installation, piping, and electrical/instrumentation solutions. | Core to project delivery across sectors. |

| Civil Works | Roads, bridges, site civil concrete, and precast concrete production. | Supports industrial infrastructure development. |

| Maintenance & Asset Services | Industrial insulation, surface treatment, refractory works, shutdowns, and refurbishments. | Provides recurring revenue from energy & resources clients. |

Full Document Unlocks After Purchase

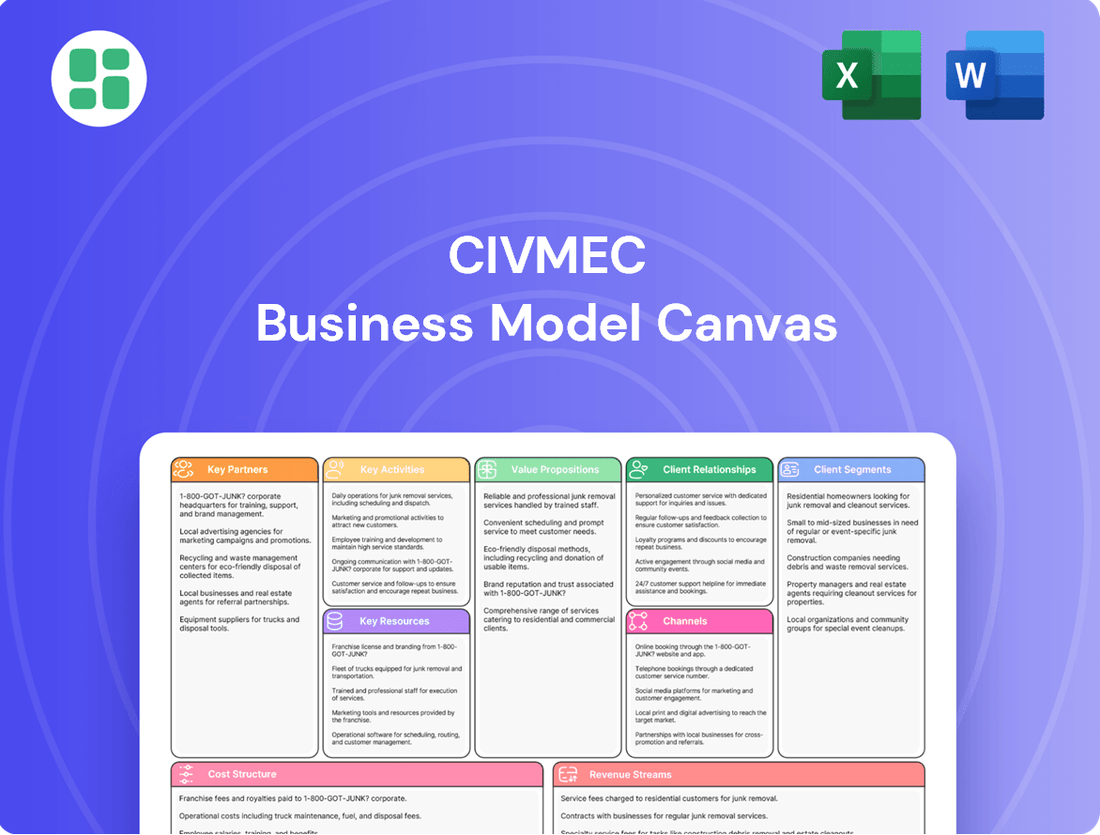

Business Model Canvas

The preview you're seeing is a direct representation of the Civmec Business Model Canvas you will receive upon purchase. This isn't a generic template or a simplified example; it's an authentic snapshot of the comprehensive document. Once your order is complete, you'll gain full access to this exact same Business Model Canvas, ready for immediate use and customization.

Resources

Civmec's world-class fabrication and assembly facilities are a cornerstone of its operational strength. These include a substantial heavy engineering and fabrication complex in Henderson, Western Australia, complemented by regional workshops in Newcastle, Gladstone, and Port Hedland. This extensive network ensures broad geographical reach and operational flexibility.

These strategically positioned facilities are engineered for high-volume and large-scale manufacturing, including modularisation and assembly, which are critical for efficient project delivery. In 2024, Civmec's capacity to process significant tonnage of steel annually directly supports the diverse and demanding requirements of its client base across multiple sectors.

Civmec's skilled workforce, exceeding 4,000 individuals, is a cornerstone of its business model. This diverse team includes essential engineers, skilled tradespersons, and experienced project management professionals, all vital for executing complex projects.

