Cencosud Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

Curious about the strategic genius behind Cencosud's diversified retail empire? Our Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their success. Discover the key partnerships and cost structures that drive their operations.

Ready to unlock the full strategic blueprint of Cencosud? This comprehensive Business Model Canvas details their core activities, resources, and channels, providing actionable insights for your own business ventures. Download the complete, editable file to gain a competitive edge.

Partnerships

Cencosud's strategic supplier and manufacturer relationships are foundational to its operational success. In 2024, the company continued to leverage these partnerships to guarantee a broad and reliable assortment of goods across its diverse retail channels, from grocery aisles to fashion floors. These collaborations are vital for managing stock, upholding quality standards, and offering attractive prices, all of which are core to Cencosud's customer value proposition.

The focus remains on refining the product selection and expanding private label offerings in tandem with these key partners. This strategic alignment allows Cencosud to differentiate itself in competitive markets and enhance customer loyalty by providing unique, high-quality own-brand products. For instance, in 2024, Cencosud reported a significant increase in sales from its private label brands, a direct testament to the strength of these supplier collaborations.

Cencosud's financial services segment, a key driver of customer loyalty and sales, relies heavily on strategic alliances with financial institutions and payment providers. These partnerships are crucial for offering private label credit cards and consumer loans, directly impacting the convenience and accessibility of purchases for Cencosud's customers.

In 2024, Cencosud solidified its presence in Brazil through a significant new agreement with Banco Bradesco for credit card issuance. This collaboration is designed to streamline payment processing, expand credit offerings, and potentially introduce innovative financial products, thereby deepening customer engagement and driving repeat business across its various retail banners.

Cencosud's strategic alliances with technology and e-commerce platforms are crucial for its digital evolution. These partnerships provide access to advanced e-commerce solutions, data analytics capabilities, and sophisticated logistics management, all vital for a robust omni-channel presence.

The company's commitment to digital transformation is evident in its collaboration with technology providers to enhance customer experience. For instance, Cencosud's Cencommerce unit leverages Amazon Web Services (AWS) infrastructure, a leading cloud provider, to ensure the seamless and high-performance operation of its online applications. This focus on technology integration aims to streamline operations and create a more engaging digital journey for customers.

Logistics and Distribution Networks

Cencosud's success hinges on robust logistics and distribution networks, partnering with key players to navigate its vast operational footprint. These alliances are crucial for the timely flow of products to over 1,500 stores and for fulfilling the growing demand for e-commerce deliveries across Latin America and the United States.

The company's strategic focus on enhancing these capabilities is evident in its 2025 investment plans. For instance, Cencosud has been actively upgrading its distribution centers and transportation fleets, aiming for greater efficiency and reduced delivery times. In 2024, the company continued to invest in technology to optimize inventory management and route planning.

- Strategic Alliances: Cencosud collaborates with third-party logistics providers to manage its complex supply chain, ensuring product availability across diverse geographical regions.

- E-commerce Fulfillment: Partnerships are essential for Cencosud's online sales, guaranteeing efficient last-mile delivery to a growing customer base.

- 2025 Investment Focus: Significant capital is allocated to modernizing logistics infrastructure, including advanced warehousing and transportation solutions, to support future growth and operational excellence.

- Operational Efficiency: These partnerships directly contribute to Cencosud's ability to maintain competitive pricing and customer satisfaction through reliable and cost-effective distribution.

Real Estate Developers and Shopping Center Tenants

Cencosud’s shopping centers thrive through strategic alliances with a diverse array of tenants. These partners, ranging from prominent retail brands and captivating entertainment venues to popular food service providers, are crucial in curating a rich and engaging customer experience. This tenant mix not only draws foot traffic but also ensures the optimal utilization of the gross leasable area (GLA) within Cencosud's malls.

The company's commitment to enhancing its retail portfolio is evident in its ongoing investments. Cencosud is actively engaged in the expansion and renovation of seven shopping centers. This strategic initiative is projected to add a significant 66,000 square meters to its total GLA, further solidifying its market presence and offering more space for its valued partners.

- Tenant Diversification: Cencosud collaborates with a broad spectrum of businesses, including major retail chains, cinemas, and restaurants, to create vibrant shopping environments.

- Gross Leasable Area (GLA) Maximization: Partnerships are key to filling and optimizing the available retail space, driving revenue and enhancing the mall's appeal.

- Investment in Growth: Cencosud is actively expanding its physical footprint by investing in seven shopping centers, aiming to boost GLA by 66,000 sqm.

- Synergistic Relationships: These collaborations foster a mutually beneficial ecosystem, where tenants gain access to high-traffic locations and Cencosud benefits from a well-occupied and attractive retail asset.

Cencosud's Key Partnerships are multifaceted, encompassing suppliers, financial institutions, technology providers, logistics firms, and a diverse tenant base for its shopping centers. These collaborations are essential for product sourcing, financial services, digital capabilities, efficient distribution, and creating attractive retail destinations. In 2024, Cencosud continued to strengthen these relationships to enhance its value proposition and operational efficiency across its various business segments.

| Partnership Type | Key Activities/Benefits | 2024 Impact/Focus |

|---|---|---|

| Suppliers & Manufacturers | Product assortment, quality, pricing, private label development | Guaranteed reliable assortment; increased private label sales |

| Financial Institutions | Credit card issuance, consumer loans | Streamlined payments, expanded credit offerings (e.g., Banco Bradesco agreement in Brazil) |

| Technology Providers | E-commerce platforms, data analytics, cloud infrastructure | Enhanced digital operations (e.g., AWS for Cencommerce), improved customer experience |

| Logistics Providers | Supply chain management, last-mile delivery | Timely product flow to over 1,500 stores; optimized inventory and route planning |

| Shopping Center Tenants | Retail brands, entertainment, food services | Curated customer experience, GLA maximization, driving foot traffic |

What is included in the product

This Cencosud Business Model Canvas provides a detailed roadmap of its diversified retail operations, outlining its broad customer segments, extensive multi-channel approach, and value propositions across home improvement, supermarkets, department stores, and financial services.

