Cencosud Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

Cencosud navigates a complex retail landscape where buyer power is significant due to brand loyalty and price sensitivity. The threat of new entrants is moderate, with high capital requirements acting as a barrier, yet online retail offers a lower entry point.

The complete report reveals the real forces shaping Cencosud’s industry—from supplier influence to the threat of substitutes. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cencosud, a major multinational retailer, sources a wide variety of goods from many suppliers globally. This broad supplier base typically weakens the bargaining power of individual suppliers, as Cencosud isn't heavily dependent on any single one.

For instance, in 2024, Cencosud's diversified sourcing strategy across categories like groceries, home improvement, and apparel meant that no single supplier represented an overwhelmingly large portion of its procurement costs. While most suppliers have limited power due to this scale, certain niche or highly specialized product categories might see a higher degree of supplier concentration, potentially giving those specific vendors more leverage.

Cencosud faces varying switching costs with its suppliers. For many everyday products, the expense and effort to change suppliers are minimal, offering Cencosud considerable leverage. This is a key factor in managing procurement for a broad retail assortment.

However, the situation shifts for more specialized Cencosud operations. Developing private label products or securing consistent, high-volume supplies of fresh produce often involves more intricate supplier relationships. Establishing new logistics, quality control measures, and potentially proprietary formulations can lead to moderate switching costs, requiring careful consideration before changing partners.

The sheer number of alternative suppliers for many products Cencosud offers, particularly in its supermarket and hypermarket divisions, significantly dilutes the bargaining power of any single supplier. This widespread availability means Cencosud can readily switch to different providers if terms become unfavorable.

Furthermore, Cencosud's strategic development of private label brands is a key factor in mitigating supplier leverage. In 2023, these private labels represented 17.3% of total sales within Cencosud's Chilean operations, demonstrating a growing ability to control product sourcing and reduce reliance on external, branded suppliers.

Threat of Forward Integration by Suppliers

The threat of forward integration by Cencosud's suppliers is generally low. Most suppliers, particularly those in consumer packaged goods and fresh produce, concentrate on manufacturing or agriculture. They typically lack the extensive retail infrastructure, established brand equity, and substantial capital needed to effectively compete with Cencosud's varied retail formats.

For instance, a major food producer might supply private label products to Cencosud, but launching their own supermarket chain would require an entirely different business model and massive investment. In 2024, the retail sector continues to be characterized by high operational costs and intense competition, making it a challenging arena for new entrants, especially those without prior retail experience.

- Low Retail Infrastructure: Suppliers typically lack the widespread store networks and logistics capabilities Cencosud possesses.

- Brand Recognition Gap: Cencosud's brands are established in the retail space, a hurdle for suppliers to overcome.

- Capital Requirements: Establishing a retail presence demands significant upfront and ongoing investment, often beyond the scope of typical suppliers.

- Focus on Core Competencies: Suppliers generally prioritize their manufacturing or agricultural operations rather than venturing into retail.

Importance of Cencosud to Suppliers

Cencosud's vast retail presence, spanning South America and the United States, makes it a vital distribution channel for numerous suppliers. This extensive reach means that many businesses, particularly smaller and medium-sized ones, rely heavily on Cencosud for sales. Consequently, these suppliers often find themselves more dependent on Cencosud than the retail giant is on any single one of them, which inherently diminishes their bargaining power.

For instance, in 2023, Cencosud reported consolidated net sales of approximately CLP 21,279 billion (around USD 23.4 billion based on average exchange rates). This substantial revenue stream underscores Cencosud's importance as a buyer. Suppliers seeking access to this market share often have to accept Cencosud's terms, limiting their ability to negotiate for higher prices or more favorable payment conditions.

- Significant Market Access: Cencosud's operations across multiple countries provide suppliers with access to a broad customer base.

- Supplier Dependence: Many smaller to medium-sized suppliers are significantly reliant on Cencosud for a substantial portion of their revenue.

- Reduced Negotiation Leverage: This dependence weakens suppliers' ability to dictate terms, such as pricing and delivery schedules.

