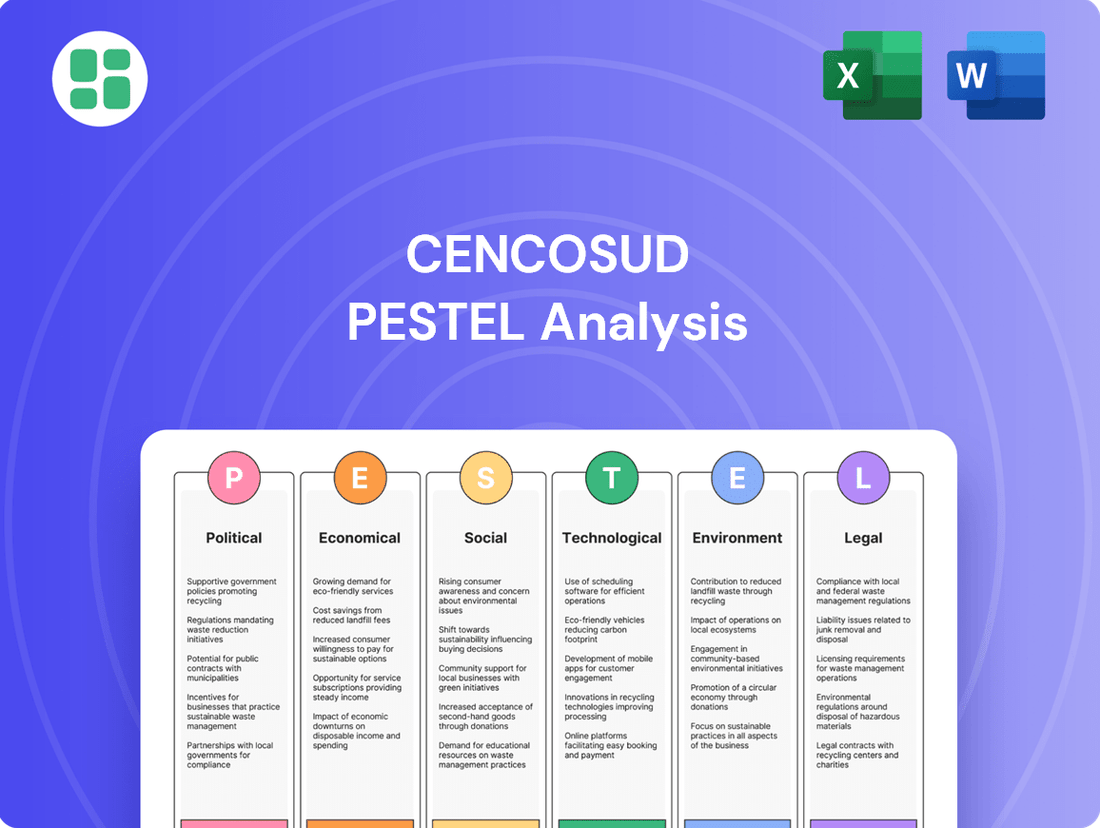

Cencosud PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Cencosud's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate this dynamic landscape and identify opportunities for growth. Gain a competitive edge by understanding the external forces impacting this retail giant. Download the full PESTLE analysis now for strategic insights you can implement immediately.

Political factors

Cencosud's extensive operations across diverse Latin American markets mean it's highly sensitive to varying degrees of political stability and evolving government policies. Shifts in leadership or regulatory frameworks can directly alter market access and operational expenses.

For example, in 2024, several Latin American nations experienced significant political transitions, which often correlate with policy reviews impacting retail sectors. These changes can manifest as new taxation regimes or altered consumer protection laws, directly influencing Cencosud's strategic planning and cost structures.

Such political dynamics can introduce new tariffs or subsidies, compelling Cencosud to adapt its supply chain management and pricing strategies to navigate these fluctuating economic landscapes effectively.

Cencosud's operations are significantly shaped by trade agreements across Latin America and with global partners. For instance, the Pacific Alliance, comprising Chile, Colombia, Mexico, and Peru, aims to foster free movement of goods and services, potentially reducing Cencosud's sourcing costs and expanding its market access within these key economies. As of early 2024, intra-regional trade within Mercosur, which includes Argentina, Brazil, Paraguay, and Uruguay, continues to evolve, impacting Cencosud's cross-border logistics and product availability in its supermarket and department store segments.

Cencosud navigates a complex web of regulations across its operating countries, impacting everything from obtaining business permits to ensuring ongoing operational compliance. The consistency of these rules, or lack thereof, directly influences the ease of opening new stores and maintaining efficient operations, as seen in the varied bureaucratic hurdles encountered in different Latin American markets during 2024.