It offers a strategic overview of Cencosud's key resources, activities, and partnerships, supported by an analysis of its cost structure and revenue streams, making it ideal for understanding their integrated market approach.

Cencosud's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and strategic adjustments.

Activities

Retail Operations Management is central to Cencosud's strategy, encompassing the daily oversight of its varied retail banners like Jumbo, Easy, and Paris. This includes meticulous inventory control, strategic product placement, and optimizing store layouts to enhance customer experience and drive sales. Ensuring smooth operations across its vast store network is paramount.

The company's commitment to expanding its physical footprint is evident in its Q4 2024 performance, where Cencosud successfully launched 10 new stores across four different countries. This expansion added more than 10,000 square meters of valuable sales space, directly supporting the core activities of retail operations management by bringing more products and services closer to customers.

Cencosud actively optimizes its supply chain, encompassing procurement, warehousing, transportation, and last-mile delivery for both physical and online operations. This focus aims to guarantee product availability, drive down expenses, and shorten delivery windows.

A significant initiative in 2024 was the company's food rescue program, which successfully recovered more than 1,900 tons of food across its regional operations. This demonstrates a commitment to reducing waste and improving efficiency within the supply chain.

Cencosud's key activities heavily involve its digital transformation, a crucial element for modern retail success. This includes a significant push to expand its e-commerce platforms and develop user-friendly mobile applications.

The company is also actively investing in retail media initiatives, aiming to create a more integrated physical-digital ecosystem for its customers. This strategic focus on enhancing online sales is yielding results, as evidenced by a notable 23.8% year-over-year increase in online sales for Q4 2024 in the US market.

Financial Services Provision

Cencosud's financial services segment is a crucial component, focusing on enhancing customer loyalty and creating diversified income. This involves the operation of private label credit cards, offering consumer financing, and managing extensive loyalty programs. For instance, the 'Puntos Cencosud' program is designed to reward frequent shoppers, thereby fostering repeat business and deepening customer relationships.

These financial activities directly support Cencosud's core retail operations by providing customers with convenient payment options and incentives to shop more frequently. This synergy allows Cencosud to capture a larger share of consumer spending. By offering these integrated services, the company aims to increase customer lifetime value and differentiate itself in a competitive market.

- Private Label Credit Cards: Facilitate seamless purchases across Cencosud's retail banners, often with exclusive benefits for cardholders.

- Consumer Loans: Provide financing options for larger purchases, making goods more accessible to a wider customer base.

- Loyalty Programs: 'Puntos Cencosud' and similar initiatives reward customer engagement, driving repeat transactions and gathering valuable purchasing data.

- Revenue Diversification: Financial services contribute to a more stable and varied revenue stream, reducing reliance solely on product sales.

Shopping Center Management and Development

Cencosud's shopping center operations are driven by core activities like meticulous property management, securing diverse tenants through active leasing, and implementing robust marketing and event strategies to boost foot traffic. These efforts are crucial for maintaining vibrant commercial hubs.

The company is actively investing in its physical retail footprint. Cencosud has outlined plans to expand and renovate seven of its shopping centers throughout 2025. This strategic initiative is projected to significantly increase the total gross leasable area across its portfolio.

- Property Management: Ensuring operational efficiency and tenant satisfaction in existing centers.

- Leasing: Attracting and retaining a varied mix of retail and service tenants to optimize space utilization.

- Marketing & Events: Driving customer engagement and sales through promotional campaigns and community events.

- Strategic Development: Expanding and upgrading physical assets to enhance competitiveness and capture new market opportunities.

Cencosud's key activities revolve around managing its diverse retail banners, optimizing supply chains, and driving digital transformation. This includes expanding its physical stores, as seen with 10 new store launches in Q4 2024, and enhancing its e-commerce presence, which saw a 23.8% year-over-year online sales increase in the US in Q4 2024. The company also focuses on its financial services, like the Puntos Cencosud loyalty program, and managing shopping centers through property management, leasing, and marketing.

| Key Activity Area | Description | Recent Data/Initiative |

|---|---|---|

| Retail Operations | Daily oversight of banners (Jumbo, Easy, Paris), inventory, store layout. | 10 new stores launched in Q4 2024 across 4 countries. |

| Supply Chain Optimization | Procurement, warehousing, transport, last-mile delivery. | Recovered over 1,900 tons of food in 2024 through food rescue program. |

| Digital Transformation | E-commerce expansion, mobile app development, retail media. | 23.8% year-over-year increase in online sales (US, Q4 2024). |

| Financial Services | Private label cards, consumer financing, loyalty programs. | 'Puntos Cencosud' loyalty program drives customer engagement. |

| Shopping Center Operations | Property management, tenant leasing, marketing, events. | Plans to expand/renovate 7 shopping centers in 2025. |

