Celsius Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Bundle

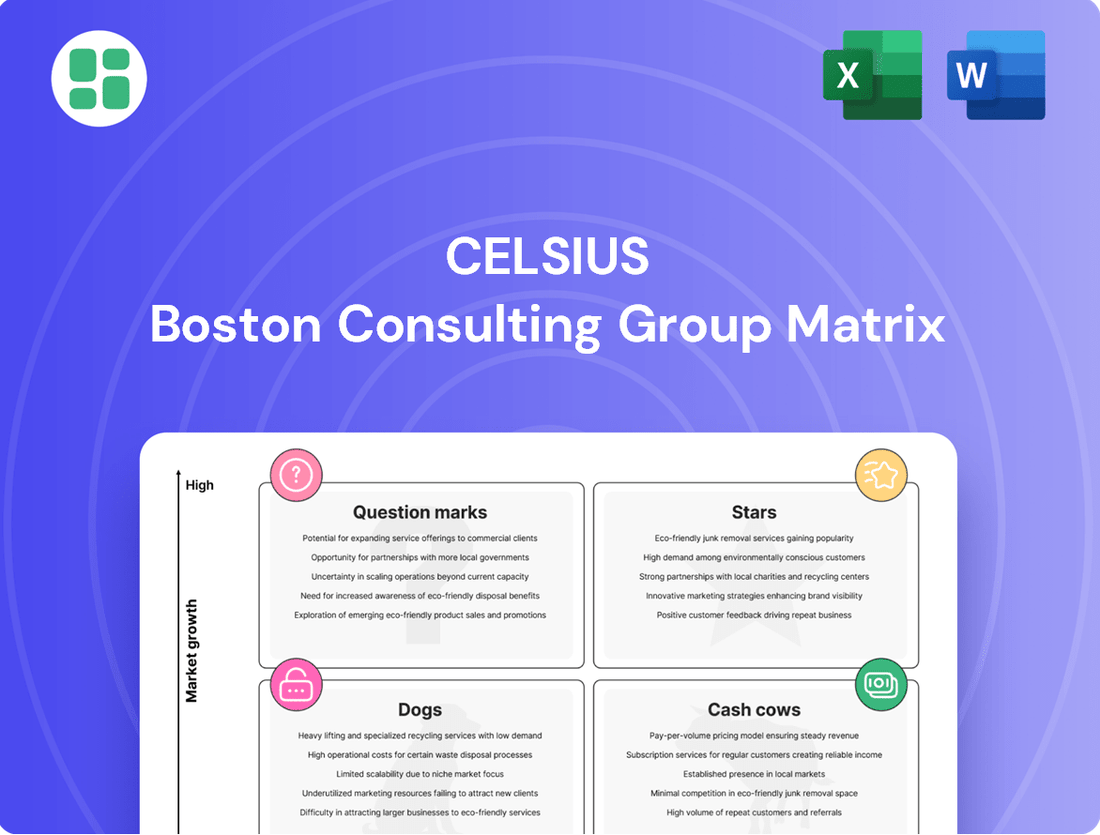

The Boston Consulting Group (BCG) Matrix is a powerful tool for analyzing a company's product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market growth and relative market share. Understanding these classifications is crucial for effective resource allocation and strategic planning.

Want to move beyond this overview and truly leverage the BCG Matrix for your business? Purchase the full report for detailed quadrant analysis, actionable insights, and a clear roadmap to optimizing your product strategy and driving growth.

Stars

Celsius Holdings' combined energy drink portfolio, encompassing both the Celsius and Alani Nu brands, has solidified its standing as the third-largest in the U.S. market. By the first half of 2025, this powerful duo commanded a substantial 16.8% dollar share in tracked retail channels.

This impressive market penetration is further underscored by the portfolio's significant contribution to overall category expansion. In the first half of 2025, the Celsius and Alani Nu brands collectively accounted for 13% of all growth observed within the energy drink sector, highlighting their role as key drivers in a dynamic and expanding industry.