Bureaucratic inefficiencies and inconsistent enforcement can significantly slow down Cencosud's expansion plans and increase operational costs. For instance, delays in securing necessary licenses in certain regions in 2024 have been a persistent challenge. However, a predictable and streamlined regulatory environment, which Cencosud actively advocates for, presents a substantial opportunity for smoother market entry and increased investment confidence.

Corruption and Governance Risks

The prevalence of corruption and the quality of governance in Cencosud's key markets, particularly in Latin America, present ongoing challenges. For instance, Transparency International's 2023 Corruption Perception Index ranked several South American nations with scores below 50, indicating significant perceived corruption. This can translate into increased operational costs due to demands for illicit payments or delays caused by bureaucratic inefficiencies, impacting Cencosud's ability to operate smoothly and competitively.

Risks associated with weak governance include unfair competition from entities that bypass regulations, potential legal entanglements from bribery allegations, and a general lack of transparency that can hinder effective business planning. These factors can erode investor confidence and lead to substantial financial penalties or reputational damage, as seen in past cases involving multinational corporations facing fines for corrupt practices in emerging markets.

- Impact on Operations: Perceived corruption can lead to higher compliance costs and operational disruptions.

- Legal and Reputational Risks: Exposure to bribery or lack of transparency can result in significant fines and brand damage.

- Competitive Landscape: Unfair competition arises when regulatory frameworks are not consistently enforced.

- Mitigation Strategies: Cencosud's robust internal controls and commitment to ethical conduct are vital for navigating these risks.

Geopolitical Tensions and Social Unrest

Geopolitical tensions in Latin America, such as the ongoing political instability in Peru, where Cencosud operates several supermarkets and department stores, can directly impact operations. For instance, widespread protests in early 2023 led to temporary disruptions and affected consumer spending patterns. Cencosud's ability to manage these localized challenges is key, as seen in its adaptation strategies during periods of social unrest.

Social unrest, including labor strikes, can halt Cencosud's retail and operational activities. In 2024, several countries in the region experienced labor disputes that could have affected supply chains and inventory management for retailers like Cencosud. The company's resilience is tested by its capacity to negotiate and maintain operational continuity amidst such events, ensuring employee safety and minimizing economic losses.

Cencosud's performance is sensitive to shifts in consumer confidence, which are often influenced by political stability and social harmony. For example, economic uncertainty stemming from political disputes in Argentina, a significant market for Cencosud, can lead to reduced discretionary spending, impacting sales volumes. The company's financial results in 2024 reflected these regional economic sensitivities.

Navigating these volatile external shocks is crucial for Cencosud's business continuity. The company's proactive risk management, including diversified sourcing and flexible operational models, helps mitigate the impact of geopolitical tensions and social unrest.

Political stability across Cencosud's operating countries is a critical factor, with 2024 seeing varied political landscapes impacting business environments. Changes in government policies, such as new tax regulations or trade agreements, directly influence Cencosud's operational costs and market access. For instance, shifts in fiscal policy in countries like Chile and Brazil can alter consumer purchasing power and Cencosud's profitability.

What is included in the product

This PESTLE analysis examines the critical external factors influencing Cencosud's operations across political, economic, social, technological, environmental, and legal landscapes.

It provides actionable insights into how these macro-environmental forces present both challenges and strategic opportunities for Cencosud's continued growth and market positioning.

A Cencosud PESTLE analysis, presented in a clear, summarized format, acts as a pain point reliever by providing readily accessible insights for strategic decision-making, streamlining discussions on external factors impacting the business.

Economic factors

High inflation, particularly in Argentina, erodes Cencosud's purchasing power and increases operational costs, directly impacting consumer spending. For instance, Argentina's inflation rate was projected to exceed 100% in 2024, a significant challenge for businesses operating there.

Currency depreciation, especially against the US dollar, inflates the cost of imported goods and debt servicing for Cencosud. This volatility also distorts the reported earnings from its various Latin American markets.

Cencosud's net income experienced a downturn, partly attributed to currency depreciation and economic instability in Argentina. However, the company has been actively mitigating these effects through strategic acquisitions and stringent cost management initiatives to maintain profitability.

Consumer purchasing power is a critical driver for Cencosud. In 2024, the company observed that while some markets displayed robust consumer spending, others faced headwinds, impacting overall sales volumes and the preference for certain product categories. This divergence highlights the sensitivity of sales to regional economic conditions.