- Economies of Scale for Cencosud: Cencosud's large purchasing volumes allow it to negotiate favorable terms from suppliers, further consolidating its power.

Cencosud's bargaining power with its suppliers is generally strong due to its immense scale and diverse sourcing. The company's ability to purchase in large volumes allows it to negotiate favorable terms, as evidenced by its 2023 consolidated net sales of approximately USD 23.4 billion. This significant market presence makes many suppliers, especially smaller ones, highly dependent on Cencosud for revenue, thereby reducing their individual negotiation leverage.

The threat of suppliers integrating forward into retail is minimal, as most lack the necessary infrastructure, brand recognition, and capital to compete. Cencosud's strategic growth in private labels, which accounted for 17.3% of Chilean sales in 2023, further solidifies its position by reducing reliance on external brands.

Switching costs for Cencosud vary; they are low for commodity products but moderate for specialized items like private label development, requiring careful supplier relationship management. The wide availability of alternative suppliers for most of its product categories significantly dilutes the power of any single supplier.

In summary, Cencosud benefits from a fragmented supplier base and its own substantial market access, which collectively minimize supplier bargaining power. This dynamic allows Cencosud to secure favorable pricing and terms, a critical advantage in the competitive retail landscape.

What is included in the product

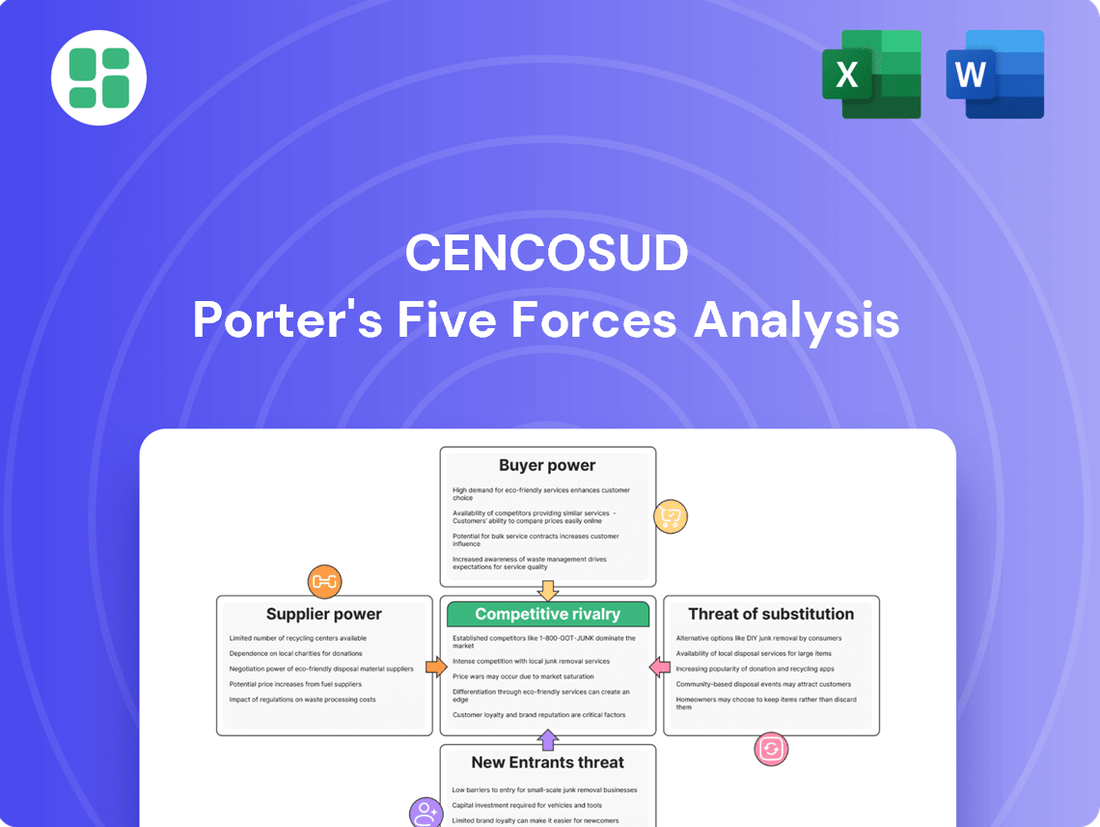

This analysis dissects the competitive forces impacting Cencosud, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Cencosud's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick, strategic decision-making in the retail sector.

