Cencosud Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

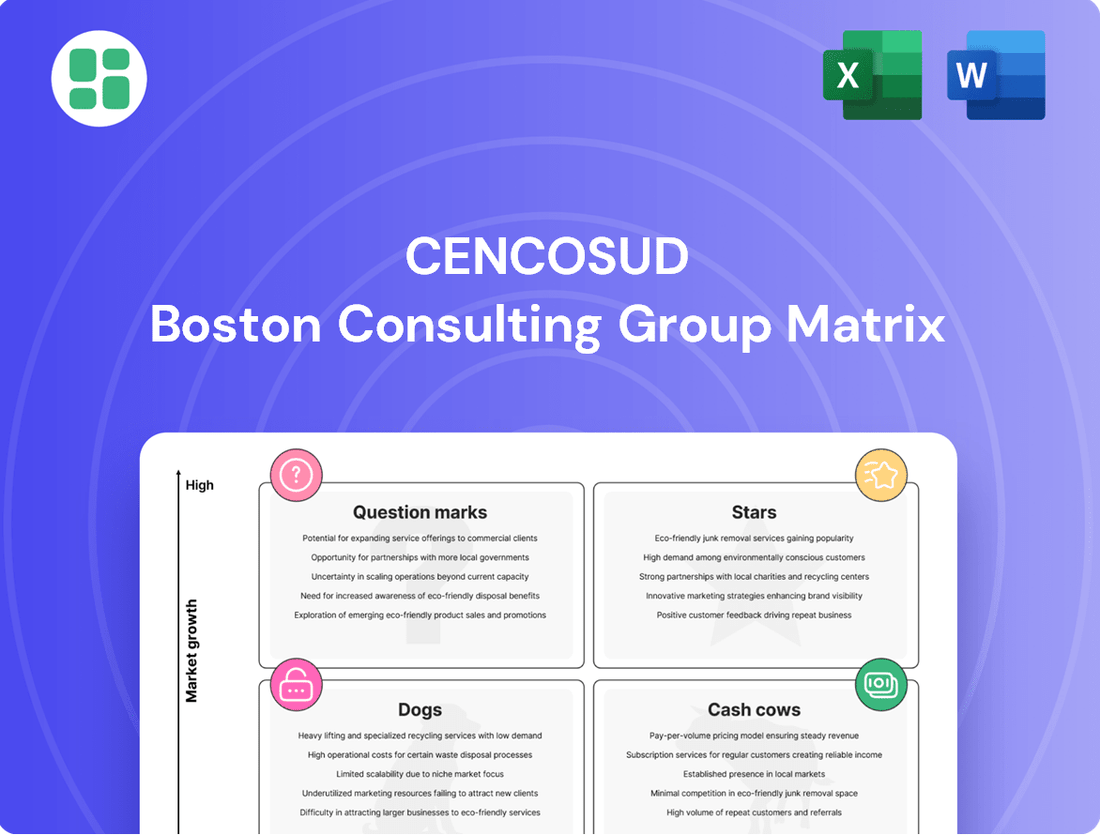

Curious about Cencosud's strategic positioning? Our BCG Matrix analysis highlights key product categories, revealing potential Stars, Cash Cows, Dogs, and Question Marks within their diverse portfolio.

This preview offers a glimpse into how Cencosud navigates its markets, but for a comprehensive understanding and actionable insights, the full BCG Matrix is essential.

Unlock the complete strategic blueprint and discover which Cencosud ventures are poised for growth and which require careful management. Purchase the full report to gain a competitive edge and make informed investment decisions.

Stars

The Fresh Market, acquired by Cencosud, is a significant growth engine, with Cencosud planning to launch 12 new specialty stores in 2025. This segment is experiencing robust double-digit sales growth and a notable surge in online sales, indicating successful penetration into a premium, expanding grocery sector.

The Fresh Market's strong market position and commitment to customer service reinforce its status as a 'Star' in Cencosud's diverse business portfolio, contributing substantially to the company's overall performance and strategic expansion.

