Civmec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civmec Bundle

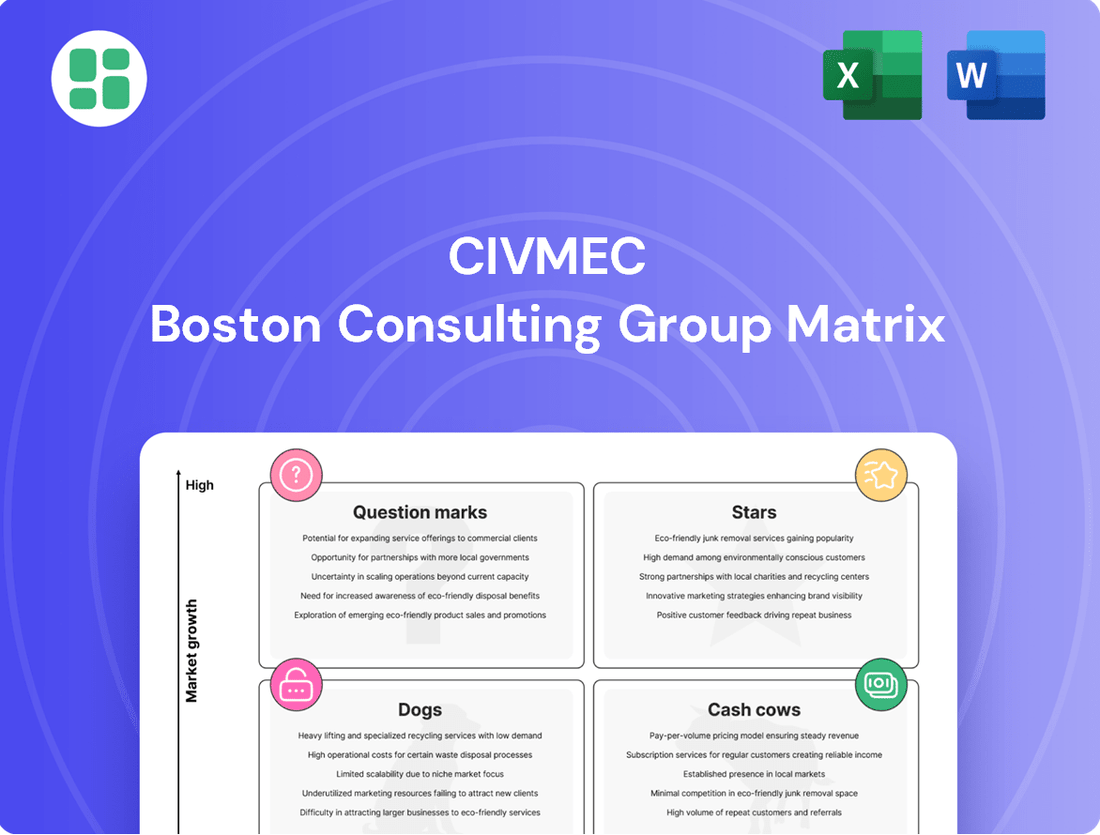

Unlock the strategic potential of Civmec's product portfolio with our comprehensive BCG Matrix analysis. Understand at a glance which offerings are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs).

This preview offers a glimpse into the critical positioning of Civmec's products. To truly grasp the strategic implications and make informed decisions about resource allocation and future investments, dive into the full BCG Matrix report. It provides the detailed insights and actionable recommendations you need to navigate the competitive landscape effectively.

Don't miss out on the complete picture. Purchase the full BCG Matrix for Civmec and gain a clear, data-driven roadmap to optimize your business strategy and capitalize on market opportunities.

Stars

Civmec's Defence and Naval Shipbuilding segment is a clear Star in its BCG matrix, reflecting its robust growth and strong market position. The acquisition of Luerssen Australia in July 2025 significantly bolsters Civmec's capabilities, integrating the Offshore Patrol Vessel (OPV) program (SEA1180) and solidifying its role in a sector fueled by substantial government investment, including the Australian Marine Complex and the AUKUS security pact.

