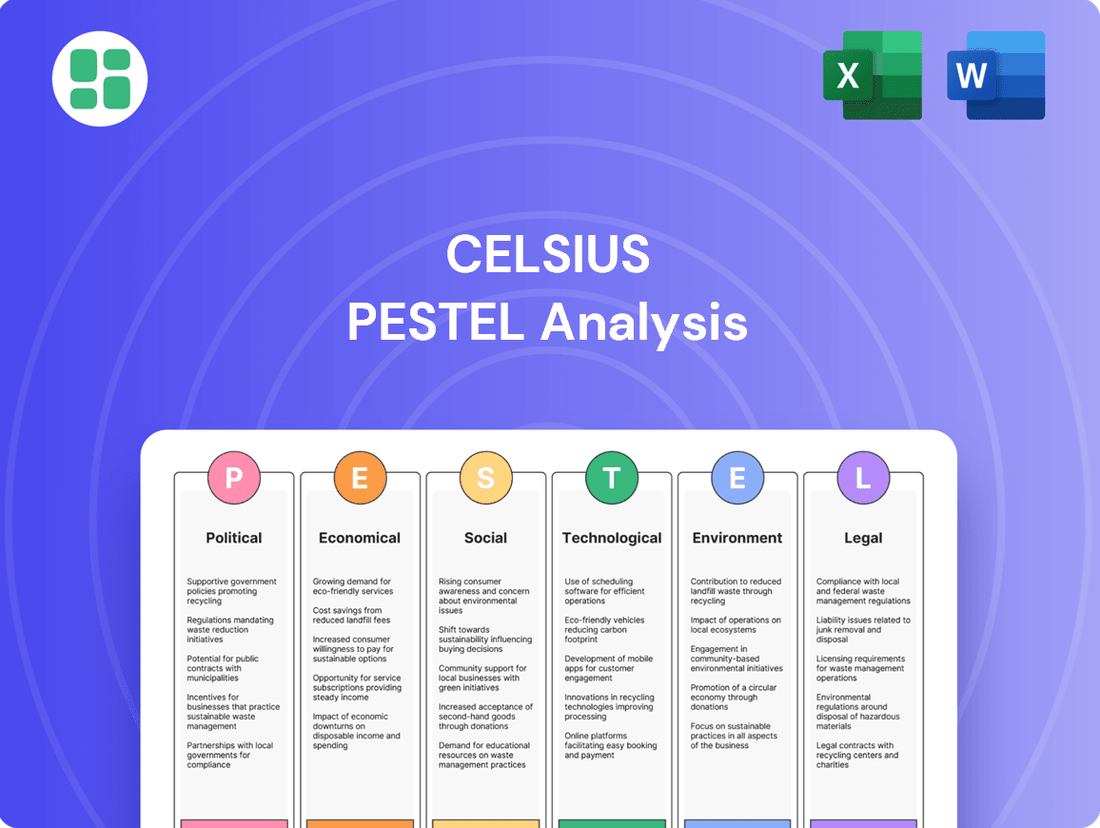

Celsius PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Bundle

Unlock a deeper understanding of Celsius's operating environment with our comprehensive PESTLE analysis. Discover how political stability, economic fluctuations, and evolving social trends are shaping the company's trajectory. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full report now to gain a critical competitive advantage.

Political factors

Governments globally are tightening their grip on health claims made by functional beverage brands, impacting companies like Celsius. This increased regulatory scrutiny means Celsius must meticulously ensure its marketing and product labeling adhere to strict guidelines to sidestep potential legal battles and reputational damage. For instance, the U.S. Food and Drug Administration (FDA) plays a crucial role, with misbranding allegations potentially arising if claims are not adequately substantiated and approved, as seen in past industry challenges.

Celsius must navigate increasingly stringent food safety and labeling regulations globally. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued its focus on updating nutrition labeling, requiring more prominent calorie counts and updated serving sizes, directly affecting how Celsius presents its product information.

These evolving standards, including detailed ingredient disclosure and allergen warnings, directly influence Celsius's product formulation, manufacturing processes, and packaging design. Non-compliance can lead to product recalls and significant reputational damage, impacting consumer trust, a critical asset for beverage brands.

As of early 2025, consumer demand for transparency in food products remains high, with surveys indicating that over 70% of consumers check labels for nutritional information and ingredients before purchasing. This trend underscores the importance of Celsius’s meticulous adherence to these political factors for maintaining market access and competitive advantage.