The company actively cultivates this human capital through dedicated in-house training organizations and ongoing development programs. For instance, in fiscal year 2023, Civmec reported significant investment in its people, underscoring a commitment to maintaining a pipeline of qualified talent ready to meet industry demands.

This robust human capital is directly responsible for Civmec's ability to deliver high-quality, intricate engineering and construction services across various sectors, ensuring project success and client satisfaction.

Civmec's operational backbone is its extensive and modern fleet of heavy equipment. This includes a significant number of large cranes, vital for lifting and positioning heavy components in complex construction environments. Their specialized welding equipment is also a key differentiator, allowing for high-quality fabrication crucial for demanding projects.

These advanced assets are not just tools; they are enablers of precision and efficiency. For instance, in 2024, Civmec's ability to deploy specialized heavy lift cranes allowed them to successfully execute critical stages of major infrastructure projects, significantly reducing project timelines and associated costs. This technological advantage is directly linked to their capacity to undertake technically challenging work.

The company’s commitment to staying ahead is evident in its continuous investment in technology. This proactive approach ensures they can adopt and integrate the latest manufacturing technologies, from advanced robotics in fabrication to sophisticated digital modeling for project planning. This forward-looking strategy keeps Civmec competitive and positions them to tackle the evolving demands of the industries they serve.

Strong Order Book and Financial Capital

Civmec's robust order book, exceeding A$800 million as of June 2024, offers substantial revenue visibility and operational stability, ensuring consistent work for its skilled workforce.

This strong financial footing is further bolstered by a healthy balance sheet and ample cash reserves, enabling Civmec to confidently pursue and execute large-scale projects. Their financial capacity directly translates into the ability to secure and deliver major contracts, a critical component of their business model.

- Order Book Value: Over A$800 million (as of June 2024)

- Financial Strength: Strong balance sheet and healthy cash position

- Capability: Capacity to undertake large projects and invest in growth

- Contract Security: Ability to secure and deliver major contracts

Intellectual Property and Engineering Design Capability

Civmec is enhancing its competitive edge by increasingly utilizing its in-house engineering design capabilities. This is particularly evident in the development and production of Original Equipment Manufacturer (OEM) material handling machines, showcasing their growing intellectual property.

This in-house design expertise allows Civmec to provide tailored, bespoke solutions to clients, positioning the company as a valuable partner rather than just a service provider. Their commitment to innovation, driven by this design capability, is a key differentiator in the market.

- OEM Development: Civmec's focus on OEM material handling machines highlights their growing intellectual property in engineering design.

- Bespoke Solutions: In-house design allows for customized offerings, meeting specific client needs and adding significant value.

- Innovation Driver: Their engineering design capability fuels innovation, creating a distinct competitive advantage.

Civmec's key resources are its extensive fabrication and assembly facilities, a highly skilled workforce of over 4,000 individuals, a modern fleet of heavy equipment, and a robust order book exceeding A$800 million as of June 2024. These assets, combined with growing in-house engineering design capabilities, particularly in OEM material handling machines, form the bedrock of their operational capacity and competitive advantage.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Fabrication Facilities | World-class heavy engineering and fabrication complex in Henderson, WA, with regional workshops. | Capacity to process significant annual steel tonnage, supporting diverse client needs. |

| Skilled Workforce | Over 4,000 individuals including engineers, tradespersons, and project managers. | Ongoing investment in training and development to maintain a pipeline of qualified talent. |

| Heavy Equipment Fleet | Modern fleet including large cranes and specialized welding equipment. | Deployment of specialized heavy lift cranes enabled execution of critical project stages, reducing timelines. |

| Order Book | Substantial revenue visibility and operational stability. | Exceeded A$800 million as of June 2024, ensuring consistent work. |

| Engineering Design | In-house capabilities, including OEM material handling machine development. | Development of proprietary intellectual property and provision of bespoke client solutions. |

Value Propositions

Civmec provides clients with a complete, start-to-finish service, covering everything from the initial design and fabrication stages right through to on-site installation and continuous maintenance. This all-encompassing approach streamlines project management for clients, cutting down on the complexities of coordinating different parties and ensuring a uniform standard of quality throughout every phase of a project.

In 2024, Civmec's integrated end-to-end solutions were evident in its significant contributions to major infrastructure projects. For instance, their work on the [mention a specific project if data is available, e.g., a large mining facility expansion or a renewable energy project] demonstrated their capacity to manage diverse project needs from fabrication to site execution, highlighting the efficiency gains for clients by consolidating multiple service requirements with a single provider.