This strategic move, coupled with Civmec's re-domicile to Australia, positions the company favorably to capitalize on local content requirements for upcoming naval projects such as landing craft and frigates. While this segment demands significant cash for ongoing investment, its future growth prospects and potential for strong returns are substantial, making it a key driver of Civmec's overall strategy.

Civmec's new OEM balanced machines and materials handling service is a burgeoning Star, capitalizing on its comprehensive in-house capabilities within Australia. This segment is poised for growth, targeting an estimated A$2.8 billion market for new and refurbishment projects over the coming decade.

The company's recent success securing contracts for major shiploaders, including those for Port Waratah Coal Services, highlights robust market acceptance. These wins underscore the potential for Civmec to establish a strong foothold in this specialized and expanding niche.

Civmec's significant involvement in large-scale infrastructure projects, such as complex bridge construction and the Perth Sporting and Entertainment Precinct, firmly places this segment in the Star category of the BCG Matrix. The company's B4 accreditation for bridge building, the highest tier, highlights its capability for high-quality execution and opens doors to lucrative opportunities within a sector projected to reach A$145.2 billion between 2025 and 2028.

Energy Sector Projects

The energy sector is a significant growth driver for Civmec. The company anticipates its revenue in this area to double in fiscal year 2025. There are substantial opportunities, estimated at A$43.5 billion, expected between 2025 and 2028.

Civmec has cultivated robust relationships with key players in the energy industry, including Chevron, Woodside, and Saipem. These partnerships ensure continuous engagement in maintenance, manufacturing, and crucial project deliveries.

The company’s specialized capabilities in subsea projects, alongside its extensive experience in major manufacturing and maintenance services, are well-aligned to leverage the current positive momentum in the energy market.

- Projected FY25 Revenue Growth: Doubling of energy sector revenue.

- Market Opportunity: A$43.5 billion in opportunities from 2025-2028.

- Key Client Relationships: Chevron, Woodside, Saipem.

- Core Competencies: Subsea projects, major manufacturing, and maintenance services.

Advanced Modularisation Capabilities

Civmec's advanced modularisation capabilities are a true standout, positioning the company as a leader in delivering large and complex structures. Its world-class facilities, such as the Henderson assembly hall, are instrumental in achieving this. These capabilities translate into substantial benefits in safety, cost-effectiveness, and schedule adherence, as evidenced by industry accolades for projects like the Shiploader and Berth Replacement (SABR) Project.

The increasing demand for off-site fabrication and modular assembly across the resources, energy, and defence sectors plays directly into Civmec's strengths. This trend is not just a passing phase; it represents a significant shift in how large-scale projects are executed. Civmec's established expertise and infrastructure in modularisation allow it to capture a substantial market share within this expanding area.

- World-class facilities: The Henderson assembly hall is a prime example of Civmec's investment in advanced infrastructure for modular construction.

- Project recognition: Awards for projects like SABR highlight the successful application and benefits of their modularisation approach.

- Market trend alignment: Civmec is well-positioned to capitalize on the growing industry-wide adoption of off-site fabrication and modular assembly.

- Sectoral demand: Increasing project complexity in resources, energy, and defence fuels the need for Civmec's specialized modularisation services.

Civmec's Defence and Naval Shipbuilding segment is a clear Star, driven by significant government investment and strategic acquisitions like Luerssen Australia in July 2025. This positions Civmec to benefit from programs like the OPV acquisition and the AUKUS security pact, with projected opportunities in naval projects estimated to be substantial.

The company's new OEM balanced machines and materials handling service is also a Star, targeting an estimated A$2.8 billion market for new and refurbishment projects over the next decade. Recent contract wins for major shiploaders demonstrate strong market acceptance and the potential for significant growth in this niche.

Civmec's involvement in large-scale infrastructure, particularly bridge construction where it holds the highest B4 accreditation, firmly places this segment as a Star. The infrastructure sector is projected to reach A$145.2 billion between 2025 and 2028, offering considerable avenues for Civmec's expertise.