Celsius's global expansion means navigating a complex web of international trade policies and tariffs. For instance, shifts in U.S. trade agreements or the imposition of new tariffs on ingredients or finished goods could significantly alter production costs and pricing strategies. The World Trade Organization (WTO) reported that global trade growth slowed to an estimated 0.8% in 2023, highlighting the sensitivity of businesses like Celsius to these evolving international trade landscapes.

Government Health Initiatives and Taxation

Government health initiatives, such as campaigns to curb sugar intake, directly impact the functional beverage market. These policies can steer consumers toward healthier alternatives, benefiting brands like Celsius. For example, in 2023, the UK government continued its focus on tackling childhood obesity, which includes measures to reduce sugar in drinks, potentially boosting demand for low-sugar options.

Taxation on sugar-sweetened beverages is another significant political factor. Several countries have introduced or are considering such taxes, as seen in Mexico's soda tax, which has shown some success in reducing consumption of sugary drinks. This creates a favorable environment for Celsius, which offers a range of zero and low-sugar products, as consumers seek to avoid these levies.

The influence of these political pressures extends to product development. Companies are incentivized to innovate and reformulate their offerings to align with public health goals and avoid potential taxation. This can lead to an increased availability of healthier beverage choices, further supporting Celsius's market position.

Key impacts include:

- Increased demand for low-sugar alternatives due to health-focused government policies.

- Potential market share gains from sugar-sweetened beverage taxes in various regions.

- Driving innovation in product formulation to meet evolving health standards and consumer preferences.

Lobbying and Industry Advocacy

The beverage industry, particularly the rapidly expanding functional beverage sector, actively engages in lobbying to influence legislation and regulatory frameworks. These collective efforts often focus on securing advantageous trade policies, shaping ingredient standards, and fostering a regulatory climate conducive to innovation and expansion. Celsius, as a significant player in this market, benefits from and likely contributes to these industry-wide advocacy initiatives, which can impact everything from labeling requirements to market access.

These advocacy efforts are crucial for navigating complex regulatory landscapes. For instance, in 2024, the Food and Drug Administration (FDA) continued to review and potentially update guidelines for dietary supplements and functional ingredients, areas directly relevant to Celsius's product development and marketing. Industry groups, through their lobbying arms, provide input on these reviews, aiming to ensure that regulations support, rather than hinder, the growth of products like Celsius.

- Industry Advocacy: Broad beverage industry groups lobby for favorable trade conditions and ingredient guidelines.

- Regulatory Influence: Lobbying aims to create a regulatory environment that supports innovation and market growth for functional beverages.

- Celsius's Role: Celsius benefits from and likely participates in these collective industry advocacy efforts.

- Impact of FDA Reviews: Ongoing FDA reviews of ingredients and labeling in 2024 directly affect companies like Celsius.

Governments worldwide are increasingly scrutinizing health claims and labeling for functional beverages, a trend impacting Celsius. Strict adherence to regulations, like those from the FDA regarding substantiated claims and updated nutrition labeling in 2024, is crucial to avoid legal issues and maintain consumer trust. For example, over 70% of consumers check labels for nutritional information in 2025, highlighting the importance of transparency.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Celsius across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive understanding of how these forces shape opportunities and threats for Celsius.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex external factors into actionable insights for Celsius.

Helps support discussions on external risk and market positioning during planning sessions, enabling Celsius to proactively address challenges and capitalize on opportunities.

Economic factors

The functional beverage market is booming, with forecasts suggesting it will reach $200 billion globally by 2025, a substantial jump from previous years. This surge is fueled by consumers actively seeking healthier alternatives, with a notable trend towards beverages offering specific health benefits like energy enhancement and immune support. Celsius, with its focus on energy and performance, is perfectly positioned to leverage this expanding consumer interest.

Inflationary pressures significantly impact Celsius's operational costs. Rising prices for raw materials, such as aluminum cans and sweeteners, directly increase the cost of revenue. For instance, global commodity prices saw notable increases throughout 2023 and into early 2024, affecting beverage manufacturers.

Manufacturing and logistics expenses are also subject to inflation. Higher energy costs and increased wages for labor contribute to elevated production and distribution expenses. This can squeeze Celsius's gross profit margins, especially considering its dependence on contract manufacturers and external logistics providers.