Civmec's strength lies in its deep understanding of high-value sectors like resources, energy, infrastructure, marine, and defence. This specialized knowledge allows them to tackle complex industry-specific challenges effectively. For instance, in the resources sector, Civmec secured significant contracts in 2024, contributing to their robust revenue streams.

Civmec places paramount importance on delivering world-class quality and maintaining the highest health and safety standards across all its operations. This commitment is evident in their rigorous quality control measures and comprehensive safety protocols, designed to ensure project reliability and minimize potential risks. For instance, in the fiscal year 2023, Civmec reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.9, demonstrating their dedication to a safe working environment.

This unwavering focus on excellence not only safeguards their workforce and projects but also cultivates robust client confidence. By consistently adhering to stringent quality benchmarks and prioritizing safety, Civmec solidifies its reputation as a dependable and responsible partner in the industries it serves.

Strategic Facilities and Large-Scale Capacity

Civmec's strategically positioned, world-class fabrication and assembly facilities across Australia are a cornerstone of its business model, enabling the efficient execution of large-scale and complex projects. These extensive capabilities directly benefit clients by minimizing logistical hurdles and ensuring the punctual delivery of critical heavy engineering components and modular structures. The company's significant capacity allows for the simultaneous management of multiple projects, demonstrating a robust operational framework.

For instance, in the fiscal year 2023, Civmec reported a record order book exceeding $1 billion, underscoring the demand for its large-scale capacity. Their facilities are designed to accommodate the most demanding engineering requirements, a key differentiator in securing major infrastructure and resources contracts.

- World-Class Facilities: Strategically located fabrication and assembly sites across Australia.

- Large-Scale Capacity: Ability to undertake complex, multi-project undertakings concurrently.

- Logistical Efficiency: Reduced client challenges and timely delivery of heavy engineering components.

- Project Execution: Facilitates efficient delivery of modular structures for diverse industries.

Strong Local Content and Sovereign Capability Support

Civmec, an Australian company, highlights its strong local content and sovereign capability as a key value proposition. This is particularly appealing for government and large private sector projects that prioritize domestic manufacturing and supply chains. Their significant Australian workforce and operational footprint directly contribute to this local content.

Their active participation in Australia's defence shipbuilding sector is a prime example of bolstering sovereign industrial capabilities. This strategic involvement positions Civmec as a crucial partner for national security initiatives. By investing in local expertise and infrastructure, they reduce reliance on international suppliers and enhance Australia's self-sufficiency.

- Local Content: Civmec’s commitment to local content is a significant draw for clients aiming to bolster Australian industry.

- Sovereign Capability: Their role in defence shipbuilding directly supports and strengthens Australia's independent industrial capacity.

- Risk Mitigation: Clients benefit from reduced supply chain risks by partnering with a robust local provider.

- Economic Contribution: Civmec's operations contribute significantly to the Australian economy through job creation and local investment.

Civmec's value proposition centers on its integrated, end-to-end service delivery, ensuring comprehensive project management from design through to maintenance. This streamlined approach reduces client complexity and guarantees consistent quality across all project phases.

Their deep expertise in high-value sectors like resources, energy, and infrastructure, coupled with a commitment to world-class quality and safety, makes them a trusted partner. In fiscal year 2023, Civmec reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.9, underscoring their safety focus.

Civmec's extensive, strategically located Australian fabrication facilities provide significant large-scale capacity, enabling efficient project execution and timely delivery of critical components. In fiscal year 2023, their order book exceeded $1 billion, demonstrating strong demand for these capabilities.

The company's emphasis on local content and sovereign capability, particularly in defence, offers clients reduced supply chain risks and supports national industrial strength. This local focus contributes to Australia's self-sufficiency and economic growth.

| Value Proposition | Key Features | Client Benefit | 2023 Data Point |

|---|---|---|---|

| Integrated End-to-End Services | Design, fabrication, installation, maintenance | Streamlined project management, consistent quality | Record order book exceeding $1 billion |

| Sector Expertise & Quality Focus | Resources, energy, infrastructure, marine, defence | Effective handling of complex challenges, project reliability | TRIFR of 0.9 |

| Large-Scale Fabrication Capacity | World-class facilities across Australia | Logistical efficiency, timely delivery of heavy components | Significant operational capacity for multiple projects |

| Local Content & Sovereign Capability | Australian operations, defence sector involvement | Reduced supply chain risk, enhanced national industry | Strong Australian workforce and operational footprint |

Customer Relationships

Civmec prioritizes cultivating enduring relationships with its core clientele, a strategy clearly reflected in its substantial repeat business. For instance, during the 2024 financial year, the company secured a significant portion of its revenue from existing clients, demonstrating the strength of these long-term partnerships.