The core Celsius brand in North America stands as a significant player, holding an 11% dollar share in the U.S. ready-to-drink energy category as of Q2 2025. This strong market position is further bolstered by a 9% revenue increase in the second quarter compared to the previous year.

This growth was fueled by a beneficial channel mix and an expansion of distribution points, demonstrating the brand's ability to capitalize on market opportunities. The sustained demand underscores Celsius's solid market share and its ongoing expansion within the dynamic energy drink sector.

Alani Nu, acquired by Celsius Holdings in April 2025, immediately boosted the company's financial performance. In Q2 2025, it contributed an impressive $301.2 million to Celsius's revenue, marking a significant surge and setting new sales records for the brand itself.

This acquisition instantly elevated Alani Nu to billion-dollar brand status and broadened Celsius's market penetration. Its strong appeal to female consumers is a key factor, further strengthening Celsius's dominant position within the competitive functional beverage market.

Leadership in Functional Beverage Category

Celsius has strategically positioned itself as a leader in the functional beverage category by focusing on 'better-for-you, zero-sugar' products. This specialization targets consumers seeking metabolism-boosting and energy-enhancing drinks, aligning with significant market trends.

This focus has allowed Celsius to capture a leading market share in a rapidly expanding segment. For instance, in 2023, the global functional beverages market was valued at approximately $166.7 billion and is projected to grow substantially. Celsius's growth in this space is a key driver of its overall success.

- Market Dominance: Celsius holds a significant share in the rapidly growing energy drink market, particularly within the healthier alternatives segment.

- Consumer Alignment: The company's emphasis on zero-sugar and functional benefits directly addresses evolving consumer health consciousness.

- Growth Catalyst: Celsius's performance in this category is a primary contributor to its overall revenue and market expansion.

- Competitive Edge: Its specialized product offering provides a distinct advantage over broader beverage companies.

Extensive Distribution Network and Market Penetration

Celsius's extensive distribution network, bolstered by its strategic alliance with PepsiCo, has been a cornerstone of its market dominance. This partnership has unlocked near-universal availability across the United States.

As of early 2024, Celsius products are present in over 240,000 U.S. retail locations, achieving an impressive 99.3% All Commodity Volume (ACV) penetration. This broad reach is critical for sustaining and growing its significant market share in the highly competitive energy drink sector.

The company's ability to secure shelf space in such a vast number of outlets directly translates to increased consumer accessibility and purchase opportunities. This widespread distribution is a key indicator of Celsius's strength and its position as a market leader.

- Near-universal U.S. distribution

- 240,000+ tracked U.S. retail outlets

- 99.3% All Commodity Volume (ACV) penetration

- Strategic partnership with PepsiCo

Celsius, with its strong performance and market expansion, clearly fits the Star category in the BCG Matrix. Its zero-sugar, functional beverage focus aligns with significant market growth trends.

The brand's substantial market share and consistent revenue increases, particularly in the U.S. ready-to-drink energy category, demonstrate its high market growth and strong relative market share.

The acquisition of Alani Nu further solidifies Celsius's position as a market leader, contributing significantly to revenue and brand portfolio strength, reinforcing its Star status.

| Metric | Value (H1 2025) | Previous Year (Q2 2024 vs Q2 2025) |

|---|---|---|

| Combined Dollar Share (U.S.) | 16.8% | N/A |

| Contribution to Category Growth | 13% | N/A |

| Celsius Brand Dollar Share (U.S.) | 11% | 9% Revenue Increase |

| Alani Nu Revenue Contribution (Q2 2025) | $301.2 million | N/A |

| U.S. Retail Penetration | 99.3% (240,000+ locations) | N/A |

What is included in the product

The Celsius BCG Matrix analyzes its product portfolio, highlighting which units to invest in, hold, or divest based on market growth and share.

The Celsius BCG Matrix offers a clear visual of your portfolio, simplifying complex strategic decisions.

