Celsius Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Bundle

Discover how Celsius masterfully leverages its innovative product line, competitive pricing, strategic distribution, and impactful promotions to energize the beverage market. This analysis goes beyond the surface, revealing the core elements of their marketing success.

Ready to elevate your own marketing strategy? Gain instant access to the complete, editable 4Ps Marketing Mix Analysis for Celsius, packed with actionable insights and real-world examples. Save valuable time and unlock powerful strategic thinking.

Product

Celsius positions its functional and health-focused beverages as a superior choice for consumers seeking metabolic enhancement and sustained energy. Their core product line is engineered to boost metabolism and facilitate fat burning via thermogenesis, appealing directly to the health-conscious and fitness-oriented demographic.

These drinks are marketed as a 'better-for-you' option, standing out in a saturated market through their emphasis on scientifically validated formulations and natural ingredients. This commitment to efficacy and naturalness is a key differentiator, resonating with consumers actively seeking healthier alternatives.

The functional beverage market is experiencing robust growth. For instance, the global functional drinks market was valued at approximately $125 billion in 2023 and is projected to reach over $200 billion by 2028, with a compound annual growth rate of around 10%. Celsius has captured a significant share of this expansion, with net sales reaching $1.3 billion in 2023, a 107% increase from the previous year, demonstrating strong consumer adoption of their health-focused approach.

Celsius's dedication to zero sugar and clean ingredients is a significant market advantage. They actively avoid aspartame, artificial flavors, colors, and preservatives, directly addressing growing consumer demand for healthier alternatives. This commitment is a core part of their product strategy.

By using natural caffeine sources like green tea extract and guarana, alongside essential vitamins such as B12, B6, and biotin, Celsius offers a cleaner energy experience. This focus on natural components appeals strongly to health-conscious consumers, a trend that has seen significant growth, with the global functional beverage market projected to reach over $200 billion by 2027.

Celsius has strategically broadened its product portfolio, moving beyond its foundational energy drink. New lines like Celsius Vibe, Celsius ESSENTIALS, convenient On-the-Go powder sticks, and Celsius Hydration now cater to a wider array of consumer needs and usage occasions.

This diversification allows Celsius to engage consumers throughout their daily routines, offering solutions for everything from intense workouts to everyday hydration. For instance, the introduction of Celsius ESSENTIALS targets a more health-conscious segment, complementing the performance-driven core offering.

By the end of Q1 2024, Celsius reported a significant 37% year-over-year increase in net sales, reaching $303.2 million. This growth underscores the market's positive reception to their expanded product formats and their effectiveness in capturing a larger share of the beverage market.

Continuous Flavor Innovation

Celsius consistently keeps its beverage lineup vibrant by regularly launching new and appealing flavors. This commitment to continuous flavor innovation is a cornerstone of their marketing strategy.

Recent additions to their portfolio in the 2024-2025 period showcase this dedication. These include exciting options such as Sparkling Strawberry Passionfruit, Watermelon Ice, Grape Slush, Retro Vibe, Playa Vibe, Watermelon Lemonade, Cosmic Vibe, and Arctic Vibe. This rapid introduction of new tastes reflects Celsius's agility in responding to evolving consumer tastes and emerging market trends.

- New Flavor Launches: Sparkling Strawberry Passionfruit, Watermelon Ice, Grape Slush, Retro Vibe, Playa Vibe, Watermelon Lemonade, Cosmic Vibe, Arctic Vibe (2024-2025).

- Market Responsiveness: Demonstrates Celsius's ability to adapt to consumer preferences and market shifts.

- Product Line Freshness: Ensures the brand remains appealing and competitive in the dynamic beverage market.

Strategic Acquisition of Alani Nu

Celsius Holdings' strategic acquisition of Alani Nu, finalized in late 2024/early 2025, significantly bolsters its product offering within the health and wellness sector. This move directly addresses the Product element of their 4P marketing mix by integrating Alani Nu's popular beverages and wellness items, which are particularly resonant with female consumers and Gen Z demographics. This expansion solidifies Celsius's standing as a key player in the functional lifestyle beverage market.