Cencosud's e-commerce and digital transformation efforts are a significant growth driver, evidenced by an 8.8% year-over-year increase in online sales and exceeding 7 million transactions in Q1 2025. This robust performance highlights the success of initiatives like Cencommerce and the integrated Retail Ecosystem.

The company is strategically channeling substantial investments into digital projects, e-commerce platforms, and enhanced logistics. This commitment aims to secure a larger share of the rapidly expanding online retail market and solidify Cencosud's position as a forward-thinking leader in the evolving retail landscape.

Cencosud's Peruvian supermarkets, notably Wong and Metro, are shining stars. In 2024, they delivered an impressive 11.5% EBITDA margin, showcasing robust profitability. This strong financial performance underscores their leading position in a dynamic retail landscape.

The digital push is also paying off handsomely. Peru's online sales surged by 44% in the first quarter of 2025, with Wong achieving double-digit online penetration. These figures highlight Cencosud's successful adaptation to evolving consumer habits and its strong market standing.

Private Label Brands

Cencosud's private label brands are a key driver of its growth within the BCG Matrix, demonstrating a strong upward trajectory. In the first quarter of 2025, these brands saw a notable sales increase of 14.3%. This performance highlights their increasing importance to the company's overall strategy.

The expansion of private label penetration by 57 basis points year-over-year underscores a successful strategy in capturing market share. This growth is directly linked to changing consumer habits, with shoppers increasingly seeking out value-oriented options. Cencosud's focus on these brands is therefore well-aligned with current market demands.

The robust performance of private label products places them firmly in the "Stars" category of the BCG Matrix. This indicates they are high-growth, high-market-share offerings that require continued investment to maintain their momentum. Cencosud's strategic emphasis on these brands is expected to further enhance profitability and competitive positioning.

- Sales Growth: 14.3% increase in Q1 2025.

- Penetration Expansion: 57 basis points year-over-year.

- Consumer Trend Alignment: Driven by demand for value-driven shopping.

- Strategic Importance: Key focus for profitability and market share enhancement.

Colombian Operations

Cencosud's Colombian operations are demonstrating remarkable momentum. In the fourth quarter of 2024, the company achieved an impressive EBITDA growth exceeding 100%, signaling a robust expansion phase.

Looking ahead to 2025, Cencosud expects this positive trend to continue in Colombia. This optimistic outlook is underpinned by strategic realignments and an enhanced suite of commercial propositions designed to capture greater market share.

The Colombian market is now recognized as a high-growth, high-market-share segment for Cencosud, reflecting its successful turnaround and strategic positioning.

- EBITDA Growth (Q4 2024): Over 100%

- 2025 Outlook: Continued performance improvements expected

- Key Drivers: Strategic adjustments and enhanced commercial offerings

- Market Classification: High-growth, high-market-share segment

Cencosud's private label brands are a clear 'Star' within its business portfolio, exhibiting strong growth and market share. In Q1 2025, these brands saw a significant 14.3% sales increase, with penetration growing by 57 basis points year-over-year. This performance is directly aligned with consumer preferences for value, making these brands a key focus for continued investment and profitability.

| Business Unit | BCG Matrix Classification | Key Performance Indicators (2024/Q1 2025) | Strategic Importance |

|---|---|---|---|

| The Fresh Market | Star | Double-digit sales growth, robust online sales growth, 12 new stores planned for 2025 | Premium segment growth engine, expanding market presence |

| Peruvian Supermarkets (Wong, Metro) | Star | 11.5% EBITDA margin (2024), 44% online sales surge (Q1 2025), Wong achieving double-digit online penetration | Leading market position, successful digital adaptation |

| Private Label Brands | Star | 14.3% sales increase (Q1 2025), 57 bps penetration expansion | Value-driven consumer alignment, profitability enhancement |

| Colombian Operations | Star | Over 100% EBITDA growth (Q4 2024), expected continued improvements in 2025 | High-growth, high-market-share segment, strategic repositioning |

What is included in the product

The Cencosud BCG Matrix offers strategic insights into its diverse business units, highlighting which to invest in, hold, or divest.