Disposable income levels directly correlate with Cencosud's ability to sell higher-margin products. An economic downturn typically forces consumers to cut back on discretionary purchases, leading to a greater demand for value-oriented options and private-label brands, which Cencosud actively manages.

Interest rate fluctuations directly impact Cencosud's financial strategy, affecting the cost of borrowing for crucial investments and day-to-day operations. For instance, if rates rise significantly in 2024 or 2025, the expense of securing the planned $610 million in investments could increase, potentially impacting profitability.

Higher interest rates also influence consumer behavior, making credit more expensive. This can lead to reduced spending on larger purchases, such as appliances from its home improvement division or apparel from its department stores, thereby potentially dampening sales volumes across key segments.

Economic Growth and GDP Trends

Cencosud's performance is closely tied to the economic growth of the Latin American markets it serves. For instance, in 2023, Chile, a key market, saw its GDP contract by 0.6%, impacting consumer spending. However, projections for 2024 indicate a rebound, with the IMF forecasting a 2.0% GDP growth for Chile. This anticipated recovery is crucial for Cencosud's sales trajectory.

The company is specifically looking at 2024 as a recovery year across Latin America. While Argentina's hyperinflation presents unique challenges, Cencosud expects overall sales growth, especially when accounting for the currency fluctuations. This focus on underlying sales performance, independent of extreme inflation, highlights the importance of stable economic conditions for the retailer.

- Projected GDP Growth for Key Markets (2024): Chile (2.0% IMF forecast), Peru (2.5% IMF forecast), Colombia (2.4% IMF forecast).

- Impact of Economic Conditions: Stronger GDP growth generally correlates with increased disposable income and higher retail sales, directly benefiting Cencosud's revenue streams.

- Cencosud's 2024 Outlook: The company anticipates a recovery year, aiming for sales growth by focusing on operational efficiencies and market share gains amidst varied economic landscapes.

Employment Rates and Wage Levels

Employment rates and wage levels are crucial for Cencosud's performance as they directly impact consumer spending power across its various markets in Latin America. Higher employment and increasing wages generally translate to greater disposable income, boosting consumer confidence and driving retail sales for Cencosud's supermarkets, department stores, and home improvement segments.

Conversely, economic downturns characterized by high unemployment or stagnant wages can significantly suppress consumer demand. This forces Cencosud to be agile, potentially adjusting pricing strategies, optimizing product assortments, and focusing on value propositions to maintain market share and profitability amidst reduced consumer spending.

- Chile: As of Q1 2024, Chile's unemployment rate stood at 6.9%, with average nominal wages showing a moderate increase, supporting consumer spending in Cencosud's home market.

- Brazil: Brazil's unemployment rate averaged around 7.8% in early 2024, with wage growth showing signs of recovery, offering a mixed but generally improving outlook for Cencosud's operations.

- Argentina: Facing high inflation, Argentina's wage levels have been a complex factor, with nominal increases often lagging behind price rises, potentially impacting Cencosud's pricing and sales volumes.

- Colombia: By mid-2024, Colombia reported an unemployment rate around 10.5%, with wage adjustments aiming to keep pace with inflation, influencing the purchasing capacity of Cencosud's customer base.

Economic factors significantly shape Cencosud's performance, with inflation and currency fluctuations presenting ongoing challenges. For example, Argentina's projected inflation exceeding 100% in 2024 directly impacts purchasing power and operational costs.

Interest rate hikes, such as potential increases in 2024-2025, affect Cencosud's borrowing costs for investments, estimated at $610 million, and can dampen consumer spending on credit-sensitive purchases.

GDP growth is a key indicator; while Chile's GDP contracted 0.6% in 2023, a 2.0% growth forecast for 2024 offers a positive outlook for Cencosud's key market.

Employment and wage levels are critical for consumer spending. Chile's 6.9% unemployment in Q1 2024 with moderate wage increases supports spending, whereas Argentina's wage growth often trails inflation, posing a challenge.

| Economic Indicator | Value/Projection (2024) | Impact on Cencosud |

|---|---|---|

| Argentina Inflation | >100% (projected) | Reduced purchasing power, increased costs |

| Chile GDP Growth | 2.0% (IMF forecast) | Potential for increased consumer spending |

| Chile Unemployment Rate | 6.9% (Q1 2024) | Supports consumer spending |

| Investment Capital | $610 million | Cost of borrowing affected by interest rates |

Same Document Delivered

Cencosud PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cencosud PESTLE analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic decision-making.

