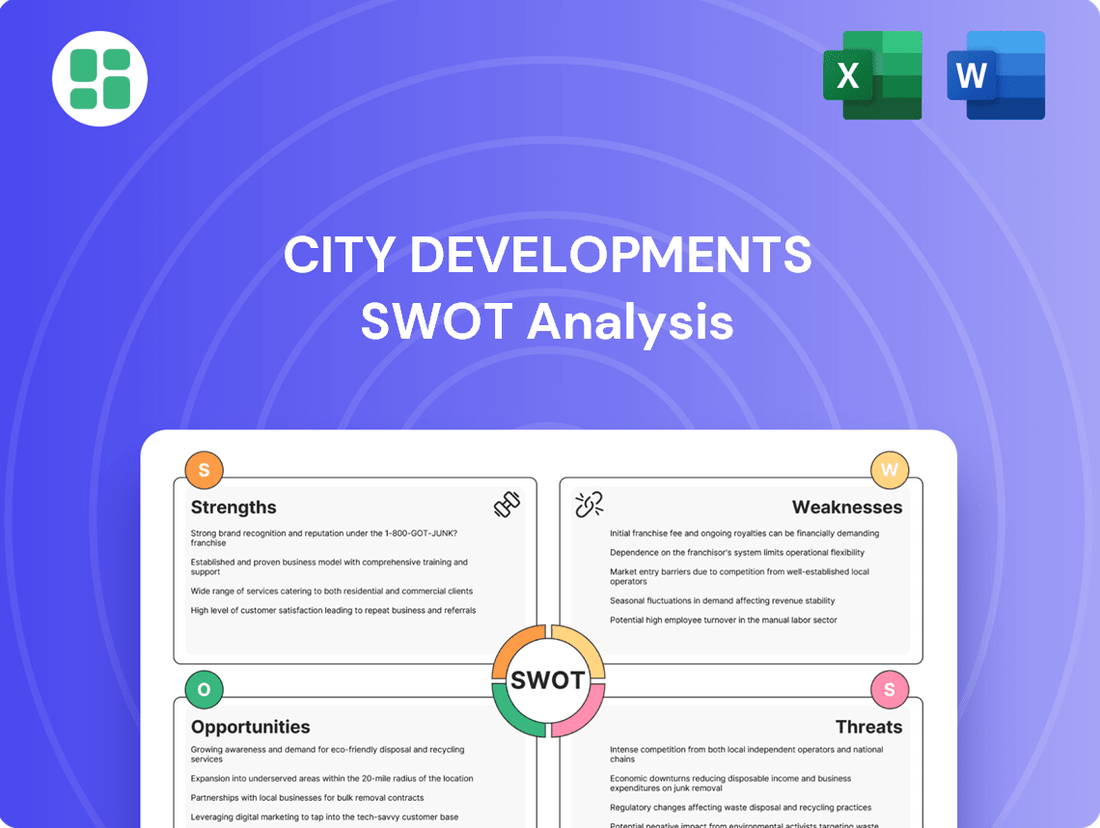

City Developments SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

Uncover the hidden potential and critical challenges shaping your city's future. Our preliminary SWOT analysis reveals key strengths like robust infrastructure and emerging opportunities in sustainable development, alongside potential weaknesses such as aging public transit and threats from economic downturns.

Want the full story behind your city's strengths, risks, and growth drivers? Purchase the complete City Developments SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, investment, and community engagement.

Strengths

City Developments Limited (CDL) possesses a remarkably diversified global real estate portfolio. This portfolio spans residential, commercial, and hospitality sectors, reaching 163 locations across 29 countries. This extensive geographical and sectoral spread is a key strength, significantly reducing the company's vulnerability to downturns in any single market or property type.

The company's substantial international footprint, notably through its Millennium & Copthorne Hotels subsidiary which operates over 160 hotels globally, ensures stable recurring income. This robust asset base, spread across numerous regions, provides a strong foundation for consistent revenue generation and resilience against localized economic challenges.

