Celsius Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Bundle

Celsius's competitive landscape is shaped by intense rivalry and the looming threat of new entrants, while buyer power and supplier leverage present distinct challenges. Understanding these forces is crucial for any player in the energy drink market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Celsius’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration can significantly influence a company's profitability. In the beverage sector, reliance on suppliers for critical components such as caffeine, vitamins, flavorings, and packaging materials is substantial. While some raw materials are standard, unique or patented ingredients can empower specific suppliers, giving them greater bargaining strength.

Celsius's financial performance, exemplified by a gross profit margin of 51.5% in the second quarter of 2025, suggests a degree of control over its input costs. This healthy margin, even accounting for acquisition-related expenses, indicates that supplier power, while present, does not appear to be an overwhelming factor for Celsius.

Switching suppliers for critical inputs presents a significant hurdle for Celsius. The process could involve substantial expenses related to product reformulation, rigorous retesting, and the lengthy qualification of new suppliers. This complexity can amplify the bargaining power of existing suppliers, particularly for specialized or premium ingredients that are integral to Celsius's unique thermogenic product positioning.

For instance, if a key ingredient contributing to Celsius's energy blend is sourced from a single, highly specialized producer, the cost and time to find and integrate an alternative could be prohibitive. This reliance can give the supplier leverage in price negotiations or supply terms. In 2023, Celsius reported a 158% increase in net revenue, reaching $1.3 billion, highlighting the scale of its operations and the importance of consistent, high-quality input sourcing.

While these switching costs can empower suppliers, Celsius appears to be proactively managing this risk. The company's strategy to diversify its supplier base aims to spread risk and, by extension, reduce the impact of any single supplier's bargaining power. This diversification effort is crucial for maintaining operational stability and cost control as Celsius continues its rapid growth trajectory.

The quality of ingredients is paramount for Celsius, directly impacting its brand promise of boosting metabolism and energy. If suppliers offer unique or superior functional ingredients, their leverage in negotiations naturally grows.

Celsius's commitment to 'better-for-you' and functional benefits means that the caliber and sourcing of its raw materials are critical for maintaining product integrity and consumer trust. For instance, the functional beverage market, where Celsius operates, saw significant growth in 2024, with consumers increasingly seeking products with scientifically backed benefits, further amplifying the importance of specialized ingredient suppliers.

Threat of Forward Integration

The threat of suppliers integrating forward into beverage manufacturing or distribution is generally low for companies like Celsius. The immense capital required to establish production facilities and navigate the complex distribution networks of the beverage industry acts as a significant barrier. For instance, setting up a beverage manufacturing plant can easily cost tens of millions of dollars, a prohibitive expense for most raw material suppliers.

This barrier effectively limits the bargaining power of suppliers. They are unlikely to become direct competitors by entering the functional drink market, which requires extensive marketing, brand building, and retail relationships. In 2024, the functional beverage market continued its robust growth, with many new entrants, but the established players like Celsius benefit from significant brand equity and distribution reach that are hard for suppliers to replicate.

- Low Forward Integration Threat: Suppliers in the beverage sector typically lack the capital and market access to directly compete with established brands like Celsius.

- High Entry Barriers: The substantial investment in manufacturing, marketing, and distribution channels deters suppliers from forward integration.

- Market Complexity: Understanding consumer preferences, regulatory landscapes, and retail dynamics within the functional beverage market presents a steep learning curve for potential supplier entrants.

Uniqueness of Inputs

While many beverage ingredients are commodities, Celsius's unique thermogenic and functional positioning relies on specific blends. If these key components, such as proprietary flavor profiles or specialized functional extracts, are sourced from a limited number of specialized suppliers, those suppliers gain significant leverage. This uniqueness means Celsius has fewer alternatives, increasing the supplier's bargaining power.

However, the broader industry trend toward widely available natural extracts like green coffee and ginseng, which Celsius also incorporates, can mitigate this supplier power. The increasing availability of these functional ingredients across multiple sources dilutes the bargaining strength of any single supplier of these particular inputs. For instance, in 2024, the global functional beverage market continued its growth trajectory, with key ingredients like green tea extract seeing stable supply chains.