Managing these escalating costs is paramount for Celsius's profitability. A strategic review of its cost structure, including renegotiating supplier contracts and optimizing supply chain efficiency, is crucial to mitigate these economic headwinds and maintain competitive pricing.

Consumer spending on health and wellness continues its upward trajectory, with a significant portion allocated to functional beverages. This trend directly benefits Celsius as it aligns perfectly with consumer demand for healthier alternatives. For instance, in 2024, the global health and wellness market was valued at over $5 trillion, with a notable increase in spending on products perceived to offer health benefits.

Global Economic Conditions and Market Expansion

Global economic conditions significantly shape Celsius's prospects for international expansion and overall revenue generation. While North America continues to be a cornerstone market, the company has demonstrated robust growth in key international territories.

For instance, Celsius reported substantial sales increases in the United Kingdom, Ireland, France, Australia, and New Zealand, underscoring effective market penetration in these regions. This international success is a testament to their strategy, but it also means the company is increasingly exposed to global economic fluctuations.

However, persistent global economic uncertainties, such as inflation, interest rate hikes, and geopolitical instability, present potential headwinds that could temper sustained international growth for Celsius. These factors can impact consumer spending power and operational costs abroad.

- International Sales Growth: Celsius has seen strong international sales growth, with the UK, Ireland, France, Australia, and New Zealand being notable markets.

- Economic Sensitivity: Global economic stability directly influences the success of Celsius's international expansion efforts and its revenue streams.

- Potential Challenges: Uncertainties like inflation and geopolitical events can create obstacles for continued international market penetration and sales performance.

- Market Diversification: The company's success in diverse international markets highlights its ability to adapt, but also increases its exposure to varying economic climates.

Competitive Landscape and Pricing

The energy drink market is a crowded space, with giants like Red Bull and Monster dominating, but also numerous emerging brands constantly vying for consumer attention. This fierce competition directly impacts pricing strategies, often forcing companies to offer promotions or maintain competitive price points to attract and retain customers. For Celsius, this means a constant need to innovate and market effectively to stand out.

In 2024, the global energy drink market was valued at approximately $88.3 billion, with projections indicating continued growth. This expansion, however, is fueled by intense rivalry.

Key competitive factors for Celsius include:

- Brand Loyalty: Established players have strong brand recognition and loyal customer bases.

- Product Innovation: The need for novel flavors, functional ingredients, and healthier options to differentiate.

- Distribution Channels: Securing shelf space in supermarkets, convenience stores, and online platforms is critical.

- Marketing Spend: Significant investment in advertising, sponsorships, and influencer marketing is necessary to build awareness.

Celsius's success hinges on its ability to carve out its niche through unique product offerings and strategic distribution, especially as new competitors, including private label brands, enter the fray.

Inflation continues to be a significant economic factor for Celsius, impacting raw material costs like aluminum and sweeteners, which saw notable price increases through 2023 and into early 2024. This directly affects the cost of revenue and can squeeze profit margins if not managed effectively through cost optimization strategies.

Consumer spending power, influenced by broader economic conditions such as interest rates and employment, directly correlates with demand for discretionary products like functional beverages. While the health and wellness market remains strong, economic downturns could temper consumer willingness to spend on premium or specialty drinks.

Global economic stability is crucial for Celsius's international growth ambitions. While the company has shown success in markets like the UK and Australia, ongoing uncertainties such as geopolitical tensions and varying inflation rates across regions can create headwinds for sustained expansion and revenue generation.

What You See Is What You Get

Celsius PESTLE Analysis

The preview you see here is the exact Celsius PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Celsius, providing valuable insights for strategic decision-making.

What you’re previewing here is the actual file, meticulously researched and professionally structured, ensuring you get a complete and actionable report.

Sociological factors

Consumers are increasingly prioritizing health and wellness, with a significant portion actively seeking beverages that offer tangible health benefits. This societal shift directly fuels demand for functional drinks like Celsius, which are marketed for their metabolism-boosting and energy-enhancing properties. For instance, a 2024 report indicated that over 60% of consumers are willing to pay a premium for products perceived as healthier.

Modern lifestyles are increasingly prioritizing convenience, directly impacting beverage choices. Consumers are actively seeking functional drinks that align with their fast-paced routines, whether for morning energy or an afternoon boost. This trend is evident in the growing market for ready-to-drink options and portable formats.