Customers Bargaining Power

Latin American consumers, including those in Cencosud's core markets, are exhibiting a pronounced price sensitivity, a trend amplified by economic headwinds such as inflation. For instance, in 2024, several Latin American countries continued to grapple with elevated inflation rates, prompting shoppers to become more discerning about their spending. This means customers are actively seeking out promotions and comparing prices across different retailers and brands, directly impacting Cencosud's ability to maintain premium pricing.

This heightened price consciousness translates into a stronger bargaining power for customers. When consumers can easily switch between Cencosud and competitors based on price alone, it forces the company to be more competitive with its offerings. In 2023, Cencosud reported a net sales increase, but this was often achieved through promotional activities, indicating the ongoing pressure to offer value to maintain market share.

Customers at Cencosud face significant bargaining power due to the sheer abundance of substitute products and services available. This is evident across various retail segments where Cencosud operates.

In 2024, the Chilean retail market, a key area for Cencosud, continues to be highly competitive. Consumers can easily switch between traditional supermarkets, hypermarkets, department stores, and increasingly, online platforms. For instance, the growth of e-commerce in Latin America, projected to reach hundreds of billions of dollars by 2025, means customers have readily accessible alternatives for groceries, home goods, and apparel, Cencosud's core businesses.

The expansion of social commerce and cross-border online sales further amplifies this. A customer looking for a specific appliance or clothing item can compare prices and product offerings from numerous domestic and international retailers with just a few clicks, directly impacting Cencosud's ability to dictate terms.

The digital age has dramatically shifted the balance of power towards customers. With readily available information on products, prices, and competitor offerings through mobile devices and online platforms, consumers are more informed and empowered than ever before. This heightened transparency means customers can easily compare options, read reviews, and make purchasing decisions based on value and quality, rather than solely on brand marketing.

In 2024, this trend continues to accelerate. For instance, a significant portion of consumers, estimated to be over 70% in many developed markets, now rely heavily on online reviews and user-generated content when making purchasing decisions, often prioritizing these over traditional advertising or celebrity endorsements. This shift forces retailers like Cencosud to be more competitive on price and product quality to attract and retain these savvy shoppers.

Customer Loyalty and Switching Costs

Cencosud's efforts to build customer loyalty through programs like 'Puntos Cencosud' face challenges as brand allegiance in Latin America increasingly hinges on shared values and tangible perceived value. This means simply offering points might not be enough if customers don't feel a deeper connection or see clear benefits beyond transactional rewards.

The bargaining power of Cencosud's customers is amplified by high price sensitivity across the region. For instance, in 2024, inflation continued to impact consumer spending power in several Latin American markets where Cencosud operates, making price a primary driver of purchasing decisions. This environment makes customers more inclined to seek out the best deals, even if it means switching providers.

Furthermore, the proliferation of retail formats and online platforms significantly lowers switching costs for customers. They can easily compare prices and product offerings across numerous competitors, both physical and digital, making it simple to move their business elsewhere if a better option arises. This ease of transition directly empowers customers in their negotiations and choices.

- Customer Loyalty Drivers: In Latin America, loyalty is increasingly influenced by shared values and perceived value, not just transactional rewards.

- Price Sensitivity: High inflation in 2024 across key markets has heightened customer price sensitivity, making them more responsive to competitor pricing.

- Low Switching Costs: The abundance of retail formats and online platforms allows customers to easily switch between competitors, increasing their bargaining power.

