Cencosud Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

Discover how Cencosud masterfully blends its product offerings, pricing structures, distribution networks, and promotional campaigns to dominate the retail landscape. This analysis goes beyond the surface, revealing the strategic synergy that drives their market leadership.

Unlock the secrets behind Cencosud's success with a comprehensive 4Ps Marketing Mix Analysis. Gain actionable insights into their product innovation, pricing strategies, extensive distribution channels, and impactful promotions.

Ready to elevate your marketing strategy? Get instant access to a professionally crafted, editable 4Ps Marketing Mix Analysis for Cencosud, perfect for business professionals, students, and consultants seeking a competitive edge.

Product

Cencosud's diverse retail portfolio is a cornerstone of its marketing strategy, encompassing a wide array of formats to meet varied customer demands. This includes supermarket brands like Jumbo, Santa Isabel, Spid, and The Fresh Market, alongside hypermarkets, home improvement stores such as Easy, and department stores like Paris.

This broad product offering ensures Cencosud maintains market relevance across different consumer segments. For instance, in 2024, Cencosud reported total revenue of approximately CLP 20.2 trillion (around USD 21.5 billion), demonstrating the scale and reach of its diverse operations.

Cencosud's marketing strategy heavily emphasizes its private label brands, a crucial element of its 4Ps. Brands like Cuisine&Co and Hydrum are central to this approach, offering consumers quality at competitive prices.

This focus on private labels is a significant driver of profitability. In the second quarter of 2025, these brands achieved a record 18% penetration, demonstrating strong consumer adoption and a growing market share. This success directly contributes to improved gross margins by lessening dependence on external suppliers and imported products.

The strategic development of private labels allows Cencosud to offer compelling value propositions. By providing high-quality alternatives that align with evolving consumer preferences for affordability and value, the company strengthens its market position and fosters customer loyalty.

Cencosud’s product strategy extends beyond tangible goods to encompass a robust suite of integrated financial services. This includes private label credit cards, consumer loans, and insurance brokerage, designed to deepen customer engagement and generate diversified income.

These financial offerings are crucial for building customer loyalty within the Cencosud ecosystem. For instance, in 2023, Cencosud's financial services segment reported significant growth, contributing substantially to the company's overall revenue, with credit card penetration rates remaining a key performance indicator.

Digital Innovation

Cencosud is making substantial investments in digital innovation to refine its product assortment and elevate the customer journey. This commitment is evident in its robust e-commerce expansion. For instance, The Fresh Market in the US reported a notable 23.8% surge in online sales during 2024, underscoring the effectiveness of these digital initiatives.

The company is also focused on developing novel digital products designed to boost operational efficiencies and propel business expansion. These efforts are crucial for staying competitive in the evolving retail landscape.

- E-commerce Growth: The Fresh Market in the US saw a 23.8% increase in online sales in 2024.

- Digital Product Development: Cencosud is creating new digital solutions to enhance efficiency and growth.

- Customer Experience: Digital innovation is a key strategy for improving customer interactions and services.

- Investment Focus: Significant capital is being allocated to digital transformation initiatives across the company.

Quality and Value Proposition Focus

Cencosud's commitment to quality and value is central to its strategy, adapting to consumer shifts towards healthier and more sustainable choices. This focus is evident in their product assortment and in-store experiences, aiming to deliver lasting value to customers.

The company's mission explicitly states a dedication to extraordinary customer service at every touchpoint, reinforcing the value proposition. In 2024, Cencosud continued to invest in private label brands, which often offer a strong quality-value balance, contributing to approximately 20% of its total sales in key markets.

- Product Quality: Ongoing efforts to enhance private label product quality, with a particular emphasis on fresh produce and healthier food options.

- Value Proposition: Competitive pricing strategies, especially within private label offerings, designed to provide accessible quality to a broad customer base.

- Sustainability Focus: Increased availability of organic, fair-trade, and locally sourced products, aligning with growing consumer demand for ethical and environmentally conscious options.