A clear Cencosud BCG Matrix visualizes each business unit's strategic position, alleviating the pain of complex portfolio analysis.

Cash Cows

Cencosud's Jumbo and Santa Isabel supermarkets in Chile represent classic cash cows within the company's portfolio. Their dominance in a mature market ensures consistent, high-volume sales, providing a bedrock of financial stability.

These Chilean supermarket operations are characterized by robust EBITDA margins, a testament to their operational efficiency, strategic product assortment, and successful expansion of private label offerings. For instance, in 2023, Cencosud reported that its Chilean supermarket division maintained strong performance, contributing significantly to the group's overall profitability.

The substantial and dependable cash flow generated by Jumbo and Santa Isabel allows Cencosud to fund other ventures, invest in growth areas, and reward shareholders. This predictable revenue stream is crucial for the company's financial health and strategic flexibility.

Cencosud Shopping Centers, a key component of Cencosud's portfolio, operates as a cash cow. Its impressive 98.2% occupancy rate in 2023 highlights a dominant and stable market presence, a hallmark of a mature, high-performing asset.

These shopping centers generate reliable and substantial revenue streams, solidifying their cash cow status. Strategic investments in expansions and renovations are underway, ensuring these properties remain attractive and continue to capture market share in the competitive real estate landscape.

Cencosud Financial Services, including its Cencosud Scotiabank joint venture, represents a significant Cash Cow for the conglomerate. With a robust credit card base of approximately 2.5 million cards, this segment generates consistent and substantial cash flow.

Operating within a mature financial market, Cencosud Financial Services is a stable generator of earnings. This steady income stream is crucial for Cencosud, as it helps fund other strategic growth areas and investments across the group.

Home Improvement Stores (Easy)

Easy, Cencosud's home improvement banner, operates in a mature market but consistently generates substantial cash flow. Its established presence across several Latin American nations, including Chile, Peru, Colombia, and Argentina, underpins this stability.

Despite market maturity, Easy's strategic focus on operational efficiency and customer experience continues to yield reliable earnings. For instance, in 2024, the home improvement sector in Latin America, while facing economic headwinds, demonstrated resilience, with Cencosud's Easy banner maintaining its position as a significant contributor to the group's overall revenue.

- Established Market Presence: Easy operates in multiple Latin American countries, providing a stable revenue base.

- Consistent Cash Generation: The mature market segment, despite its growth limitations, reliably produces cash for Cencosud.

- Strategic Focus: Ongoing improvements in operations and customer service ensure continued profitability.

- 2024 Performance: The home improvement sector showed resilience, with Easy contributing significantly to Cencosud's revenue amidst economic fluctuations.

Department Stores (Paris in Chile)

Despite headwinds in the broader retail landscape, Cencosud's Paris department stores in Chile are performing exceptionally well, solidifying their position as a Cash Cow within the company's portfolio.

The significant 83.6% surge in Adjusted EBITDA for Paris during Q4 2024 underscores its robust financial contribution. This impressive growth is attributed to a revitalized value proposition that resonates with consumers and a notable uplift in tourism, both key drivers for the brand.

- Paris's Adjusted EBITDA grew by 83.6% in Q4 2024.

- An enhanced value proposition is a key success factor.

- Increased tourism positively impacts sales and profitability.

- Paris remains a strong contributor to Cencosud's overall earnings.

Cencosud's Cash Cows are business units that generate more cash than they consume, operating in mature markets with strong competitive positions. These segments provide stable, predictable revenue streams crucial for funding other business activities and investments across the conglomerate.