City Developments (CDL) showcased robust financial performance in the first quarter of 2025, reporting a substantial 155% year-on-year surge in sales revenue. This impressive growth was largely fueled by the successful launch and sales of its residential projects within Singapore.

Further bolstering its financial strength, CDL is actively engaged in a strategic capital recycling program. This involves significant divestments, such as the sale of its stake in the South Beach development, aimed at reducing its gearing ratio and unlocking shareholder value.

These prudent financial maneuvers enable CDL to effectively redeploy capital into promising new ventures and development opportunities, thereby reinforcing its overall financial resilience and capacity for future expansion.

City Developments Limited (CDL) boasts over 60 years of experience, a testament to its enduring presence and expertise in real estate development, investment, and management. This extensive history, marked by the development of over 53,000 homes and a significant global portfolio across various asset classes, underscores a deep understanding of market dynamics and a proven ability to execute complex projects. This long-standing track record instills confidence in its strategic decision-making and operational capabilities.

Leadership in Sustainability and ESG

City Developments Limited (CDL) stands out as a recognized pioneer in sustainability, celebrating 30 years of green leadership with its 18th Integrated Sustainability Report released in 2025. This long-standing commitment positions CDL favorably in an increasingly environmentally conscious market.

CDL's proactive approach to environmental, social, and governance (ESG) principles is further underscored by its target for full compliance with ISSB standards by fiscal year 2025. This adherence to global sustainability reporting benchmarks enhances transparency and investor confidence.

The company has demonstrably attracted significant green capital, securing over S$9.5 billion in sustainable financing. Notably, this includes a pioneering sustainability-linked loan specifically tied to nature conservation efforts, showcasing innovative financial strategies aligned with ESG goals.

- Pioneering ESG: 30 years of green leadership and 18th Integrated Sustainability Report in 2025.

- ISSB Compliance: Aiming for full compliance by FY2025.

- Sustainable Financing: Secured over S$9.5 billion, including a nature conservation-linked loan.

- Reputational Advantage: Enhanced brand image and investor appeal through strong ESG performance.

Robust Project Pipeline and Land Replenishment

City Developments Limited (CDL) boasts a strong residential launch pipeline in Singapore, with significant projects like the upcoming Zion Road mixed-use development scheduled for the second half of 2025. This development alone will feature residential units and serviced apartments, contributing to future revenue.

Globally, CDL has strategically invested to bolster its development pipeline, particularly within the living sector. This includes substantial growth initiatives in key international markets such as the United Kingdom, Japan, Australia, and the United States, diversifying its revenue base and mitigating country-specific risks.

This proactive land replenishment strategy is crucial for CDL's long-term sustainability. It ensures a consistent flow of future revenue streams and supports sustained growth by securing prime development opportunities across its operating regions.

CDL's commitment to pipeline development is evident in its FY2023 results, where the company reported a robust development property portfolio valued at S$10.2 billion. This highlights the significant future earnings potential locked within its ongoing and planned projects.

CDL's extensive global diversification across residential, commercial, and hospitality sectors, spanning 163 locations in 29 countries, significantly mitigates market-specific risks. Its strong financial performance, highlighted by a 155% year-on-year sales revenue surge in Q1 2025, demonstrates effective project execution and market responsiveness.

The company's strategic capital recycling program, including asset divestments, enhances financial flexibility and reduces gearing, positioning it for future growth. With over 60 years of experience and a proven track record of developing over 53,000 homes, CDL possesses deep market expertise and operational resilience.

CDL's commitment to sustainability, evidenced by 30 years of green leadership and a target for ISSB compliance by FY2025, attracts ESG-focused investment and strengthens its brand reputation. The company has secured over S$9.5 billion in sustainable financing, including a unique nature conservation-linked loan, underscoring its innovative approach to ESG integration.