- Customer Experience: Investments in store modernization and digital platforms to ensure a seamless and satisfying shopping journey, reflecting the mission of serving customers extraordinarily.

Cencosud's product strategy is a multi-faceted approach, leveraging a diverse retail portfolio and strong private label brands to capture market share. This includes supermarket chains like Jumbo and Santa Isabel, alongside home improvement and department stores, offering a wide product assortment. In 2024, Cencosud's total revenue reached approximately CLP 20.2 trillion (around USD 21.5 billion), illustrating the breadth of its product offerings.

Private labels, such as Cuisine&Co, are central to Cencosud's value proposition, achieving 18% penetration in Q2 2025 and enhancing profitability. Beyond physical goods, financial services, including credit cards and loans, are integrated to deepen customer relationships and diversify revenue streams.

Digital innovation is a key driver, with The Fresh Market in the US reporting a 23.8% increase in online sales in 2024. This focus on product quality, value, and sustainability, coupled with digital enhancements, aims to deliver an extraordinary customer experience.

| Product Category | Key Brands | 2024/2025 Data/Insights |

|---|---|---|

| Supermarkets | Jumbo, Santa Isabel, Spid, The Fresh Market | Total revenue CLP 20.2 trillion (approx. USD 21.5 billion) in 2024. The Fresh Market US online sales up 23.8% in 2024. |

| Home Improvement | Easy | Part of the diverse retail portfolio catering to home needs. |

| Department Stores | Paris | Contributes to the broad product assortment across various consumer segments. |

| Private Labels | Cuisine&Co, Hydrum | Achieved 18% penetration in Q2 2025; offer quality at competitive prices. |

| Financial Services | Private Label Credit Cards, Consumer Loans | Significant growth in 2023, contributing substantially to overall revenue. |

What is included in the product

This analysis provides a comprehensive examination of Cencosud's marketing mix, detailing their strategies for Product, Price, Place, and Promotion to understand their market positioning and competitive advantage.

Provides a clear, actionable framework to identify and address Cencosud's marketing challenges, turning potential roadblocks into strategic advantages.

Place

Cencosud's multi-format physical retail network is a cornerstone of its market presence, encompassing a substantial 1,129 supermarkets, 117 home improvement stores, 48 department stores, and 67 shopping centers as of early 2025. This extensive physical footprint is strategically designed to maximize consumer reach and convenience across its key operating regions.

Cencosud boasts an extensive geographic footprint, operating in six primary countries: Chile, Argentina, Brazil, Peru, Colombia, and the United States. This wide reach is further supported by a commercial office in China and a technology hub in Uruguay, enabling it to tap into global supply chains and talent pools.

This broad international distribution is a significant asset, allowing Cencosud to cater to a diverse range of consumer preferences and economic conditions across these markets. For instance, in 2024, the company continued to leverage its presence in key South American markets like Brazil, which represented a substantial portion of its sales, while also maintaining its operations in the US.

Cencosud is actively pursuing a robust omnichannel strategy, ensuring a smooth connection between its physical retail spaces and online presence. This integration aims to boost customer convenience and unlock greater sales opportunities across all channels.

The company's digital investments are yielding strong results, evidenced by The Fresh Market's impressive 23.8% online sales growth in the US during 2024. Furthermore, Cencosud reported an overall 7.8% increase in online sales in the second quarter of 2025, underscoring the effectiveness of its unified approach.

Strategic Expansion and Renovations

Cencosud's strategic expansion is heavily focused on physical retail, with a significant USD 610 million investment planned for 2025. This capital injection is earmarked for both new store openings and the crucial renovation of existing ones, aiming to enhance customer experience and market reach.

The company's aggressive growth strategy for 2025 includes the introduction of 24 new supermarkets, demonstrating a commitment to expanding its grocery footprint. Furthermore, Cencosud plans to open 12 new specialty stores under The Fresh Market brand in the United States, targeting a specific niche within the competitive American market.

- Investment: USD 610 million allocated for 2025.