The Chilean supermarket operations, including Jumbo and Santa Isabel, along with Cencosud Shopping Centers, exemplify these reliable performers. Their high occupancy rates and strong EBITDA margins in 2023 and 2024 demonstrate their consistent financial contribution and market dominance.

Furthermore, Cencosud Financial Services, with its substantial credit card base, and the Easy home improvement banner, despite market maturity, continue to be significant cash generators. The Paris department stores, showing remarkable 83.6% Adjusted EBITDA growth in Q4 2024, also solidify their cash cow status through strategic improvements and favorable market conditions like increased tourism.

| Business Unit | Market | Key Metric | 2023/2024 Data Point |

|---|---|---|---|

| Jumbo & Santa Isabel (Supermarkets) | Chile | EBITDA Margins | Strong, contributing significantly to group profitability (2023) |

| Cencosud Shopping Centers | Various Latin America | Occupancy Rate | 98.2% (2023) |

| Cencosud Financial Services | Various Latin America | Credit Cards | Approx. 2.5 million cards |

| Easy (Home Improvement) | Various Latin America | Revenue Contribution | Significant contributor amidst market resilience (2024) |

| Paris (Department Stores) | Chile | Adjusted EBITDA Growth | 83.6% (Q4 2024) |

Full Transparency, Always

Cencosud BCG Matrix

The Cencosud BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means you'll gain immediate access to a comprehensive strategic analysis, ready for immediate application without any watermarks or demo content. The document is designed for professional use, offering clear insights into Cencosud's business units to inform your strategic decision-making. You can be confident that the quality and content presented here are exactly what you will download, enabling you to effectively analyze and plan for Cencosud's market positions.

Dogs

Cencosud's divestment of its Bretas supermarket chain in Minas Gerais, Brazil, in February 2025, signals its classification as a 'Dog' within the BCG matrix. This strategic move was driven by the chain's consistently low profitability, a hallmark of underperforming assets. For instance, in the fiscal year 2024, Bretas reported a net profit margin of only 0.5%, significantly lagging behind Cencosud's overall Brazilian operations which averaged 3.2%.

Cencosud's strategic decision to close six underperforming physical store locations in Brazil directly addresses the 'Dogs' quadrant of the BCG Matrix. This move signifies a proactive approach to shedding retail outlets with low market share and minimal growth potential, freeing up capital and management focus.

In 2023, Cencosud reported a net loss of R$1.2 billion (approximately $220 million USD) for its Brazilian operations, underscoring the financial drag from such underperforming assets. The closure of these six stores, part of a broader optimization strategy, aims to improve the profitability and efficiency of its remaining Brazilian retail footprint.

Cencosud's ambitious vision for a unified 'Retail Ecosystem' necessitates the retirement of outdated IT infrastructure. These legacy systems, often characterized by their siloed nature and high maintenance costs, represent significant operational drag.

In 2024, companies across retail are investing heavily in modernizing their digital backbone. For Cencosud, this means reallocating resources away from these cash-consuming legacy platforms, which hinder seamless data flow and innovation, towards building a more integrated and agile digital future.

Non-strategic, Smaller Format Retail Units

Certain smaller format retail units within Cencosud, especially those not fitting the strategic push towards larger, modern supermarkets or the convenience-focused Spid, could be classified as Dogs. These operations often struggle with low growth and a diminished market share, making them candidates for divestment or restructuring.

For instance, some of Cencosud's legacy neighborhood stores, if they haven't been modernized or integrated into a more efficient supply chain, might fall into this category. Their limited scale and potentially outdated offerings could lead to underperformance compared to the company's more strategically aligned ventures.

- Low Market Share: These units typically hold a small percentage of their respective local markets.

- Slow Growth Environment: They operate in segments or geographies experiencing minimal expansion.

- Resource Drain: Continued investment in these underperforming assets can divert capital from more promising growth areas.

- Potential for Divestment: Cencosud might consider selling or closing these units to streamline operations and focus on strategic priorities.