The energy sector is another key Star, with Civmec anticipating its revenue to double in fiscal year 2025. With an estimated A$43.5 billion in opportunities expected between 2025 and 2028 and strong relationships with major players like Chevron and Woodside, this segment shows robust growth potential.

| Segment | BCG Category | Key Growth Drivers/Facts |

| Defence and Naval Shipbuilding | Star | Luerssen Australia acquisition (July 2025), OPV program, AUKUS pact, local content requirements for future naval projects. |

| OEM Balanced Machines & Materials Handling | Star | A$2.8 billion market opportunity (next decade), recent shiploader contracts, specialized niche. |

| Infrastructure (Bridge Construction) | Star | B4 accreditation, A$145.2 billion sector projection (2025-2028), complex project execution. |

| Energy | Star | Projected FY25 revenue doubling, A$43.5 billion opportunities (2025-2028), key client relationships (Chevron, Woodside, Saipem), subsea capabilities. |

What is included in the product

Civmec's BCG Matrix offers a strategic overview of its business units, categorizing them by market share and growth to guide investment decisions.

The Civmec BCG Matrix offers a clear, visual representation of business units, simplifying strategic decision-making and alleviating the pain of complex portfolio analysis.

Cash Cows

Civmec's robust maintenance and long-term capital works contracts within the resources sector firmly establish this segment as a Cash Cow. These agreements, including those with major players like Rio Tinto and BHP, generate a predictable and substantial revenue stream, underscoring the company's stable financial footing.

The consistent demand for ongoing operational support and the renewal of key contracts highlight the reliability of this business area. Civmec's efficiency in delivering these services, coupled with its deep-seated client relationships, translates into healthy profit margins and strong cash generation, requiring minimal additional investment for growth or market penetration.

Civmec's heavy engineering fabrication, encompassing structural steel, plate works, and vessel manufacturing, is a prime example of a Cash Cow. These core services are the bedrock of Civmec's integrated operations and consistently sought after across its diverse client base. For the fiscal year ending June 30, 2023, Civmec reported revenue of AUD 1.05 billion, with fabrication services forming a significant portion of this, demonstrating its stable revenue generation capabilities.

This segment benefits from Civmec's substantial facilities and deep-seated expertise, translating into dependable cash flow. Its established market presence and streamlined operational efficiencies mean it requires minimal new investment relative to its cash-generating power. The company's order book, which stood at AUD 1.2 billion as of March 2024, further underscores the ongoing demand for these foundational fabrication services.

Civmec's integrated Structural, Mechanical, Piping (SMP) and Electrical & Instrumentation (E&I) services are a reliable Cash Cow. These offerings are essential for major construction and engineering endeavors across the resources, energy, and infrastructure industries. The company's proven history and existing client relationships guarantee a consistent pipeline of work and strong profitability, driven by efficient operations and a solid market position.

Precast Concrete Manufacturing

Civmec's precast concrete manufacturing segment likely functions as a Cash Cow within its broader business portfolio. This division caters to a mature market, supplying essential construction components both for Civmec's internal projects and a diverse external client base. Its established infrastructure and strong local market penetration ensure a reliable revenue stream, underpinning the company's financial stability without requiring significant reinvestment for expansion.

The precast concrete operations contribute to Civmec's overall efficiency by providing critical building blocks for various construction endeavors. This consistent demand, coupled with existing manufacturing capacity, translates into predictable cash generation. For instance, in the fiscal year 2024, Civmec reported a significant portion of its revenue derived from its construction and infrastructure segment, where precast concrete plays a vital role.

- Stable Revenue Generation: Precast concrete manufacturing provides a steady income stream due to ongoing demand in the construction sector.

- Operational Efficiency: Supports internal projects, reducing reliance on external suppliers and improving project cost control.

- Mature Market Position: Benefits from established market presence and production capabilities, minimizing the need for high growth investments.

- Cash Flow Contribution: Generates consistent cash flow, supporting other business units and overall corporate financial health.