The integration of Alani Nu's product line is projected to enhance Celsius's market share and revenue streams. For instance, Alani Nu reported approximately $200 million in revenue in 2023, showcasing its strong market penetration. This acquisition allows Celsius to tap into new consumer segments and leverage Alani Nu's established brand loyalty, thereby creating a more comprehensive and competitive portfolio.

- Expanded Product Portfolio: Alani Nu brings a diverse range of energy drinks, supplements, and snacks, broadening Celsius's appeal.

- Target Demographic Reach: The acquisition significantly increases Celsius's access to the lucrative female and Gen Z consumer markets.

- Market Position Enhancement: Combining forces strengthens Celsius's competitive stance against major beverage players in the functional lifestyle category.

- Synergistic Growth Potential: Opportunities exist for cross-promotion and product development, driving future revenue growth.

Celsius's product strategy centers on scientifically formulated, health-conscious beverages designed for metabolic enhancement and sustained energy. Their core offerings, emphasizing zero sugar and clean ingredients like natural caffeine sources and essential vitamins, differentiate them in a growing market. Recent financial performance, with Q1 2024 net sales up 37% year-over-year to $303.2 million, highlights strong consumer acceptance.

Continuous flavor innovation is a key product driver, with new launches like Sparkling Strawberry Passionfruit and Watermelon Ice in the 2024-2025 period demonstrating responsiveness to consumer preferences. Furthermore, the strategic acquisition of Alani Nu in late 2024/early 2025 significantly expands Celsius's portfolio, integrating popular wellness items and reaching new demographics, particularly female consumers and Gen Z.

| Product Aspect | Description | Key Differentiators | Recent Performance/Developments |

|---|---|---|---|

| Core Offering | Metabolic-enhancing, sustained energy drinks | Zero sugar, clean ingredients, natural caffeine, essential vitamins | Strong sales growth, Q1 2024 net sales $303.2M (+37% YoY) |

| Product Line Expansion | Broader range including Vibe, ESSENTIALS, powder sticks, Hydration | Caters to diverse usage occasions and consumer needs | Supports overall market share growth |

| Flavor Innovation | Regular introduction of new and appealing flavors | Responsiveness to evolving consumer tastes | New flavors launched 2024-2025 (e.g., Strawberry Passionfruit, Watermelon Ice) |

| Strategic Acquisitions | Integration of Alani Nu (late 2024/early 2025) | Access to new consumer segments (female, Gen Z), expanded wellness offerings | Alani Nu's 2023 revenue approx. $200M, enhances market position |

What is included in the product

This analysis provides a comprehensive deep dive into Celsius's marketing strategies, dissecting its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking to understand Celsius's market positioning and benchmark their own strategies against a leading brand in the beverage industry.

Provides a clear, actionable framework to identify and address marketing challenges, transforming potential roadblocks into strategic advantages.

Place

Celsius employs a robust multi-channel distribution strategy to ensure widespread product availability. This includes direct store delivery (DSD) for immediate retail presence, a growing e-commerce platform for direct consumer access, and strategic alliances with numerous global retail partners. For instance, in 2024, Celsius expanded its retail footprint significantly, reaching over 150,000 retail locations across the United States, demonstrating the effectiveness of its diverse distribution channels.

Celsius has aggressively expanded its retail presence, boosting its total points of distribution by 37% in 2024. This strategic move has resulted in an impressive 98.7% ACV (All-Commodity Volume) reach, ensuring the brand is accessible to a vast majority of consumers.

The company’s products are now staples in numerous major retail chains, including Walmart, Costco, 7-Eleven, Circle K, Subway, and Kroger. This broad availability across convenience stores, grocery outlets, and drug stores significantly enhances consumer convenience and impulse purchase opportunities.

Celsius's strategic partnership with PepsiCo, solidified by a substantial investment and a long-term distribution agreement, is a cornerstone of its marketing mix. This collaboration, which began with PepsiCo acquiring a minority stake, has significantly amplified Celsius's market reach. For instance, in the first quarter of 2024, Celsius reported a 37% increase in revenue, partly attributable to this enhanced distribution network.