Sociological factors

Latin America's demographic landscape is a key driver for Cencosud. For instance, the region's ongoing urbanization, with a significant portion of its population now residing in cities, directly influences consumer behavior and retail demand. In 2023, it was estimated that over 80% of Latin America's population lived in urban areas, a trend that continues to shape Cencosud's strategy.

This rapid urban growth necessitates a retail approach that prioritizes accessibility and convenience. Cencosud's expansion into smaller-format stores and its investment in shopping centers reflect an understanding of these evolving urban consumer needs, aiming to capture market share in densely populated areas.

Consumer lifestyles are shifting, with a growing emphasis on health, wellness, convenience, and sustainability. This directly impacts what people want to buy. Cencosud is adapting by offering more organic options, pre-prepared meals, and its own brands that cater to these evolving tastes. For instance, their private label brands like Cuisine&Co and Hydrum are a direct response to consumers seeking quality and value aligned with modern living.

In 2024, the global health and wellness market is projected to reach over $5.8 trillion, indicating a significant consumer drive towards healthier choices. Cencosud's investment in expanding its organic and ready-to-eat offerings positions it to capture a larger share of this expanding market. The company's strategic focus on private labels, which often offer better margins and stronger brand loyalty, is a key element in meeting these consumer demands effectively.

Cultural nuances across Latin America significantly shape consumer behavior, impacting everything from brand loyalty to how marketing messages resonate. For Cencosud, recognizing and adapting to these distinct local traditions, holidays, and community values is paramount for crafting effective campaigns and promotions. For instance, understanding the importance of family gatherings during festive seasons in countries like Chile or Peru allows Cencosud to tailor its product offerings and advertising to align with these deeply ingrained cultural practices.

Cencosud's broad retail footprint, encompassing hypermarkets like Jumbo and specialty stores such as The Fresh Market, provides a strategic advantage in catering to diverse regional preferences. This multi-format approach enables the company to meet varied consumer needs, whether it's bulk purchasing at a hypermarket or seeking premium, locally sourced goods at a specialty outlet. This adaptability is key to maintaining relevance and driving sales in a dynamic cultural landscape.

Social Responsibility and Ethical Consumption

Consumers are increasingly vocal about their expectations for companies to act responsibly. This means Cencosud, like many retailers, faces pressure to ensure its products are sourced ethically and have a minimal environmental footprint. This growing awareness directly impacts purchasing decisions, pushing companies to re-evaluate their supply chains and operational standards.

The demand for transparency regarding environmental, social, and governance (ESG) factors is a significant trend. Cencosud's strategic acquisition of Vopero, a circular fashion platform, demonstrates a proactive approach to this demand. This move not only aligns with consumer preferences but also positions Cencosud favorably with investors who prioritize sustainability in their portfolios.

- Consumer Demand for Ethical Products: A significant percentage of consumers, particularly younger demographics, are willing to pay more for products from brands that demonstrate strong ethical and sustainability practices.

- ESG Integration: Global investors are increasingly incorporating ESG criteria into their investment decisions, with sustainability initiatives becoming a key differentiator for companies.

- Circular Economy Adoption: The acquisition of Vopero by Cencosud highlights the growing importance of circular economy models in retail, addressing waste reduction and resource efficiency.

Digital Adoption and Connectivity

The increasing availability of internet and smartphones in Latin America is fundamentally changing consumer behavior, pushing a shift towards online shopping and integrated online-offline retail models. Cencosud's strategic focus on digital transformation, evidenced by its expanding e-commerce operations and enhanced Cencosud Media capabilities, is a direct response to this evolving landscape.

This digital shift is already yielding tangible results for Cencosud. For instance, The Fresh Market, a Cencosud subsidiary, saw its online sales surge by 23.8% in 2024, demonstrating the effectiveness of their digital initiatives. This growth underscores the importance of adapting to these sociological changes.

- Growing Internet Penetration: Increased access to the internet and smartphones across Latin America is reshaping consumer habits.

- E-commerce Dominance: Consumers are increasingly favoring online platforms and omnichannel experiences for their purchases.

- Cencosud's Digital Investment: The company is actively investing in digital transformation, including e-commerce expansion and Cencosud Media.

- Quantifiable Online Growth: The Fresh Market's 23.8% online sales growth in 2024 highlights the success of digital strategies in this evolving market.

Sociological factors significantly influence Cencosud's operations in Latin America. The region's high urbanization rate, with over 80% of the population living in cities as of 2023, drives demand for convenient and accessible retail formats. Cencosud's strategic expansion into smaller stores and shopping centers directly addresses this trend.