Buyer Volume and Concentration

Cencosud's customer base is incredibly diverse, spanning millions of individual consumers across its various retail formats. This vast and fragmented customer base significantly dilutes the bargaining power of any single buyer or small group of buyers. For instance, in 2023, Cencosud served a massive number of shoppers through its supermarket and hypermarket divisions, making it difficult for individual customers to exert substantial influence on pricing or terms.

The sheer volume of transactions and the wide geographical spread of Cencosud's operations further diminish concentrated buyer power. While specific segments might show localized purchasing patterns, the overall retail landscape Cencosud operates in is characterized by millions of independent purchasing decisions. This fragmentation is a key factor in Cencosud's ability to maintain its pricing strategies.

- Fragmented Customer Base: Cencosud's retail operations, including supermarkets, department stores, and home improvement centers, cater to millions of individual consumers.

- Low Buyer Concentration: The dispersed nature of its customer base prevents any single customer or small group from wielding significant bargaining power.

- Individual Purchasing Power: The purchasing decisions of individual consumers, while numerous, are generally too small to impact Cencosud's overall sales volume or pricing structure.

- Limited Negotiation Leverage: This lack of buyer concentration translates into limited leverage for customers to negotiate preferential terms or prices.

Cencosud's customers possess significant bargaining power, primarily driven by high price sensitivity and the availability of numerous alternatives. In 2024, persistent inflation in key Latin American markets like Chile and Peru has made consumers more cost-conscious, actively comparing prices and seeking promotions. This environment means customers can easily switch to competitors offering better value, directly pressuring Cencosud's pricing strategies.

The proliferation of retail channels, including a burgeoning e-commerce sector and social commerce platforms, further empowers consumers. For instance, the online retail market in Latin America is expected to continue its rapid expansion, offering customers readily accessible substitutes for Cencosud's core offerings in groceries, apparel, and home goods. This ease of comparison and switching significantly amplifies customer leverage.

While Cencosud serves millions, the bargaining power of its customer base is somewhat mitigated by its highly fragmented nature. The sheer volume of individual transactions across its diverse retail formats means no single customer or small group can exert substantial influence on the company's overall pricing or terms. This low buyer concentration limits the ability of individual consumers to negotiate preferential treatment.

| Factor | Impact on Cencosud | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Price Sensitivity | High; customers actively seek deals. | Elevated inflation rates in Chile and Peru in 2024 increased consumer price consciousness. |

| Availability of Substitutes | High; numerous competitors and online platforms. | Latin American e-commerce growth projected to reach significant figures by 2025, providing easy alternatives. |

| Switching Costs | Low; easy to compare and move between retailers. | Digital platforms allow for seamless price and product comparison across a wide range of competitors. |

| Customer Concentration | Low; millions of individual consumers. | Cencosud's vast customer base across supermarkets, department stores, and home improvement segments limits individual buyer leverage. |

Same Document Delivered

Cencosud Porter's Five Forces Analysis

This preview showcases the comprehensive Cencosud Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately upon purchase, ensuring full transparency and immediate usability.

Rivalry Among Competitors

Cencosud navigates a fiercely competitive retail environment in Latin America, characterized by a wide spectrum of participants. This includes global giants, established regional players, nimble local businesses, niche specialty retailers, and the rapidly expanding online marketplace. For instance, in 2023, the Latin American e-commerce market reached an estimated $160 billion, highlighting the significant digital competition Cencosud must contend with.

The company's diversified business model means it encounters distinct rivals in each of its operating segments and geographic markets. In its supermarket division, Cencosud competes with companies like Walmart de México y Centroamérica and local powerhouses such as Supermercados Peruanos. Meanwhile, its home improvement segment faces competition from players like Sodimac, which is also a significant presence in the region.

The Latin American retail sector is indeed on an upward trajectory, especially with the rapid expansion of e-commerce. This growth, however, is a magnet for fierce competition, creating a challenging environment for established players like Cencosud.