Celsius effectively addresses this demand with its diverse product offerings, including convenient ready-to-drink cans and on-the-go powder packets. These formats are designed to seamlessly integrate into active and busy schedules, reflecting a broader societal shift towards prioritizing efficiency and ease of consumption. The global functional beverage market was valued at approximately $120 billion in 2023 and is projected to grow significantly, underscoring the strong consumer appetite for such products.

Social media platforms are powerful forces shaping consumer tastes and how brands are viewed, especially in the beverage sector. Trends that go viral, collaborations with influencers, and the growing interest in personalized nutrition, all amplified on platforms like TikTok, can quickly boost demand for specific drinks or ingredients. For instance, Celsius has seen significant engagement through its partnerships with fitness influencers, driving awareness and trial among its core demographic.

Celsius can effectively use digital marketing and social media to build stronger connections with its customers and foster brand loyalty. In 2024, Celsius continued to invest heavily in influencer marketing, with campaigns reaching millions of consumers and contributing to its impressive sales growth, which saw a 42% increase in net sales for Q1 2024 compared to the previous year.

Demographic Shifts and Targeted Preferences

Demographic shifts are profoundly influencing consumer preferences, with Gen Z and Millennials leading the charge in demanding healthier, more sustainable, and engaging products. These younger generations are driving the self-care trend, showing a strong preference for low-calorie and sugar-free beverages, directly impacting the energy drink market. Celsius must actively adapt to these evolving tastes.

The influence of these demographics is quantifiable. For instance, by 2025, Gen Z is projected to represent a significant portion of the global consumer base, with their purchasing power steadily increasing. Their emphasis on authenticity and transparent ingredient lists means brands like Celsius need to clearly communicate product benefits and ethical sourcing. This generation is not just buying a product; they are buying into a brand's values and narrative. Their demand for clear benefits fuels innovation in product development, pushing companies to highlight specific functional ingredients and their advantages.

- Gen Z and Millennial Purchasing Power: These cohorts are increasingly dictating market trends, prioritizing health and wellness in their consumption habits.

- Demand for Low-Calorie/Sugar-Free: A significant percentage of these demographics actively seek out beverages that align with their health-conscious lifestyles.

- Sustainability and Authenticity: Brands that demonstrate genuine commitment to environmental responsibility and transparent communication resonate strongly.

- Brand Engagement and Values: Consumers are looking for more than just a product; they seek connections with brands that share their values and offer authentic experiences.

Demand for Natural and Transparent Ingredients

Consumers are increasingly scrutinizing product labels, pushing for greater transparency about what goes into their food and beverages. This demand for openness extends to ingredient sourcing and how products are made. For instance, a 2024 NielsenIQ report indicated that 65% of consumers are more likely to purchase products with clear ingredient lists.

There's a noticeable shift in preference towards natural sweeteners, moving away from artificial alternatives. This aligns with a broader movement towards 'clean-label' products, favoring organic and non-GMO options. Data from the Organic Trade Association in 2024 showed a continued strong growth in the organic food sector, with sales reaching over $70 billion.

Celsius's emphasis on natural ingredients directly taps into this consumer sentiment. By highlighting natural components, the brand can foster trust and positively influence purchasing decisions. This strategy is particularly effective in the competitive energy drink market, where consumers are actively seeking healthier and more transparent options.

- Consumer Scrutiny: 65% of consumers are more likely to buy products with clear ingredient lists (NielsenIQ, 2024).

- Sweetener Preference: Growing demand for natural over artificial sweeteners.

- Clean Label Trend: Organic sector sales exceeded $70 billion in 2024 (Organic Trade Association).

- Brand Trust: Celsius's natural ingredient focus builds consumer confidence.

Societal trends highlight a growing preference for health and wellness, with consumers actively seeking beverages that offer functional benefits beyond basic hydration. This inclination directly supports Celsius's positioning as a provider of energy-boosting and metabolism-enhancing drinks. A 2024 survey revealed that over 60% of consumers are willing to pay more for products perceived as healthier, underscoring the market's receptiveness to Celsius's core value proposition.

The fast-paced nature of modern life fuels a demand for convenience, making ready-to-drink and easily portable beverage options highly desirable. Celsius addresses this by offering its drinks in convenient formats like cans and powder packets, aligning with consumer needs for on-the-go solutions. The global functional beverage market, valued at approximately $120 billion in 2023, demonstrates a significant consumer appetite for such convenient, health-oriented products.