Preview Before You Purchase

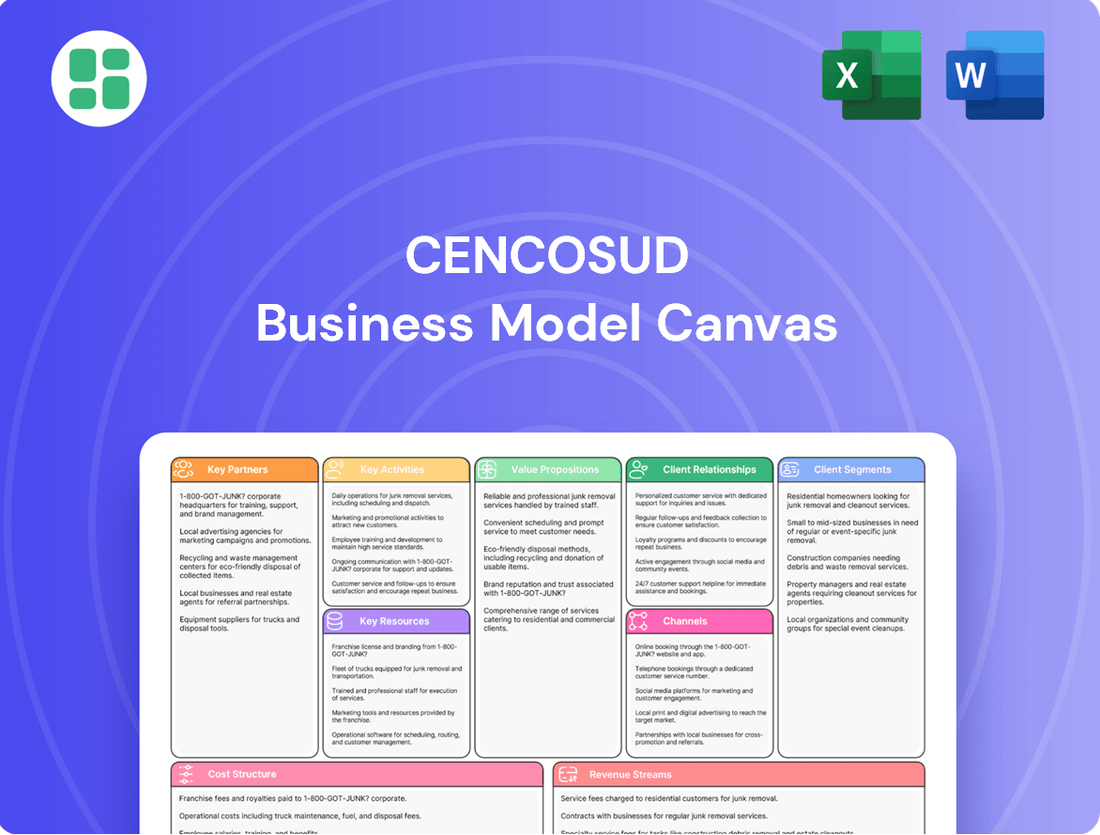

Business Model Canvas

The Cencosud Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive overview details Cencosud's value proposition, customer segments, channels, revenue streams, and key resources, providing a clear strategic blueprint. You'll gain immediate access to this fully editable and professionally formatted document, ready for your analysis and application.

Resources

Cencosud's extensive retail store network, encompassing supermarkets, hypermarkets, home improvement, and department stores, forms a critical physical asset. This vast infrastructure spans multiple countries, offering significant reach and customer accessibility.

The company's real estate holdings are substantial, including numerous shopping centers that contribute considerable gross leasable area. This integrated approach leverages both retail operations and property management.

As of early 2025, Cencosud proudly operates a network of approximately 1,180 stores and shopping centers. This impressive scale underscores its significant presence in the retail landscape.

Cencosud's strength lies in its diverse portfolio of highly recognized brands such as Jumbo, Santa Isabel, Paris, Easy, and The Fresh Market. This collection of brands represents a significant intangible asset, fostering deep customer trust and loyalty across a wide range of market segments.

The company's commitment to corporate responsibility and business reputation was acknowledged in the prestigious Merco 2024 rankings. This recognition underscores the value Cencosud places on maintaining a positive public image, which directly supports its brand equity and customer relationships.

Cencosud's extensive workforce, exceeding 100,000 individuals as of 2024, represents a core asset. This vast pool of talent brings specialized knowledge crucial for success in retail, logistics, financial services, and burgeoning digital sectors.

The collective expertise of these employees is instrumental in optimizing operational efficiency, elevating customer experiences, and fostering innovation across Cencosud's varied business segments. Their skills directly contribute to the company's competitive edge.

Cencosud actively cultivates a corporate environment that values its people and champions diversity. This focus on human capital ensures a motivated and skilled workforce, capable of adapting to evolving market demands and driving sustained growth.

Financial Capital and Investments

Cencosud's ability to access substantial financial capital is fundamental to its continued growth, market expansion, and strategic maneuvers, including potential acquisitions. This financial strength underpins its operational capacity and future development.

The company has outlined a significant investment strategy, earmarking USD 610 million for its 2025 plans. These funds are primarily directed towards opening new stores, modernizing existing ones, and advancing its digital initiatives, reflecting a commitment to both physical and online retail presence.

Cencosud demonstrated robust financial performance in 2024, with revenues climbing by 15.9% to reach CLP $16,493,815 million. This substantial revenue increase highlights the company's expanding market reach and operational success.

- Financial Resources: Essential for operations, expansion, and strategic acquisitions.

- 2025 Investment Plan: USD 610 million allocated to store openings, renovations, and digital projects.

- 2024 Revenue Growth: 15.9% increase, reaching CLP $16,493,815 million.

Technology Infrastructure and Data

Cencosud's technology infrastructure is the backbone of its diverse retail operations. This includes sophisticated e-commerce platforms, advanced data analytics systems, and integrated supply chain management software. These technologies are crucial for seamlessly managing both their extensive physical store network and their growing digital presence. In 2023, Cencosud reported significant investments in digital transformation initiatives, aiming to enhance customer experience and operational efficiency across its markets.

The company's commitment to its Retail Ecosystem pillar is heavily reliant on these technological assets. By leveraging data analytics, Cencosud aims to gain deeper insights into consumer behavior, personalize offerings, and identify new avenues for revenue generation. This focus on data-driven strategies is designed to strengthen customer loyalty and unlock further growth opportunities within their existing business segments.

- E-commerce Platforms: Essential for online sales and customer engagement, supporting omnichannel strategies.

- Data Analytics Systems: Used to understand customer preferences, optimize inventory, and personalize marketing efforts.

- Supply Chain Management Software: Crucial for efficient logistics, inventory control, and timely product delivery across all channels.

- Digital Transformation Investments: Cencosud has been actively investing in upgrading its technology to support its long-term growth and competitive positioning.