E-commerce in Latin America is expected to see substantial growth, with forecasts indicating a significant increase in market size by 2025. Key players such as Mercado Libre are not only capturing a large share of this market but are also making substantial investments in their logistics networks and customer loyalty programs, further intensifying the competitive landscape.

Cencosud's competitive rivalry is intensified by its multi-format strategy, encompassing supermarkets, hypermarkets, home improvement, department stores, shopping centers, and financial services. This broad reach allows them to capture a wider customer base and cater to diverse needs, creating a complex competitive landscape.

The company actively differentiates itself through a strong emphasis on private label brands, which often offer a more attractive price point for consumers and higher margins for Cencosud. In 2024, private label penetration remains a key strategic focus across its retail segments.

Furthermore, Cencosud is investing in digital initiatives, such as its retail media network, to enhance customer experience and foster loyalty. These digital advancements aim to personalize offerings and create stickier customer relationships, directly impacting competitive dynamics.

Exit Barriers

Cencosud faces substantial exit barriers due to its deeply entrenched infrastructure. The company's extensive real estate holdings, large workforce across various countries, and intricate supply chain networks translate into very high fixed costs. These factors make it difficult and costly to simply shut down or divest operations cleanly.

For instance, Cencosud's significant presence in markets like Chile, Peru, Colombia, and Argentina means that exiting any one of these would involve complex legal, financial, and operational hurdles. The sheer scale of its retail footprint, encompassing supermarkets, home improvement stores, and department stores, solidifies these barriers.

The strategic decision to divest its Bretas supermarket chain in Brazil in 2021, for example, highlighted the complexities involved. This sale, valued at approximately $300 million, was a significant undertaking that required careful negotiation and execution, illustrating the challenges inherent in unwinding such large-scale operations.

- High Fixed Costs: Significant investment in real estate, technology, and logistics across multiple geographies.

- Large Workforce: The considerable number of employees in each country presents severance and operational wind-down costs.

- Complex Supply Chains: Established and integrated supply networks are costly and time-consuming to dismantle.

- Brand Reputation: Exiting a market can impact the company's overall brand image and future market entry potential.

Strategic Commitments of Rivals

Competitors are doubling down on strategic commitments, especially in areas like digital transformation and artificial intelligence. For example, Mercado Libre, a major player in the region, announced plans to invest around $1.7 billion in 2024, focusing heavily on technology and logistics. This aggressive expansion forces Cencosud to similarly allocate significant capital to maintain its competitive edge and drive innovation.

These substantial investments are not just about staying current; they are about future growth and profitability. Cencosud's rivals are enhancing their loyalty programs and integrating AI to personalize customer experiences and optimize operations. Cencosud's own strategic commitments, therefore, must be robust to counter these moves and secure its market position.

- Digital Transformation: Competitors are heavily investing in e-commerce platforms and data analytics.

- AI Integration: Rivals are leveraging AI for personalized marketing and supply chain efficiency.

- Loyalty Programs: Enhanced customer loyalty initiatives are a key focus for competitors.

- Logistics and Infrastructure: Significant capital is being deployed to upgrade distribution networks.

Cencosud faces intense rivalry from a diverse set of competitors across Latin America, ranging from global e-commerce giants to local specialists. This competition is amplified by significant investments in digital capabilities and logistics by key players like Mercado Libre, which planned to invest approximately $1.7 billion in 2024. These strategic moves by rivals necessitate Cencosud to also commit substantial capital to maintain its market standing and foster innovation.

The company's multi-format approach, spanning supermarkets to financial services, means it encounters distinct rivals in each sector, such as Walmart de México y Centroamérica in its supermarket division. Cencosud's strategy of strengthening private label brands and investing in digital initiatives like retail media networks are key differentiators in this crowded market.

The rapid growth of e-commerce in Latin America, projected to reach significant market sizes by 2025, further fuels this competitive intensity. Competitors are leveraging AI for personalization and optimizing operations, pushing Cencosud to enhance its own customer loyalty programs and digital offerings.