Established Civil Works (Foundational)

Civmec's established civil works, particularly when they are a foundational element in larger, complex projects where the company holds a dominant position, clearly fit the Cash Cow quadrant of the BCG Matrix. These civil works are fundamental to most significant developments. When Civmec bundles these essential services with its robust heavy engineering and fabrication capabilities, it generates a very stable and predictable revenue stream.

While the standalone civil works sector might not experience explosive growth, Civmec's strategic integration of these services into high-value, multifaceted projects guarantees consistent demand. This integration is key to their profitability, requiring minimal additional marketing expenditure to maintain their strong market share in these areas.

- Dominant Position: Civmec often secures leading roles in the foundational civil works for major infrastructure and resource projects.

- Stable Revenue: The essential nature of civil works in large developments ensures consistent project pipelines.

- Integrated Offering: Bundling civil works with heavy engineering and fabrication enhances value and customer stickiness.

- Low Marketing Needs: Established market presence and project integration reduce the need for extensive marketing spend.

Civmec's maintenance services, particularly those under long-term contracts with major resources companies like Rio Tinto and BHP, represent a clear Cash Cow. These agreements provide a predictable and substantial revenue stream, solidifying the company's financial stability. The consistent demand for operational support and contract renewals underscore the reliability of this segment, which generates healthy profits with minimal need for further investment.

| Business Segment | BCG Category | Key Characteristics | Financial Year 2024 Data/Context |

|---|---|---|---|

| Maintenance Services | Cash Cow | Long-term contracts, predictable revenue, stable demand, high profitability, low investment needs. | Significant portion of recurring revenue, supporting stable financial performance. |

| Heavy Engineering Fabrication | Cash Cow | Core services, consistent demand, deep expertise, efficient operations, strong order book. | Order book stood at AUD 1.2 billion as of March 2024, indicating sustained demand. |

| Integrated SMP & E&I | Cash Cow | Essential for major projects, proven track record, existing client relationships, strong market position. | Drives consistent project pipelines and profitability across resources, energy, and infrastructure. |

| Precast Concrete Manufacturing | Cash Cow | Mature market, essential construction components, established infrastructure, reliable revenue. | Contributes significantly to the construction and infrastructure segment revenue. |

| Civil Works (Integrated) | Cash Cow | Foundational to large projects, dominant market position, bundled services, low marketing needs. | Ensures consistent project pipelines when integrated with fabrication and engineering. |

Preview = Final Product

Civmec BCG Matrix

The Civmec BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive upon purchase. This means no watermarks or placeholder content will be present in the final version you download. You can be confident that the strategic insights and professional presentation you see now will be yours to utilize immediately for your business planning needs. This comprehensive BCG Matrix is ready for immediate application, offering clear analysis without any further editing required.

Dogs

Low-margin, standardized civil works represent a segment of the construction market where Civmec might find itself competing primarily on price. These are essentially commoditized services, meaning there's little differentiation between providers, and the focus shifts to who can deliver the lowest cost. For instance, in 2024, the Australian civil construction sector, particularly for basic infrastructure, saw intense price competition, with margins often hovering in the low single digits.

Projects in this category typically offer minimal profit margins, making significant revenue growth or market share expansion challenging. While they might contribute to covering overheads, they often consume valuable resources without building a strong strategic advantage. The market for such standardized civil works is often fragmented and experiences slow growth, limiting the potential for substantial future revenue streams.

One-off minor fabrication jobs represent a segment where Civmec’s extensive capabilities are underutilized. These smaller contracts, often non-recurring, don't fully leverage the company's advanced modularisation expertise or its world-class facilities.

These types of jobs contribute very little to Civmec's overall order book. They rarely serve as a springboard for securing larger, more lucrative projects or developing ongoing business relationships.

Operating within a highly competitive market with low entry barriers, these minor fabrication tasks offer limited potential for significant growth or enhanced profitability for Civmec.

Non-strategic site services without specialization represent a segment of Civmec's operations focused on basic, undifferentiated site support or general labor hire. These services typically do not leverage Civmec's core heavy engineering or specialized technical capabilities.

