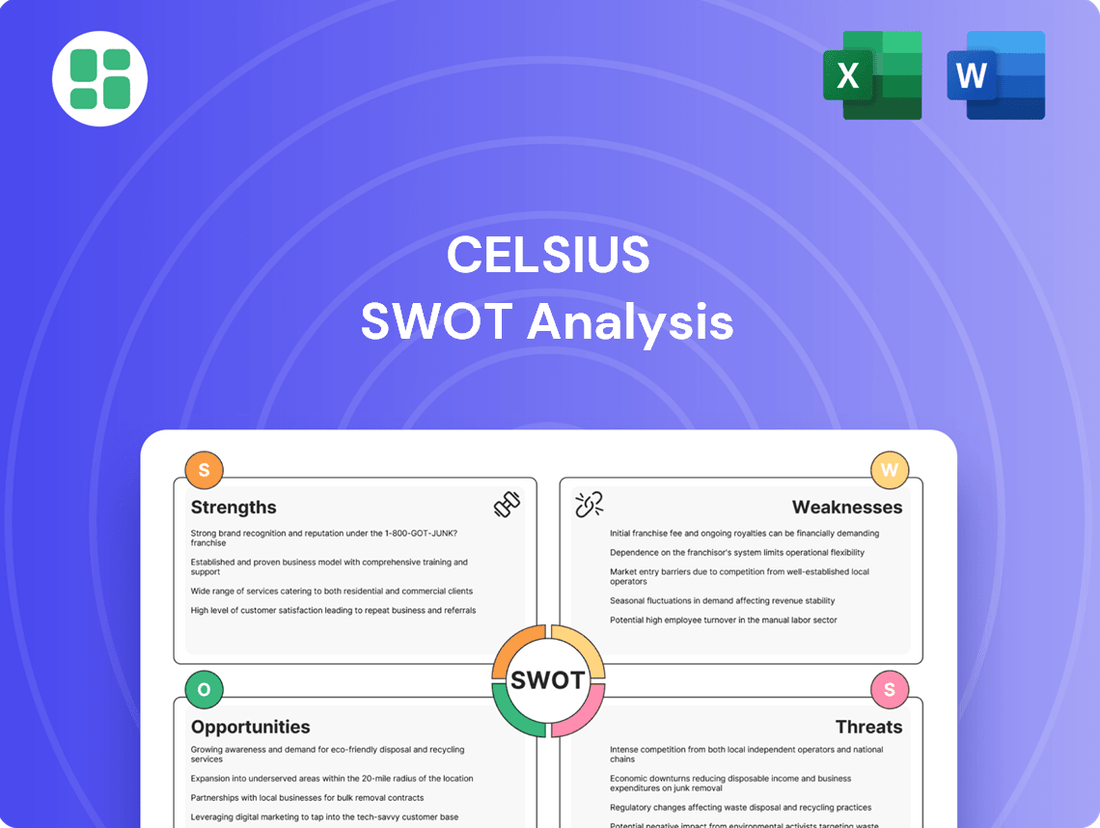

Celsius SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Bundle

Celsius's innovative product line and strong brand recognition present significant strengths in the competitive beverage market. However, understanding the nuances of their distribution challenges and the evolving regulatory landscape is crucial for strategic planning.

Want the full story behind Celsius's market advantages, potential threats, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic decisions and competitive edge.

Strengths

Celsius has built a powerful brand identity, resonating strongly with health-conscious consumers and fitness aficionados. Its functional positioning centers on unique formulations aimed at boosting metabolism, aiding fat burn, and delivering sustained energy via thermogenesis, perfectly tapping into the growing demand for healthier beverage options.

Celsius's strategic distribution partnership with PepsiCo, solidified through a long-term agreement, is a major strength, granting the company extensive access to retail channels across North America. This collaboration significantly boosts Celsius's market penetration and product visibility, leveraging PepsiCo's robust supply chain and merchandising expertise.