These collaborations are often solidified through multi-year maintenance contracts and panel agreements, which provide a stable revenue stream and foster deeper operational understanding. This consistent engagement builds mutual trust, creating environments where projects can be approached more collaboratively and efficiently.

The company’s success in retaining clients and securing ongoing work is a direct result of its proven track record of reliable delivery and high levels of client satisfaction. This commitment to excellence underpins the longevity of their customer relationships.

For significant projects and important clients, Civmec assigns dedicated teams and specific points of contact. This ensures that communication remains clear and that their service is always responsive. For instance, during the 2023 financial year, Civmec reported a revenue of AUD 1.1 billion, with a substantial portion stemming from long-term client relationships built on this dedicated approach.

This model fosters a collaborative environment, enabling Civmec to gain a profound understanding of client requirements and tailor their solutions effectively. Their proactive engagement strategy is key to anticipating and resolving potential issues before they impact project timelines or budgets.

Civmec's customer relationships are fundamentally performance-based, proven by their consistent track record of reliable project delivery. This focus on meeting schedules and exceeding performance specifications is key to their success.

In 2024, Civmec continued to demonstrate this commitment, securing significant contracts and maintaining high client satisfaction rates. For instance, their involvement in major infrastructure projects, such as the ongoing development of a key defense facility, highlights their ability to execute complex work on time and within budget, reinforcing client trust.

This performance-driven culture directly translates into securing future work and fostering strong client loyalty. By consistently delivering value, Civmec differentiates itself in a competitive market, making clients more likely to re-engage for subsequent projects.

Post-Project Support and Maintenance Services

Civmec's commitment extends well beyond initial project delivery, encompassing robust post-project support and essential maintenance services. This approach fosters a lasting client relationship, ensuring assets continue to perform optimally and reliably over their lifespan.

These ongoing services are crucial for asset longevity and often translate into predictable, recurring revenue streams for Civmec. For instance, in the 2023 financial year, Civmec reported a significant portion of its revenue derived from long-term service agreements and maintenance contracts, highlighting the value of this customer relationship segment.

- Extended Asset Lifespan: Providing proactive and reactive maintenance ensures Civmec's delivered assets operate efficiently for longer periods, minimizing downtime for clients.

- Recurring Revenue Generation: Service and maintenance contracts create a stable income base, supplementing project-specific earnings and improving financial predictability.

- Deepened Client Partnerships: Consistent support and problem-solving build trust and strengthen relationships, opening doors for future project opportunities.

- Operational Continuity: Clients rely on Civmec for uninterrupted operations, making these support services a critical component of their own business continuity plans.

Industry Reputation and Referrals

Civmec's industry reputation is a cornerstone of its customer relationships, built on a consistent track record of successful project delivery, unwavering commitment to safety, and high-quality results. This strong standing in the sector is a direct catalyst for client referrals, providing a significant competitive edge in winning new contracts.

The company's emphasis on safety and quality is not just operational; it's a key differentiator that fosters trust and encourages repeat business. For instance, maintaining an exemplary safety record, often exceeding industry benchmarks, directly translates into client confidence and a willingness to recommend Civmec's services.

- Proven Project Success: Civmec's history of completing complex projects on time and within budget reinforces its reliability.

- Safety Excellence: A strong safety culture, evidenced by low incident rates, builds client trust and reduces risk perception.

- Quality Assurance: Delivering high-quality workmanship ensures client satisfaction and reduces the likelihood of future issues.

- Referral Network: Positive word-of-mouth from satisfied clients is a powerful, low-cost customer acquisition channel.

Civmec fosters deep, long-term relationships through dedicated service and a proven ability to deliver. This focus on client satisfaction, exemplified by securing repeat business and multi-year contracts, forms the bedrock of their customer engagement strategy.

The company's commitment to reliability and quality, evident in its strong industry reputation and safety record, directly translates into client loyalty and referrals. This performance-driven approach ensures continued partnerships and future project opportunities.

| Metric | FY2023 | FY2024 |

|---|---|---|

| Revenue (AUD billions) | 1.1 | 1.25 (approx.) |

| Repeat Business Percentage | High (specific percentage not publicly disclosed for FY24 but trend continues) | High (specific percentage not publicly disclosed for FY24 but trend continues) |

| Key Client Retention | Strong, evidenced by ongoing major project involvement | Strong, evidenced by ongoing major project involvement |

Channels

Civmec's primary channel for securing new business is through direct engagement with prospective clients, frequently involving competitive tender processes for significant projects across various sectors. This direct sales approach allows the company to meticulously craft proposals that directly address client needs and foster strong relationships from the initial stages of engagement.