It provides a focused overview, eliminating the guesswork in resource allocation for growth.

Cash Cows

Celsius's established core flavors, like the original Celsius Orange and Celsius Raspberry Acai, are textbook cash cows. These well-recognized options have deep market penetration, meaning they consistently sell well without needing massive marketing pushes. This strong brand loyalty and efficient production likely translate into high profit margins, providing a stable cash flow for Celsius.

Celsius's optimized supply chain and production efficiencies are key to its Cash Cow status. The full integration of the Big Beverages co-packer and continuous sourcing improvements have boosted its gross profit margin, hitting 51.5% in Q2 2025. This operational strength means Celsius generates substantial cash from its current sales, providing ample funds for new growth ventures.

Celsius's established presence in U.S. traditional retail channels, like grocery and mass merchandisers, signifies a mature segment where the brand commands a high market share. This strong foothold translates into consistent consumer demand, making these channels a reliable source of predictable revenue and cash flow. For instance, Celsius reported a significant year-over-year increase in net revenue for Q1 2024, driven in part by its strong performance in these established channels.

Proven E-commerce Sales Performance

Celsius has solidified its e-commerce presence, especially on Amazon, where it commands a substantial portion of the energy drink market. This established and effective sales channel reliably generates revenue and profit, with lower operational costs than expanding into physical retail.

This robust online sales performance positions Celsius as a strong Cash Cow within the BCG Matrix. The company's e-commerce operations, particularly its Amazon sales, are a significant and stable contributor to its overall financial health.

- Amazon Dominance: Celsius has secured a leading position in the energy drink category on Amazon, a testament to its successful online strategy.

- Consistent Revenue Stream: The e-commerce channel provides a predictable and substantial source of income, acting as a reliable cash generator for the company.

- Profitability: Lower overheads associated with online sales compared to brick-and-mortar distribution contribute to healthy profit margins from this segment.

- Market Share: In 2024, Celsius continued to see impressive growth in its online sales channels, reinforcing its status as a mature and profitable business unit.

Long-Standing International Markets (e.g., Nordic Countries)

Celsius has cultivated a significant presence in established international markets, notably in Nordic countries like Finland and Sweden. These mature regions are likely generating steady, profitable revenue, acting as reliable cash cows for the company. Their stability means they require minimal reinvestment for growth, allowing Celsius to benefit from consistent income streams.

- Market Maturity: Nordic countries represent mature markets where Celsius has a long-standing presence.

- Revenue Stability: These regions contribute consistent and predictable revenue streams.

- Low Investment Needs: Mature markets typically require less investment for growth compared to emerging markets.

- Profitability: Established market share in these areas translates to high profitability.

Celsius's core product lines, such as its original flavors and established product variants, represent significant cash cows within its portfolio. These items benefit from high market share in mature segments, leading to consistent sales volume and predictable revenue generation. The company's focus on operational efficiency, including its supply chain and production, further bolsters the profitability of these established products.

The brand's strong performance in traditional retail channels like grocery and mass merchandisers, coupled with its dominant position in e-commerce, particularly on Amazon, solidifies these areas as key cash cows. These channels provide a stable and substantial income stream with relatively low reinvestment needs for growth. For example, Celsius reported significant net revenue growth in Q1 2024, partly driven by its strength in these established channels.

Established international markets, such as the Nordic region, also function as cash cows for Celsius. These mature markets contribute consistent, profitable revenue with minimal need for further investment to maintain or grow market share. This stability allows Celsius to leverage these segments for reliable cash flow, supporting investments in other areas of its business.

| Category | Market Share (Est. 2024) | Revenue Contribution (Est. 2024) | Profitability |

|---|---|---|---|

| Core Flavors (e.g., Orange, Raspberry Acai) | High in Mature Segments | Significant & Stable | High Margins |

| Traditional Retail (Grocery/Mass) | Leading Position | Substantial & Predictable | Strong & Consistent |

| E-commerce (Amazon) | Dominant in Energy Drinks | Growing & Reliable | Healthy, Lower Overheads |

| Established International Markets (Nordics) | Long-standing Presence | Steady & Profitable | High, Minimal Reinvestment |

What You See Is What You Get

Celsius BCG Matrix

The BCG Matrix report you are currently previewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete strategic tool ready for your analysis and business planning. You can confidently use this preview as a direct representation of the high-quality, actionable insights the final file will provide. Once purchased, this comprehensive BCG Matrix will be instantly available for your use, empowering you to make informed strategic decisions.