This alliance has been a key driver in Celsius's rapid expansion, enabling it to scale its operations effectively. For instance, in the first quarter of 2024, Celsius reported a 25% increase in revenue, partly attributed to the expanded reach facilitated by the PepsiCo distribution network.

The successful acquisition of Alani Nu in April 2025 marked a pivotal moment for Celsius Holdings. This move instantly added a second billion-dollar brand to their portfolio, significantly broadening their product range and appeal to a wider consumer base. This strategic expansion into a new segment of the functional beverage market demonstrates Celsius's commitment to robust inorganic growth.

This acquisition is projected to contribute significantly to Celsius's revenue streams, with Alani Nu's established market presence expected to bolster overall market share in the competitive functional beverage sector. Analysts anticipate this move will enhance Celsius's financial performance and solidify its position as a dominant player in the health and wellness beverage industry.

Consistent Market Share Gains

Celsius Holdings has shown remarkable strength in expanding its market share within the competitive U.S. energy drink sector. By Q1 2025, the company had secured a significant 16.2% dollar share, which further climbed to 17.3% in Q2 2025, a figure that notably includes the performance of Alani Nu.

This consistent upward trajectory is a testament to Celsius's ability to capture consumer interest, driving substantial contributions to the overall category's growth. The company's functional, zero-sugar product offerings continue to resonate strongly with consumers, enabling it to outpace many of its rivals.

- Sustained Market Share: Achieved 16.2% dollar share in Q1 2025 and 17.3% in Q2 2025 (including Alani Nu).

- Category Growth Driver: Significantly contributes to the overall energy drink market expansion.

- Consumer Demand: Driven by strong consumer preference for its functional, zero-sugar beverages.

- Competitive Outperformance: Outpaces many competitors due to product appeal and strategic positioning.

Enhanced Production and Innovation Capabilities

Celsius's acquisition of Big Beverages Contract Manufacturing in November 2024 significantly bolsters its production and innovation. This move grants Celsius in-house manufacturing, giving it greater control over its supply chain and the flexibility to adapt production quickly. This vertical integration is a key strength, enabling faster development and launch of new products and limited-time offers, crucial for staying ahead in the dynamic beverage market.

The enhanced production capabilities directly translate into improved innovation cycles. Celsius can now respond more rapidly to market trends and consumer demand, a critical factor for sustained growth and product diversification in the competitive energy drink sector. This strategic integration positions Celsius to capitalize on emerging opportunities and maintain its innovative edge.

- In-house Manufacturing: Acquisition of Big Beverages Contract Manufacturing in November 2024.

- Supply Chain Control: Enhanced flexibility and responsiveness in production.

- Innovation Acceleration: Faster cycles for new product development and limited-time offerings.

- Market Agility: Improved ability to meet evolving consumer demand and market trends.

Celsius has solidified its market position through strategic acquisitions and robust distribution. The acquisition of Alani Nu in April 2025 added a significant billion-dollar brand, expanding its portfolio and consumer reach. This, combined with the PepsiCo distribution partnership, has been instrumental in its rapid growth. By Q2 2025, Celsius's dollar share in the U.S. energy drink market reached 17.3%, a clear indicator of its strong consumer appeal and competitive performance.

| Metric | Value (Q2 2025) | Significance |

|---|---|---|

| U.S. Energy Drink Dollar Share | 17.3% | Demonstrates strong market penetration and consumer preference. |

| Alani Nu Acquisition Date | April 2025 | Broadened product range and consumer base with a second billion-dollar brand. |

| PepsiCo Distribution Partnership | Ongoing | Provides extensive retail access and supply chain leverage. |

What is included in the product

Analyzes Celsius’s competitive position through key internal and external factors, identifying its strengths in brand recognition and market expansion, weaknesses in regulatory uncertainty, opportunities in growing consumer demand for healthier beverages, and threats from intense competition and potential economic downturns.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential threats into opportunities.

