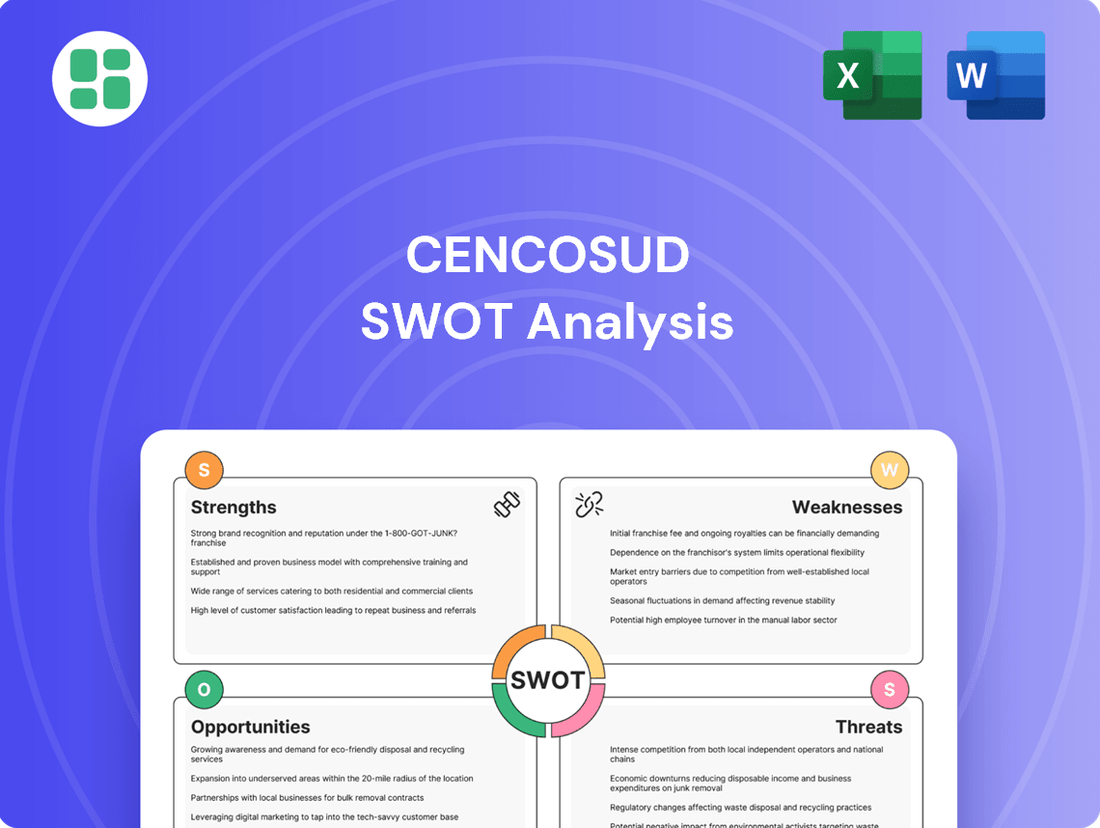

Cencosud SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

Cencosud's robust retail presence across Latin America presents significant strengths, but understanding its vulnerabilities and the competitive landscape is crucial for strategic advantage. Our comprehensive SWOT analysis delves into these dynamics, offering a clear roadmap for navigating opportunities and mitigating risks.

Want the full story behind Cencosud's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cencosud's diverse multi-format portfolio is a significant strength, encompassing supermarkets, hypermarkets, home improvement, department stores, shopping centers, and financial services. This broad operational scope, as seen in their extensive presence across South America, mitigates risks associated with any single retail segment. For instance, in 2023, Cencosud reported total revenues of approximately CLP 101,512 billion, demonstrating the scale and resilience offered by this diversification.

Cencosud showcased a strong financial recovery, achieving a net profit in the first quarter of 2025. This turnaround followed a period of revenue growth in 2024 and continued expansion in early 2025, accompanied by a rise in adjusted EBITDA, highlighting operational efficiency improvements.

The company's commitment to growth is evident in its ambitious 2025 investment plan, totaling USD 610 million. This represents a 16% increase from the prior year, with funds earmarked for strategic store expansions and significant digital transformation initiatives.