Cencosud's key resources include its vast physical store network and significant real estate holdings, encompassing approximately 1,180 stores and shopping centers as of early 2025. These are complemented by a portfolio of strong brands like Jumbo and Paris, and a dedicated workforce of over 100,000 employees in 2024. The company's financial strength is evident in its 2025 investment plan of USD 610 million and its 2024 revenue growth of 15.9% to CLP $16,493,815 million. Crucially, its technology infrastructure, including e-commerce platforms and data analytics, underpins its retail ecosystem and digital transformation efforts.

| Key Resource Category | Specific Assets/Capabilities | Data Point/Significance |

|---|---|---|

| Physical Infrastructure | Retail Store Network | ~1,180 stores and shopping centers (early 2025) |

| Real Estate | Shopping Centers | Significant gross leasable area |

| Brand Equity | Recognized Brands (Jumbo, Paris, etc.) | Merco 2024 recognition for corporate responsibility |

| Human Capital | Workforce | Over 100,000 employees (2024) |

| Financial Resources | Capital Access & Investment | USD 610 million planned for 2025; 15.9% revenue growth in 2024 |

| Technology | Digital Platforms & Analytics | Investments in digital transformation; e-commerce and data systems |

Value Propositions

Cencosud's extensive product variety across its supermarket, home improvement, and department store segments creates a compelling one-stop shopping experience. This broad offering, encompassing everything from groceries to home furnishings, caters to a wide array of customer needs in a single visit, significantly boosting convenience.

In 2024, Cencosud continued to leverage this diverse portfolio to capture market share. For instance, their supermarket division, a core component of this value proposition, consistently reported strong customer traffic, driven by the ability to fulfill multiple shopping missions simultaneously.

The company's commitment to delivering value is evident in how this product breadth translates into customer loyalty. By offering a comprehensive selection, Cencosud aims to be the primary retail destination for its target demographics, reinforcing its position as a go-to provider for everyday essentials and specialized purchases.

Cencosud actively pursues competitive pricing and compelling promotions across its supermarket and hypermarket segments, aiming to deliver exceptional value for money. This strategy is crucial for drawing in and keeping a wide array of customers, especially when economic conditions become more demanding.

For instance, in 2024, Cencosud's focus on optimizing its product assortment and expanding its private label offerings played a significant role in enhancing its value proposition. These private label brands, often priced lower than national brands, allow Cencosud to offer customers more affordable options without compromising on quality, thereby reinforcing its commitment to value.

Cencosud excels by offering customers the ease of shopping across physical stores, its e-commerce website, and dedicated mobile apps. This approach significantly boosts accessibility, adapting to how people prefer to shop today.

The company saw a notable increase in online sales throughout 2024 and into the first quarter of 2025, underscoring the effectiveness of its integrated strategy in meeting modern consumer demands.

Integrated Financial Services and Loyalty Programs

Cencosud's integrated financial services and loyalty programs are a cornerstone of its customer strategy. By offering private label credit cards and consumer loans, the company provides significant financial convenience, making purchases more accessible. For instance, in 2023, Cencosud's financial services segment reported robust performance, contributing to the overall revenue stream by facilitating sales across its diverse retail formats.

These offerings are tightly linked to their loyalty program, 'Puntos Cencosud'. This program is designed to foster deeper customer engagement and drive repeat business. Customers earn points on purchases which can be redeemed for discounts and other benefits, creating a compelling incentive to choose Cencosud. The program's regional presence and simplified redemption process are key to its success in encouraging consistent customer participation.

- Financial Convenience: Private label credit cards and consumer loans offer customers flexible payment options, boosting purchasing power and sales conversion rates.

- Customer Engagement: The 'Puntos Cencosud' loyalty program rewards repeat purchases with exclusive discounts and points, fostering brand loyalty.

- Regional Reach: The loyalty program aims for a simplified, widespread redemption process across Cencosud's various markets, enhancing its appeal.

- Sales Driver: In 2023, financial services played a crucial role in driving sales, demonstrating their direct impact on Cencosud's financial performance.

Quality Products and Enhanced Shopping Experience

Cencosud is dedicated to providing high-quality products and elevating the overall shopping journey for its customers. This commitment extends to enhancing both physical store environments and digital platforms, focusing on superior customer service, appealing store atmospheres, and a carefully curated product assortment.

The company actively invests in improving customer interactions, from the moment a shopper enters a store or visits a website to the final purchase. This includes training staff to offer exceptional service and optimizing store layouts and online interfaces for ease of use and enjoyment.

A testament to this focus is the recognition received by The Fresh Market, a Cencosud brand operating in the United States. In 2025, The Fresh Market was awarded a 5-star rating for its customer service, underscoring Cencosud's success in delivering a premium shopping experience.

- Commitment to Quality: Cencosud prioritizes product excellence across all its offerings.

- Enhanced Shopping Experience: Continuous improvements are made to both in-store and online retail environments.

- Customer Service Excellence: Staff training and service protocols are designed for optimal customer satisfaction.

- Brand Recognition: The Fresh Market, a Cencosud brand, achieved a 5-star customer service rating in 2025.

Cencosud's value proposition centers on offering a wide, integrated product selection across its diverse retail formats, from supermarkets to home improvement stores. This broad assortment aims to provide customers with a convenient one-stop shopping experience, catering to a multitude of needs in a single visit. In 2024, the company continued to emphasize this breadth, with its supermarket segment showing consistent customer engagement due to the ability to fulfill multiple shopping missions.

Customer Relationships

Cencosud actively cultivates customer loyalty through its comprehensive 'Puntos Cencosud' program. This initiative rewards frequent shoppers with points, redeemable for a variety of benefits including discounts and exclusive products, thereby encouraging repeat business and enhancing customer retention. The company is working to unify this loyalty program across its regional operations under a single, cohesive brand.

Cencosud leverages data analytics to craft personalized offers and communications, directly addressing individual shopping habits and preferences. This hyper-personalization strategy aims to boost the relevance of promotions, fostering deeper connections with each customer. In 2024, Cencosud's commitment to enhancing customer loyalty is evident in its Retail Ecosystem unit's focus on customer experience, analytics, and media integration.

Cencosud prioritizes exceptional customer service across all touchpoints. This includes dedicated in-store assistance, responsive call centers, and efficient online support, all aimed at creating a seamless experience for shoppers.

The company's philosophy centers on serving customers extraordinarily at every moment, striving to consistently surpass expectations. This commitment is a cornerstone of building lasting customer loyalty.