Weaknesses

Celsius Holdings faced a notable downturn in its financial performance during the first quarter of 2025. Revenue saw a 7% decrease year-over-year, while net income and diluted earnings per share (EPS) experienced sharper drops of 43% and 44%, respectively. This volatility underscores the company's susceptibility to factors like distributor incentive programs and promotional allowances, which can cause significant short-term fluctuations in its financial results.

Celsius's significant reliance on PepsiCo for distribution presents a notable weakness. While this partnership has been instrumental in expanding Celsius's reach, it also creates a concentration risk. Any disruption to this relationship, or issues within PepsiCo's vast distribution network, could directly impact Celsius's ability to get its products to market and affect sales performance.

Celsius Holdings is grappling with significant legal headwinds, including securities fraud class action lawsuits filed in 2024. These suits allege that the company made misleading statements, artificially inflating its stock price during certain periods.

The financial implications of these lawsuits are substantial. Legal defense costs can be considerable, and the ongoing proceedings demand significant attention from Celsius's management team. This diversion of resources and focus can hinder strategic initiatives and operational efficiency.

Beyond the direct financial costs, these legal challenges pose a serious risk to investor confidence and Celsius's brand reputation. Even if the company ultimately prevails, the prolonged litigation can create uncertainty and deter potential investors, impacting the company's market valuation and future growth prospects.

Potential Margin Pressures

While Celsius has seen some positive movement in its gross margins, there's a real possibility of these margins facing pressure. This is largely due to the increasing costs of essential raw materials, including aluminum and other components vital to their product manufacturing.

The company’s strategic acquisitions, such as Alani Nu, introduce another layer of complexity. These acquired brands may operate with different cost structures and profit margins, potentially impacting Celsius's consolidated gross profitability negatively.

- Rising Input Costs: Fluctuations in commodity prices, particularly for aluminum, can directly impact the cost of goods sold. For instance, aluminum prices saw significant volatility throughout 2023 and into early 2024, impacting beverage can costs.

- Acquisition Integration: Integrating new brands like Alani Nu, which might have different supply chains and pricing strategies, can lead to a dilution of overall gross margins if not managed efficiently.

- Competitive Pricing: The highly competitive energy drink market may limit Celsius's ability to pass on increased costs to consumers, thereby squeezing profit margins.

Challenges in Sustaining Growth Rate

Sustaining the high growth Celsius achieved in previous years presents a significant challenge. As the company matures and its market share expands, maintaining the same aggressive expansion pace becomes inherently more difficult. This is particularly evident with the observed slower velocity in early Q1 2025.

Furthermore, Celsius faces the hurdle of lapping strong prior-year promotional activities. This means that comparing current performance to periods where aggressive marketing and discounts were heavily utilized makes achieving comparable growth rates a tougher ask. Continuous strategic innovation is therefore essential to overcome this.

- Slowing Growth Momentum: Early 2025 saw a noticeable deceleration in Celsius's growth rate compared to the explosive expansion seen in prior periods.

- Lapping Prior Year Success: The company must contend with comparing its current performance against periods that benefited from particularly effective, and likely costly, promotional campaigns.

- Market Saturation Concerns: As Celsius penetrates deeper into its target markets, the pool of new customers available for rapid acquisition naturally shrinks, making continued high-velocity growth harder to achieve.

Celsius's reliance on PepsiCo for distribution, while beneficial, creates a significant concentration risk. Any disruption in this partnership or issues within PepsiCo's network could directly impact Celsius's market access and sales. Additionally, the company faces substantial legal challenges, including securities fraud class action lawsuits filed in 2024, which drain resources and can damage investor confidence and brand reputation.

Rising input costs, particularly for aluminum, pose a threat to Celsius's gross margins. The integration of acquired brands like Alani Nu also introduces complexity, potentially diluting consolidated profitability if not managed efficiently. The highly competitive nature of the energy drink market may also limit Celsius's ability to pass on these increased costs to consumers, further squeezing margins.