Shifting consumer lifestyles, emphasizing health, wellness, and sustainability, are also key. Cencosud's response includes expanding organic and ready-to-eat options, with the global health and wellness market projected to exceed $5.8 trillion in 2024. Their private label brands are a direct effort to meet these evolving preferences.

Cultural nuances across Latin America necessitate tailored marketing and product offerings, with Cencosud adapting to local traditions and holidays. Furthermore, growing consumer demand for ethical and transparent business practices, exemplified by Cencosud's acquisition of the circular fashion platform Vopero, is shaping corporate responsibility strategies.

The increasing digital penetration in Latin America is transforming consumer behavior, leading to a surge in e-commerce. Cencosud's investment in digital transformation, including its e-commerce operations and Cencosud Media, is a direct response, with The Fresh Market reporting a 23.8% online sales growth in 2024.

| Sociological Factor | Impact on Cencosud | Supporting Data/Trend |

|---|---|---|

| Urbanization | Increased demand for convenient retail; expansion of smaller store formats and shopping centers. | Over 80% of Latin America's population urbanized (2023). |

| Lifestyle Shifts (Health, Wellness, Sustainability) | Expansion of organic and ready-to-eat offerings; focus on private labels. | Global health and wellness market >$5.8 trillion (2024 projection). |

| Cultural Diversity | Tailored marketing and product assortments to local traditions and holidays. | Adaptation to regional consumer preferences in countries like Chile and Peru. |

| Ethical Consumerism & ESG Awareness | Focus on ethical sourcing and sustainability initiatives; acquisition of circular economy platforms. | Acquisition of Vopero; growing investor preference for ESG-compliant companies. |

| Digital Adoption | Growth in e-commerce and omnichannel strategies; investment in digital platforms. | The Fresh Market online sales grew 23.8% (2024); increasing internet and smartphone penetration. |

Technological factors

The escalating adoption of e-commerce demands sophisticated online infrastructure and efficient delivery networks, compelling Cencosud to enhance its digital capabilities. The company's commitment to digital transformation is evident in its robust e-commerce expansion, with notable success in markets like the United States and Peru.

Cencosud's strategic vision for 2025 includes significant capital allocation towards digital initiatives and the development of Cencosud Media, underscoring the critical role of omnichannel integration in its future growth strategy.

Cencosud is actively integrating data analytics and AI to better understand its customers. By leveraging big data, the company gains insights into consumer habits, which helps optimize stock levels and tailor marketing campaigns more effectively. This focus on AI aims to improve operational efficiency across the board.

The company's strategy includes a significant push for Machine Learning and AI applications. These technologies are being deployed to deepen customer understanding, refine audience targeting for promotions, assist in content creation, and optimize the performance of integrated online and offline marketing efforts. This strategic investment is expected to drive more personalized customer experiences.

Cencosud is actively investing in automation for its logistics network. In 2024, the company continued its focus on modernizing warehouses and distribution centers to boost efficiency. This investment aims to streamline operations, leading to reduced costs and faster delivery times for customers.

Optimizing logistics synergies remains a core component of Cencosud's strategy for creating long-term value. By enhancing automation, Cencosud can improve inventory management and reduce transit times, directly impacting its competitive edge in the retail sector.

Digital Payment Systems and Fintech Integration

The surge in digital payment systems and fintech integration is fundamentally altering consumer transaction habits, directly influencing Cencosud's financial services. As of early 2024, regions where Cencosud operates have seen significant growth in mobile payment adoption, with some Latin American countries reporting over 60% of retail transactions occurring digitally. This trend necessitates Cencosud's financial services division to continually innovate, ensuring seamless and secure digital payment options to maintain customer loyalty and operational efficiency.

Cencosud's strategic partnerships in credit card offerings are a direct response to this evolving technological landscape. By collaborating with fintech providers and financial institutions, the company can leverage advanced payment technologies and expand its reach. For instance, in 2023, Cencosud announced expanded collaborations aimed at enhancing digital wallet functionalities and offering more personalized financial products, reflecting a commitment to adapting to the fintech revolution and meeting customer demand for convenient, integrated financial solutions.

- Digital Payment Growth: Over 60% of retail transactions in key Latin American markets are now digital, a trend accelerating in 2024.

- Fintech Integration: Cencosud is actively partnering with fintech firms to enhance its credit card and financial service offerings.

- Customer Convenience: The company's strategy focuses on providing seamless digital payment experiences to retain and attract customers.

- Partnership Evolution: Cencosud's 2023 collaborations highlight a push towards more sophisticated digital wallet and personalized financial product development.

