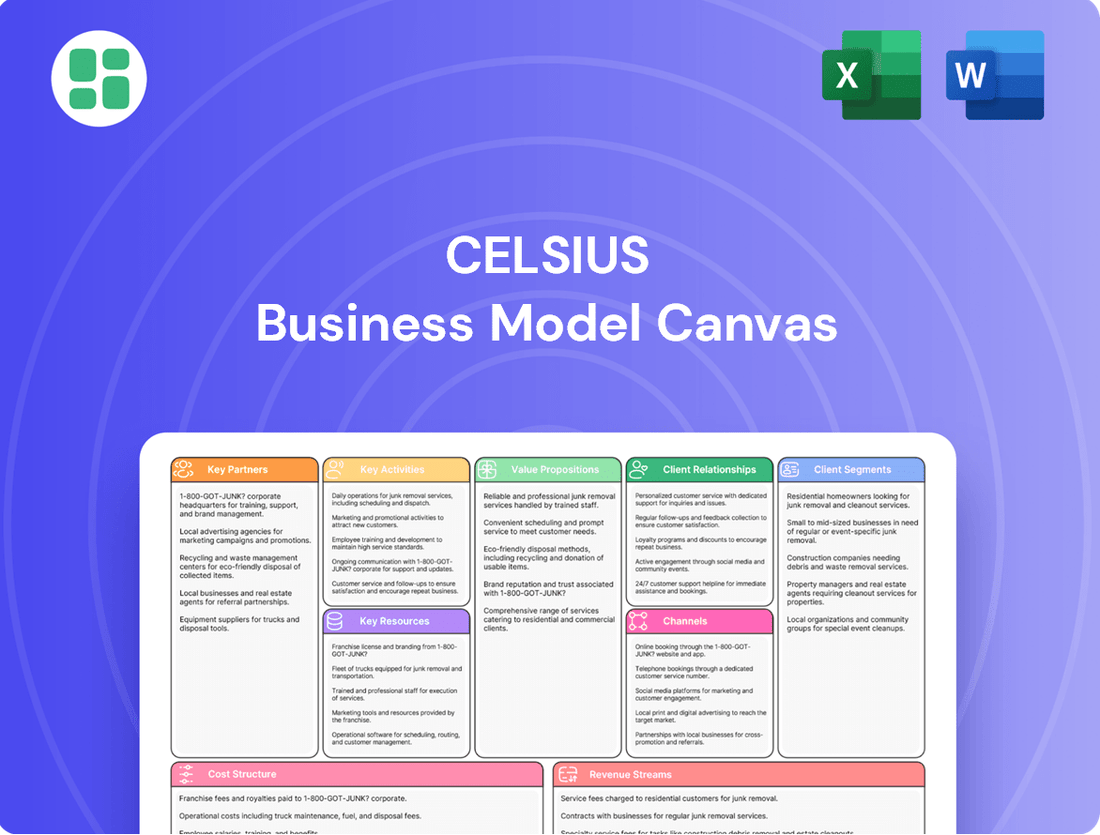

Celsius Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Bundle

Curious about Celsius's innovative approach to customer engagement and revenue streams? Our comprehensive Business Model Canvas breaks down their core activities, key resources, and cost structures, offering a clear roadmap to their success. This detailed analysis is perfect for anyone looking to understand how Celsius thrives in the competitive beverage market.

Partnerships

Celsius's strategic distribution is anchored by its pivotal partnership with PepsiCo, acting as the exclusive distributor in the United States and Canada. This alliance capitalizes on PepsiCo's vast direct store delivery (DSD) infrastructure, a network that ensures efficient product placement from coast to coast.

This relationship is instrumental in Celsius's market penetration, allowing it to reach consumers through a broad spectrum of retail and foodservice outlets. In 2023, Celsius reported net sales of $1.3 billion, a significant portion of which is attributable to the expanded reach facilitated by this distribution agreement.

Celsius strategically partners with global beverage giants to fuel its international growth. For instance, its collaboration with Suntory Beverage & Food grants Celsius access to distribution networks in the United Kingdom, Ireland, and France. Similarly, the partnership with Suntory Oceania is crucial for market entry and operational setup in Australia and New Zealand.

Celsius strategically partners with co-packers to guarantee robust production capacity and a streamlined supply chain. These alliances are crucial for meeting escalating consumer demand.

A significant move in late 2024 was Celsius's acquisition of Big Beverages, a key co-packer. This acquisition signals a proactive strategy to secure greater control over its manufacturing processes, thereby speeding up innovation and increasing production agility.

Influencer and Sports Marketing Partnerships

Celsius heavily leverages influencer marketing, particularly within the fitness and wellness sectors, to amplify its brand message and reach health-conscious consumers. These partnerships are crucial for building credibility and demonstrating the product's alignment with active lifestyles.

The company's commitment to sports marketing is substantial, highlighted by its significant investment in sponsorships. For instance, Celsius's multi-year partnership with Major League Soccer (MLS), initiated in 2022, underscores its strategy to connect with a broad, active audience.

- Influencer Reach: Celsius partners with a diverse range of fitness and wellness influencers to tap into niche communities and drive product trial.

- Sports Sponsorships: Major League Soccer (MLS) is a key sports marketing partnership, enhancing brand visibility among a large, engaged, and athletic demographic.

- Brand Association: These collaborations aim to foster strong brand associations with health, performance, and an active lifestyle, resonating with target consumers.

Retail and E-commerce Platforms

Celsius heavily relies on partnerships with major retailers across various formats, including grocery, convenience, club, and mass merchandisers. This extensive retail footprint is crucial for making its beverages readily accessible to a wide consumer base. For instance, by Q1 2024, Celsius had secured placement in over 50,000 retail doors, a significant increase from previous years, demonstrating the depth of these crucial relationships.