Cencosud commands a formidable presence across key Latin American economies, including Chile, Peru, and Argentina, where it consistently achieves strong market share and robust financial performance. This regional leadership is a significant competitive advantage.

The company's strategic foray into the United States, notably through the acquisition and subsequent development of The Fresh Market, has opened doors to a lucrative and stable market segment. This expansion into a high-margin territory diversifies revenue streams and bolsters overall market reach.

In 2023, Cencosud's Chilean operations reported net sales of CLP 4,250 billion, underscoring its deep-rooted strength in its home market, while The Fresh Market's performance in the US contributed significantly to the group's international growth narrative, showing a 7.2% increase in comparable store sales for the fiscal year ending December 2023.

Accelerated Digital Transformation and Private Label Growth

Cencosud has significantly accelerated its digital transformation, evidenced by robust e-commerce growth. Online sales saw a notable surge, with double-digit increases reported in key markets like the US and Peru during the first quarter of 2025. This digital push is crucial for adapting to changing consumer behaviors.

The company's strategic focus on private label expansion is also yielding strong results. By Q1 2025, private label penetration reached 17.3% of total sales. This trend is vital for several reasons:

- Enhanced Profitability: Private labels typically offer higher profit margins compared to branded goods.

- Customer Loyalty: Developing unique private label offerings can foster stronger customer relationships and repeat purchases.

- Market Adaptation: This strategy directly addresses the evolving preferences of consumers who increasingly seek value and distinct product experiences.

Strengthened Corporate Governance and Sustainability Focus

Cencosud has significantly bolstered its corporate governance, demonstrating a commitment to transparency and ethical business practices. This strengthening is crucial for building investor confidence and ensuring long-term stability.

The company is also making notable strides in sustainability, evidenced by an 8% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2023 levels. This focus on environmental responsibility not only aligns with global ESG (Environmental, Social, and Governance) trends but also positions Cencosud favorably to attract socially conscious investment capital.

- Enhanced Corporate Governance: Cencosud's reinforced structures improve accountability and operational integrity.

- Sustainability Achievements: An 8% reduction in Scope 1 and 2 GHG emissions (vs. 2023) highlights environmental commitment.

- Attracting ESG Investors: The company's sustainability focus appeals to a growing segment of socially responsible investors.

- Building Stakeholder Trust: Ethical operations and environmental stewardship foster stronger relationships with all stakeholders.

Cencosud's diversified retail formats, spanning supermarkets to financial services, offer significant resilience. This broad operational base, evident in their 2023 revenues of CLP 101,512 billion, allows them to weather sector-specific downturns. Their strong market share across key Latin American economies like Chile and Peru further solidifies this advantage.

The company's strategic expansion into the US market via The Fresh Market has proven successful, contributing to international growth with a 7.2% increase in comparable store sales in fiscal year 2023. This move diversifies revenue and taps into a high-margin segment, complementing their robust Chilean operations which generated CLP 4,250 billion in net sales in 2023.

Cencosud's digital transformation is accelerating, with e-commerce sales showing double-digit growth in Q1 2025 across markets like the US and Peru. Furthermore, their private label penetration reached 17.3% of total sales by Q1 2025, boosting profitability and customer loyalty.

The company's commitment to sustainability is demonstrated by an 8% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2023, enhancing its appeal to ESG-focused investors and building stakeholder trust.

| Strength | Description | Supporting Data |

|---|---|---|

| Diversified Business Model | Multi-format retail operations across various sectors and geographies. | 2023 Total Revenues: CLP 101,512 billion |

| Strong Regional Presence | Leading market share in key Latin American countries. | Chile Net Sales (2023): CLP 4,250 billion |

| International Expansion | Successful entry and growth in the US market. | The Fresh Market Comparable Store Sales Growth (FY2023): +7.2% |

| Digital Acceleration & Private Labels | Robust e-commerce growth and increasing private label penetration. | E-commerce Growth (Q1 2025): Double-digit increases; Private Label Penetration (Q1 2025): 17.3% |

| Sustainability Focus | Commitment to reducing environmental impact. | GHG Emissions Reduction (Scope 1 & 2 vs. 2023): 8% |

What is included in the product

Delivers a strategic overview of Cencosud’s internal and external business factors, highlighting its strong regional presence and diverse retail formats alongside challenges like intense competition and economic volatility.