- Proprietary Blends: Celsius's specific ingredient combinations for its energy-enhancing effects are a key differentiator.

- Limited Specialized Suppliers: Dependence on a few providers for these unique components increases supplier leverage.

- Industry Trends: The widespread availability of common functional ingredients like green coffee extract can reduce reliance on any single supplier.

- Market Dynamics: In 2024, the functional beverage sector's expansion indicated robust ingredient sourcing, potentially balancing supplier power.

The bargaining power of suppliers for Celsius is moderate, influenced by the specialization of ingredients and the company's scale. While Celsius's strong financial performance, with a gross profit margin of 51.5% in Q2 2025, suggests some cost control, the switching costs for unique ingredients can empower suppliers. However, Celsius's diversification efforts and the low threat of supplier forward integration help to mitigate this power.

| Factor | Impact on Celsius | Supporting Data/Observation |

|---|---|---|

| Supplier Concentration | Moderate to High for specialized ingredients | Reliance on unique ingredients for thermogenic properties. |

| Switching Costs | High for specialized ingredients | Product reformulation and supplier qualification are costly and time-consuming. |

| Supplier Forward Integration | Low | High capital requirements and market access barriers deter suppliers. |

| Celsius's Revenue Growth | Mitigates supplier power through scale | 158% increase in net revenue to $1.3 billion in 2023. |

What is included in the product

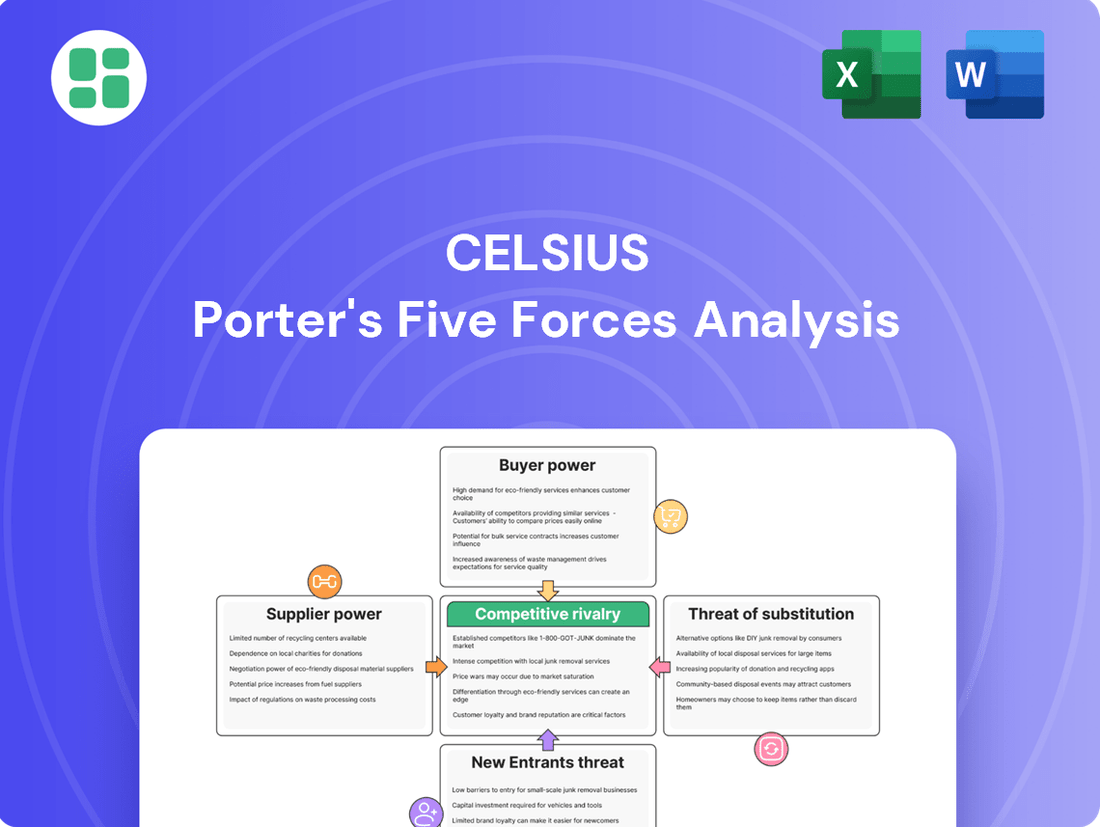

This analysis dissects the competitive forces impacting Celsius, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the energy drink market.