Furthermore, collaborations with leading e-commerce platforms such as Amazon are integral to Celsius's multi-channel distribution strategy. These online partnerships not only expand product visibility but also cater to the growing segment of consumers who prefer online shopping. In 2023, e-commerce sales represented a substantial portion of Celsius's revenue growth, highlighting the importance of these digital channels.

- Retail Expansion: Key partnerships with grocery chains like Kroger and Walmart, convenience stores like 7-Eleven, and club stores such as Costco ensure widespread physical availability.

- E-commerce Reach: Collaborations with Amazon and other online retailers drive significant sales and brand exposure in the digital marketplace.

- Sales Growth Driver: These distribution channels are fundamental to Celsius's ability to meet surging consumer demand and achieve its ambitious sales targets.

- Market Penetration: By being present in over 50,000 retail locations by early 2024, Celsius leverages these partnerships for deep market penetration.

Celsius's key partnerships are crucial for its rapid expansion and market penetration. The exclusive distribution agreement with PepsiCo in the U.S. and Canada, leveraging its extensive DSD network, has been a cornerstone of Celsius's growth, contributing significantly to its $1.3 billion in net sales for 2023.

International expansion is driven by strategic alliances with global players like Suntory Beverage & Food in Europe and Suntory Oceania for Australia and New Zealand, ensuring effective market entry and distribution.

Furthermore, Celsius strengthens its supply chain through co-packer relationships and has taken a more proactive approach by acquiring Big Beverages in late 2024 to enhance manufacturing control and agility.

The company also cultivates vital retail partnerships across all channels, securing placement in over 50,000 retail doors by Q1 2024, and leverages e-commerce platforms like Amazon to broaden its reach and cater to online shoppers, which was a substantial driver of revenue growth in 2023.

| Partner Type | Key Partners | Impact | 2023/2024 Data Point |

|---|---|---|---|

| Distribution | PepsiCo | Exclusive U.S. & Canada distribution, leveraging DSD infrastructure | Contributed to $1.3B net sales in 2023 |

| International Distribution | Suntory Beverage & Food, Suntory Oceania | Market entry and distribution in UK, Ireland, France, Australia, New Zealand | Facilitated global market penetration |

| Retail & E-commerce | Kroger, Walmart, Amazon, Costco | Widespread product accessibility and online sales growth | Over 50,000 retail doors by Q1 2024; significant e-commerce revenue |

| Manufacturing | Big Beverages (acquired late 2024) | Secured production capacity and supply chain control | Acquisition aimed at increasing production agility |

What is included in the product

A detailed breakdown of Celsius's strategy, focusing on its crypto-lending platform, customer acquisition, and revenue streams.

Explores Celsius's key partners, resources, and cost structure to understand its operational efficiency and competitive positioning.

The Celsius Business Model Canvas streamlines complex business strategy into a clear, actionable framework, alleviating the pain of convoluted planning and communication.

Activities

Celsius's core activity revolves around relentless product development and innovation, consistently introducing new and exciting functional beverage flavors and product lines. A prime example is the expansion into CELSIUS Essentials, demonstrating their commitment to adapting to evolving consumer tastes and demands. This focus ensures they remain at the forefront of the functional beverage market.

A significant part of this innovation involves deep research into ingredients scientifically proven to support metabolism acceleration, fat burning, and energy enhancement through thermogenesis. By prioritizing these scientifically backed components, Celsius aims to deliver tangible benefits to their consumers, differentiating their offerings in a crowded marketplace.

The company's dedication to delighting consumers is evident in their unwavering commitment to providing innovative, sugar-free options. This strategic choice not only caters to health-conscious consumers but also positions Celsius as a leader in healthier beverage alternatives, a trend that saw significant growth in 2024 with the functional beverage market projected to reach over $200 billion globally by 2027.

Celsius manages the intricate production of its functional beverages and liquid supplements, a critical element of its business model. This involves carefully overseeing relationships with co-packers, ensuring consistent quality and efficient output across its product lines.

Optimizing the supply chain is paramount, with recent initiatives focusing on freight cost reduction and securing essential raw materials. For instance, in 2024, Celsius continued to invest in supply chain efficiencies to bolster its gross margins.

The strategic acquisition of a co-packing facility in 2023 significantly enhanced Celsius's control over its manufacturing process. This move aims to further streamline operations, improve cost management, and ensure greater agility in responding to market demand.

Celsius actively manages its extensive multi-channel sales and distribution network. This includes optimizing direct store delivery, expanding its e-commerce presence, and strengthening relationships with a wide array of retail partners.

A key focus is on increasing distribution points and ensuring efficient inventory management, particularly through strategic partnerships like the one with PepsiCo. This collaboration is crucial for reaching a broader consumer base and maintaining product availability.

The company also prioritizes securing and expanding shelf space in key retail locations. For instance, in 2024, Celsius continued its aggressive push into traditional grocery and convenience channels, aiming to capture more consumer attention at the point of purchase.

Marketing and Brand Building

Celsius heavily invests in marketing to cultivate its lifestyle brand, specifically targeting active and health-conscious individuals. This strategy encompasses robust digital marketing efforts, collaborations with influential personalities, and significant sports sponsorships to embed the brand within relevant communities.

The company's integrated media approach is exemplified by initiatives like the 'Live. Fit. Go' campaign launched in 2025, designed to resonate with consumers seeking energy and fitness solutions. These campaigns aim to build brand loyalty and expand market reach by associating Celsius with a vibrant, healthy lifestyle.

In 2024, Celsius reported a substantial increase in its marketing expenditure, contributing to a 42% year-over-year revenue growth, reaching $1.35 billion for the first quarter. This demonstrates a direct correlation between their marketing investments and tangible business results.

Key marketing activities include:

- Digital Marketing: Targeted online advertising and social media engagement.