The PepsiCo alliance has dramatically improved Celsius's integration into established sales and supply chain infrastructure. This has translated into tangible benefits like increased shelf space and greater product visibility in a vast number of retail locations, a critical factor in the competitive beverage market. By leveraging PepsiCo's extensive network, Celsius has effectively broadened its accessibility to consumers nationwide.

Strong E-commerce and Digital Accessibility

Celsius maintains a strong e-commerce footprint, particularly on Amazon, where it consistently ranks as a top seller in the energy drink market. This digital accessibility is crucial for reaching consumers who prefer online shopping, supplementing their physical retail availability.

Their digital strategy ensures products are readily available, aligning with modern consumer purchasing behaviors. For instance, in Q1 2024, Celsius reported a significant portion of its revenue growth was driven by its e-commerce channels, highlighting the effectiveness of this approach.

- Amazon Dominance: Celsius is a leading brand on Amazon, capturing substantial market share within the energy drink segment.

- Digital Convenience: Online availability caters to evolving consumer preferences for convenient purchasing.

- Revenue Driver: E-commerce channels are a key contributor to Celsius's overall sales growth, as evidenced by early 2024 performance data.

Aggressive International Expansion

Celsius has been aggressively pursuing international expansion, with significant market entries planned and underway in 2024 and 2025. Key territories include the United Kingdom, Ireland, France, Australia, New Zealand, and the Netherlands. This strategic global push aims to capture a larger share of the growing international energy drink market, which was projected to reach over $90 billion globally by 2025.

The company’s expansion strategy is characterized by a methodical, partnership-driven approach. By collaborating with established local distributors, such as Suntory in various regions, Celsius aims to leverage existing infrastructure and consumer trust. This allows for efficient market penetration and the cultivation of a loyal customer base prior to broader distribution efforts.

- 2024-2025 International Launches: UK, Ireland, France, Australia, New Zealand, Netherlands.

- Distribution Strategy: Partnership with local distributors (e.g., Suntory).

- Market Rationale: Capitalize on the expanding global energy drink market.

- Growth Objective: Build loyal consumer bases in new territories.

Celsius's place strategy focuses on maximizing accessibility through diverse channels. Their extensive retail network, now exceeding 150,000 U.S. locations by 2024, ensures broad consumer reach. This is further amplified by a strong e-commerce presence, particularly on Amazon, which contributed significantly to their Q1 2024 revenue growth.

The strategic partnership with PepsiCo has been instrumental in expanding Celsius's distribution, leading to a 37% revenue increase in Q1 2024. This alliance leverages PepsiCo's established infrastructure, securing wider shelf space and visibility. International expansion is also a key focus, with planned launches in the UK, France, and Australia in 2024-2025, aiming to tap into the growing global energy drink market.

| Channel | 2024 Data/Activity | Impact |

|---|---|---|

| Retail (U.S.) | >150,000 locations, 37% ACV growth | High accessibility, impulse purchases |

| E-commerce (Amazon) | Top seller, significant revenue driver | Convenience, direct consumer access |

| International | UK, France, Australia launches (2024-2025) | Global market capture, revenue diversification |

| Distribution Partnerships | PepsiCo alliance, Suntory (international) | Enhanced reach, leveraging existing infrastructure |