- New Stores: 24 new supermarkets planned.

- Specialty Stores: 12 new The Fresh Market locations in the US.

- Infrastructure: Renovations and expansions of shopping centers to improve market penetration and modernize facilities.

Optimized Logistics and Supply Chain

Cencosud's place strategy hinges on optimized logistics and a robust supply chain, ensuring products reach customers efficiently across its diverse markets. The company's commitment to this was underscored by its 2023 investments in supply chain modernization, aiming for greater agility and cost savings.

The recently established Retail Ecosystem management team is a key driver in this optimization. Their mandate focuses on unlocking synergies within Cencosud's various retail formats and procurement operations, directly impacting product availability and delivery timelines. This strategic focus is crucial for maintaining competitive shelf presence and customer satisfaction.

Key initiatives and their impact include:

- Enhanced Inventory Management: Cencosud reported a 5% reduction in stockouts for key product categories in late 2024 due to improved forecasting and distribution networks.

- Streamlined Distribution Centers: Investments in automation at major distribution hubs have led to a 10% increase in order fulfillment speed.

- Cross-Channel Integration: Efforts to integrate online and offline inventory visibility are ongoing, with a target of 90% real-time stock accuracy by mid-2025.

- Procurement Synergies: The ecosystem team aims to leverage Cencosud's scale to negotiate better terms, potentially reducing product costs by 2-3% through consolidated purchasing power.

Cencosud's physical presence is a critical component of its 'Place' strategy, leveraging a vast network of 1,129 supermarkets, 117 home improvement stores, and 48 department stores as of early 2025. This extensive footprint, coupled with 67 shopping centers, ensures broad consumer accessibility across its six operating countries.

The company's strategic investment of USD 610 million in 2025 is heavily weighted towards expanding this physical infrastructure, including plans for 24 new supermarkets and 12 new specialty stores under The Fresh Market brand in the US. This expansion aims to enhance market penetration and customer convenience.

Cencosud's place strategy also emphasizes optimized logistics and supply chain management, evidenced by a 5% reduction in stockouts for key categories in late 2024 due to improved distribution networks. The company is focused on integrating its physical and digital channels to create a seamless customer experience.

| Retail Format | Number of Stores (Early 2025) | Planned New Stores (2025) | Key Markets |