- Influencer Campaigns: Partnerships with fitness and lifestyle influencers.

- Sports Sponsorships: Aligning the brand with athletic events and teams.

- Media Investments: Broad media outreach, including the 'Live. Fit. Go' campaign.

International Market Expansion

Celsius actively pursues international market expansion as a core activity, aiming to bring its beverages to a wider global audience. This involves meticulous planning and execution of market entry strategies. For instance, by the end of 2023, Celsius had established a significant presence in key international markets.

The company's strategic growth includes recent expansions into countries like Canada, the United Kingdom, Ireland, France, Australia, and New Zealand. These efforts are crucial for diversifying revenue streams and capturing market share beyond its domestic base. Celsius reported a substantial increase in its international net sales in 2023, reaching $378.5 million, a significant jump from the previous year, underscoring the success of these expansion initiatives.

- International Market Entry: Executing strategic plans to enter new countries and establish distribution networks.

- Partnership Development: Identifying and securing partnerships with local distributors and retailers in target markets.

- Market Tailoring: Adapting product offerings and marketing approaches to suit local consumer preferences and regulations.

- Sales Growth: Driving revenue growth through increased availability and consumer adoption in expanded territories.

Celsius's key activities center on developing innovative, scientifically backed functional beverages, managing a complex production process often utilizing co-packers, and optimizing its supply chain for efficiency and cost reduction. The company also focuses on expanding its multi-channel sales and distribution, securing prime retail shelf space, and driving brand awareness through targeted marketing and sponsorships.

International market expansion is another critical activity, involving strategic market entry, developing local partnerships, and tailoring offerings to diverse consumer preferences. These efforts are supported by significant investments in marketing, which have directly correlated with substantial revenue growth, as seen in their 2024 performance where marketing expenditure contributed to a 42% year-over-year revenue increase.

| Key Activity | Description | 2024/2023 Data Point |

|---|---|---|

| Product Development & Innovation | Creating new functional beverage flavors and product lines based on scientific research. | Expansion into CELSIUS Essentials. |

| Production & Supply Chain Management | Overseeing co-packing relationships, optimizing freight costs, and securing raw materials. | Acquisition of a co-packing facility in 2023; focus on supply chain efficiencies in 2024. |

| Sales & Distribution | Managing multi-channel sales, expanding e-commerce, and strengthening retail partnerships. | Continued push into grocery and convenience channels in 2024. |

| Marketing & Brand Building | Cultivating a lifestyle brand through digital marketing, influencers, and sponsorships. | 42% year-over-year revenue growth in Q1 2024 linked to marketing investment. |

| International Expansion | Entering new global markets and establishing distribution networks. | International net sales reached $378.5 million in 2023. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a mockup; it's a live representation of the comprehensive tool you'll gain access to. Upon completing your order, you will download this identical file, ready for immediate use and customization.

Resources

Celsius's brand recognition is a cornerstone of its business model. The company has cultivated a strong image associated with functional benefits, primarily metabolism acceleration and energy, making it a distinct player in the crowded beverage industry.

This strong brand equity is bolstered by its intellectual property. Proprietary formulations for its drinks represent a significant intangible asset, providing a competitive edge. The 'Essential Energy' trademark further solidifies its unique market positioning.

In 2023, Celsius saw a remarkable 107% increase in net sales, reaching $1.34 billion, underscoring the market's positive reception to its brand promise and product differentiation.

Celsius's extensive distribution network is a cornerstone of its business model, acting as a vital physical and operational resource. This network is significantly bolstered by strategic partnerships, notably with PepsiCo in North America and Suntory for international markets, ensuring products reach consumers efficiently.

The sheer scale of this network is impressive, facilitating access to over 241,000 retail outlets across the United States. This broad market penetration, managed through sophisticated logistics, is critical for meeting high consumer demand and maintaining a competitive edge in the beverage industry.

Celsius's unique product formulations, featuring ingredients like ginger, green tea, and guarana for their thermogenic effects, represent a critical intellectual resource. These proprietary blends are central to their functional beverage appeal.

While Celsius's reported direct R&D expenses are notably low, their ongoing innovation in developing palatable and effective functional drinks is a significant asset. This ability to translate consumer trends into successful product lines drives their market presence.

Financial Capital and Strategic Investments

Celsius's business model relies heavily on significant financial capital to fuel its aggressive growth strategy and market expansion. These substantial financial inflows are the engine for its operations and future development.

Key resources include major investments that enable scaling and strategic moves. For instance, the $550 million investment from PepsiCo in 2022 was a pivotal moment, providing the necessary capital for operational enhancements and marketing initiatives.

Further bolstering its financial strength, Celsius secured a $1.8 billion acquisition of Alani Nu in 2025. This significant capital infusion directly supports the company's ability to broaden its product portfolio and capture greater market share.

- $550 million PepsiCo investment in 2022.

- $1.8 billion acquisition of Alani Nu in 2025.

- Funding for growth, marketing, and strategic expansions.

- Underpinning scalability and market share increases.

Human Capital and Management Expertise

Celsius's skilled workforce, encompassing leadership, sales, marketing, and supply chain specialists, is a critical asset. Their collective knowledge fuels product development, fosters vital partnerships, and drives market entry strategies, all essential for continuous expansion.

In 2024, the company's focus on retaining and developing this talent was evident. For instance, a significant portion of their operational budget was allocated to training and development programs aimed at enhancing specialized skills within their teams. This investment directly supports their ability to innovate and manage intricate collaborations.

The expertise of Celsius's management team is particularly noteworthy. They are instrumental in navigating the evolving financial landscape and executing strategic initiatives that have historically contributed to the company's resilience and growth. Their leadership ensures that the company remains agile and responsive to market dynamics.

Key human capital resources include:

- Leadership Team: Responsible for strategic direction and overall company management.