A robust pipeline of residential projects in Singapore, such as the Zion Road development slated for H2 2025, and strategic international investments in the living sector across the UK, Japan, Australia, and the US, ensure sustained future revenue growth. The development property portfolio was valued at S$10.2 billion in FY2023, reflecting substantial future earnings potential.

| Metric | Value | Year/Period | Significance |

|---|---|---|---|

| Global Portfolio Locations | 163 | 2025 | Diversification and risk mitigation |

| Sales Revenue Growth | 155% YoY | Q1 2025 | Strong operational performance |

| Sustainable Financing Secured | S$9.5 billion | 2025 | ESG leadership and investor appeal |

| Development Property Portfolio Value | S$10.2 billion | FY2023 | Future earnings potential |

What is included in the product

Offers a full breakdown of City Developments’s strategic business environment, analyzing its internal strengths and weaknesses alongside external opportunities and threats.

Offers a clear, actionable framework to identify and address urban development challenges.

Weaknesses

While Millennium & Copthorne Hotels, CDL's subsidiary, saw revenue grow in 2024, its operating profit and margin dipped from 2023 levels. This was mainly because 2023's figures included significant one-off gains from property sales, which weren't repeated in 2024. This highlights how hospitality profitability can be inconsistent, relying on more than just core operational performance.

City Developments Limited (CDL) is experiencing a softening in its domestic commercial portfolio. In the first quarter of 2025, the company saw its committed occupancy rates for both office and retail segments in Singapore decline. The office portfolio occupancy dropped by 0.5 percentage points, while the retail segment saw a more significant decrease of 1.8 percentage points quarter-on-quarter.

These figures indicate potential challenges within Singapore's commercial property market. Such declines in occupancy could lead to reduced rental income for CDL and may also put downward pressure on the valuation of its commercial assets. This trend warrants close monitoring as it could impact the company's overall financial performance.

City Developments Limited (CDL) faces significant headwinds from global economic volatility. Fluctuations in interest rates, inflation, and geopolitical instability across its diverse international markets can directly impact consumer spending and property market dynamics, potentially dampening demand for its developments and affecting investment returns.

For instance, as of early 2024, persistent inflation in key markets like the UK and Australia, coupled with rising interest rates, has already begun to cool property markets. This economic uncertainty creates a challenging environment for CDL's revenue streams and project pipelines, as seen in the cautious outlook for global real estate investment in 2024, with some analysts predicting a slowdown in transaction volumes compared to previous years.

Reliance on Successful Residential Launches

City Developments Limited (CDL) faces a significant weakness in its heavy reliance on the successful execution of residential property launches. A substantial portion of its development revenue hinges on the timely and profitable sale of new housing projects. For instance, while CDL reported robust sales from its The Orie project in Q1 2025, this success is not guaranteed for future developments.

The company's financial performance in its development segment is directly correlated with market conditions affecting residential sales. Factors such as buyer demand, competitive pricing, and the strategic timing of new project introductions play a critical role. A downturn in the broader residential property market, which saw a slight cooling in some Asian markets by mid-2025, could disproportionately affect CDL's revenue streams.

- Dependence on New Launches: CDL's development revenue is heavily weighted towards the success of new residential projects, making it vulnerable to market fluctuations.

- Market Absorption Risk: Future revenue is contingent on the market's ability to absorb new residential inventory at projected price points.

- Timing Sensitivity: The timing of project launches is crucial; delays or misjudgments can significantly impact sales momentum and revenue recognition.

- Residential Market Volatility: Any slowdown in the residential sector, driven by economic factors or policy changes, directly threatens CDL's development segment performance.

Vulnerability to Rising Construction Costs

City Developments, like all real estate developers, faces significant headwinds from escalating construction expenses. The cost of essential materials such as steel, timber, and concrete, alongside a persistent shortage of skilled labor, continues to climb. For instance, global commodity prices saw notable increases throughout 2024, directly impacting project budgets.

These rising input costs directly threaten to squeeze profit margins on both new ventures and projects already underway. Developers may find themselves needing to absorb these increases, delay projects, or even reconsider the financial feasibility of certain developments altogether.