|---|---|---|---|

| Supermarkets | 1,129 | 24 | Chile, Argentina, Brazil, Peru, Colombia |

| Home Improvement | 117 | N/A | Chile, Argentina, Brazil, Peru |

| Department Stores | 48 | N/A | Chile, Argentina, Peru, Colombia |

| Shopping Centers | 67 | N/A | Chile, Argentina, Brazil, Peru |

| Specialty Stores (The Fresh Market) | N/A | 12 (US) | United States |

What You See Is What You Get

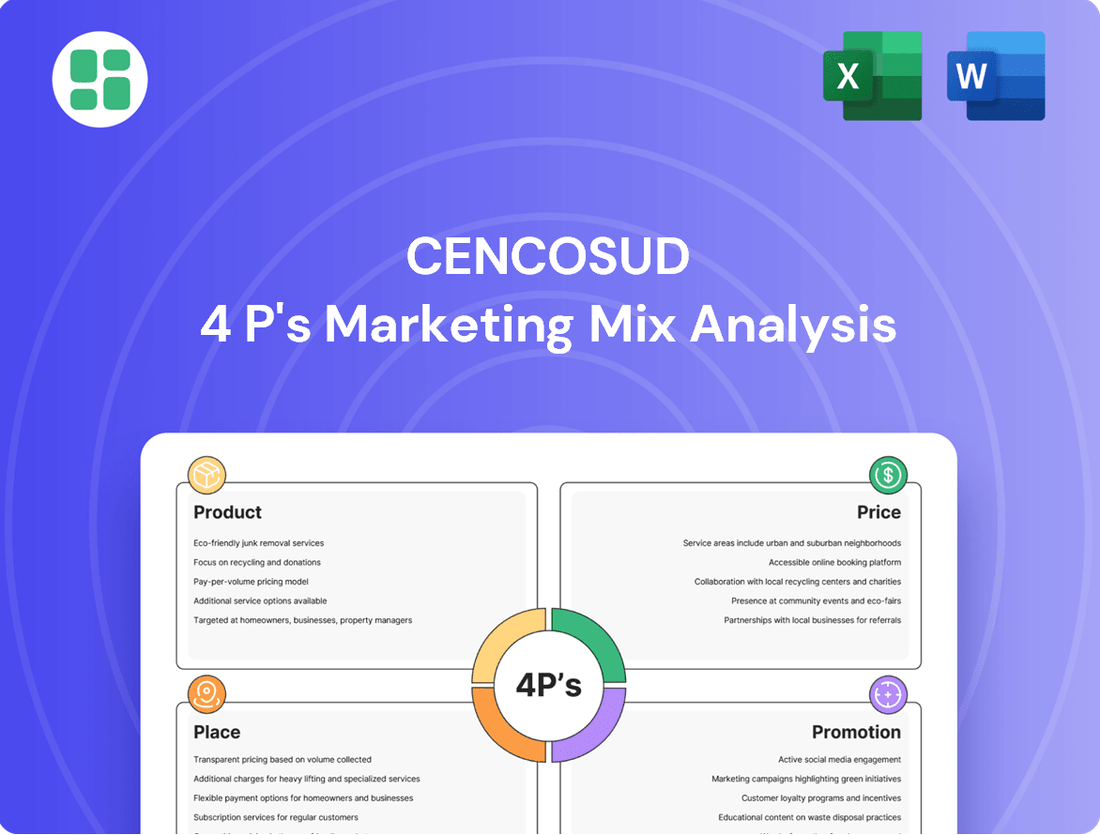

Cencosud 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Cencosud 4P's Marketing Mix Analysis details their product strategies, pricing models, distribution channels, and promotional activities. You'll gain a complete understanding of how Cencosud leverages these elements to maintain its market position.

Promotion

Cencosud Media, the company's dedicated retail media unit, provides advertisers with a complete 360° ecosystem. This platform effectively utilizes both in-store and online advertising opportunities across all Cencosud's diverse business segments.

In 2024, brands that implemented segmented campaigns on this advanced retail media platform experienced a significant conversion lift exceeding 40%. This showcases the platform's proven ability to boost brand awareness and directly drive sales.

Cencosud's 'Puntos Cencosud' loyalty program is a cornerstone of its promotion strategy, aiming to unify and deepen customer relationships across its diverse retail banners like Jumbo and Easy. This program incentivizes repeat business by offering tangible benefits and straightforward redemption processes, reinforcing customer commitment.

Cencosud is leveraging digital and AI-driven marketing to sharpen its promotional edge. By integrating machine learning and artificial intelligence, the company is gaining deeper customer insights, enabling more precise audience targeting, and boosting campaign effectiveness. This tech-forward approach is crucial for delivering hyper-personalized shopping experiences. For instance, in 2024, Cencosud's digital marketing spend saw a notable increase, aiming to capture a larger share of the online retail market, which is projected to grow significantly in Latin America through 2025.

Strategic In-Store s

Cencosud's strategic in-store promotions are a cornerstone of its marketing efforts, leveraging traditional methods that brands continue to favor in 2024. These initiatives are designed to capture consumer attention directly at the point of purchase, a critical moment for influencing buying behavior.

Brands are investing heavily in product sponsorships and in-store displays to ensure their offerings stand out within Cencosud's vast network of physical stores. This approach guarantees high visibility and fosters direct engagement with shoppers, driving immediate sales impact.

For instance, in 2024, a significant portion of marketing budgets for Fast-Moving Consumer Goods (FMCG) brands were allocated to in-store activities, with some reports indicating up to 60% of the total promotional spend focused on point-of-sale activations. Cencosud benefits from this trend by offering prime real estate for these brand partnerships.