Effortlessly identify and prioritize competitive threats with a visual breakdown of each Porter's Five Force.

Customers Bargaining Power

Individual consumers of energy drinks generally face low switching costs and numerous alternatives, which can make them quite sensitive to price changes. For instance, a typical 12-ounce can of a competitor might retail for $2.00, while Celsius often commands $2.25 to $2.50, reflecting a 12-15% premium.

However, Celsius strategically targets health-conscious consumers who value specific functional benefits, like zero sugar or metabolism enhancement. This focus allows Celsius to command a premium, as these consumers may be less deterred by slightly higher prices due to the perceived added value.

Major retailers and distributors, integral to Celsius's extensive multi-channel distribution, including the Pepsi DSD network, represent substantial purchase volumes. These large-scale customers wield considerable bargaining power, enabling them to negotiate advantageous terms, pricing, and prime shelf placement.

Celsius's strategic expansion to over 240,000 tracked U.S. retail outlets underscores its dependence on these high-volume partners. This broad reach means that the purchasing decisions of a few key distributors can significantly impact Celsius's sales volume and profitability, giving them leverage.

The energy drink market is crowded, meaning Celsius faces significant competition. Consumers have a wide array of choices, from established brands like Red Bull and Monster to newer entrants and even traditional beverages like coffee and tea. For instance, the global coffee market alone was valued at over $100 billion in 2023, presenting a substantial alternative for those seeking a caffeine boost.

The proliferation of functional beverages, such as protein-infused drinks and sparkling waters with added vitamins, further expands consumer options. This growing category offers alternatives that cater to health-conscious consumers who might otherwise turn to energy drinks. The ease with which consumers can switch between these diverse beverage types directly translates into increased bargaining power for them.

Buyer Information and Transparency

Buyer information and transparency significantly amplify customer bargaining power. Consumers in 2024 are more informed than ever, actively seeking details about ingredients, nutritional content, and the health benefits of products like energy drinks. This heightened awareness, fueled by readily available online resources and social media, allows them to compare offerings and demand greater value, directly impacting companies like Celsius.

The ease with which consumers can access and disseminate information puts considerable pressure on brands to be upfront and honest. For Celsius, this means clear labeling and substantiated health claims are crucial. For instance, a growing segment of consumers prioritizes natural ingredients and low sugar content, and their ability to quickly research and share this preference online can sway purchasing decisions away from less transparent competitors.

- Informed Consumers: Over 70% of consumers globally report reading product labels before purchasing, a trend that has only intensified in recent years.

- Digital Empowerment: Online reviews and social media discussions allow consumers to collectively voice preferences and dissatisfaction, influencing brand perception.

- Demand for Transparency: A significant portion of consumers express willingness to pay more for products with transparent ingredient lists and clear sourcing information.

Threat of Backward Integration

While individual consumers typically lack the power to integrate backward into Celsius's operations, large retail chains or major distributors could theoretically explore developing their own private-label functional beverages. However, the significant investment in research and development, marketing, and scaling required to compete with an established brand like Celsius makes this a low threat for most customers.

The primary leverage customers, particularly large distributors and retailers, hold over Celsius lies in their extensive distribution networks and direct access to consumers. For instance, a major supermarket chain's decision to allocate or reduce shelf space for Celsius can significantly impact sales volume. In 2024, major retailers like Walmart and Target continue to wield considerable influence over CPG brand performance through their purchasing power and promotional strategies.