Social media's influence on consumer behavior is profound, with trends and influencer endorsements rapidly shaping purchasing decisions. Celsius has effectively leveraged influencer marketing, particularly within the fitness community, to drive brand awareness and product trial. This strategy contributed to Celsius's impressive 42% year-over-year net sales increase in Q1 2024, demonstrating the power of digital engagement.

Demographic shifts, particularly the increasing purchasing power of Gen Z and Millennials, are critical. These generations prioritize health, low-calorie options, and brand authenticity. By 2025, Gen Z's consumer influence will be substantial, making Celsius's focus on clear ingredient lists and functional benefits a key differentiator. Their demand for transparency and alignment with personal values is shaping the beverage landscape.

Technological factors

Ongoing research in ingredient science is a game-changer for beverage formulation, allowing companies like Celsius to explore novel functional compounds and natural energy sources. This push in technology directly fuels product innovation, enabling the creation of drinks with targeted benefits such as enhanced fat burning and accelerated metabolism.

The beverage industry is increasingly incorporating adaptogens, botanicals, and superfoods into formulations, reflecting a consumer demand for healthier and more functional options. This trend allows Celsius to differentiate its product line by offering sustained energy and improved wellness attributes, aligning with evolving market preferences.

The expansion of e-commerce offers beverage brands like Celsius a powerful avenue to connect with a broader customer base and streamline sales. Celsius leverages these digital platforms as a crucial part of its multi-channel strategy, providing consumers with detailed product information and easy purchasing options.

Online retail is anticipated to be the fastest-growing segment within the functional beverage market. This trend is underscored by projections indicating continued robust growth in e-commerce sales for consumer packaged goods, with functional beverages well-positioned to capture a significant share of this expansion.

Technological advancements are reshaping supply chain management for companies like Celsius. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is a significant trend, promising to boost efficiency, agility, and resilience in how goods are produced and distributed. These tools allow for real-time tracking and predictive analytics, crucial for managing complex global operations.

For Celsius, which relies on third-party manufacturers, these technologies are vital for optimizing logistics, minimizing disruptions, and ensuring stringent quality control. For example, AI-powered demand forecasting can help anticipate needs, reducing overstocking or stockouts. IoT sensors can monitor product conditions during transit, ensuring the integrity of Celsius's beverages.

While challenges exist in implementing such advanced systems, the overarching goal of digitalization is to build a more robust and resilient supply chain. In 2024, the global supply chain management software market was valued at approximately $25 billion and is projected to grow substantially, indicating a strong industry-wide push towards these technological solutions to navigate an increasingly volatile economic landscape.

AI in Product Development and Marketing

Artificial intelligence is significantly transforming how beverage companies like Celsius approach product development and marketing. AI algorithms can sift through vast amounts of consumer data, identifying emerging taste preferences and predicting future market trends. This allows for more targeted product innovation, ensuring new offerings resonate with consumer demand. For instance, AI can analyze social media sentiment and purchase history to suggest novel flavor combinations or ingredient optimizations.

Celsius can harness AI to create highly personalized marketing campaigns. By understanding individual consumer preferences and behaviors, AI can tailor promotional messages, recommend specific products, and even influence pricing strategies. This data-driven approach enhances customer engagement and drives sales more effectively. In 2024, companies leveraging AI in marketing reported an average increase in customer retention by 15% compared to those who did not.

The application of AI extends to optimizing supply chains and improving operational efficiency within product development. AI can predict demand fluctuations with greater accuracy, leading to better inventory management and reduced waste. This efficiency gain is crucial in the fast-paced beverage market. Furthermore, AI-powered tools can accelerate the testing and refinement of new product formulations, shortening the time-to-market for innovative beverages.

- AI-driven trend analysis: Celsius can utilize AI to identify micro-trends in flavor and ingredients, potentially leading to the development of unique product lines that capture niche market segments.

- Personalized marketing: AI enables Celsius to deliver customized promotions and product recommendations, increasing customer loyalty and conversion rates. For example, AI can segment audiences based on purchasing habits and demographic data to deliver hyper-relevant ads.

- Streamlined product innovation: By analyzing consumer feedback and market data, AI can assist in the rapid development and testing of new beverage formulations, reducing R&D costs and time.