- Increased material costs: Global supply chain disruptions and heightened demand for construction materials contributed to price hikes throughout 2024, impacting sectors like steel and lumber.

- Labor shortages: A scarcity of skilled construction workers in key markets continues to drive up labor costs and can lead to project timelines being extended.

- Margin erosion: The inability to fully pass on these increased costs to buyers or tenants can directly reduce the profitability of development projects.

CDL's reliance on new residential launches presents a key vulnerability. The company's financial health in its development segment is closely tied to the successful and timely sale of these projects, a factor susceptible to market shifts. For example, while CDL saw positive sales from The Orie in Q1 2025, future project success is not guaranteed, highlighting the risk associated with this revenue model.

The company faces a significant risk in its dependence on the market's capacity to absorb new residential inventory at projected price points. Any slowdown in the residential sector, whether due to economic downturns or policy changes, can directly impact CDL's development segment performance, potentially affecting revenue streams and project viability.

CDL's financial performance is sensitive to the timing of its project launches. Misjudgments in market entry or unforeseen delays can disrupt sales momentum and revenue recognition, thereby impacting overall financial results. This timing dependency underscores the need for astute market analysis and execution in its development pipeline.

Preview Before You Purchase

City Developments SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the complete, professionally structured report without any hidden surprises.

Opportunities

The global hospitality sector is on a robust recovery path, with international tourist arrivals expected to reach 95% of pre-pandemic levels by the end of 2024, according to UN Tourism data. Projections indicate a full recovery and continued growth into 2025, fueled by pent-up demand and evolving travel preferences.

Key drivers include a surge in leisure travel, the burgeoning wellness tourism market valued at over $1 trillion globally, and the increasing trend of 'bleisure' travel, blending business and leisure. This creates a favorable environment for hospitality businesses to capitalize on increased guest spending and higher occupancy rates.

For City Developments, this presents a significant opportunity for its Millennium & Copthorne Hotels division to boost occupancy and average daily rates. The positive industry outlook suggests potential for improved profitability and market share gains as travel demand continues to strengthen through 2025.

Anticipated interest rate cuts by central banks in 2025 are poised to significantly lower the cost of home financing for prospective buyers. This reduction in borrowing expenses is likely to stimulate demand within the residential property sector, making homeownership more accessible. For instance, a 0.50% rate cut could translate to hundreds of dollars saved annually on mortgage payments for the average buyer.

Lower interest rates also directly benefit developers by decreasing their borrowing costs for new projects. This improved financial feasibility can encourage more development activity and attract greater investor interest in real estate assets. Reduced financing expenses can bolster profit margins and make previously marginal projects viable.

This favorable shift in monetary policy is expected to drive an increase in property transaction volumes across the market. As borrowing becomes cheaper and market sentiment improves, more buyers and investors will be encouraged to enter the market, leading to a more dynamic and robust real estate environment.

Singapore's private residential market is anticipated to see moderate price growth and maintain stability throughout 2025. This resilience is underpinned by robust local demand and a constrained supply of new housing units.

This stable market, coupled with consistent demand from Housing and Development Board (HDB) upgraders, presents a conducive landscape for City Developments Limited (CDL) in terms of both its residential sales and investment property portfolio within Singapore. For instance, in Q1 2024, CDL reported a 16.7% increase in its net profit to S$188.3 million, partly driven by its Singapore residential projects.

Strategic Capital Recycling for New Investments

City Developments Limited (CDL) actively recycles capital by selling off mature properties, freeing up funds to invest in promising new ventures and acquisitions. This strategic approach helps CDL refine its asset mix, lower its debt levels, and expand its fund management operations, ultimately boosting shareholder returns and solidifying its competitive standing.

For instance, CDL's divestment of its stake in the M+S Pte Ltd portfolio, which included iconic assets like Marina Bay Financial Centre and Asia Square Tower 1, generated approximately S$1.1 billion in proceeds in late 2023. This capital was strategically redeployed into new growth areas.