- Low Likelihood of Private Label Entry: The capital and expertise needed to launch a successful functional beverage brand are substantial barriers, making backward integration by most customers improbable.

- Distribution Power: Key customers, such as large grocery chains, control crucial access to the end consumer, giving them significant bargaining power.

- Retailer Influence in 2024: Major retailers' decisions on product placement and promotional support remain critical drivers of Celsius's market penetration and sales figures.

Individual consumers have moderate bargaining power due to low switching costs and a wide array of beverage alternatives, including coffee and other functional drinks. However, Celsius mitigates this by targeting a specific health-conscious niche willing to pay a premium for perceived benefits, such as zero sugar. This differentiation lessens price sensitivity for a key customer segment.

Large distributors and retailers, such as those in the Pepsi DSD network, possess significant bargaining power due to their substantial order volumes and control over shelf space. Celsius's extensive retail presence, exceeding 240,000 U.S. outlets, makes these partners crucial, allowing them to negotiate favorable terms and pricing. For instance, major retailers in 2024 continue to leverage their scale to secure better margins and promotional support from CPG brands.

| Customer Type | Leverage Factor | Impact on Celsius |

|---|---|---|

| Individual Consumers | Low switching costs, numerous alternatives | Price sensitivity, demand for value |

| Large Retailers/Distributors | High purchase volume, distribution control | Negotiation power on pricing, placement, promotions |

What You See Is What You Get

Celsius Porter's Five Forces Analysis

This preview shows the exact Celsius Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain immediate access to this comprehensive document, detailing the competitive landscape of the Celsius brand. This professional analysis is ready for your use the moment you buy.

Rivalry Among Competitors

The energy drink arena is a battleground, with established titans like Red Bull, Monster Energy, and major beverage conglomerates such as PepsiCo (Rockstar) and Coca-Cola (Reign, BodyArmor) holding significant sway. Celsius has carved out a strong position, achieving the #3 spot in the U.S. energy drink market with a 16.8% share in the first half of 2025, underscoring the fierce competition it faces from these well-entrenched players.

The functional beverage and energy drink markets are booming, with the global energy drinks market expected to reach $97.27 billion by 2029, growing at a compound annual growth rate of 7.5%. This robust expansion naturally draws in new entrants and spurs existing companies to ramp up their efforts, intensifying competition.

In this dynamic landscape, Celsius has made a significant impact, accounting for an impressive 13% of the entire energy drink category's growth during the first half of 2025. This suggests that while rivalry is high, Celsius is effectively capturing market share and driving expansion within the sector.

Celsius actively carves out its niche by emphasizing a 'better-for-you' positioning, featuring zero sugar and a thermogenic focus, distinguishing it from many competitors offering a standard caffeine jolt. This strategic differentiation is crucial in a market saturated with energy drink options.

The company's commitment to product innovation is evident in its continuous launch of new flavors and its expansion into the hydration category, ensuring its offerings remain appealing and distinct. For instance, Celsius reported a 42% year-over-year revenue increase in Q1 2024, reaching $303 million, underscoring the market's positive reception to its differentiated products.

In the fiercely competitive energy drink landscape, robust branding and targeted marketing are paramount for Celsius to capture consumer attention and maintain its unique market position. The company's strategic partnerships and endorsements, including its collaboration with influencers and athletes, contribute significantly to its brand visibility and appeal.

Exit Barriers

High capital investment in manufacturing, extensive distribution networks, and substantial brand building efforts in the beverage sector act as significant exit barriers. These substantial sunk costs make it difficult and costly for companies to leave the market, even when facing profitability challenges.

Consequently, competitors are more inclined to remain and continue vying for market share, which can intensify competitive rivalry. This dynamic is evident in the beverage industry, where companies often persevere through downturns rather than exiting.

The beverage industry, particularly the energy drink segment where Celsius operates, demands considerable upfront investment. For example, establishing a national beverage distribution network can cost millions of dollars, and building a recognized brand requires sustained marketing expenditures. These factors contribute to the high exit barriers.