In 2025, Cencosud's Fresh Market division received accolades for its outstanding customer service, highlighting the effectiveness of their customer-centric approach and dedication to quality support.

Community Engagement and Social Responsibility Initiatives

Cencosud actively fosters community engagement through impactful social responsibility programs. These initiatives, including food rescue efforts and comprehensive sustainability projects, are designed to build strong, trusting relationships with customers by showcasing a genuine commitment to societal betterment.

The company's dedication to sustainability and corporate responsibility has not gone unnoticed. For instance, in 2023, Cencosud was recognized by the Dow Jones Sustainability Index for its efforts in the Retailing sector, highlighting its consistent performance in environmental, social, and governance (ESG) criteria.

- Food Rescue Programs: In 2023, Cencosud's food rescue initiatives diverted over 1.5 million kilograms of food from landfills, donating it to various charitable organizations across its operating regions.

- Sustainability Investments: The company allocated approximately $50 million in 2023 towards renewable energy projects and waste reduction programs across its supermarket and home improvement divisions.

- Community Partnerships: Cencosud partnered with over 200 local non-profits in 2023, supporting initiatives focused on education, health, and environmental conservation.

Feedback Mechanisms and Continuous Improvement

Cencosud actively cultivates customer relationships by implementing robust feedback mechanisms. The company diligently gathers insights through various channels, including customer surveys, direct interactions with staff, and monitoring online reviews. This proactive approach allows Cencosud to pinpoint specific areas where its services and product offerings can be enhanced.

This continuous feedback loop is instrumental in Cencosud's strategy for adapting its value proposition and elevating the overall customer experience. By understanding evolving customer needs and preferences, Cencosud can more effectively tailor its retail strategies. Notably, Cencosud's banners, Jumbo and Paris, were recognized with the 2024 NPS Consumer Loyalty Award, underscoring the success of their customer-centric initiatives.

- Customer Feedback Channels: Surveys, direct interactions, online reviews.

- Objective: Identify areas for improvement and adapt offerings.

- Impact: Refines value proposition and customer experience.

- Recognition: Jumbo and Paris won the 2024 NPS Consumer Loyalty Award.

Cencosud's customer relationships are built on a foundation of loyalty programs, personalized engagement, and exceptional service. The unified Puntos Cencosud program, across its regional operations, rewards shoppers, encouraging repeat business. Data analytics drive personalized offers, enhancing customer connections, with a 2024 focus on customer experience within its Retail Ecosystem unit.

The company prioritizes outstanding customer service across all touchpoints, aiming to consistently exceed expectations. This commitment is further demonstrated by community engagement through social responsibility programs and a strong focus on sustainability, as recognized by the Dow Jones Sustainability Index in 2023.

Cencosud actively gathers customer feedback through surveys, direct interactions, and online reviews to refine its offerings and enhance the overall experience. This dedication to understanding customer needs led to Jumbo and Paris receiving the 2024 NPS Consumer Loyalty Award.

| Initiative | 2023 Data | 2024 Focus/Recognition |

|---|---|---|

| Loyalty Program | Puntos Cencosud | Unification across regional operations |

| Personalization | Data analytics for tailored offers | Retail Ecosystem unit focus on customer experience, analytics, and media integration |

| Customer Service | Dedicated in-store, call center, and online support | Fresh Market division recognized for outstanding customer service |

| Sustainability | $50 million allocated to renewable energy and waste reduction; 1.5 million kg food rescued | Recognized by Dow Jones Sustainability Index for ESG performance |

| Customer Feedback | Surveys, direct interactions, online reviews | Jumbo and Paris won 2024 NPS Consumer Loyalty Award |

Channels

Cencosud's backbone is its vast physical retail presence, encompassing supermarkets, hypermarkets, department stores, and home improvement centers. This network offers customers a tangible shopping experience and immediate product availability. The company's commitment to this channel is evident in its ongoing investments, with plans for 24 new supermarket openings slated for 2025, further expanding its reach.

Cencosud's e-commerce presence is a cornerstone of its customer engagement, featuring dedicated websites for brands like Jumbo and Easy. These platforms offer convenient online shopping with options for home delivery and in-store pickup, catering to evolving consumer preferences.

The digital channel is proving to be a significant engine for growth. In the first quarter of 2025, online sales saw a substantial uplift, increasing by 27.5% in the United States, underscoring the strategic importance of these digital storefronts.

Cencosud's mobile applications are central to its strategy of integrating physical and digital retail. These apps allow customers to conveniently order groceries and other items for delivery or pickup, access their loyalty program benefits, and receive personalized offers. In 2024, Cencosud continued to invest in enhancing these digital touchpoints, aiming to provide a seamless omnichannel experience that bridges online browsing with in-store purchasing.

Financial Services Branches and Points of Sale

Cencosud's financial services are delivered through a network of dedicated branches and integrated points of sale located within its extensive retail stores. This strategic placement ensures easy access for customers seeking credit cards, personal loans, and other financial solutions directly at the point of purchase.

These financial touchpoints are crucial for supporting the everyday financial needs of Cencosud's broad customer base. For instance, in 2024, Cencosud's financial arm, Banco Cencosud, continued to be a key enabler of consumer spending across its retail banners, facilitating millions of transactions.

- Dedicated Financial Branches: Standalone locations offering a full suite of banking and credit services.

- In-Store Points of Sale: Service desks within Cencosud retail outlets (e.g., Jumbo, Easy, Paris) providing immediate access to financial products.

- Customer Support: These channels are designed to enhance customer loyalty by offering convenient financial solutions that complement their shopping experience.

- Product Integration: Seamless integration of financial product offerings with retail purchases, driving cross-selling opportunities and customer engagement.

Shopping Centers (Cenco Malls)

Cencosud's shopping centers, often branded as Cenco Malls, function as crucial channels, hosting not only Cencosud's own retail banners like department stores and home improvement outlets but also a diverse array of third-party retailers, restaurants, and entertainment venues. These centers are designed to be vibrant commercial hubs, drawing substantial customer traffic.