Uncovers critical threats and weaknesses, enabling proactive risk mitigation and strategic adjustments for Cencosud.

Weaknesses

Cencosud's operations in Latin America, especially in Argentina, are significantly vulnerable to macroeconomic shifts. Economic instability, hyperinflation, and currency depreciation directly impact the company's financial health.

For instance, while Cencosud reported consolidated revenue growth in 2024, its net income faced headwinds. The depreciation of the Chilean peso and the challenging economic climate in Argentina specifically weighed on profitability during the year.

This heightened exposure to volatile economic environments introduces substantial financial unpredictability and operational hurdles for Cencosud, making consistent performance a challenge.

Cencosud faces challenges in certain markets, notably Brazil, where revenue declined in the first quarter of 2024 due to store closures and a difficult economic climate. This downturn impacted the company's performance significantly.

Colombia also presented headwinds, with revenue remaining flat during the same period, largely attributed to fierce competition within the retail sector. These underperforming regions necessitate strategic recalibration and potentially increased capital allocation to improve their trajectory.

The ongoing struggles in these key territories, such as the reported 5.1% revenue drop in Brazil for Q1 2024, pose a risk of negatively affecting Cencosud's consolidated financial results if not addressed effectively.

Cencosud has grappled with operational hiccups, notably a cyberattack impacting a US logistics partner in Q2 2025. This event directly hampered distribution channels and shaved off from EBITDA, underscoring the fragility of its operational backbone.

Such vulnerabilities in its supply chain and operational framework can translate into tangible financial consequences. These disruptions often necessitate increased operational expenditures, diminish overall efficiency, and risk alienating the customer base through service interruptions.

Debt Burden and Leverage Management

While Cencosud successfully refinanced its debt in 2024, improving its maturity profile, the company still carries a significant debt burden. This leverage, though managed, can constrain its financial agility for pursuing new investment opportunities or strategic acquisitions.

The ongoing objective to lower leverage is critical. A high debt load can impact credit ratings and limit the company's capacity to respond to market shifts or capitalize on growth prospects. Effective debt management remains a key focus for ensuring long-term financial health.

- Debt Load: Cencosud's debt levels, despite refinancing efforts, require careful oversight.

- Financial Flexibility: Substantial debt can restrict the company's ability to invest in new ventures.

- Leverage Reduction: Ongoing efforts to decrease leverage are vital for enhancing financial stability.

- Credit Ratings: Prudent debt management is essential for maintaining favorable creditworthiness.

Intense Competitive Landscape

Cencosud operates within a fiercely competitive retail environment across Latin America. This is not a new challenge, but the intensity has amplified. Both established local giants and aggressive international retailers are constantly vying for consumer attention and spending. For instance, in 2023, the Chilean retail market, a key territory for Cencosud, saw significant growth in online sales, driven by players like Falabella and Ripley, alongside new entrants. This dynamic forces Cencosud to constantly re-evaluate its pricing strategies and invest heavily in innovation to maintain its market position.

The pressure from this intense competition directly impacts Cencosud's profitability. With so many options available to consumers, retailers are often compelled to engage in price wars, which can erode profit margins. Beyond pricing, staying relevant requires continuous innovation not only in product assortments but also in the overall customer experience, both online and in-store. Cencosud's ability to differentiate itself and retain market leadership hinges on its capacity for sustained strategic investment and adaptation to evolving consumer preferences. For example, in 2024, Cencosud announced significant investments in its digital transformation and supply chain to better compete with agile online retailers.

- Intensified Competition: Latin America's retail sector is characterized by a crowded marketplace with both domestic and global players.

- Margin Pressure: The need to remain price-competitive in this environment can significantly squeeze profit margins.

- Innovation Imperative: Continuous investment in product offerings and customer experience is essential to stand out.

- Strategic Investment: Maintaining market leadership demands ongoing strategic efforts and capital allocation.

Cencosud's reliance on specific markets, particularly Argentina, exposes it to significant macroeconomic volatility. Economic instability and currency depreciation in these regions directly impact its financial performance and create operational challenges. For example, Argentina's persistent inflation rates and currency fluctuations in 2024 have presented ongoing difficulties for Cencosud's operations there.