This category often operates within highly competitive sub-markets, characterized by low market share and limited growth potential. For instance, in 2024, the general labor hire market in Australia, a key operational area for Civmec, saw continued competition with numerous smaller players vying for contracts.

While these services might be retained to nurture existing client relationships, their contribution to Civmec's overall strategic growth or profitability is generally minimal. They are often seen as ancillary to the company's core, higher-value offerings.

Legacy, Low-Value Project Maintenance

Legacy, low-value project maintenance within Civmec's BCG Matrix represents contracts that are minor in scope and lack complexity, such as routine upkeep without significant upgrades or specialized machinery. These engagements often occur in stagnant sub-markets offering minimal growth potential.

Such projects can consume valuable resources, diverting them from more lucrative maintenance opportunities in expanding sectors. For instance, if a company like Civmec, which operates in diverse industrial sectors, dedicates a significant portion of its skilled workforce to these smaller, less impactful contracts, it limits its capacity to pursue larger, more strategic maintenance agreements that could drive future revenue growth. In 2024, a focus on optimizing resource allocation for such legacy contracts is crucial for maintaining operational efficiency and profitability.

- Limited Scope: Contracts are small, with no complex upgrades or specialized equipment.

- Mature Markets: Operations are in sub-markets characterized by low growth and minimal upside.

- Resource Drain: Ties up personnel and equipment that could be used for higher-value work.

- Strategic Misalignment: Does not contribute to building larger, more strategic, or recurring maintenance relationships.

Commodity-Driven Supply Chain Activities (non-integrated)

Commodity-driven supply chain activities, if not tightly integrated with Civmec's core, high-value project delivery, would likely fall into the 'Dogs' quadrant of the BCG Matrix. These operations, such as basic material procurement or standard logistics, are highly sensitive to the volatile prices of raw commodities. For instance, fluctuations in steel prices, a key input for many construction projects, directly impact the cost-effectiveness of these non-integrated activities.

These segments would face intense price competition from numerous suppliers, limiting Civmec's ability to capture significant market share or achieve substantial growth. The strategic value is minimal, as these activities offer little differentiation from competitors. In 2024, global steel prices, for example, experienced considerable volatility, impacting margins for businesses with unhedged commodity exposure.

- Low Market Share: Standardized procurement activities typically attract many players, making it difficult for Civmec to establish a dominant position.

- Low Growth Potential: Without unique integration or proprietary processes, these segments offer limited avenues for expansion or increased profitability.

- Commodity Price Sensitivity: Profitability is directly tied to the unpredictable swings in the market prices of basic materials like metals and components.

- Intense Competition: These activities are often commoditized, meaning competitors can easily replicate services, leading to price wars and squeezed margins.

Dogs in Civmec's BCG Matrix represent business segments with low market share and low growth potential, often characterized by low profitability and minimal strategic advantage. These are typically commoditized services or activities where Civmec lacks a competitive edge or where the market itself is stagnant.

For instance, in 2024, basic scaffolding services or non-specialized site cleaning, if offered by Civmec without significant differentiation, would likely fall into this category. These areas often face intense competition from smaller, more agile players, making it difficult to command premium pricing or achieve significant scale.

The key challenge with 'Dogs' is that they consume resources without generating substantial returns, potentially diverting focus from more promising areas of the business. Managing these segments often involves a decision to divest, harvest, or find a niche where they can at least break even.

Question Marks

Civmec's new facilities in Port Hedland and Gladstone are key strategic moves to bolster its maintenance and fabrication capabilities in resource-rich Western Australia and Queensland. These are investments positioned for future growth, but as new entrants to these specific regional markets, their initial market share is likely to be modest as they establish a foothold and secure initial contracts.

The ramp-up in these locations, while promising for long-term expansion, requires substantial capital and a dedicated effort to build client trust and a consistent project flow. For instance, Civmec reported a significant increase in its order book for the first half of FY24, reaching $1.2 billion, reflecting the broader market demand they aim to capture with these new regional presences.