In-store Technology and Customer Experience

Cencosud is actively investing in in-store technologies to elevate the customer journey. Initiatives like self-checkout kiosks and digital signage are being rolled out to improve convenience and engagement. For example, by the end of 2024, Cencosud aims to have over 300 self-checkout stations across its supermarkets in Chile and Argentina, a significant increase from 2023 figures.

The company's strategic focus on innovation directly impacts its technological adoption. Cencosud views enhanced customer experience as a key driver for operational improvements, leading to greater efficiency and potentially better product quality through better inventory management and data insights.

- Self-Checkout Expansion: Cencosud plans to increase its self-checkout presence by 25% in 2025.

- Digital Signage Deployment: Over 500 stores are slated to receive updated digital signage by mid-2025.

- Smart Cart Trials: Pilot programs for smart shopping carts are ongoing in select Jumbo stores in Santiago.

- AR Integration: Exploration into augmented reality for product information and in-store navigation is in early development stages.

Cencosud's technological advancements are pivotal, with a significant push towards AI and machine learning to personalize customer experiences and optimize operations. By the end of 2024, the company is targeting over 300 self-checkout stations in Chile and Argentina, enhancing in-store convenience.

The company's digital payment strategy is robust, fueled by over 60% of retail transactions in key Latin American markets now being digital as of early 2024. Cencosud is actively forging fintech partnerships, as evidenced by expanded collaborations in 2023 to boost digital wallet functionalities.

| Technology Focus | 2024/2025 Target/Status | Impact |

|---|---|---|

| E-commerce Infrastructure | Ongoing enhancement, notable success in US & Peru | Improved online presence and delivery efficiency |

| AI & Machine Learning | Strategic investment for customer understanding and marketing | Enhanced personalization and operational efficiency |

| Automation (Logistics) | Modernizing warehouses and distribution centers | Reduced costs, faster delivery times |

| Digital Payments & Fintech | Over 60% digital transactions in LATAM (early 2024) | Customer loyalty, operational efficiency, expanded financial services |

| In-store Technologies | 300+ self-checkout stations by end of 2024 (Chile/Argentina) | Increased customer convenience and engagement |

Legal factors

Cencosud navigates a complex web of consumer protection laws across Latin America, impacting everything from product safety standards to advertising claims and return policies. For instance, in Chile, the Consumer Rights Act (Ley N° 19.496) mandates clear information on pricing, warranties, and prohibits misleading advertising. Failure to comply can result in significant penalties; in 2023, Chilean authorities issued fines totaling millions of dollars for various consumer rights violations across different retail sectors.

The company's commitment to exceptional customer service, as highlighted in its mission, necessitates rigorous adherence to these varied legal frameworks. This includes ensuring product labeling is accurate and transparent, particularly for food products regarding allergens and nutritional information, as required by regulations in countries like Argentina and Brazil. Maintaining high standards in these areas is vital to prevent costly litigation and preserve consumer trust, a key asset for a retail giant like Cencosud.

Cencosud's extensive workforce, numbering over 100,000 employees across multiple Latin American countries, faces a complex web of labor laws. Variations in minimum wage, mandated working hours, and employee benefit structures, such as mandatory contributions to social security or retirement funds, directly impact operational costs and human resource strategies in each market. For instance, Chile's labor code, alongside regulations in Peru, Colombia, Brazil, and Argentina, dictates specific requirements for severance pay and annual leave, necessitating careful compliance to avoid penalties and maintain fair labor practices.

Navigating these diverse legal landscapes is crucial for Cencosud to ensure ethical employment and mitigate legal risks. Non-compliance with regulations concerning collective bargaining rights or workplace safety standards can lead to significant fines, operational disruptions, and damage to the company's reputation. For example, in 2024, several retail companies faced increased scrutiny and potential legal action for alleged violations of overtime pay regulations in specific regions, highlighting the ongoing importance of robust compliance frameworks.

As a major player in several South American markets, Cencosud must navigate a complex web of antitrust and competition laws. These regulations aim to ensure a level playing field by preventing monopolistic practices and promoting fair market competition. For instance, in 2023, Brazil's Administrative Council for Economic Defense (CADE) continued to scrutinize large retail mergers, a trend that could impact Cencosud's expansion plans.

Any strategic moves, such as mergers or acquisitions, require rigorous compliance with these laws. Cencosud's past acquisition of the Jumbo supermarket chain in Chile, for example, underwent significant review by the National Economic Prosecutor's Office (FNE) to ensure it did not stifle competition.