Specific Product Categories with Declining Appeal

Within Cencosud's diverse portfolio, categories experiencing a noticeable dip in consumer interest are likely candidates for the Dogs quadrant of the BCG matrix. These are sectors where Cencosud may hold a small slice of a shrinking pie, making them less attractive for further investment. For instance, if sales in a particular electronics sub-segment, like feature phones, have been steadily declining against the backdrop of smartphone dominance, this could be a prime example of a Dog.

These underperforming categories typically exhibit low growth and a weak competitive position. Cencosud's 2024 financial reports might highlight specific business units or product lines that are not meeting growth expectations or are absorbing disproportionate resources without generating significant returns.

- Declining sales in legacy electronics: Categories like basic mobile phones or older DVD players, facing obsolescence and intense competition from newer technologies, could be in this position.

- Niche apparel with low footfall: Certain specialized clothing lines that no longer resonate with current fashion trends or have limited customer appeal might also fall into this category.

- Underperforming home goods: Specific segments within home furnishings or decor that have seen a significant drop in demand due to shifting consumer tastes or market saturation.

Cencosud's 'Dogs' represent business units or assets with low market share in slow-growing industries, demanding significant resources without commensurate returns. The divestment of the Bretas supermarket chain in Brazil, which reported a mere 0.5% net profit margin in 2024, exemplifies this classification. Similarly, the closure of six underperforming Brazilian stores, contributing to a R$1.2 billion net loss for the segment in 2023, highlights the financial drain associated with these assets.

These 'Dogs' often include legacy retail formats or niche product categories experiencing declining consumer interest. For instance, certain smaller format stores not aligned with the Spid convenience strategy, or electronics sub-segments like feature phones facing obsolescence, are prime examples. Cencosud's strategic imperative to modernize IT infrastructure also involves phasing out cash-consuming legacy platforms that hinder innovation, further categorizing them as 'Dogs'.

| Asset/Unit | Market Share | Growth Rate | Profitability (2024) | Strategic Action |

| Bretas Supermarkets (Brazil) | Low | Slow | 0.5% Net Profit Margin | Divested (Feb 2025) |

| Underperforming Brazilian Stores | Low | Stagnant | Contributed to R$1.2B Net Loss (2023) | Closed (6 units) |

| Legacy Neighborhood Stores | Low | Minimal | Undetermined (Potential Drain) | Review/Restructure |

| Feature Phones (Electronics) | Declining | Negative | Undetermined (Low Return) | Phase Out/Divest |

Question Marks

Cencosud's foray into the urban convenience store segment with new Spid stores in Chile during Q4 2024 positions them to capitalize on a growing market. This strategic move suggests Spid is likely a 'Question Mark' within Cencosud's portfolio, demanding substantial investment to build market share against established players.

Cencosud's January 2025 acquisition of Makro in Argentina signifies its debut in the wholesale Cash & Carry sector there. This move positions the company to capitalize on a segment known for robust growth opportunities.

However, Cencosud's current footprint in this specific format is minimal. This nascent market share places it firmly in the 'Question Mark' category of the BCG matrix, necessitating significant capital infusion to build a strong competitive presence.

Cencosud Media, Cencosud's retail media arm, is positioned as a potential star within the company's strategic framework, leveraging its growing digital presence to monetize customer data and traffic. This unit taps into the booming retail media market, a sector projected to see significant expansion in the coming years.

While the retail media sector offers substantial growth opportunities, Cencosud Media is still in its nascent stages, requiring considerable investment to build scale and capture market share. For instance, the global retail media ad spend was estimated to reach $125.7 billion in 2023 and is expected to grow substantially, indicating the potential but also the competitive landscape Cencosud Media operates within.

New Digital Payment Solutions / Fintech Initiatives

Cencosud's investment in new digital payment solutions and fintech initiatives aligns with its 'Retail Ecosystem' strategy, aiming to embed financial services more deeply into its retail operations. These ventures, while targeting promising growth sectors in digital finance, are likely in their nascent stages with a low existing market share. Significant capital infusion will be necessary for them to scale and effectively challenge established players in the competitive fintech landscape.