Cencosud's competitive rivalry is characterized by a dynamic landscape where players are continuously investing in technology and customer experience to capture market share.

| Competitor/Segment | Key Focus Areas | Recent Investment Example (2024) |

|---|---|---|

| Mercado Libre (E-commerce) | Technology, Logistics, AI, Loyalty Programs | ~$1.7 billion planned investment |

| Walmart de México y Centroamérica (Supermarkets) | Digitalization, Store Expansion | Ongoing investments in omnichannel capabilities |

| Sodimac (Home Improvement) | E-commerce, In-store experience | Focus on digital integration and customer service |

SSubstitutes Threaten

Consumers in Latin America face a wide array of direct substitutes for Cencosud's retail offerings. These include numerous other supermarket chains, traditional local markets, and specialized food or home goods stores. For instance, in 2024, the discount retail sector in countries like Brazil and Chile continued to expand, attracting consumers seeking more budget-friendly options, directly impacting Cencosud's market share.

There's a noticeable trend of consumers shifting towards smaller, neighborhood-focused stores and discount retailers. This movement is driven by a clear consumer preference for both perceived value and enhanced convenience. In 2023, reports indicated a significant uptick in sales for smaller format stores across several Latin American markets, a trend that has persisted into 2024, putting pressure on larger retailers like Cencosud to adapt their strategies.

The rise of e-commerce and super apps like Mercado Libre presents a substantial threat to Cencosud. These platforms, including Amazon and Rappi, offer an extensive product range and competitive pricing, directly challenging traditional retail. For instance, Mercado Libre's net revenue in the first quarter of 2024 reached $4.3 billion, showcasing its significant market penetration and ability to attract consumers away from physical stores.

Latin American consumers are increasingly turning to digital platforms, with social media now acting as a primary search engine for products. This shift means consumers can easily discover and purchase from a wider array of brands, including smaller, niche players, posing a direct threat to Cencosud's established market presence.

The growing demand for sustainable and locally sourced goods presents another significant challenge. For instance, in 2024, the Latin American e-commerce market for sustainable products saw a notable increase, with consumers actively seeking out brands that align with their values, potentially bypassing Cencosud if its offerings aren't perceived as sufficiently eco-friendly or locally rooted.

Do-It-Yourself (DIY) and Home Production

The threat of substitutes from DIY and home production is a growing concern for retailers like Cencosud, especially in categories like home improvement and food. A segment of consumers increasingly chooses to undertake projects themselves or prepare meals at home, sourcing ingredients from local suppliers or even growing their own produce. This shift can directly reduce demand for traditional retail offerings.

For instance, the home improvement sector has seen a rise in DIY enthusiasts. In 2024, reports indicate that consumer spending on home improvement projects undertaken by homeowners themselves continued to be robust, with many seeking out online tutorials and local hardware stores for supplies rather than engaging full-service contractors. Similarly, the culinary trend of home cooking, amplified by accessible online recipes and ingredient delivery services, provides a direct substitute for pre-prepared meals and restaurant dining, impacting grocery sales.

- DIY Home Improvement: Consumers opting for self-managed renovations and repairs reduce reliance on professional services and the associated retail purchases of finished goods.

- Home Cooking and Local Sourcing: The increasing popularity of preparing meals at home and buying ingredients from farmers' markets or local producers directly competes with supermarket sales.

- Reduced Demand for Services: When consumers choose DIY, it can mean fewer purchases of services that often accompany retail products, such as installation or assembly.

- Cost and Customization Benefits: DIY and home production can offer cost savings and greater personalization, making them attractive alternatives to mass-market retail options.

Alternative Service Models (e.g., Subscription Boxes, Direct-to-Consumer)

Emerging business models like subscription boxes and direct-to-consumer (DTC) brands present an evolving threat. These models offer curated selections and convenience, directly appealing to consumers seeking specialized products or a more personalized shopping experience, potentially diverting spending from traditional retail channels.

For instance, the subscription box market has seen significant growth. In 2024, reports indicate the global subscription box market is projected to reach over $65 billion, demonstrating a clear consumer appetite for this alternative service model.