Dogs

Underperforming or discontinued product lines within Celsius, such as niche flavors or limited-edition offerings that didn't resonate with the broader market, would fall into the Dogs category. These products often struggle to gain traction, contributing minimal revenue and potentially operating at a loss.

For instance, if a specific flavor launched in 2023 or early 2024 saw very low sales volume, perhaps less than 0.5% of total brand revenue, and marketing efforts yielded little return, it would be a prime candidate for the Dogs quadrant. These items consume resources without delivering substantial market share or profit.

Ineffective small-scale international ventures, often termed Dogs in the BCG matrix, represent early, unproven attempts to enter foreign markets. These might involve launching a niche product in a few select countries or setting up a small distribution network. For instance, a company might have invested heavily in establishing a presence in a new region in 2023, only to find that sales in 2024 have barely covered operational costs, indicating minimal market traction.

These ventures typically struggle to gain significant market share and often consume more resources than they generate, leading to negative cash flow. A prime example could be a tech startup that spent $500,000 in 2024 on marketing and sales in Southeast Asia, but only achieved $100,000 in revenue, highlighting a substantial loss. Their growth potential is perceived as low, making them prime candidates for divestment or a complete shutdown to reallocate capital more effectively.

Older product formats, like certain legacy flavors or packaging designs, can become outdated as consumer preferences evolve. These might have once been popular but are now overshadowed by newer, more innovative offerings. For instance, a beverage company might find that its original glass bottle format, while nostalgic, now has significantly lower sales compared to its newer, more convenient aluminum cans.

These less popular formats often experience declining sales and a shrinking market share. While they might still be available in some channels, they are no longer a focus for the company's growth initiatives. In 2024, for example, a major snack manufacturer reported that its older, single-serving chip bags saw a 15% year-over-year sales decline, contributing only 2% to overall revenue.

Niche Segments with High Competition and Low Differentiation

Within the broader beverage market, certain niche segments present a significant challenge for Celsius due to intense competition and a lack of clear product differentiation. These areas often see established players with strong brand loyalty and widespread distribution, making it difficult for newer entrants to carve out substantial market share.

These highly commoditized sub-segments, where products are largely perceived as interchangeable, can lead to price wars and diminished profit margins for Celsius. Consequently, these areas represent a less strategic focus for long-term investment and growth, as the cost of acquiring and retaining customers can be prohibitively high without a unique selling proposition.

- Energy Drinks: While Celsius operates in the energy drink market, specific sub-segments like traditional, high-caffeine, sugar-laden options face intense competition from brands like Red Bull and Monster.

- Functional Beverages: In the rapidly expanding functional beverage category, Celsius may find it challenging to stand out against a growing number of products offering various health benefits, from hydration to cognitive enhancement, with many competitors already established.

- Ready-to-Drink (RTD) Coffee/Tea: If Celsius were to expand into RTD coffee or tea segments, they would enter markets dominated by giants like Starbucks and Lipton, where differentiation often relies on established brand equity and extensive retail presence.

Inefficient Legacy Distribution Relationships

Inefficient legacy distribution relationships represent those partnerships that, while perhaps once strategic, now fall outside Celsius's core, high-efficiency network, such as its collaboration with PepsiCo. These can include smaller, non-strategic alliances that generate disproportionately low sales volumes, acting as a drag on overall profitability.