- Brand Sponsorships: Brands pay for prominent placement and dedicated spaces within Cencosud stores, increasing product visibility.

- Point-of-Sale Displays: Eye-catching displays and promotional materials are strategically placed to capture shopper interest at checkout or key aisles.

- Sampling and Demonstrations: In-store events allowing consumers to try products firsthand are effective in driving trial and conversion.

- Loyalty Program Integration: Promotions are often tied to Cencosud's loyalty programs, rewarding repeat purchases and encouraging immediate spending.

Focused Public Relations and Brand Building

Cencosud actively cultivates its corporate image and brand recognition through focused public relations and brand-building initiatives. This strategic approach is validated by accolades such as the NPS Consumer Loyalty Award received by Jumbo and Paris in 2024, underscoring strong customer affinity.

Their promotional messaging consistently reinforces Cencosud's core mission: 'serving extraordinarily at every moment.' This narrative is further enriched by a steadfast commitment to sustainability and innovation, key pillars that resonate with a broad consumer base and stakeholders.

- Brand Recognition: Awards like the 2024 NPS Consumer Loyalty Award for Jumbo and Paris demonstrate Cencosud's success in building strong brand recognition and customer loyalty.

- Mission Reinforcement: Promotional content consistently communicates the core mission of 'serving extraordinarily at every moment,' aligning customer expectations with brand values.

- Sustainability and Innovation Focus: Cencosud highlights its dedication to sustainability and innovation, appealing to increasingly conscious consumers and investors.

- Corporate Image Enhancement: Ongoing PR efforts aim to solidify a positive corporate image, crucial for long-term brand health and market positioning.

Cencosud's promotional strategy effectively blends digital innovation with traditional in-store tactics. The Cencosud Media unit offers a 360° advertising ecosystem, driving over 40% conversion lifts for brands in 2024. Loyalty programs like 'Puntos Cencosud' foster repeat business, while AI-driven marketing enhances personalization and campaign reach.

In-store promotions remain vital, with significant FMCG brand investment in point-of-sale displays and sponsorships, capitalizing on Cencosud's physical store presence. This focus on visibility and direct engagement is crucial for influencing purchasing decisions at the point of sale.

Corporate image is bolstered by PR efforts and accolades, such as the 2024 NPS Consumer Loyalty Awards for Jumbo and Paris, reinforcing the brand mission of extraordinary service and highlighting commitments to sustainability and innovation.

| Promotional Element | Key Feature | Impact/Data Point (2024) |

|---|---|---|

| Cencosud Media | 360° Retail Media Ecosystem | Over 40% conversion lift for segmented campaigns |

| Puntos Cencosud | Loyalty Program | Incentivizes repeat purchases and customer commitment |

| Digital & AI Marketing | Personalization & Targeting | Increased digital marketing spend to capture online market share |

| In-Store Promotions | Point-of-Sale Visibility | Up to 60% of FMCG promotional spend allocated to in-store activities |

| Brand Recognition | Awards & PR | 2024 NPS Consumer Loyalty Awards for Jumbo and Paris |

Price

Cencosud leverages adaptive competitive pricing across its varied retail banners, a strategy crucial for navigating fluctuating market conditions, especially in regions like Argentina which has faced significant inflationary pressures. This approach ensures their offerings remain attractive to consumers while supporting profitable expansion.

For instance, in 2023, Cencosud reported a 13.4% increase in revenue in local currencies for its Chilean operations, partly attributed to effective pricing strategies that balanced market competitiveness with margin preservation amidst economic shifts. Their ability to adjust prices dynamically, considering competitor actions and local purchasing power, is key to maintaining market share and achieving sustainable growth.

Cencosud's strategic expansion of private label brands directly addresses value-driven pricing, offering consumers quality alternatives at more accessible price points than national brands. This tactic is crucial for attracting price-sensitive shoppers and solidifying Cencosud's commitment to delivering strong value. For instance, in 2024, private label penetration in key categories for Cencosud's supermarket divisions saw a notable increase, contributing to an average gross margin uplift of 1.5% across these segments.