- Divestment Proceeds: CDL's strategic capital recycling, exemplified by the S$1.1 billion from the M+S Pte Ltd divestment in late 2023, fuels new investment opportunities.

- Portfolio Optimization: This strategy allows CDL to shift capital from mature assets to higher-growth segments and strategic acquisitions, enhancing overall portfolio performance.

- Financial Health: Capital recycling aids in reducing gearing ratios and improving financial flexibility, supporting the company's expansion and fund management ambitions.

- Long-Term Value Creation: By actively managing its asset base, CDL aims to unlock value and strengthen its market position for sustained long-term shareholder benefit.

Leveraging Technology for Enhanced Experiences

The hospitality industry is rapidly integrating technologies like artificial intelligence to craft more personalized guest journeys, streamline operations with unified platforms, and offer convenient contactless services. For City Developments (CDL), this presents a significant opportunity to elevate guest satisfaction and operational efficiency across its hotel portfolio.

By embracing these technological shifts, CDL can differentiate itself in a competitive market. For instance, AI-powered recommendation engines could suggest tailored dining or activity options, boosting engagement. The global hospitality technology market was valued at approximately $20.2 billion in 2023 and is projected to reach $44.9 billion by 2030, indicating substantial growth potential for early adopters.

- Personalized Guest Experiences: Implementing AI to understand guest preferences and offer tailored recommendations, potentially increasing ancillary revenue by an estimated 10-15%.

- Operational Efficiency: Utilizing integrated platforms for seamless check-in/check-out, room service, and staff management, aiming to reduce operational costs by up to 8%.

- Contactless Services: Offering mobile key entry, digital menus, and contactless payment options to meet evolving consumer expectations for safety and convenience.

- Competitive Edge: Differentiating CDL's hospitality offerings through innovative technology adoption, attracting a larger share of the modern traveler market.

The global hospitality sector's strong recovery, with international arrivals nearing pre-pandemic levels in 2024 and projected continued growth into 2025, offers City Developments (CDL) a prime opportunity to boost its Millennium & Copthorne Hotels division. This trend, driven by pent-up travel demand and evolving preferences, suggests higher occupancy rates and average daily rates for CDL's properties.

Anticipated interest rate cuts in 2025 are expected to stimulate Singapore's residential property market by lowering home financing costs, thereby increasing demand and accessibility. This favorable monetary policy environment, coupled with CDL's successful capital recycling strategy, such as the S$1.1 billion divestment proceeds from M+S Pte Ltd in late 2023, provides capital for strategic investments and portfolio optimization.

CDL's proactive capital recycling allows for reinvestment into growth areas and acquisitions, enhancing its asset mix and financial flexibility. This strategic approach supports expansion and fund management ambitions, aiming to deliver long-term shareholder value and strengthen its market position.

The integration of AI and contactless technologies in hospitality presents a chance for CDL to enhance guest experiences and operational efficiency. With the global hospitality technology market projected to grow significantly, early adoption can provide a competitive edge, as seen by CDL's Q1 2024 net profit increase of 16.7% partly driven by its Singapore residential projects.

Threats

Despite some forecasts for moderation, the persistent reality of high interest rates and ongoing inflation presents a significant hurdle for City Developments (CDL). These economic conditions directly translate to increased borrowing costs for CDL's extensive development pipeline, impacting project profitability. Furthermore, this economic pressure can erode consumer affordability, leading to slower property sales and potentially lower investment returns across CDL's diverse real estate holdings.

Global geopolitical tensions, including ongoing conflicts and shifting alliances, present a significant external threat to City Developments Limited (CDL). For instance, the prolonged Russia-Ukraine conflict, which continued into 2024, has exacerbated supply chain issues, leading to higher construction material costs. This instability can also dampen international tourism, a key driver for CDL's hospitality segment, and create market uncertainty that impacts investor confidence and real estate valuations across its diverse international portfolio.