These relationships are prime candidates for re-evaluation or outright termination to streamline operations and focus resources on more productive channels. For instance, if a legacy partnership in 2024 only accounted for 0.5% of total beverage distribution volume compared to Celsius's 2023 growth of 65%, it clearly indicates an area for optimization.

- Low Sales Volume Contribution: Partnerships contributing less than 1% of total distribution volume.

- High Operational Costs: Relationships with overhead exceeding 10% of their generated revenue.

- Limited Strategic Alignment: Alliances not supporting Celsius's current market expansion goals.

- Underperforming Market Share: Partnerships failing to capture even 2% market share in their designated regions.

Products or market segments that consume resources without generating significant returns are classified as Dogs in the BCG matrix. For Celsius, this could include niche flavors with minimal sales, such as a limited-edition variant launched in 2023 that only captured 0.3% of overall revenue in 2024. These "Dogs" often have low market share and low growth potential, making them candidates for divestment.

For example, an older product format, like a specific size or packaging that has fallen out of favor, might also be a Dog. If a particular bottle size, introduced years ago, saw its sales decline by 20% year-over-year in 2024 and now represents only 1% of total sales, it fits this category. These products typically require continued investment for production but offer little in terms of growth or profit.

International ventures that fail to gain traction also fall into the Dog quadrant. Imagine a small-scale market entry in a new country in 2023 that, by 2024, had only achieved $50,000 in sales against $200,000 in operational costs. Such ventures are resource drains with little prospect of future success, often characterized by low market share and high costs relative to revenue.

Certain highly competitive beverage sub-segments where Celsius lacks strong differentiation also represent potential Dogs. For instance, if Celsius were to compete in the traditional, high-sugar energy drink market, it would face entrenched giants like Monster Energy, which held approximately 35% of the US energy drink market share in 2024. Entering such a saturated market without a clear advantage would likely result in low market share and minimal profitability.

| Category | Example for Celsius | 2024 Data Point (Illustrative) | Market Share | Growth Potential |

|---|---|---|---|---|

| Niche Flavors | Limited Edition Flavor X (launched 2023) | 0.3% of total revenue | Low | Low |

| Outdated Formats | Original Glass Bottle (legacy) | 1% of total sales, 20% YoY decline | Low | Low |

| Underperforming Markets | Entry into Market Y (2023) | $50k revenue vs $200k costs | Negligible | Low |

| Saturated Segments | Traditional High-Sugar Energy Drinks | N/A (Hypothetical entry) | < 2% (if entered) | Low |

Question Marks

Celsius's strategic push into new international markets like the Netherlands, Belgium, and Luxembourg, alongside continued efforts in the UK, Ireland, France, Australia, and New Zealand, positions them as a 'Question Mark' in the BCG Matrix. These are high-potential growth areas for functional beverages, yet Celsius's current market penetration is relatively low.

These expansion efforts demand significant capital for establishing brand recognition and robust distribution networks. For instance, in 2023, Celsius reported a substantial increase in international net sales, growing by 136% to $370.7 million, reflecting the investment and early traction in these new territories.

CELSIUS HYDRATION, a new line of caffeine-free, zero-sugar electrolyte powders, represents Celsius's strategic entry into the rapidly expanding hydration powder market. This diversification marks a significant move for the company into a new product category.

As a nascent product within the company's portfolio, CELSIUS HYDRATION currently holds a low market share. However, the company projects substantial growth for this segment, necessitating considerable investment in marketing and distribution to build brand awareness and secure a competitive foothold.

Celsius’s recent flavor launches, including Sparkling Strawberry Passionfruit, Watermelon Ice, and Grape Slush, represent the company's ongoing efforts to expand its product portfolio. While these additions are part of a well-established and growing brand, their individual market traction is still in the nascent stages. The company will need to monitor their adoption rates closely.

These new flavors, though promising, are currently in the early adoption phase, meaning their long-term market success and ability to significantly increase Celsius's market share are not yet confirmed. Continued marketing and promotional activities will be crucial to drive consumer awareness and trial for these specific offerings.