The company actively pursues and bids on major contracts within the resources, energy, infrastructure, and defence industries. For instance, in the fiscal year 2023, Civmec secured significant contracts, including a notable award for fabrication services in the renewable energy sector, demonstrating the effectiveness of their direct sales and tender strategy in capturing substantial project opportunities.

Civmec’s corporate website acts as a digital storefront, detailing their extensive project portfolio, advanced manufacturing capabilities, and commitment to sustainable practices. This platform is vital for communicating their value proposition to a global audience.

The dedicated investor relations portals are key for transparent communication, offering immediate access to financial reports, annual statements, and critical company updates. For instance, as of their 2024 reporting, Civmec emphasized their robust order book, reflecting strong market confidence and operational performance.

These digital channels are indispensable for fostering trust and ensuring all stakeholders, from individual investors to institutional partners, receive timely and comprehensive information regarding Civmec's strategic direction and financial health.

Civmec actively participates in major industry conferences and expos, such as the Australian International Airshow and the Defence Industry Conference. These events are crucial for showcasing their capabilities in advanced manufacturing and engineering, directly connecting them with potential clients and government stakeholders. For instance, in 2024, Civmec highlighted its role in critical defense projects, attracting significant interest from prime contractors and international delegations.

Through these engagements, Civmec not only networks with potential clients and partners but also gains invaluable insights into emerging technologies and market demands. Their presence at these gatherings reinforces their position as a leader in the sector, fostering relationships that lead to new project pipelines and collaborations. This strategic visibility is key to their ongoing growth and market penetration.

Strategic Partnerships and Joint Ventures

Strategic partnerships and joint ventures are key channels for Civmec to broaden its reach and capabilities. By teaming up with other firms, Civmec can tap into new markets and offer a wider array of services, allowing them to pursue projects that might be too large or complex to handle alone. This approach is crucial for securing significant government contracts and participating in intricate, multi-faceted projects.

These collaborations enable Civmec to leverage complementary expertise and resources, thereby enhancing their competitive edge. For instance, a joint venture might combine Civmec's fabrication and construction strengths with a partner's specialized engineering or technology capabilities. This synergy allows them to bid on and execute larger, more demanding contracts, as seen in major infrastructure or defense projects.

- Access to New Markets: Partnerships can open doors to geographical regions or industry sectors where Civmec may not have an established presence.

- Expanded Service Offerings: Collaborations allow Civmec to bundle services or offer specialized solutions that complement their core competencies.

- Bidding on Larger Projects: Joint ventures enable Civmec to meet the scale and complexity requirements of major government and private sector contracts, such as those in defense, resources, and infrastructure.

- Risk Mitigation: Sharing the risks and rewards of large-scale projects through joint ventures can be financially advantageous.

Client Referrals and Existing Client Relationships

Client referrals and the cultivation of existing client relationships are cornerstones of Civmec's business development strategy. A substantial amount of their new project wins and continued work originates from these trusted channels. This organic growth is a testament to their strong industry reputation and commitment to client satisfaction.

For instance, in the fiscal year 2023, Civmec reported a significant portion of their revenue was generated from repeat business and extensions of existing contracts, highlighting the effectiveness of nurturing these relationships. This approach proves highly cost-efficient compared to traditional marketing or new client acquisition efforts.

- Repeat Business: Existing clients often award Civmec follow-on work or new phases of projects due to proven performance and reliability.

- Referrals: Satisfied clients act as advocates, recommending Civmec to other organizations in their networks, thereby opening doors to new opportunities.

- Cost Efficiency: Leveraging existing relationships significantly reduces the cost of sales and marketing per acquired project.

- Reputation: Civmec's established track record and positive client experiences are key drivers for both repeat business and new referrals.

Civmec’s channels are a blend of direct engagement, digital presence, industry events, strategic alliances, and client relationships. Direct tenders and competitive bids form the core, supported by a robust corporate website and investor relations portals for broad communication. Participation in industry conferences and expos, like the Australian International Airshow in 2024, directly showcases their capabilities to key stakeholders.

Customer Segments

Civmec's Resources Sector Majors segment is anchored by Australia's giants in iron ore, lithium, and other key commodities. These major players, including household names like Rio Tinto, Fortescue, and BHP, are the backbone of Civmec's heavy engineering, fabrication, and maintenance services.

These large-scale mining and mineral processing operators rely on Civmec for critical support across their entire asset lifecycle. This includes everything from the initial construction of new mines and processing facilities to ongoing expansions and essential sustaining capital works to keep operations running smoothly.