- Sales and Marketing Professionals: Driving customer acquisition and brand awareness.

- Supply Chain and Operations Experts: Ensuring efficient product delivery and service management.

- Technical and Product Development Staff: Innovating and improving Celsius's offerings.

Celsius's key resources are multifaceted, encompassing strong brand equity, proprietary product formulations, an extensive distribution network, significant financial capital, and a skilled workforce. These elements collectively enable the company to execute its growth strategy and maintain a competitive edge in the functional beverage market.

The brand’s appeal, driven by its association with metabolism acceleration and energy, is a critical intangible asset. This is further reinforced by intellectual property, including unique product recipes and the ‘Essential Energy’ trademark. In 2023, Celsius achieved $1.34 billion in net sales, a 107% increase, highlighting the market's strong embrace of its differentiated offerings.

Financial capital is a vital resource, evidenced by PepsiCo's $550 million investment in 2022 and the $1.8 billion acquisition of Alani Nu in 2025, which fuel expansion and product development.

Celsius's operational strength is built upon a robust distribution network reaching over 241,000 U.S. retail outlets, supported by strategic alliances with PepsiCo and Suntory. Their human capital, from leadership to sales and operations specialists, is crucial for innovation and market execution, with significant investment in talent development seen in 2024.

| Resource Category | Key Assets | Significance |

|---|---|---|

| Brand & Intellectual Property | Brand recognition, Proprietary formulations, 'Essential Energy' trademark | Market differentiation, Competitive advantage |

| Distribution Network | Extensive retail presence (241,000+ outlets), PepsiCo & Suntory partnerships | Market penetration, Efficient product delivery |

| Financial Capital | $550M PepsiCo investment (2022), $1.8B Alani Nu acquisition (2025) | Growth funding, Strategic expansion, Scalability |

| Human Capital | Skilled leadership, Sales, Marketing, Supply Chain & R&D teams | Innovation, Market execution, Partnership management |

Value Propositions

Celsius's core value proposition is rooted in its thermogenic formula, designed to boost metabolism and support fat burning. This directly targets individuals prioritizing health and fitness, offering functional benefits beyond simple refreshment or energy.

This appeal is amplified by the growing market for weight management and performance-enhancing beverages. In 2024, the global weight loss market alone was projected to reach hundreds of billions of dollars, with functional beverages playing a significant role.

Celsius offers essential energy without the unhealthy additives like sugar, aspartame, or high fructose corn syrup, directly addressing a growing consumer demand for healthier alternatives. This focus on clean ingredients positions Celsius as a preferred choice for individuals prioritizing well-being and active lifestyles.

By providing a performance-enhancing beverage that aligns with fitness goals and overall health consciousness, Celsius differentiates itself significantly from traditional, less healthy energy drink options. This value proposition resonates strongly with a health-aware demographic, contributing to its market appeal and sales growth.

In 2023, Celsius reported a remarkable 116% year-over-year revenue increase, reaching $1.3 billion, underscoring the strong market reception of its clean energy and enhanced performance value proposition. This growth indicates consumers are actively choosing healthier energy solutions.

Celsius positions its beverages as offering a superior taste and a refreshing experience, moving beyond the functional benefits of energy and fitness. This sensory appeal is crucial for attracting a wider consumer base, including those who might not prioritize performance alone but seek enjoyable hydration. In 2024, the beverage industry saw continued growth in flavored and functional drinks, with consumer preference for taste being a significant driver of repeat purchases.

Better-for-You Functional Beverage

Celsius positions itself as a 'better-for-you' functional beverage, directly addressing the increasing consumer desire for healthier options within the energy drink market. This focus on wellness is a key differentiator, appealing to a broad audience seeking performance without compromising health.

The brand's commitment to a zero-sugar, low-calorie formulation is a significant draw for health-conscious consumers. This resonates strongly with individuals actively pursuing mindful consumption habits and seeking to reduce sugar intake. In 2024, the global functional beverage market was valued at over $160 billion, highlighting the substantial demand for products like Celsius.

- Health-Conscious Appeal: Zero sugar and low calorie count attract consumers avoiding traditional sugary drinks.

- Functional Benefits: Offers energy and other perceived health benefits beyond simple hydration.

- Market Growth: Taps into the expanding functional beverage sector, projected for continued expansion.

- Consumer Trends: Aligns with the prevailing trend towards healthier lifestyle choices and ingredient transparency.

Convenience and Accessibility

Celsius delivers unparalleled convenience through its widespread multi-channel distribution network. Consumers can find Celsius products in over 100,000 retail locations across the United States, including major grocery stores, convenience stores, and mass merchandisers. This extensive reach ensures that the brand is readily accessible, catering to the on-the-go lifestyles of its target audience.

The brand's commitment to accessibility extends to its robust e-commerce presence. Celsius beverages are available on major online retail platforms, allowing customers to purchase their preferred flavors from the comfort of their homes. This dual approach, combining physical and digital availability, solidifies Celsius's value proposition of making functional beverages easy to obtain.

In 2023, Celsius reported a significant net sales increase of 107% year-over-year, reaching $1.3 billion. This growth underscores the effectiveness of their convenience and accessibility strategy in capturing market share and meeting consumer demand across diverse purchasing channels.

- Extensive Retail Footprint: Availability in over 100,000 U.S. retail locations.

- E-commerce Integration: Accessible through major online shopping platforms.

- 2023 Net Sales Growth: $1.3 billion in net sales, a 107% increase year-over-year.

- Consumer Accessibility: Meeting demand wherever and whenever consumers shop.

Celsius's value proposition centers on providing essential energy and a refreshing taste, differentiating itself from traditional energy drinks by offering a healthier alternative. This is achieved through a zero-sugar, low-calorie formulation that appeals to a growing health-conscious consumer base. The brand's commitment to clean ingredients, avoiding sugar and artificial sweeteners, directly addresses consumer demand for wellness-focused products.