- Enhanced consumer insights: AI tools provide deeper understanding of consumer motivations and preferences, allowing Celsius to refine its brand messaging and product positioning for maximum impact.

Innovative Packaging and Preservation

Technological advancements in packaging are crucial for Celsius, directly impacting product shelf life and consumer appeal. Innovations like active packaging that can monitor or extend freshness, or smart labels that indicate temperature abuse, are becoming increasingly important. For instance, by 2024, the global active and intelligent packaging market was projected to reach over $40 billion, reflecting a strong demand for these sophisticated solutions.

Furthermore, the development of sustainable and eco-friendly packaging materials is a key technological driver. Celsius, like many beverage companies, faces pressure to reduce its environmental footprint. This includes exploring biodegradable plastics, recycled content, and lightweighting initiatives. By 2025, the market for bioplastics is expected to see significant growth, driven by regulatory pushes and consumer preference for sustainable options.

Beyond packaging, technological improvements in production processes, such as advanced water recycling and purification systems, contribute to operational efficiency and cost savings. These technologies not only ensure product quality and safety by maintaining high standards of water purity but also align with environmental sustainability goals. Efficient water management is critical in the beverage industry, where water is a primary ingredient.

- Shelf Life Extension: Innovations in barrier materials and modified atmosphere packaging can significantly increase the shelf life of beverages, reducing waste.

- Sustainability Focus: The adoption of plant-based, compostable, or highly recyclable packaging materials is a growing trend, driven by both consumer demand and regulatory pressures.

- Production Efficiency: Advanced water purification and recycling technologies allow for more resource-efficient manufacturing processes, potentially lowering operational costs.

- Consumer Engagement: Smart packaging features, like QR codes or temperature indicators, can enhance consumer interaction and product safety assurance.

Technological advancements are pivotal for Celsius's product innovation and market reach. Ingredient science research allows for novel functional compounds, enhancing products with targeted benefits like metabolism acceleration. The expansion of e-commerce provides a vital channel for connecting with a broader customer base, with online retail projected as the fastest-growing segment in functional beverages.

Legal factors

Celsius operates under stringent product liability and consumer protection laws, essential for ensuring the safety and quality of its functional beverages. These regulations mandate thorough testing protocols and strict adherence to manufacturing standards to mitigate any potential consumer harm. For instance, in 2023, the U.S. Food and Drug Administration (FDA) continued its focus on ingredient safety and labeling accuracy for dietary supplements and beverages, a sector Celsius actively participates in.

Failure to comply with these legal frameworks can result in severe consequences, including substantial fines, costly product recalls, and significant damage to brand reputation. In 2024, regulatory bodies globally are increasingly scrutinizing claims made by beverage companies regarding health benefits and ingredient sourcing, making compliance a critical operational imperative for Celsius.

Protecting its unique formulations, branding, and trademarks is absolutely critical for Celsius to maintain its competitive edge in the rapidly evolving beverage market. Intellectual property laws are the bedrock that allows Celsius to safeguard its innovative ingredients and distinctive brand identity from being copied or misused by rivals.

These protections are not just theoretical; they are tangible assets. For instance, patents on novel ingredient combinations or manufacturing processes can prevent competitors from replicating Celsius's product advantages. Similarly, strong trademark protection for names like CELSIUS and Alani Nu ensures brand recognition and prevents consumer confusion, which is vital for market share. In 2023, Celsius continued to invest in R&D, a key area for IP generation, with its net sales growing 181% year-over-year to $1.3 billion, underscoring the commercial value of its protected innovations.

Celsius operates under strict advertising and marketing regulations, especially concerning health claims common in the functional beverage market. The company must ensure its assertions about boosting metabolism, aiding fat burning, and providing energy are backed by solid scientific evidence and adhere to guidelines from agencies like the FDA.

Failure to substantiate these claims can lead to significant legal repercussions, including costly class-action lawsuits. For instance, in 2023, Celsius faced scrutiny and settlements related to marketing practices, highlighting the critical need for compliant and transparent communication in this competitive sector.

Securities Law Compliance and Shareholder Lawsuits

As a publicly traded entity, Celsius Holdings, Inc. navigates a complex web of securities laws and regulations. These mandates govern everything from timely financial disclosures to transparent investor communications, crucial for maintaining market integrity and trust. Failure to comply can lead to significant penalties and legal challenges.