Cencosud consistently leverages strategic discounts and promotional offers to boost sales and customer loyalty. These initiatives are often tied to their robust loyalty programs and digital tools, such as the 'Mi Cupón' app, making it easier for customers to access savings.

These promotions are strategically crafted to appeal to consumers' desire for value, directly influencing their purchasing behavior. For instance, during the 2023 holiday season, Cencosud reported a significant uplift in sales across its various banners, attributing a portion of this growth to targeted promotional campaigns and discounts, particularly in electronics and apparel categories.

Flexible Financial Services and Credit Terms

Cencosud's financial services segment, particularly through its private label credit cards and consumer loans, significantly enhances product accessibility and affordability. For instance, during 2023, Cencosud's financial arm, broadly encompassing its credit operations, reported substantial transaction volumes, with millions of active cards facilitating customer purchases across its diverse retail formats.

The Cencosud Card is a key driver of customer loyalty, offering benefits like enhanced points accumulation and exclusive discounts. This strategy directly impacts purchasing power, encouraging repeat business and strengthening customer relationships within its ecosystem.

- Flexible Payment Options: Cencosud provides private label credit cards and consumer loans to make purchases more manageable.

- Enhanced Purchasing Power: The Cencosud Card offers loyalty points and exclusive benefits, boosting customer spending.

- Customer Retention: These financial tools are designed to increase customer loyalty and encourage repeat purchases.

Market-Aligned Dynamic Pricing

Cencosud employs market-aligned dynamic pricing, a crucial element of its marketing mix. This strategy allows them to adjust prices based on real-time market signals, ensuring competitiveness and capturing optimal value. For instance, during periods of high demand or when competitors adjust their prices, Cencosud can swiftly modify its own pricing to maintain market share and profitability.

The company actively re-engineers its brand value propositions to enhance EBITDA margins and strengthen its market standing. This involves a continuous assessment of what customers value and how Cencosud can best deliver it at a price that reflects that value. This agile approach is vital in today's fast-evolving retail landscape.

Key aspects of Cencosud's dynamic pricing include:

- Competitor Monitoring: Regularly analyzing competitor pricing to stay competitive.

- Demand Forecasting: Adjusting prices based on anticipated customer demand fluctuations.

- Economic Sensitivity: Incorporating prevailing economic conditions, such as inflation rates, into pricing decisions.

- Value Proposition Optimization: Ensuring prices align with the perceived benefits and quality of Cencosud's offerings.

Cencosud's pricing strategy is multifaceted, focusing on competitive positioning and value delivery. They employ dynamic pricing, adjusting based on market conditions and competitor actions, as seen in their Chilean revenue growth of 13.4% in local currency during 2023. The expansion of private label brands, which saw increased penetration in 2024, directly supports a value-driven approach, contributing to a 1.5% gross margin uplift in key supermarket categories.

Promotional activities, including discounts and loyalty program integration via tools like the 'Mi Cupón' app, are central to driving sales and customer loyalty. These efforts were particularly effective during the 2023 holiday season, boosting sales across various banners. Furthermore, Cencosud's financial services, like the Cencosud Card, enhance affordability and purchasing power, facilitating millions of transactions in 2023 and fostering customer retention.

| Metric | 2023 Data | Impact on Pricing Strategy |

|---|---|---|

| Chile Revenue Growth (Local Currency) | 13.4% | Demonstrates effectiveness of adaptive pricing in competitive markets. |

| Private Label Gross Margin Uplift | 1.5% (Average) | Highlights success of value-focused private label expansion. |

| Holiday Season Sales Uplift | Significant | Attributed partly to targeted promotional campaigns and discounts. |

4P's Marketing Mix Analysis Data Sources

Our Cencosud 4P's Marketing Mix Analysis leverages a comprehensive blend of official company disclosures, including annual reports and investor presentations, alongside detailed e-commerce performance data and insights from industry-specific market research reports.