The recent acquisition of Alani Nu by Celsius for $350 million in 2023 underscores the significant commitments and investments made within the sector, further reinforcing the idea that companies are deeply entrenched and less likely to exit.

- High Capital Investment: Significant funds are required for manufacturing facilities, supply chains, and marketing to establish a presence in the beverage market.

- Entrenched Competitors: High exit barriers encourage existing players to stay and compete, potentially leading to prolonged periods of intense rivalry.

- Brand Loyalty and Distribution: Building strong brand recognition and securing shelf space in retail channels are costly and time-consuming, creating further barriers to entry and exit.

- Industry Consolidation: Acquisitions, like Celsius's purchase of Alani Nu, signal a commitment to the sector and can further solidify the positions of major players, raising the stakes for all involved.

Acquisition and Consolidation Activity

The energy drink sector is experiencing a surge in mergers and acquisitions. A prime example is Celsius's substantial $1.8 billion acquisition of Alani Nu, completed in late 2024. This strategic move significantly bolstered Celsius's market reach and revenue streams.

This wave of consolidation highlights a broader trend where dominant companies are actively seeking to enhance their market share and diversify their product portfolios. Such aggressive expansion by major players undeniably intensifies the competitive landscape, posing a considerable challenge for smaller, independent brands striving to maintain their footing.

- $1.8 billion - The acquisition price of Alani Nu by Celsius in late 2024.

- Expanded Market Presence - Celsius's acquisition of Alani Nu broadened its reach within the energy drink market.

- Portfolio Strength - Consolidation efforts aim to strengthen brand portfolios and competitive positioning.

- Intensified Competition - M&A activity increases pressure on smaller brands to compete with larger, consolidated entities.

Competitive rivalry in the energy drink market is intense, with Celsius facing formidable opponents like Red Bull and Monster Energy. Despite this, Celsius has secured the third position in the U.S. market, capturing 16.8% of the share in the first half of 2025, demonstrating its ability to compete effectively. This fierce competition is further fueled by the overall market growth, expected to reach $97.27 billion by 2029, attracting new players and prompting existing ones to innovate and expand.

Celsius differentiates itself through a "better-for-you" approach, emphasizing zero sugar and thermogenic properties, a strategy that has resonated well with consumers, contributing to its 42% year-over-year revenue increase in Q1 2024. The company's strategic acquisitions, such as the $1.8 billion purchase of Alani Nu in late 2024, underscore its commitment to strengthening its market position and expanding its portfolio amidst this heightened rivalry.

| Competitor | Estimated U.S. Market Share (H1 2025) | Key Product Differentiators |

|---|---|---|

| Red Bull | Dominant Player | Iconic branding, established global presence |

| Monster Energy | Significant Share | Diverse flavor profiles, strong association with extreme sports |

| Celsius | 16.8% | Zero sugar, thermogenic focus, "better-for-you" positioning |

| Rockstar (PepsiCo) | Key Competitor | Wide distribution, broad product range |

| Reign/BodyArmor (Coca-Cola) | Growing Presence | Focus on performance and hydration |

SSubstitutes Threaten

The threat of substitutes for energy drinks is significant, as consumers have a wide array of alternative options available. These include readily accessible choices like coffee and tea, which have long-established consumer bases and perceived health benefits. In 2024, the global coffee market alone was valued at over $130 billion, demonstrating the scale of these established substitutes.

Furthermore, traditional soft drinks and even non-caffeinated options such as adequate sleep and balanced nutrition present viable alternatives for individuals seeking an energy boost. Growing consumer awareness and concern regarding high caffeine intake are increasingly driving people towards these more natural or traditional energy sources, further intensifying the competitive pressure from substitutes.

The broader functional beverage market, encompassing protein waters, hydration drinks, and gut-friendly sodas, poses a significant substitute threat to Celsius. These products increasingly cater to the same health-conscious consumers, offering benefits that extend beyond basic hydration or energy, such as enhanced mental clarity or improved gut health. For instance, the global functional beverage market was valued at approximately $126.5 billion in 2023 and is projected to reach $237.4 billion by 2030, indicating robust growth and intense competition for consumer attention and spending.