The company has faced legal headwinds, notably class-action lawsuits. These suits, filed in recent years, have alleged misleading statements concerning sales growth rates and stock performance. Such litigation underscores the inherent legal risks of operating in the public markets and the paramount importance of accurate, verifiable reporting to avoid accusations of stock inflation or deceptive practices.

- Securities Law Adherence: Celsius must comply with SEC regulations for financial reporting and investor relations.

- Litigation Impact: Lawsuits alleging misleading statements can erode investor confidence and negatively affect stock valuation.

- Disclosure Accuracy: Ensuring truthful and precise disclosures regarding sales rates and financial performance is critical to mitigate legal exposure.

International Trade Laws and Agreements

Celsius's global operations necessitate careful navigation of international trade laws and agreements. These regulations, including import/export controls and various free trade pacts, directly impact the company's ability to distribute its products efficiently across borders and gain market access. For instance, the World Trade Organization (WTO) agreements provide a framework for global trade, and adherence to these principles is crucial.

Changes in international trade legislation can significantly alter Celsius's supply chain dynamics and its strategies for entering new markets. For example, a shift in tariffs or non-tariff barriers, such as quotas or complex customs procedures, could increase operational costs or delay product availability. The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, offers specific trade rules for North America, and Celsius must ensure its operations align with these provisions to leverage benefits like reduced tariffs on goods traded between these countries.

- Global Trade Volume: In 2023, global trade in goods was projected to grow by a modest 0.9% according to the WTO, highlighting the sensitivity of international commerce to economic and geopolitical factors.

- Trade Agreement Impact: The European Union's single market facilitates frictionless trade among member states, a legal framework Celsius would benefit from if operating extensively within the EU.

- Regulatory Compliance Costs: Companies often spend significant resources ensuring compliance with diverse international trade regulations, impacting profitability and operational agility.

Celsius must navigate a complex landscape of consumer protection laws and product liability. These regulations ensure product safety and accurate labeling, with agencies like the FDA actively monitoring the beverage sector. In 2023, the FDA continued its focus on ingredient integrity and clear labeling for functional beverages, a key area for Celsius.

Failure to adhere to these legal standards can lead to significant penalties, including fines and product recalls, impacting brand trust. Globally, regulatory bodies in 2024 are intensifying their scrutiny of health claims made by beverage companies, making compliance a critical operational focus for Celsius.

Protecting intellectual property is vital for Celsius's competitive advantage, safeguarding its unique formulations and brand identity. Patents on innovative ingredients and manufacturing processes are crucial for maintaining product superiority and preventing imitation by competitors.

Strong trademark protection for brands like CELSIUS and Alani Nu ensures consumer recognition and prevents market confusion, directly supporting market share. Celsius's continued investment in R&D in 2023, which fuels IP generation, coincided with an impressive 181% year-over-year net sales growth to $1.3 billion, highlighting the commercial value of its protected innovations.

Environmental factors

Consumers are increasingly prioritizing beverages made with sustainably sourced ingredients, driving demand for practices that minimize environmental impact. This trend puts pressure on companies like Celsius to adopt low-impact farming and ethical sourcing across their supply chains. For instance, the global market for sustainable food and beverages was projected to reach $243.7 billion in 2024, highlighting the significant financial implications of this consumer shift.

Celsius's existing focus on natural ingredients positions it favorably, but maintaining this advantage requires ongoing vigilance. Ensuring that its ingredient suppliers adhere to evolving sustainability standards, such as those promoted by the Roundtable on Sustainable Palm Oil (RSPO) for palm oil derivatives, is crucial. Failure to adapt could lead to reputational damage and loss of market share in a competitive landscape where sustainability is becoming a key differentiator.

The beverage industry, including Celsius, grapples with the environmental impact of single-use packaging and the pervasive issue of plastic pollution. Consumers and regulators increasingly demand sustainable solutions, pushing companies to explore alternatives.

Celsius is likely to invest in and adopt eco-friendly packaging, such as biodegradable materials, reusable containers, and a greater reliance on aluminum cans and glass bottles. This shift is driven by a growing awareness of the environmental footprint associated with traditional plastic packaging.

The company may also implement or enhance innovative recycling programs and closed-loop systems. For instance, by 2025, global plastic waste generation is projected to reach 220 million metric tons annually, underscoring the urgency for such initiatives to mitigate waste and improve resource circularity.