Cencosud actively works to elevate the appeal and commercial diversity within its malls, aiming to maximize their draw. For instance, in the first quarter of 2024, Cencosud reported that its shopping centers segment demonstrated resilience, contributing significantly to the group's overall performance. The company continues to invest in modernizing its properties and attracting a strong tenant mix to ensure sustained footfall and sales.

- Commercial Hubs: Cenco Malls serve as central marketplaces, aggregating diverse retail and service offerings.

- Tenant Mix: They host Cencosud's proprietary brands alongside external retailers, restaurants, and entertainment providers.

- Foot Traffic Generation: The strategic location and comprehensive offerings are designed to attract and retain significant customer visits.

- Enhancement Strategy: Cencosud focuses on upgrading mall infrastructure and tenant curation to boost attractiveness and sales performance.

Cencosud's channels extend beyond its physical stores to include robust digital platforms and financial services, creating a comprehensive customer ecosystem. These channels work in tandem to drive sales and foster loyalty.

The company's e-commerce sites and mobile apps are pivotal, offering convenience and personalized experiences. In 2024, Cencosud continued to invest in these digital touchpoints to ensure a seamless omnichannel journey.

Financial services, integrated within retail locations and through dedicated branches, support consumer spending and build deeper customer relationships. Banco Cencosud's role in facilitating transactions highlights the synergy between retail and finance.

Shopping centers, or Cenco Malls, act as significant traffic generators and commercial hubs, housing both Cencosud's brands and third-party retailers. Their ongoing modernization and tenant mix optimization are key to sustained performance.

| Channel | Description | Key Data/Focus (2024-2025) |

|---|---|---|

| Physical Retail | Supermarkets, hypermarkets, department stores, home improvement centers. | 24 new supermarket openings planned for 2025. |

| E-commerce | Dedicated websites (Jumbo, Easy) offering delivery and pickup. | 27.5% online sales growth in Q1 2025 (US). |

| Mobile Apps | Integrated platform for ordering, loyalty, and offers. | Continued investment in enhancing digital touchpoints. |

| Financial Services | Branches and in-store POS for credit cards, loans. | Banco Cencosud facilitated millions of transactions in 2024. |

| Shopping Centers | Malls hosting Cencosud brands and third-party retailers. | Focus on modernization and tenant mix to drive footfall. |

Customer Segments

Cencosud's core customer base is the mass market, encompassing millions of households across Latin America. This segment values convenience and affordability, making Cencosud's supermarkets and hypermarkets their go-to for daily essentials. The company's strategy focuses on serving these everyday shoppers, aiming to enhance their quality of life through accessible products and services.

Cencosud's department stores, like Paris, and its specialty supermarket chain, The Fresh Market, are specifically designed to attract middle to upper-income households. These consumers are looking for more than just basic goods; they value superior product quality, well-known premium brands, and a generally more pleasant and sophisticated shopping environment.

The Fresh Market, in particular, has carved out a niche in the United States by focusing on the specialty grocery segment. This means it appeals to shoppers who are willing to pay a premium for unique, high-quality, and often organic or locally sourced food items, further reinforcing its appeal to a more affluent demographic.

Families and households are a cornerstone for Cencosud, relying on its diverse retail formats for everyday essentials and lifestyle purchases. From stocking the pantry at its supermarkets to finding supplies for home upkeep at its improvement stores and outfitting the family at department stores, Cencosud's broad product range directly addresses the multifaceted needs of modern family life.

In 2024, Cencosud's supermarkets, like Jumbo and Santa Isabel, continued to be primary destinations for grocery shopping, a critical spend for households. The company's integrated approach means families can consolidate their shopping, saving time and effort across different categories.

Small Businesses and Institutional Buyers

Cencosud's strategic move into the cash-and-carry sector, particularly with the acquisition of Makro and Basualdo supermarkets in Argentina, directly addresses the needs of small businesses and institutional buyers. This segment is characterized by a strong demand for bulk purchasing capabilities and favorable wholesale pricing structures. These businesses rely on efficient supply chains to manage their operational costs effectively.

The integration of Makro and Basualdo, which commenced in early 2025, is designed to streamline Cencosud's offerings to this crucial customer base. By consolidating these operations, Cencosud aims to provide a more cohesive and competitive wholesale experience. This expansion into cash-and-carry is a significant step in diversifying Cencosud's market penetration.

- Targeting Small Businesses: Cencosud's cash-and-carry format caters to independent retailers, restaurants, and other small enterprises requiring significant volumes of goods.

- Serving Institutional Buyers: This includes entities like hotels, catering companies, and other organizations that benefit from bulk procurement and wholesale pricing.

- Competitive Wholesale Pricing: A primary driver for this segment is access to lower per-unit costs through larger purchase quantities.

- Bulk Purchasing Options: Cencosud's expanded infrastructure now facilitates the efficient handling and distribution of larger order sizes for its business clients.

Digital-First and Omnichannel Shoppers

Digital-first and omnichannel shoppers represent a rapidly expanding customer base for Cencosud. These consumers actively engage with online platforms, mobile applications, and increasingly blend digital interactions with physical store visits. Cencosud's strategic focus on enhancing its digital infrastructure, including its e-commerce capabilities and loyalty programs, directly targets this segment's preferences.

The growing importance of this customer group is underscored by the significant growth in online sales experienced by retailers globally. For instance, in 2024, e-commerce sales in Latin America, Cencosud's primary market, were projected to continue their upward trajectory, driven by increased digital adoption and convenience-seeking consumers.

- Digital Engagement: Cencosud's investments in its digital ecosystem are designed to capture a larger share of the growing online retail market.

- Omnichannel Experience: The company is working to provide a seamless experience for customers who move between online and offline channels.

- Sales Growth Driver: Online sales performance is a key indicator of Cencosud's success in attracting and retaining digital-first shoppers.

- Market Trends: This segment aligns with broader retail trends showing increased consumer reliance on digital channels for shopping and product discovery.