This focus on health and performance aligns with significant market trends. In 2024, the global functional beverage market was valued at over $160 billion, with a strong emphasis on products supporting active lifestyles. Celsius's ability to deliver on both taste and functional benefits, as evidenced by its 2023 net sales of $1.3 billion, a 107% year-over-year increase, highlights its successful execution of this value proposition.

The brand's extensive distribution network, spanning over 100,000 U.S. retail locations and major e-commerce platforms, ensures widespread accessibility. This convenience factor is crucial for a product aimed at consumers with active, on-the-go lifestyles, reinforcing its market appeal and driving continued sales growth.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Health-Conscious Formulation | Zero sugar, low calorie, and clean ingredients | Appeals to consumers avoiding traditional sugary drinks. |

| Functional Benefits | Provides energy and supports fitness goals | Targets individuals prioritizing performance and wellness. |

| Market Alignment | Taps into growing functional beverage sector | Global functional beverage market valued over $160 billion in 2024. |

| Taste and Refreshment | Offers enjoyable hydration beyond functional benefits | Crucial for broader consumer appeal and repeat purchases. |

| Accessibility | Widespread retail and e-commerce availability | Over 100,000 U.S. retail locations; available online. |

Customer Relationships

Celsius actively cultivates a vibrant community, especially within fitness and wellness, using platforms like Instagram and hosting events to foster direct connections with customers. This approach significantly boosts brand loyalty and encourages users to share their experiences, effectively becoming brand advocates.

In 2024, Celsius continued to see robust engagement across its social channels, with its Instagram account alone boasting over 2 million followers, a testament to its successful community-building efforts. This digital presence translates into tangible brand advocacy, with user-generated content frequently highlighting the product's role in their active lifestyles.

Celsius actively cultivates relationships with a broad network of influencers, fitness experts, and athletes who genuinely champion the brand. These partnerships are crucial for building trust and credibility, as authentic endorsements resonate powerfully with consumers seeking reliable health and wellness products.

In 2024, Celsius continued to leverage these relationships, with many sponsored athletes and influencers showcasing the brand's products across social media platforms. For instance, a significant portion of Celsius's marketing budget is allocated to these collaborations, aiming to reach millions of potential customers through relatable and aspirational figures in the fitness community.

Celsius actively connects with its consumers directly through digital avenues like its official website, various social media channels, and its e-commerce platform. This allows for seamless information dissemination, responsive customer support, and straightforward purchasing.

This robust digital engagement facilitates real-time feedback loops, enabling Celsius to understand consumer sentiment and adapt its offerings accordingly. For instance, in Q1 2024, Celsius reported a 42% year-over-year increase in net sales, demonstrating the effectiveness of its direct-to-consumer strategies in driving growth.

Retailer and Distributor Support

Celsius actively cultivates robust relationships with its distribution and retail partners through tailored support. This includes offering competitive incentive programs and providing comprehensive promotional assistance to drive sales and brand visibility at the point of purchase.

Efficient inventory management is a cornerstone of these relationships, ensuring that products are consistently available and optimally positioned on shelves. For instance, in 2024, Celsius continued to invest in supply chain technology to minimize stockouts and overstock situations, a key concern for retailers.

- Incentive Programs: Offering financial incentives and volume-based rewards to distributors and retailers to encourage increased sales and commitment to the Celsius brand.

- Promotional Support: Providing marketing collateral, co-op advertising funds, and in-store promotional activities to drive consumer demand at the retail level.

- Inventory Management: Collaborating with partners on forecasting and logistics to ensure efficient stock levels, reducing waste and maximizing product availability.

- Partnership Growth: In 2024, Celsius saw continued expansion of its retail footprint, with over 100,000 retail locations carrying its products, underscoring the strength of its retailer relationships.

Brand Loyalty and Retention Programs

Celsius actively fosters brand loyalty and retention through a strategy that emphasizes continuous product innovation and unwavering quality. This approach ensures customers consistently receive appealing new options that reinforce the brand's core benefits, aiming to make Celsius their go-to beverage for a wider range of occasions.

The company's commitment to delivering a superior product experience is a key driver for repeat purchases. For instance, in 2023, Celsius reported a significant 117% increase in net revenue, reaching $1.33 billion, a testament to its growing customer base and their continued engagement with the brand's offerings.

- Product Innovation: Regular introduction of new flavors and product lines keeps the brand fresh and exciting.

- Consistent Quality: Maintaining high standards in taste and effectiveness encourages repeat purchases.

- Occasion Expansion: Strategically positioning Celsius for various consumption moments drives deeper integration into consumers' lifestyles.

Celsius nurtures strong connections with its community through active social media engagement and influencer collaborations, fostering brand advocacy and loyalty. This digital-first approach, evident in its substantial social media following, translates into tangible user-generated content that reinforces the brand's association with active lifestyles.

Direct communication channels, including its website and e-commerce platform, enable Celsius to gather real-time consumer feedback, facilitating agile product development and marketing adjustments. The company's impressive growth, with a 42% year-over-year increase in net sales reported in Q1 2024, highlights the effectiveness of these direct customer relationships.

| Customer Relationship Strategy | Key Tactics | 2024 Impact/Data |

|---|---|---|

| Community Building | Social media engagement, influencer marketing, events | Over 2 million Instagram followers; significant user-generated content |

| Direct Engagement | Website, e-commerce, responsive customer support | 42% YoY increase in net sales (Q1 2024) |

| Partnership Management | Incentives, promotional support, inventory collaboration | Presence in over 100,000 retail locations |

| Product Loyalty | Innovation, consistent quality, occasion expansion | 117% net revenue increase in 2023 ($1.33 billion) |

Channels

Celsius leverages a robust Direct Store Delivery (DSD) network as a critical channel, ensuring its products reach consumers efficiently. This network is significantly strengthened by its strategic partnership with PepsiCo in the U.S. and Canada, which commenced in 2023.