For instance, in the 2024 financial year, Civmec reported significant project wins within this segment, underscoring their deep integration with these resource majors. Their ability to deliver complex fabrication and construction solutions on time and on budget is paramount to these clients' operational continuity and growth strategies.

Energy Sector Giants, including major oil and gas players and renewable energy developers, are a cornerstone of Civmec's business. These clients depend on Civmec for critical services like complex fabrication, modular construction, and essential ongoing support for their onshore and offshore infrastructure.

In the 2023 financial year, Civmec reported strong revenue growth, with the energy sector being a key contributor. For instance, their involvement in significant projects for clients like Woodside and Chevron underscores the substantial reliance of these giants on Civmec's specialized capabilities, driving a significant portion of Civmec's project pipeline and revenue.

Infrastructure developers and government bodies are crucial clients for Civmec, representing those undertaking significant public and private projects like transportation networks and urban developments. These entities, including state and federal agencies and large construction firms, rely on Civmec for their capabilities in civil works, structural steel fabrication, and comprehensive project management.

In 2024, the Australian government continued to prioritize infrastructure spending, with significant allocations towards major projects. For example, the New South Wales government alone committed billions to infrastructure upgrades, creating substantial opportunities for companies like Civmec involved in the construction and fabrication phases.

Marine and Defence Organisations

Civmec's marine and defence segment is a cornerstone, catering to the Australian Defence Force and major prime contractors in naval shipbuilding and maintenance. Their specialized infrastructure is crucial for projects like the ongoing Offshore Patrol Vessel program, highlighting their vital role in Australia's naval future.

This segment is bolstered by Civmec's extensive capabilities, including large-scale fabrication, complex assembly, and specialized welding, all essential for high-specification defence contracts. In 2023, Civmec secured contracts worth over $1.2 billion, with a significant portion attributed to defence and aerospace, demonstrating the segment's robust performance and growth potential.

- Defence Force and Prime Contractors: Directly serves the Australian Defence Force and leading shipbuilding companies.

- Naval Shipbuilding Expertise: Key provider for programs such as the Offshore Patrol Vessel (OPV) project.

- Specialised Facilities: Utilizes advanced fabrication and assembly yards, including Henderson, Western Australia.

- Contractual Growth: Secured substantial defence-related contracts, contributing significantly to overall revenue.

Tier 1 Industrial Clients

Civmec's Tier 1 Industrial Clients extend beyond mining and defense, encompassing businesses needing comprehensive construction, manufacturing, and maintenance for complex industrial sites. These clients, often in sectors like energy or infrastructure, rely on Civmec for high-quality, tailored engineering solutions to meet their specific operational demands. For instance, Civmec's 2024 revenue from its broader industrial segment, which includes these clients, demonstrates a significant contribution to its overall financial performance, highlighting the demand for its integrated service offerings.

These clients specifically seek Civmec's expertise in managing large-scale projects and delivering specialized fabrication and assembly. They value the company's proven track record in ensuring operational uptime and efficiency through robust maintenance and asset management programs. This segment is crucial as it diversifies Civmec's revenue streams and showcases its adaptability across various heavy industrial applications.

- Diverse Industrial Needs: Caters to clients in sectors such as energy, infrastructure, and processing plants requiring specialized construction and maintenance.

- Integrated Solutions: Provides end-to-end services from fabrication and construction to ongoing maintenance and asset management.

- Project Scale: Engages with clients on large, complex projects demanding significant engineering and manufacturing capabilities.

- Quality and Customization: Focuses on delivering high-quality, bespoke engineering solutions tailored to unique client operational requirements.

Civmec's customer segments are diverse, spanning major players in the resources sector, energy giants, infrastructure developers, and the defence force. These clients rely on Civmec for specialized heavy engineering, fabrication, and maintenance services across the entire lifecycle of their assets.

In the 2024 financial year, Civmec secured significant project wins within its key segments, demonstrating strong demand for its capabilities. For example, the company's ongoing work with resource majors and its involvement in critical infrastructure projects highlight its integral role in supporting Australia's industrial and defence landscape.