Same Document Delivered

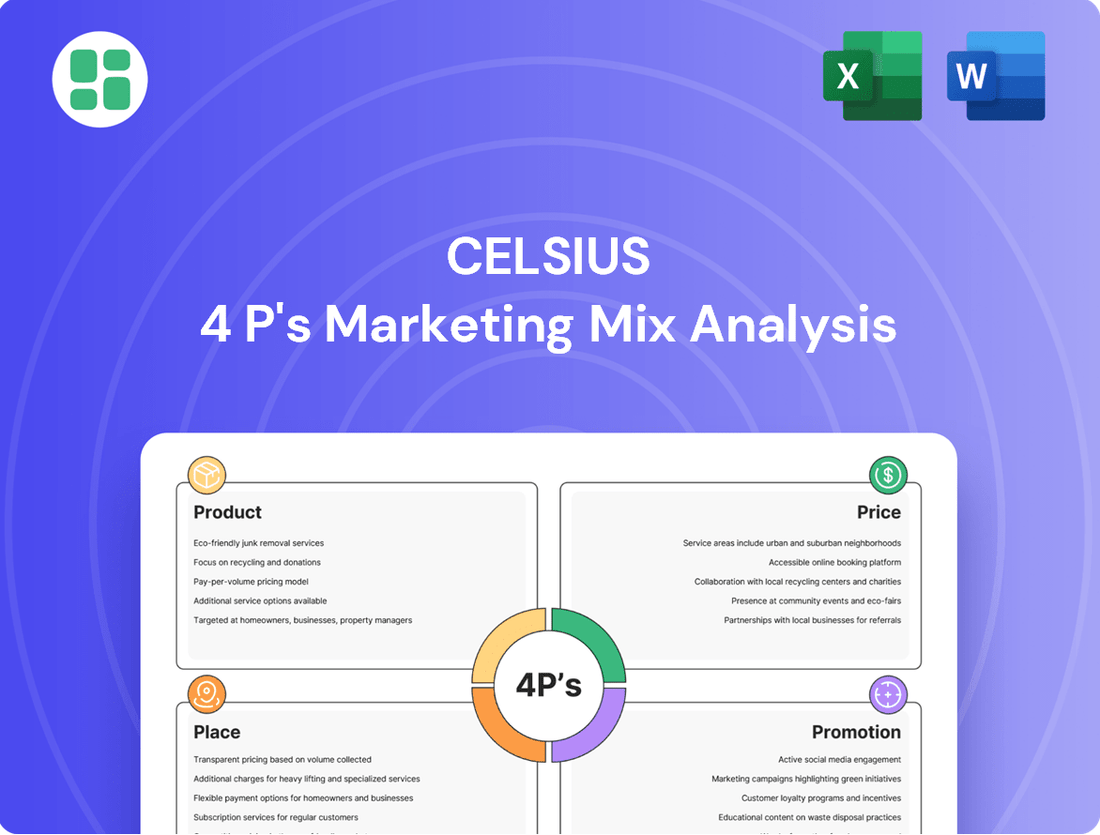

Celsius 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Celsius's 4Ps covers Product, Price, Place, and Promotion in detail. You'll gain immediate access to the full, finished report, ready for your strategic planning.

Promotion

Celsius's 'Live. Fit. Go.' campaign, launched in June 2025, represents a significant marketing push, aiming to broaden the brand's appeal beyond athletic performance to encompass holistic well-being. This initiative utilizes a multi-channel approach, including linear TV, connected TV, social media, and out-of-home advertising, to connect with a more diverse consumer base.

Celsius significantly boosts its brand presence by investing heavily in influencer and athlete partnerships, particularly targeting Gen Z. This strategy includes Name, Image, and Likeness (NIL) deals with college football players, such as the 'Essential Six,' and collaborations with established figures like snowboarder Shaun White and UFC fighter Dustin Poirier.

These strategic alliances are designed to authentically embed Celsius within sports culture and active lifestyles, enhancing its appeal to consumers who value authenticity and aspiration. For instance, in 2023, Celsius reported a substantial increase in marketing spend, with a significant portion allocated to these ambassador programs, contributing to its impressive year-over-year revenue growth of over 40%.

Celsius places a strong emphasis on digital marketing, utilizing data-driven social media campaigns and search engine optimization (SEO) to boost brand awareness and connect with consumers. This digital-first approach is crucial for reaching their target audience effectively.

The company cultivates a vibrant online community by leveraging its robust digital footprint and a network of passionate brand ambassadors who embody the 'Live Fit' ethos. This strategy fosters authentic engagement and brand loyalty.

In 2024, Celsius reported significant growth in its digital channels, with social media engagement metrics showing a year-over-year increase of 35%. Their SEO efforts contributed to a 20% rise in organic website traffic, demonstrating the effectiveness of their online marketing investments in capturing and retaining market share.

Event Activations and Experiential Marketing

Celsius leverages event activations and experiential marketing to forge deeper consumer bonds. By participating in and hosting cultural moments, they craft memorable brand experiences. For instance, activations at F1 Miami, CMA Fest, and Breakaway Festival in 2024 provided direct consumer engagement.