Pills, powders, and other dietary supplements providing energy, fat burning, or metabolism-boosting effects represent direct substitutes for Celsius's liquid offerings. These alternatives often target the same health-conscious consumer base, providing concentrated active ingredients. For instance, the global dietary supplement market was valued at approximately $150 billion in 2023 and is projected to grow significantly, indicating a robust competitive landscape.

Convenience and Price of Substitutes

The threat of substitutes for Celsius is significant, primarily due to the widespread availability and lower cost of traditional beverages. Consumers often opt for a cup of coffee or a standard soda, which are readily accessible and generally more budget-friendly than specialized functional drinks. This convenience and potential cost saving make them attractive alternatives for a broad consumer base.

In 2024, the U.S. coffee market alone was valued at approximately $47.5 billion, highlighting the sheer scale of this substitute category. Similarly, the U.S. carbonated soft drink market continues to be a dominant force, with major players maintaining strong market share. These established markets represent readily available and often cheaper alternatives for consumers seeking a beverage experience.

- Widespread Availability: Coffee shops and convenience stores offer coffee and soda globally, often on every corner.

- Lower Price Points: A standard 12oz can of soda or a basic coffee can cost between $1-$3, significantly less than many Celsius products.

- Established Consumer Habits: Coffee and soda consumption are deeply ingrained habits for many, making switching less likely.

- Perceived Functional Equivalence: For many consumers, caffeine from coffee or sugar from soda provides the desired energy boost, negating the need for specialized functional beverages.

Changing Consumer Preferences for Wellness

Consumers are increasingly prioritizing holistic well-being, shifting demand away from single-purpose energy drinks towards products offering broader health benefits. This growing preference for comprehensive wellness solutions directly impacts the threat of substitutes for Celsius. For instance, the market for functional beverages, incorporating ingredients like adaptogens for stress management or electrolytes for hydration, is expanding rapidly.

This trend means that beverages offering more than just a caffeine kick pose a significant threat. In 2024, the global functional beverage market was projected to reach over $200 billion, demonstrating a clear consumer appetite for products aligned with wellness goals. This growth highlights how substitutes that cater to a wider range of health needs can effectively draw consumers away from traditional energy drinks.

- Growing Demand for Adaptogens: Ingredients like ashwagandha and rhodiola are becoming popular for their stress-reducing properties, offering an alternative to the stimulant-focused benefits of energy drinks.

- Increased Electrolyte Consumption: Consumers are seeking beverages that replenish electrolytes lost through exercise or daily activity, a function not typically central to energy drink offerings.

- Rise of Hydration Beverages: The market for enhanced water and other hydration-focused drinks is booming, providing a healthier alternative for those looking to stay refreshed without added sugars or artificial ingredients.

The threat of substitutes for Celsius is substantial, stemming from a wide array of readily available and often more affordable alternatives. Traditional beverages like coffee and tea, along with soft drinks, represent significant competition due to their established consumer bases and lower price points. For instance, the U.S. coffee market was valued at approximately $47.5 billion in 2024, illustrating the scale of these deeply ingrained substitutes.

Beyond traditional drinks, the growing functional beverage market and dietary supplements also pose a direct threat. These alternatives cater to health-conscious consumers seeking broader benefits, such as improved gut health or stress management, with products like protein waters and adaptogen-infused drinks gaining traction. The global functional beverage market was projected to exceed $200 billion in 2024, underscoring the competitive pressure from these evolving substitutes.

| Substitute Category | 2024 Market Value (Approx.) | Key Differentiators |

|---|---|---|

| Coffee | $47.5 billion (U.S.) | Established habit, lower price, perceived natural energy |

| Soft Drinks | Significant market share | Ubiquitous availability, lower price, brand loyalty |

| Functional Beverages | >$200 billion (Global projection) | Broader health benefits (gut health, stress relief), wellness focus |

| Dietary Supplements | >$150 billion (Global, 2023) | Concentrated active ingredients, targeted effects (energy, metabolism) |

Entrants Threaten

Launching a new beverage brand, particularly one with ambitions for widespread distribution like Celsius, demands significant financial resources. These funds are essential for everything from creating the product and setting up production lines to extensive marketing campaigns and building out robust distribution channels. For instance, establishing a national beverage brand in 2024 could easily require tens of millions of dollars, making it a formidable hurdle for aspiring competitors.