Cencosud's customer segments are diverse, ranging from the mass market seeking affordability and convenience in its supermarkets to affluent households drawn to the premium offerings of its department stores and specialty groceries. The company also actively serves small businesses and institutional buyers through its cash-and-carry operations, emphasizing bulk purchasing and wholesale pricing.

Families across Latin America are a core demographic, utilizing Cencosud's various retail formats for their everyday needs and lifestyle purchases. Furthermore, Cencosud is increasingly targeting digital-first and omnichannel shoppers, recognizing the growing importance of online platforms and seamless integration between digital and physical retail experiences.

| Customer Segment | Key Characteristics | Cencosud's Offering | 2024 Relevance |

| Mass Market Households | Value affordability, convenience, daily essentials | Supermarkets (Jumbo, Santa Isabel) | Primary spend for groceries, large customer base |

| Middle to Upper-Income Households | Seek quality, premium brands, pleasant shopping experience | Department Stores (Paris), Specialty Supermarkets (The Fresh Market) | Drives higher average transaction value |

| Small Businesses & Institutional Buyers | Require bulk purchasing, wholesale pricing, operational efficiency | Cash-and-carry (Makro, Basualdo) | Growing segment, benefits from economies of scale |

| Digital-First & Omnichannel Shoppers | Engage online, value digital convenience, blend online/offline | E-commerce platforms, loyalty programs | Key driver of future sales growth, aligns with market trends |

Cost Structure

The cost of purchasing inventory for its wide range of retail segments, encompassing groceries, home improvement goods, and clothing, represents the most significant element within Cencosud's cost structure. Effectively managing procurement and the entire supply chain is paramount for keeping these costs in check.

This focus on cost control is particularly important as Cencosud navigates the market. In 2024, the company demonstrated positive financial performance, with its operating profit seeing a healthy increase of 7.1%, underscoring the impact of efficient cost management on overall profitability.

Cencosud's operating expenses are substantial, with employee salaries and benefits for its vast workforce representing a significant portion. In 2023, personnel expenses amounted to approximately CLP 2,800 billion (around USD 3 billion), reflecting the scale of its retail operations across multiple countries.

Rent and maintenance costs for its extensive network of over 1,300 stores and numerous shopping centers also contribute heavily to operating expenses. Utility costs, which fluctuate with energy prices and store usage, are another key component that Cencosud actively manages to control.

The company is focused on achieving operational efficiency to mitigate these costs. Initiatives aimed at reducing expenses, such as optimizing energy consumption and streamlining administrative processes, are vital for maintaining profitability in a competitive retail landscape.

Cencosud dedicates significant resources to marketing and advertising, a crucial component for brand visibility and customer engagement across its diverse retail segments. In 2024, the company continued its robust investment in promoting its extensive range of products and services through a multi-channel approach. This strategy encompasses traditional advertising like television and print, alongside a strong focus on digital marketing and targeted online campaigns to reach a wider audience.

Promotional activities are also a cornerstone, particularly those linked to its popular loyalty programs, aiming to foster repeat business and customer retention. Cencosud actively highlights its retail media initiatives as a key growth driver, leveraging its customer data and physical store presence to offer advertising opportunities to third-party brands, thereby creating an additional revenue stream and enhancing the effectiveness of its own marketing efforts.

Logistics and Distribution Costs

Cencosud faces significant logistics and distribution costs, encompassing the movement of goods from suppliers to distribution centers and ultimately to stores or customers across its various operating countries. These expenses include vital components like fuel for transportation, ongoing fleet maintenance, and the operational overhead of warehousing facilities.

For 2024, Cencosud's commitment to optimizing its supply chain is evident in its planned investments in new logistics capabilities, aiming to enhance efficiency and reduce these substantial costs. This strategic focus is crucial for maintaining competitiveness in the retail sector.

- Fuel Expenses: A major contributor to logistics costs, fluctuating fuel prices directly impact transportation budgets.

- Fleet Maintenance: Keeping a large transportation fleet operational requires continuous investment in repairs and upkeep.

- Warehousing: The cost of maintaining and operating distribution centers across multiple countries adds another layer to these expenses.

- Logistics Investments: Planned capital expenditures for 2025 are directed towards upgrading and expanding logistics infrastructure.

Technology and Digital Infrastructure Costs

Cencosud's commitment to its digital presence, encompassing e-commerce sites, mobile applications, and sophisticated data analytics, necessitates considerable spending on technology and digital infrastructure. This expenditure covers essential elements like software licensing, the employment of skilled IT personnel, and ongoing cloud service subscriptions. For instance, in 2023, Cencosud reported significant investments in its digital transformation initiatives, aiming to enhance customer experience and operational efficiency across its diverse business units.

The company's ongoing digital transformation strategy involves substantial capital allocation towards its technological hubs. This investment is crucial for maintaining and upgrading the systems that support its vast retail operations, from inventory management to customer relationship management. These investments are designed to foster innovation and ensure Cencosud remains competitive in an increasingly digital retail landscape.

- Software Licenses: Costs associated with acquiring and maintaining the software necessary for e-commerce, CRM, ERP, and data analytics platforms.

- IT Staffing: Expenses related to hiring, training, and retaining skilled IT professionals, including developers, data scientists, and system administrators.

- Cloud Services: Ongoing fees for cloud computing infrastructure, data storage, and specialized software-as-a-service (SaaS) solutions.

- Digital Infrastructure Development: Capital expenditures for building and enhancing the underlying technology that powers Cencosud's digital ecosystem.

Cencosud's cost structure is heavily influenced by its substantial inventory purchases across grocery, home improvement, and apparel sectors, making efficient supply chain management critical. Employee compensation, a significant operating expense, saw personnel costs around CLP 2,800 billion in 2023. The company also incurs considerable costs for rent and maintenance of its extensive store and shopping center network, alongside fluctuating utility expenses.

Marketing and advertising are key investments, with a continued strong focus on multi-channel promotions in 2024 to drive brand visibility and customer engagement. Logistics and distribution costs, including fuel, fleet maintenance, and warehousing, are substantial, with planned investments in 2025 to enhance supply chain efficiency.