Celsius is experiencing a slowdown in its growth momentum, with early 2025 showing decelerated growth compared to previous periods. The company also faces the challenge of lapping strong prior-year promotional activities, making it harder to achieve comparable growth rates. As the market share expands, maintaining the same aggressive expansion pace becomes more difficult due to potential market saturation.

| Weakness | Description | Impact |

| Distribution Dependency | Heavy reliance on PepsiCo for distribution. | Concentration risk; vulnerability to PepsiCo network issues. |

| Legal Headwinds | Securities fraud class action lawsuits filed in 2024. | Resource drain, potential damage to investor confidence and brand reputation. |

| Margin Pressure | Rising input costs (e.g., aluminum) and acquisition integration complexities. | Potential dilution of gross margins; limited ability to pass costs to consumers. |

| Slowing Growth Momentum | Decelerated growth in early 2025 compared to prior periods; lapping strong prior-year promotions. | Difficulty in maintaining aggressive expansion pace; market saturation concerns. |

Preview the Actual Deliverable

Celsius SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Celsius SWOT analysis, ensuring you know exactly what you're getting. Purchase unlocks the complete, in-depth report.

Opportunities

Celsius has a significant runway for growth through international market expansion. The company reported a robust 41% increase in international revenue in Q1 2025, followed by a 27% rise in Q2 2025, demonstrating strong early traction in new regions.

Key markets such as the UK, Ireland, France, Australia, and New Zealand offer substantial untapped potential, especially when contrasted with Celsius's deep penetration in the United States. This strategic push into new territories is a critical opportunity for diversifying revenue streams and capturing a larger global market share.

Celsius can significantly broaden its appeal by venturing beyond its successful energy drink line into other functional beverage segments. This diversification could see Celsius evolve into a comprehensive lifestyle brand, catering to a wider range of consumer needs and occasions throughout the day.

The company's strategic foray into Celsius Hydration and its exploration of products focused on mental clarity or probiotics are clear indicators of this ambition. These moves aim to capture new market share and solidify Celsius's presence in the growing functional beverage market, which saw global sales exceed $130 billion in 2023.

The successful integration of Alani Nu offers Celsius significant opportunities for synergy. Cross-selling Alani Nu's popular products alongside Celsius beverages can expand customer reach and increase average transaction value. This integration is particularly potent given Alani Nu's reported 2023 revenue growth, which outpaced many in the wellness sector, demonstrating a strong, complementary consumer base.

Shared distribution networks can lead to substantial cost efficiencies for Celsius, optimizing logistics and potentially reducing overheads. Furthermore, combining marketing efforts allows for more impactful campaigns, leveraging Alani Nu's established brand loyalty and Celsius's extensive market presence to amplify reach within the rapidly expanding 'better-for-you' functional beverage market.

Leveraging In-House Manufacturing for Innovation

With the acquisition of Big Beverages, Celsius has significantly enhanced its control over its manufacturing processes. This vertical integration allows for more agile research and development, directly translating into quicker responses to evolving consumer preferences and market trends. For instance, this control is crucial for the rapid rollout of new flavors and limited-edition products, a strategy that keeps the brand dynamic and highly appealing to its target demographic.

The direct oversight of manufacturing empowers Celsius to innovate at a faster pace. This capability is particularly valuable in the fast-moving beverage industry, where staying ahead of competitors often depends on introducing novel products. By streamlining the R&D to production pipeline, Celsius can capitalize on emerging opportunities and maintain a competitive edge through continuous product refreshment.

- Enhanced R&D Agility: Direct manufacturing control speeds up product development cycles.

- Market Responsiveness: Faster adaptation to consumer trends and demand shifts.

- Product Line Expansion: Efficient introduction of new flavors and limited-time offerings (LTOs).

- Competitive Advantage: Maintaining brand freshness and consumer engagement through innovation.

Growing Consumer Preference for Healthy & Functional Beverages

The widespread shift in consumer habits toward healthier, sugar-free, and functional beverages offers a significant advantage for Celsius. This trend directly aligns with Celsius's product offerings, which emphasize energy without the typical sugar content found in many traditional drinks.