The company has also faced setbacks in other key markets, such as Brazil, where revenue saw a decline in early 2024 due to economic conditions and store closures, impacting overall results. Similarly, Colombia's retail sector presented flat revenue growth in the same period due to intense competition.

Operational vulnerabilities, like the Q2 2025 cyberattack on a logistics partner, highlight the fragility of its supply chain and can lead to increased costs and service disruptions, affecting EBITDA. This event underscored the need for robust cybersecurity measures across its network.

Despite successful debt refinancing in 2024, Cencosud maintains a substantial debt load. This leverage, while managed, can limit financial flexibility for new investments and strategic growth initiatives, making ongoing debt reduction a critical objective for long-term stability.

| Region | 2024 Performance Metric | Key Challenge |

|---|---|---|

| Argentina | Revenue Impacted by Inflation | Macroeconomic Volatility, Currency Depreciation |

| Brazil | Q1 2024 Revenue Decline (-5.1%) | Economic Climate, Store Closures |

| Colombia | Flat Revenue Growth | Intense Retail Competition |

| Supply Chain | EBITDA Reduction (Q2 2025) | Cybersecurity Vulnerabilities |

Full Version Awaits

Cencosud SWOT Analysis

This is a real excerpt from the complete Cencosud SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of the company's strategic position.

You’re viewing a live preview of the actual Cencosud SWOT analysis file. The complete version, detailing all strengths, weaknesses, opportunities, and threats, becomes available after checkout.

The file shown below is not a sample—it’s the real Cencosud SWOT analysis you'll download post-purchase, in full detail. This ensures you get the exact professional document you expect.

Opportunities

Cencosud's 2025 investment plan is targeting significant expansion, with 24 new supermarkets slated for opening, including 12 new The Fresh Market stores in the United States. This strategic move into high-growth, high-margin markets like the US is designed to bolster revenue stability and lessen dependence on the often-unpredictable economies of Latin America.

This focus on the US market, particularly with The Fresh Market brand, presents a substantial opportunity for Cencosud to tap into a consumer base that values quality and freshness, potentially leading to higher profit margins. Continued investment in these lucrative segments could unlock considerable growth potential for the company.

Cencosud can significantly boost its market position by further investing in e-commerce and digital platforms, aiming to create a seamless omnichannel experience. This digital push is crucial, as online retail sales in Latin America are projected to reach $200 billion by 2025, a substantial increase from previous years.

The establishment of a dedicated Retail Ecosystem management team is a strategic move to harmonize Cencosud's physical stores with its growing digital presence. This integration is key to fostering customer loyalty, with data from 2024 showing that consumers who engage with retailers across multiple channels spend, on average, 10% more than single-channel shoppers.

Expanding retail media networks offers a prime opportunity to generate new revenue streams by leveraging customer data and traffic. In 2024, retail media ad spend globally is expected to exceed $50 billion, highlighting the immense potential for Cencosud to monetize its digital footprint and enhance its value proposition to both consumers and brands.

The rise of private label brands presents a compelling avenue for Cencosud. With private label sales already capturing 17.3% of total revenue in the first quarter of 2025, there's a clear opportunity to boost gross margins and create unique product assortments that set Cencosud apart from competitors.

Furthermore, the strategic introduction of new non-food private label brands, such as Hydrum and Cross Check, is actively diversifying Cencosud's product portfolio. This expansion into higher-margin categories is crucial for improving overall profitability and lessening reliance on external suppliers.

Synergies from Recent Acquisitions and Market Consolidation

Cencosud's recent acquisitions, including Supermercados Makro and Basualdo in Argentina, significantly bolster its market position, particularly by introducing the cash-and-carry format. This strategic expansion is poised to unlock considerable synergies.

The integration of these acquired businesses presents a prime opportunity to realize efficiency gains through consolidated logistics, centralized procurement, and the cross-pollination of customer bases. For instance, by leveraging Makro's established wholesale infrastructure, Cencosud can optimize its supply chain and potentially negotiate better terms with suppliers across its expanded network. This consolidation also strengthens Cencosud's competitive stance in a dynamic retail landscape, allowing for more effective market penetration and operational cost optimization.

- Market Presence Enhancement: Acquisitions like Makro and Basualdo in Argentina directly increase Cencosud's footprint and customer reach.