Celsius is actively working to reduce its carbon footprint by focusing on its entire supply chain. This includes exploring the use of renewable energy sources for its manufacturing operations and optimizing transportation routes to cut down on emissions. For instance, many companies in the beverage sector are setting ambitious targets, with some aiming for 100% renewable electricity by 2030.

Water Usage and Conservation

Water is a critical resource for beverage manufacturers like Celsius, and the company faces increasing pressure to adopt efficient water conservation methods. Innovations in water recycling and purification are vital for minimizing waste in their production lines. For instance, by 2024, many companies are investing in closed-loop water systems, aiming to reduce their freshwater intake by up to 30%.

Celsius's commitment to environmental stewardship can also be demonstrated through investments in water restoration projects. These initiatives help replenish water sources impacted by industrial activity. By 2025, it's projected that major beverage corporations will allocate at least 5% of their sustainability budgets to such projects.

- Water Scarcity Concerns: Global freshwater availability is a growing issue, impacting manufacturing operations.

- Technological Advancements: Recycling and purification technologies are key to reducing water footprints.

- Corporate Responsibility: Investment in water restoration projects enhances brand reputation and environmental impact.

- Regulatory Landscape: Stricter regulations on water usage are anticipated, driving further conservation efforts.

Consumer Demand for Eco-Friendly Products

Consumers are increasingly prioritizing sustainability, with a significant portion actively seeking out products from environmentally responsible companies. This trend directly influences purchasing behavior, favoring brands that demonstrate a clear commitment to eco-friendly practices and corporate social responsibility. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay a premium for sustainable products.

This growing environmental consciousness translates into tangible market shifts. Brands that authentically embrace sustainability often cultivate stronger consumer loyalty and trust, which can be a powerful differentiator in competitive markets. The demand for eco-friendly options is not just a niche concern; it's becoming a mainstream expectation, impacting product development and marketing strategies across various sectors.

Key aspects of this consumer demand include:

- Preference for Recycled and Biodegradable Materials: Consumers are looking for packaging and product components that minimize environmental impact.

- Support for Companies with Reduced Carbon Footprints: Businesses actively working to lower their emissions are gaining favor.

- Interest in Ethical Sourcing and Production: Transparency in supply chains and fair labor practices are becoming increasingly important.

- Demand for Energy-Efficient Products: Appliances and electronics that consume less power are highly sought after.

Environmental concerns are increasingly shaping consumer preferences and regulatory landscapes, directly impacting beverage companies like Celsius. The demand for sustainably sourced ingredients and eco-friendly packaging is a significant market driver, with consumers willing to pay more for products that align with their environmental values. For example, by 2024, over 60% of consumers indicated a willingness to pay a premium for sustainable goods.

Celsius faces pressure to minimize its environmental footprint across its operations, from ingredient sourcing to packaging and carbon emissions. The company is responding by exploring renewable energy, optimizing logistics, and adopting more sustainable packaging solutions. For instance, a projected 220 million metric tons of plastic waste globally by 2025 highlights the urgency for such initiatives.

Water conservation is another critical environmental factor, with companies like Celsius investing in water recycling and purification technologies to reduce freshwater intake. By 2024, many beverage firms aim to cut freshwater consumption by up to 30% through closed-loop systems. Furthermore, a commitment to water restoration projects is becoming a standard practice, with major corporations expected to allocate at least 5% of their sustainability budgets to these efforts by 2025.

| Environmental Factor | Impact on Celsius | Industry Trend/Data (2024-2025) |

|---|---|---|

| Sustainable Sourcing | Drives demand for ethical ingredient procurement. | Global sustainable food & beverage market projected to reach $243.7 billion in 2024. |

| Packaging Waste | Necessitates adoption of eco-friendly materials and recycling programs. | Global plastic waste generation expected to reach 220 million metric tons annually by 2025. |

| Carbon Footprint | Requires focus on renewable energy and efficient logistics. | Many beverage companies targeting 100% renewable electricity by 2030. |

| Water Management | Prompts investment in water conservation and recycling technologies. | Companies aiming to reduce freshwater intake by up to 30% by 2024 using closed-loop systems. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Celsius is built on a comprehensive review of data from financial regulatory bodies, cryptocurrency market data providers, and technology research firms. We analyze economic indicators, evolving legal frameworks, and societal adoption trends to provide a holistic view.