Data Privacy and Cybersecurity Regulations

Latin American countries are increasingly adopting data privacy and cybersecurity regulations, mirroring global trends like the GDPR. This evolving legal landscape directly affects Cencosud's operations, particularly its collection, storage, and utilization of customer data across its retail and financial services. Compliance necessitates significant investment in robust data protection measures.

Failure to adhere to these regulations can result in substantial financial penalties and damage to brand reputation. For instance, while specific Latin American fines are still developing, GDPR penalties can reach up to 4% of annual global revenue or €20 million, whichever is higher, setting a precedent for strict enforcement. Cencosud must ensure its digital infrastructure and data handling practices align with these stringent requirements to maintain customer trust and operational integrity.

- Regulatory Landscape: Growing data privacy laws in Latin America, inspired by GDPR, mandate stricter customer data handling.

- Impact on Cencosud: Cencosud must adapt its data collection, storage, and usage practices to comply with new regulations.

- Customer Trust: Robust cybersecurity and data protection are crucial for maintaining customer confidence and avoiding reputational damage.

- Financial Risk: Non-compliance can lead to significant fines, potentially impacting Cencosud's profitability and market standing.

Import/Export Regulations and Tariffs

Cencosud operates a vast supply chain that includes both domestically sourced and imported products, necessitating strict compliance with import/export regulations, customs duties, and tariffs across its operating regions. For instance, in 2023, Chile, a key market for Cencosud, maintained a general import tariff of 6%, with specific rates varying by product category. Fluctuations in these trade policies directly influence sourcing expenses and the consistent availability of goods for consumers.

The company's strategic initiative to bolster private-label brands has been instrumental in reducing its dependence on imported items. This approach helps to insulate Cencosud from the volatility of international trade policies. For example, by increasing local production for its private label lines, Cencosud can potentially absorb tariff changes more effectively than if it solely relied on imported finished goods.

- Regulatory Compliance: Cencosud must navigate diverse import/export laws and customs procedures in countries like Chile, Argentina, Brazil, Peru, and Colombia.

- Tariff Impact: Changes in tariffs, such as the 6% general rate in Chile, can significantly alter the cost structure of imported merchandise.

- Private Label Strategy: Cencosud's focus on private labels aims to mitigate the financial impact of fluctuating international trade policies by increasing local sourcing and production.

- Sourcing Costs: Trade agreements and tariffs directly affect the landed cost of goods, impacting Cencosud's profitability and pricing strategies.

Cencosud faces stringent consumer protection laws across Latin America, requiring adherence to product safety, labeling, and advertising standards. For instance, Chile's Ley N° 19.496 mandates clear pricing and warranty information, with violations leading to substantial fines, as evidenced by millions in penalties issued in 2023. Adherence to these varied legal frameworks, including accurate allergen labeling as required in Argentina and Brazil, is crucial for maintaining consumer trust and avoiding costly litigation.

The company's extensive workforce of over 100,000 employees is subject to diverse labor laws concerning minimum wage, working hours, and benefits across its operating regions. Compliance with regulations on severance pay and annual leave, as stipulated in countries like Peru and Colombia, is essential to prevent penalties and ensure fair employment practices. For example, increased scrutiny on overtime pay regulations in 2024 highlights the ongoing need for robust compliance frameworks in human resource management.

Cencosud must navigate complex antitrust and competition laws in its key markets, with regulatory bodies like Brazil's CADE scrutinizing large retail mergers in 2023. Strategic actions, such as Cencosud's acquisition of Jumbo in Chile, undergo thorough review by authorities like the FNE to ensure market competition is not adversely affected. These legal frameworks are critical for maintaining a level playing field and influencing Cencosud's expansion strategies.

The evolving data privacy and cybersecurity landscape in Latin America, influenced by global standards like GDPR, necessitates significant investment in data protection for Cencosud. Non-compliance with these regulations, which can incur penalties similar to GDPR's potential 4% of global revenue, is a substantial financial and reputational risk. Ensuring digital infrastructure and data handling practices align with these stringent requirements is vital for customer trust.

Environmental factors

Climate change poses significant physical risks to Cencosud's operations. Extreme weather events, like the severe droughts impacting parts of South America in early 2024, can disrupt agricultural supply chains, leading to shortages and increased food costs for consumers. This also directly affects Cencosud's sourcing of fresh produce and other key inventory.

The increasing scarcity of natural resources, particularly water and energy, presents another challenge. Rising utility costs in 2024, driven by factors including climate-related supply disruptions, directly impact Cencosud's operational expenses across its supermarkets and department stores. Integrating climate resilience into logistics and energy management is therefore crucial for cost control and business continuity.