- Synergy Realization: Expected efficiencies are anticipated in logistics, procurement, and customer data management from integrating new operations.

- Format Diversification: The addition of the cash-and-carry model broadens Cencosud's service offering and appeals to a wider customer segment.

- Operational Efficiency: Consolidation allows for streamlined operations, potentially leading to reduced overheads and improved profitability.

Real Estate Development and Shopping Center Optimization

Cencosud is strategically investing in its real estate portfolio, with plans to expand and renovate seven shopping centers throughout 2025. This initiative is projected to add 66,000 square meters to its Gross Leasable Area (GLA), a move that underscores a commitment to optimizing its physical assets. The company aims to maintain robust occupancy rates across these enhanced properties.

This focus on real estate development and optimization is a significant opportunity for Cencosud. By improving the shopping experience and increasing GLA, the company anticipates driving higher foot traffic, which directly translates into increased rental income. The shopping center division is already a proven performer, boasting high EBITDA margins, suggesting these investments are built on a solid foundation.

The strategic enhancements are designed to create more value for both customers and investors. These improvements can include modernizing facilities, incorporating new retail concepts, and enhancing the overall customer journey. Such upgrades are crucial in a competitive retail landscape, aiming to solidify Cencosud's position as a leading shopping center operator.

Key aspects of this opportunity include:

- Expansion of GLA: Adding 66,000 square meters across seven shopping centers in 2025.

- Occupancy Rate Maintenance: Commitment to keeping high occupancy levels in renovated and expanded centers.

- Enhanced Customer Experience: Investments aimed at improving foot traffic and customer engagement.

- Revenue Growth: Potential for increased rental income driven by optimized and expanded retail spaces.

Cencosud's strategic expansion into the US market with The Fresh Market brand presents a significant opportunity to capture higher profit margins and stabilize revenue streams. This move targets a consumer base valuing quality, aiming to boost overall profitability.

Investing in e-commerce and digital platforms is crucial, as online retail in Latin America is projected to reach $200 billion by 2025, offering a substantial growth avenue. A unified retail ecosystem, blending physical and digital, enhances customer loyalty, with multi-channel shoppers spending 10% more.

Expanding retail media networks offers a new revenue stream, with global ad spend expected to exceed $50 billion in 2024. Furthermore, the growth of private label brands, already contributing 17.3% of revenue in Q1 2025, provides a chance to increase gross margins and differentiate offerings.

The acquisitions of Makro and Basualdo in Argentina expand Cencosud's market presence and introduce the cash-and-carry format, diversifying its service offering. These integrations are expected to yield significant synergies in logistics and procurement, improving operational efficiency.

Cencosud's investment in its real estate portfolio, including expanding seven shopping centers by 66,000 square meters in 2025, aims to drive foot traffic and rental income. This focus on enhancing the physical retail experience is expected to maintain high occupancy rates and boost profitability.

Threats

Ongoing economic volatility, especially hyperinflation and currency swings in markets like Argentina, presents a substantial threat to Cencosud's financial results. Despite a return to profitability in Q1 2025, the ongoing normalization of inflation could still squeeze profit margins and affect consumer spending power.

Managing these persistent macroeconomic challenges remains a core concern for the company. For instance, Argentina's inflation rate, while showing signs of moderation, still hovered around 250% year-on-year in early 2025, directly impacting operational costs and consumer purchasing behavior across Cencosud's diverse business segments.

Cencosud faces intense rivalry in Latin America from established local retailers and increasingly from international players, including major e-commerce platforms. This dynamic environment pressures margins and demands constant investment in innovation to stay competitive.

For instance, in 2024, e-commerce sales in Latin America were projected to grow significantly, with estimates suggesting a 15-20% increase year-over-year, directly impacting traditional brick-and-mortar retail. This surge highlights the growing threat from online-only competitors who often operate with lower overheads.

The need to compete on price and offer compelling digital experiences means Cencosud must allocate substantial capital to technology and logistics. Failure to keep pace could lead to a gradual erosion of its customer base, particularly among younger demographics who are more inclined towards online shopping and value-driven pricing.