Brand loyalty is a significant barrier for new entrants in the energy drink market. Established players like Celsius have spent years building strong brand recognition and cultivating a devoted customer following. For instance, Celsius reported a net sales increase of 37% to $1.3 billion in the first quarter of 2024, demonstrating its continued market strength and consumer appeal, making it challenging for newcomers to capture market share without substantial investment in marketing and brand building to overcome this existing loyalty.

Securing widespread shelf space and access to robust direct store delivery (DSD) networks presents a significant hurdle for new entrants in the beverage market. Celsius's strategic partnership with PepsiCo, a global distribution powerhouse, exemplifies the kind of established infrastructure that is difficult for newcomers to replicate. In 2024, the beverage industry continues to see major players leverage their existing relationships and logistical capabilities to maintain market share, making it a formidable challenge for emerging brands to gain comparable reach.

Regulatory Hurdles and Health Claims

The functional beverage market faces significant regulatory hurdles concerning health claims and ingredient transparency. New entrants must meticulously comply with evolving standards set by bodies like the FDA, which can involve extensive testing and documentation. For instance, in 2024, the FDA continued to refine guidelines on what constitutes a permissible health claim for dietary supplements and functional foods, adding layers of complexity for new product launches.

Navigating these complex regulations is a substantial barrier to entry, demanding considerable time and financial investment. Companies must ensure that all claims made about a product's benefits are substantiated by scientific evidence and that labeling accurately reflects ingredients and potential allergens. Failure to comply can result in product recalls, fines, and severe damage to brand reputation.

These regulatory complexities significantly deter potential new entrants due to the high cost and risk associated with market entry. Key compliance areas include:

- Ingredient Substantiation: Ensuring all functional ingredients have proven efficacy and safety.

- Labeling Accuracy: Adhering to strict rules for nutritional information and health claims.

- Manufacturing Standards: Meeting Good Manufacturing Practices (GMP) for product quality and safety.

- Marketing Compliance: Avoiding deceptive or unsubstantiated advertising.

Product Differentiation and Innovation

For Celsius, the threat of new entrants is significantly shaped by the need for product differentiation and innovation. In a market experiencing rapid growth, new companies must present a compelling and unique offering to capture consumer attention. Simply matching existing functional benefits, such as energy or taste, is unlikely to be sufficient for sustained success.

Success stories in the beverage sector, like Bloom Nutrition's entry with a distinct focus on prebiotic sodas, underscore this point. Their clear differentiation allowed them to carve out a niche. This suggests that any new competitor entering the energy drink market, particularly one aiming to challenge established players like Celsius, would need a similarly well-defined and innovative product proposition to gain traction.

- Market Saturation: The energy drink market is increasingly crowded, demanding unique value propositions from newcomers.

- Innovation as a Barrier: Competitors must innovate beyond basic functional benefits to attract and retain customers.

- Niche Market Success: Brands like Bloom Nutrition demonstrate that targeted, differentiated products can effectively enter and grow within the beverage industry.

- Celsius's Position: Celsius itself has benefited from its focus on a specific consumer profile and product attributes, making it a benchmark for differentiation.

The threat of new entrants for Celsius is moderated by substantial capital requirements and the need for extensive marketing to build brand loyalty. Established distribution networks, like Celsius's partnership with PepsiCo, also present a significant barrier. Furthermore, stringent regulatory compliance regarding health claims and ingredient transparency adds complexity and cost for any newcomers.

Porter's Five Forces Analysis Data Sources

Our Celsius Porter's Five Forces analysis is built upon a foundation of publicly available company filings, including SEC submissions and investor relations materials. We also incorporate data from reputable market research firms and industry-specific publications to capture competitive dynamics and emerging trends.