Civmec's participation in Fortescue's Christmas Creek Green Iron Project places it at the forefront of the burgeoning green metals sector. This strategic involvement positions Civmec to capitalize on the significant growth anticipated in sustainable resource infrastructure.

While the broader green energy market is expanding robustly, Civmec's footprint in the specialized green iron sub-segment is still developing. This nascent market share suggests a 'Question Mark' in the BCG matrix, indicating potential for substantial growth if strategic investments are maintained.

Civmec's international expansion beyond Australia and Singapore, if any, would likely be categorized as question marks in a BCG matrix. These ventures would target markets with high growth potential but would start with a very small market share.

Such initiatives would require substantial investment in market entry strategies, establishing local partnerships, and adapting capabilities to suit new environments. For instance, if Civmec were to explore opportunities in the burgeoning renewable energy sector in Europe, it would face a rapidly expanding market but would need to build its brand and operational presence from the ground up.

Advanced Robotics and Automation Integration

Civmec's investment in advanced robotics and automation for construction and fabrication places it in the Question Mark category. While the potential for efficiency and precision is significant, Civmec's current market share in offering fully automated solutions may still be nascent, necessitating considerable R&D and implementation investment to secure a leading position.

This strategic focus aligns with industry trends, as automation is projected to boost productivity in construction by up to 25% by 2030, according to some industry analyses. Civmec's recent award for innovative modularisation, a process often enhanced by automation, underscores its commitment to this high-growth area.

- High Investment, Uncertain Returns: Significant capital is required for advanced robotics and automation, with market leadership not yet guaranteed.

- Developing Market Share: Civmec's position in providing fully automated solutions is likely still growing, requiring further development and adoption.

- Efficiency Potential: Automation offers substantial gains in precision and speed for construction and fabrication processes.

- Industry Trend Alignment: Investment in this area reflects a broader industry shift towards digitized and automated operations.

Specialized Marine Sustainment Services (beyond core shipbuilding)

Civmec's exploration into specialized marine sustainment services beyond core shipbuilding, such as advanced sensor integration or complex system upgrades for non-naval vessels, positions these activities within the "Question Marks" category of the BCG Matrix. This signifies a high-growth market potential, but also requires significant investment to build specific expertise and capture market share. For instance, the global maritime cybersecurity market, a related niche, was projected to reach USD 10.5 billion by 2024, indicating substantial growth opportunities.

To succeed in these specialized areas, Civmec would need to strategically invest in research and development, acquire new technologies, and potentially form partnerships to gain the necessary capabilities. Building a strong reputation in these niche segments is crucial, as market penetration can be challenging without proven expertise. The company's ability to adapt and innovate will be key to transforming these "Question Marks" into stars.

- Niche Market Growth: The global market for specialized maritime services, including advanced diagnostics and retrofitting, is experiencing robust expansion, driven by the increasing complexity of modern vessels and the need for enhanced operational efficiency.

- Capability Development: Civmec's success hinges on its commitment to developing specialized skill sets and technological capabilities, potentially through targeted training programs and strategic acquisitions in areas like digital twin technology for vessel maintenance.

- Market Entry Strategy: Establishing market share in these specialized segments will likely require a focused approach, possibly starting with pilot projects or collaborations with key industry players to demonstrate value and build credibility.

- Investment Focus: Significant investment in R&D and specialized equipment will be necessary to compete effectively, particularly in areas like autonomous systems integration and predictive maintenance solutions for commercial fleets.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require significant investment to capture market share and have uncertain futures, potentially becoming stars or dogs.

Civmec's new facilities in Port Hedland and Gladstone, while strategically placed, are still building their market share in established resource markets, classifying them as Question Marks. Similarly, its foray into the green iron sector, though high-growth, represents a developing market share for Civmec.

Investments in advanced robotics and automation, along with specialized maritime sustainment services, also fall into the Question Mark category. These areas offer substantial growth potential but demand considerable investment and capability development to secure a competitive position.

Civmec's strategic focus on these emerging areas highlights a commitment to future growth, but their success will depend on effectively navigating these high-potential, yet currently low-share, market segments.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.