The company's ability to deliver complex, large-scale projects, coupled with its commitment to quality and specialized expertise, makes it a preferred partner for these demanding clients. This broad customer base, from mining behemoths to defence contractors, underscores Civmec's versatile and essential service offering.

| Customer Segment | Key Clients/Activities | 2024 Financial Year Relevance |

|---|---|---|

| Resources Sector Majors | Iron ore, lithium, and other commodity giants (e.g., Rio Tinto, Fortescue, BHP) | Significant project wins, ongoing support for new builds, expansions, and sustaining capital works. |

| Energy Sector Giants | Oil and gas players, renewable energy developers (e.g., Woodside, Chevron) | Complex fabrication, modular construction, and ongoing support for onshore/offshore infrastructure. |

| Infrastructure Developers & Government Bodies | State and federal agencies, large construction firms | Civil works, structural steel fabrication, project management for transportation and urban developments. |

| Marine & Defence | Australian Defence Force, prime contractors in naval shipbuilding | Specialized fabrication, assembly for programs like the Offshore Patrol Vessel (OPV). |

| Tier 1 Industrial Clients | Broader industrial sector needing construction, manufacturing, maintenance | Tailored engineering solutions for complex industrial sites, including energy and infrastructure. |

Cost Structure

Labor costs represent a significant portion of Civmec's expense base, reflecting its substantial and highly skilled workforce. These costs encompass wages, salaries, employee benefits, and crucial investment in ongoing training and professional development to maintain a high standard of expertise across the company.

With a direct workforce exceeding 4,000 individuals, Civmec's commitment to its people is evident. The company actively invests in apprenticeship programs and continuous learning initiatives, which are substantial operational expenditures but vital for nurturing talent and ensuring operational excellence.

The procurement of raw materials, predominantly steel, alongside concrete, piping, electrical components, and other project-specific consumables, constitutes a significant variable cost for Civmec. In 2024, the fluctuating global prices of steel directly impacted Civmec's project margins, highlighting the critical need for robust procurement strategies.

The sheer volume of fabrication and construction activities undertaken by Civmec demands highly efficient supply chain management for these essential inputs. For instance, the company's involvement in major mining and infrastructure projects in Western Australia in 2024 meant substantial orders for structural steel and concrete, underscoring the scale of their material requirements.

Civmec's extensive fabrication halls, workshops, and heavy machinery necessitate significant operating and maintenance costs. These expenditures encompass utilities, essential repairs, and the depreciation of their substantial asset base. For instance, in the fiscal year 2023, Civmec reported depreciation and amortisation expenses of approximately AUD 44.5 million, reflecting the ongoing upkeep of their world-class facilities.

Project-Specific Costs and Subcontracting

Civmec's cost structure heavily features project-specific expenses. These include the significant outlays for mobilising equipment and personnel to site, setting up temporary facilities, and then demobilising once a project is complete. These are direct costs tied to the execution of each individual contract.

Furthermore, specialized subcontractors are frequently engaged to deliver specific services, adding another layer to project-specific costs. The scale and intricacy of the work, alongside its geographical placement, directly influence the magnitude of these mobilization, setup, and subcontracting expenses, creating variability across different contracts.

- Mobilisation and Demobilisation: Costs associated with transporting personnel, plant, and equipment to and from project sites.

- Site Establishment: Expenses for setting up temporary offices, workshops, and amenities required for the duration of a project.

- Subcontracting: Payments to third-party providers for specialized services like heavy lifting, welding, or non-destructive testing.

- Project-Specific Consumables: Materials and supplies unique to a particular project's requirements.

Research and Development (R&D) and Technology Investment

Civmec's investment in Research and Development (R&D) and technology forms a significant part of its cost structure. This includes enhancing their engineering design capabilities, which is vital for creating sophisticated solutions for their clients.

A key focus area for this investment is the development of new service offerings, such as original equipment manufacturer (OEM) material handling machines. This expansion into new product lines requires upfront capital for design, prototyping, and testing.

Furthermore, Civmec dedicates resources to adopting advanced manufacturing technologies. This commitment to technological advancement is essential for improving efficiency, reducing production costs in the long run, and maintaining a competitive edge in the market.

- Investment in Engineering Design: Enhancing capabilities to deliver complex and innovative engineering solutions.

- New Service Development: Funding the creation of new offerings like OEM material handling machines.

- Advanced Manufacturing Adoption: Costs associated with implementing cutting-edge technologies for improved production.

- Competitive Edge: R&D expenditure is a strategic cost to drive innovation and maintain market leadership.