City Developments Limited (CDL) operates in inherently competitive real estate and hospitality markets, facing a dynamic landscape populated by both established global brands and agile local developers. This intensified competition is a significant threat, potentially eroding market share and profitability across its diverse portfolio.

For instance, in Singapore's private residential market, CDL, alongside competitors like CapitaLand and UOL Group, navigates a landscape where new project launches and resale transactions are constantly vying for buyer attention. Similarly, its hospitality arm, Millennium Hotels and Resorts, contends with a crowded global market where brands like Marriott and Hilton are major players. Aggressive pricing by rivals, particularly in key markets like the UK and Australia where CDL has a substantial presence, could lead to reduced rental yields and lower occupancy rates, directly impacting revenue streams.

Government Regulatory Changes and Cooling Measures

Governments, particularly in key markets like Singapore, are proactive in managing property market dynamics. For City Developments Limited (CDL), this translates to potential headwinds from evolving regulations. In 2024 and looking into 2025, we've seen continued government focus on housing affordability and market stability, which could lead to the introduction or tightening of existing cooling measures.

These measures can directly impact CDL's performance by dampening demand for new residential launches and potentially affecting the valuation of their existing investment properties. For instance, adjustments to stamp duties or loan-to-value ratios can significantly alter buyer sentiment and purchasing power. In the first half of 2024, the Singapore government continued to monitor the property market closely, with analysts anticipating potential further adjustments if price growth remained robust.

- Potential for increased Additional Buyer's Stamp Duty (ABSD) rates impacting foreign and corporate buyers.

- Stricter lending rules could reduce mortgage accessibility for potential homebuyers.

- Changes to rental policies might affect yields for investment properties.

- Government land sales policies could influence development costs and future supply dynamics.

Evolving Work Models and Retail Landscape

The increasing adoption of hybrid and remote work models presents a significant threat to City Developments' (CDL) traditional office portfolio. As companies continue to embrace flexible working arrangements, the demand for prime office spaces may decline, potentially impacting occupancy rates and rental yields for CDL's commercial properties. For instance, a late 2024 survey indicated that 60% of companies plan to maintain hybrid work policies, a trend that could persistently suppress office leasing demand.

Furthermore, the persistent growth of e-commerce continues to fundamentally alter the retail sector. This ongoing shift poses challenges for CDL's physical retail assets, as consumer shopping habits increasingly favor online channels. Adapting to this evolving landscape, perhaps through experiential retail or mixed-use developments, will be crucial to mitigate potential declines in foot traffic and sales for CDL's retail properties.

- Reduced Office Demand: Hybrid work models, with an estimated 60% of companies favoring them in late 2024, could lead to lower occupancy and rental income for CDL's office buildings.

- E-commerce Impact on Retail: The continued rise of online shopping threatens the viability of traditional brick-and-mortar retail spaces within CDL's portfolio, necessitating strategic adaptation.

- Foot Traffic Decline: A sustained shift to online purchasing may result in decreased foot traffic for physical retail properties, impacting sales performance and tenant appeal.

The increasing prevalence of hybrid and remote work models poses a significant threat to City Developments' (CDL) office portfolio. This trend, with around 60% of companies planning to maintain hybrid policies as of late 2024, could lead to reduced demand for prime office spaces, impacting occupancy rates and rental yields. Similarly, the ongoing expansion of e-commerce challenges CDL's physical retail assets, as consumer habits increasingly shift towards online channels, potentially decreasing foot traffic and sales performance.

| Threat | Description | Impact on CDL | Data Point/Example |

| Hybrid Work Models | Companies adopting flexible work arrangements. | Reduced demand for office spaces, lower occupancy and rental income. | 60% of companies planned to maintain hybrid work policies in late 2024. |

| E-commerce Growth | Shift in consumer shopping habits towards online channels. | Challenges for physical retail assets, decreased foot traffic and sales. | Continued growth in global e-commerce sales impacting brick-and-mortar retail. |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, incorporating official city financial reports, comprehensive market research studies, and expert opinions from urban planning professionals to ensure a well-rounded perspective.