- Subscription Box Market Growth: Projected to exceed $65 billion globally in 2024, highlighting a significant shift in consumer purchasing habits.

- Direct-to-Consumer (DTC) Expansion: DTC brands continue to gain traction by offering unique value propositions and bypassing traditional retail intermediaries.

- Specialized Product Offerings: These alternative models often cater to niche markets with highly specialized products, directly competing for consumer attention and loyalty.

Consumers in Latin America have a wealth of alternatives to Cencosud's retail offerings, ranging from local markets to specialized stores and increasingly, online platforms. The competitive landscape is intensified by the growing popularity of discount retailers and smaller format stores, a trend evident throughout 2023 and continuing into 2024, as consumers prioritize value and convenience.

E-commerce giants and super apps like Mercado Libre, which reported $4.3 billion in net revenue for Q1 2024, represent a significant substitute, offering vast product selections and competitive pricing. Furthermore, the rise of social media as a product discovery tool allows consumers to easily access a broader array of brands, including niche players, directly challenging Cencosud's established market position.

The increasing consumer demand for sustainable and locally sourced goods, coupled with the DIY movement and the growth of subscription boxes, further diversifies the competitive set. The subscription box market, projected to exceed $65 billion globally in 2024, exemplifies the evolving consumer preferences for curated and convenient alternatives.

| Substitute Category | Examples | 2024 Impact/Trend |

|---|---|---|

| Discount Retailers & Small Format Stores | Local supermarkets, neighborhood shops | Continued expansion and consumer preference for value and convenience. |

| E-commerce & Super Apps | Mercado Libre, Amazon, Rappi | Significant market penetration; Mercado Libre's Q1 2024 revenue was $4.3 billion. |

| Social Media & Niche Brands | Social platforms, specialized online retailers | Increasing use as product discovery tools, offering wider brand access. |

| DIY & Home Production | Home improvement stores, local produce suppliers | Robust consumer spending on self-managed projects and home cooking. |

| Subscription Boxes & DTC | Curated boxes, direct-to-consumer brands | Global market projected to exceed $65 billion in 2024; growing consumer appetite for personalization. |

Entrants Threaten

Entering the large-scale retail sector, like Cencosud does across multiple Latin American countries, demands immense capital. Think about the costs involved: securing prime real estate, stocking vast amounts of inventory, building efficient supply chains, and investing in cutting-edge technology. These aren't small figures; they represent significant barriers to entry for potential new competitors.

For instance, Cencosud's own strategic plans underscore this. Their announced investment of USD 610 million for 2025 clearly illustrates the scale of financial resources required to not only enter but also to expand and maintain operations effectively in this competitive landscape. This substantial financial commitment acts as a powerful deterrent for smaller players or those without deep pockets.

Cencosud's substantial economies of scale in purchasing, logistics, and marketing, driven by its extensive multinational operations and diverse business segments, present a significant barrier to new entrants. For instance, in 2023, Cencosud reported consolidated net sales of CLP 16,381 billion, reflecting its vast operational footprint and purchasing power.

New competitors would face immense difficulty replicating these cost efficiencies without substantial upfront capital and a considerable period to establish market presence and operational expertise. This scale advantage allows Cencosud to negotiate better terms with suppliers and optimize its supply chain, creating a cost structure that is hard for newcomers to match.

Brand loyalty is a significant barrier for new entrants, as established players like Cencosud have cultivated deep customer relationships over many years. This loyalty isn't solely based on price or values; it's also a result of consistent service and a strong market presence. For instance, in 2023, Cencosud reported a significant portion of its sales coming from repeat customers, underscoring the effectiveness of its loyalty initiatives.

Cencosud actively works to increase customer switching costs through its integrated loyalty programs, such as 'Puntos Cencosud,' and by offering financial services. These initiatives create a sticky ecosystem, making it less attractive for customers to shift to a new retailer. In 2024, Cencosud's loyalty program members accounted for over 60% of its total customer transactions, demonstrating its power in retaining customers and deterring new competition.