This collaboration allows Celsius to utilize PepsiCo's established distribution infrastructure, facilitating effective stocking and prominent merchandising across a wide array of retail environments. These include convenience stores, supermarkets, and mass merchandisers, reaching a broad consumer base.

The DSD model, powered by this partnership, is instrumental in maintaining product freshness and on-shelf availability, a key factor in Celsius's rapid growth. In 2024, Celsius reported a significant increase in its U.S. retail sales, partly attributed to this enhanced distribution capability.

E-commerce platforms, especially Amazon, are a cornerstone of Celsius's distribution strategy. These online channels enable direct consumer purchasing and have shown robust sales performance, contributing significantly to the company's overall revenue. In 2023, Celsius reported substantial growth in its e-commerce segment, reflecting its strong market presence in the energy drink category online.

Celsius strategically places its energy drinks in a wide array of traditional retail outlets, including grocery stores, drug stores, convenience stores, and large club stores like Costco and Sam's Club. This broad distribution ensures widespread consumer access. In 2024, Celsius continued to aggressively expand its retail footprint, aiming for greater shelf space and an increased number of stock-keeping units (SKUs) per location to boost visibility and drive sales.

Fitness and Health

Fitness and Health channels are crucial for Celsius, leveraging its roots in the fitness community. These channels directly connect the brand with its target audience of health-conscious individuals and fitness enthusiasts. For instance, Celsius's presence in gyms and health clubs in 2024 continues to be a primary avenue for engaging consumers seeking performance-enhancing beverages.

This strategic placement reinforces Celsius's image as a brand intrinsically linked to an active lifestyle. By being physically present where their core customers are already engaged in health-related activities, Celsius effectively captures attention and drives trial. This approach is supported by the growing market for functional beverages, with the global sports drink market projected to reach significant growth by 2030.

- Gyms and Health Clubs: Direct access to a highly relevant demographic.

- Fitness Events and Sponsorships: Increased brand visibility and association with active lifestyles.

- Online Fitness Platforms: Reaching consumers digitally through partnerships and targeted advertising.

International Distribution Partners

Celsius actively cultivates relationships with international distribution partners to achieve widespread global reach. These collaborations are crucial for market entry and expansion, allowing Celsius to tap into established networks and local expertise.

For instance, the partnership with Suntory Beverage & Food has been instrumental in Celsius's expansion into key markets. This strategic alliance facilitates access to new consumer bases and enhances logistical capabilities in regions like the UK, Ireland, France, Australia, and New Zealand.

- Global Market Penetration Celsius's strategy relies on distribution partners to navigate diverse international markets effectively.

- Key Partnerships Suntory Beverage & Food is a notable partner, enabling expansion into regions including the UK, Ireland, France, Australia, and New Zealand.

- Market Access These partnerships provide critical access to new territories, significantly broadening Celsius's global footprint and sales potential.

Celsius's distribution strategy is multi-faceted, encompassing both traditional retail and e-commerce. The Direct Store Delivery (DSD) network, amplified by the 2023 PepsiCo partnership, ensures efficient product placement and visibility in convenience stores, supermarkets, and mass merchandisers. This collaboration was a key driver in Celsius's significant U.S. retail sales growth reported in 2024.

Online channels, particularly Amazon, represent a vital sales avenue, facilitating direct consumer purchases and contributing substantially to overall revenue. The brand's presence in fitness-centric environments like gyms and health clubs further reinforces its connection with health-conscious consumers.

International expansion is facilitated through strategic distribution partnerships, such as the one with Suntory Beverage & Food, which has been crucial for market entry in regions including the UK and Australia. These diverse channels collectively support Celsius's rapid market penetration and sales growth.

| Channel Type | Key Partners/Platforms | 2023/2024 Impact |

|---|---|---|

| Direct Store Delivery (DSD) | PepsiCo (US & Canada) | Enhanced stocking, merchandising, and sales growth in U.S. retail (2024). |

| E-commerce | Amazon | Robust sales performance and significant segment growth (2023). |

| Traditional Retail | Grocery, Convenience, Mass Merchandisers, Club Stores | Aggressive footprint expansion and increased SKU presence (2024). |

| Fitness/Health | Gyms, Health Clubs, Fitness Events | Direct engagement with target demographic, brand association with active lifestyles. |

| International Distribution | Suntory Beverage & Food | Market entry and expansion in UK, Ireland, France, Australia, New Zealand. |

Customer Segments

Health-conscious individuals are a key demographic for Celsius, actively seeking beverages that align with their wellness goals. They are drawn to Celsius's promise of zero sugar, low calories, and the inclusion of ingredients like green tea extract and vitamins, which they perceive as beneficial for their health. This segment represents a significant portion of the functional beverage market, which saw global sales reach approximately $120 billion in 2023, with continued growth projected.

Fitness enthusiasts and athletes form a crucial customer base for Celsius. This segment actively seeks products to enhance their workouts, improve performance, and aid recovery. In 2024, the global sports nutrition market, which includes energy drinks like Celsius, was projected to reach over $60 billion, highlighting the significant demand from this active demographic.

Busy professionals and everyday energy seekers represent a significant customer segment for Celsius, as they require sustained energy and focus to navigate demanding work schedules and daily life. This group actively seeks alternatives to traditional energy drinks, aiming to avoid the unpleasant side effects like jitters and subsequent crashes. Celsius's 'Live. Fit. Go.' campaign effectively broadens its appeal to this demographic, recognizing their need for a healthier, more functional energy solution.

Younger Consumers (Gen Z, Millennials)

Celsius actively courts younger consumers, including Gen Z and Millennials, by leveraging a strong social media presence and engaging in influencer marketing. Their sponsorships of events like Major League Soccer (MLS) further solidify the brand's association with active and modern lifestyles appealing to these demographics.