Operational incidents, like the cyberattack on a US logistics provider in Q2 2025, underscore the significant vulnerability of intricate supply chains to external threats. Such disruptions can lead to substantial delays, escalating costs, and a tarnished brand image for companies like Cencosud.

The interconnected nature of modern logistics means that a single breach can have cascading effects, impacting inventory availability and delivery schedules across multiple regions. For Cencosud, this translates to potential revenue losses and increased operational expenses as they navigate these unforeseen challenges.

To counter these threats, Cencosud must prioritize the implementation of robust cybersecurity measures and foster resilient supply chain management strategies. This proactive approach is essential for mitigating risks and ensuring business continuity in an increasingly unpredictable global environment.

Regulatory and Political Risks in Operating Countries

Cencosud's extensive operations across various Latin American nations mean it navigates a complex web of differing regulatory and political landscapes. This diversity inherently introduces risks, as shifts in one country's policies can have a ripple effect. For instance, changes in import tariffs or local content requirements could directly impact Cencosud's supply chain and product costs.

The company must remain agile to adapt to evolving legal frameworks. For example, a tightening of labor laws in one market could necessitate adjustments to employment practices and associated costs. Similarly, alterations in tax regimes, such as corporate income tax rates or VAT, can directly affect Cencosud's bottom line and financial planning.

Political instability is another significant threat. Periods of unrest or significant governmental change can erode consumer confidence, leading to reduced discretionary spending, which directly impacts retail sales. Cencosud's reliance on consistent consumer demand makes it particularly vulnerable to economic sentiment influenced by political events.

- Regulatory Divergence: Cencosud operates in markets with distinct consumer protection laws, potentially increasing compliance burdens and operational complexity.

- Tax Policy Volatility: Changes in corporate tax rates, as seen in some Latin American countries in recent years, can impact profitability. For example, Chile, a key market, has seen debates around tax reform.

- Political Sensitivity: Economic policies and consumer spending are highly sensitive to political stability. A downturn in consumer sentiment due to political uncertainty can directly affect Cencosud's revenue streams.

Evolving Consumer Preferences and Digital Disruption

Cencosud faces a significant threat from rapidly evolving consumer preferences, fueled by technological advancements and shifting demographics. For instance, in 2024, the global retail e-commerce sales were projected to reach $6.3 trillion, highlighting a strong digital shift. If Cencosud doesn't adapt its offerings and customer experience to these changing tastes, it risks becoming less relevant.

The accelerating pace of digital disruption demands continuous investment in technology and innovation. By the end of 2025, it's estimated that over 60% of retail sales globally will have an online component. Failing to keep pace with digital transformation, including enhancing online platforms and omnichannel capabilities, could directly impact Cencosud's market share and competitive standing.

Key areas of concern for Cencosud regarding these threats include:

- Adapting to personalized shopping experiences: Consumers increasingly expect tailored recommendations and seamless online-offline integration.

- Investing in data analytics: Utilizing customer data effectively is crucial for understanding and anticipating preference shifts.

- Staying ahead of emerging retail technologies: Innovations like AI-powered customer service and augmented reality shopping need consideration.

- Maintaining agility in supply chain and inventory management: Quick responses to demand fluctuations driven by changing preferences are vital.

Intensifying competition from both established local players and global e-commerce giants poses a significant threat, pressuring Cencosud's profit margins and necessitating continuous innovation. The rapid growth of online retail, projected to capture an increasing share of the market by 2025, demands substantial investment in digital capabilities and logistics to remain competitive.

Macroeconomic volatility, particularly high inflation and currency fluctuations in key markets like Argentina, directly impacts operational costs and consumer purchasing power, potentially squeezing profit margins. For instance, Argentina's inflation rate remained exceptionally high in early 2025, affecting consumer spending and Cencosud's financial performance.

Operational risks, such as cyberattacks on supply chain partners, can lead to significant disruptions, increased costs, and reputational damage. The interconnected nature of modern logistics means a single incident can have cascading effects on inventory and delivery schedules across Cencosud's operations.

Navigating diverse and evolving regulatory and political landscapes across Latin America introduces complexity and risk, as policy shifts can impact supply chains and profitability. Political instability can also dampen consumer confidence and discretionary spending, directly affecting retail sales.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Cencosud's official financial reports, comprehensive market research studies, and expert analyses of the retail and financial sectors.