Access to Distribution Channels

Cencosud's significant advantage lies in its vast physical distribution network. With hundreds of supermarkets, hypermarkets, and shopping centers strategically located across several Latin American countries, new entrants face immense difficulty replicating this reach.

Securing prime retail locations and building equally efficient supply chains are substantial hurdles. For instance, as of early 2024, Cencosud operates over 1,500 stores, a scale that new competitors would struggle to match without considerable investment and time.

- Extensive Physical Footprint: Cencosud's network comprises numerous supermarkets, hypermarkets, and shopping centers.

- Supply Chain Efficiency: Established logistics and operational infrastructure create a barrier.

- Prime Location Access: Difficulty for new entrants to secure comparable, high-traffic retail spaces.

Government Policy and Regulations

Cencosud's extensive experience operating across multiple Latin American countries means it has developed a deep understanding of diverse and often complex government policies and regulations. This includes navigating varying labor laws, import/export requirements, and consumer protection standards, which can be significant barriers for newcomers. For instance, in 2024, Cencosud continued to adapt its operations to evolving consumer protection laws across its key markets, such as Chile and Brazil, ensuring compliance while maintaining competitive pricing strategies.

New entrants would face substantial challenges in acquiring the necessary expertise and resources to comply with these disparate legal frameworks. Cencosud's established compliance infrastructure and legal teams provide a distinct advantage, allowing it to operate efficiently and avoid costly penalties. The company's proactive approach to regulatory changes, particularly in areas like data privacy and sustainability reporting, further solidifies its position.

- Navigating Diverse Regulatory Landscapes: Cencosud operates in markets with distinct legal requirements for retail, finance, and home improvement sectors.

- Compliance Expertise as a Barrier: New entrants require significant investment in legal and compliance teams to understand and adhere to regulations in countries like Argentina, Colombia, Peru, and Brazil.

- Established Legal Frameworks: Cencosud has built robust internal processes to manage compliance with consumer protection, labor, and trade regulations, a significant hurdle for potential new competitors.

- Impact of 2024 Regulatory Shifts: Ongoing changes in areas like e-commerce regulations and tax policies across Latin America in 2024 continue to create a complex operating environment that Cencosud is better equipped to handle than new market entrants.

The threat of new entrants for Cencosud is relatively low due to significant capital requirements and established economies of scale. The sheer cost of setting up operations, from real estate to supply chains, deters many potential competitors. Cencosud's extensive purchasing power, as evidenced by its 2023 net sales of CLP 16,381 billion, allows it to achieve cost efficiencies that are difficult for newcomers to replicate.

Brand loyalty and customer retention strategies, such as Cencosud's loyalty program which in 2024 saw members account for over 60% of transactions, create a substantial barrier. Furthermore, Cencosud's vast physical distribution network, comprising over 1,500 stores as of early 2024, and its deep understanding of diverse regulatory environments across Latin America, further solidify its competitive position against potential new entrants.

| Barrier Type | Description | 2023/2024 Data Point |

|---|---|---|

| Capital Requirements | High costs for real estate, inventory, and supply chains. | USD 610 million planned investment for 2025. |

| Economies of Scale | Cost advantages from large-scale purchasing and logistics. | CLP 16,381 billion in consolidated net sales (2023). |

| Brand Loyalty & Switching Costs | Customer retention through loyalty programs and financial services. | Over 60% of transactions from loyalty members (2024). |

| Distribution Network | Extensive physical store presence and efficient logistics. | Over 1,500 stores operated (early 2024). |

| Regulatory Expertise | Navigating complex and varied legal frameworks in Latin America. | Adaptation to evolving consumer protection laws in Chile and Brazil (2024). |

Porter's Five Forces Analysis Data Sources

Our Cencosud Porter's Five Forces analysis is built upon a foundation of credible data, including Cencosud's annual reports, investor presentations, and SEC filings. We also incorporate insights from reputable market research firms specializing in the retail sector and macroeconomic data from international financial institutions.