These hands-on experiences, including product sampling at fitness and wellness events, are crucial for building emotional connections. Media and influencer events further amplify reach, translating into tangible brand advocacy and potential sales uplift.

- F1 Miami Activation: Enhanced brand visibility and product trial among a high-energy audience.

- CMA Fest Presence: Connected with a key demographic through music and lifestyle integration.

- Fitness/Wellness Events: Targeted health-conscious consumers directly, reinforcing product benefits.

Strategic Messaging of Functional Benefits

Celsius consistently communicates its functional advantages, such as enhancing metabolism and delivering sustained energy without the typical post-consumption slump. This approach directly addresses consumer needs for performance and well-being.

The brand’s strategy centers on its "better-for-you" positioning, presenting Celsius as a cleaner, more effective, and healthier option compared to conventional energy drinks. This differentiation is key to attracting consumers prioritizing health.

- Metabolism Boost: Messaging highlights Celsius' role in supporting metabolic function.

- Sustained Energy: Consumers are assured of long-lasting energy without jitters.

- Calorie Burning: The products are promoted for their contribution to calorie expenditure.

- Healthy Alternative: Celsius is positioned as a superior choice to traditional sugary energy drinks.

In 2024, Celsius continued to leverage these functional benefits in its marketing, contributing to its significant market share growth. For instance, the company reported a 20% year-over-year increase in net sales for the first quarter of 2024, underscoring the effectiveness of its benefit-driven messaging.

Celsius's promotional strategy is a multi-faceted approach focusing on broad reach and authentic engagement. The 'Live. Fit. Go.' campaign, launched in June 2025, targets holistic well-being across various media platforms. Significant investment in influencer and athlete partnerships, particularly with Gen Z and sports figures, aims to embed the brand within active lifestyles.

Digital marketing is a cornerstone, with data-driven social media and SEO efforts boosting brand awareness and community building. Experiential marketing, through event activations like F1 Miami and CMA Fest in 2024, fosters direct consumer connections and brand advocacy.

The brand consistently highlights its functional benefits, such as metabolism enhancement and sustained energy, positioning itself as a healthier alternative to traditional energy drinks. This benefit-driven messaging supports substantial market share growth, with Q1 2024 net sales increasing by 20% year-over-year.

| Marketing Tactic | Key Focus | 2024/2025 Impact |

|---|---|---|

| Campaigns | Holistic well-being, broad appeal | 'Live. Fit. Go.' launched June 2025 |

| Partnerships | Influencers, athletes, NIL deals | Authentic integration into sports culture; 40%+ YoY revenue growth in 2023 |

| Digital Marketing | Social media engagement, SEO | 35% YoY social engagement increase, 20% organic traffic rise in 2024 |

| Experiential Marketing | Event activations, sampling | Direct consumer engagement at F1 Miami, CMA Fest (2024) |

| Product Messaging | Functional benefits, healthier alternative | 20% YoY net sales increase (Q1 2024) |

Price

Celsius employs a premium pricing strategy, reflecting its identity as a health-oriented functional beverage. This approach underscores the perceived value of its unique ingredient formulations and the health advantages it provides, appealing to consumers who prioritize 'better-for-you' choices and are willing to invest more. For instance, Celsius reported net sales of $1.33 billion for the fiscal year 2023, a substantial increase from $853 million in 2022, demonstrating strong market acceptance of its premium price positioning.

While Celsius positions itself as a premium energy drink, its pricing strategy remains competitive within the broader market. For instance, in early 2024, a standard 12-ounce can typically retailed between $2.29 and $2.99 in convenience stores, aligning closely with major players like Monster Energy and Red Bull.

This strategic pricing allows Celsius to attract its health-conscious and active consumer base without alienating them with significantly higher costs. By maintaining price parity with established competitors, Celsius effectively balances its premium perception with market accessibility, a key factor in its continued market share growth throughout 2024.

Celsius has shown a strong ability to keep its gross margins healthy, consistently staying above 50% in 2024. This resilience in pricing and cost control is crucial for profitability, especially when facing rising input costs.

Looking ahead to 2025, the company anticipates these robust margins to continue, likely settling in the low 50% range. This suggests that Celsius's strategies for managing raw material expenses and freight costs are proving effective, supporting sustained financial performance.