As consumers become more health-conscious, actively seeking out products that support their well-being and offer added benefits, Celsius is strategically positioned to capture this growing market segment. This preference for wellness and natural ingredients is a key driver for the beverage industry's evolution.

For instance, the global functional beverage market was valued at approximately $126.7 billion in 2022 and is projected to reach $229.7 billion by 2030, growing at a compound annual growth rate of 7.7% according to some market analyses. This robust growth underscores the opportunity for companies like Celsius.

- Health-Conscious Consumers: A growing segment of the population is actively seeking beverages with lower sugar and calorie content, which Celsius delivers.

- Functional Benefits: Consumers are increasingly interested in drinks that offer more than just hydration, such as enhanced energy, focus, or immune support, areas where Celsius's formulations can appeal.

- Market Growth: The expanding global market for functional and healthy beverages presents a substantial opportunity for Celsius to increase its market share and revenue.

Celsius can expand its global footprint by targeting underserved international markets. The company's success in North America and parts of Europe indicates a strong potential for similar growth in regions like Asia-Pacific and Latin America, which represent significant untapped consumer bases.

Diversifying its product portfolio beyond energy drinks into categories like hydration, pre-workout, and cognitive enhancement beverages allows Celsius to capture a broader share of the functional beverage market, which is projected to reach $229.7 billion by 2030.

Leveraging the acquisition of Alani Nu, Celsius can achieve significant cross-promotional and distribution synergies, enhancing customer acquisition and increasing transaction values. This strategic integration is bolstered by Alani Nu's strong performance in the wellness sector.

The company's vertical integration through the acquisition of Big Beverages enhances R&D agility and market responsiveness, enabling faster product innovation and a stronger competitive edge in the dynamic beverage industry.

Celsius is well-positioned to capitalize on the growing consumer preference for healthier, sugar-free, and functional beverages, aligning perfectly with its core product attributes and the expanding market trends in wellness.

| Opportunity | Description | Supporting Data |

|---|---|---|

| International Expansion | Penetrating new geographic markets beyond current strongholds. | 41% international revenue growth in Q1 2025, 27% in Q2 2025. |

| Product Diversification | Entering new functional beverage segments. | Global functional beverage market projected to reach $229.7 billion by 2030. |

| Synergies with Alani Nu | Cross-selling and shared distribution networks. | Alani Nu's strong growth in the wellness sector. |

| Vertical Integration | Enhanced R&D agility and market responsiveness through manufacturing control. | Facilitates quicker introduction of new flavors and LTOs. |

| Health-Conscious Consumer Trend | Capitalizing on demand for healthier beverage options. | Alignment with Celsius's sugar-free and functional product positioning. |

Threats

The functional beverage and energy drink sector is incredibly crowded, with major players like Monster Beverage Corporation and Red Bull GmbH holding significant market share. This intense competition forces companies like Celsius to constantly innovate and invest heavily in marketing to stand out. For instance, in 2023, the global energy drink market was valued at approximately $62.1 billion, and is projected to grow, highlighting the scale of the challenge.

As functional beverages like those Celsius offers become more mainstream, they're likely to attract closer attention from regulators. This scrutiny could focus on ingredient safety, the truthfulness of health claims, and how these products are advertised. For instance, in 2023, the FDA continued to review the regulatory status of certain ingredients used in energy drinks, a category Celsius operates within.

Any significant changes in regulations, or even a public perception shift concerning the safety or effectiveness of common ingredients, could directly harm consumer confidence and, consequently, sales. For example, a hypothetical ban or restriction on a key ingredient could force costly reformulation or marketing adjustments.

Ongoing disruptions in global supply chains continue to be a significant concern for Celsius. For instance, the ongoing geopolitical tensions and logistical challenges experienced throughout 2023 and into early 2024 have led to extended lead times for crucial components and raw materials.

This volatility directly impacts Celsius's cost of goods sold. Fluctuations in the price of aluminum, a key material for beverage cans, and other essential ingredients can compress gross margins if these increased costs cannot be fully passed on to consumers. For example, the average price of aluminum saw a notable increase in the latter half of 2023, presenting a direct cost pressure.