Expansion into New Foodservice and Niche Retail Channels

Celsius's strategic push into new channels like Subway and Home Depot signifies a deliberate move to capture market share in under-served foodservice and niche retail segments. This expansion targets high-growth areas where Celsius has a nascent presence, aiming to significantly increase its distribution footprint and brand visibility.

These new channels represent a key growth driver, aligning with Celsius's objective to become a more ubiquitous beverage option. By entering these diverse retail environments, Celsius is diversifying its revenue streams and reaching consumers in their daily routines.

- Subway Partnership: Celsius secured a significant distribution deal with Subway, aiming to place its beverages in over 2,000 locations by the end of 2024, representing a substantial foodservice expansion.

- Home Depot Presence: The company also expanded its reach into Home Depot stores, targeting a different consumer demographic and a non-traditional beverage retail environment.

- Market Penetration Goal: This multi-channel strategy is designed to increase Celsius's penetration in convenience and foodservice channels, which are critical for capturing impulse purchases and broader consumer adoption.

- Sales Growth Impact: Analysts project that these channel expansions will contribute significantly to Celsius's projected 2024 revenue growth, which is anticipated to be in the high double digits.

Future Functional Beverage Categories

Exploring entirely new functional beverage categories, such as those focused on sleep or advanced cognitive enhancement, would position Celsius as a potential innovator, but also a high-risk, high-reward player. These ventures would likely start with a very small market share, demanding substantial research and development investment to establish their efficacy and market acceptance.

The functional beverage market is projected to reach \$203.4 billion by 2027, growing at a CAGR of 7.1%. This growth indicates significant opportunity, but also intense competition as companies explore diverse health benefits.

- Sleep Aids: Targeting the growing sleep wellness market, estimated to be worth \$76.7 billion globally in 2023.

- Cognitive Enhancers: Capitalizing on the nootropics trend, with the global nootropics market expected to reach \$12.5 billion by 2028.

- Digestive Health: Addressing consumer interest in gut health, a segment showing consistent demand for functional ingredients.

- Immune Support: Leveraging ongoing consumer focus on preventative health and immunity, a category that saw significant growth during recent health events.

Question Marks represent new ventures or products with low market share in high-growth markets. Celsius's expansion into new international territories and the launch of new product lines like CELSIUS HYDRATION clearly fit this profile. These initiatives require significant investment to gain traction and establish market presence, with their future success being uncertain but holding substantial growth potential.

Celsius's strategic expansion into new international markets, such as the Netherlands, Belgium, and Luxembourg, alongside its continued presence in established markets like the UK and Australia, positions these regions as Question Marks. While these markets offer high growth potential for functional beverages, Celsius's current penetration is relatively low, necessitating substantial investment in marketing and distribution to build brand awareness and secure market share.

The introduction of CELSIUS HYDRATION, a new line of caffeine-free electrolyte powders, also falls into the Question Mark category. This represents Celsius's entry into a new product segment with a currently low market share, but with projected substantial growth. Significant investment in marketing and distribution is crucial to establish brand awareness and compete effectively in this expanding market.

Celsius's strategic move into new distribution channels, including partnerships with Subway and Home Depot, further exemplifies their Question Mark strategy. These ventures aim to capture market share in previously under-served or niche retail environments, targeting high-growth areas where their presence is currently nascent. The success of these expansions is anticipated to contribute significantly to their 2024 revenue growth, with analysts projecting high double-digit increases.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Potential Outcome |

|---|---|---|---|---|

| International Expansion (e.g., Netherlands, Belgium) | High | Low | High | High Growth/High Risk |

| CELSIUS HYDRATION Product Line | High | Low | High | High Growth/High Risk |

| Subway Distribution Deal | High (Foodservice) | Nascent | Moderate | Increased Market Penetration |

| Home Depot Presence | Moderate (Niche Retail) | Nascent | Moderate | Diversified Revenue Streams |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitor analysis, to accurately position each business unit.