This segment often embraces functional beverages as part of their health-conscious routines. In 2024, the functional beverage market continued its upward trajectory, with brands like Celsius seeing significant growth driven by younger consumers seeking energy and wellness benefits.

- Targeting Strategy: Social media engagement, influencer collaborations, and event sponsorships (e.g., MLS).

- Consumer Behavior: Early adoption of functional beverages, preference for brands aligning with active lifestyles.

- Market Relevance: Gen Z and Millennials represent a key growth driver in the expanding functional beverage sector.

- Financial Impact: This demographic's purchasing power significantly contributes to Celsius's revenue growth, with the company reporting substantial year-over-year sales increases in recent quarters.

International Consumers in Expansion Markets

Celsius is strategically focusing on international consumers in expansion markets, recognizing a significant opportunity for growth. This segment includes individuals in countries like Canada, the UK, Ireland, France, Australia, and New Zealand who are actively seeking out functional energy drinks.

These consumers represent a burgeoning demographic with a demonstrated and increasing demand for beverages that offer more than just hydration or a caffeine boost. They are looking for products that can enhance performance, improve focus, or provide specific health benefits, aligning perfectly with Celsius's product positioning.

The company's methodical international expansion is directly catering to this demand. For instance, in 2023, Celsius saw substantial revenue growth in its international segments, with reported net sales increasing by 121% year-over-year to $316.9 million, highlighting the strong reception in these new territories.

Key characteristics of these international consumers include:

- Growing disposable income: Enabling greater spending on premium beverage options.

- Health and wellness consciousness: A rising trend driving preference for functional ingredients.

- Adaptability to new brands: Openness to trying innovative products that meet evolving lifestyle needs.

- Digital engagement: High receptiveness to online marketing and e-commerce channels for product discovery and purchase.

Celsius's customer base is diverse, encompassing health-conscious individuals and fitness enthusiasts who prioritize wellness and performance. Busy professionals and younger demographics like Gen Z and Millennials are also key, seeking sustained energy and brand alignment with active lifestyles. The company's international expansion targets consumers in markets like Canada, the UK, and Australia, who exhibit growing health consciousness and openness to functional beverages.

Cost Structure

Production and manufacturing costs are a significant part of Celsius's business model. These expenses encompass the procurement of essential ingredients like filtered carbonated water, citric acid, and various flavorings, alongside packaging materials such as aluminum cans and plastic bottles. In 2024, the company continued to focus on supply chain efficiencies to mitigate rising raw material prices.

Co-packing fees, paid to third-party manufacturers who assemble and package the beverages, also fall under this category. Celsius leverages co-packers to scale production effectively and maintain flexibility. Operational costs, including energy consumption for production lines and quality control measures, are critical elements that directly impact the cost of goods sold.

Optimizing freight and material costs remains a strategic priority for Celsius. By negotiating better terms with suppliers and exploring more efficient logistics, the company aims to reduce the overall manufacturing expense. For instance, in Q1 2024, Celsius reported that its cost of sales increased by 36% year-over-year, partly due to higher input costs and increased production volume, highlighting the ongoing challenge of managing these expenses.

Celsius significantly invests in sales and marketing, allocating a substantial portion of its budget to advertising, promotions, and brand development. This includes high-profile influencer collaborations, prominent sports sponsorships, and robust digital marketing campaigns to capture market share.

In 2024, Celsius notably increased its marketing expenditure to ensure continued brand visibility and to counter competitive pressures in the dynamic beverage market. This strategic investment aims to solidify its brand presence and attract new consumers.

Distribution and logistics costs are a significant expense for Celsius, encompassing freight, warehousing, and fees paid to partners like PepsiCo, who handle a substantial portion of their distribution. In 2023, Celsius reported a notable increase in cost of goods sold, partly driven by these distribution efforts as they expanded their market reach. For instance, their strategic partnership with PepsiCo, while crucial for market penetration, involves associated distribution fees that impact the bottom line.

Supply chain optimizations are actively pursued to mitigate these expenses. This includes efforts to streamline warehousing and transportation. Furthermore, distributor incentive programs, designed to encourage broader stocking and sales, can influence these costs. The success of these programs directly impacts Celsius's overall profitability by managing the efficiency of getting their products to consumers.

General and Administrative Expenses

General and Administrative Expenses (G&A) represent the overhead costs crucial for Celsius's overall corporate functioning. This includes salaries for their administrative teams, essential legal counsel fees, and various other operational expenses that keep the business running smoothly.

In 2024, Celsius experienced a notable uptick in these G&A costs. This rise was largely attributed to increased spending on professional services, particularly those related to ongoing acquisition activities and the management of complex legal matters. For instance, the company's 2023 annual report highlighted significant legal reserves and ongoing litigation, which naturally contribute to higher administrative burdens and associated expenses.

- Salaries for administrative and support staff.

- Legal fees, including those related to litigation and regulatory compliance.

- Corporate overhead and operational costs.

- Professional services, especially those tied to mergers and acquisitions.

Research and Development (R&D) Costs

Celsius's Research and Development (R&D) costs, while appearing modest in their reporting, are a critical component of their innovation engine. These expenses encompass vital activities such as engaging external consultants for specialized expertise, the procurement of raw materials specifically for developing new beverage formulations, and the costs associated with test production runs to refine new products before wider release.

These R&D investments directly fuel Celsius's commitment to continuous product development and staying ahead in the competitive beverage market. For instance, in 2024, the company continued to focus on expanding its flavor profiles and exploring functional ingredient advancements, necessitating these underlying R&D expenditures.

- Consulting Fees: Engaging industry experts to guide new product innovation and market trend analysis.