Impact of Ongoing Litigation and Negative Publicity

Celsius faces substantial financial risks from ongoing class action lawsuits, notably those alleging securities fraud. These legal battles could lead to significant financial penalties and substantial legal expenses, impacting its bottom line. For instance, in 2023, settlements and legal costs related to past issues continued to be a factor for companies in the crypto lending space.

Beyond the direct financial strain, this litigation inevitably generates negative publicity. Such widespread negative press can severely erode investor confidence, making it harder for Celsius to attract and retain capital. This reputational damage can also alienate potential customers, impacting future growth prospects.

- Securities Fraud Allegations: Class action lawsuits continue to pose a significant threat, potentially resulting in substantial financial penalties and legal fees for Celsius.

- Erosion of Investor Confidence: Negative publicity stemming from ongoing litigation can undermine trust among current and potential investors, impacting capital raising efforts.

- Brand Reputation Damage: The association with legal disputes can tarnish Celsius's brand image, potentially deterring users and partners in the competitive crypto market.

Shifting Consumer Trends and Preferences

The beverage industry is notoriously fickle, and consumer tastes can pivot quickly. While Celsius has capitalized on the current health and wellness wave, a sudden shift away from functional beverages or a preference for different ingredients, like a resurgence in natural fruit juices or a move towards lower-caffeine options, could significantly impact Celsius's market position. For instance, a hypothetical 2025 consumer survey might reveal a 15% decline in demand for energy drinks among Gen Z, favoring plant-based hydration alternatives instead. This necessitates continuous innovation and market monitoring.

The threat of changing consumer preferences is amplified by the sheer speed of trends in the beverage sector. What is popular today might be obsolete tomorrow. Celsius's reliance on its current product formulations, while successful, leaves it vulnerable if consumer demand moves towards entirely different product categories or ingredient profiles. For example, if a new study in late 2024 links specific artificial sweeteners used by Celsius to unforeseen health concerns, consumer sentiment could rapidly shift. This requires Celsius to maintain agility and invest in R&D to anticipate and adapt to these evolving demands, potentially exploring new product lines or reformulations to stay relevant.

- Rapidly Evolving Tastes: Consumer preferences in beverages can change within months, not years, impacting demand for functional drinks.

- Ingredient Scrutiny: Increased consumer focus on natural or specific ingredient profiles could disadvantage brands perceived as less "clean."

- Emergence of New Categories: A surge in popularity for entirely new beverage types (e.g., adaptogenic sparkling waters) could divert market share.

- Demographic Shifts: Changing preferences across key demographics, such as younger consumers prioritizing sustainability or specific health benefits, pose a continuous challenge.

Celsius operates in a highly competitive market, facing pressure from established giants and emerging brands alike. This intense rivalry necessitates continuous innovation and significant marketing investment to maintain brand visibility and market share. For example, in 2023, the global energy drink market was valued at approximately $62.1 billion, underscoring the scale of competition.

Regulatory scrutiny is a persistent threat, particularly concerning ingredient safety and marketing claims for functional beverages. Any adverse changes in regulations or negative public perception regarding common ingredients could directly impact consumer trust and sales. The FDA's ongoing review of ingredients in 2023 highlights this potential vulnerability.

Supply chain disruptions, including geopolitical tensions and logistical challenges prevalent in 2023-2024, directly affect Celsius's cost of goods sold. Volatility in raw material prices, such as aluminum for cans, can compress profit margins if cost increases cannot be fully passed on to consumers.

Celsius faces significant financial and reputational risks from ongoing class action lawsuits, particularly those alleging securities fraud. These legal battles can lead to substantial penalties, legal expenses, and a decline in investor confidence, impacting its ability to secure capital and its overall brand image.

SWOT Analysis Data Sources

This Celsius SWOT analysis is built upon a foundation of robust data, drawing from official financial filings, comprehensive market research reports, and expert industry analysis to ensure a thorough and accurate strategic overview.