Value Proposition through Functional Benefits

Celsius positions its pricing around the tangible, clinically proven functional benefits it offers, encouraging consumers to view the purchase as an investment in their health and fitness. This strategy aims to justify a premium price point by highlighting enhanced energy, improved metabolism, and focus, rather than simply the cost of a beverage.

The company's pricing reflects a deliberate choice to align with a value proposition centered on performance and well-being. For example, in 2024, Celsius continued to command a higher price per unit compared to many traditional energy drinks, a strategy supported by consumer willingness to pay for perceived health advantages.

- Health Investment: Consumers are educated to see Celsius as a tool for achieving health goals, thus accepting a higher price.

- Premium Perception: The brand's association with fitness and performance reinforces a premium image that supports its pricing.

- Functional Differentiation: Unique ingredient blends and scientifically backed claims differentiate Celsius, allowing for price premiums.

- Market Performance: Celsius's strong sales growth, with net sales reaching $1.34 billion in 2023 and projected to continue strong growth into 2024, demonstrates consumer acceptance of its value-driven pricing.

Flexible Formats for Accessibility

Celsius understands that consumers have diverse needs and preferences, so they offer their energy drinks in various formats beyond traditional cans. This includes convenient powder stick packets, often marketed as On-the-Go, which can be a more economical choice for regular consumers. These powders also allow for greater customization of the beverage's strength and flavor.

This strategic approach to product presentation directly addresses different price points and consumption habits. By providing both ready-to-drink cans and mix-it-yourself powders, Celsius broadens its market reach. For instance, in 2024, the energy drink market saw continued growth, with consumers increasingly seeking value and convenience, trends that Celsius's flexible formats are well-positioned to capitalize on.

The availability of powder sticks, in particular, can offer a lower cost per serving compared to canned beverages. This allows Celsius to appeal to budget-conscious consumers or those who consume energy drinks more frequently. The company's ability to adapt its packaging and product forms is a key element in its marketing mix, ensuring broader accessibility and market penetration.

Celsius's pricing strategy is a cornerstone of its premium positioning, aligning with its identity as a health-focused functional beverage. This premium approach is supported by the perceived value of its unique formulations and health benefits, attracting consumers who prioritize wellness and are willing to pay more. The company's net sales growth, reaching $1.33 billion in 2023 and showing continued upward momentum into 2024, validates this strategy.

While premium, Celsius maintains competitive pricing, with a 12-ounce can typically retailing between $2.29 and $2.99 in early 2024, matching key competitors like Red Bull and Monster. This balance ensures market accessibility for its health-conscious demographic. The brand's strong gross margins, consistently above 50% in 2024, underscore effective cost management and pricing power.

Celsius further diversifies its pricing approach through various product formats, such as powder stick packets. These offer a potentially lower cost per serving, appealing to frequent consumers and budget-conscious buyers, thereby broadening market reach and accessibility in the growing energy drink sector of 2024.

| Pricing Strategy Element | Description | 2023/2024 Data/Observation |

|---|---|---|

| Premium Positioning | Reflects health-oriented, functional beverage identity. | Net sales of $1.33 billion in 2023, indicating strong consumer acceptance of higher price points. |

| Competitive Parity | Prices align with major competitors. | Typical retail price for a 12oz can in early 2024 was $2.29 - $2.99, similar to Red Bull and Monster. |

| Value-Based Justification | Price supported by functional benefits (energy, metabolism). | Consumers view purchase as an investment in health and fitness, supporting higher price points. |

| Format Diversification | Offers powder sticks for potentially lower cost per serving. | Powder sticks provide an economical option for frequent consumers, enhancing accessibility. |

| Profitability Indicator | Healthy gross margins. | Gross margins remained above 50% throughout 2024, demonstrating pricing power and cost control. |

4P's Marketing Mix Analysis Data Sources

Our Celsius 4P's Marketing Mix Analysis is built upon comprehensive data, encompassing product features, pricing strategies, distribution channels, and promotional activities. We leverage official company reports, public financial filings, industry analyses, and competitive intelligence to ensure accuracy.