- Raw Material Usage: Costs associated with testing new ingredients and flavor combinations for future beverages.

- Test Production: Expenses incurred for small-scale manufacturing runs to validate new products and processes.

- Product Innovation: Supporting the ongoing development of new flavors, functional ingredients, and beverage formats.

Celsius's cost structure is heavily influenced by production and marketing. In 2024, the company saw its cost of sales rise significantly, partly due to increased input costs and production volumes, as noted in Q1 2024 results. Distribution, particularly through partnerships like PepsiCo, also adds to these expenses, with supply chain optimizations being a constant focus.

Marketing expenditure saw a notable increase in 2024 to maintain brand visibility against competitors. General and administrative costs also rose in 2024, driven by professional services related to acquisitions and legal matters, as highlighted by ongoing litigation mentioned in their 2023 report.

Research and development, though appearing smaller, supports innovation through consulting fees, raw material testing, and test production runs, crucial for expanding flavor profiles and functional ingredients in 2024.

| Cost Category | Key Components | 2024 Focus/Impact |

| Production & Manufacturing | Raw Materials, Packaging, Co-packing Fees | Mitigating rising input costs, supply chain efficiencies |

| Sales & Marketing | Advertising, Promotions, Sponsorships | Increased expenditure for brand visibility and competitive positioning |

| Distribution & Logistics | Freight, Warehousing, Partner Fees (e.g., PepsiCo) | Streamlining operations, managing partner agreements |

| General & Administrative (G&A) | Salaries, Legal Fees, Professional Services | Increased spending on acquisitions and legal matters |

| Research & Development (R&D) | Consulting, Test Materials, Test Production | Supporting new flavor and functional ingredient development |

Revenue Streams

North American product sales are Celsius's main money-maker, primarily through selling its functional drinks and liquid supplements across the United States and Canada. This core segment has seen impressive expansion, fueled by wider availability and a growing consumer appetite for their products.

In 2024, Celsius reported substantial growth in its North American segment, with net sales reaching $1.35 billion for the first quarter. This performance highlights the strong market reception and successful distribution strategies in these key regions.

International product sales represent a rapidly expanding revenue stream for Celsius, with significant growth observed in 2024 across key markets like the UK, Ireland, France, Australia, and New Zealand. This global expansion is a strategic priority, indicating a strong demand for Celsius products beyond its domestic market.

E-commerce sales are a significant driver for Celsius, with online platforms, especially Amazon, accounting for a substantial portion of their revenue. This highlights the effectiveness of their digital strategy and the growing consumer trend towards purchasing beverages online.

In 2024, Celsius reported robust growth in its e-commerce channels, with online sales demonstrating a strong upward trajectory. This digital channel is crucial for reaching a broad consumer base and capitalizing on the convenience of online shopping for their energy drinks.

Club and Food Service Channel Sales

Celsius generates revenue through sales in club channels, such as Costco and Sam's Club, and also via food service channels. These channels are crucial for reaching a broad consumer base and have demonstrated significant growth.

The food service sector, in particular, has been a strong contributor to Celsius's revenue expansion. This indicates a successful strategy in placing products within environments like restaurants, cafes, and other hospitality venues.

For example, in 2024, Celsius continued to expand its presence in these channels, contributing to its overall sales performance. The company’s strategic partnerships and distribution efforts in these areas are key drivers of this revenue stream.

- Club Channel Sales: Leverages bulk purchasing power and high foot traffic in warehouse clubs.

- Food Service Channel Sales: Captures consumers in on-the-go and out-of-home consumption occasions.

- Growth Driver: The food service segment has shown particularly robust growth, indicating increasing consumer adoption in these settings.

- Strategic Importance: These channels are vital for brand visibility and accessibility, complementing direct-to-consumer and retail efforts.

Licensing and Other Agreements

While Celsius primarily generates revenue through the direct sale of its beverages, the company explores other avenues. Licensing its brand or proprietary formulations represents a potential future revenue stream, though specific current figures for this are not as readily available as product sales data.

The strategic acquisition of Alani Nu in late 2023 significantly broadened Celsius's brand portfolio and, consequently, its revenue base. This move is expected to contribute substantially to overall company earnings moving forward.

- Brand Licensing: Potential for future revenue through licensing Celsius's brand or product formulations to other companies.

- Acquisition Synergies: Revenue diversification and growth through the integration of acquired brands like Alani Nu.

- Product Sales Dominance: Core revenue remains driven by the direct sale of Celsius energy drinks.

Celsius's revenue streams are predominantly driven by the direct sale of its functional energy drinks and liquid supplements. North America remains the largest contributor, with strong performance in both traditional retail and e-commerce channels, including significant sales through platforms like Amazon. The company is also actively expanding its international presence, with notable growth in markets across Europe and Oceania.

Beyond direct product sales, Celsius leverages various distribution channels to maximize reach and revenue. This includes sales through club stores, such as Costco, which capitalize on bulk purchasing, and the food service sector, catering to on-the-go consumption. The strategic acquisition of Alani Nu in late 2023 further diversifies its revenue base by adding complementary brands.

| Revenue Stream | Key Channels/Activities | 2024 Performance Highlight |

| North American Product Sales | Retail, E-commerce (Amazon) | Q1 Net Sales: $1.35 billion |

| International Product Sales | UK, Ireland, France, Australia, New Zealand | Significant growth observed |

| Club & Food Service Sales | Costco, Sam's Club, Restaurants, Cafes | Strong growth, particularly in food service |

| Acquired Brands | Alani Nu integration | Broadened brand portfolio and revenue base |

Business Model Canvas Data Sources

The Celsius Business Model Canvas is informed by a combination of internal financial data, extensive market research on the crypto lending landscape, and strategic insights derived from competitor analysis. These diverse sources ensure a comprehensive and accurate representation of Celsius's operational and strategic framework.