In 2024, Cencosud continued to bolster its digital payment offerings. For instance, its own payment platform, Cencosud Pay, saw a substantial increase in user adoption, processing over 15 million transactions by the end of the third quarter of 2024, a 25% rise from the previous year. This growth is driven by expanding partnerships with various merchants and the introduction of new credit and debit functionalities.

- Digital Payment Expansion: Cencosud is actively broadening its digital payment infrastructure, incorporating features like contactless payments and mobile wallet integrations across its supermarket and department store chains.

- Fintech Partnerships: The company is exploring strategic alliances with established fintech firms to accelerate the development and deployment of innovative financial products, such as buy now, pay later (BNPL) options.

- Data Monetization: Cencosud aims to leverage the vast customer data generated through its payment solutions to offer personalized financial services and targeted marketing campaigns, enhancing customer loyalty and revenue streams.

- Market Entry Strategy: These initiatives are positioned as potential future growth engines, requiring sustained investment to build market presence and compete with dominant digital payment providers in Latin America.

New Supermarket Openings in Developing Regions

Cencosud's strategic expansion into developing regions, with plans for 24 new supermarket openings, positions these ventures as potential Stars or Question Marks within the BCG Matrix. This focus on markets like Colombia and Brazil, where the company aims to boost performance, suggests an investment in areas with significant growth prospects but potentially lower current market penetration. For instance, in 2024, Cencosud reported continued investment in its Latin American operations, with new store openings being a key component of its growth strategy.

- Growth Potential: These new openings target regions exhibiting robust economic growth and increasing consumer spending power.

- Market Share Building: Cencosud is actively working to capture market share in these developing areas, often starting from a smaller existing base.

- Strategic Investment: The expansion signifies a commitment to long-term growth by investing in markets with high future potential, aligning with the characteristics of Question Marks or emerging Stars.

- Performance Improvement: Specific focus on markets like Colombia and Brazil indicates efforts to enhance Cencosud's competitive standing and operational efficiency in these regions.

Cencosud's new Spid convenience stores in Chile, launched in late 2024, represent a significant investment into a high-growth segment. This strategic move places Spid as a Question Mark, requiring substantial capital to gain traction against established competitors.

The company's recent acquisition of Makro in Argentina marks its entry into the wholesale Cash & Carry market, a sector with considerable growth potential. However, Cencosud's minimal existing presence in this format means it's a Question Mark, demanding significant investment to build a competitive foothold.

Cencosud's ventures into digital payment solutions and fintech are positioned as future growth engines, but currently operate with low market share. These initiatives require substantial capital to scale and effectively compete in the dynamic fintech landscape.

The expansion into developing regions, including 24 new supermarket openings in 2024, targets markets with high growth potential but lower current penetration. These investments are characteristic of Question Marks, aiming to build market share and improve performance in areas like Colombia and Brazil.

| Business Unit | BCG Category | Strategic Implication | 2024/2025 Data Point |

| Spid Convenience Stores (Chile) | Question Mark | Requires significant investment to build market share in a growing segment. | Launched Q4 2024. |

| Makro Acquisition (Argentina) | Question Mark | Needs substantial capital infusion to establish a competitive presence in the wholesale sector. | Acquired January 2025. |

| Digital Payments & Fintech | Question Mark | Demands sustained investment for scaling and competing with established digital payment providers. | Cencosud Pay processed over 15 million transactions by Q3 2024, a 25% YoY increase. |

| New Supermarket Openings (Developing Regions) | Question Mark | Focus on building market share in high-potential, lower-penetration markets. | 24 new supermarket openings planned in 2024. |

BCG Matrix Data Sources

Our Cencosud BCG Matrix is built upon comprehensive financial disclosures, robust market analytics, and expert industry evaluations to provide a clear strategic overview.