Technology and digital infrastructure represent another major cost area, covering software licenses, IT staffing, and cloud services, with significant digital transformation investments made in 2023. These varied costs are actively managed to maintain profitability and competitiveness.

| Cost Category | Key Components | 2023/2024 Data/Focus |

| Cost of Goods Sold | Inventory Purchases | Largest cost element; supply chain management is paramount. |

| Operating Expenses | Employee Salaries & Benefits | Approx. CLP 2,800 billion (USD 3 billion) in 2023 for personnel. |

| Rent & Maintenance | Extensive network of over 1,300 stores and shopping centers. | |

| Utilities | Fluctuates with energy prices and store usage. | |

| Marketing & Advertising | Promotional Activities, Digital Marketing | Continued robust investment in 2024; focus on retail media. |

| Logistics & Distribution | Fuel, Fleet Maintenance, Warehousing | Planned investments in logistics capabilities for 2025. |

| Technology & Digital | Software Licenses, IT Staffing, Cloud Services | Significant investments in digital transformation in 2023. |

Revenue Streams

Cencosud's core revenue generation hinges on the sale of a vast array of retail goods. This encompasses everything from daily groceries and household essentials found in their supermarkets and hypermarkets to electronics, apparel, and home improvement items stocked in their specialized stores.

This broad retail offering allows Cencosud to capture a significant share of consumer spending across multiple categories. The company's financial performance in 2024 underscored the strength of this revenue stream, with total revenue climbing by 15.9% to reach USD 17.5 billion.

Cencosud's financial services segment is a significant revenue generator, primarily earning income from interest and fees associated with its private label credit cards and consumer loans. This financial arm directly supports its retail operations by providing essential financing options to customers, thereby enhancing the overall shopping experience and driving sales.

In 2023, Cencosud's financial services division, primarily through its Banco Cencosud, reported solid performance, contributing to the company's diversified income streams. For instance, the segment's net interest income and commission income are key components, reflecting the volume of credit extended and services offered to millions of customers across its various retail banners.

Cencosud generates substantial income by leasing retail spaces in its shopping centers to various businesses. This rental income is a consistent revenue source, separate from the direct sales of goods. In 2023, Cencosud reported rental income as a key contributor to its overall financial performance.

The company is strategically focused on growing its shopping center portfolio. Cencosud aims to increase its Gross Leasable Area (GLA), which directly correlates with its potential rental income. This expansion is a core part of their strategy to bolster recurring revenue streams.

E-commerce and Digital Sales

Cencosud's e-commerce and digital sales are a significant and growing revenue driver. This segment encompasses direct product sales across its various online platforms and mobile applications, as well as revenue generated from digital services such as Cencosud Media. The company is actively expanding its digital footprint to capture a larger share of the online retail market.

The company reported robust performance in its digital channels, with online sales demonstrating strong year-on-year growth. Specifically, in the first quarter of 2025, Cencosud's online sales experienced an 8.8% increase compared to the same period in the previous year. This growth highlights the increasing consumer preference for digital shopping experiences and Cencosud's successful adaptation to these trends.

- E-commerce Platforms: Revenue generated from direct sales of products through Cencosud's online stores and mobile apps.

- Digital Services: Income derived from digital services offered, such as advertising and media solutions via Cencosud Media.

- Q1 2025 Performance: Online sales saw an 8.8% year-on-year growth in the first quarter of 2025, indicating a positive trend in digital revenue.

Private Label Sales and Retail Media

Cencosud leverages its private label brands as a significant revenue driver, often achieving enhanced profit margins compared to national brands. This strategic focus on proprietary products strengthens customer loyalty and provides a competitive edge.

Beyond product sales, Cencosud is actively developing its retail media network, creating valuable advertising channels. This allows suppliers and other businesses to reach Cencosud's customer base through digital platforms and in-store placements.

The company saw substantial growth in these areas. Private label sales experienced a notable increase of 14.3% in the first quarter of 2025. Concurrently, the Retail Media segment demonstrated robust expansion, growing by 22.5% in the same period.

- Private Label Sales Growth: Private label sales saw a 14.3% increase in Q1 2025, contributing significantly to overall revenue and profitability.

- Retail Media Expansion: The Retail Media segment grew by 22.5% in Q1 2025, highlighting the increasing demand for advertising opportunities within Cencosud's ecosystem.

- Margin Improvement: Private label brands typically offer higher margins, bolstering Cencosud's profitability.

- Brand Differentiation: The emphasis on private labels helps Cencosud differentiate itself in a competitive retail landscape.

Cencosud's revenue streams are multifaceted, driven by direct retail sales across various formats, financial services, shopping center leasing, and a growing digital presence. The company also capitalizes on its private label brands and a burgeoning retail media network.

In 2024, Cencosud reported total revenue of USD 17.5 billion, a 15.9% increase year-over-year. This growth reflects the strength across its diverse revenue channels, with specific segments like e-commerce and retail media showing particularly strong expansion in early 2025.

| Revenue Stream | Key Activities | 2024 Performance Highlight | Q1 2025 Growth Highlight |

|---|---|---|---|

| Retail Sales | Groceries, electronics, apparel, home improvement | 15.9% total revenue growth | N/A |

| Financial Services | Credit card interest, consumer loans | Solid performance contributing to diversified income | N/A |

| Shopping Center Leasing | Rental income from leased retail spaces | Key contributor to overall financial performance | N/A |

| E-commerce & Digital Services | Online product sales, Cencosud Media advertising | Robust performance, expanding digital footprint | 8.8% online sales growth |

| Private Label & Retail Media | Sales of proprietary brands, advertising channels | N/A | 14.3% private label sales growth; 22.5% Retail Media growth |

Business Model Canvas Data Sources

The Cencosud Business Model Canvas is constructed using a blend of internal financial reports, extensive market research on consumer behavior and retail trends, and competitive intelligence gathered from industry analysis. These diverse data sources ensure a comprehensive and accurate representation of Cencosud's strategic framework.