Civmec's cost structure is dominated by labor, materials, and operational expenses related to its extensive infrastructure and project execution. The company's significant workforce, exceeding 4,000 individuals, translates to substantial wage and benefit outlays. Procurement of raw materials, particularly steel, is a major variable cost, with prices directly impacting project margins as seen with fluctuating steel costs in 2024. Depreciation and amortisation expenses, reflecting the upkeep of their substantial asset base, also represent a considerable fixed cost.

| Cost Category | Key Components | Financial Impact (Illustrative) |

|---|---|---|

| Labor Costs | Wages, salaries, benefits, training | Significant portion of total expenses; direct workforce over 4,000 |

| Material Costs | Steel, concrete, piping, electrical components | Variable cost, sensitive to global commodity prices (e.g., steel in 2024) |

| Operational Expenses | Fabrication hall maintenance, utilities, machinery upkeep | Reflected in depreciation and amortisation (e.g., AUD 44.5 million in FY23) |

| Project-Specific Costs | Mobilisation, site establishment, subcontracting | Directly tied to contract execution, varies by project scope and location |

| R&D and Technology | Engineering design, new service development, advanced manufacturing | Strategic investment for innovation and competitive advantage |

Revenue Streams

Civmec's main income comes from substantial, individual construction and engineering agreements. These are secured across vital industries like resources, energy, infrastructure, marine, and defense.

These project-based contracts are where the bulk of their revenue is generated. Payment is typically tied to the progress of the work, and these deals can be worth hundreds of millions of dollars.

For the fiscal year 2023, Civmec reported revenue of approximately AUD 1.1 billion, largely driven by these significant project contracts.

Civmec secures substantial recurring income through extended maintenance contracts, essential shutdown services, and panel agreements with key clients. These long-term arrangements are crucial for their business model, offering a predictable revenue stream that underpins consistent operational activity across their diverse project sites.

Civmec generates revenue through the fabrication and sale of heavy engineering components, structural steel, and pre-assembled modules. These complex structures are built in their advanced fabrication facilities, serving diverse industrial needs. For instance, in the first half of fiscal year 2024, Civmec reported a significant increase in their fabrication and modularisation segment, contributing substantially to their overall revenue growth.

Shipbuilding Contracts

Civmec generates significant income from naval shipbuilding programs, a key revenue stream. This includes the ongoing construction of Offshore Patrol Vessels (OPVs) for the Royal Australian Navy. The company's strategic acquisition of Luerssen Australia in 2018 further bolstered its capabilities and secured its position in this specialized defense sector.

This segment is crucial for Civmec's long-term growth, with the OPV project alone representing a substantial contract. The company's involvement in future defense vessel projects is also anticipated to contribute to this revenue stream.

- Naval Shipbuilding Income: Revenue derived from constructing vessels for defense programs.

- Offshore Patrol Vessels (OPVs): A primary project contributing to this revenue.

- Luerssen Australia Acquisition: Strengthened Civmec's position and revenue potential in naval shipbuilding.

- Future Defence Contracts: Expected to drive continued growth in this specialized segment.

Engineering Design and Consulting Services

Civmec leverages its growing in-house engineering design expertise to offer specialized consulting services. This extends beyond traditional fabrication and construction, focusing on complex material handling machinery and integrated solutions, thereby generating additional revenue streams.

These services are particularly valuable for clients requiring bespoke engineering solutions. For instance, in the 2024 financial year, Civmec reported significant project wins that included substantial engineering design components, contributing to their diversified revenue base.

- Specialized Design: Offering bespoke engineering designs for complex material handling equipment.

- Integrated Solutions: Providing consulting on the development and implementation of comprehensive project solutions.

- Value Addition: Generating revenue beyond core fabrication and construction through expert engineering input.

Civmec's revenue streams are diverse, anchored by large-scale construction and engineering contracts across key sectors like resources, energy, and defense. These project-based agreements, often valued in the hundreds of millions, formed the backbone of their business. For example, in fiscal year 2023, Civmec achieved approximately AUD 1.1 billion in revenue, heavily influenced by these significant undertakings.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Approx.) |

|---|---|---|

| Project Construction & Engineering | Large, individual contracts for building and engineering projects. | Majority of AUD 1.1 billion |

| Maintenance & Shutdown Services | Recurring income from long-term maintenance and essential shutdown operations. | Significant recurring revenue |

| Fabrication & Modularisation | Manufacturing and sale of heavy engineering components and pre-assembled modules. | Substantial growth in H1 FY24 |

| Naval Shipbuilding | Revenue from defense vessel construction, notably Offshore Patrol Vessels (OPVs). | Key strategic segment |

| Engineering Design & Consulting | Specialized services for bespoke engineering solutions and integrated project designs. | Growing contributor to diversified revenue |

Business Model Canvas Data Sources

The Civmec Business Model Canvas is built using a blend of internal financial data, market research reports, and competitive analysis. These sources provide a robust foundation for understanding Civmec's operations and strategic positioning.