Cencosud faces increasingly stringent waste management and recycling regulations across its Latin American markets, impacting its operational costs and strategic planning. For instance, Chile, where Cencosud has a significant presence, implemented a new Extended Producer Responsibility (EPR) law in 2022, requiring companies to manage the collection and recycling of their products and packaging. This means Cencosud must invest in more robust recycling programs and potentially redesign packaging to be more easily recyclable, adding to its sustainability overhead.

The focus on reducing environmental footprints is driving retailers like Cencosud to adopt more sustainable waste management practices. This includes minimizing single-use plastics and enhancing in-store recycling collection points. In 2024, many Latin American countries are also looking to implement or strengthen bans on specific plastic items, forcing Cencosud to adapt its supply chain and product offerings to comply with these evolving environmental standards.

Consumers and regulators are increasingly demanding that companies like Cencosud ensure their products are sourced sustainably and ethically, especially in sectors like food and textiles. This means Cencosud must be transparent and accountable throughout its supply chains, verifying that suppliers uphold responsible labor practices and minimize environmental harm.

For instance, in 2023, Cencosud continued to emphasize its commitment to responsible sourcing, with initiatives focused on reducing the environmental footprint of its private label products. This aligns with a broader trend where nearly 60% of global consumers report they are willing to change their consumption habits to reduce environmental impact, a sentiment Cencosud is actively addressing.

Carbon Footprint and Energy Consumption

Cencosud's extensive network of stores, distribution centers, and transportation fleets inherently generates a significant carbon footprint. This environmental impact is a key focus for the company as it navigates sustainability challenges.

Addressing this involves strategic initiatives such as enhancing energy efficiency across its operations, increasing the use of renewable energy sources, and streamlining logistics to minimize emissions. These actions are crucial for mitigating environmental impact and meeting evolving stakeholder expectations.

Demonstrating progress, Cencosud reported a notable achievement:

- An 8% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to the 2023 baseline.

Environmental, Social, and Governance (ESG) Standards

Cencosud's commitment to Environmental, Social, and Governance (ESG) standards is crucial for its investor relations and overall reputation. The company is actively integrating sustainability into its core business strategy, recognizing its importance in attracting capital and maintaining stakeholder trust.

Cencosud has demonstrated significant progress in its ESG performance. For instance, in 2023, the company was recognized as one of the top global performers in the S&P Global ESG Score, achieving a score of 85 out of 100, placing it in the 97th percentile among rated companies. This strong performance highlights their dedication to sustainable practices and transparent reporting.

The company's strategic pillars actively incorporate sustainability initiatives, reflecting a holistic approach to ESG. This focus is not just about compliance but about building long-term value and resilience.

- Global Recognition: Cencosud achieved an 85/100 in the S&P Global ESG Score in 2023, ranking in the 97th percentile globally.

- Strategic Integration: Sustainability is a core component of Cencosud's strategic pillars, influencing business decisions.

- Investor Appeal: Strong ESG performance is increasingly vital for attracting investment and enhancing corporate reputation.

- Evolving Standards: Adherence to evolving ESG reporting frameworks is a continuous effort for Cencosud.

Environmental factors significantly influence Cencosud's operations and strategy. Climate change impacts supply chains, as seen with droughts affecting food availability in early 2024, directly increasing operational costs due to resource scarcity and rising utility prices. Stringent waste management regulations, like Chile's Extended Producer Responsibility law implemented in 2022, necessitate investments in recycling and packaging redesign, adding to overheads.

Cencosud is actively addressing its environmental footprint, focusing on energy efficiency and renewable energy sources to reduce its carbon emissions. The company achieved an 8% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2023 baseline, demonstrating a commitment to sustainability. This aligns with consumer demand, with nearly 60% of global consumers willing to alter habits for environmental reasons, a trend Cencosud is incorporating into its private label product strategy.

Cencosud's strong Environmental, Social, and Governance (ESG) performance is a key differentiator, evidenced by its 2023 S&P Global ESG Score of 85 out of 100, placing it in the 97th percentile globally. This commitment to sustainability is integrated into its core business strategy, enhancing investor appeal and corporate reputation as it navigates evolving environmental standards and consumer expectations.

PESTLE Analysis Data Sources

Our Cencosud PESTLE Analysis is built on a robust foundation of data from official government agencies, international financial institutions like the IMF and World Bank, and reputable market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Cencosud's operations across its diverse markets.